August 18, 2025

Top 5 Melbourne Regions Leading the Property Market Recovery

While Greater Melbourne’s market remains quiet, several parts of Melbourne are already staging a clear recovery. In this blog, we are going to spotlight five SA3 regions leading Melbourne’s rebound.

After a post-COVID property boom between 2021 and 2022, Melbourne’s housing market has since cooled. Over the past 15 months, the market has remained relatively subdued, with median house prices hovering around $845,000, according to Domain Insight. Nevertheless, early signs, such as tightening inventory and shorter days on market in many areas, suggest momentum is beginning to build. While the broader market remains quiet, several parts of Melbourne are already staging a clear recovery. In this blog, we are going to spotlight five SA3 regions leading Melbourne’s rebound.

Before you dive in, please note: The areas featured in this blog are NOT the only markets in Melbourne showing growth. Also, a strong recovering market doesn’t mean it’s a good spot to invest in.

1. Frankston

Located in Melbourne’s south-east along the eastern shore of Port Phillip Bay, Frankston is known as the gateway to the Mornington Peninsula. Its blend of coastal lifestyle, relative affordability compared to inner suburbs, a strengthening local economy, and ongoing transport upgrades has put Frankston firmly on the radar of both investors and homeowners alike.

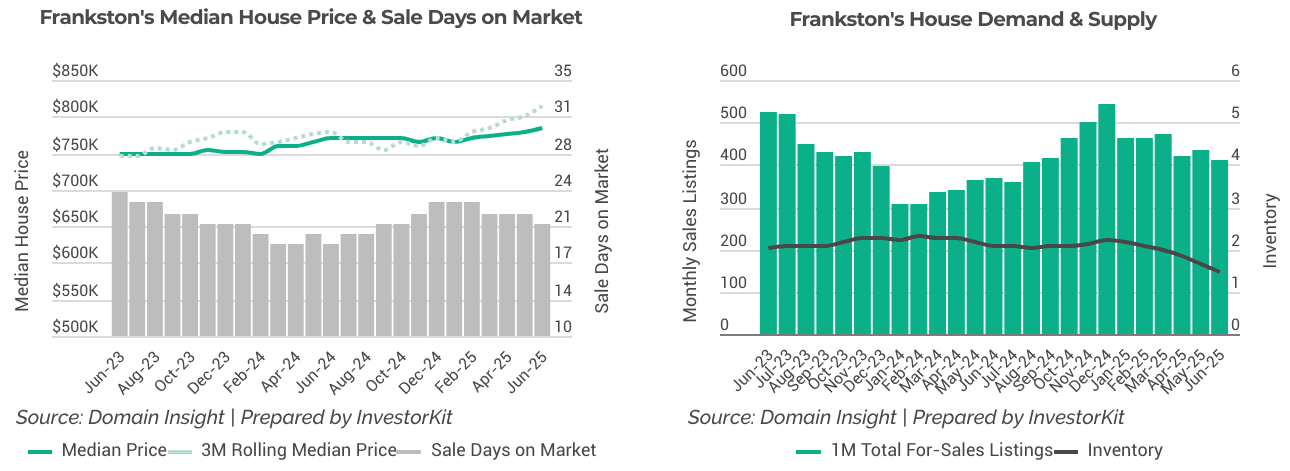

Frankston’s sales momentum is picking up

Frankston is one of the fastest-recovering regions in Melbourne’s far south-east. After months of subdued conditions, growth began to accelerate in early 2025, supported by stronger buyer demand, tightening inventory and shorter days on market. Over the last three months, house prices have increased by 1.6%, well ahead of Greater Melbourne’s 0.6%. Inventory has fallen sharply to around 1.5 months of supply, a clear sign that demand is outpacing available stock and competition among buyers is rising.

