For decades, Australia’s rental market was dominated by individual landlords. In recent years, a new model is taking hold: Build-to-Rent (BTR), where the entire buildings are built for renters, professionally managed, and held long-term by institutional investors.

On the ground, Australia’s BTR market is maturing, with more projects being completed and stronger pipelines across VIC, NSW and QLD. Government incentives are also boosting momentum: faster depreciation (rising from 2.5% to 4%), lower foreign investor tax (MIT rate cut from 30% to 15%), a 15-year integrity rule to ensure long-term ownership, and NSW’s permanent 50% land tax concession.

Developers are moving ahead by converting old offices into rental apartments and partnering with large investors to fund projects from start to finish. Yields for top-quality BTR assets in Sydney, Melbourne, and Brisbane sit around 4.25-4.50%, reflecting growing investor confidence and willingness to pay for stability and quality.

With momentum building, how could BTR reshape Australia’s property market, and what might it mean for everyday investors?

In this blog, we’ll tackle three questions:

- How much can BTR really impact supply?

- Is BTR more affordable?

- How might it change renters’ and investors’ outlook?

BTR is increasing rental supply, but it’s still a drop in the ocean

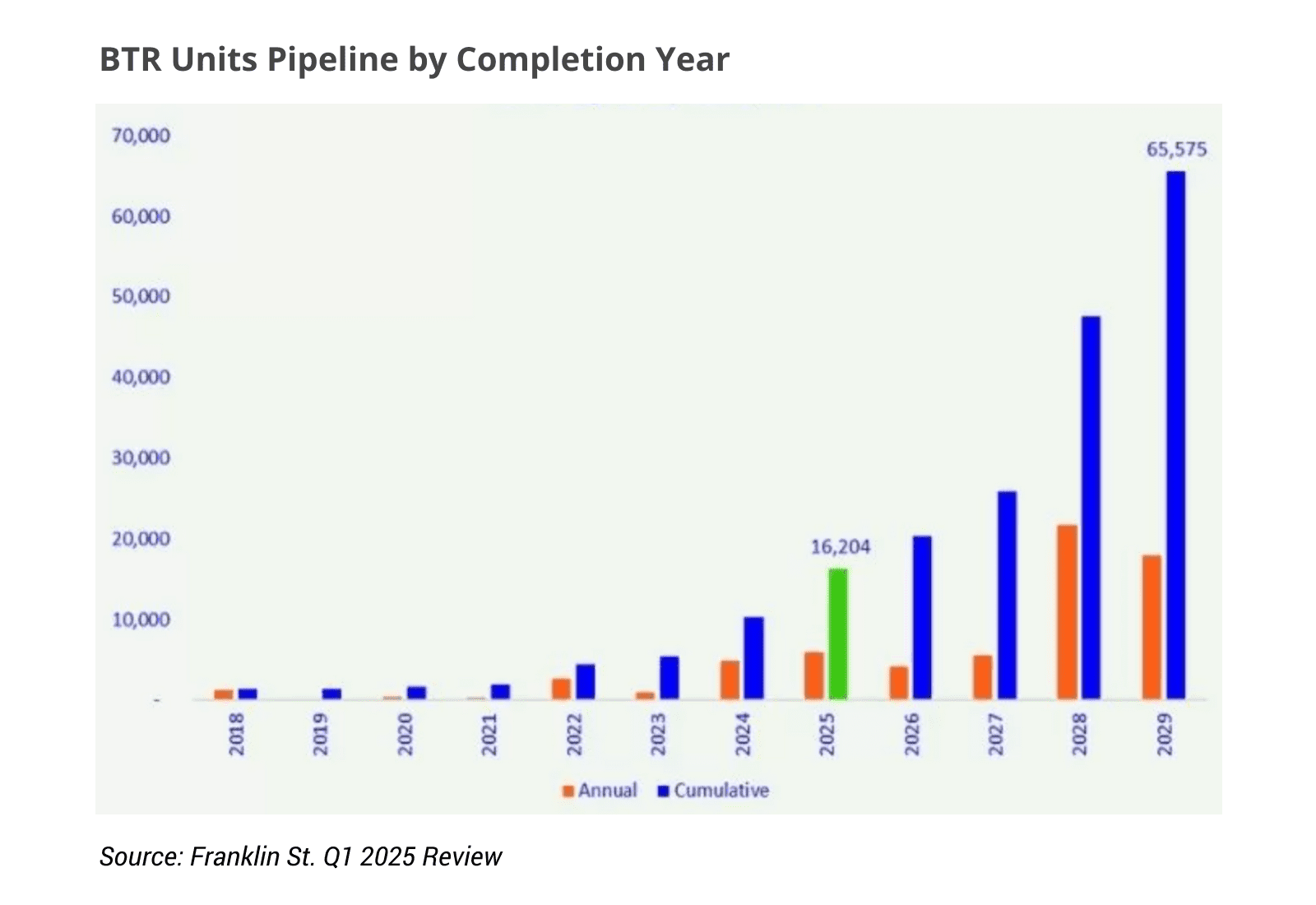

Australia’s BTR footprint is growing fast. Franklin St’s Q1-2025 review records 10,276 BTR homes in operation. By the end of 2025, this is forecast to reach 16,204 (a 58% increase), with 2025 deliveries concentrated in VIC (61%), QLD (25%) and NSW (14%).

The pipeline now stands at 65,575 units, a 26% year-on-year increase, with VIC leading the way, accounting for 40% of the pipeline, followed by NSW (29%) and QLD (23%).

Despite rapid growth, operational BTR comprises just around 0.09% of Australia’s total dwellings. Even if the entire pipeline were delivered, BTR would still make up only 0.6% of the total housing stock.

“Australia’s BTR market is still in its infancy. Just 0.29% of rental housing is institutionally owned and managed – compared to the UK and US, where that figure is significantly higher. For reference, Germany’s Vonovia (Europe’s largest private residential landlord group) alone owns 485,000 rental units – 47 times the size of Australia’s entire current BTR market.” – Franklin St. Q1 2025 Review.

In short, although the BTR sector is growing, it’s still much smaller than the private rental market. Therefore, private landlords will remain the main suppliers of rental properties, and the rental crisis is likely to continue.

BTR doesn’t mean “more affordable”

BTR offers new-build homes with professional on-site management, more amenities, and responsive services. It prioritises retention and a stable income over the lowest headline rent.

