A few weeks ago, we discussed why “Investment-Grade Properties” was nothing but a marketing phrase and why investors shouldn’t chase them. Today, let’s talk about location and move our eyes to another popular but misleading term in the property investment realm: “Blue Chip Suburb”.

You must have heard many people promoting blue chip suburbs. Most would tell you that blue chip suburbs promise constant high value growth. These people can be sales agents, investors, and finance advisors, but unfortunately, they’re all wrong.

Because there’s no such thing as a “blue chip suburb”. The so-called blue chip suburbs are NO DIFFERENT than others. In this blog, let’s bust 3 myths about blue chip suburbs.

Myth #1: Blue chip suburbs offer constant high value growth.

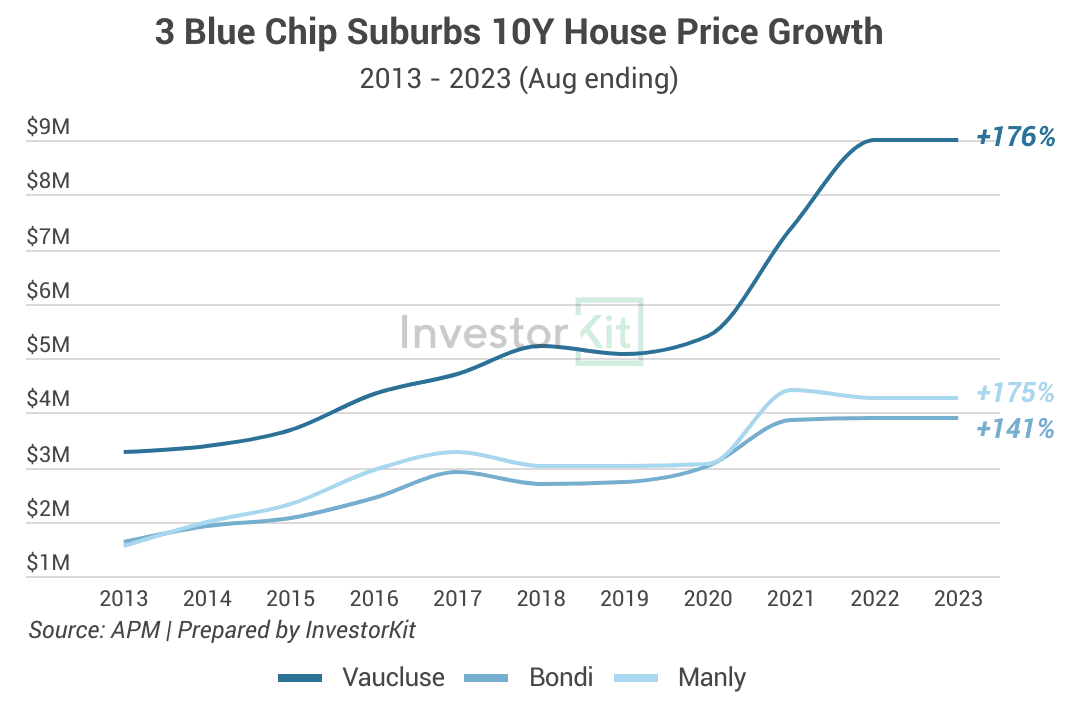

Sydney’s Vaucluse, Bondi and Manly are commonly considered “blue chip suburbs”. The below chart shows how the three suburbs’ median house prices have grown over the past 10 years.

The total growth seems high. However, is the growth constant?

No. Their house values declined in 2018/19, just like every other Sydney suburb, and didn’t grow much until the COVID boom in 2020/21; as interest rates hiked in 2022/23, their house values stopped growing again.

