Cairns: Gateway to the Tropics

Nestled between the Great Barrier Reef and the lush Wet Tropics rainforest, Cairns is one of Queensland’s most iconic coastal cities. Renowned for its tourism, tropical lifestyle, and growing local economy, it offers a unique blend of natural beauty, cultural vibrancy, and investment potential.

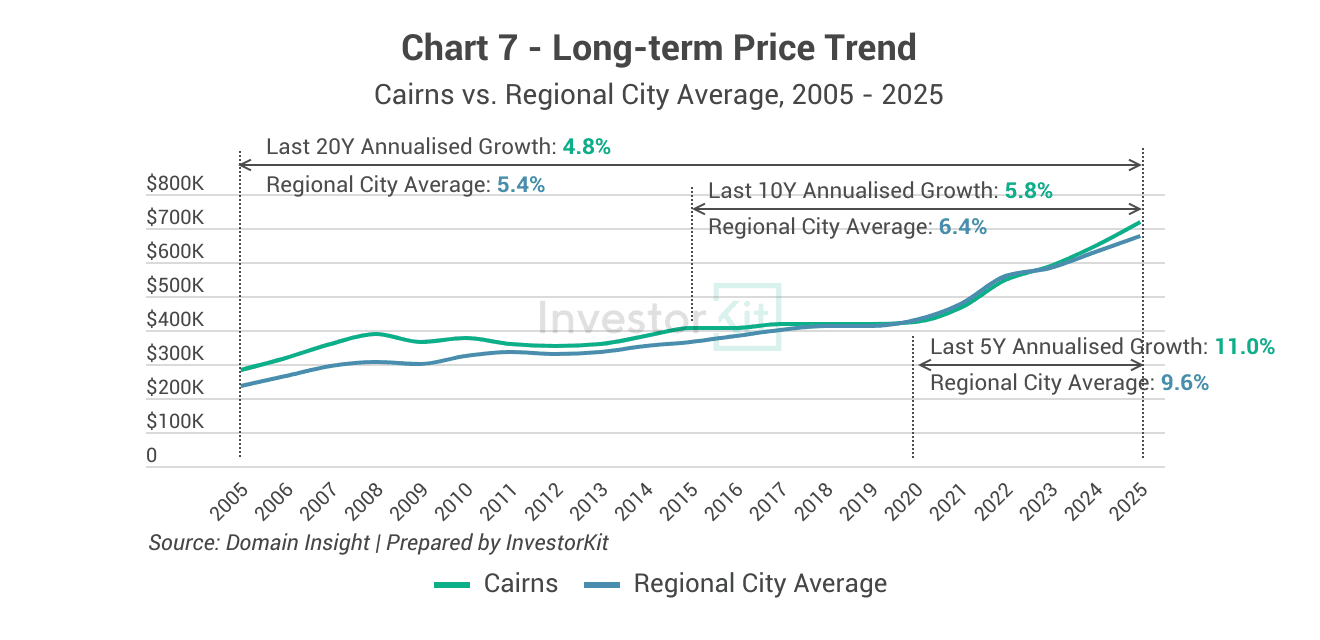

Since 2021, Cairns’s house prices have recorded solid gains after a prolonged period of slow growth, with an average annual growth of around 11%. Will this momentum carry into the year ahead? Join us today to explore the city’s current property market conditions and outlook!

As of October 2025, Cairns’s House Market Pressure is high.

