Australia’s major cities are among the least affordable housing markets in the world.

Governments try to help property buyers, especially first-home buyers, access housing ownership primarily through cash incentives, such as the ongoing First Home Owner Grant (FHOG), stamp duty exemptions, the Homebuilder program during the pandemic, etc.

However, are these incentives helping improve affordability or worsening it?

Let’s discuss it in this article.

Price Growth Pace Before and After the Introduction of the FHOG

Australia’s First Home Owner Grant (FHOG) was introduced in July 2000, where first-time home buyers can receive a $7,000 once-off payment to offset the cost of the GST. How fast did house prices grow before and after that?

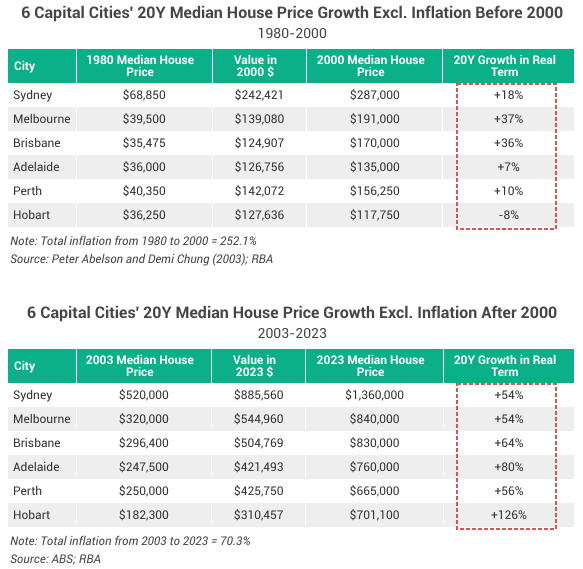

The two tables below show the changes in six capital cities.

Across all six cities, house prices grew faster in the two decades after the introduction of the FHOG than in the two decades before.

The FHOG didn’t help suppress price growth but has possibly boosted it.

Understandably, the extra thousands of dollars help increase your upfront payment affordability, making it easier or more attractive to enter the market. As more home buyers excitedly enter the market, market demand increases, and prices go up in response.

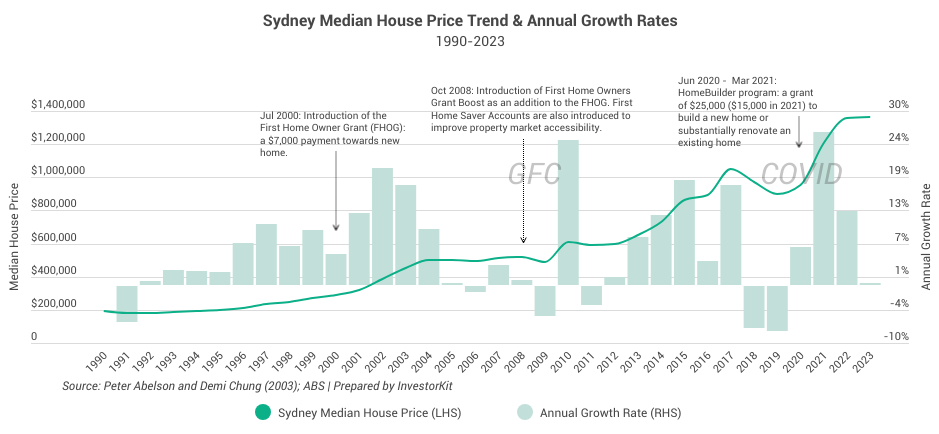

Sydney’s house price trend over the past 30 years shows the effect (chart below): Every time a new incentive is introduced, the price surges in the following year/years.