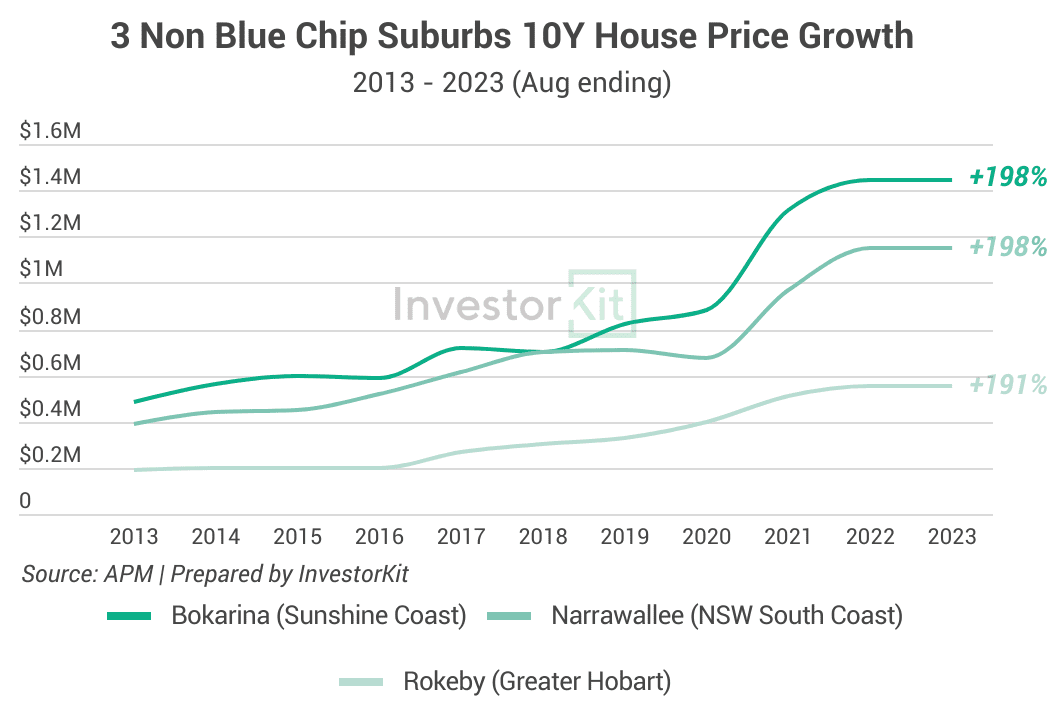

Then let’s look at some non blue chip suburbs’ house value growth (below chart). You may not have heard of these suburbs, but their long-term growth easily beats the so-called “blue chip suburbs”.

At the end of the day, just remember two things.

First, all markets are subject to market cycles, and no suburb can be immune to the natural ups and downs.

Second, value growth is led by a combination of demand, supply, market confidence, economic activity, and many more factors, not just location. An expensive location is expensive NOT, in 99% of cases, because it’s grown more, but more likely because it was originally expensive.

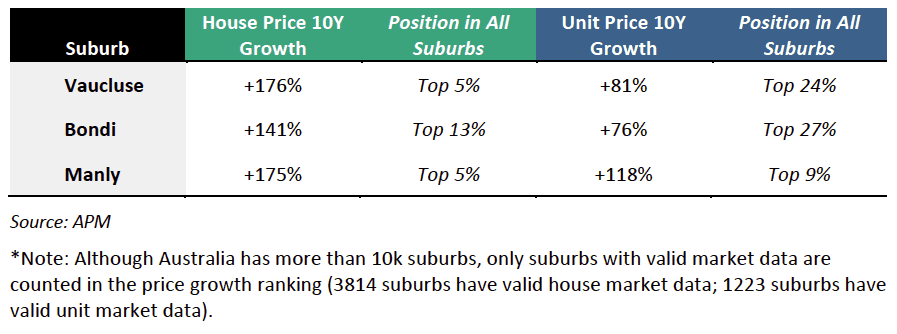

Myth #2: In a blue chip suburb, it doesn’t matter whether you buy a house or an apartment.

Oh, my friend, it matters. The below table shows the difference.

Units’ value growth is below houses’ in both growth rate and ranking in all three suburbs. It’s unsurprising if you’ve seen the numerous new apartment buildings emerging in Sydney’s Eastern Suburbs and Northern Beaches in the past decade.