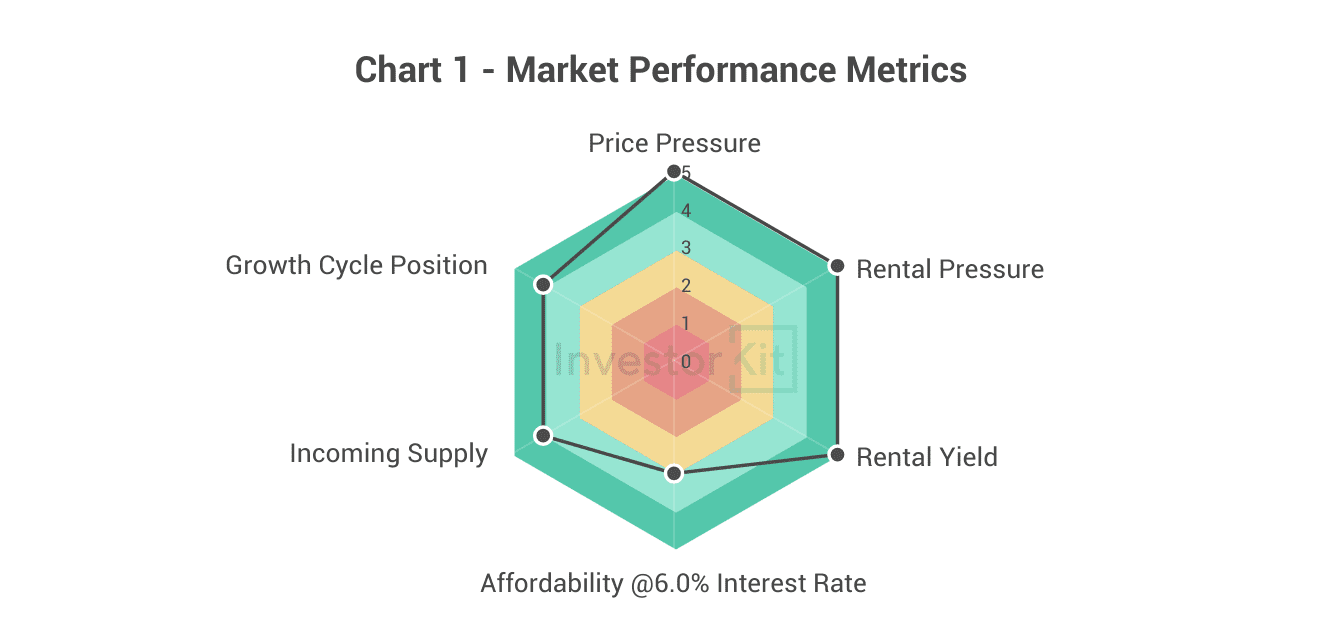

Among the six metrics that InvestorKit uses to measure market performance, Cairns scores:

- 5 (very strong) in price pressure, rental pressure, and rental yield,

- 4 (strong) in incoming supply and growth cycle,

- 3 (balanced) in affordability.

This suggests Cairns is showing very strong market pressure on both the sales and rental sides.

