January 15, 2026

Kiama-Shellharbour Property Market in 10 Charts

House prices in Kiama have been growing relatively slowly. Over the past 12 months, house prices grew by only 3.2%. Will Kiama-Shellharbour’s house prices accelerate in the year ahead? Join…

A Coastal Lifestyle Hub on the Illawarra

Located around 90 minutes south of Sydney, Kiama-Shellharbour offers a compelling lifestyle alternative for buyers seeking coastal living without sacrificing access to major employment centres. With healthy population growth, an improving economy, expanding infrastructure, and strong employment links to Greater Sydney, Kiama-Shellharbour has become an appealing place for both homeowners and investors.

Regarding its property market, after a period of double-digit price growth in 2021-22, house prices fell in 2023 and have since slowly recovered. Over the past 12 months, house prices grew by only 3.2%. Will Kiama-Shellharbour’s house prices accelerate in the year ahead? Join us today to explore the city’s current property market conditions and outlook!

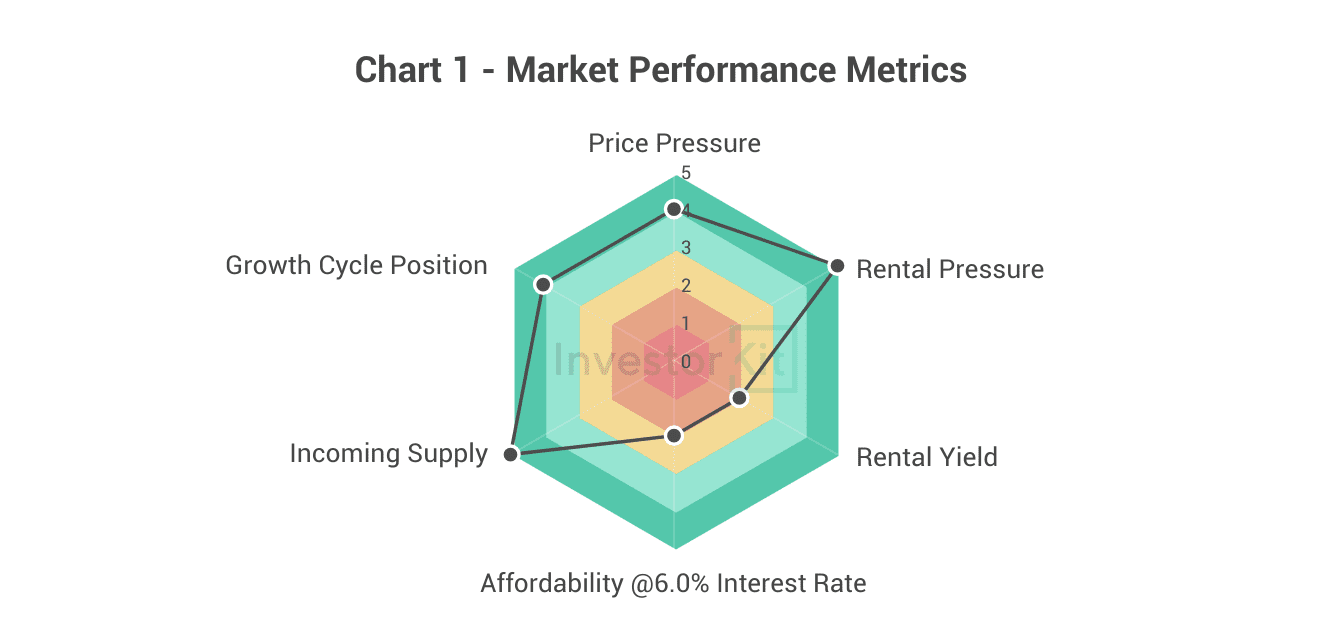

As of January 2026, Kiama-Shellharbour’s house market pressure is relatively high.

