I’ve lost count of how many times I’ve heard from proclaimed expert investors and sales agents that blue-chip suburbs are the best investment. “Buy one, hold it, and watch it grow”, they said. With prestigious locations, tight housing stock, and an established reputation, there is a very low chance you can go wrong with blue-chip properties. But I’m not so convinced.

Blue-chip suburbs can be a great investment if you have ample capital, but for people with limited budgets, they can be risky.

In our previous blog, Why There’s No Such Thing As a “Blue Chip Suburb”, we took a deep dive into this concept. If you’re curious about the truth behind the blue-chip myths, it’s worth a look.

In this blog, I’ll focus on the portfolio growth perspective by unpacking three major pitfalls of investing in blue-chip suburbs, explaining why chasing the “best” option could end up being your “worst” move. Let’s get started!

Pitfall 1: Worse cash flow

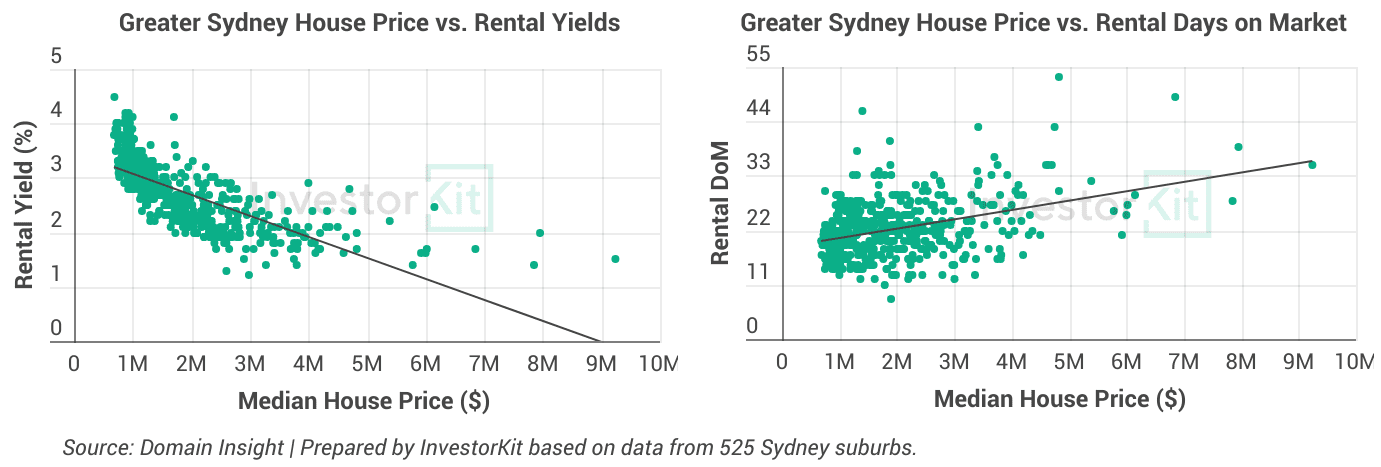

Blue-chip suburbs often see longer rental days on the market and lower rental yields due to their high price points. Our analysis of 525 suburbs in Sydney showed that:

- There is a negative correlation between house prices and rental yields: the more affordable the property, the higher the rental yields tend to be (left chart).

- There is a positive correlation between house prices and rental days on market: the higher the house price, the longer it tends to stay on the market (right chart).

The lower your rental yields and the longer your property sits vacant, the more your cash flow feels the squeeze. To better understand, let’s walk through some numbers with Sam and Sally, a rentvesting couple with no children, who are currently exploring their investment choices. The following are key assumptions for borrowing capacity calculation.

