Hundreds of factors influence the property market, some more significant than others.

InvestorKit categorises the important influencers into three types of fundamentals: demand, supply, and confidence, and we’re creating a trilogy of articles to introduce them to you.

We started with the demand fundamentals, which include people movement, economic activity, finance, and affordability – Everything driving housing demand.

Then, we moved on to the supply fundamentals, introducing how to measure the established supply and incoming supply and how they influence prices together with demand.

Today, shall we wrap this trilogy up on a high note by examining the confidence fundamentals?

We examine three Confidence Fundamentals as listed below:

- Consumer Sentiment

The level and moving trend of the Consumer Confidence/Sentiment Indices not only indicate households’ confidence in general spending but also their confidence in spending on housing.

- Media Cycle

What the media says has a huge influence on the public’s opinion. If the media sounds confident in the property market, the public will be confident, too, and vice versa.

- Governments’ Support

Government policies also have a profound impact on the public’s confidence. While incentives or encouraging policies boost confidence, suppressive policies damage it.

Now, let me show them to you one by one.

Consumer Sentiment

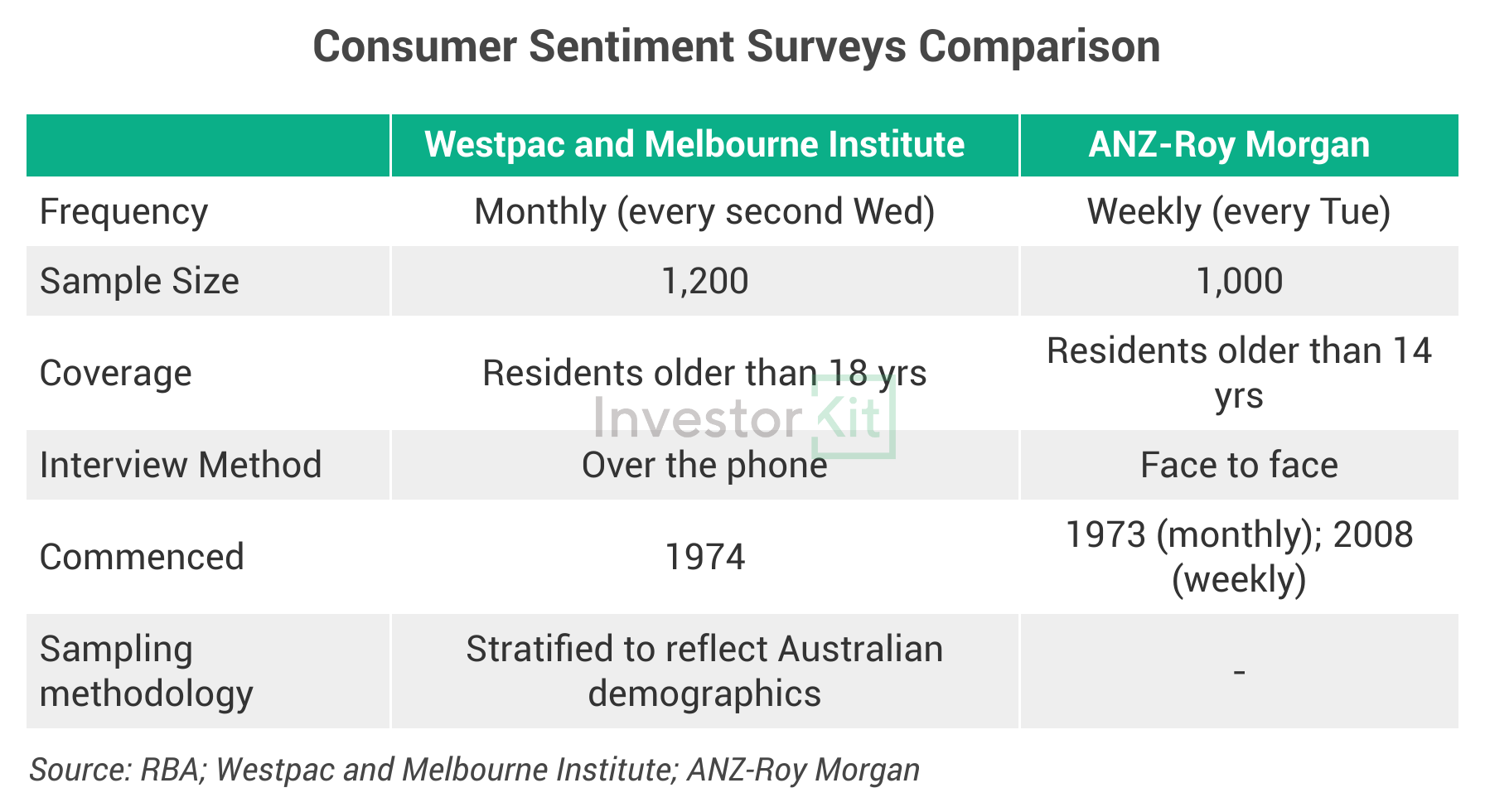

Australia has two leading consumer sentiment/confidence indices: the Westpac-Melbourne Institute Consumer Sentiment Index and the ANZ-Roy Morgan Consumer Confidence Index. They are generated through similar surveys. The table below shows the features of each survey.