Among the six metrics that InvestorKit uses to measure market performance, Kiama-Shellharbour scores:

- 2 (weak) for rental yield and affordability

- 4 (strong) for price pressure and growth cycle position

- 5 (very strong) for rental pressure and incoming supply

Demographic & Economic Trends

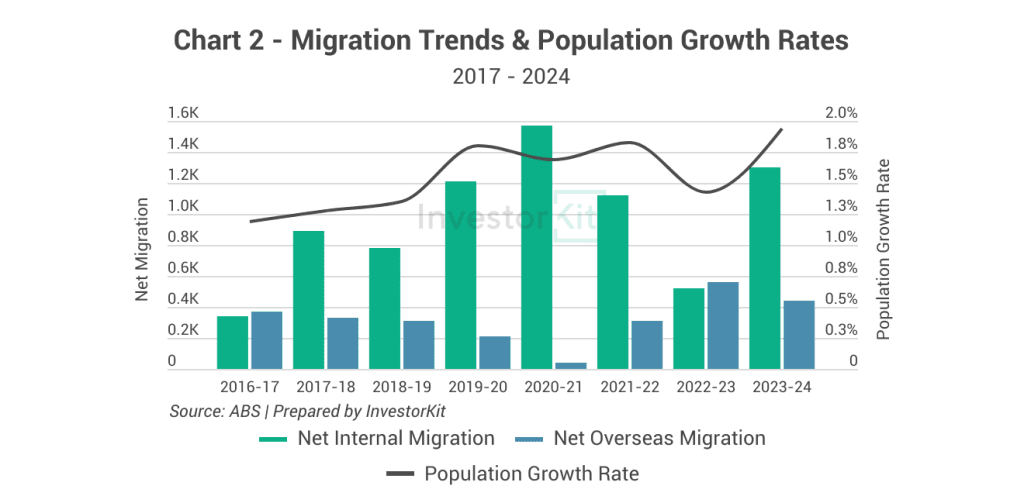

Population growth has generally trended upward over the past eight years, despite some fluctuations between 2019 and 2023, and is now sitting at 1.9%. Internal migration has been much higher than overseas migration in most years, except in 2016-17 and 2022-23, when overseas inflows were slightly stronger.

