Many property investors are fascinated by the idea of development potential: I’m not just buying a house, but a development opportunity where I can demolish one house, build two, and sell them for double profit – It sounds exciting!

As exciting as it sounds, investing in a property with development potential can be a complex endeavour. This type of investment offers a unique set of advantages and challenges that investors need to carefully consider. In this article, we’ll delve into the potential profits and pitfalls of buying a property with development potential in the Australian market.

The Advantages – Profit Potential

Consider a scenario where you purchase a quaint house with a sizable backyard. With a keen eye for development potential, you may

- divide the land into two lots, turning one property into two, or

- renovate the current house by adding an extra bedroom, a modern kitchen, and perhaps a deck.

The result? Two properties that align with current market demands or a bigger and nicer property. Both would command a significantly higher price if reselling, bringing you high equity growth that’s worth years of growth in the normal buy-hand-hold scenarios. The profit potential in such cases is a compelling reason for investors to explore properties with room for improvement.

The Challenges

1. High Costs

Let’s not underestimate the financial aspect. Property development involves significant costs, including construction expenses, labour, and various fees.

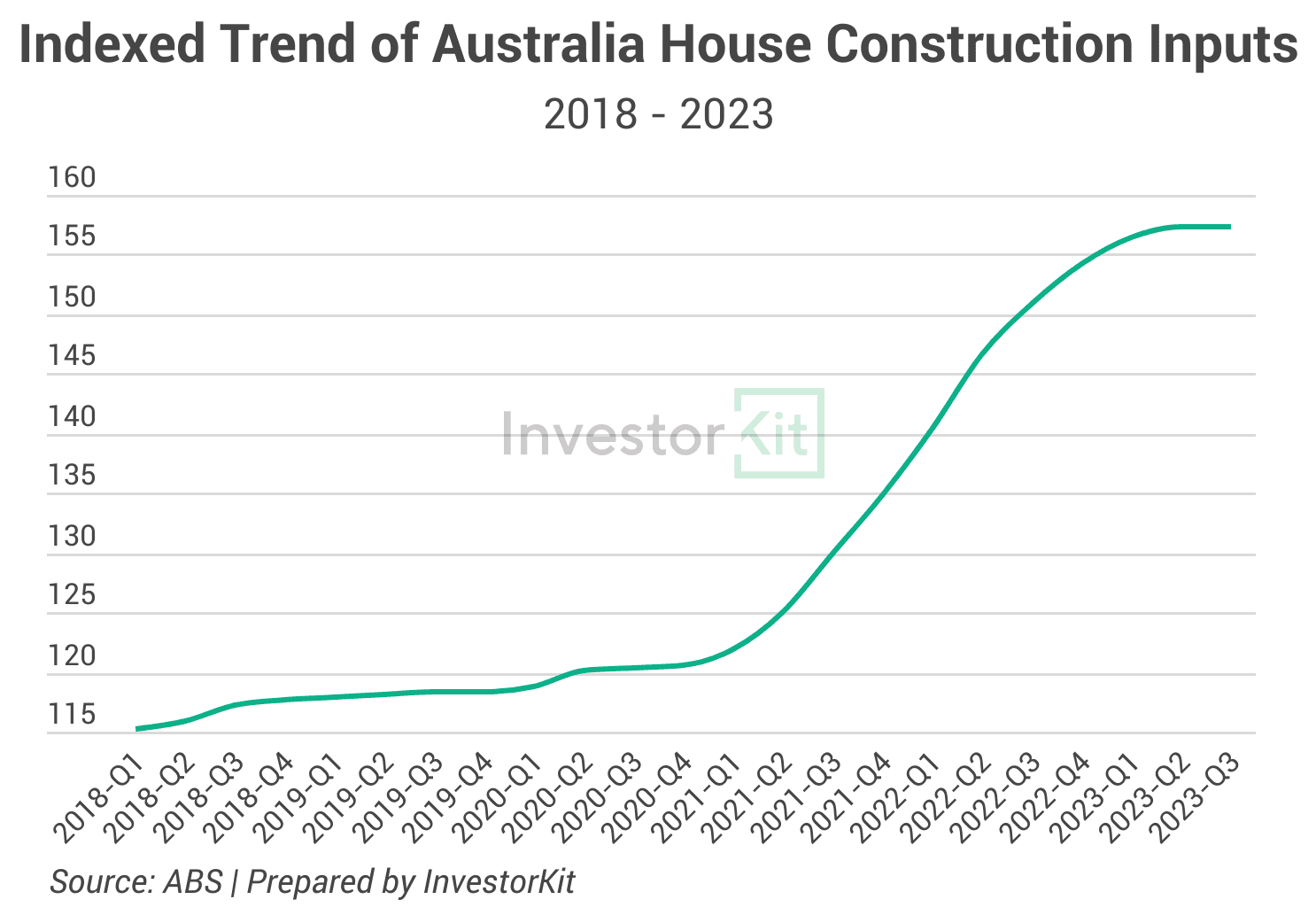

Australia’s construction costs have surged significantly since 2021 as both material and labour supply chains were disturbed by the pandemic. The chart below shows the indexed trend of construction costs in Australia.

The surge has stopped in 2023, but consumers are still paying high prices compared to pre-pandemic time. The high costs mean that the profit you make in the end may not be as large as you thought initially.

