While more young women in Australia want to own properties than their male counterparts, the property ownership percentage in young women is only a bit more than half of that in young men!

This finding from CoreLogic’s latest Women and Property report, released last week, stunned me.

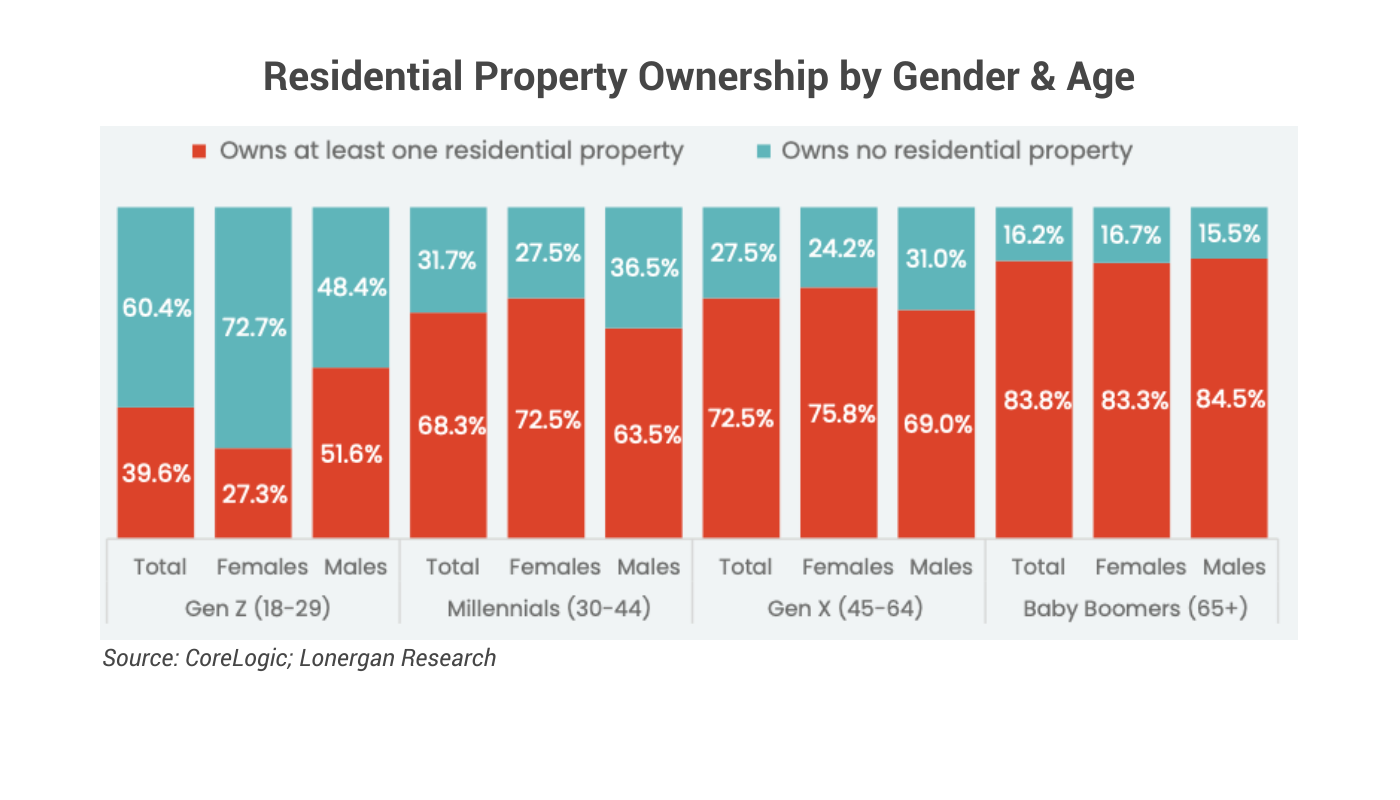

The survey reveals that although, in general, more Australian women (68.2%) own properties than men (67.4%), there is a huge gap between the property ownership percentages of women and men in Gen Z (18-29), the youngest generation surveyed: 51.6% of Gen Z males own at least one property, but only 27.3% of women of this age group are property owners (chart below).