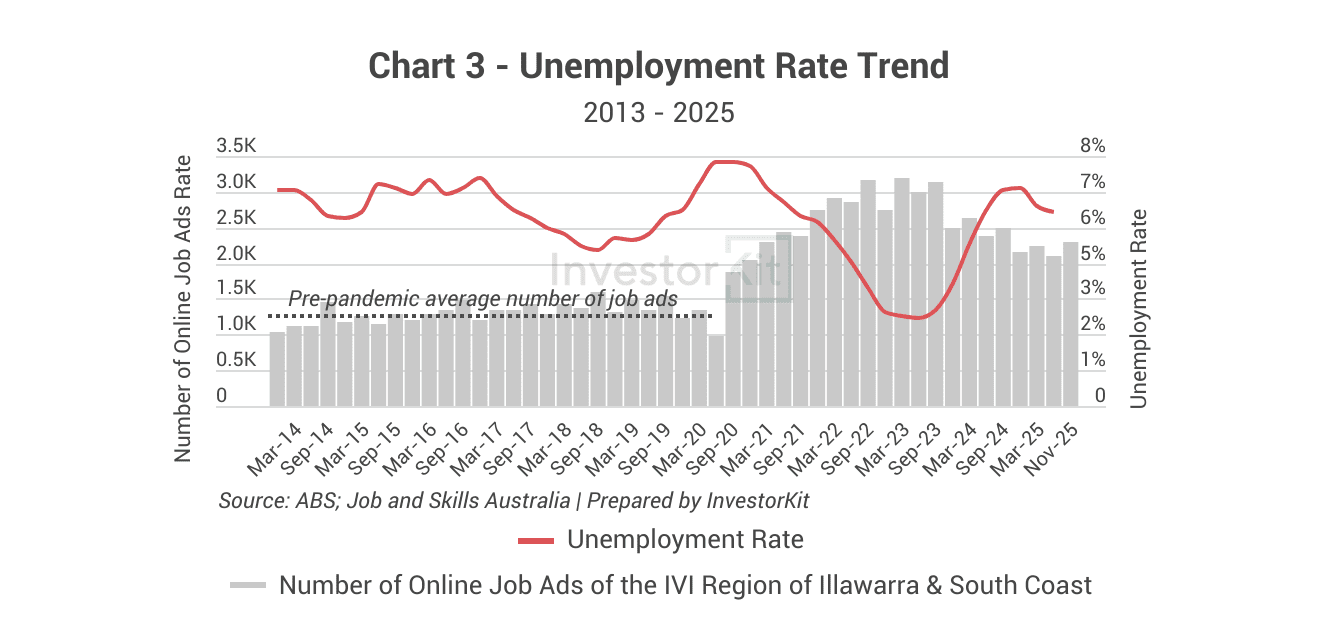

Economic conditions are improving. Even though the unemployment rate is still relatively high (6.2%), it has declined recently. Labour demand is still robust, with online job advertisements sitting at around 1.8 times the pre-pandemic average.

Healthy population growth alongside improving economic conditions point to resilient underlying housing demand and continued support for the local property market.

Kiama-Shellharbour’s Property Market: Sales Market Trends

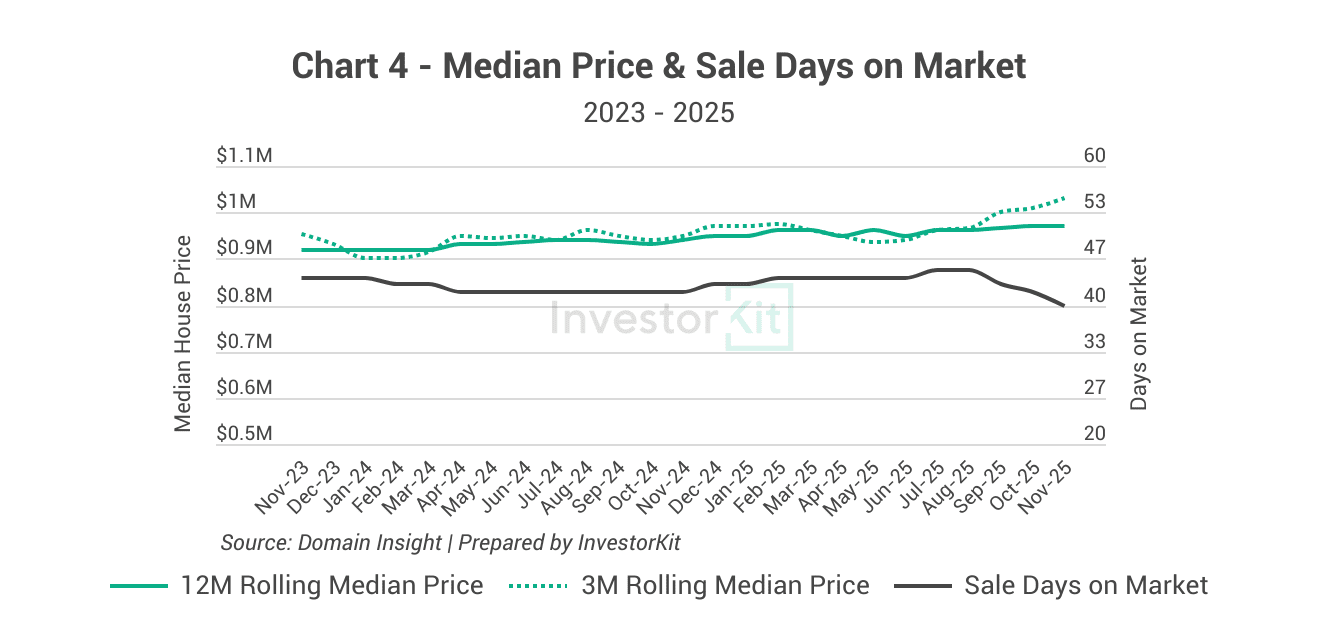

Kiama-Shellharbour’s house prices have recorded modest growth over the past 12 months, rising by around 3.2% to a median of approximately $970,000.

