Perth and Its Robust Comeback

With a 2m+ population, Perth is Australia’s fourth-largest city. However, it is the second most affordable capital city to buy a house in, with a median house price lower than half of Sydney’s. This is all because of the market decline from 2013 to 2020. In 2023, Perth shone as the best performer in both the sales and rental markets, attracting investors from across the country flocking into the market. Today, let’s dive into the data and find out why Perth has become such a superstar!

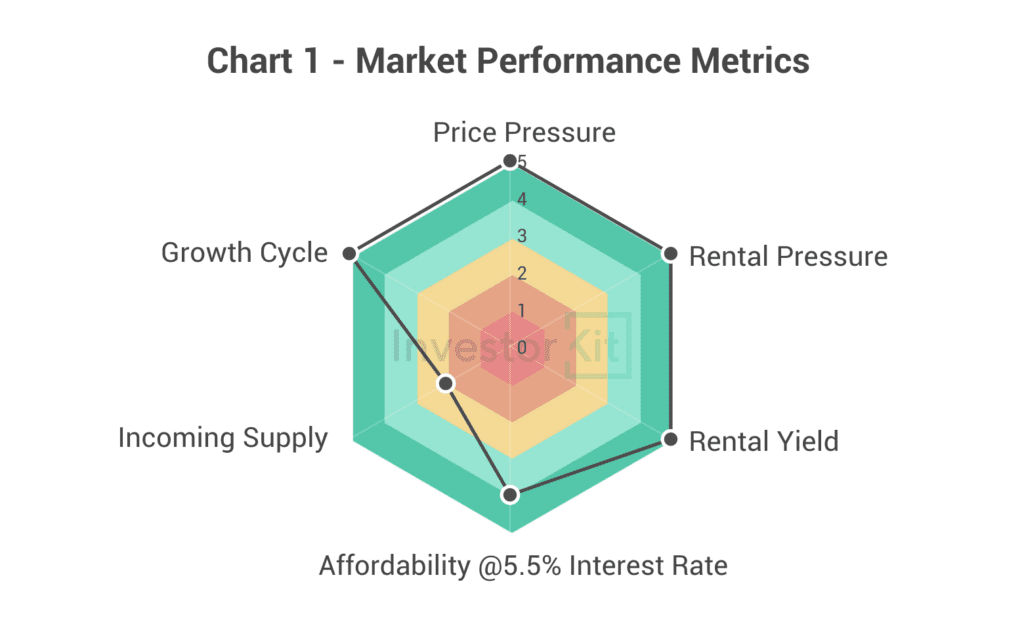

As of December 2023, Perth is showing signs of a hot market with high pressure.

Perth scores high in every metric InvestorKit uses to measure market performance except Incoming Supply, which is seen in relatively high new house building approvals as the city expands. Details are discussed below.