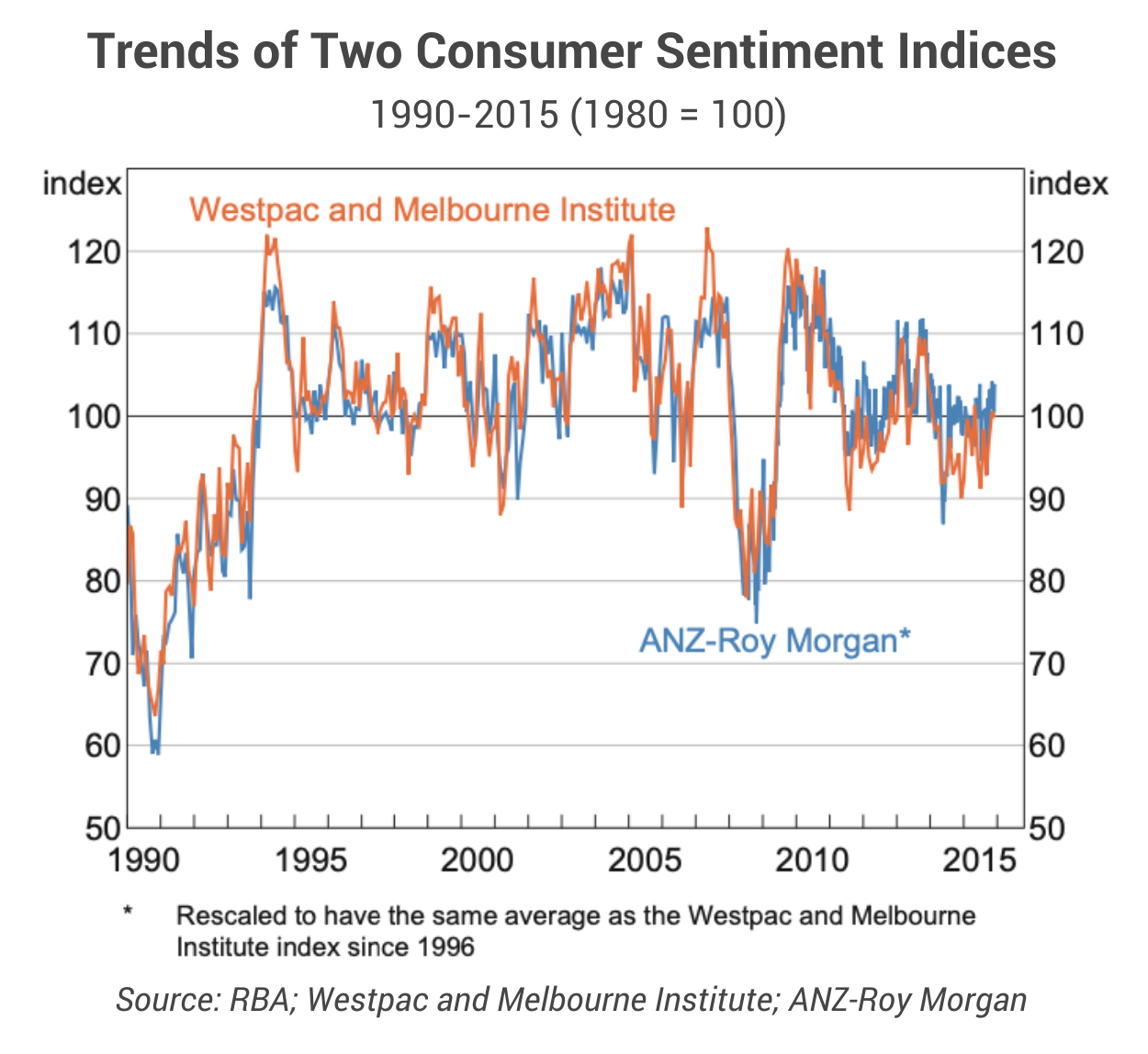

The differences in surveying methodology result in different index values; however, the two indices have correlated well over time (chart below).

Intuitively, consumer confidence links with housing consumer sentiment: When households are confident about their income and wealth, they should be confident in spending on both daily purchases and large items, such as properties.