Cairns’s Demographic & Economic Trends

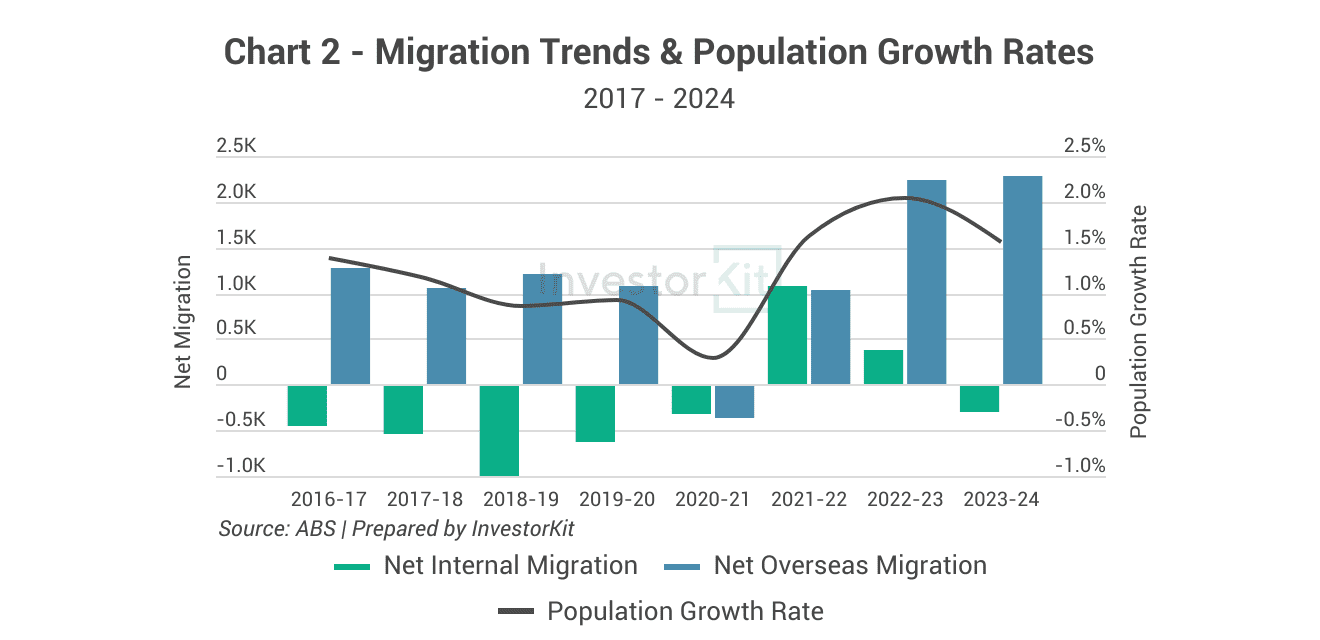

Cairns’s population growth has strengthened since 2022, driven primarily by overseas migration. In FY2023–24, the growth rate was around 1.6%, in line with the national average. While net overseas migration has increased significantly since 2022, net internal migration has moved in the opposite direction.