Demographic & Economic Trends

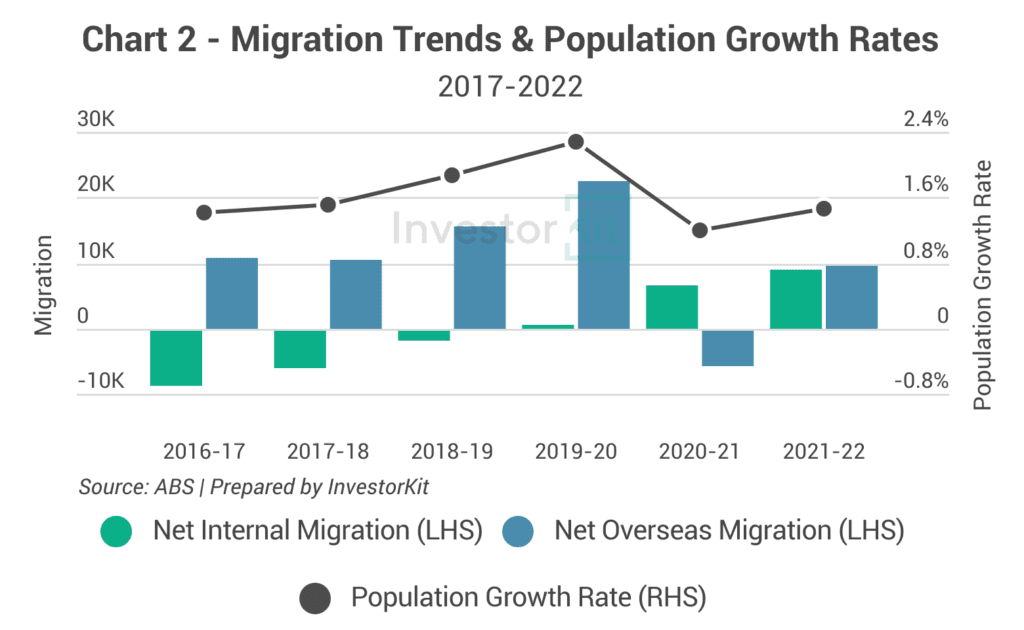

Perth’s net internal migration has been rising in the past 5 years as the local economy recovers gradually from the end of the last Mining Boom. Net overseas migration was also increasing acceleratingly before the COVID border closure, and we’re seeing a strong recovery since the international border reopened. The robust migration trends have made Perth the second strongest capital city in population growth in FY2021-22, just after Brisbane.

While Greater Perth’s population growth data in FY2022-23 is not available yet, in FY2022-23, Western Australia’s population growth surged by 3.1%, ranking #1 among all states. As the capital of WA where 80% of the state’s population is concentrated, Perth’s population growth should be around 3% in the latest financial year, showing robust growth momentum.

Behind Perth’s high population growth is the city’s strong economic comeback.

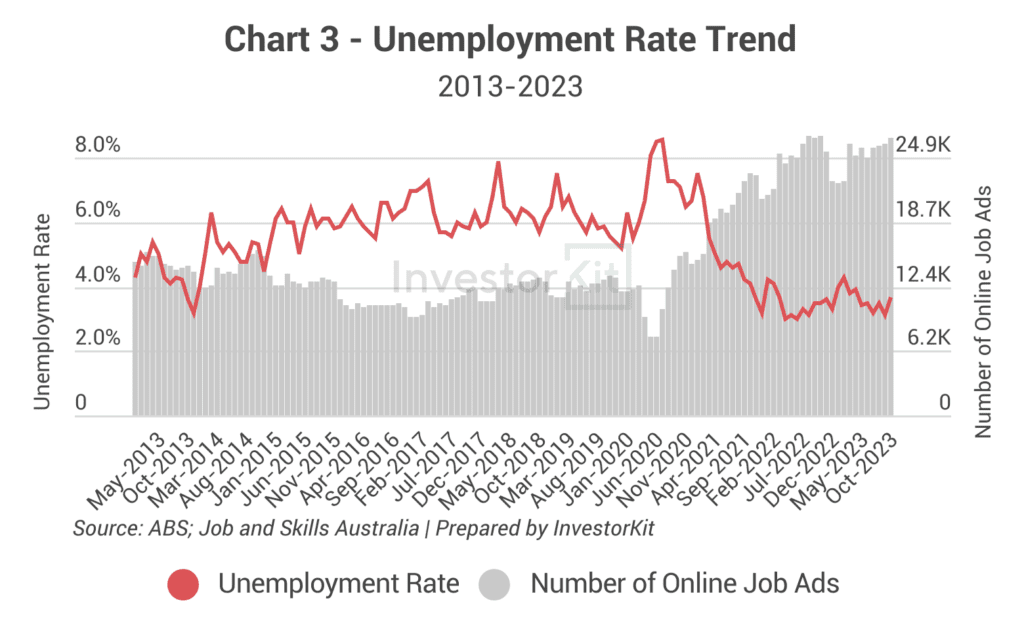

Being the top contributor to Perth’s GRP and employment opportunities, Mining significantly influences Perth’s economy. The unemployment rate has been trending up since 2013, indicating a weakening economy as a result of the end of the Mining Boom. In the meantime, the number of job vacancies declined. The subdued economy lasted until 2020, when iron ore & oil prices surged, creating a big rise in job opportunities and a steep decline in unemployment rates. The current unemployment rate has been hovering below 4% for 2 years, showcasing the most active job market in a decade.

