Hobart: A Well-Deserved Break Before More Robust Growth

In the picturesque Apple Isle capital of Hobart, a city that has flourished in the past decade, witnessing a surge in both population and tourism, the real estate landscape has been nothing short of a captivating narrative. As a rising number of individuals seek to establish roots in this thriving city, the property market experienced remarkable highs, achieving the highest overall growth in both house values and rents over the last decade (2013 – 2023). However, the echoes of its last peak in the first quarter of 2022 have since resonated with a notable correction. Where is Hobart going in 2024? Join us today in this exploration of the city’s current property market conditions and outlook!

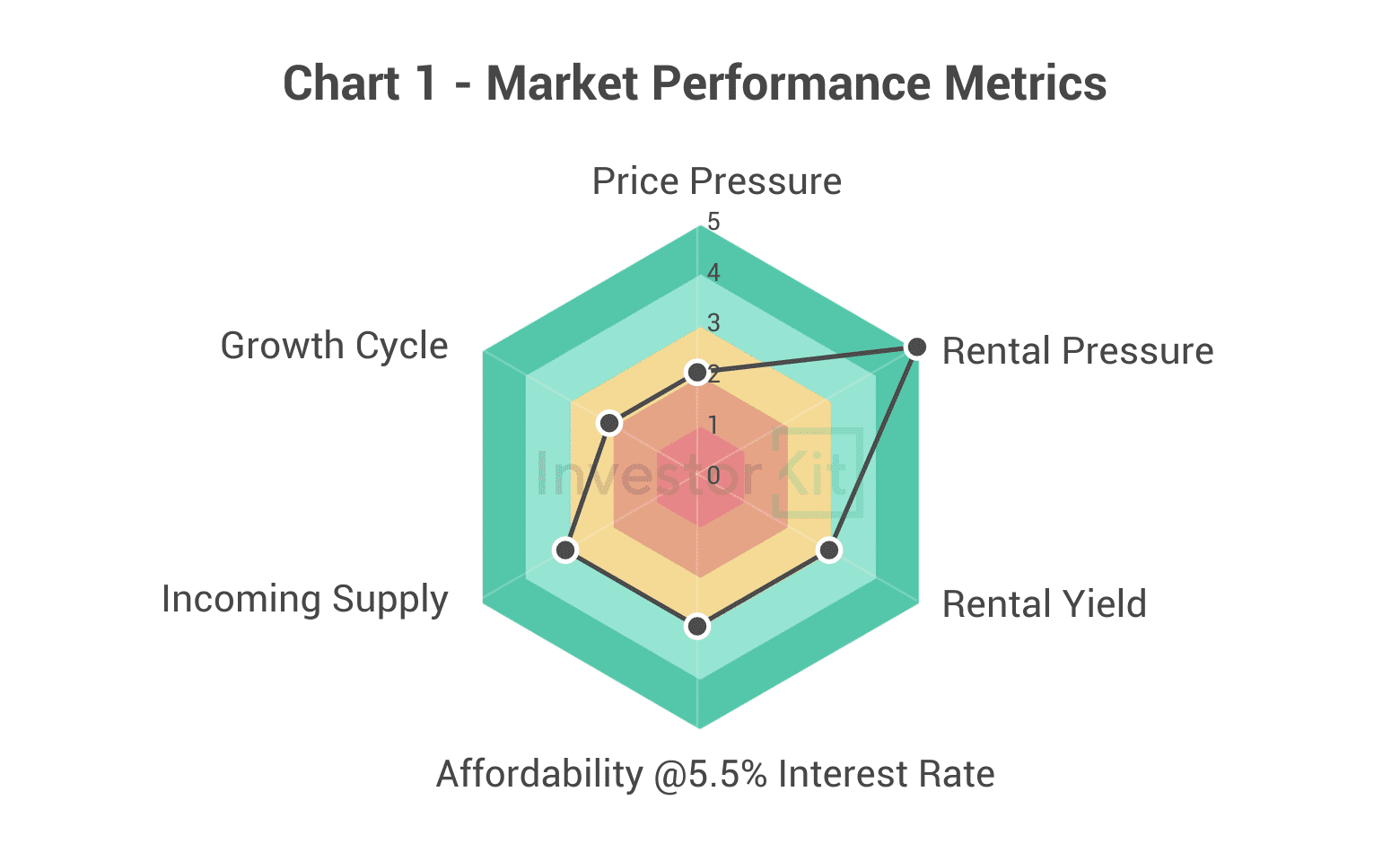

As of January 2024, Greater Hobart’s House Market Pressure is relatively Weak.

Among the 6 metrics InvestorKit uses to measure market performance, the rental pressure in Hobart is notably high, whilst the price pressure is still low, with an unfavourable position in its growth cycle. Other than that, incoming supply, rental yield, and affordability are all in a balanced position.

