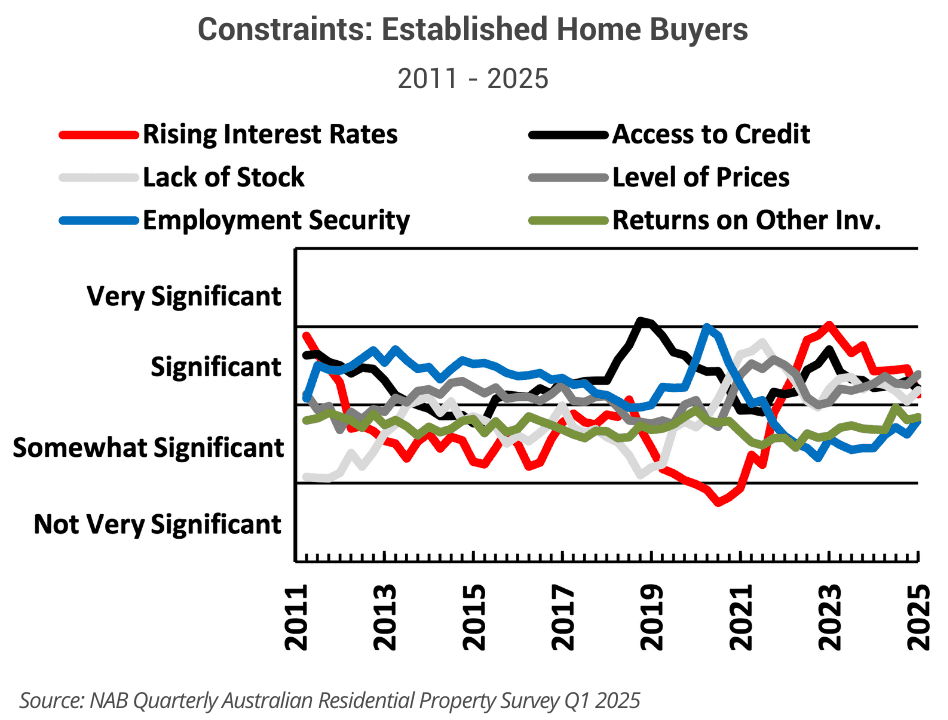

The idea of escaping the renting trap and owning a place to call “home” has long been the Aussie dream, but for many, that dream is drifting further out of reach. According to CoreLogic’s July HVI report, the national median dwelling price has surpassed $837,000, with the median house and unit prices now above $905,000 and $686,000, respectively. In NAB’s latest Residential Property Survey, price levels and low housing supply overtook interest rates as the biggest hurdles for buyers.

While house prices continue to soar in many parts of the country, wage growth remains sluggish. Over the past five years, median house prices have increased by a total of 47.1%, while average earnings have grown by just 20.4%, less than half the pace. This imbalance has widened the affordability gap, pricing more buyers out of the market.

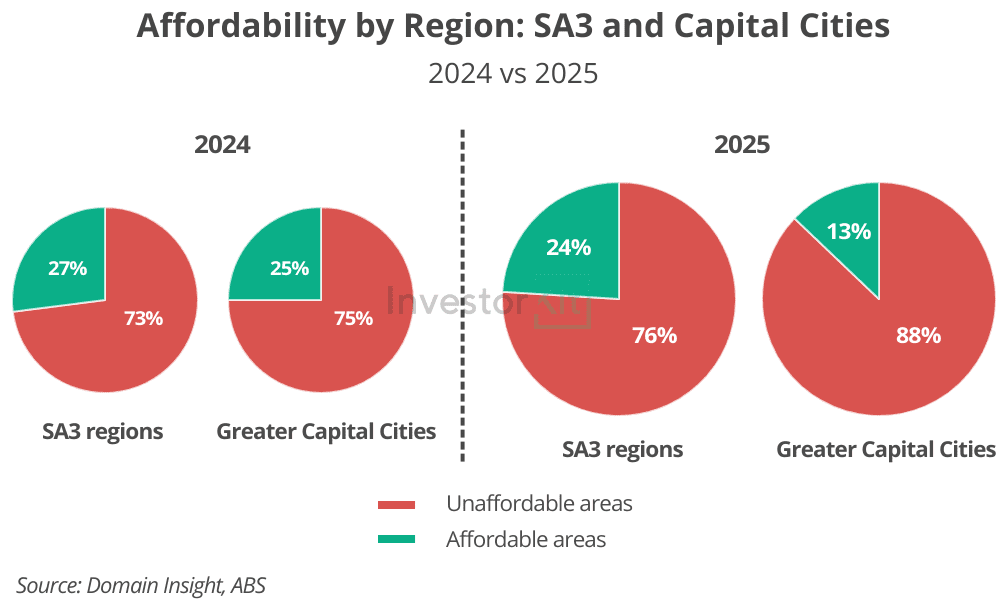

Our analysis of 331 SA3 regions and 8 Greater Capital City Statistical Areas (GCCSAs) shows that by May 2025:

- At the SA3 level, about 252 out of 331 regions (76%) are now considered unaffordable when the interest rate is at 6%, a 3% increase compared to 2024.