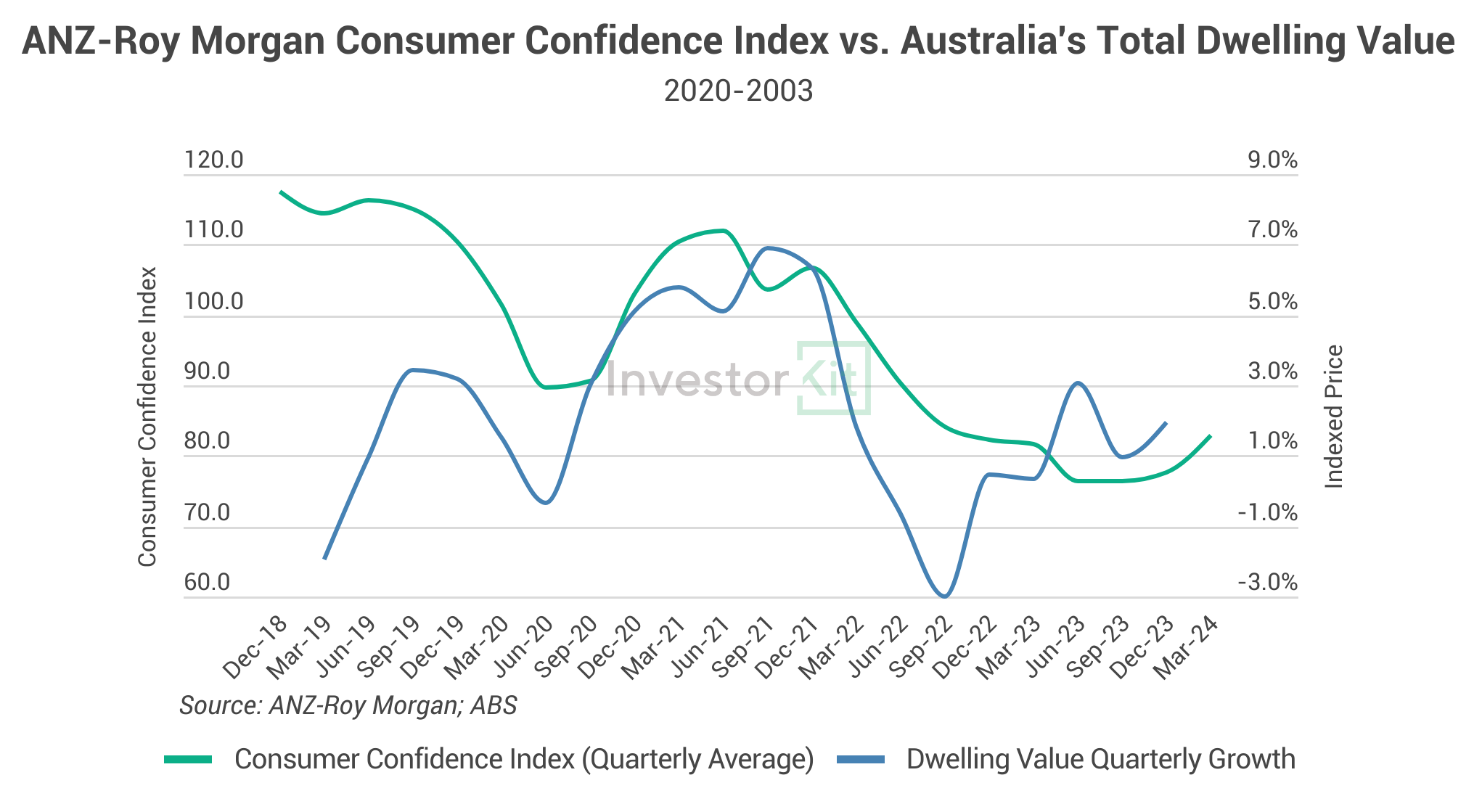

The chart below shows the relationship between the ANZ-Roy Morgan Consumer Confidence Index and Australia’s total dwelling value over the past 5 years.

- From 2018 to early 2020, consumer confidence dropped from 117 to 90, and Australia’s dwelling value was declining for most of that period.

- From 2020 to early 2022, consumer confidence was boosted by governments’ financial support (e.g., JobKeeper Payment, spending vouchers) and surging household savings. During this period, the property market experienced an unprecedented boom.

- From early 2022 to 2023, households were discouraged by high inflation and interest rate hikes. As a result, consumer confidence declined in 2023 to the lowest point in more than 30 years. In the property market, dwelling value declined sharply in 2022, followed by a weak recovery in 2023.

- Currently, in early 2024, consumer confidence is gradually recovering as inflation gets under control and interest rates have stabilised. This is a good sign that the property market will start gaining more solid growth.

