Property Investment involves more than just falling in love with a charming facade.

To make a wise investment, it’s essential to delve into the factors that property valuers consider. Whether you’re a seasoned investor or a first-time buyer, understanding these seven key aspects can empower you on your property-buying journey.

1. Sales Comparison

When it comes to residential property, the most common approach is sales comparison. This method is especially suitable for active markets, where a considerable number of sales occur every month.

When doing sales comparisons, valuers often adopt a rating scale (superior, slightly superior, similar, slightly inferior, inferior). This will help you create a roof on pricing to avoid overpaying and a price benchmark to avoid constantly missing out. For example, a property is superior to your target, you wouldn’t want to pay more than that, and you wouldn’t want to pay less than a property that’s inferior to your target.

Here’s an example.

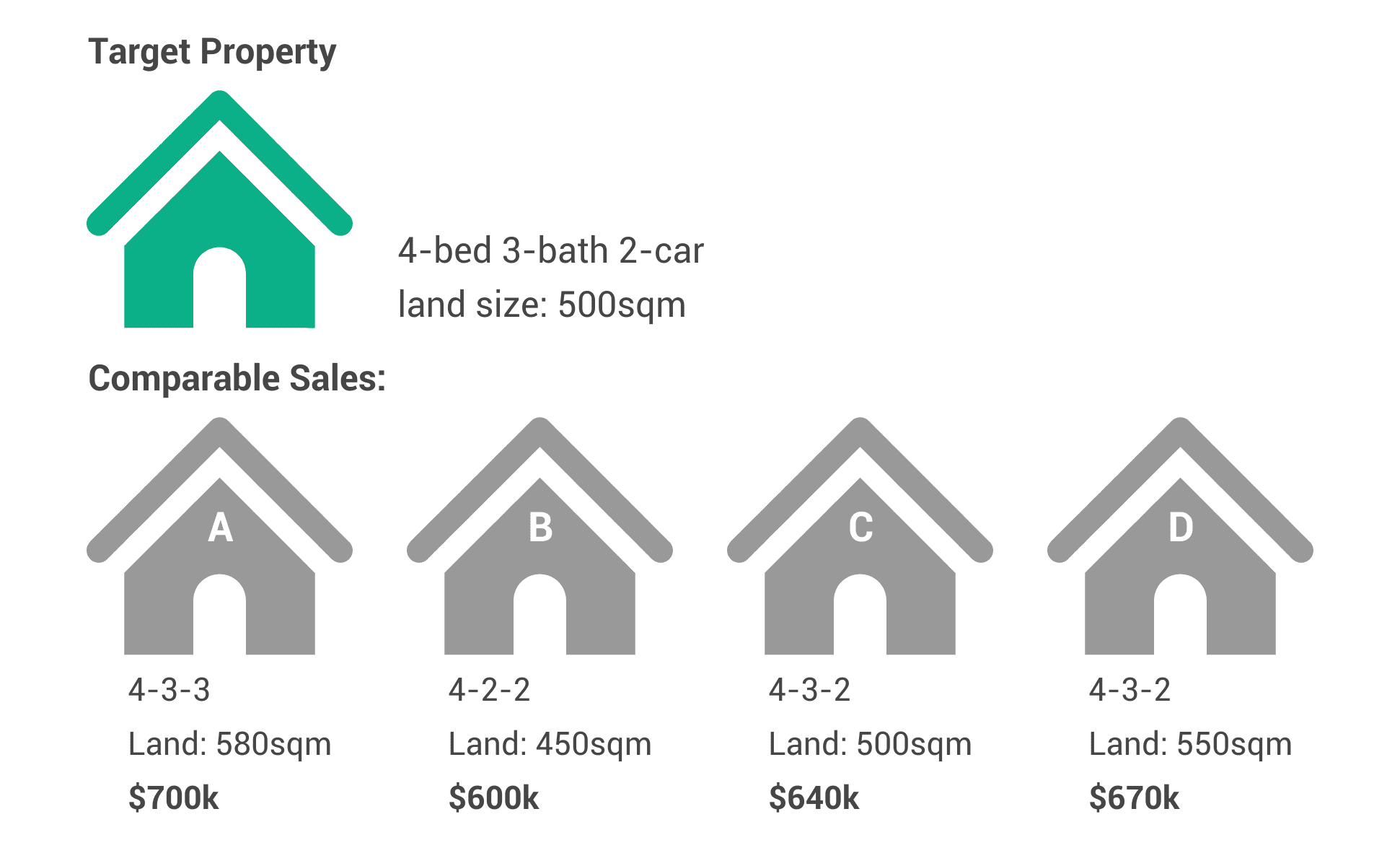