- At the capital city level, Perth has joined the unaffordable groups, leaving Darwin as the only city still within reach for the average buyer.

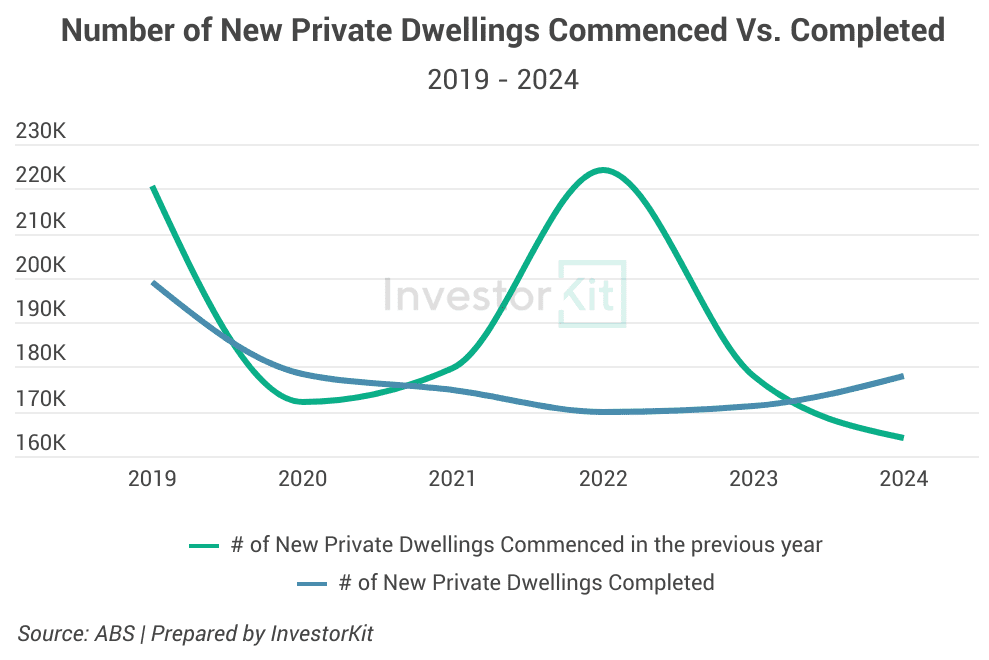

The tight housing supply continues to challenge affordability. While Australia’s population has grown steadily, the new housing supply has struggled to keep up. In 2024, according to ABS, only around 178,000 new residential dwellings were completed, well below the estimated 254,000 homes needed to meet demand targets in 2023.

To keep pace with population growth and address the backlog from years of undersupply, both the National Housing Finance and Investment Corporation (NHFIC) and the Housing Industry Association (HIA) recommend building at least 200,000 new homes annually. Yet, slightly more than 168,000 dwellings were approved in 2024.

The Four Pillars of Labor’s Housing Plan

Against this backdrop, the Albanese government has made housing a central focus in its second term. The strategy focuses on increasing supply, supporting first-home buyers (FHB), and improving affordability. The four major initiatives include:

- National Housing Accord: Launched in August 2023, this initiative aims to deliver 1.2 million new homes between 2024 and 2029, starting from 1 July 2024.

- Housing Australia Future Fund (HAFF): A $10 billion fund to build 30,000 social and affordable homes by 2029.

- Help to Buy Scheme Expansion: Originally launched in 2022, this initiative allows eligible FHBs to co-purchase with the government. This scheme is expected to commence later in 2025.

- Foreign Investment Ban: A 2-year ban (April 2025 to March 2027) on foreign purchases of established homes was implemented to ease competition and redirect investment into new housing.

These initiatives sound promising, yet a question remains: “Will they successfully deliver fundamental changes in Australia’s property market?” Let’s find out below.