Sales Market Trends

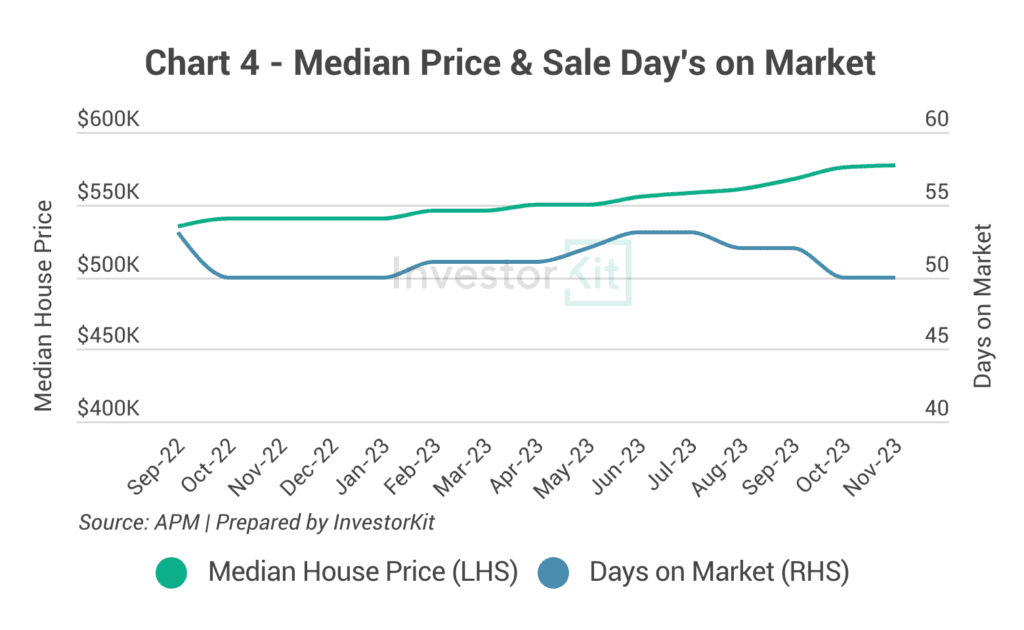

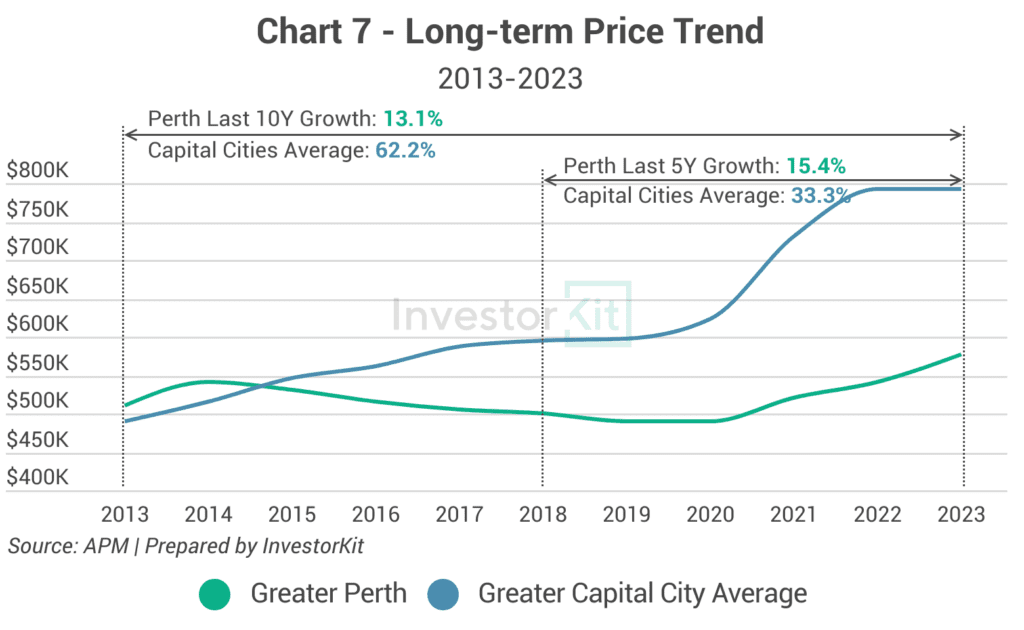

Despite a brief -0.6% decline in late 2022, Greater Perth’s house prices have been increasing steadily over the past 3 years. In the 12 months to the end of Nov 2023, Perth’s house market has achieved 13.8% growth, the highest among all capital cities.

The Sale Days on Market, a leading indicator of market pressure, has been hovering between 50-53 in the past year. The recent downward trend suggests that market pressure is still rising.

With a median price of $577k, Perth’s houses are not only perfectly affordable relative to the local income levels (undervalued by -18% assuming interest rate = 5.5%, and by -6% if interest rate = 6.5%), but also quite attractive to investors from the eastern states, where capital-city house prices have skyrocketed.

