Hervey Bay: The Jewel of the Fraser Coast

Located on the stunning Fraser Coast of Queensland, Hervey Bay is a charming coastal regional city. Famous globally as the whale-watching capital of Australia and the gateway to K’gari (Fraser Island), it has transformed from a quiet holiday spot into a dynamic lifestyle hub supported by expanding health, tourism, and construction sectors.

Just over three hours north of Brisbane, Hervey Bay offers an enviable work-life balance, attracting families and retirees alike. Its strong population growth, healthy rental yields, and improving local economy continue to make it a standout destination for buyers seeking coastal assets.

Regarding its property market, after a period of exceptional price acceleration between 2021 and 2022, growth briefly moderated in 2023. However, the market has since regained momentum significantly. Will Hervey Bay’s house prices continue to grow strongly in the year ahead? Join us today to explore the city’s current property market conditions and outlook!

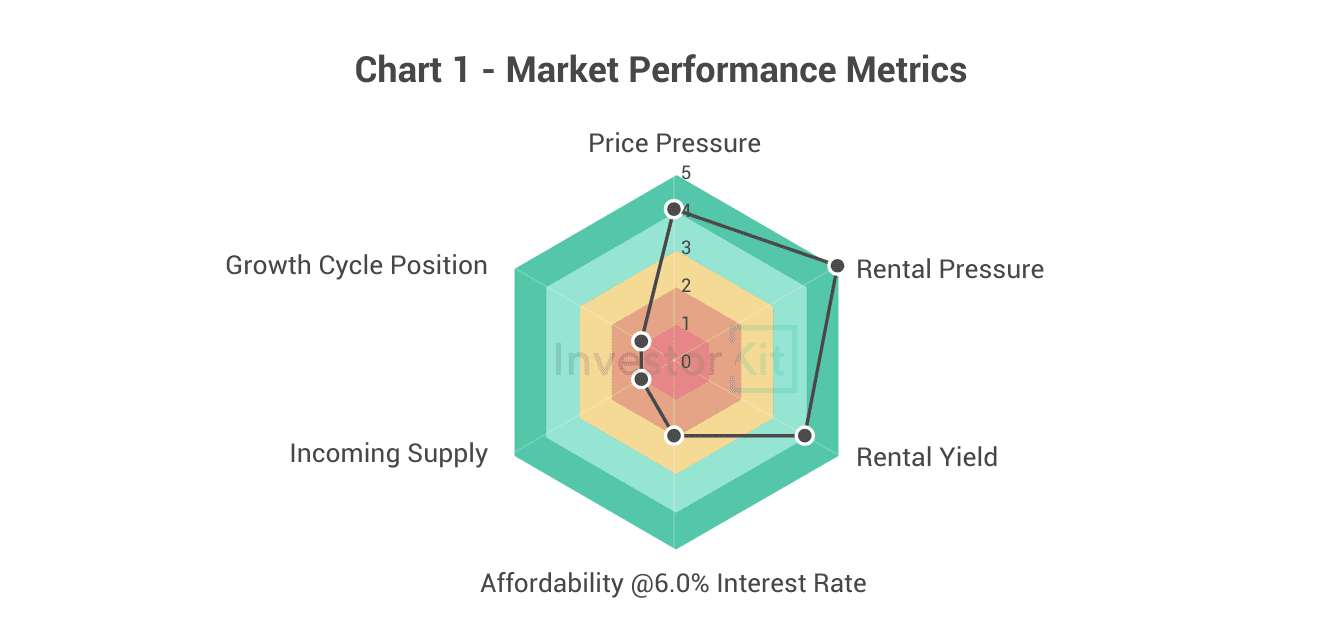

As of December 2025, Hervey Bay’s house market pressure is relatively high.