However, market conditions have strengthened since mid-2025, with the 3-month rolling median showing more noticeable growth momentum. Days on market have also trended lower since late 2025, indicating improving buyer urgency.

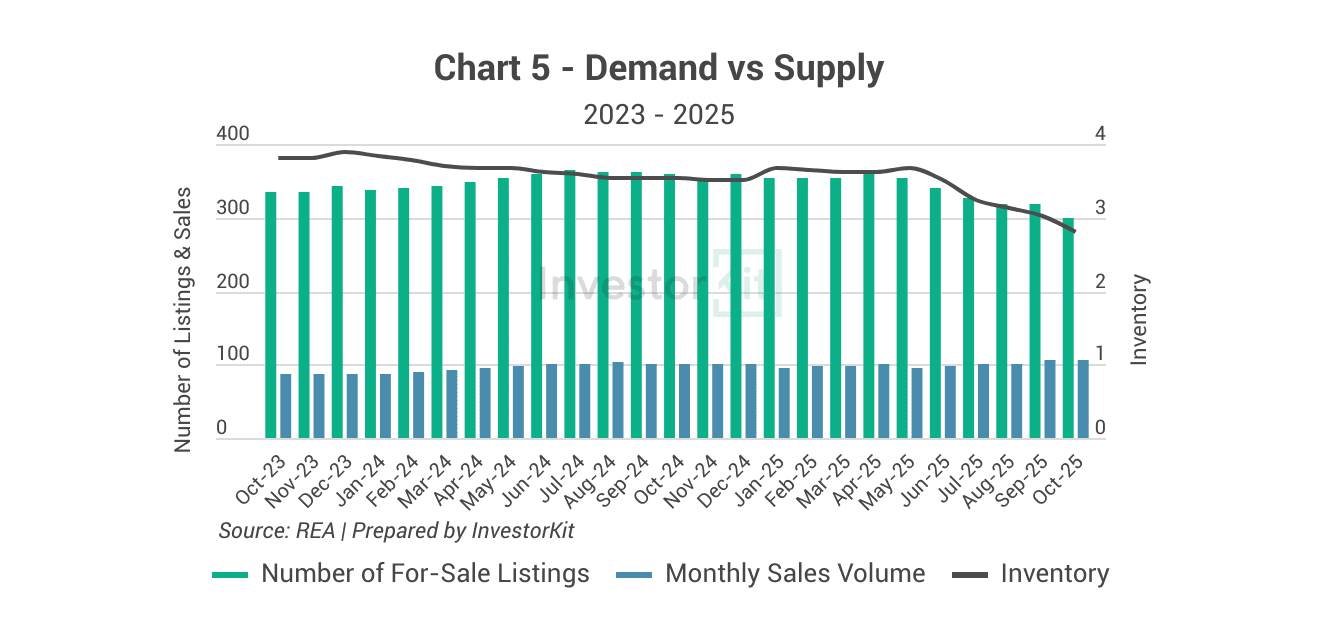

Inventory has fallen to around 2.8 months of supply as listings for sale have declined since mid-2025, while sales volumes have risen steadily.