The chart shows that property ownership % increases gradually in men as their age grows, but in women? A dramatic jump from the 20s (27.3%) to the 30s (72.5%).

Is it because young ladies don’t want to own property?

No, the survey also finds that more Gen Z females (51.0%) rate property ownership as highly important than their male counterparts (43.2%).

The main reason here is financial issues – The top two barriers reported for Gen Z females not owning a property yet are both about money:

- 61.4% say they don’t have enough saved for upfront costs (deposit, stamp duty, transaction costs, etc.)

- 28.4% say the ongoing costs are too high (mortgage repayment, council rates, etc.)

So, they tend to delay property purchases to their 30s when they earn more or when they have a long-term partner to buy properties with (53.9% of female property owners co-own at least one property with someone else, compared to 51.9% of males).

It’s sad to see young women suppressing their property ownership dreams purely because they believe that “they can’t afford it”… When they probably can. Lorna, a former client of InvestorKit and a current colleague (yes, she chose to work with InvestorKit as a buyer’s agent after successfully building her investment portfolio. Check her story here!), purchased 5 investment properties across multiple states before the age of 30 with her salary – right, she was a salary-earner just like you and me.

If Lorna could do it, you can do it, too.

Let me show you why property investing is not as inaccessible as you think.

You have many choices even with a lower salary.

While you have just started your career and don’t earn as much as you can in 5-10 years, you can always make the most of your current income and kick into the property market in a strategic way: looking over the border. You may not be able to save enough deposit or afford the monthly mortgage repayment for a house in your backyard, but you can make it somewhere else.

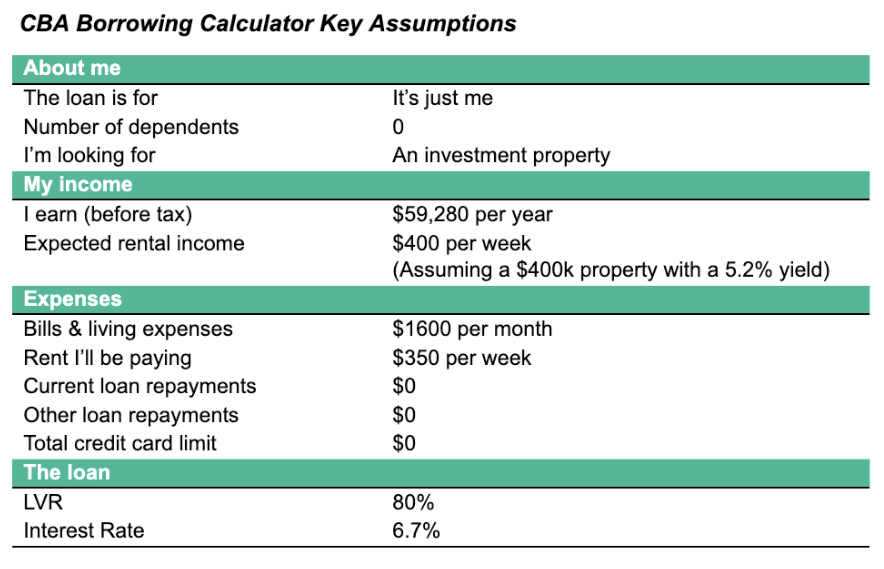

Let’s assume a young lady who just started working full-time and is earning the median income of her age group. There’s no generation-based income data for women, so I’ll be using the median weekly income of women of the 25-34 age group — $1,140/w (ABS Employee Earnings Dec 2023 release), which is equivalent to $59,280/y. Based on a calculation with the CBA Borrowing Calculator with the below assumptions, she can afford a $378k house.

Can $378k get her a proper house?