Demographic & Economic Trends

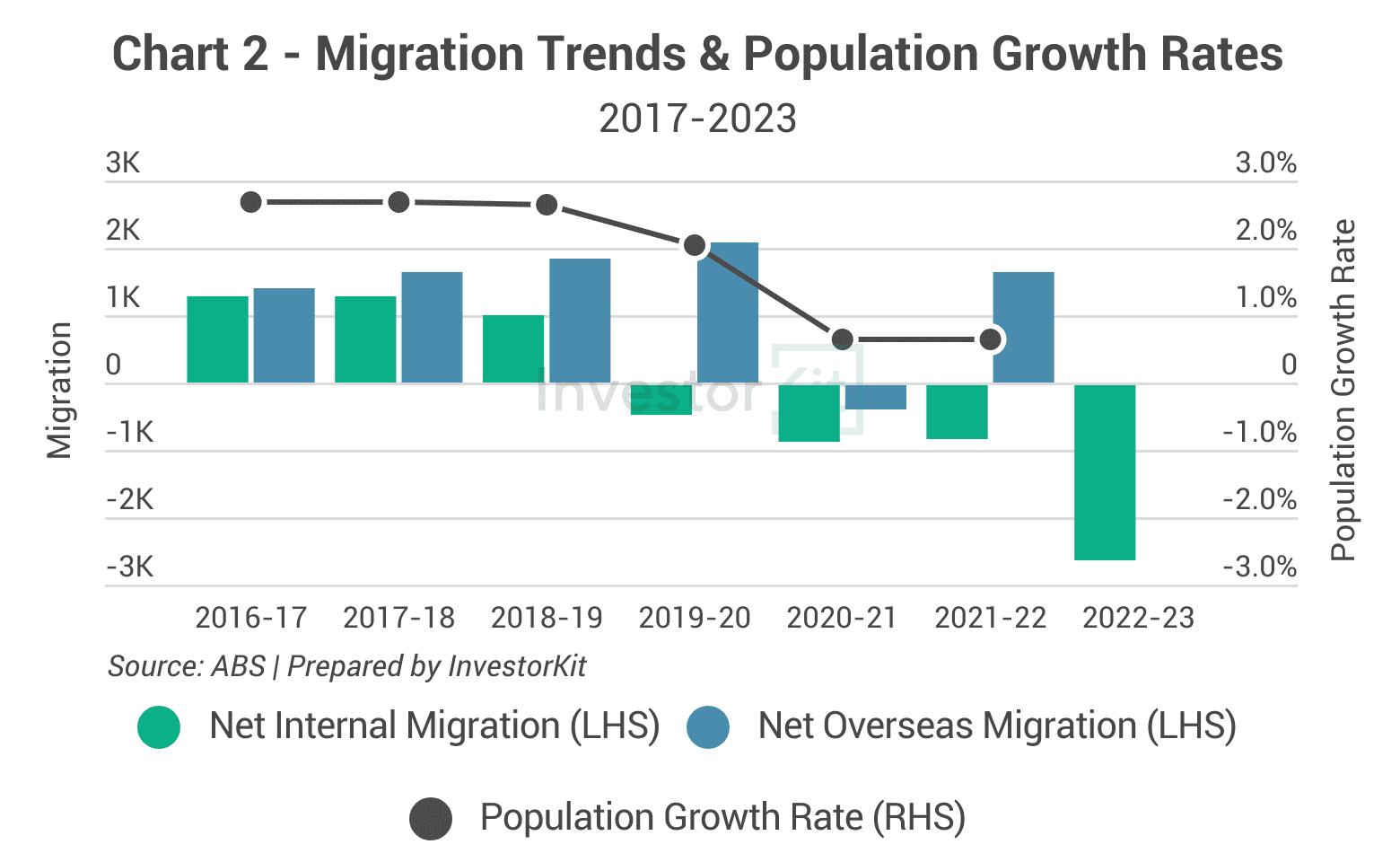

In the past 6-7 years, Hobart has been receiving more and more overseas migrants. COVID disrupted the momentum but we’re now seeing a strong bounce since the international border reopening. However, the decreasing number of net internal migrants indicates that Hobart is struggling to persuade its residents to stay. This negative internal migration since 2020 has slowed down Hobart’s population growth significantly.