Media Cycle

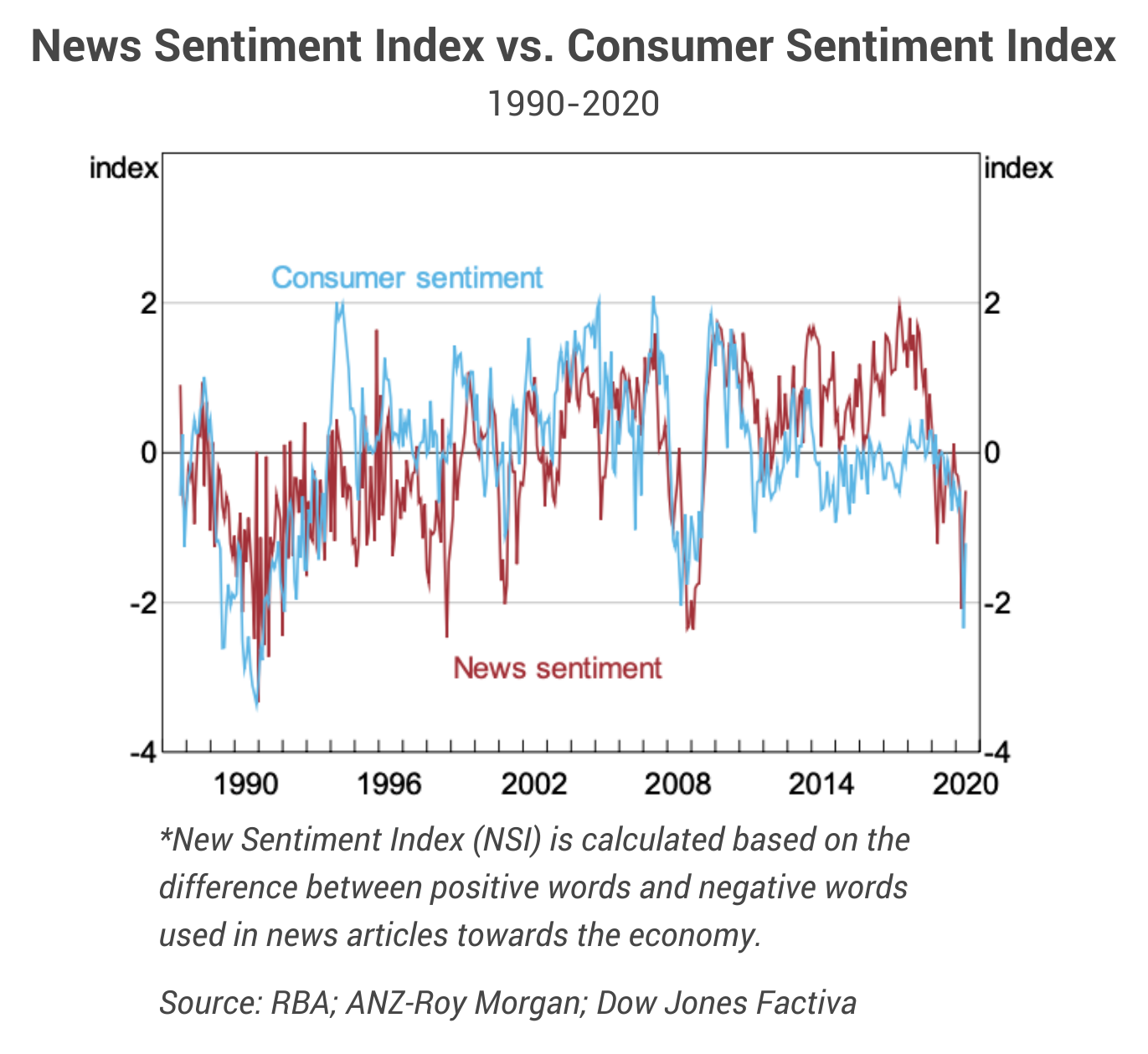

Research shows that the media has a great influence on the public’s confidence in the economy. The chart below, extracted from a 2020 RBA research, shows how news sentiment has correlated with consumer sentiment (ANZ-Roy Morgan Index) over the past 30 years.