You are trying to buy a house with 4 bedrooms, 3 bathrooms, and 2 car spaces, on a 500sqm land. You’ve found 4 similar properties in the same neighbourhood sold in the past month: property A, B, C, D, as shown in the chart below.

– Property A is on a bigger piece of land, and with a larger garage, so it’s superior to the target property.

– Property B has one less bathroom and smaller land size, so it’s inferior to the target property.

– Property C has the same land size and the same house layout, but the house is older and more worn than the target property, so it’s slightly inferior.

– Property D has the same house layout and condition, but the land is bigger than the target property, so it’s slightly superior.

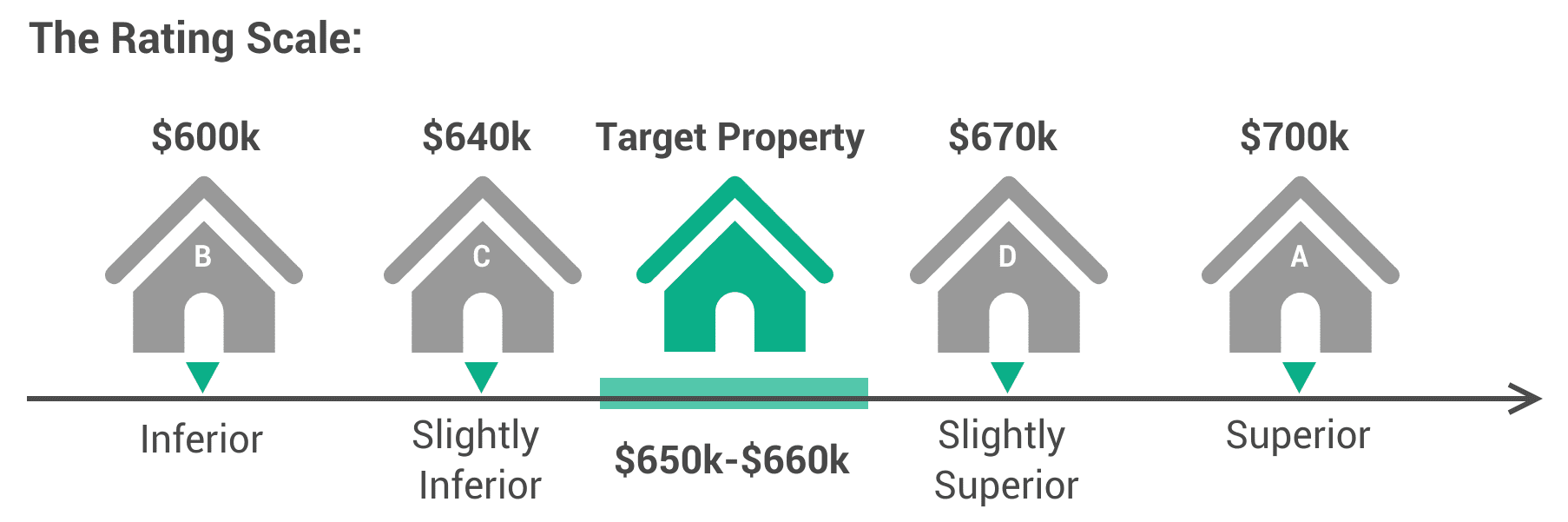

Therefore, out rating scale would look like this:

And a reasonable offer for the target property would be around $650k-$660k. You don’t want to offer as high as $700k because, with that money, you could afford a better property, and you don’t want to offer $600k, the same price as an inferior property, as you’d probably miss out on it.