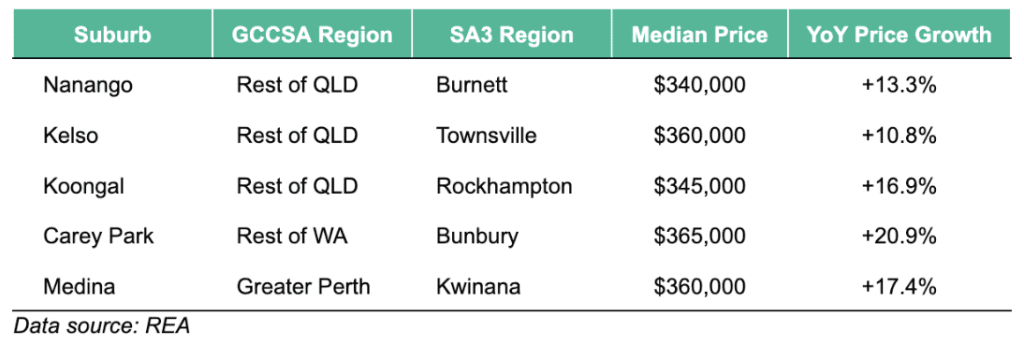

Yes, it can! Although they may not be in your city or even state.

Among the 4300 suburbs across Australia that have valid property price data, 401 still enjoy a median price equal to or less than $378k. Among the 401 affordable suburbs, 225 have a sizeable rental market with solid rental market data (eg. rental prices, rental yields) available.

Some of these suburbs are:

225 indeed seems tiny compared to the total number of suburbs (10,000+) across the country, but remember, all we need is one property in one suburb to kick-start our investment journey.

Affordable locations achieve impressive growth, too.

