December 5, 2025

Will A Granny Flat Boost Your Investment Property’s Performance? – 6 Key Findings

Thinking about a granny flat? We analyse real sales to uncover how second dwellings impact rental income, capital growth and how long it takes to sell.

Sydney buyers are swapping pool dreams for granny flats amid weakening affordability and growing multigenerational living. Domain’s latest report shows “granny flat” is now the most searched term in Sydney, ahead of pools, waterfronts and views.

This reflects what many Sydney buyers are looking for. More owner-occupiers see granny flats as a flexible space for adult children or ageing parents, or as a rental that helps with the mortgage or boosts household income. Investors are also eyeing properties with granny flats as a potential investment. However,

- Does adding a granny flat really lift your rental returns?

- Does it significantly boost your capital growth?

- And when you go to sell, does the granny flat make it easier or harder?

In this blog, let’s find out the answers with a case study we conducted recently.

Before diving in, I will briefly explain the methodology of this research.

Methodology

1. Study area

Our study focuses on Blacktown, a large residential suburb in Western Sydney with an active market for granny flats (secondary dwellings).

2. Hypotheses

Based on the above questions, we tested three hypotheses:

- H1 (rental yield): Houses with a granny flat achieve higher rental yields than comparable freestanding houses without one.

- H2 (capital growth): Houses with a granny flat achieve higher capital growth than the Blacktown house market.

- H3 (liquidity): Houses with a granny flat have lower market liquidity (longer days on market) than the Blacktown house market.

3. Data sources

To build the datasets for each hypothesis, we used:

- RP Data: estimated current rents and values of houses with and without a granny flat, sales prices and days on market of properties with a granny flat.

- Domain Insight: Blacktown median house price and median days on market.

- Blacktown City Council: estimated build costs of granny flats.

- Reserve Bank of Australia (RBA): cash rates.

4. Sample selection

4.1. H1 – Rental yield

To test H1, we used two Blacktown samples with estimated current rents and property values as of 2025:

- GF group: Houses with a granny flat.

- H group: Comparable freestanding houses without a granny flat.

The final H1 sample was 95 properties per group.

4.2. H2 – Capital growth

To test H2, we selected Blacktown houses with a granny flat that had two sales records: one when the owner bought the property and one when they later sold it between 2015 and 2025. When preparing the data, we:

- Included properties where the granny flat was built either before purchase or added during the holding period to increase the sample size. For cases where it was added after purchase, we adjusted the capital growth figures to account for the estimated build cost.

- Excluded properties that appeared to have undergone extensive renovations between sales (such as structural changes, large extensions, or major rebuilds). More minor cosmetic updates (for example, repainting, new flooring, or minor kitchen or bathroom refreshes) may still be present, as they are not consistently recorded in the data.

The final H2 sample was 41 properties.

4.3. H3 – Liquidity

To test H3, we selected Blacktown houses with a granny flat that had recorded days on market (DOM) for sales between 2013 and 2025.

The final H3 sample was 63 properties.

4.4. Notes on samples

Differences in sample size

Sample sizes differ among hypotheses mainly due to limited data. In particular, not all properties in H1 had both purchase and sale records or a recorded DOM figure.

Sample characteristics control

All properties in our samples are standard family houses: built before 2000, with 3-4 bedrooms and on blocks of roughly 400-800 m². To check whether these characteristics influenced the results, we ran a regression including build period, bedroom count and land size as additional variables, and none showed a meaningful or statistically significant relationship with performance.

5. Analysis approach

For each hypothesis, we compared the average result for houses with a granny flat to that for freestanding houses without one (H1) or to the suburb benchmark (H2 and H3). We then used t-tests to see whether the differences were statistically significant or likely due to random variation.

Why use the suburb benchmark in H2 and H3?

We used the Blacktown suburb median as a benchmark because of limited clean data on comparable non-granny-flat sales. The suburb median includes both houses with and without a granny flat, so it does not isolate houses without one. Even so, if the GF group consistently sits above or below the suburb benchmark, it still gives a meaningful signal about how these properties perform relative to the overall house market.