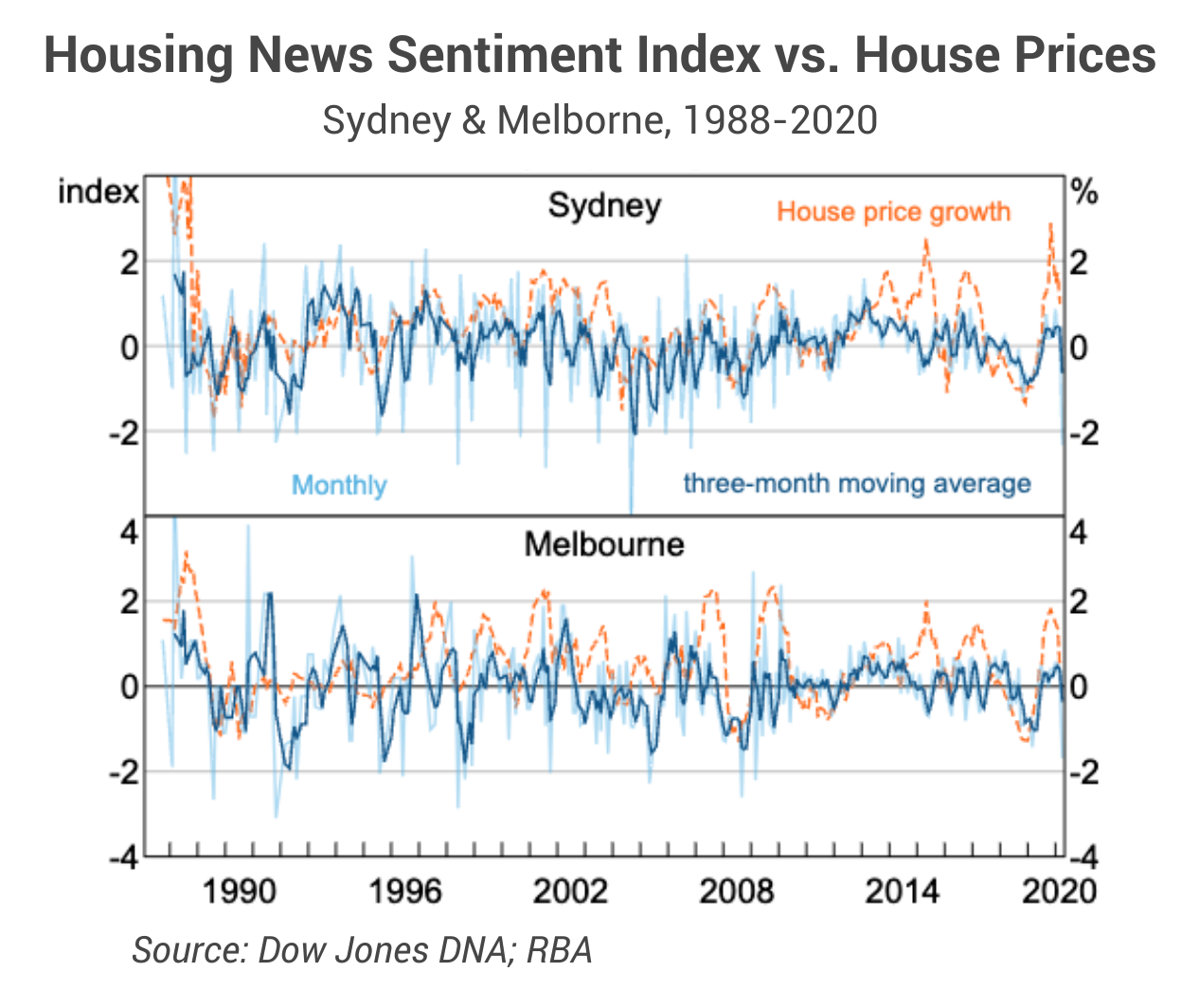

Similarly, housing news sentiment influences property market performance. In the same RBA research, economists found that in Sydney and Melbourne, Australia’s two largest property markets, the local housing news sentiment captures key fluctuations in the local house prices (chart below).