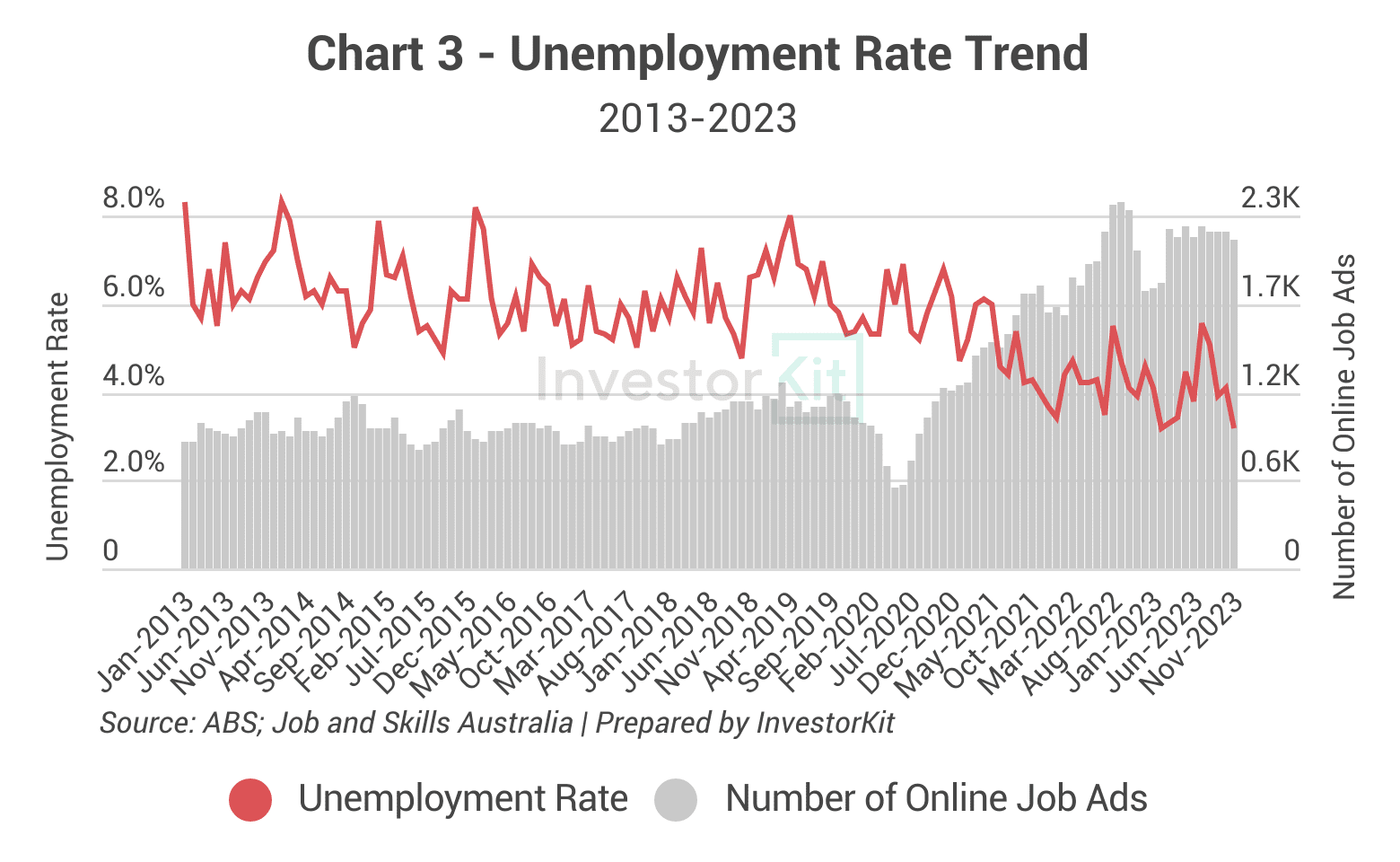

Despite the volatile nature of Greater Hobart’s unemployment rate, likely because 12%+ of employment opportunities are in tourism, the figure has been trending down since 2019, reaching the lowest level in a decade (3.2%) in 2023, indicating a thriving local economy.

Since the outbreak of COVID-19, the number of job ads in Hobart has increased exponentially to a peak in late 2022. We have observed a slight decline from the high peaks, but this doesn’t overshadow the larger trend that Hobart’s job market is much more active than pre-COVID.