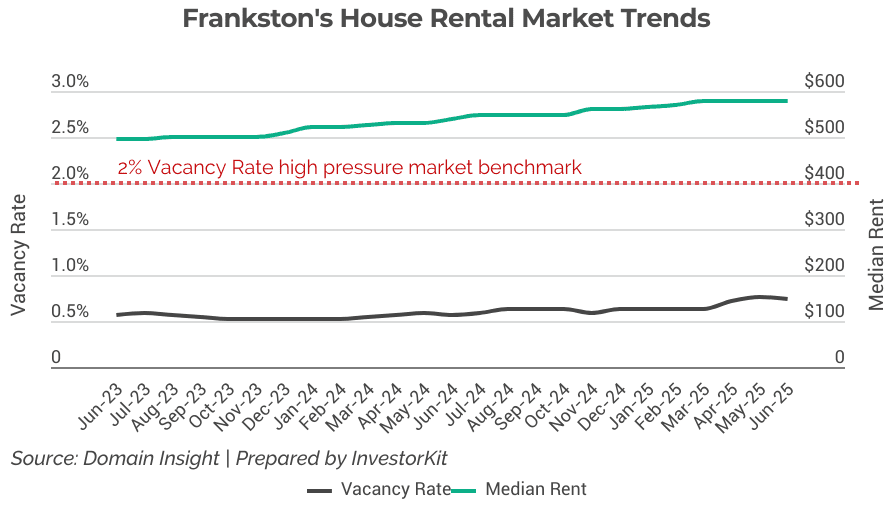

Frankston’s rental market is tight

The momentum is also evident in the rental market. Over the past five years, vacancy rates have remained well below 1%, with consistent rental growth, suggesting a healthy yet competitive rental market.

2. Tullamarine – Broadmeadows

Situated in Melbourne’s north-west and close to Melbourne Airport, Tullamarine-Broadmeadows has traditionally been a hub for logistics and manufacturing. Benefiting from its proximity to major employment hubs, a strong local economy, improved transport links, and affordable housing, it has become a favourable choice for young families and first-home buyers who are priced out of Melbourne’s inner-city and middle-ring suburbs, while also attracting growing interest from investors.

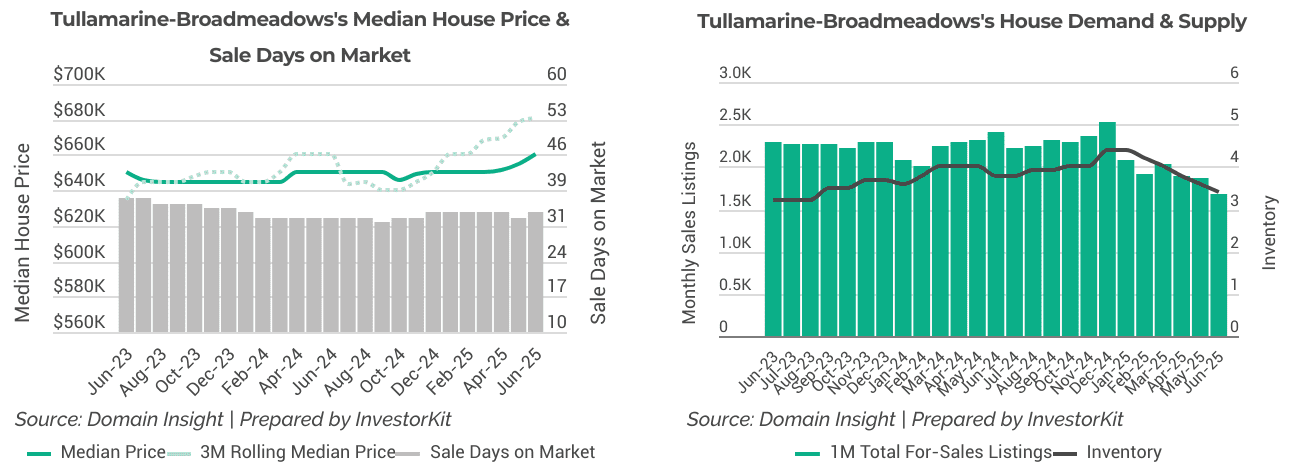

Tullamarine-Broadmeadows’s sales pressure is rising

Tullamarine-Broadmeadows’s sales market has shown renewed momentum in 2025, following a relatively flat period throughout 2023 and 2024. Median price has lifted in recent months, while the 3-month rolling trend has already moved upward steadily since late 2024. The tightening listings for sales have resulted in a steep fall in inventory, pointing to a growing imbalance between supply and demand.