- Dual annual income before tax: $250,000

- Live in NSW

- Weekly living expense: $750

- Weekly rental payment: $850

- Other loans: $0

- Credit cards: $0

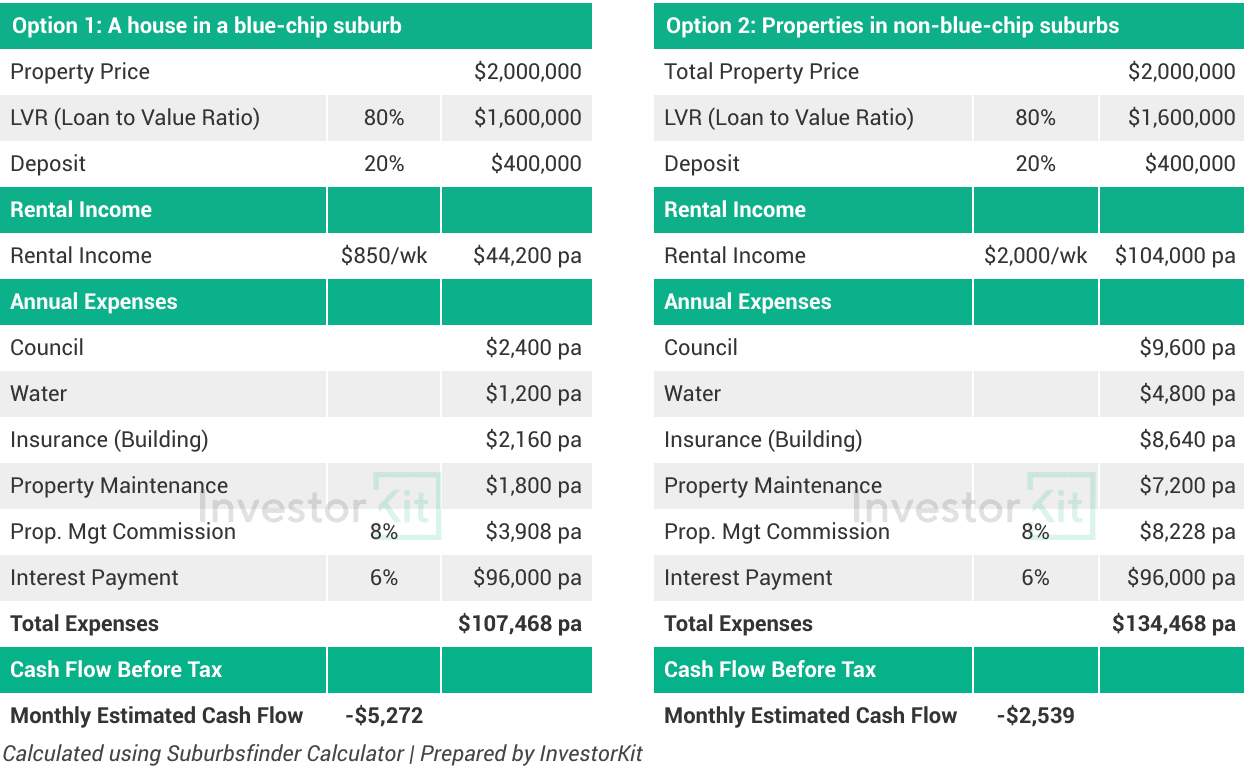

With a $2 million budget, Sam and Sally are considering two investment options: one is a house in the blue-chip suburb of Burnside in Adelaide, and the other is four properties across regional Australia in non-blue-chip areas.

After factoring in all expenses, here’s where Sam and Sally stand each month:

- Option 1: a monthly loss of -$5,272.

- Option 2: a monthly loss of -$2,539.

If choosing non-blue-chip suburbs with the same investment value and loan amount, they can cut their loss by approximately 52%.