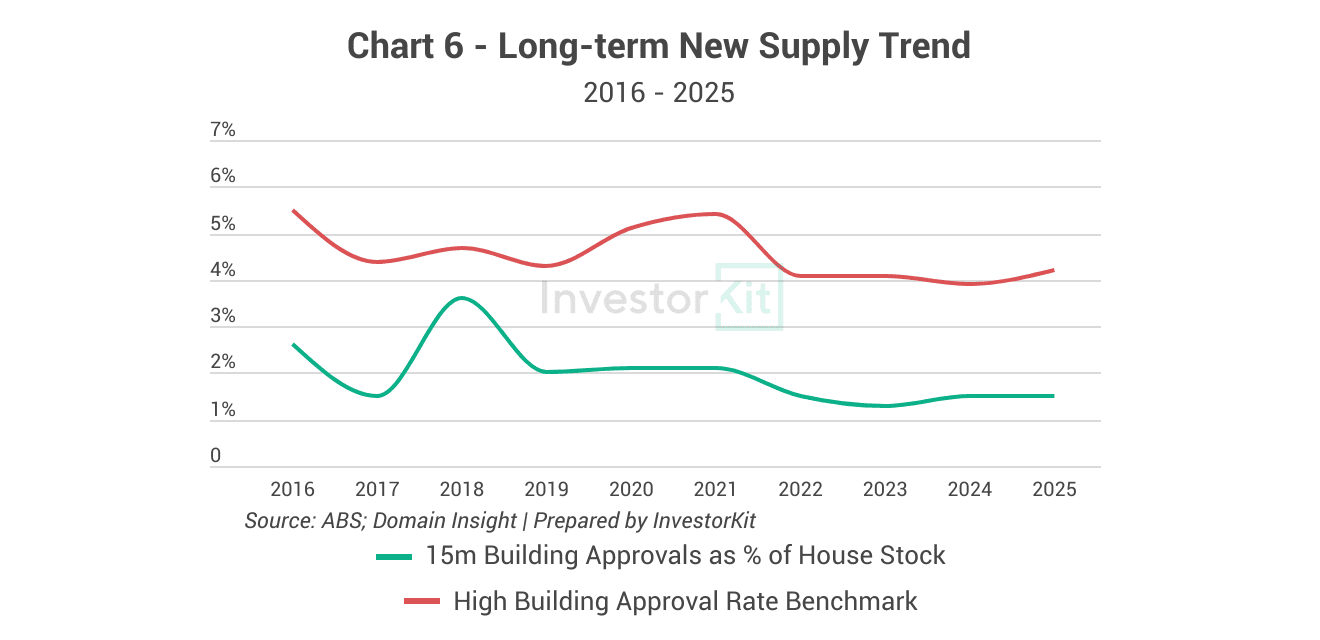

Kiama-Shellharbour’s incoming supply has become increasingly restricted over time. Building approval rates peaked in 2018, then trended lower, and have remained well below the balanced range of around 2-3% since 2022. This subdued new supply pipeline and healthy underlying housing demand point to healthier future market conditions and are expected to support ongoing price growth.