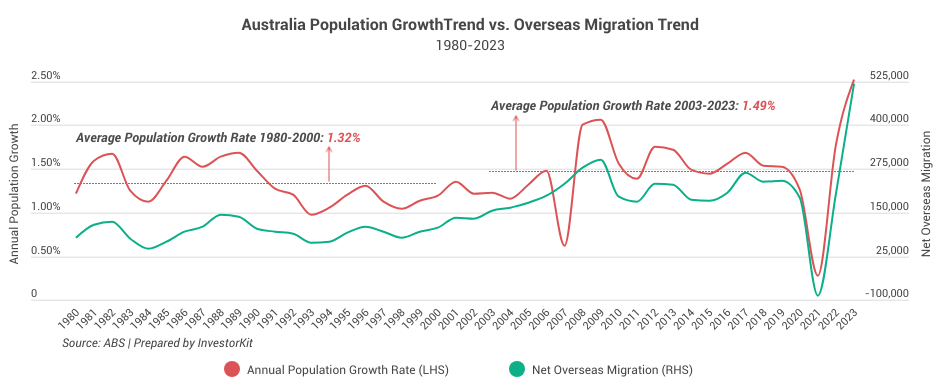

Of course, first-home buyer incentives are not the only force driving housing prices up. The faster population growth (contributed by the rising number of overseas migrants, as shown in the chart below) and the reduced supply in the recent decade (check this whitepaper out to learn more about Australia’s Housing Supply Crunch!) are both among the reasons why house prices grew faster after 2000.

The Effective Solutions Instead of Cash Incentives

If the first home buyer incentives do nothing but push house prices up, what is effective to help improve housing affordability?

Wage Growth

We need to make more money to better afford something whose price is unlikely to fall in the long term.

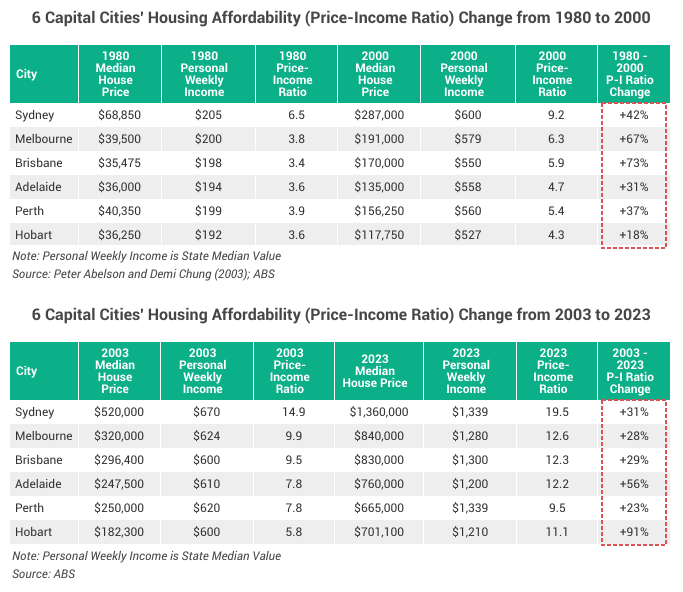

Remember we have just tested the house price growth rates over two 20y periods, one before the introduction of FHOG and the other after? The two tables below show the changes in housing affordability in terms of price-to-income ratio over the same periods.

- From 1980 to 2000, while the nominal wage level increased by 190%, the real wage level (purchasing power) actually declined because of the high inflation. As a result, The price-income ratio increased by as much as 73% in the capital cities;

- From 2003 to 2023, nominal wage growth wasn’t as high as in the previous decades, but the low and stable inflation made the real wage growth higher. Therefore, the increase in price-income ratio was actually lower than in the previous two decades in many cities (Sydney, Melbourne, Brisbane, Perth).

That’s the power of income growth. It has the same effect as the cash incentives on housing demand, but it lifts buyers’ overall affordability from upfront payment savings to mortgage servicing, while the cash grants do not help with mortgage servicing.