Sales Market Trends

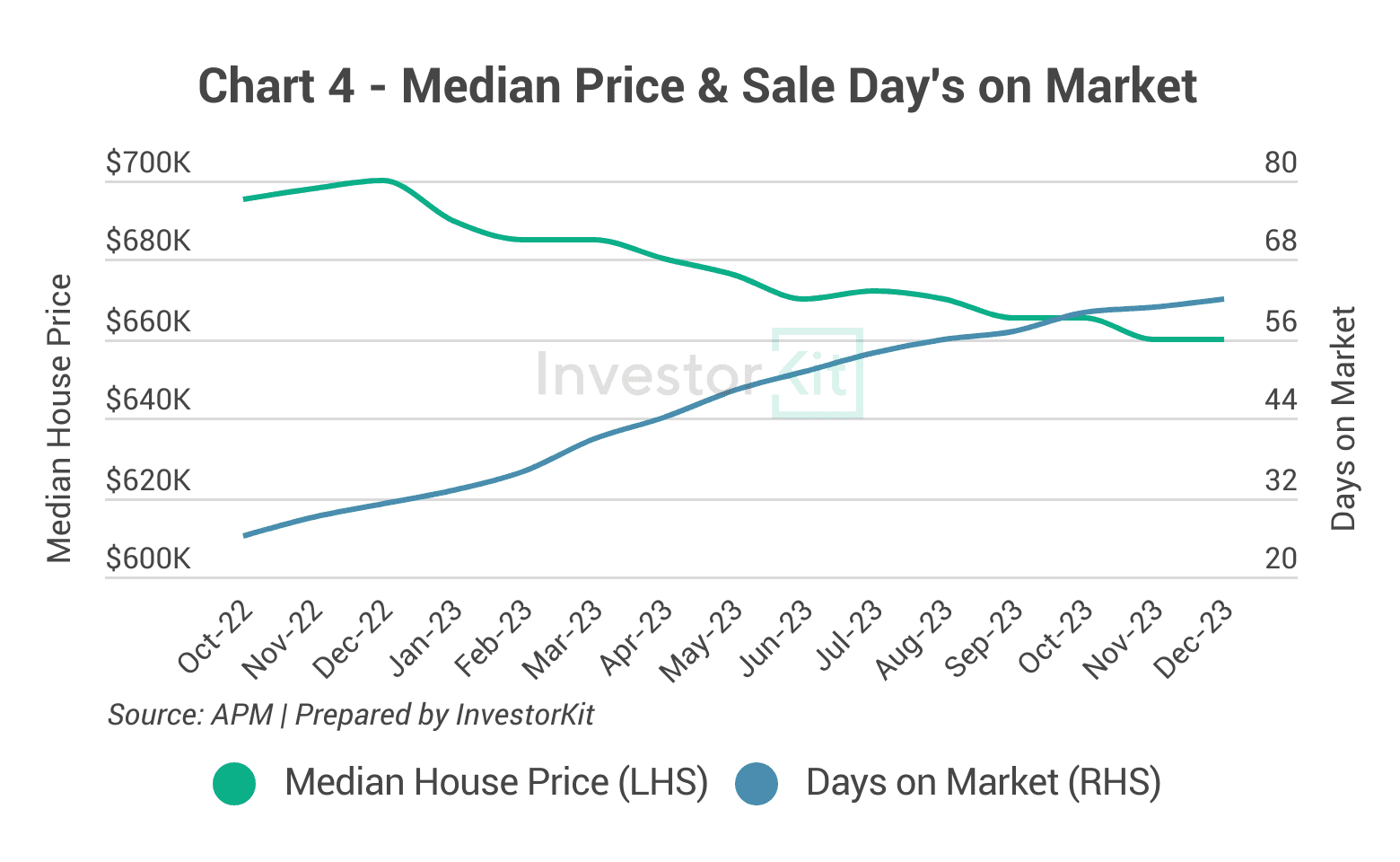

Over the past 12 months, the number of sale days on market has been increasing, indicating a relaxation of market pressure. As a result, Hobart’s median house price has been gradually dropping, down -5.7% in a year. This was what we anticipated late last year.

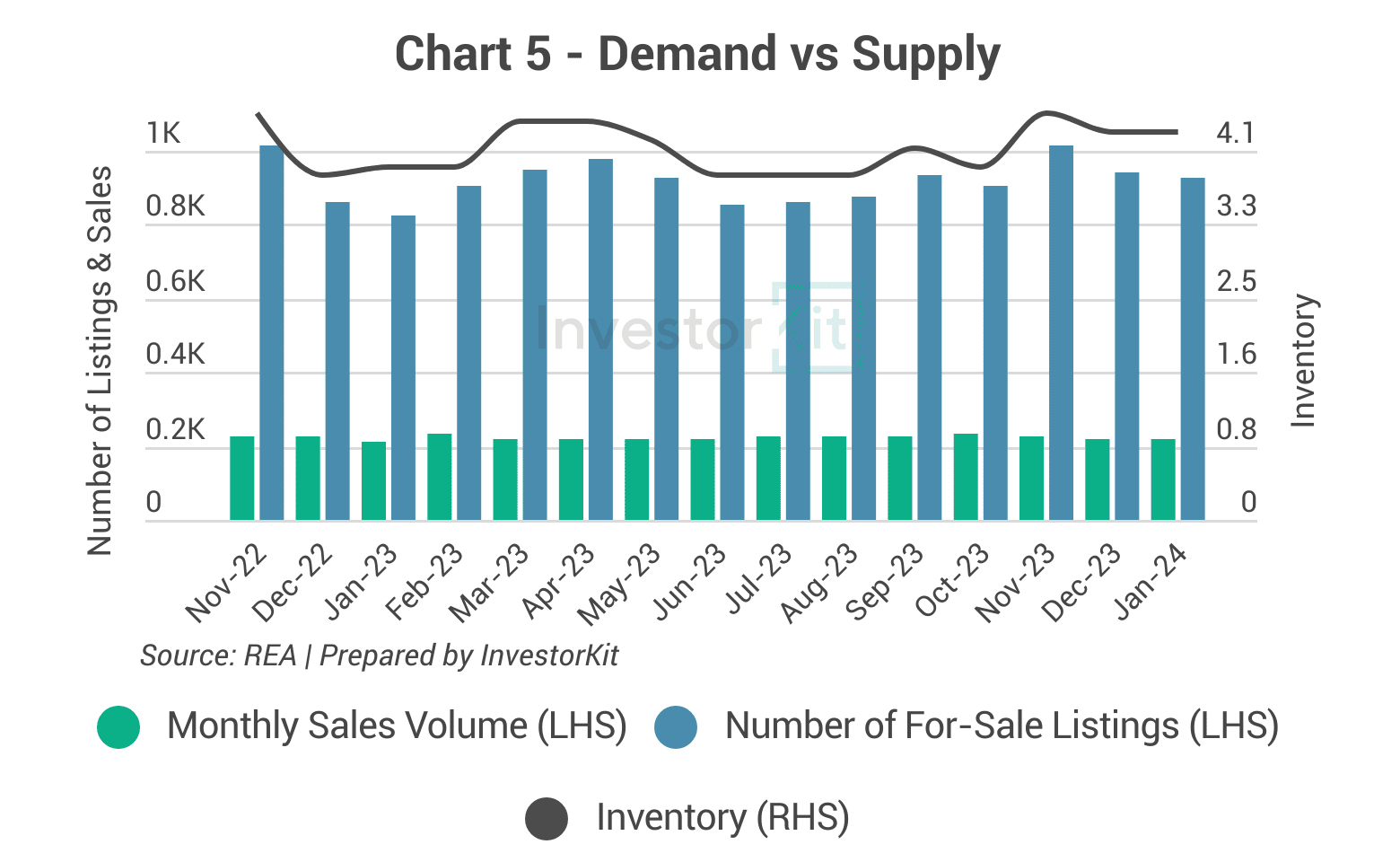

The number of sales in Greater Hobart has been stable, and the for-sale stock has been flucturating between 800 and 1000 in the past year. As a result, we see inventory hovering around 4 months of stock over the past year, a relatively high level, in line with the low market pressure reflected by increasing days on market and declining prices. Listing levels vs sales volumes will be key to watch in order to understand how the recovery goes from here.