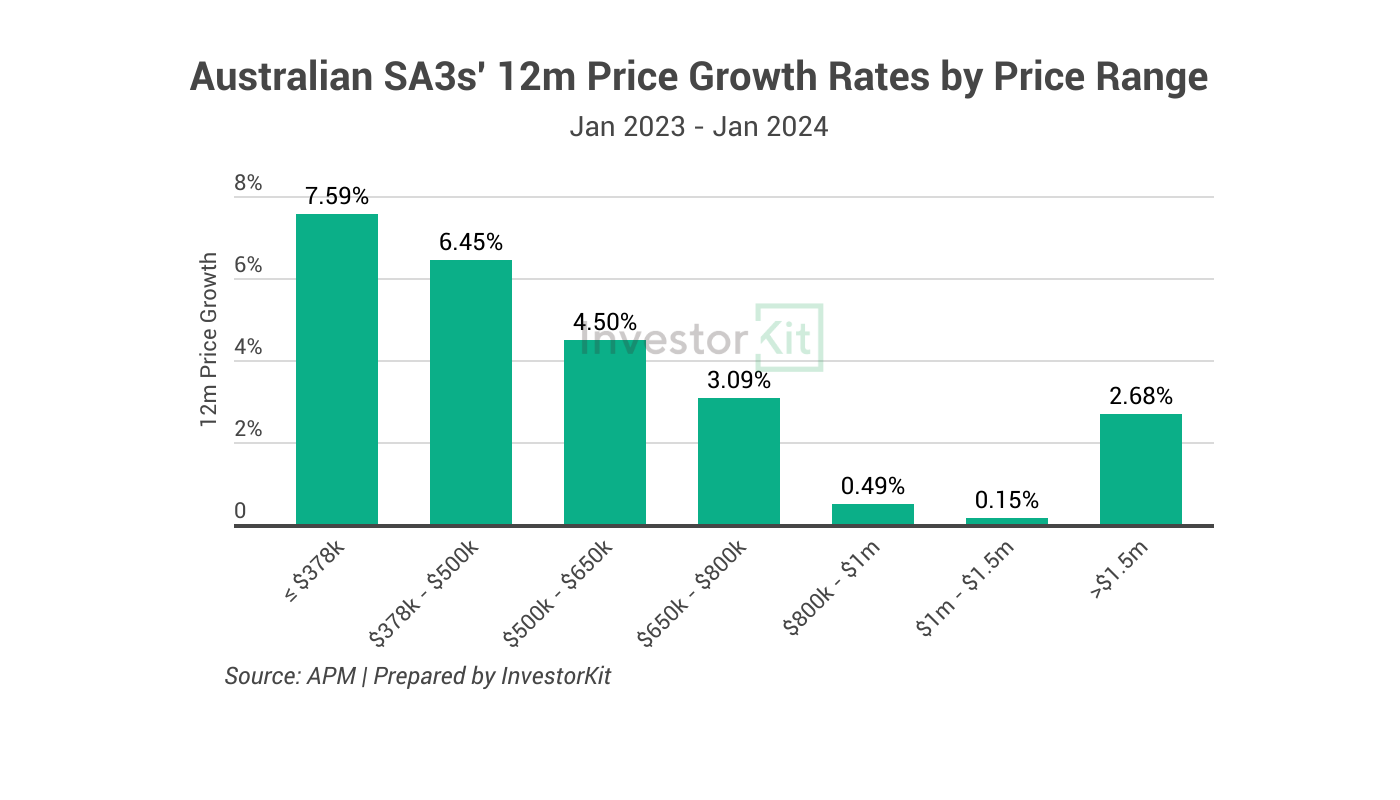

of the most common misunderstandings about property investment is that “the more expensive, the better the growth.” However, that’s not true.

First, in the long run (30 years or longer), most sub-markets with healthy and balanced local economies tend to achieve similar annualised growth (5-6% per year) no matter their price points;

Second, in the short term, growth depends more on the demand-supply dynamics. Guess what? In the current high-interest-rate environment, affordable sub-markets are in high demand. In 2023, we see a significant negative correlation between price level and growth: The more affordable, the higher the price growth, as shown in the chart below.