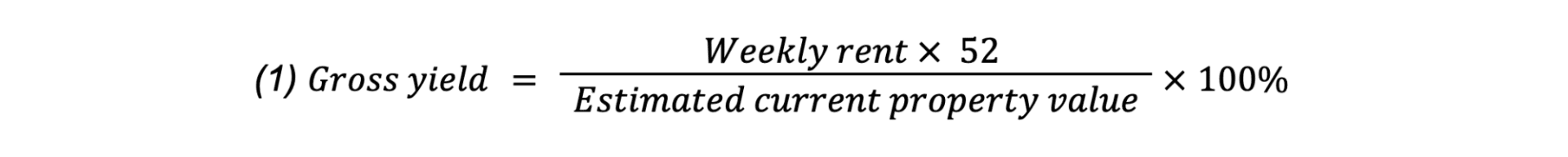

5.1. H1 – Rental yield

Descriptive statistics: We calculated the gross rental yield for each property in the granny-flat sample and in the comparison group. We then compared the average yield of the GF sample with that of the H group as an initial check of how their returns differ.

Metric (GF & H groups):

Statistical test: To assess whether this yield gap is statistically meaningful rather than due to sampling variation, we ran a t-test on the rental yields of the GF properties and the comparable freestanding houses.

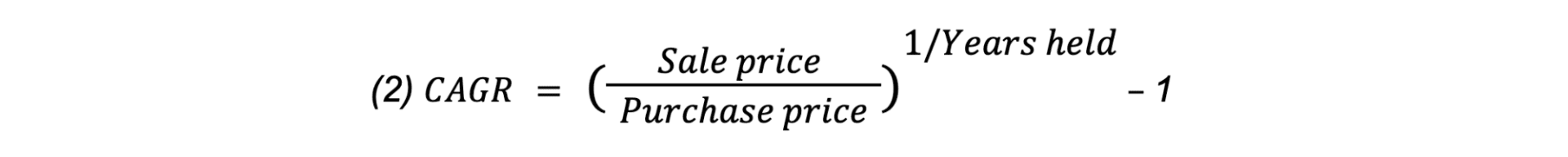

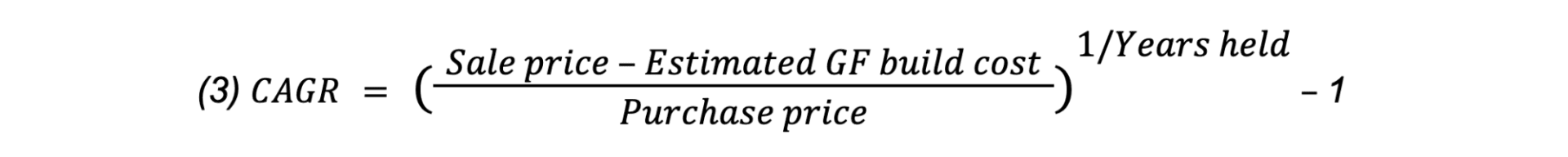

5.2. H2 – Capital growth

Descriptive statistics: We first calculated the compound annual growth rate (CAGR) for each property in the granny flat sample and the matching suburb benchmark CAGR for the same holding period. We then compared the average CAGR of the GF sample with the average of the matched suburb benchmark CAGRs as a simple check of how the two compare.

Metric (GF group):

If the granny flat existed before purchase:

If the granny flat was added during the holding period:

Metric (suburb benchmark): We applied equation (2) to Blacktown’s median house prices at the start and end of each granny flat property’s holding period to calculate Blacktown’s CAGR over the same years.

Statistical test: To see whether granny flat properties truly grew at a different average rate from the suburb benchmark or if the difference was just random noise, we ran a t-test using each property’s CAGR and its matched suburb benchmark CAGR.

5.3. H3 – Liquidity

Descriptive statistics: We compared the average DOM of the GF properties with that of their matched suburb benchmark to check how their selling times differ.

Statistical test: To assess whether granny flat properties consistently sell faster or more slowly than the suburb benchmark, or whether any gap could be due to random variation, we ran a t-test using each property’s DOM and its matched suburb benchmark DOM.

5.4. Market cycle checks (H2 and H3)

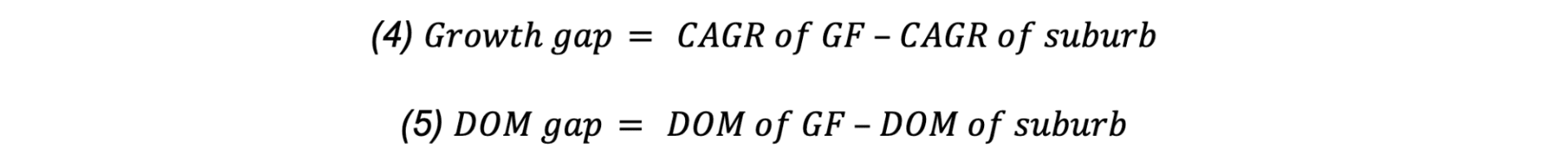

In both H2 and H3, sales span multiple years, so the averages include boom periods and slower phases of the cycle. To examine whether the average growth gap and the average DOM gap differed across market cycles, we ran two separate one-way ANOVAs on these gaps.