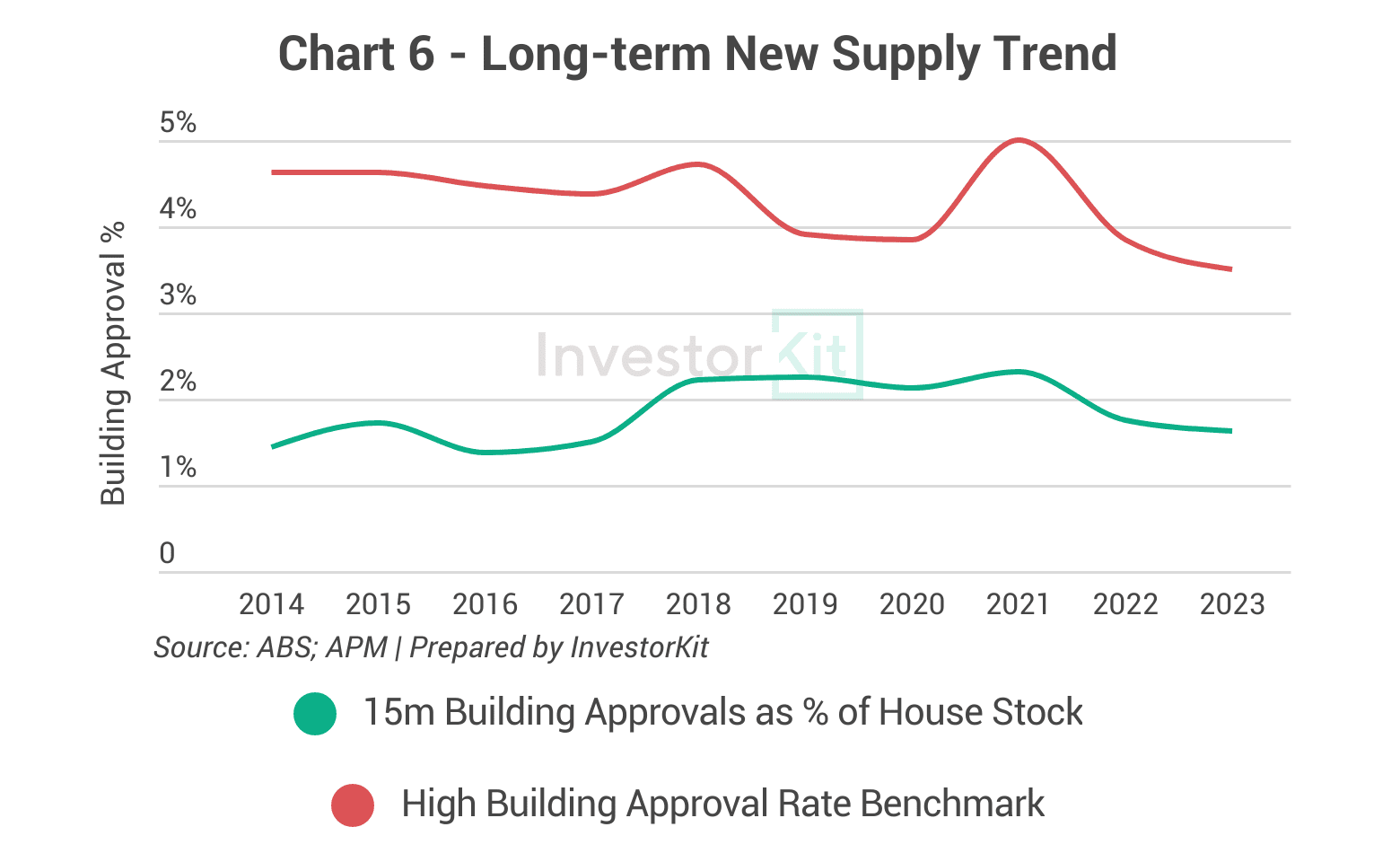

Over the past decade, Hobart’s new house construction activities have remained low and stable. The low level of new supply has contributed to Hobart’s house price surge since 2017 together with surging demand, and it will contribute to the market recovery in the near future once demand and confidence recover.