Besides sales comparison, the below factors need to be taken into consideration as well to make your valuation as precise as possible.

2. Location Matters

Australia offers a wide range of lifestyle options. For instance, consider a house in the eastern suburbs of Sydney, known for their proximity to iconic beaches like Bondi and vibrant cultural scenes. These locations often come with a premium due to their desirability. In contrast, a house in the South Western suburbs may provide more space but could entail longer commute times.

Location also refers to what’s around your target property: Does the property sit beside a busy road? Is there a bus stop close by? Will the overflow from a nearby creek affect this property? All these undesirable elements would affect a property’s value. For example, a house on a smaller piece of land in a quiet cul-de-sac can be more valuable than one on a larger lot on a noisy main road.

3. Size and Layout Speak Volumes

In big cities like Melbourne, where terrace houses are common, the size and layout of the property can significantly impact its appeal. A well-designed layout in a Victorian-era terrace can enhance the historical charm, while a spacious modern layout might be more prevalent in newly developed areas like Docklands. Consider the local lifestyle preferences and the practicality of the space.

4. Condition is Key

For established houses, most of the property’s value may go to the land, but the house’s condition is still important.

It’s critical to not only check the photos but also have a look on the ground. This is because, first, the photos posted online might have been taken years ago, eg. right after the last renovation, not showing the current condition of the property. Second, one can only tell how certain materials feel in person when checking on the ground; for example, by only looking at the photos, you may mistake laminate flooring as timber flooring and overestimate its value, while a check on site would tell you the difference; Vinyl and weatherboard may look the same in photos but feel different in person; Many interior materials look great in photos but not necessary in person, and vice versa; etc.

If you are not able to go and inspect the property yourself, it’s advisable to get someone to do it for you, for example, a buyer’s agent or a professional inspector.

5. Stay Informed About Market Trends

Property markets experience fluctuations influenced by interest rates, migration patterns, supply, and other factors. How do market trends affect property values? Say your estimate of a property’s value is $630k-$650k: If the market is booming where demand and competition are high, you may want to offer $650k; If the market is trending downwards where demand is declining and competition is low, you may want to offer $630k to avoid overpaying.

6. Zoning and Planning Regulations

Zoning and planning regulations can also impact property values.