We first grouped the years into three market phases by comparing Blacktown’s house CAGR in each year with the national average (around 5-7% p.a.):

- Group 1 – Underperforming years: Blacktown’s CAGR below the national average.

- Group 2 – In-line years: Blacktown’s CAGR in line with the national average.

- Group 3 – Outperforming years: Blacktown’s CAGR above the national average.

Next, for each granny flat property, we calculated:

Each property was then assigned to one of the three groups based on the year it was sold, and these growth and DOM gaps were used as the inputs to the ANOVA tests.

5.5. Interest rate checks (H2 and H3)

Between 2013 and 2025 (our research timeframe), interest rates moved through very different settings, from ultra-low to high. To test whether the relative performance gap between houses with a granny flat and the broader house market changed across different interest-rate environments, we ran two one-way ANOVAs on the CAGR and DOM gaps relative to the suburb benchmark.

We classified each sale into four interest-rate environment groups based on the RBA cash rate in the month and year the granny flat property was sold:

- Group 1 – Ultra-low rates: cash rate below 0.5%.

- Group 2 – Low rates: cash rate between 0.5% and 1.5%.

- Group 3 – Moderate rates: cash rate between 1.5% and 3%.

- Group 4 – High rates: cash rate above 3%.

We then used the same growth and DOM gaps defined in (4) and (5) as the inputs to these ANOVA tests.

5.6. Holding time since granny flat was built versus CAGR (H2)

To test whether selling a property soon after the granny flat was completed leads to higher capital growth, we ran a simple linear regression with CAGR as the outcome and the number of years between granny flat completion and sale as the explanatory variable.

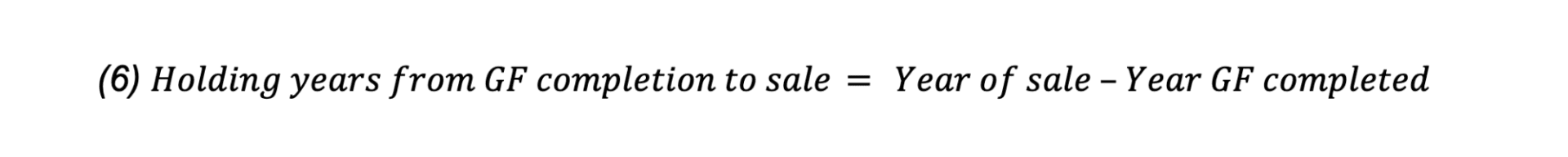

Metric (GF group):

Findings

#1. Adding a granny flat can significantly improve your cash flow.