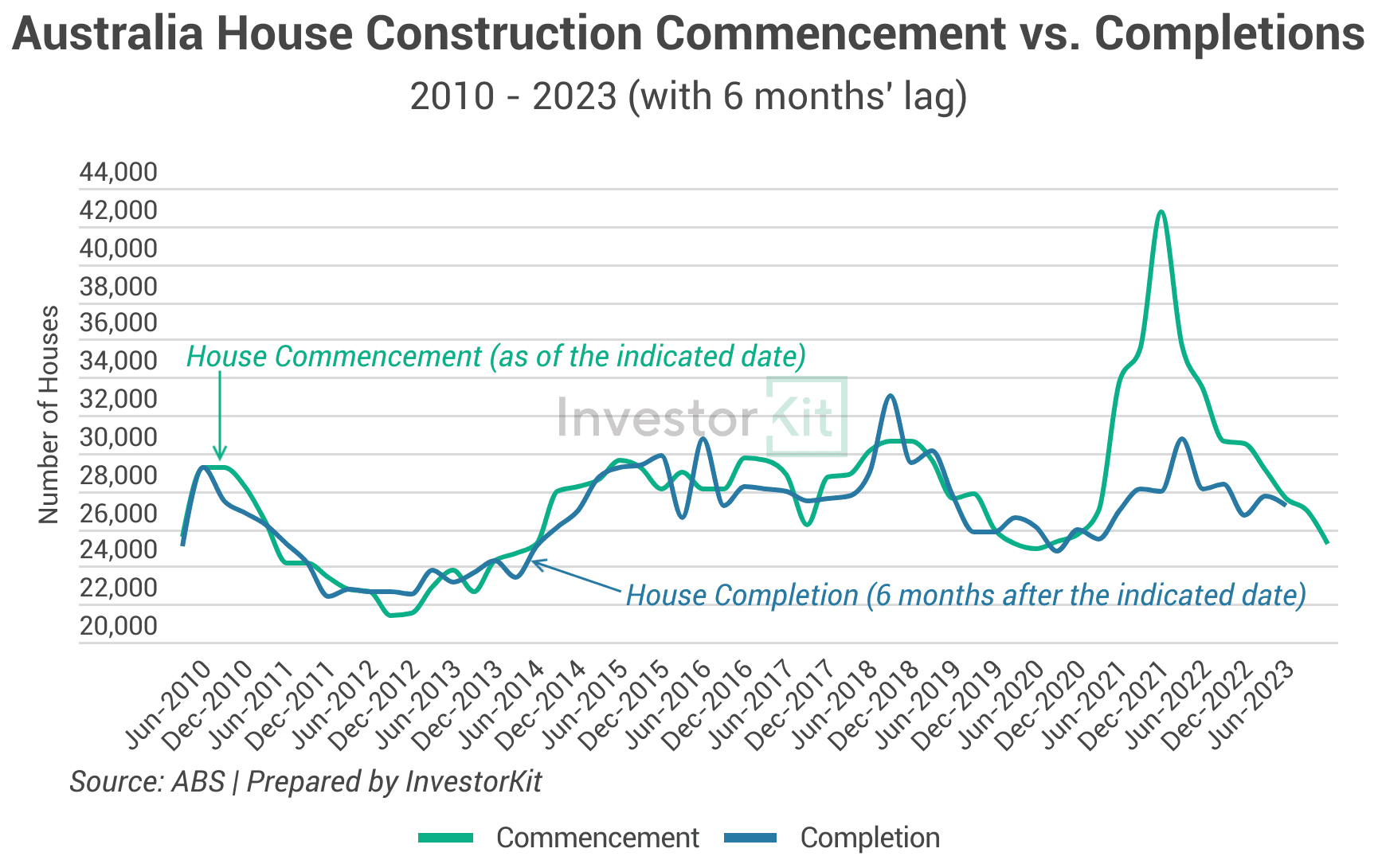

2. Risks of Delays

Construction delays due to unexpected rain or other issues can extend timelines and increase costs. The last few years have seen many houses delayed because of a shortage in material supply, shortage in labour, financial difficulty due to rising interest rates, or a combination of all these factors. The chart below demonstrates the situation. Before the pandemic, it usually took 6 months to complete a new house as the commencement and completion lines align with each other with a 6-month lag. However, the commencement-completion balance has broken since 2020, suggesting that a huge number of dwellings are completed longer than 6 months after commencement.

3. Regulatory Challenges

Consider a case where you have bought a property with development potential that is STCA, i.e. subject to council approval; You lodge your development proposal, but the council won’t approve it, and you must revise the proposal again and again, causing delays and more costs… Isn’t that annoying?

That’s the tricky part of “STCA”. Buying a property with the potential for development and buying a property with the potential for an executable and profitable development project are two separate things. Even the most experienced developer wouldn’t be 100% sure what a council would like to build and what they wouldn’t. This may lead to situations where you pay for 100% of your development expectation, but the council would only allow 70% of it to happen, making your investment more costly. As uncertainties arise around the time councils take to issue DAs (Development Approvals), you may suffer from delays in the DA stage already.

4. Market Fluctuations

Picture this: you invest in a property with development potential in an up-and-coming neighbourhood. However, economic downturns or interest rate changes can significantly impact the real estate market. While you may have anticipated increased property values, external factors beyond your control can influence market conditions. Here is what happened to a friend: He purchased a property with development potential in Blackheath, a suburb in Sydney’s Blue Mountains region, at the end of 2021 when the market was piping hot, and started redevelopment. When he finished the construction and tried selling the new house in early 2023, the market had cooled down as hiking interest rates bit. He couldn’t sell the property at a price high enough to recover his costs.