Among the six metrics that InvestorKit uses to measure market performance, Hervey Bay scores:

- 1 (very weak) for incoming supply and growth cycle

- 2 (weak) for affordability

- 4 (strong) for price pressure and rental yield

- 5 (very strong) for rental pressure

Hervey Bay’s Demographic & Economic Trends

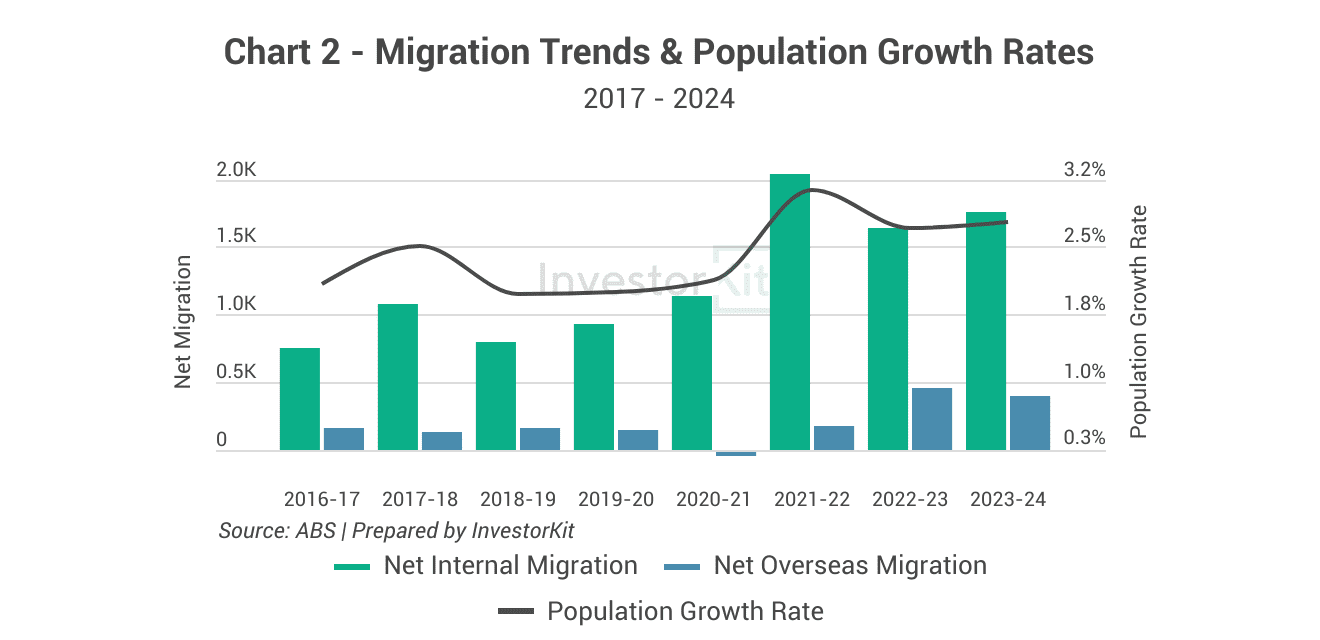

Hervey Bay’s population growth has been healthy over the past eight years. While there have been some ups and downs, it has generally tracked above the national average. This growth is driven primarily by internal migration, with the latest annual rate sitting around 2.8%, significantly outpacing the national pace of 1.6%.