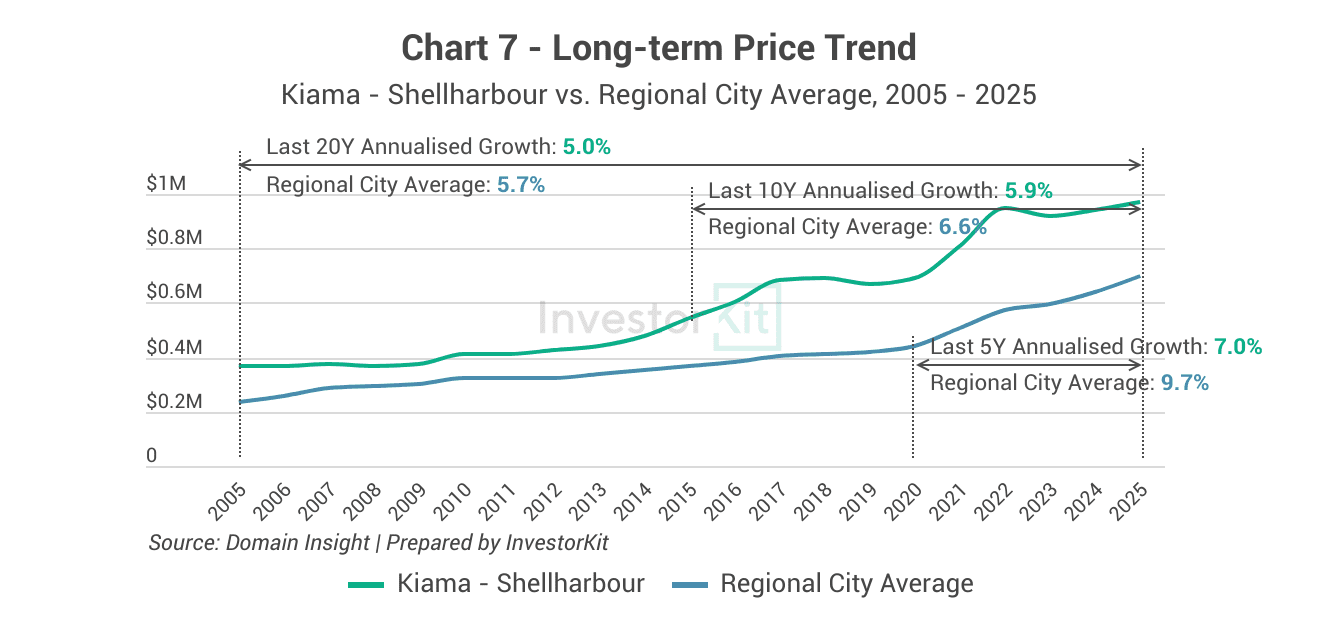

Kiama-Shellharbour has experienced healthy price growth over the past decade, with a 10-year annualised growth rate of around 5.9%, in line with the national long-term average of 5-7%. This suggests growth has normalised to the long-term average, creating more room for medium-term growth, which would also be supported by improving market and economic conditions, a low level of incoming supply and healthy underlying housing demand.