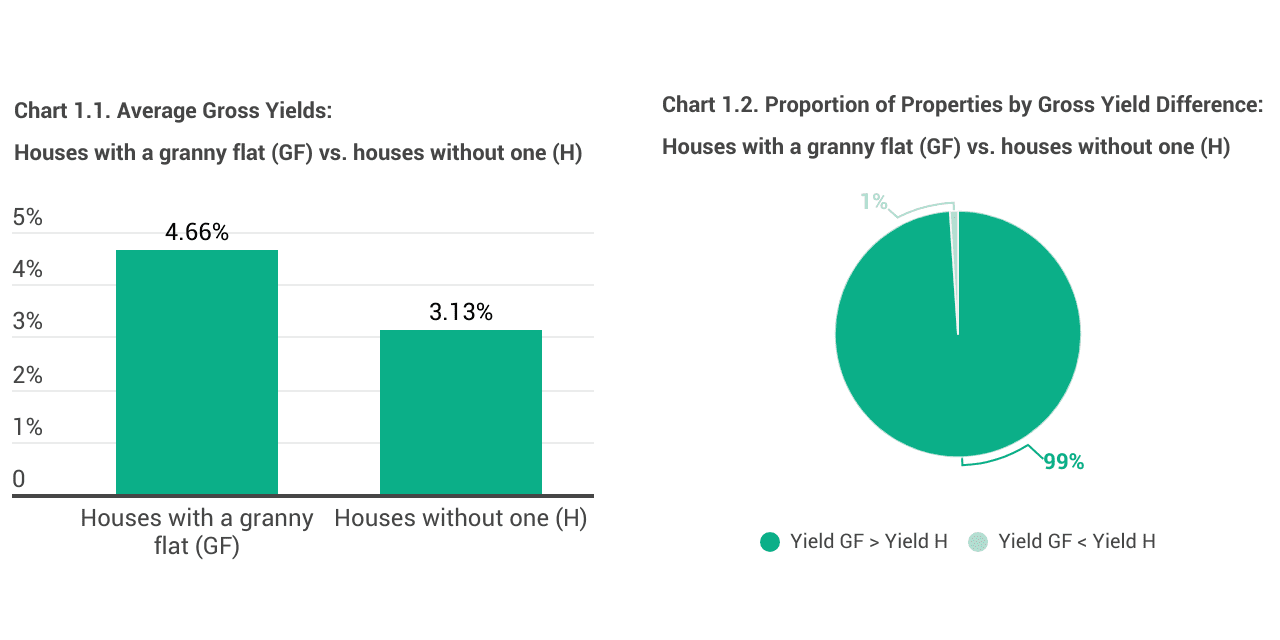

Our first test found that almost all houses in our sample with a granny flat achieved higher yields than those without one (Chart 1.2). On average, yields in the GF group are about 1.5% higher than those in the H group (Chart 1.1).

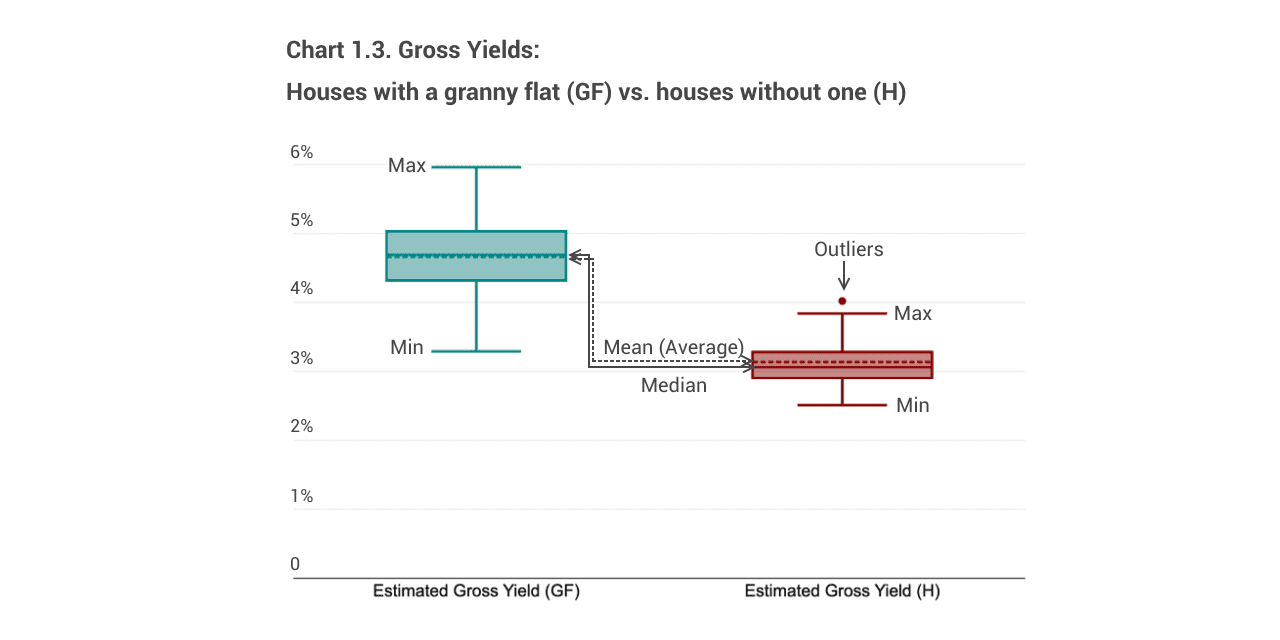

Chart 1.3 shows that most GF properties fall within the 4-5% range (teal box), while houses without a granny flat cluster around 3% (red box).

The t-test indicated that the gap is statistically significant, which means houses with a granny flat consistently earn higher yields. At the 95% confidence level, yields for dwellings with a granny flat are about 1.40% to 1.65% higher than those without a granny flat.

This is understandable because you can earn two rents at once, one from the main house and one from the secondary dwelling, while the property value itself doesn’t increase significantly.