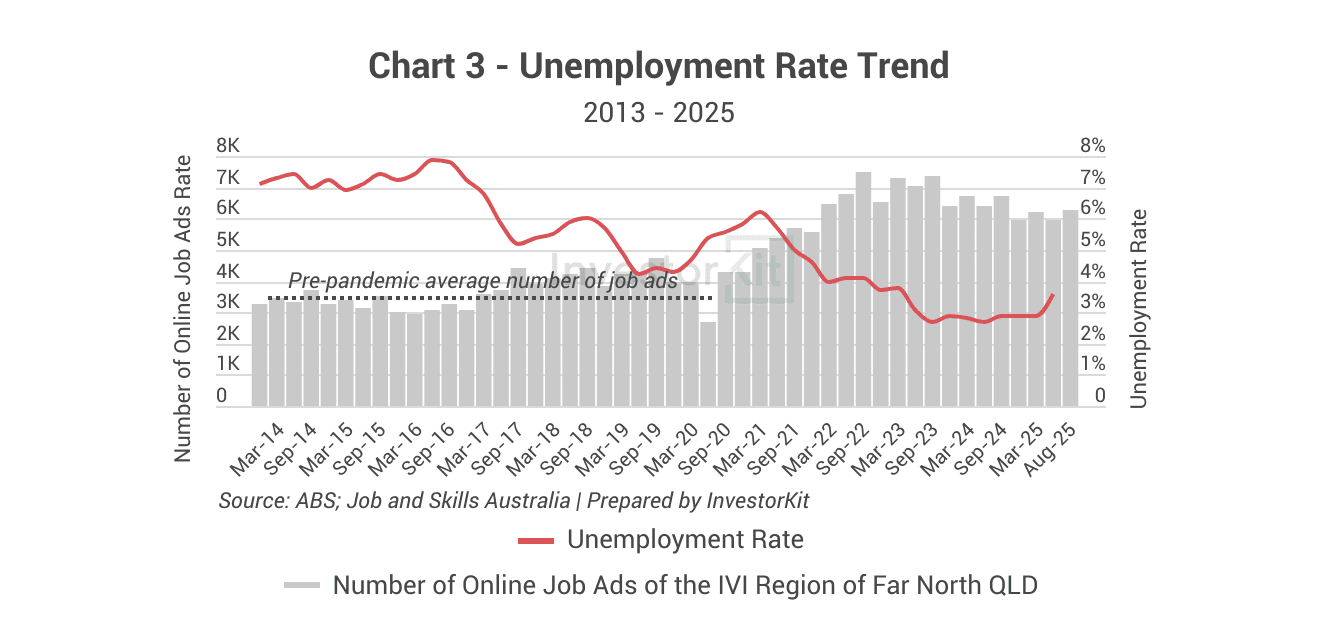

Despite a slight uptick in June 2025, the unemployment rate remains exceptionally low at around 3.6%, well below levels seen before the COVID years. Online job advertisements continue to sit well above their pre-pandemic average, reflecting ongoing strength in the local labour market.

Cairns’s Sales Market Trends

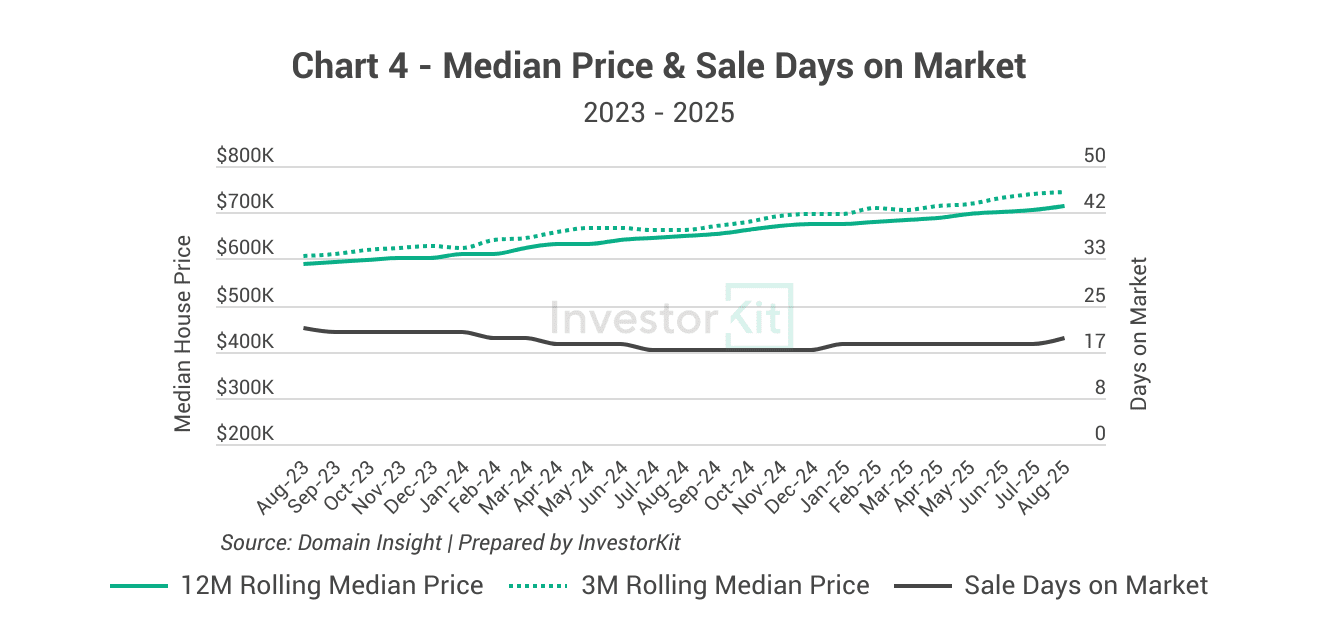

Cairns’s house market pressure is high, pushing its current median price to around $715k. Over the last 12 months, prices have increased by approximately 10.3%, while the median days on market have been consistently low at around 19 days.