Pitfall 2: Weaker borrowing capacity

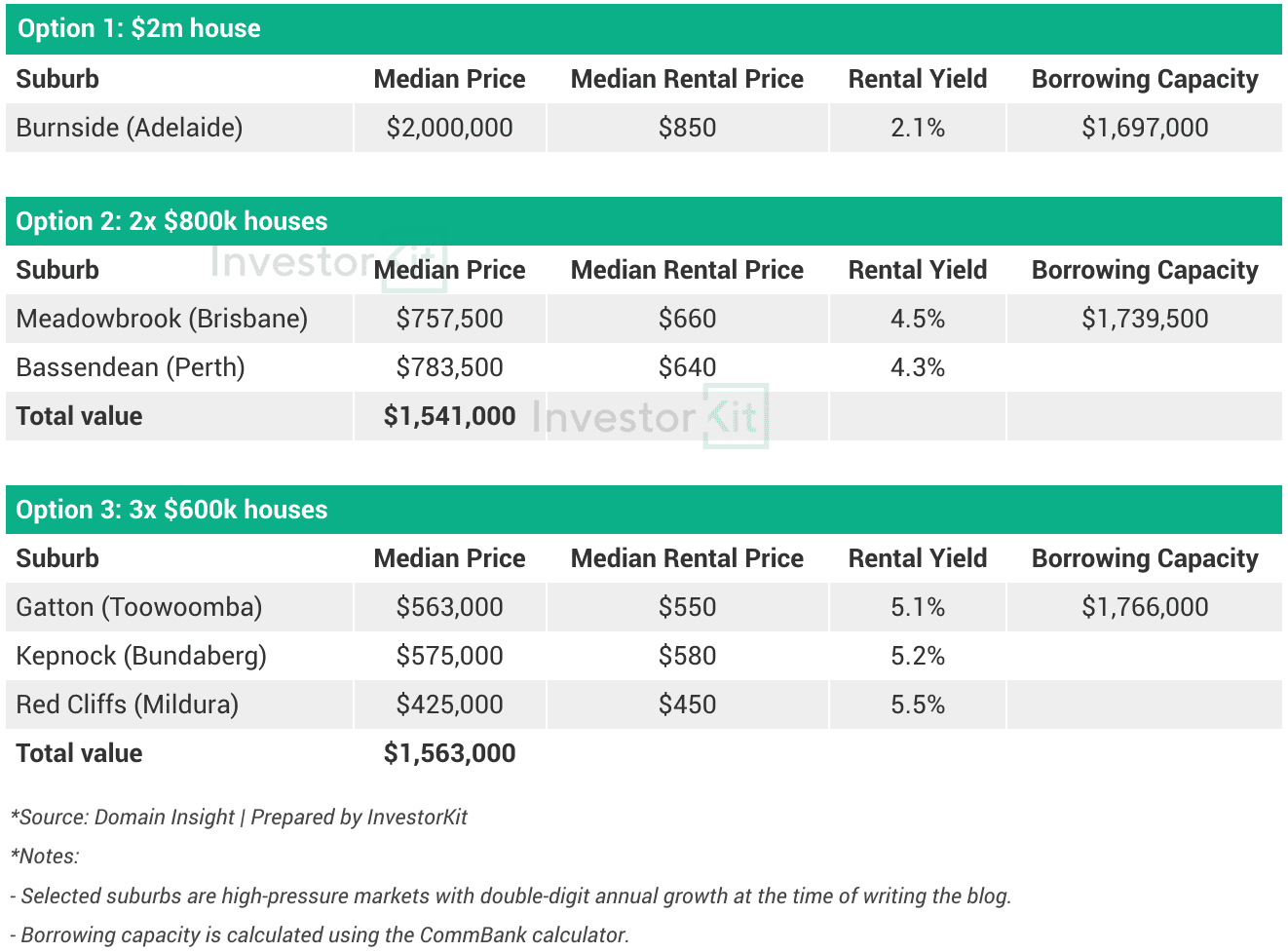

Investing in blue-chip properties can lower your borrowing capacity. Let’s continue with Sam and Sally’s situation.

If Sam and Sally stick with a $2 million home in the blue-chip suburb, their borrowing capacity caps at $1.697 million.

But if they’re open to moving beyond blue-chip areas to suburbs with more moderate prices and healthier rental yields (Option 2), their borrowing power will increase by around 2.5%.

If they go a step further into regional areas with even more affordable homes and stronger yields (Option 3), their borrowing capacity will be even higher, a 1.5% increase over Option 2.

From a portfolio growth perspective, high-priced and low-yield markets/properties can limit your borrowing power, reducing your capacity to scale.

No guesswork. Just data-backed results.

Find out how InvestorKit helps buyers secure high-performing properties using a proven 30-point framework and 92% rejection rate.