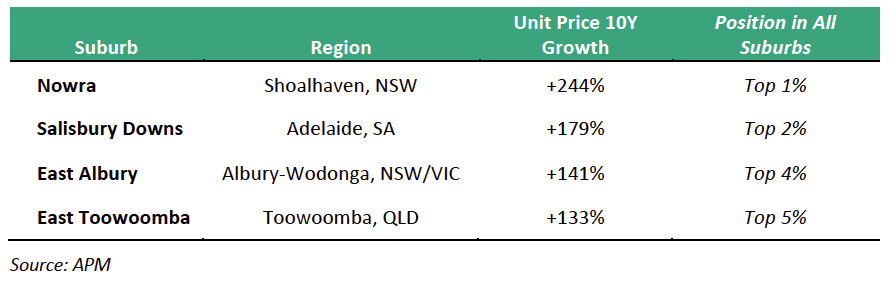

Wonder which non blue chip suburbs’ apartment markets performed better? They may actually surprise you. Below are some of them:

Don’t forget that apartments suffer from oversupply risks. An oversupplied popular location cannot beat an undersupplied average location.

Myth #3: Blue chip suburbs always enjoy strong demand.

How to measure demand?

Let’s examine the number of interested buyers per for-sale listing (# of interested buyers / # of for-sale listings; both numbers are available on REA). The more interested buyers, the higher the demand.

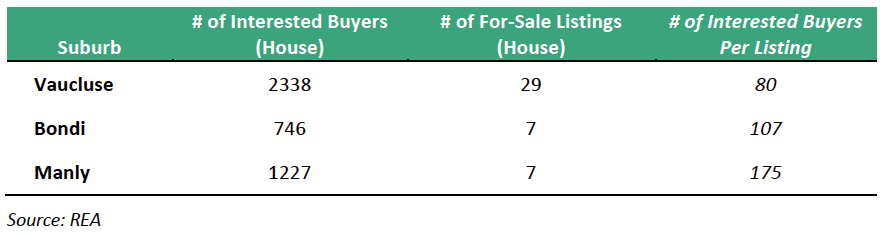

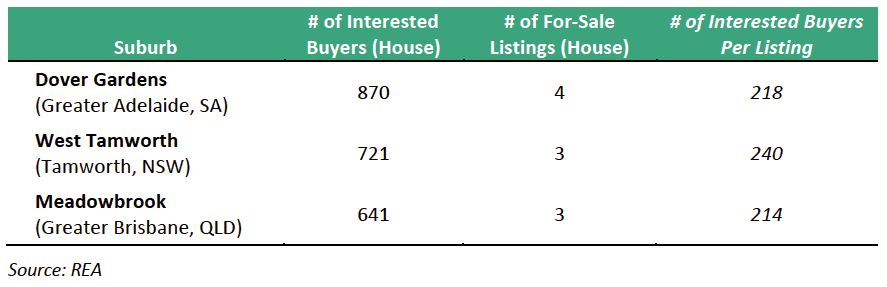

The table below lists the numbers of the three “blue chip suburbs” as of the first week of Oct 2023.

The numbers look good, indeed. However, they’re not the highest. Check the below suburbs out:

The 3 suburbs in the second table are not considered “blue chip” – Dover Gardens is 15km from Adelaide CBD; Meadowbrook is 28km from Brisbane CBD; Tamworth is an inland regional city far from Sydney. However, their houses get more interest than the “blue chip suburbs”. What’s more, don’t forget the huge population difference between Sydney and the three smaller cities!

Demand, just like price growth, is more complicated than you thought. It’s not merely dependent on a location’s distance to CBD/shops/beaches/public transport/etc, but a combination of local job opportunities, housing affordability, lifestyle, and more.

“Blue Chip Suburb” starts with bias, not data.

Now that the so-called “blue chip suburbs” do not necessarily perform any better than others, why are they considered blue chips?

It’s all bias. Many people like to assume that:

“Expensive suburbs must have grown a lot; Cheap suburbs must have grown little.”

“I really want/wish to live in that popular seaside suburb; everyone else must want to live there, too.”

“Regional towns don’t have corporate jobs – Who would want to move there?”

However, none of the above can be proven by data.

As a smart investor, you want to get rid of bias and make sound decisions based on solid data. Find it hard? Get a helper! InvestorKit is a data-driven buyers’ agency that dedicate ourselves to data digging and analysing to help our clients find the best-suited locations and properties. Would like to know more about our approach? Click here and secure your 15-minute FREE, no-obligation discovery call!

.svg)