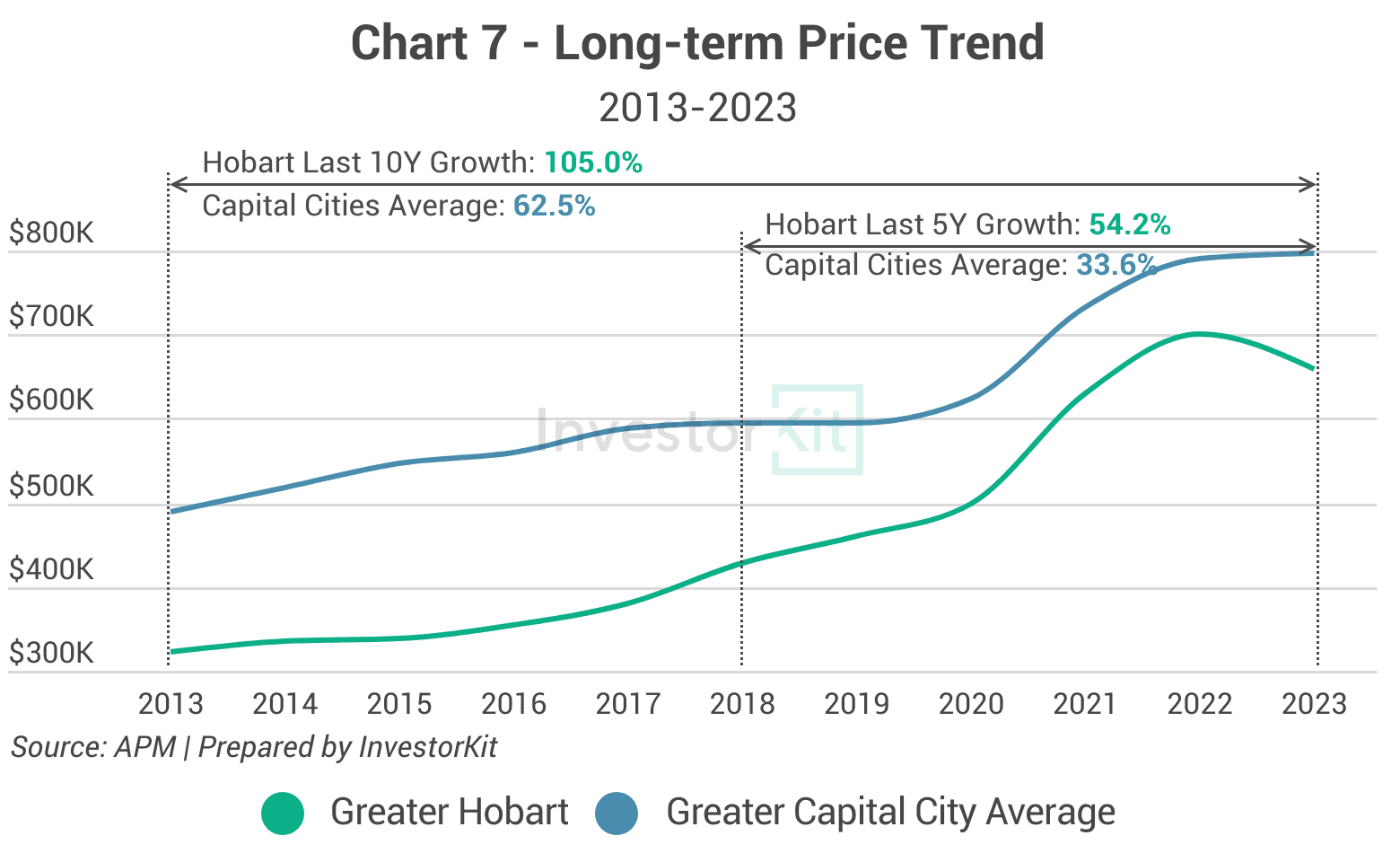

Over the past decade, Hobart’s house prices have seen a substantial increase of 105.0%, surpassing both its long-term average and the average of all greater capital cities (62.5%). Similarly, its performance in the last 5 years (54.2%) has remained higher than the capital cities average of 33.6%. The outperformance has reduced Hobart’s upside potential in the short term, and it needs more time for correction before the city regains growth momentum.