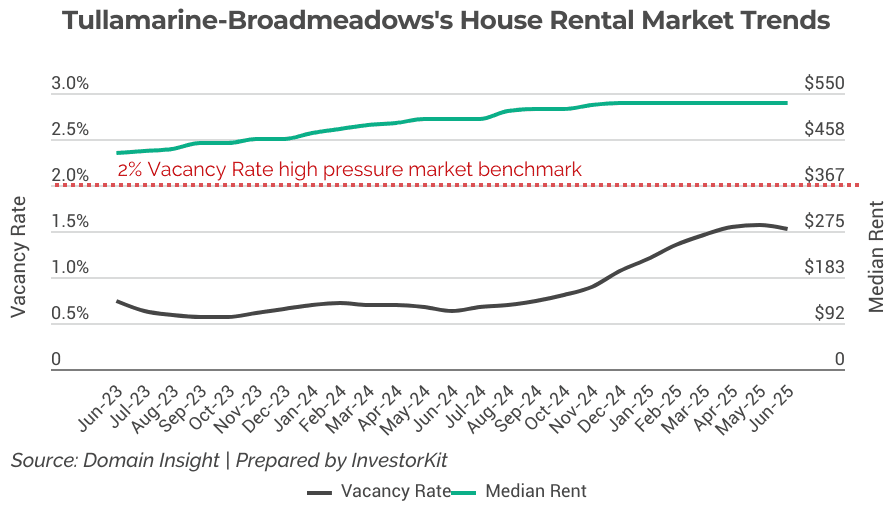

Tullamarine-Broadmeadows’s rental pressure is relatively high

After climbing rapidly in late 2024, vacancy rates peaked in May and have since edged lower. While this is an early positive sign that the rental pressure is improving, it’s important to monitor the trend in the coming months to see whether vacancy rates will continue to decline or begin to stabilise. Overall, the rental market remains healthy with vacancy rates well below 2%.

3. Brimbank

Located in western Melbourne, Brimbank is a diverse region that blends established suburbs with emerging growth corridors. With strong links to Melbourne CBD, easy access to major employment hubs, growing local amenities, and relatively affordable housing, Brimbank has become an increasingly attractive destination for buyers.