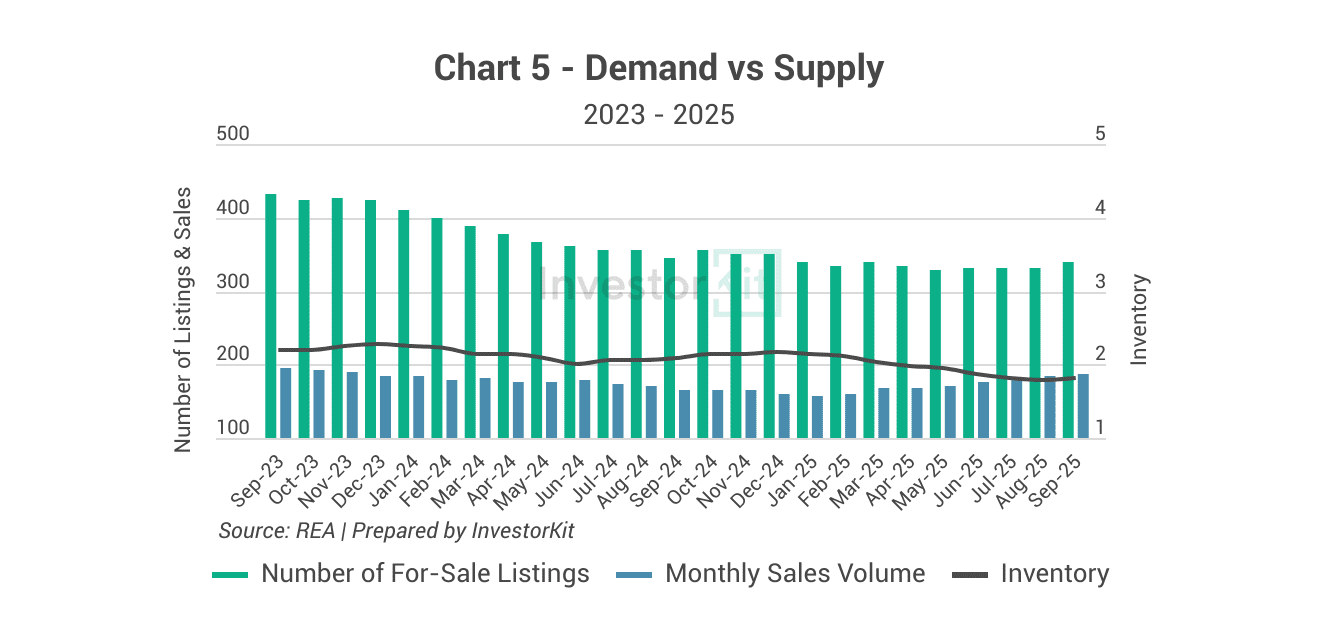

Since early 2025, the number of for-sale listings has been relatively stable, while sales volume has risen steadily. As a result, inventory has dropped to below 2 months of stock.