Labor’s Housing Policies Are Unlikely to Significantly Shift Market Dynamics in the Short Term

#1: The 1.2 Million Homes and 30,000 Affordable Dwellings Goals Are Likely to Fall Short

The ambitious goal to construct 1.2 million new homes and 30,000 social and affordable dwellings by 2029 is facing major headwinds. To stay on track, Australia would need to deliver over 240,000 new homes annually from 2025 onwards. However, in 2024, only around 168,131 new dwellings were approved, a 30% shortfall against the annual target. Housing completions also have consistently lagged behind commencements. Between 2019 and 2024, completions trailed starts by roughly 6%.

To understand the underlying reasons why Australia’s 1.2 million homes target is unlikely to be met, check out our previous blog by clicking here.

#2: The Help to Buy scheme is expected to increase FHB activity and potentially drive up property prices rather than improve housing affordability.

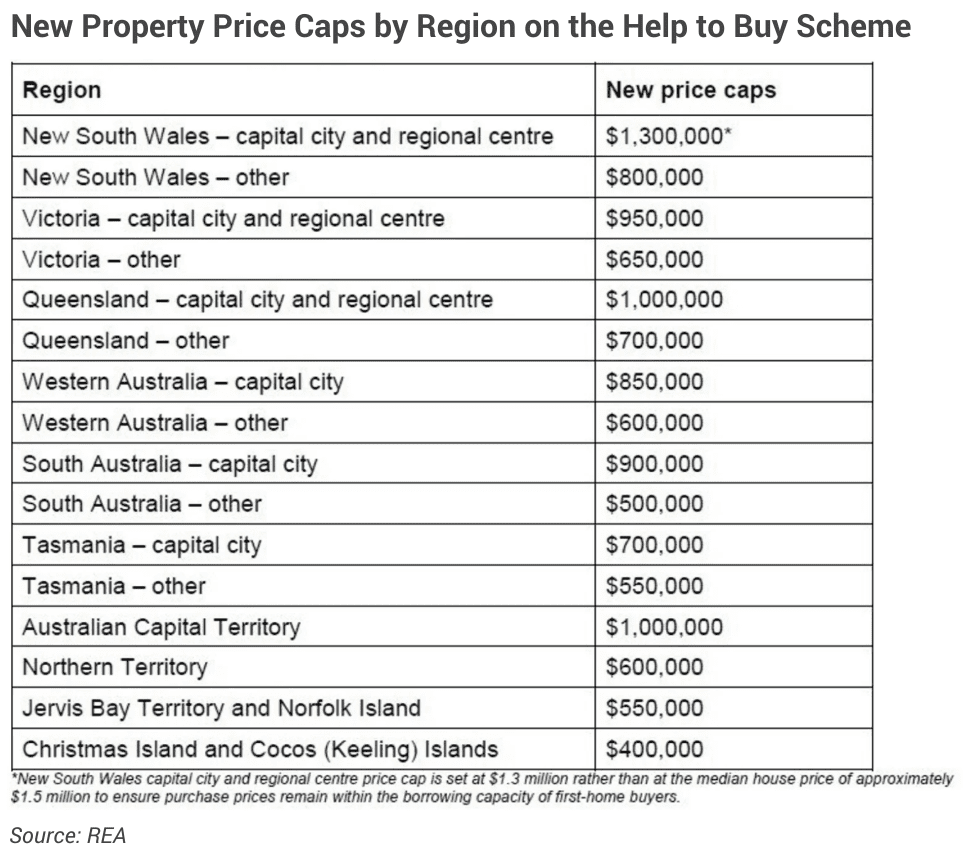

Under the latest updated Help to Buy scheme, income caps have increased to $100,000 for singles and $160,000 for couples, with new property price caps introduced (see table below).

By raising the income thresholds and these caps, the scheme enables more buyers to enter the market and target a broader range of properties, particularly in high-demand cities and segments where prices sit just below these thresholds.

With government contributions of up to 40% for new homes and 30% for existing ones, and only a 2% deposit without LMI is required, FHB activity is expected to pick up and potentially fuel competition.

A number of previous studies on other FHB programs have shown that they are likely to put higher pressure on property prices, especially in markets where supply is constrained.

- Blight, Field & Henriquez (2012), “The First Home Buyer Grant and house prices in Australia“. This study found that the FHB schemes increased Australian median house prices by approximately $57,321 (18.8%) at the time. The grant boosted demand in a market with inelastic supply, leading to higher prices rather than greater affordability.