#2. Adding a granny flat does not significantly boost your capital growth.

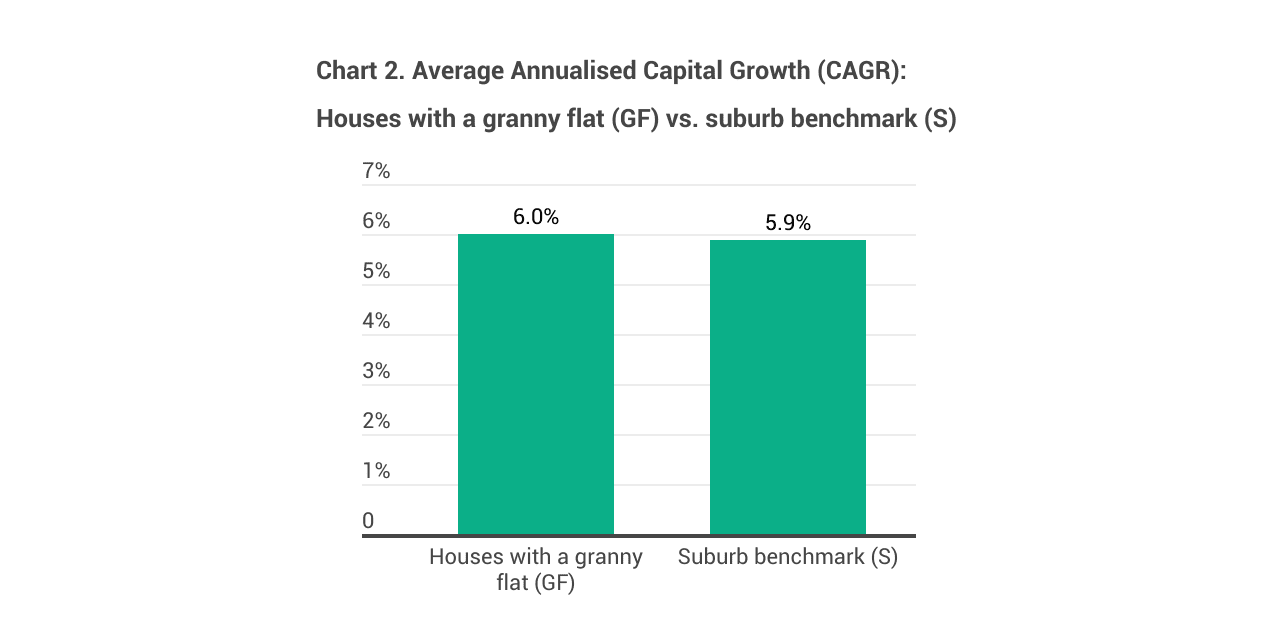

The second analysis revealed no statistically significant difference in capital growth between houses with a granny flat and the broader Blacktown house market.

By observation, houses with a granny flat had a relatively similar average annualised growth with the suburb benchmark of about 6%, with only a modest gap between them (Chart 2).

A t-test found that the difference is not statistically significant, indicating that both groups appear to have very similar capital growth overall.

A likely explanation is that land value, which accounts for most of the property value, remains roughly the same regardless of whether a granny flat is present. A granny flat changes how the land is used, but it doesn’t make the land scarcer, so it doesn’t influence how fast the land appreciates.