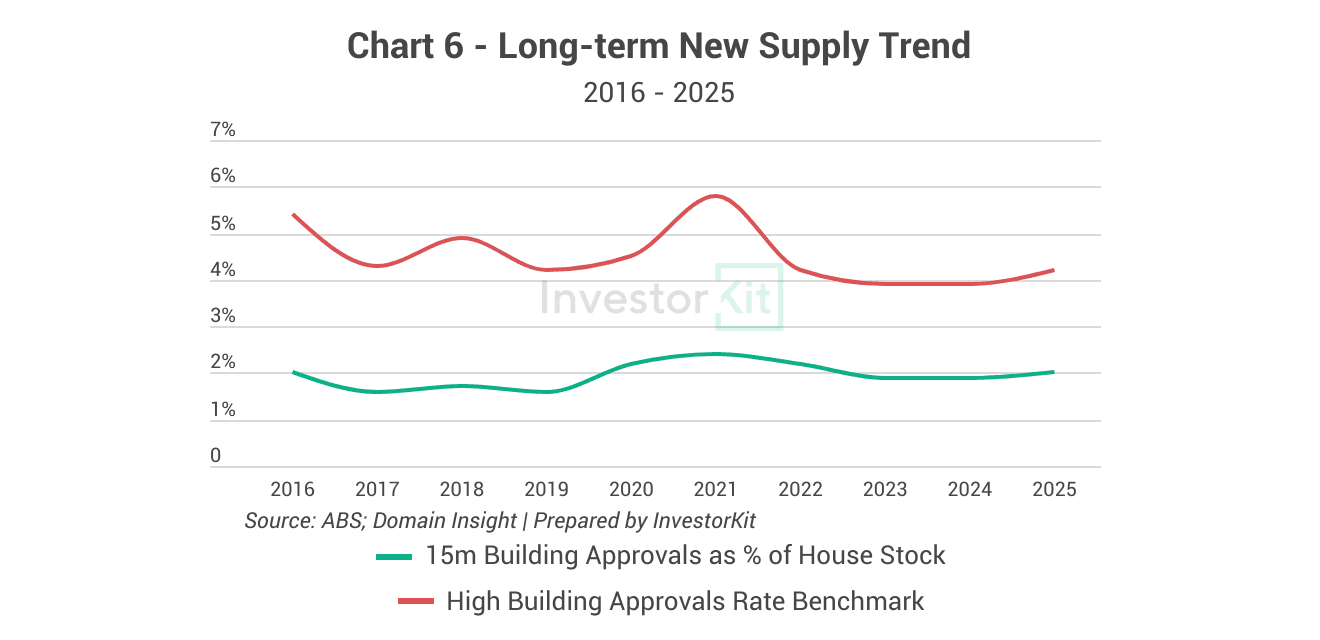

In terms of incoming supply, Cairns’s building approval rates have been relatively low over the last decade, well below the 2-3% balanced benchmark, indicating a low risk of oversupply.

Since 2021, Cairns’s house prices have accelerated after a prolonged period of slow growth. Its 10-year growth and beyond are in line with the long-term average of 5% to 7% per year, suggesting there is still room for healthy growth in the medium term, given the current high market pressure.