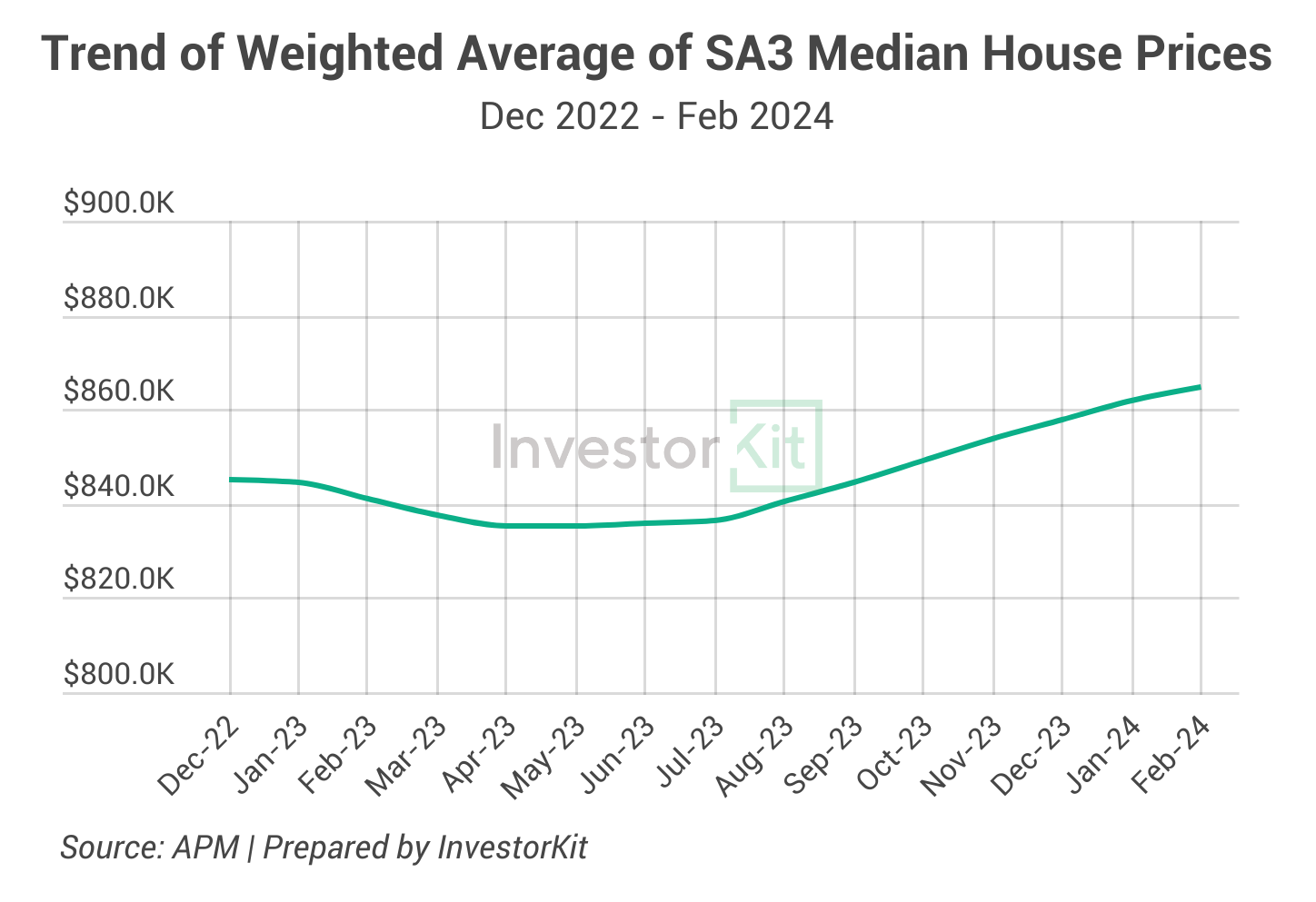

At the end of each financial year, InvestorKit does a similar exercise to measure housing news sentiment in Australia. In July 2022, we found that 32.5% of housing market news articles from the 3 largest media (ABC, AFR, News Corp) were pessimistic about the property market, 24% were positive, and the rest were neutral. In July 2023, only 17.9% were pessimistic, indicating higher news sentiment. The news sentiment improvement made us believe that Australia’s housing market would gain strength in the coming financial year. And it turned out, just as expected, that price growth started picking up in the second half of 2023 (chart below).

Government Policies

Historical data has shown that government incentives or encouraging policies boost property buyers’ confidence, and unfavourable policies discourage property buyers.