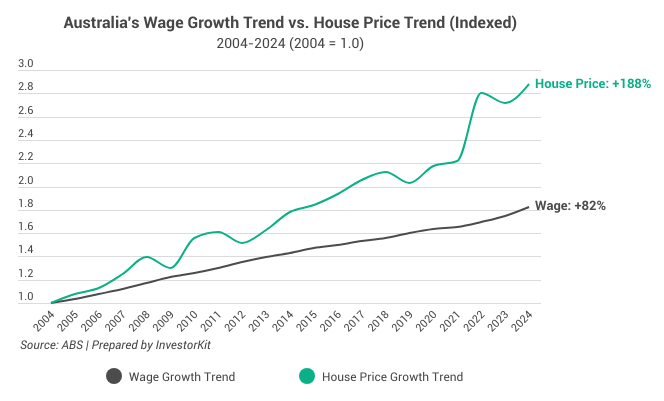

Australia’s wage growth has lagged behind house price growth for decades. The chart below only shows this trend over the past 20 years due to data availability limitations, but it’s been longer than that. Although the wage growth rates have been surging lately, it will be a slow process for the wage level to catch up. Therefore, we need more solutions, such as the following two.

Housing Supply Increase

The housing supply shortage is one of the major reasons why prices have been soaring. Generating more supply will effectively slow the pace of price growth so that wage growth has a better chance of catching up.

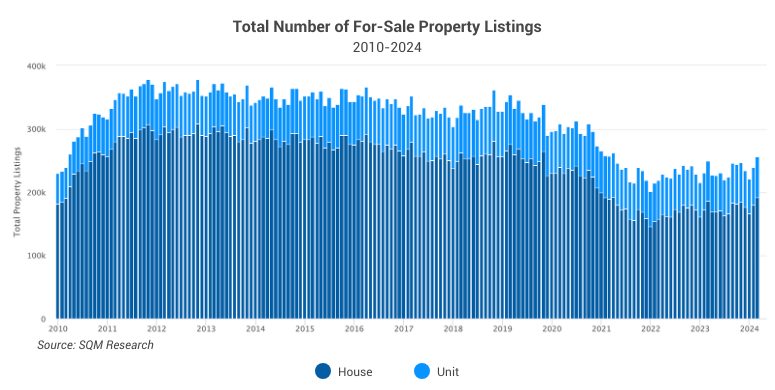

The chart above shows that the total number of for-sale property listings is approximately 30% lower than a decade ago. This is caused by many factors, including the increasing hold periods, high transaction costs, suppressed investor (who tend to transact more frequently than owner-occupiers) activities, limited land supply, slowed development due to the lack of planning certainty, rising construction costs in recent years, and more.

To increase housing supply, Australia needs not just to build more houses but, more importantly, to improve the efficiency of the planning system, have a fairer tax system to encourage stock mobility, make the housing market more friendly to investors, improve the diversity of housing/rental providers, etc.

*Check out this whitepaper for a more detailed analysis of housing shortage solutions!

More Evenly Distributed Housing Demand

Besides increasing supply, balancing out the housing demand is crucial. Currently, 70% of Australia’s population concentrates in the top 8 cities, which, in the meantime, are also the most sought-after destinations for overseas migrants. Imagine how much more housing demand they bear than the rest of the country!

Whilst we cannot expect Australia’s population or immigration to stop growing as they benefit the economy, Australia needs to improve the distribution of its population by improving the connectivity and liveability of its regional areas to reduce the housing demand pressure on the biggest cities, and release the housing supply potential in regional cities.

In fact, Australia is on the move: The regional infrastructure boom and recovering regional economies are some good starts.

In summary, first-home buyer incentives in cash form, such as the FHOG, do not help improve housing affordability or contain house price growth. In fact, they work the opposite way. To improve affordability, we need a combination of solutions, including wage growth, an increase in housing supply, and more evenly distributed housing demand across the country.

InvestorKit is a data-driven buyer’s agency that dedicate ourselves to helping investors better understand the Australian property market so that you make smarter investment decisions. Like what we do and would like to have us by your side on your investment journey? Connect with us today for a free 15-minute discovery call!

.svg)