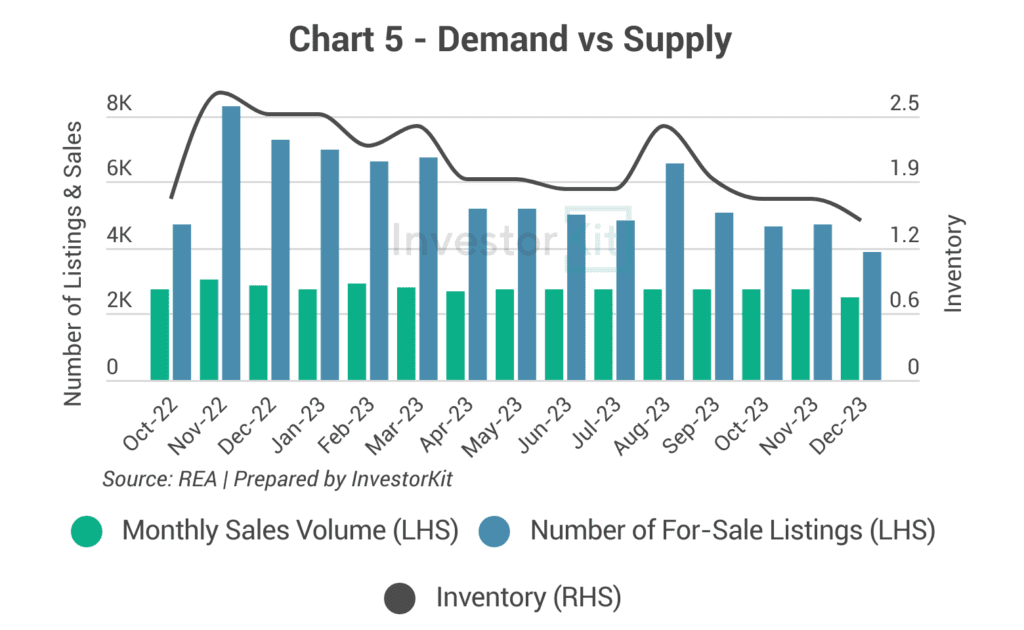

Perth’s high market pressure is reflected by its demand-supply relationship as well. The monthly sales volume (demand) has largely stayed stable, while the number of listings (supply) has been declining over the past year. As a result, Perth’s house inventory decreased from a low 2.7 (3-3.5 is considered balanced) in Nov 2022 to an extremely tight 1.5 today, suggesting high yet still increasing market pressure.

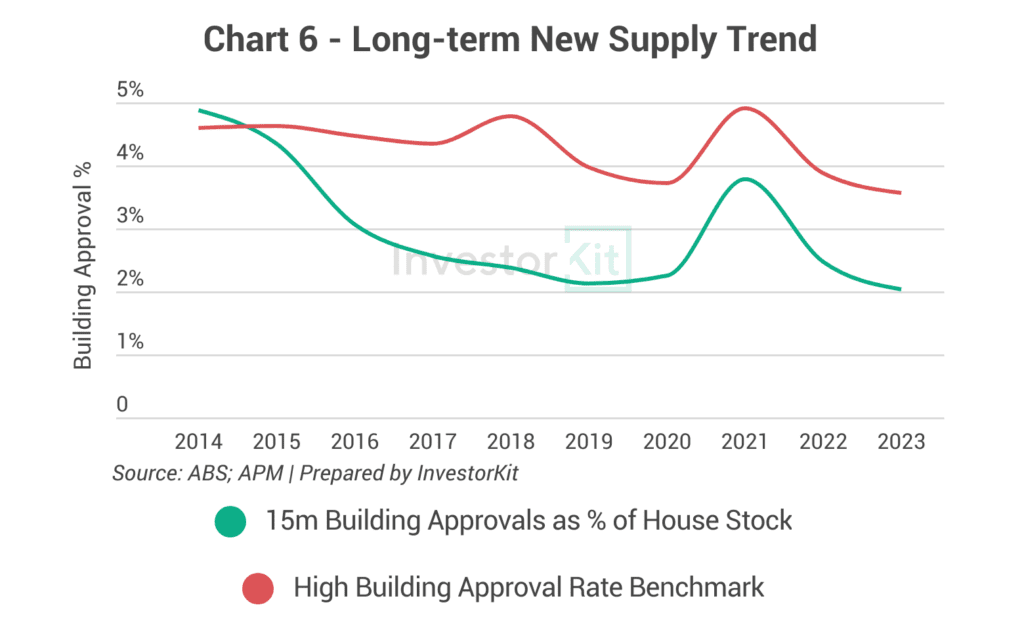

Perth’s new house construction activities have trended down over the past decade, only stimulated by the HomeBuilder Grant in 2021. Currently, the proportion (%) that new house building approvals represent in the total house stock in Perth is at a balanced level of around 2%: Not as low as many cities on the east coast, but not high enough to create oversupply.