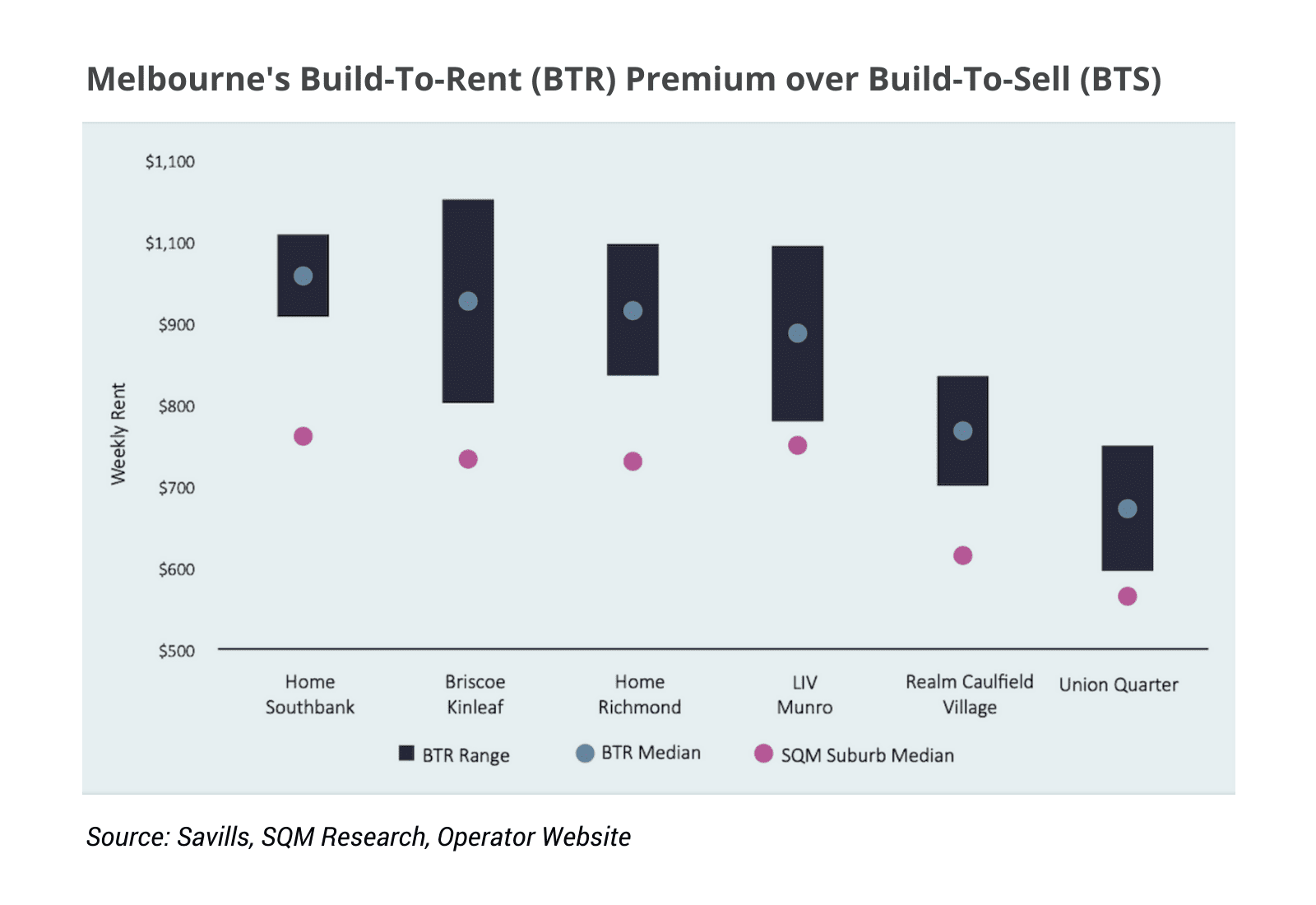

Savills’ Melbourne analysis (2024) shows BTR/multifamily isn’t cheaper. Across six newly built schemes, advertised two-bed rents sat around 18-26% above the suburb median.