#3. Adding a granny flat reduces your property liquidity

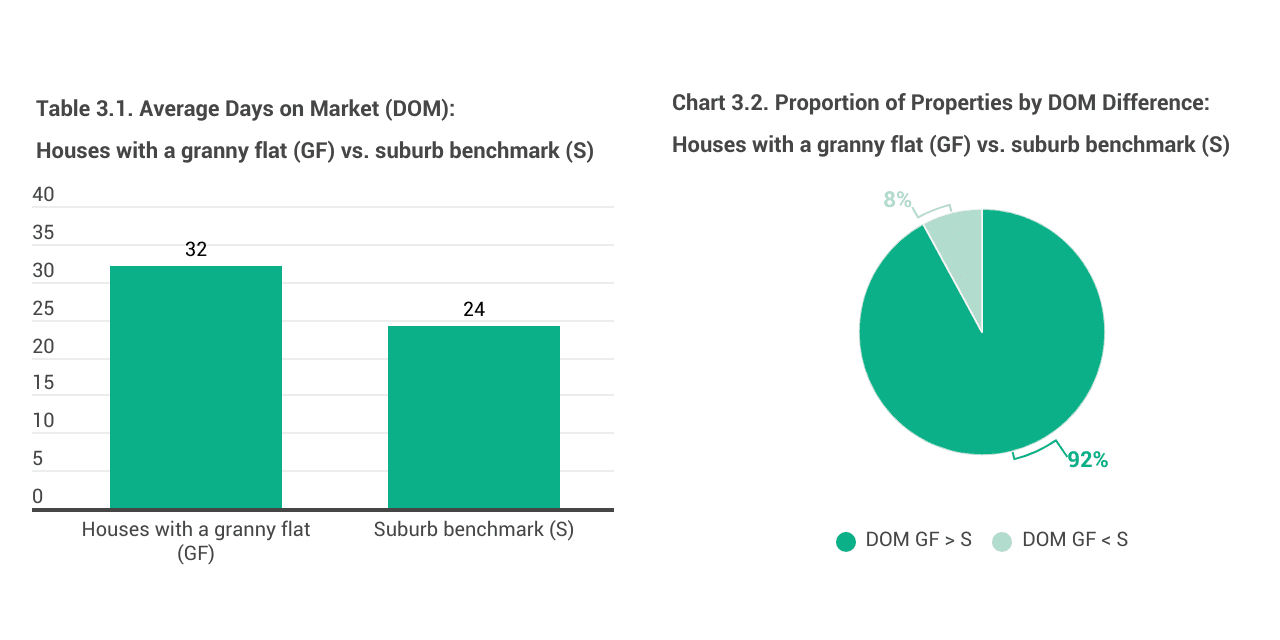

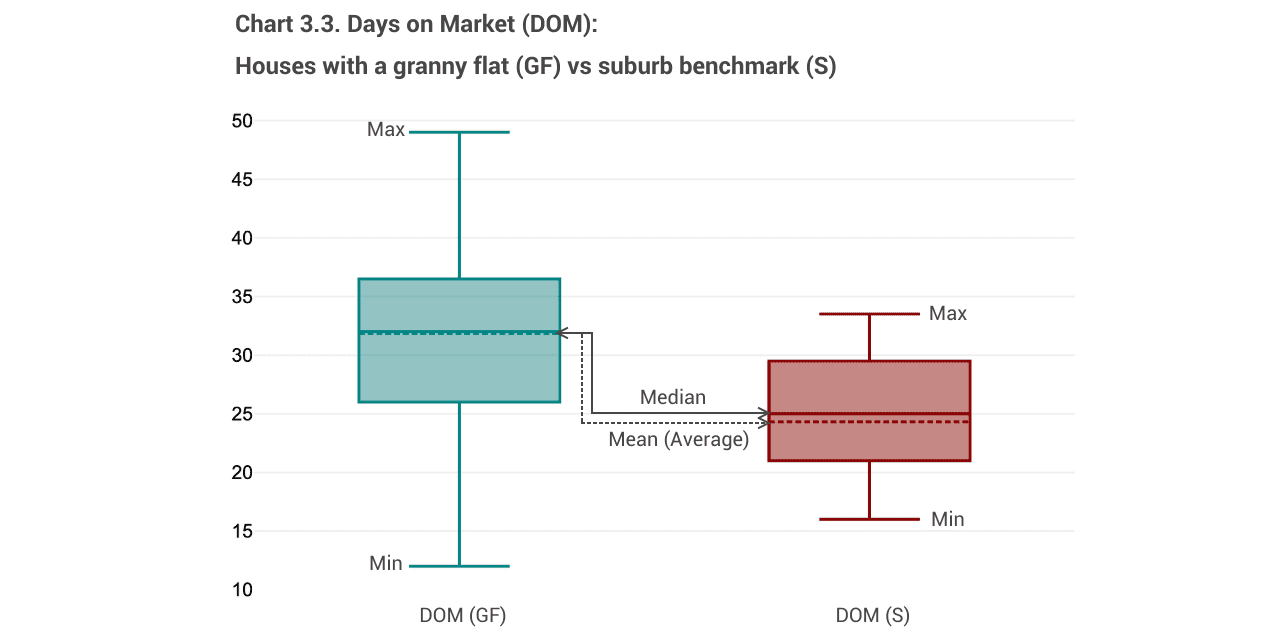

A third analysis showed that houses with a granny flat tend to sell more slowly than the broader Blacktown house market (Chart 3.2), staying about 8 extra days on the market (roughly an extra week) compared with the suburb benchmark (Table 3.1).