Cairns’s Rental Market Trends

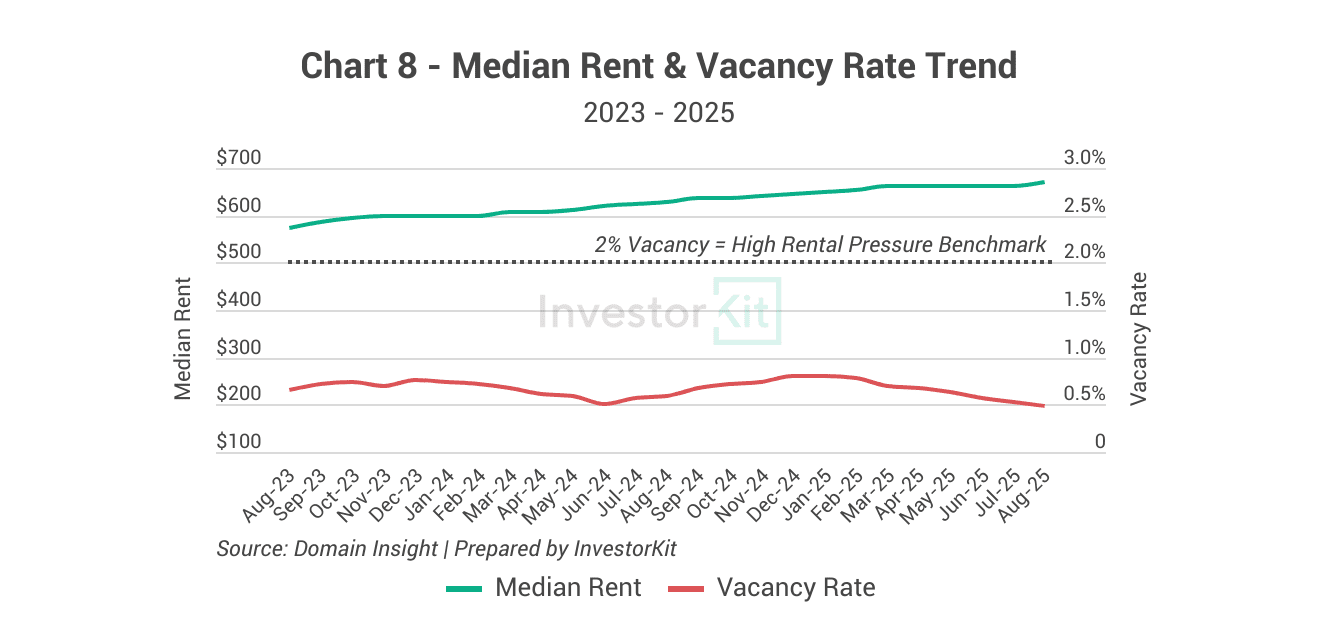

The rental market is under high pressure, with vacancy rates consistently below 1% for the past two years. The median rent now stands at $670/week, roughly 6.8% higher than it was 12 months ago.

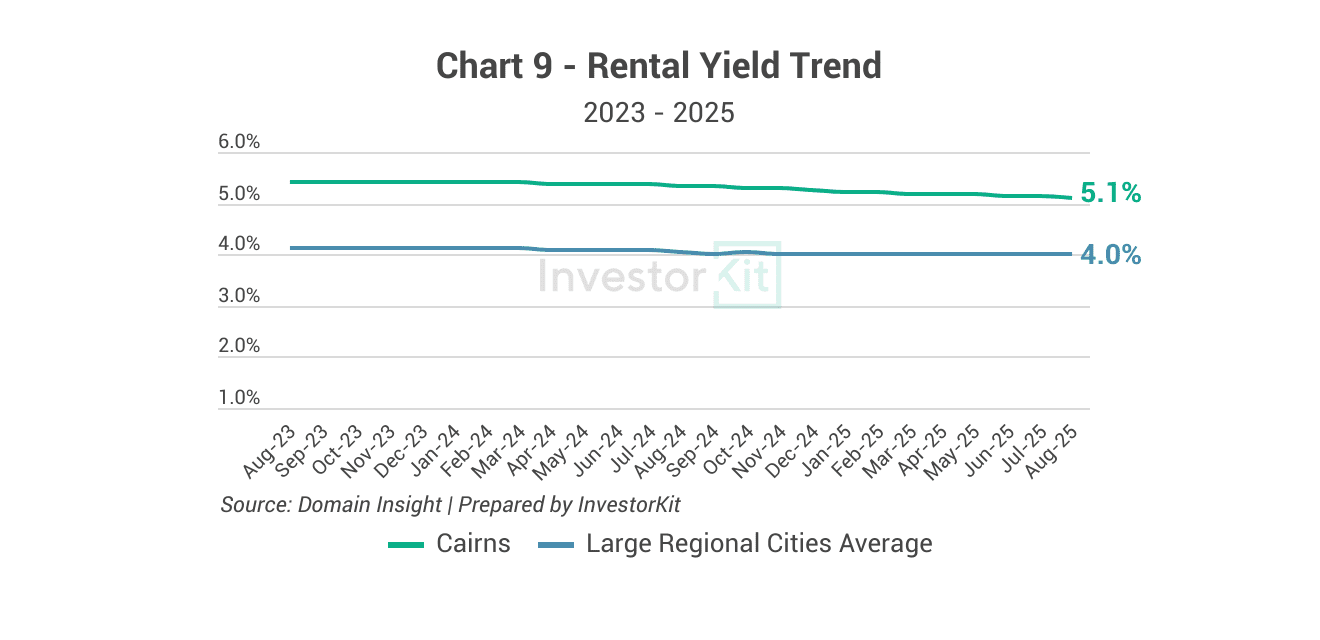

Cairns’s yields are still strong (above 5%), well above the average yield of the most populated regional cities, despite softening slightly as sales price growth has outpaced rental growth over the past 12 months.