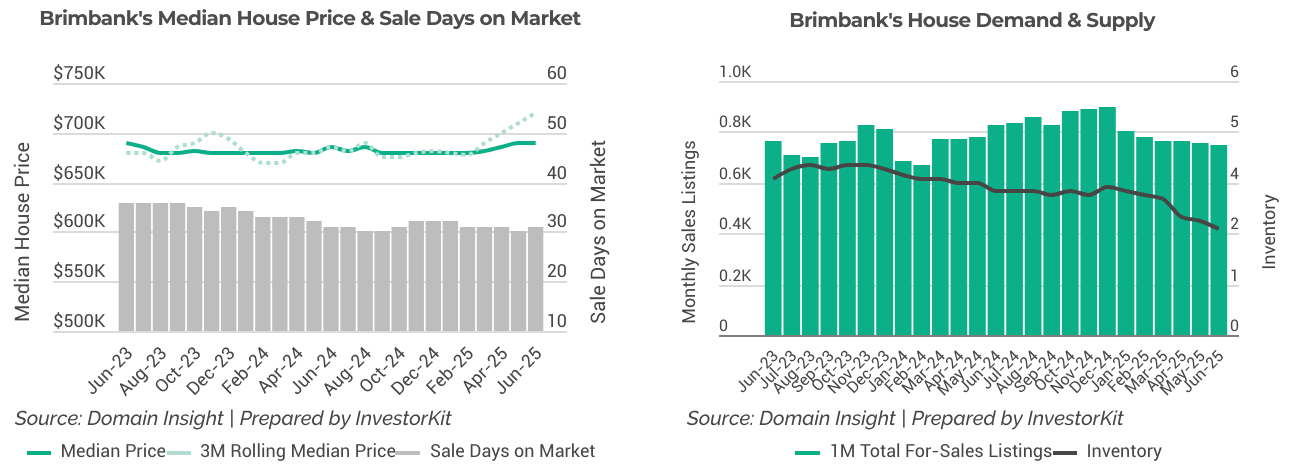

Brimbank’s sales market is gradually regaining momentum

After a period of decline in late 2022 and stability from mid-2023 to late 2024, Brimbank’s house market began to show growth in early 2025, supported by falling inventory and shorter days on market. Over the past three months, house prices have risen by 1.3%, more than double Greater Melbourne’s 0.6% and West Melbourne’s average of 0.4%. The consistent and noticeable decline in inventory since late 2023 indicates that stock is being absorbed at a faster pace, signalling strengthening buyer demand.

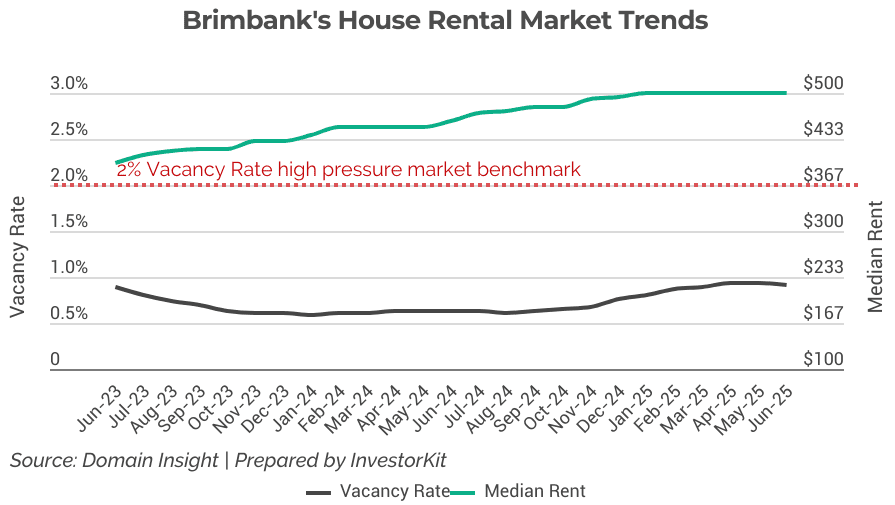

Brimbank’s rental pressure is high

Over the past two years, Brimbank’s rental market has remained tight, with vacancy rates below 1% and steady rental growth. Rents are expected to grow further given the current high market pressure.

4. Casey – North

Situated in Melbourne’s outer south-east, Casey-North is one of the city’s fastest-growing regions, driven by state-leading population growth and ongoing infrastructure investment. Large-scale housing developments and improved transport connections have drawn a steady influx of homebuyers and investors in recent years.