Kiama-Shellharbour’s Property Market: Rental Market Trends

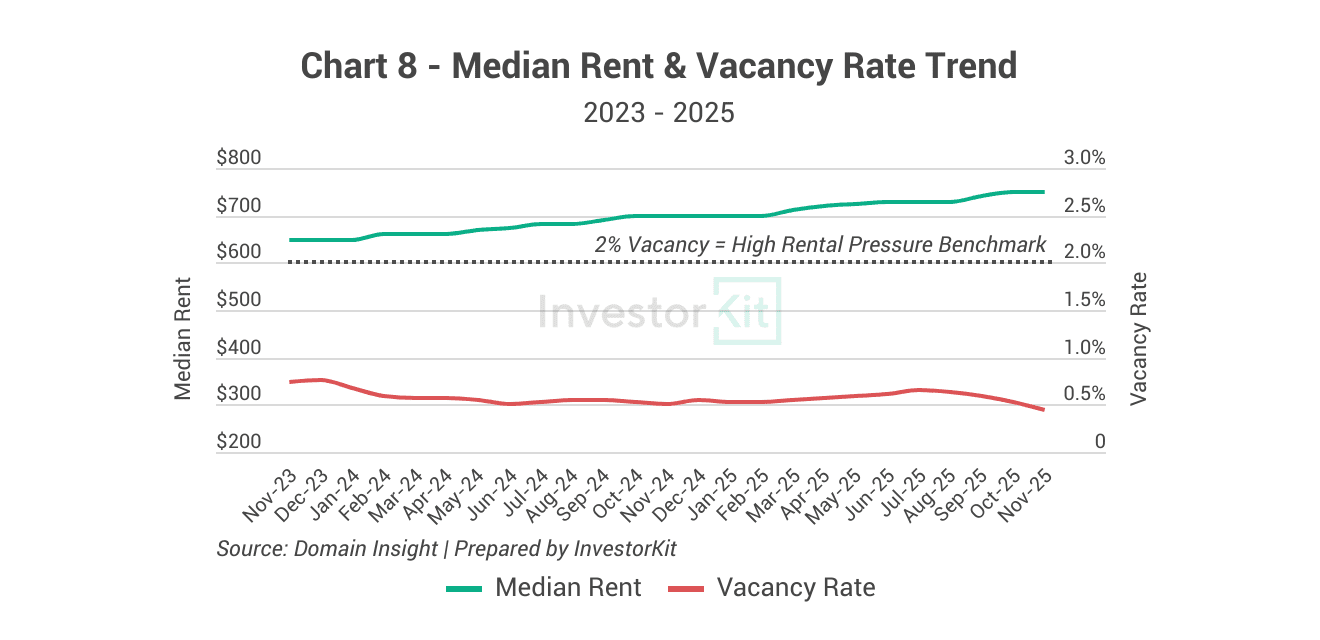

Kiama-Shellharbour’s rental market is under high pressure, as reflected in the extremely low vacancy rates of below 1%. Median rent has grown relatively strongly over the last 12 months, up by around 7.1%.

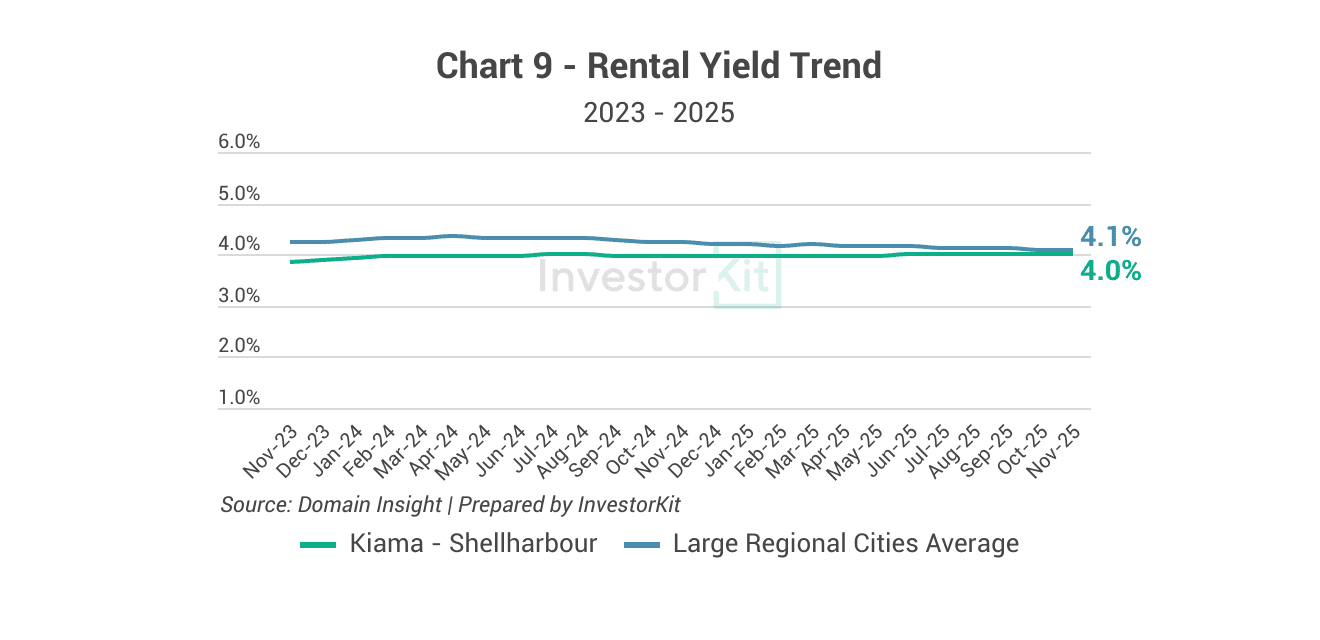

Kiama–Shellharbour’s median rental yield has been relatively steady at around 4.0% over the past two years, sitting slightly below the 4.1% average across the most populated regional cities. Yields are likely to remain constrained as house prices catch up with rental growth while sales market pressure improves.