This pattern is shown in Chart 3.3. Most granny-flat sales sit in the mid-20s to mid-30s (teal box). Meanwhile, the suburb’s days on market are usually in the 20s (red box).

The t-test indicated that the gap is statistically significant, meaning the longer selling time observed in our sample is unlikely to be due to random variation. At the 95% confidence level, properties with a granny flat take approximately 6 to 9 days longer to sell.

One possible reason is a smaller pool of buyers, particularly owner-occupiers. Some see a granny flat as reducing usable yard space for children or pets, making parking and access less convenient when driveways are shared, reducing privacy if it is tenanted, increasing ongoing maintenance, or making the property less visually appealing.

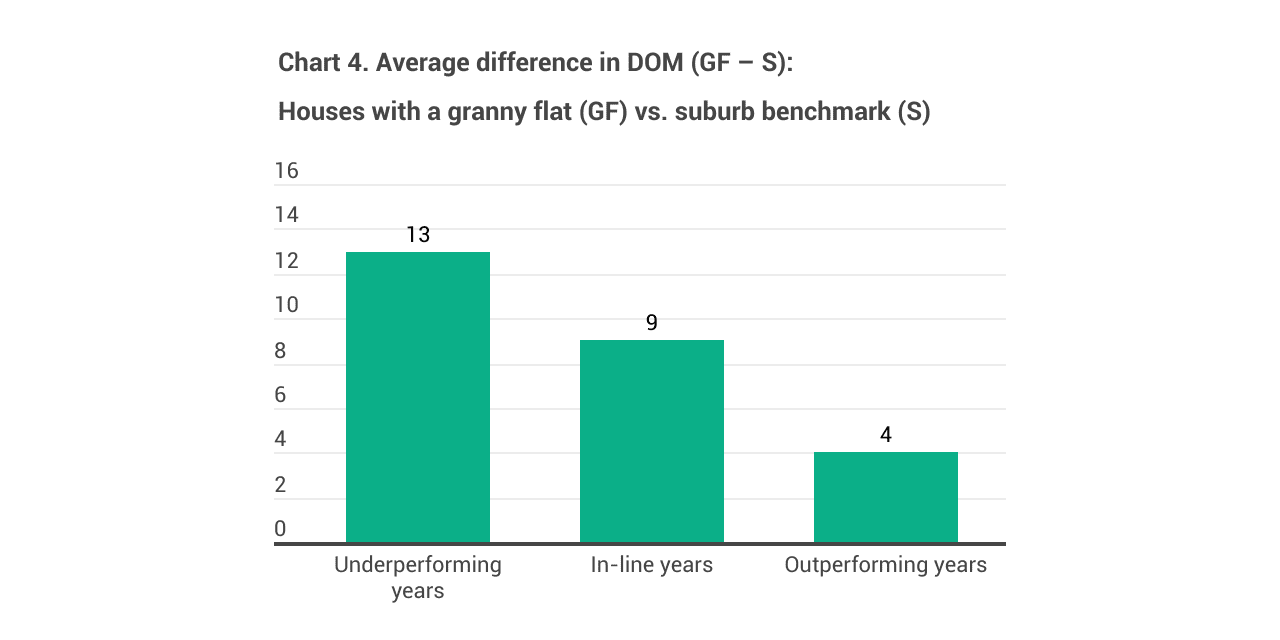

#4. Market cycles affect selling time but not capital growth.

The first ANOVA on the growth gap found no statistically significant differences across weaker, average and stronger years, suggesting that the capital growth of granny flat properties relative to the broader house market did not depend on the market’s position in the cycle.

Meanwhile, a second ANOVA on selling time found a statistically significant difference in the DOM gap across the three market-cycle groups. Granny flat properties lagged the market the most in underperforming years and the least in outperforming years (Chart 4). This suggests liquidity is more sensitive to the cycle than growth, and that granny flat properties are more vulnerable in weak markets, likely because the buyer pool is narrower.