Rental Market Trends

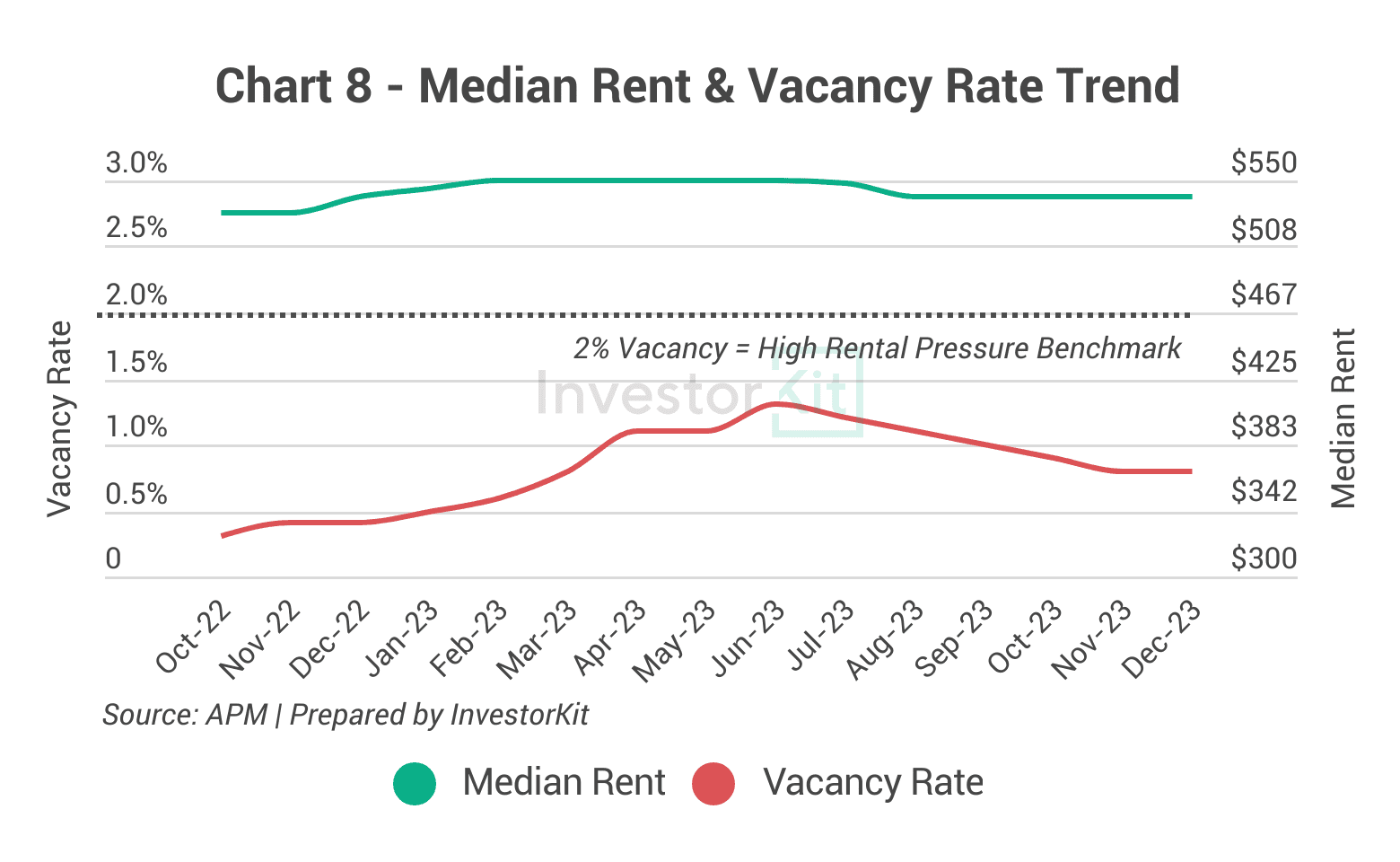

From the end of 2022 to mid-2023, Hobart saw its rental vacancy rate climb from 0.4% to 1.3%, which led to a release of rental market pressure and a slowdown in rental price growth. However, in the second half of 2023, Hobart’s vacancy rates have been declining, reaching a crisis level of <1.0% again in Q4. We expect Hobart’s rental growth to pick up some speed as a result of the lifted rental pressure.

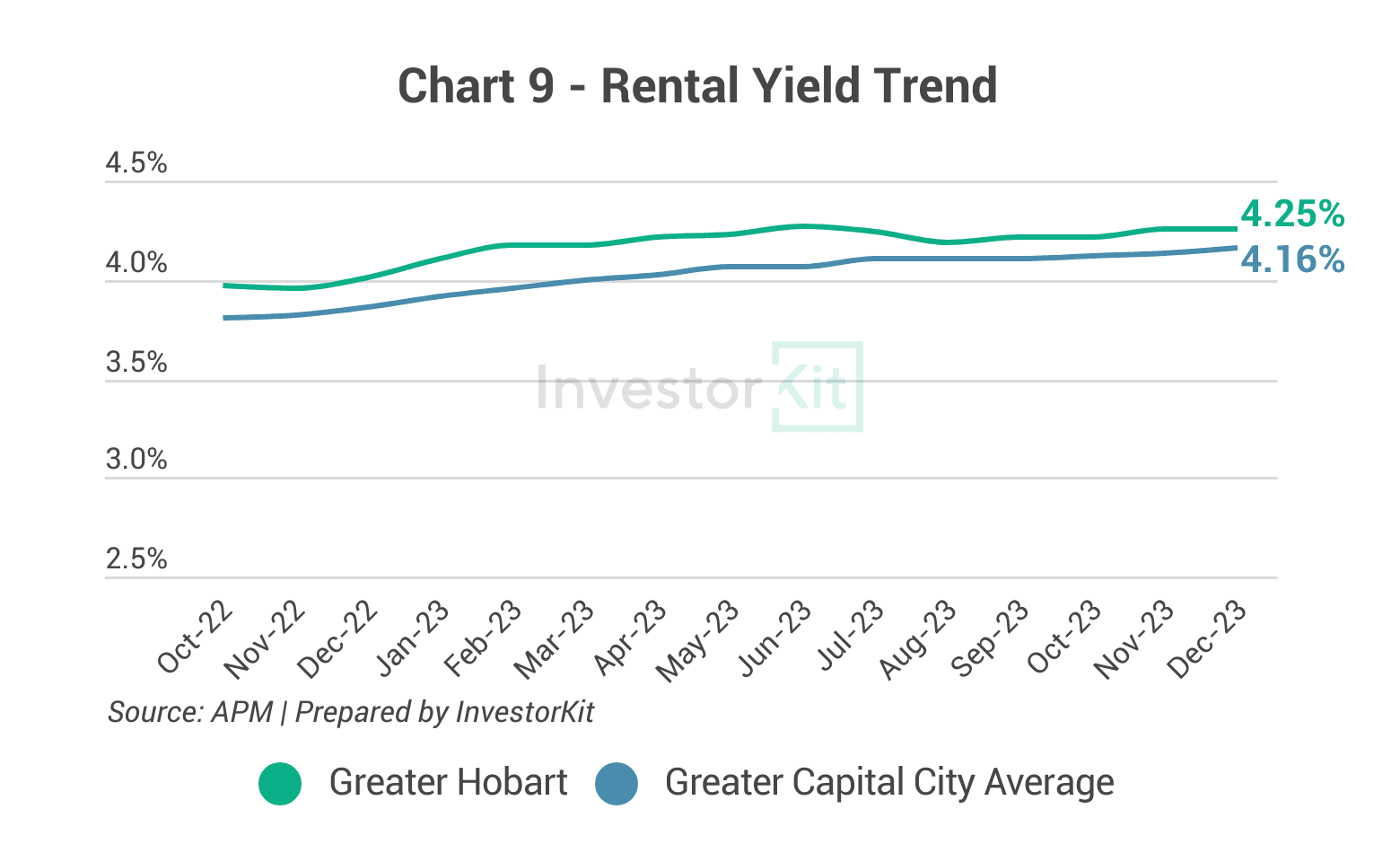

The decline in house values paired with unchanged rental prices has led to a slight increase in Greater Hobart’s rental yields. Now at 4.25%, Hobart’s rental yield is the third highest among all capital cities, after Darwin (5.88%) and Perth (5.27). As the rental market regains pressure and would likely push rental prices up again, we expect Hobart’s rental yield to further improve in the short term.