Kiama-Shellharbour’s Property Market: Affordability

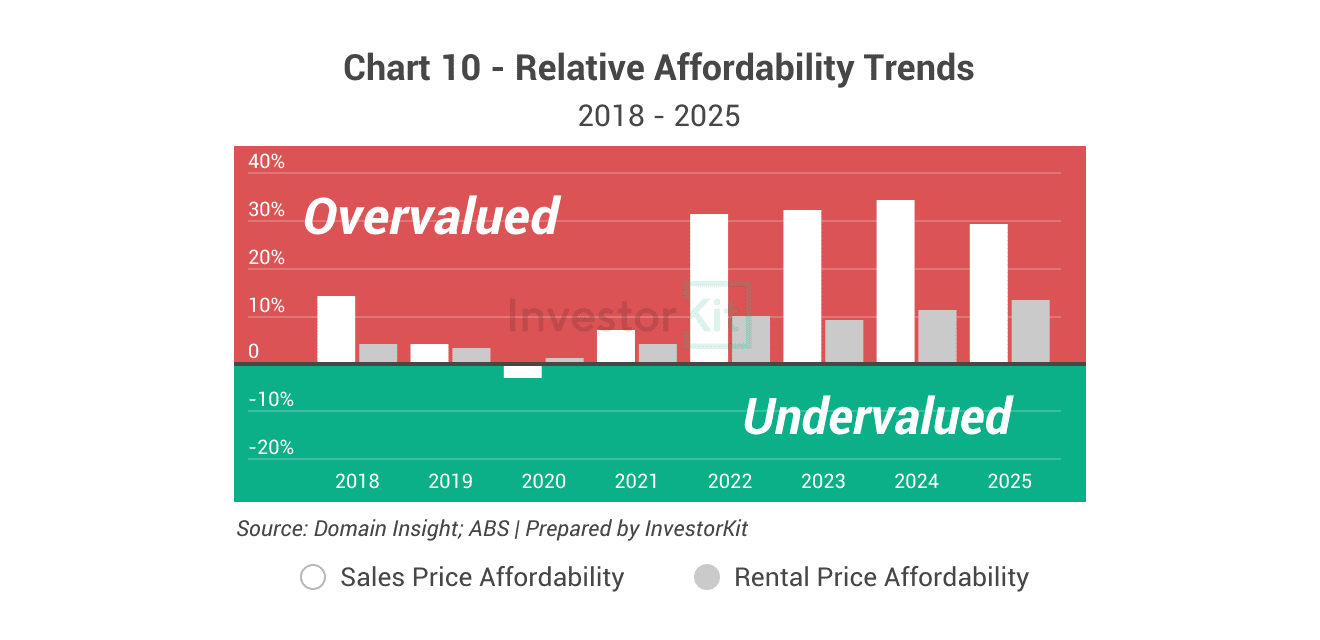

Affordability has worsened since 2022 across both the sales and rental markets. As shown in Chart 10, house prices in Kiama-Shellharbour currently sit around 29% above the local income benchmark, while rents are approximately 13% above it.

Kiama-Shellharbour’s Property Market Outlook

Over the next 6 to 12 months, we expect:

- Faster price growth: House price momentum will likely accelerate as market conditions tighten, supported by declining inventory levels and shorter days on market.

- Sustained rental strength: Rental conditions are expected to stay strong, with persistently low vacancy rates supporting continued rental growth. However, with price growth catching up with rental growth, yields are likely to remain capped.

Kiama-Shellharbour is the 22nd regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that selects purchase locations using a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve above-average growth and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-minute FREE discovery call!