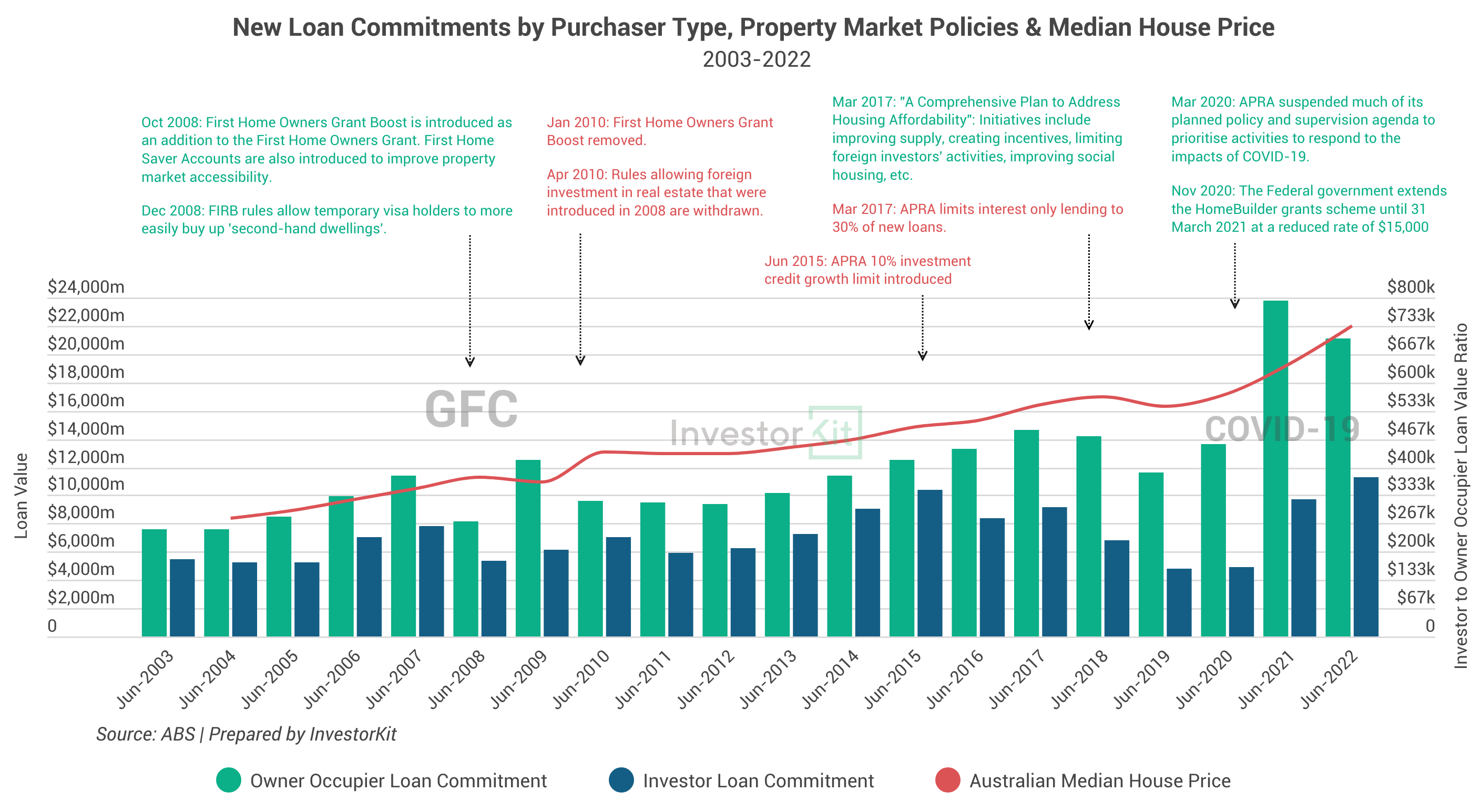

The chart below shows Australia’s property market trend in the two decades from 2003 to 2022, with major government policies noted along the journey (green = encouraging; red = discouraging).

- The FHOG Booster and the loosening up of FIRB restrictions in 2008 significantly encouraged owner-occupying buyers, as seen in the big jump in the number of owner-occupier home loan commitments in 2009. However, the removal of these policies two years later brought down the number of owner-occupying buyers immediately.

- The 2015 and 2017 APRA policies to limit investment activities both immediately supressed investors’ confidence, as seen in the decrease in investor loan commitments in 2016 and 2018.

- In 2021, the encouraging policies and cash incentives, together with the historic low interest rates and high household savings, boosted both owner-occupiers’ and investors’ confidence in property purchasing and pushed the number of both groups to the highest level in over a decade. At the same time, prices skyrocketed, leading to the COVID property boom.

The impact of government policies on the property market can be seen on lower levels as well. One example is Victoria. The state’s land tax change in 2023 has triggered a large number of investors to leave the state. According to local investors, the state’s increased land taxes, high council rates, and high compliance costs have all damaged their confidence in property investment in Victoria.

In summary, consumer sentiment, media cycle, and government policies are three confidence fundamentals that greatly influence the property market. Now you know what to look for when examining the property market pressure and trends.

InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system, in which fundamentals analysis is essential. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)