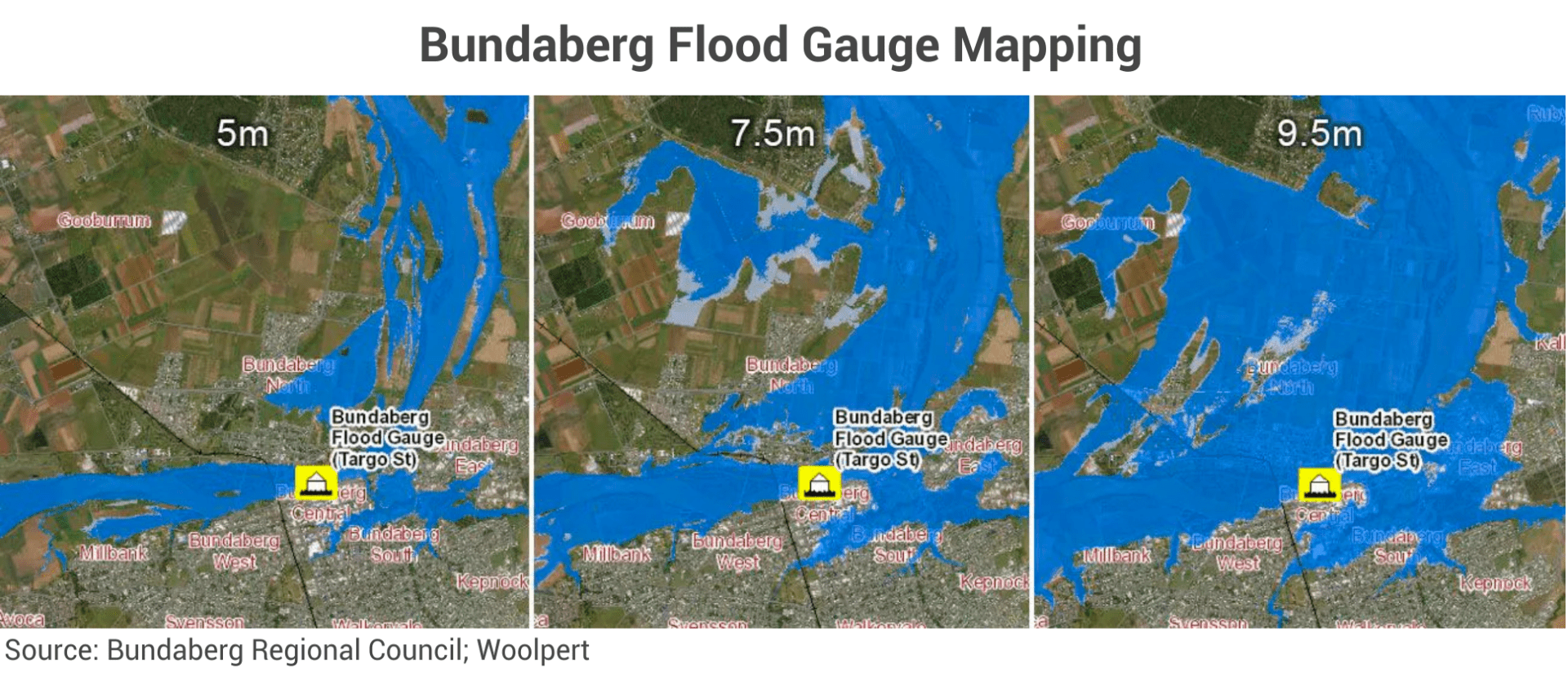

In some circumstances, they can limit a property’s value. For example, if an area is in a flood-impacted zone according to the council’s flood management plan, houses here may suffer longer sale days on market and higher discounts during flooding seasons, and, understandably, valuers may have lower confidence and be conservative in the houses’ values. However, it’s important to note that flooding is not a top factor that influences property values – demand and supply are. That is why many flood-prone suburbs see solid value growth, especially when there are no flooding events. An example is Bundaberg North. It’s a suburb on the north bank of Burnett River and is at risk of floods, as shown in the 9.5m scenario in the below chart. However, the house market there has been extremely hot since 2022, growing by 17% in 2023. This is compared to Bundaberg West, a suburb not impacted by floods, where house value increased only by 9% in 2023. The high growth of Bundaberg North is thanks to its low supply level relative to demand.

In other circumstances, zoning and planning regulations would benefit a property’s value. For example, a property with a single-storey house on a 600sqm lot may be worth $600k in a low-density residential zone, but can be worth $800k in a medium-density residential zone because it has the upside of subdivision/redevelopment (Check this article about development potential to get more insights on this type of property!).

Purchasing a property, either as an investment or as your residence, involves a nuanced understanding of local market conditions, economic dynamics, and lifestyle preferences. By considering these seven factors, you’ll be better equipped to evaluate your target property precisely, increasing winning chances and avoiding overpaying.

That sounds too much? You’re not alone in thinking so. That’s why property buyer’s agencies have become more and more popular in recent years. InvestorKit is a data-driven buyer’s agency that helps property investors identify markets and properties that best suit their portfolio needs with profound research and analysis: We take over all the hard work, not only valuation but everything from market selection, property search, due diligence, valuation, negotiation, settlement, to property manager referral and leasing guidance! Want to have this skilful helper on your property investment journey? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)