Perth’s house price growth in the past decade significantly lagged behind most other capital cities due to its extended economic decline. The lag gives Perth plenty of space to grow once all influencers come together well, such as now. In the short term, we expect Perth to continue the robust catch-up, considering its high and increasing market pressure.

Rental Market Trends

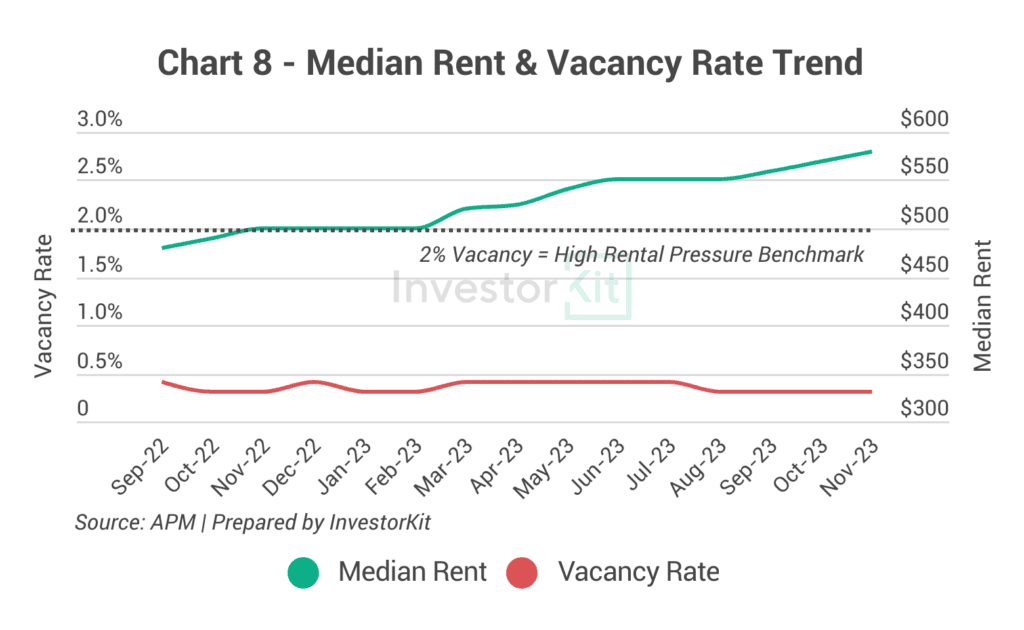

With a crisis-level vacancy rate of 0.3%, Greater Perth’s rental market is under extremely high pressure. This high pressure has led to a 16.0% annual increase in house rental prices, the highest among all capital cities. Further increases are expected as the rental pressure remains high.