Pitfall 3: Higher risks

If your only focus is on blue-chip suburbs, you’re more likely to put all your eggs in one basket, just like Sam and Sally’s option 1. However, by spreading your investments nationwide in non-blue-chip areas, you can take advantage of different market cycles and lower your risk through diversification.

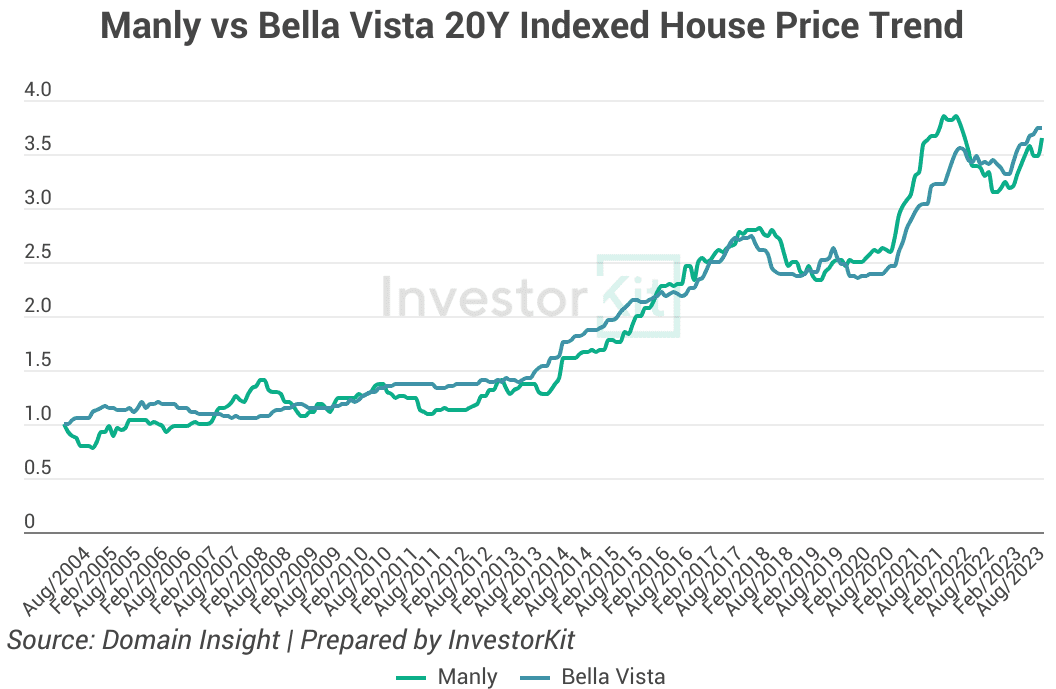

Additionally, price trends in blue-chip suburbs tend to be more volatile than in ordinary suburbs. Let’s take a look at the 20-year indexed house price trends of Bella Vista and Manly:

- A decade ago, Bella Vista was a typical mid-tier suburb with relatively stable price growth. Manly, a classic blue-chip area, experienced more dramatic fluctuations.

- However, since 2014, as Bella Vista gentrified and joined the blue-chip club, its price movements have become noticeably more volatile.

Buying in a blue-chip suburb often means your property is more exposed to market swings.

In a nutshell,

Blue-chip suburbs are not for everyone, and they are not always the best option for your portfolio growth, especially if you have limited capital. The high price tags often mean worse cash flow, higher risks and lower borrowing capacity. However, if you can comfortably manage these trade-offs, there’s nothing wrong with going blue-chip; just make sure that your decision is backed by solid research and a clear investment strategy.

This blog is inspired by the podcast Why Blue Chip Assets Aren’t Always the Best Investment Choice, featuring our Lead Research Analyst, Junge Ma. Check it out for more insight!

If blue-chip suburbs aren’t your best option, then what is? Let InvestorKit help you find out. We specialise in identifying high-performance markets and assisting you to make data-backed decisions that accelerate your portfolio’s growth. Would you like to start your investing journey or accelerate your portfolio growth? Get in touch today by clicking here to request a free, no-obligation 15-minute discovery call!

.svg)