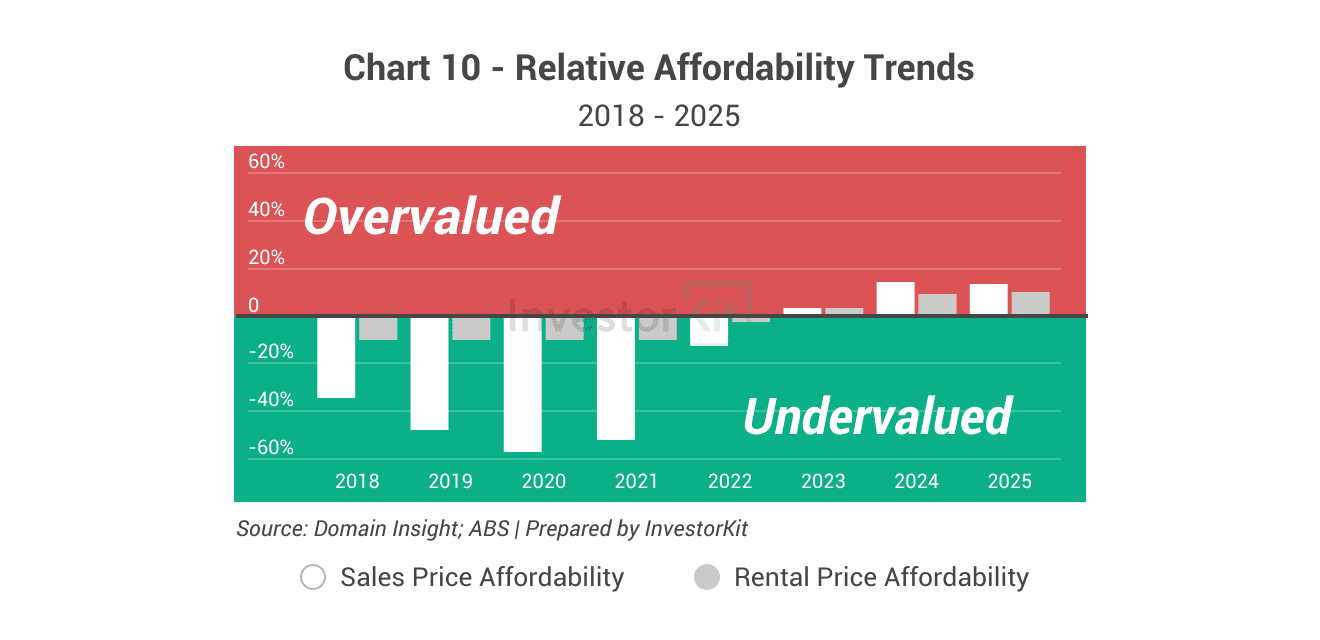

In terms of affordability, Cairns houses are less affordable than they were before 2022, with the price-to-income ratio increasing. House prices are around 13% overvalued, while the rental prices are around 10% overvalued.

However, the shift is not too extreme. It remains more affordable than many coastal lifestyle markets such as Whitsunday, Coffs Harbour and Port Macquarie.

In the next 6 to 12 months…

House prices are expected to continue growing at a healthy pace, supported by strong pressure in both the sales and rental markets. Rents are likely to rise steadily, while yields are expected to stabilise at healthy levels as sale price growth is expected to stay ahead of rental growth.

Cairns is the 17th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-minute FREE discovery call!

.svg)