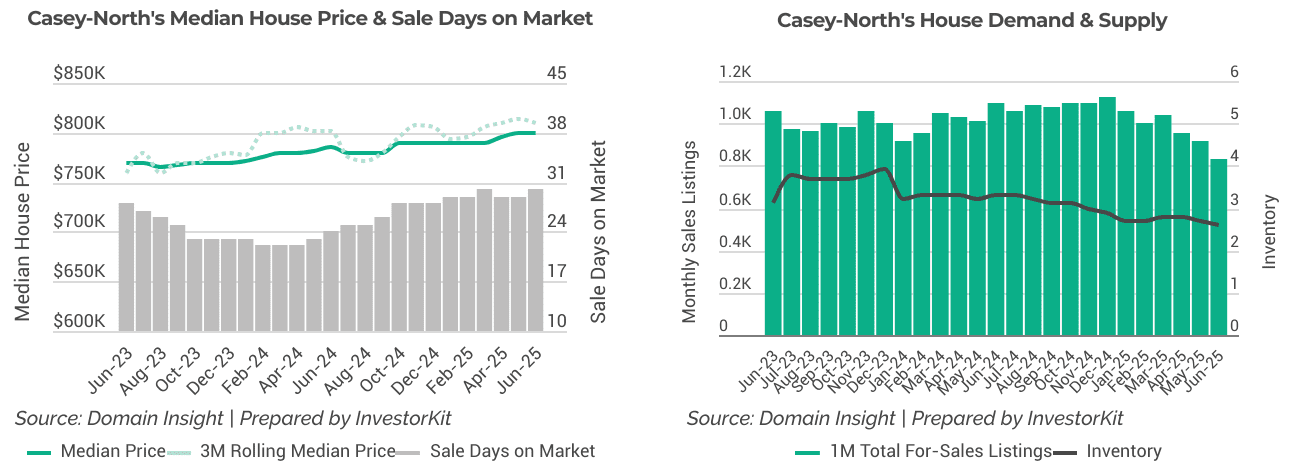

Casey-North’s sales market is heating up

Median sale prices have risen steadily over the last 2 years, up by 1.3% in the previous 3 months, well above Greater Melbourne’s 0.6% and the south-east Melbourne’s average of just 0.03%. Casey-North is one of only three SA3s in the south-east showing a strong rebound, with 3-month growth exceeding 1%. Sales listings have trended down significantly since late 2024, leading to a drop in inventory.

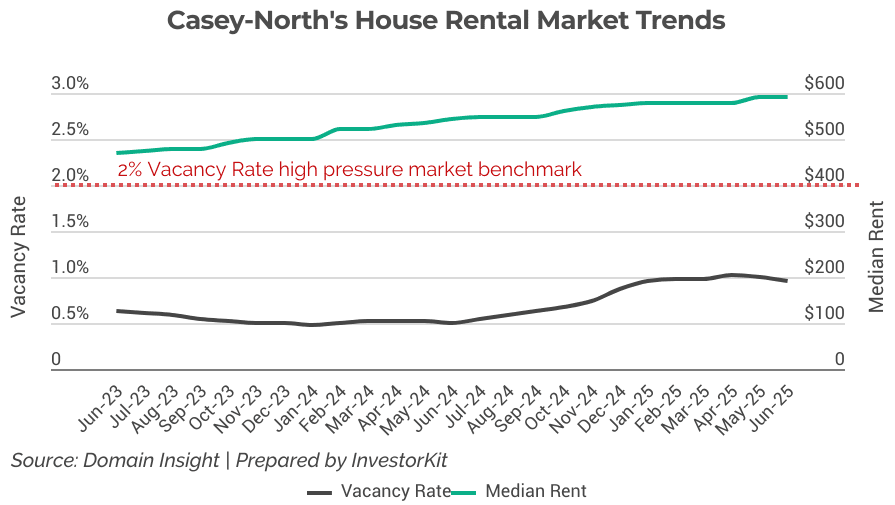

Casey-North’s rental market is under high pressure

Vacancy rates have stabilised around 1% since early 2025, following a brief period of increases. Rents have shown consistent growth, and with market pressure remaining elevated, further increases are likely in the coming year.

5. Dandenong

Located around 35 km south-east of Melbourne’s CBD, Dandenong is a major commercial and cultural hub, offering a mix of retail, business, and residential dwellings. Known for its vibrant multicultural community, strong transport links, and ongoing infrastructure projects, Dandenong has long been a magnet for buyers seeking value.