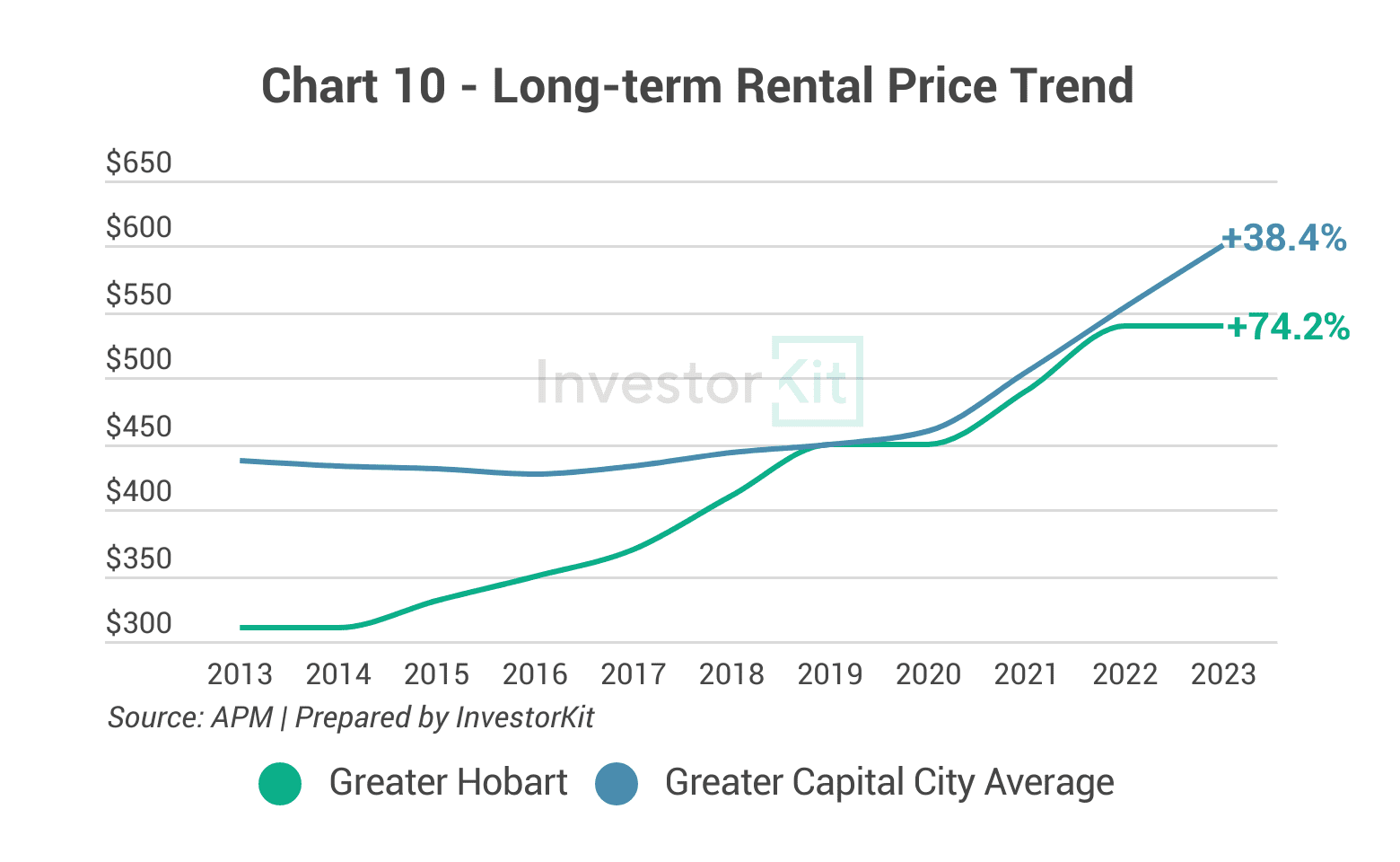

In the past decade, Greater Hobart’s rental prices have experienced substantial growth, registering a notable increase of 74.2%, almost double the average growth rate of greater capital cities (38.4%). Seeing the currently high rental market pressure, we expect Hobart’s rental prices to grow further but at a more modest pace.

In the next 6-12 months…

Greater Hobart’s house market has performed exceptionally well in the past decade, having achieved both the highest price growth and the highest rental growth among all capital cities. For now, the city has entered a correction phase with declining house values and flattened rental prices. In the sales market, we do not see any robust recovery in the coming 6-12 months, given the low market pressure (rising sale days on market, rising vendor discount and a relatively high inventory). In the rental market, the extremely low vacancy rate may push rents further up but at a much milder pace. However, in the longer term, once Hobart has stepped out of this correction phase, the city’s low housing supply level, thriving economy, and massive infrastructure improvements will, no doubt, help its property market achieve robust growth again.

As the sixth city in our Market Pressure Review Blog Series, Hobart’s trajectory tells a unique story. Stay tuned for more city insights to come! Check our News & Insights for previous volumes on Sydney, Melbourne, Brisbane, Adelaide and Perth!

InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

Acknowledgement:

Thanks to Douglas Bygrave for his invaluable assistance with chart preparation and drafting.

.svg)