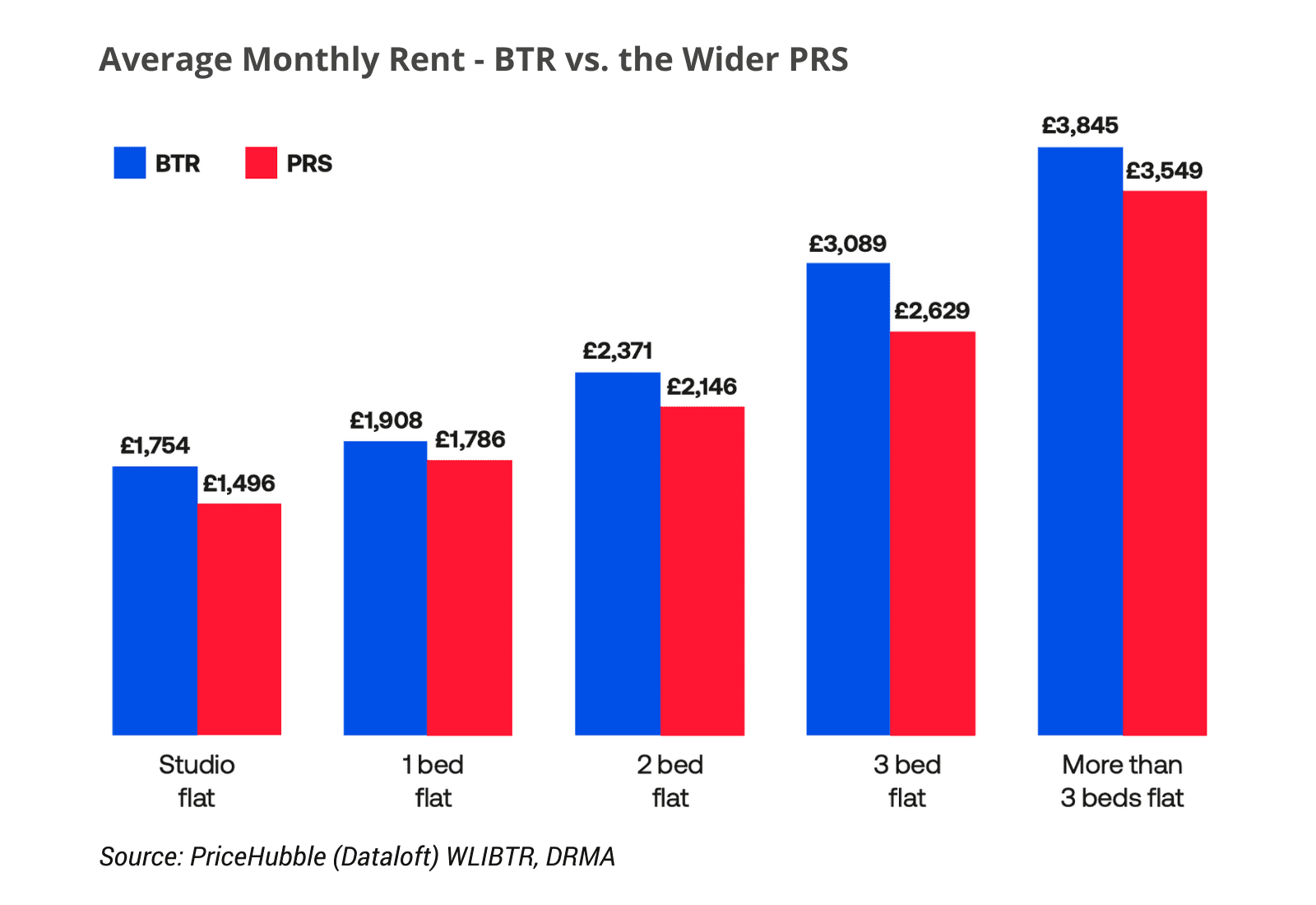

In mature markets like London, a BusinessLDN (2025) study shows that average BTR rents are higher than those in the wider private rented sector (PRS) across all unit types.