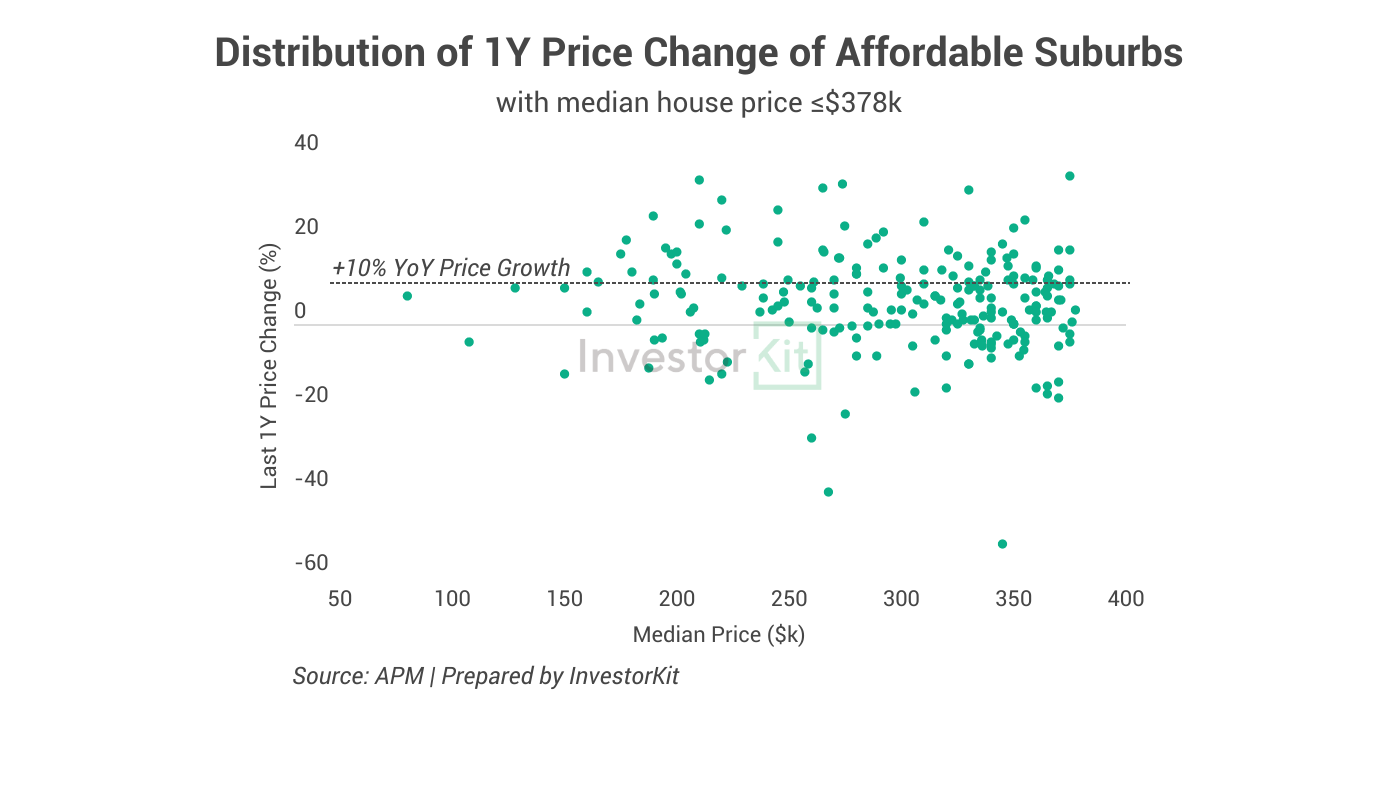

Among the 225 affordable suburbs, 155 saw hose prices grow in the past year (chart below). Of the 155 suburbs, 67 achieved double-digit growth, including the 5 suburbs listed in the previous section.

Rental income can help cover your holding costs.

You might still be concerned about the holding costs, especially the monthly mortgage repayment. Will that be a burden, given the high interest rates?

Don’t worry. With proper research and investing in a market with healthy rental yields, the house’s rental income can cover either the entire holding costs or the majority of them, making your life easy.

Rental yield is the annual gross rent expressed as a share of the total purchase price. If a property’s purchase price is $400k, and it’s rented out for $400/w, the gross rental yield would be $400/w * 52 weeks / $400,000 = 5.2%.

In a high-interest-rate time like now, we would like our rental yield to be 5-6% or even higher to achieve a healthy rental income cash flow that covers as much of the mortgage repayment and other holding expenses as possible.

Sure, it’d be impossible if you looked at the “premium” suburbs: the Stonnington region in Melbourne only offers an average rental yield of 1.9%; the eastern suburbs in Sydney have seen their yields recover, but they are still as low as 2.4%; and the inner Adelaide region of Unley, after house prices have surged over two years, is only yielding 2.6%. Buying in these areas, you’ll have to take a lot of cash out of your pocket to repay the mortgage.