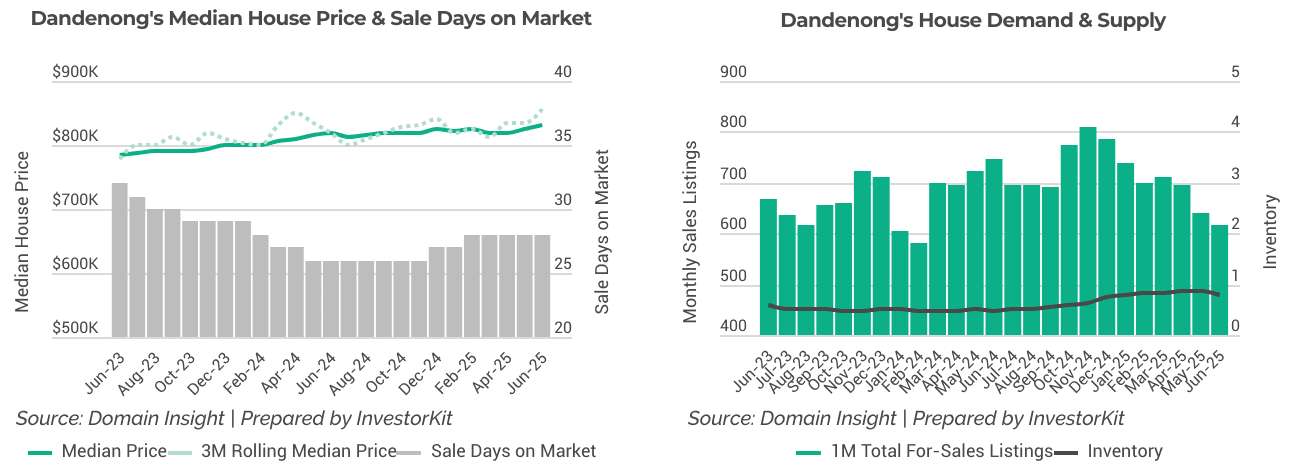

Dandenong‘s sales pressure is increasing

Dandenong’s house prices have grown steadily over the past two years, with momentum accelerating in recent months, up by 1.2% over the last three months, outperforming Greater Melbourne’s 0.6% and the south-east Melbourne’s average of just 0.03%. Days on market have stabilised at around 28 days after previously trending upward. Inventory remains extremely tight, sitting at just around one month of stock.

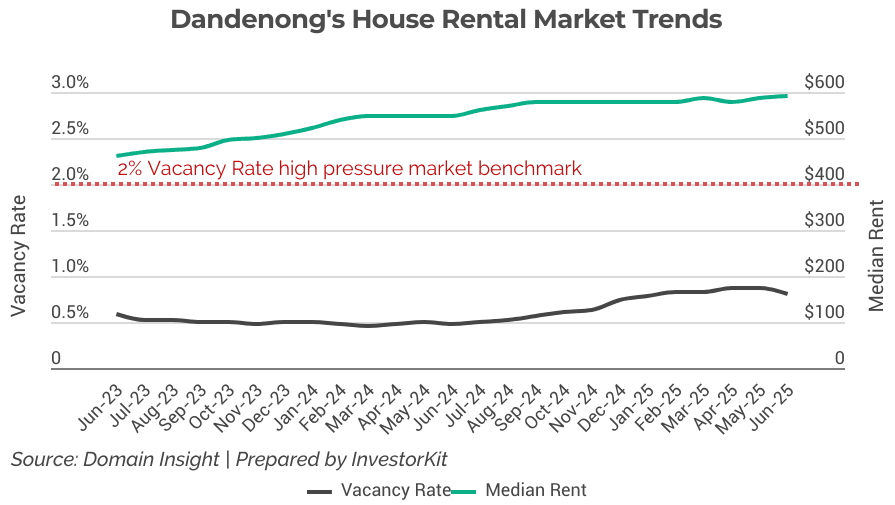

Dandenong‘s rental pressure is high

Dandenong’s rental market is tight, with vacancy rates sitting below 1% since late 2022 and rents trending upward steadily over the last two decades, reflecting a healthy and resilient rental environment. Given the current high market pressure, further rental growth is expected in the year ahead.

In short,

As the Melbourne market continues to gain momentum, it presents opportunities for homebuyers and investors seeking full-cycle growth. Rising buyer confidence, tightening inventory, and anticipated rate cuts are combining to drive renewed demand. For investors, this creates a strategic window to enter strengthening markets before competition intensifies and prices climb further.

Even though these areas are leading Melbourne’s growth, they may not be the right fit for your portfolio. Choosing the right markets requires more detailed analysis and an understanding of what best fits your portfolio. At InvestorKit, we identify suitable markets based on your investment goals, strategy, and risk profile. Our research spans beyond the areas mentioned here, covering over 30 SA3 regions and hundreds of suburbs across Melbourne, with ongoing reviews to ensure we identify the best-fit opportunities for each client.

If you’re considering buying in Melbourne but aren’t sure where to invest, InvestorKit is here to help. We specialise in identifying high-performance markets and guiding investors with data-backed insights to accelerate long-term portfolio growth. Would you like to talk to our experts? Get in touch today by clicking here to request a free, no-obligation 15-minute discovery call!