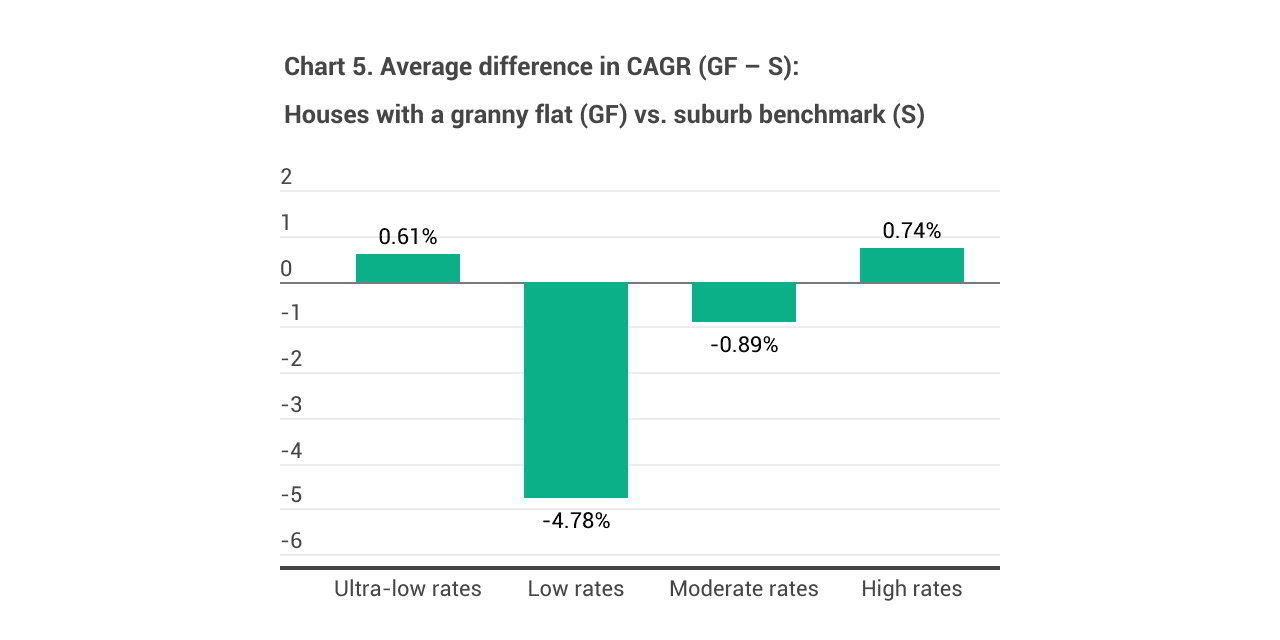

#5. Interest-rate environments affect capital growth but not days on market.

A one-way ANOVA showed that the average growth gap between granny flat properties and the suburb benchmark varied significantly across the four interest-rate environments. Granny flat properties lagged the suburb the most in the low-rate period and pulled ahead the most in the high-rate environment (Chart 5). However, the low-rate group contains only three observations, so this pattern could be treated as indicative rather than definitive.

In contrast, the ANOVA found no statistically significant difference in the DOM gap across the four interest-rate environments. In this sample, houses with a granny flat consistently took longer to sell than the broader house market, whether rates were ultra-low, low, moderate or high. In other words, interest rates did not meaningfully affect the DOM gap.

#6. Selling sooner after building a granny flat does not lead to higher capital growth

The regression showed a very weak and statistically insignificant relationship between holding time after the granny flat was built and capital growth. In this sample, properties that were held longer performed much the same, on average, as those sold sooner.

In a nutshell

Granny flats performed well as a cash-flow play, not as a growth booster. If your goal is to increase your capital growth significantly, having a granny flat in the backyard won’t do much. In terms of liquidity, properties with a granny flat took a bit longer to sell.

We also found that:

- Market cycles affected selling time but not capital growth.

GF properties took longer to sell in weaker market cycles than in stronger ones, but their growth gap to the suburb median was stable across different cycles.

- Interest-rate environments affected capital growth but not days on market.

GF properties lagged the suburb most in low-rate periods and outperformed it most in high-rate periods, but the DOM gaps did not differ meaningfully across rate regimes.

- The time between building the granny flat and selling the property did not affect capital growth.

***Disclaimer

1. Sample limitations

The study used a relatively small Blacktown sample and approximate matching, so differences in location, renovation or property quality may still affect the findings. Results should be read as indicative rather than precise.

2. Market variation

These findings reflect suburbs where granny flats are reasonably typical. Areas with different characteristics, such as prestige suburbs and regional towns where granny flats are less popular, may show different outcomes for yield, growth and liquidity.

At InvestorKit, we’re dedicated to helping Australian property investors explore the property market through data-backed research and insights, and support your portfolio-building journey with data and our on-the-ground experience. Get in touch today by clicking here to request a free, no-obligation 15-minute discovery call!