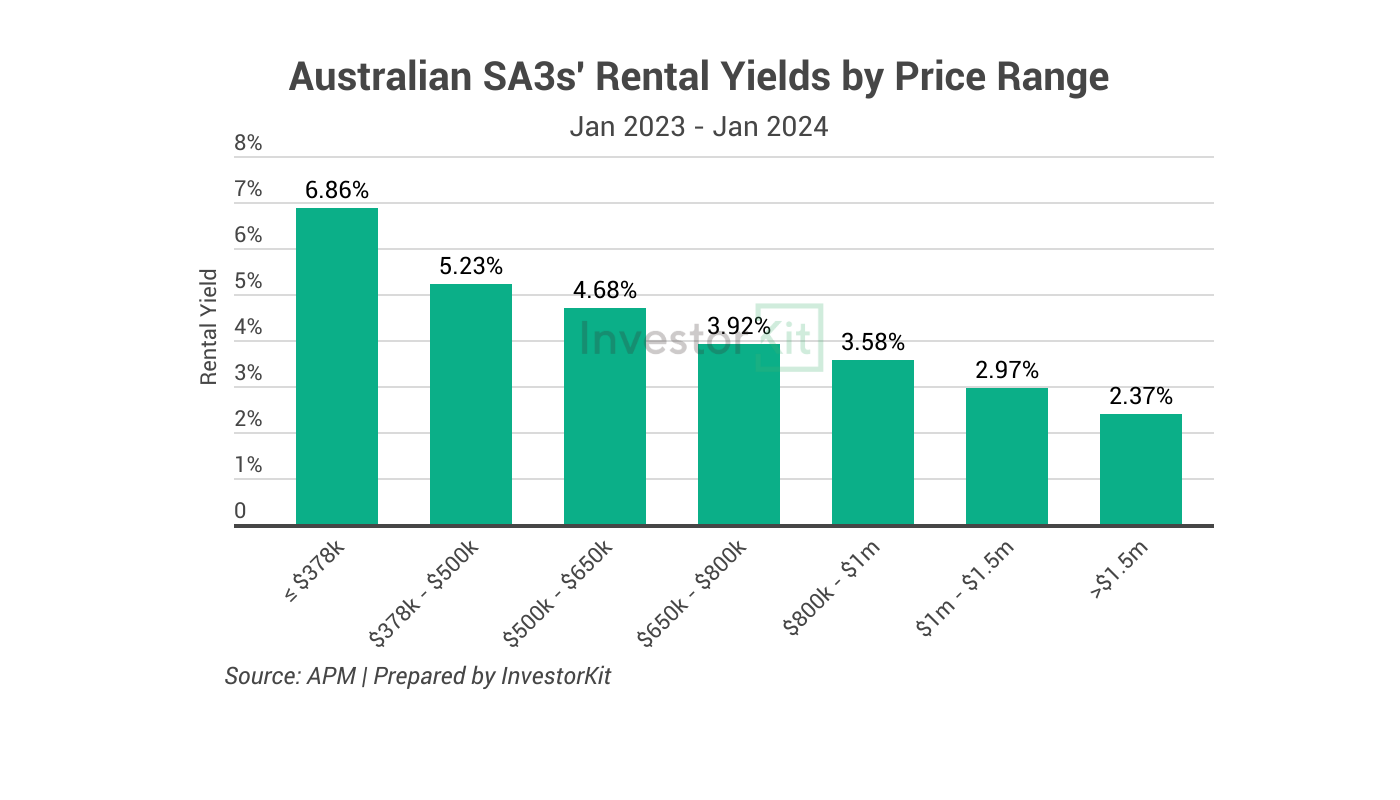

However, data would tell you that the affordable sub-markets tend to offer much higher rental yields than the less affordable ones.

As of January 2024, the sub-$378k markets enjoy the highest rental yields, and the higher the price range, the lower the rental yields achieved (chart below).