5. Market Saturation

Let’s explore a scenario where you decide to develop a property in a suburb already saturated with similar offerings. Finding buyers or tenants can be challenging despite your property’s unique features. Understanding the local demand and supply dynamics is crucial to navigating potential market saturation.

6. Risk of Low Yield

Suppose you opt not to develop the property immediately but instead choose to rent it out. There’s a significant risk of low yield, especially if the purchase price is high due to the large land size. Rental prices are primarily determined by the house, not the land. If the house is in average condition like others in the area or worse than average because it’s “suitable for redevelopment”, it may be challenging to achieve a high enough rental price to match your rental return expectation.

In the dynamic landscape of property development, balancing potential profits with inherent challenges is the key to success. Before investing in a property with development potential, it’s essential to conduct thorough research, seek advice from professionals, and develop a robust business plan. Consider the specific context of the property and the unique demands of the market in which it resides.

Sounds too effort and time-consuming to you? The good news is that property investment doesn’t need to be that complicated. You can be very successful in property investment without touching development AT ALL. In a recent episode of InvestorKit Podcast, Arjun, founder and director of InvestorKit, shares his reasoning behind building a roughly $12m worth of portfolio without a single development site and when he believes it’d be a good time to try it. Interested? Check the episode out!

InvestorKit is a data-driven buyer’s agency that helps property investors identify markets and properties that best suit their portfolio needs with profound research and analysis – Yes, you still need thorough research even if you’re not touching development, and yes, a good buyer’s agency like InvestorKit takes over all the hard work from you! Want to have this skilful helper on your property investment journey? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)