Overall, BTR gives renters more choice and higher-quality living options, but not cheaper prices.

BTR is changing how renters see renting

- Longer leases and renewals

In the private rental market, most leases last only 6 or 12 months before shifting to month-to-month, sometimes leaving tenants uncertain about how long they can stay. BTR developments, on the other hand, offer multi-year leases that provide more stability. For example, Greystar’s Haiku Yarra in South Yarra offers leases of up to three years, easing the common renter stress of “Will I be asked to leave?”

- Professional management and on-site service

Traditional rentals often rely on off-site agents and individual landlords, meaning repairs can take time and standards vary. BTR simplifies that with professional, on-site management focused on tenant experience. Renters benefit from faster maintenance, consistent service, and smoother move-ins and move-outs.

- More choice near jobs and transport

Many BTR projects are emerging in inner-city and middle-ring areas close to major transport links and employment hubs. Examples include Indi Sydney, located above the Gadigal Metro Station on Pitt Street, and Greystar’s South Yarra projects offering quick CBD access. As state governments roll out more transport-oriented developments, more BTRs in well-connected areas are expected.

With longer leases, professional management, and prime, well-located projects, BTR could gradually shift renting from a short-term stopgap to a stable, service-led lifestyle. It may also lift the overall service expectations across Australia’s rental market.

BTR is reshaping how investors think and plan

- More competition in the rental market

With longer leases, premium amenities, responsive service, and prime city locations, BTR projects are becoming more appealing to renters. This means private investors could face tougher competition, especially in suburbs with a high number of apartments and BTR developments.

BTR could expand to the house market, as seen in the US, where single-family build-to-rent (SFBFR) projects, often called “horizontal apartments”. If that model lands here, competition among investors could extend beyond apartments to houses.

To stay competitive, traditional landlords may need to focus on pricing or improve their service and maintenance standards.

- Shifting demand toward houses

Most BTR projects are apartments in inner and middle-ring areas, where institutional owners are capturing part of the unit-renter demand. With BTR offering better lease terms, quality facilities, and professional management, competition has intensified, pushing some private landlords to lower rents to attract renters. Combined with the slower long-term growth prospects for units, this could prompt many investors to pivot toward houses, where BTR has little presence. The resulting extra demand may place upward pressure on house prices, especially in suburbs with limited supply.

- Opening new investment pathways

In mature markets like the US, it’s common for entire apartment blocks to be sold to one buyer or a small consortium. This “whole block” model supports professional management, consistent standards, and long-term rental income at scale.

If it gains traction here, BTR could shift from a developer-led model to an institutional investment class open to super funds, real estate trusts, and high-net-worth investors. For private investors, it could also create opportunities to participate indirectly through fractional ownership models or managed funds targeting BTR assets.

The rise of BTR is giving investors a new perspective on Australia’s rental market. While it’s not yet reshaping investment strategies, it’s adding a layer of competition and professionalism that’s worth watching closely. By understanding how BTR interacts with local supply, tenant expectations, and emerging ownership models, investors can identify where it complements, rather than replaces, traditional investment opportunities.

In a nutshell,

- BTR will add to rental supply, but its small share means the near-term impact will be modest, with private landlords remaining the main providers.

- BTR offers renters more choice and higher-quality living, though not cheaper prices.

- For renters, BTR could gradually change how they think of renting, from a short-term stopgap to a stable, service-focused lifestyle.

- For investors, BTR brings stronger competition in the unit rental market and may redirect demand toward houses. Looking ahead, BTR could even expand into houses and open new pathways for large-scale, whole-building investment.

This blog was inspired by the podcast episode: “Build to Rent: A Game Changer for Australian Real Estate?” featuring our CEO, Arjun Paliwal. Check it out for further insight.

At InvestorKit, we’re dedicated to helping you deepen your understanding of the Australian property market through data-driven research and insights. Our goal is to support you in building and growing a strong investment portfolio backed up by analysis and on-the-ground experience. Get in touch today by clicking here to request a free, no-obligation 15-minute discovery call!

.svg)