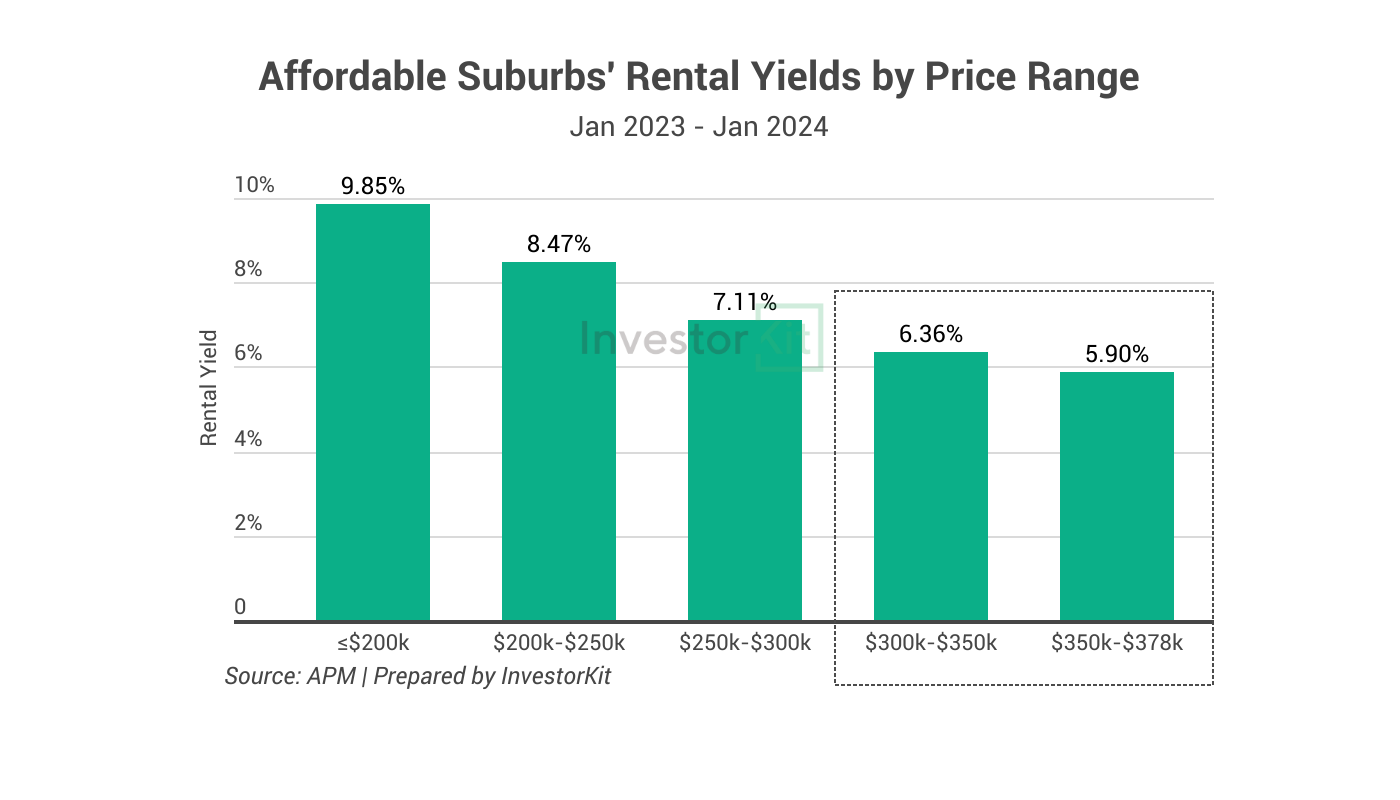

Now let’s zoom into the sub-$378k price bracket (chart below): Even in the suburbs with median house prices between $300k and $378k, yields are well above 5.5%, the high-yield benchmark.

Ladies, let’s property up!

A KPMG 2021 report reported that the median super balance for men aged 60-64 is $204,107, whereas, for women in the same age group, it is $146,900, a gap of 28%! Compared to men, we women, in general, need more investment beyond superannuation to secure our retirement lives. Property investment is one good option, given that the Australian property market is healthy, with robustly growing demand and short supply.

Data has proven that successful property investing is not out of reach for young women if you understand that there are plenty of locations across the country where the price is affordable, strong growth is happening, and the rental income can cover your holding costs. The key is to identify these locations and put your money in with the right timing – The sooner you build a scaled property portfolio, the higher compound growth you’ll enjoy.

The only question, now, is how to identify these locations.

InvestorKit is a data-driven buyer’s agency that dedicate ourselves to helping you clarify your investment goals and plans, identify the right markets and properties that suit your strategy and budget, and eventually achieve your investment goals faster than you initially thought. Sounds like something you’d like to try? Connect with us today for a free 15-minute discovery call!

.svg)