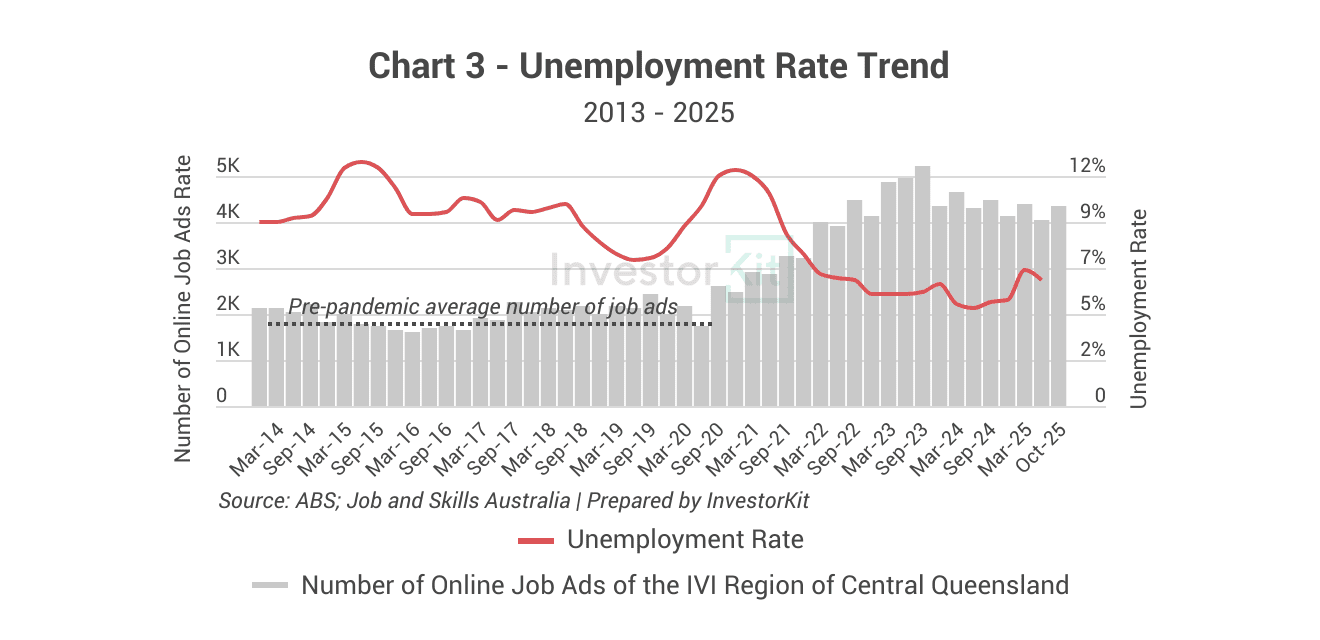

On the economic side, conditions are strengthening. The latest unemployment rate is at about 6.4%, well below the pre-COVID levels. Online job advertisements remain elevated at roughly 2.2 times the pre-pandemic average.

The combination of solid population growth and an improving economy suggests healthy underlying housing demand and ongoing support for the local property market.