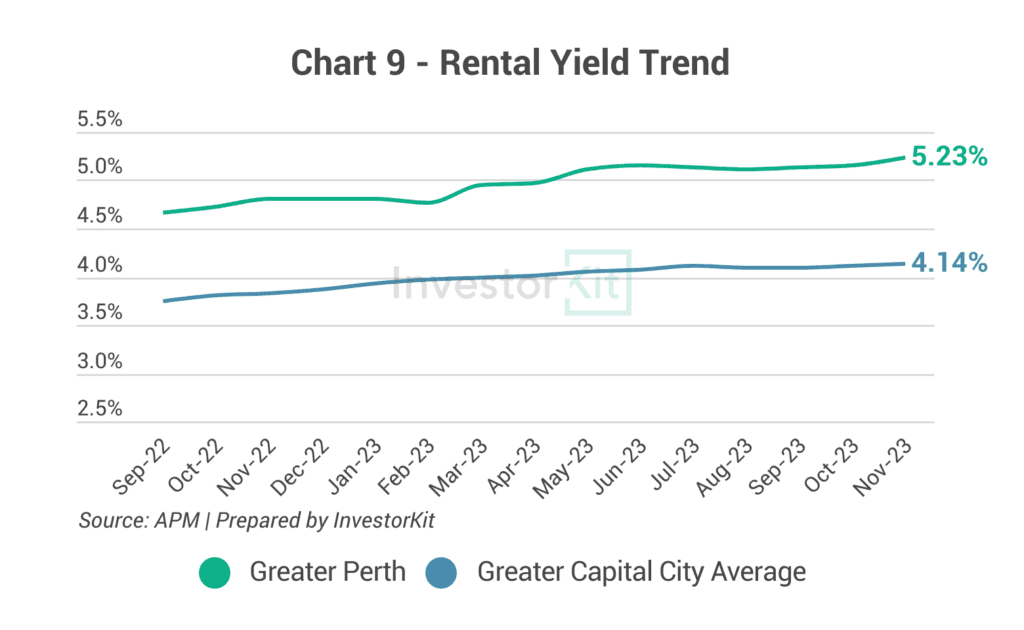

In a high-interest-rate environment like today, high yield is especially appealing to investors in order to achieve a healthy cashflow. Therefore, it’s easy to get that one of the major reasons why Perth attracts so many investors is because of its high rental yields. As rents surge faster than house value, rental yields in Perth have increased considerably over the past year, from 4.7% to 5.2%. This is much higher than Brisbane and Adelaide’s 4%, not to mention Sydney and Melbourne’s 3%.

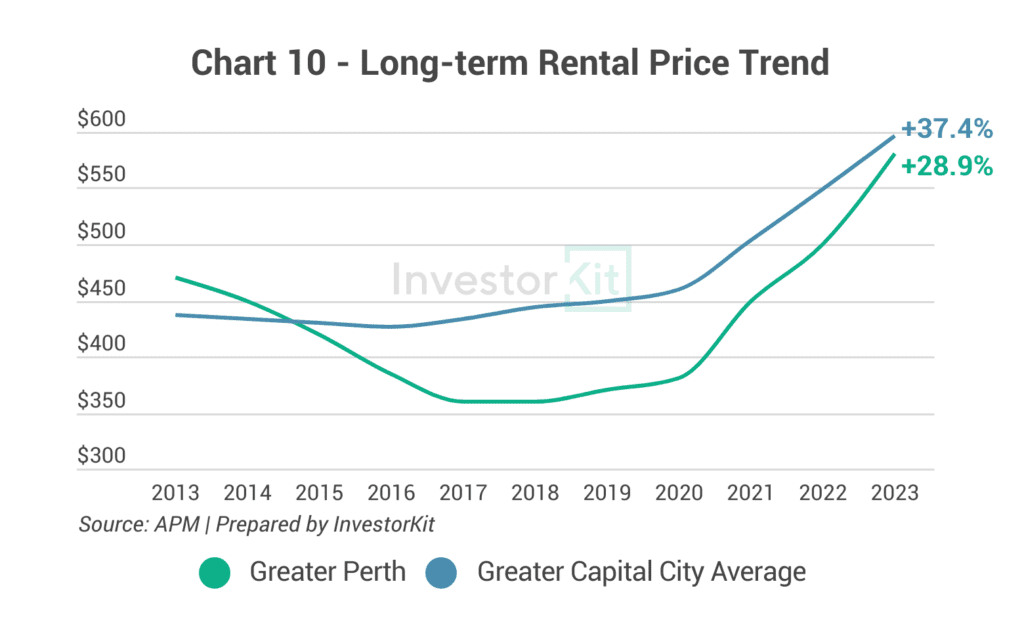

Over the past decade, Greater Perth’s rental prices have grown by 37.4%, higher than the capital cities’ average growth rate. However, the extremely low vacancy rate indicates that rents will likely keep the robust growing momentum in the short term before slowing down.

In the next 6-12 months…

As Greater Perth’s housing market experiences high pressure with low inventory and declining days on the market in the sales sector, and low vacancy rates in the rental market, prices are expected to maintain robust growth momentum in the coming 6-12 months in both sales and rental markets.

However, it’s important to remember that Perth and Western Australia’s economies are still heavily reliant on the mining industry, especially iron ore mining. Iron ore prices are forecasted to remain relatively high in the coming years, benefiting Perth’s economy and its property market. In the longer term, however, as production increases worldwide and demand from China, the largest iron ore consumer, declines, prices will likely decrease. Will Perth experience another period of subdued economic growth? That’s something investors need to consider when deciding to buy in Perth.

Perth is the fifth city we examine in this Market Pressure Review Series. Stay tuned for the next city to come! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)