- AHURI (2022), “Assisting first homebuyers: an international policy review”. The report revealed that FHB programs have failed to improve affordability and have benefitted existing homeowners more than new buyers by inflating property prices.

- AHURI (2023), “Financing first home ownership: modelling policy impacts at market and individual levels”. The report showed that FHB incentives can increase demand and prices, with limited effectiveness in improving long-term affordability.

- Our previous analysis conducted by Junge Ma, “Do First-Home Buyer Incentives Help Improve Housing Affordability Or Worsen It?” (2024), concluded that FHB grants did not improve affordability or contain price growth. Instead, house prices grew faster as increased demand pushed prices higher.

While the Help to Buy scheme is expected to raise property prices, its impact will vary across different states and markets. The effect will likely be more noticeable in the affordable and mid-tier segments, while luxury or high-end markets may see little direct impact. Supply constraints in established areas could further amplify price pressures where demand is strongest.

#3: The 2-year Ban on Foreign Investment is likely to create modest short-term relief for the established housing market.

Previously, foreign non-residents were banned from buying established homes for investment, while temporary residents could purchase one to live in and sell it upon leaving Australia. Under the latest ban, all foreigners, including temporary residents and foreign-owned companies, are prohibited from buying existing properties between April 2025 and March 2027.

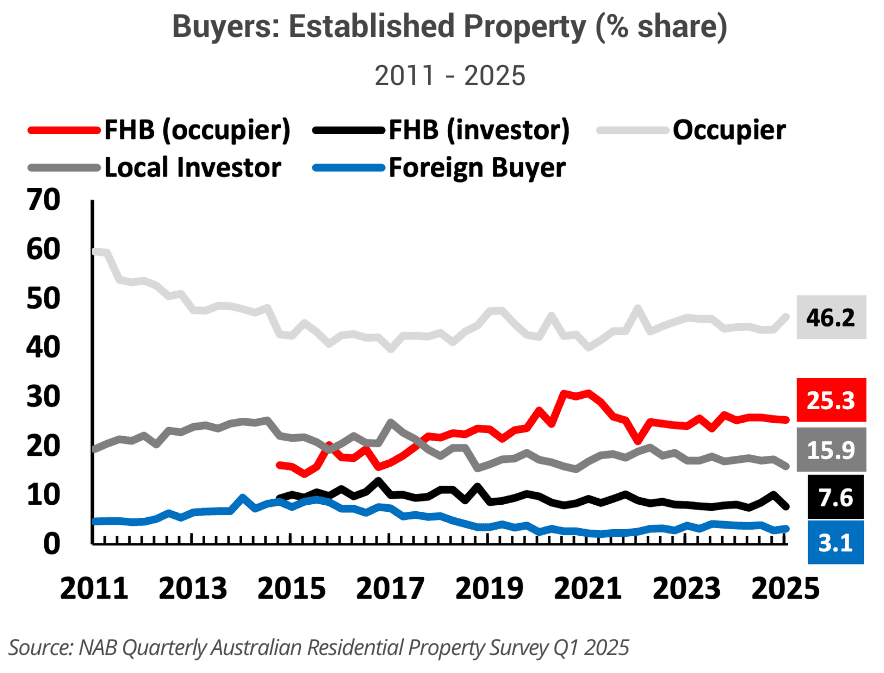

This could create short-term relief by reducing competition in the established market. However, the overall impact is expected to be insignificant, as foreign buyers account for only 3% of all established property buyers, and their share has declined since 2024 (NAB’s latest Residential Property Survey).

In short,

Amid the housing crisis, the Albanese government’s housing policies are unlikely to bring significant relief to the property market in the short run. Key initiatives encounter structural and implementation challenges that limit their immediate impact.

- The target of 1.2 million new homes and 30,000 social and affordable dwellings by 2029 is likely to fall short, as current construction levels are behind what is needed to meet demand.

- The Help to Buy scheme is likely to increase demand and drive up property prices rather than improve housing affordability.

- The temporary ban on foreign buyers may create modest relief in the established markets.

Overall, good news for investors is that dwelling prices are expected to continue climbing, and rental pressure is likely to remain high in the coming year, driven by increasing housing demand, undersupply, and upcoming rate cuts.

If you’re considering entering the market, now is a strategic time to act. At InvestorKit, we’re dedicated to helping you identify high-performance markets and assisting you in making data-backed decisions to accelerate your portfolio’s growth. Would you like to start your investing journey or accelerate your portfolio growth? Get in touch today by clicking here to request a free, no-obligation 15-minute discovery call!

.svg)