Hervey Bay’s Property Market: Sales Market Trends

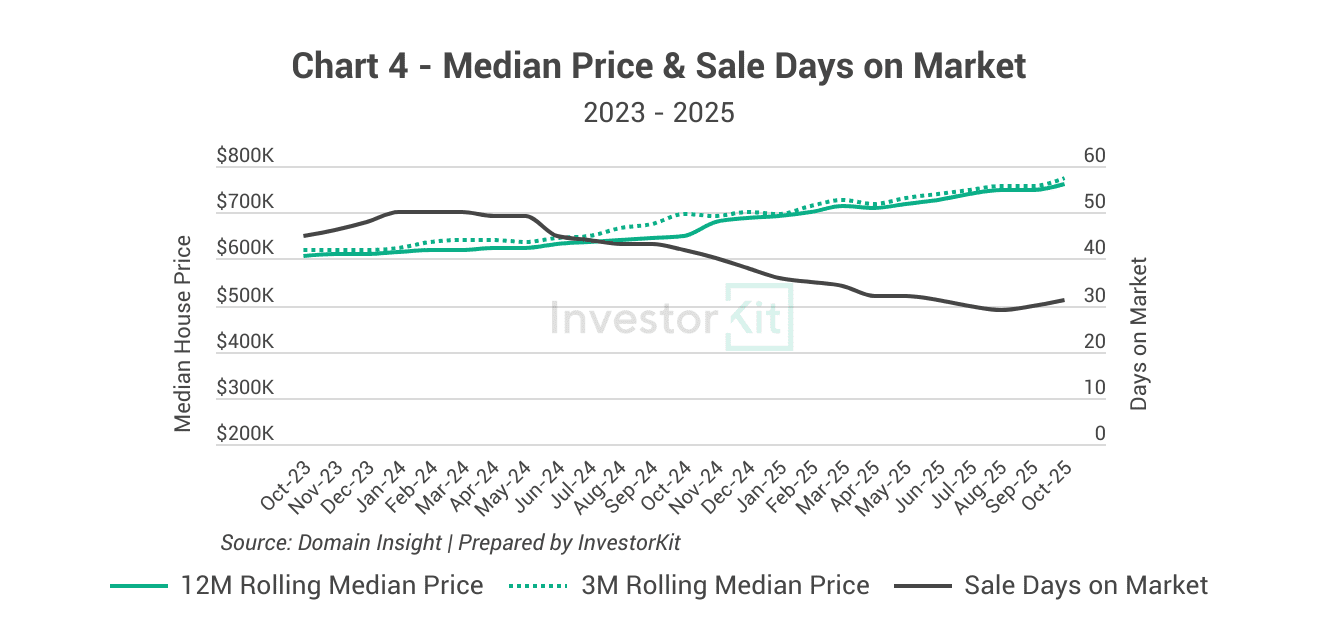

Hervey Bay’s house prices have risen strongly over the past year, up by around 16.9%, taking the median to roughly $760,000.

The market has shown signs of strengthening since 2024. Days on market fell from 50 to 31 days, signalling stronger buyer urgency and quicker absorption of listings.

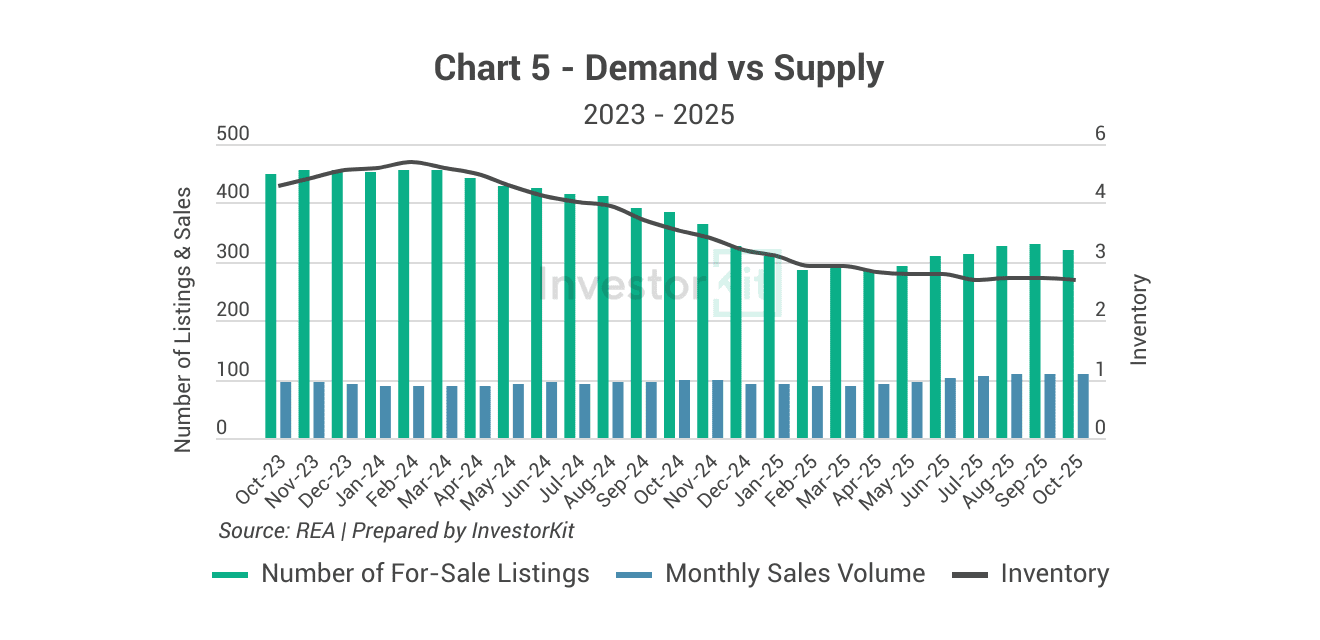

Inventory has also tightened. Since early 2024, a sharp drop in listings for sale, while sales volumes stayed relatively steady, has pushed months of stock down from about 5.2 months to around 2.9 months.

Hervey Bay has seen active house construction over the past decade. Except for 2017, building approval rates have stayed above the balanced benchmark of around 2% to 3%, and have recently surged to around 6.4%. This suggests a high level of new supply entering the market in the coming years. Even so, oversupply is not a big concern given Hervey Bay’s strong underlying housing demand.

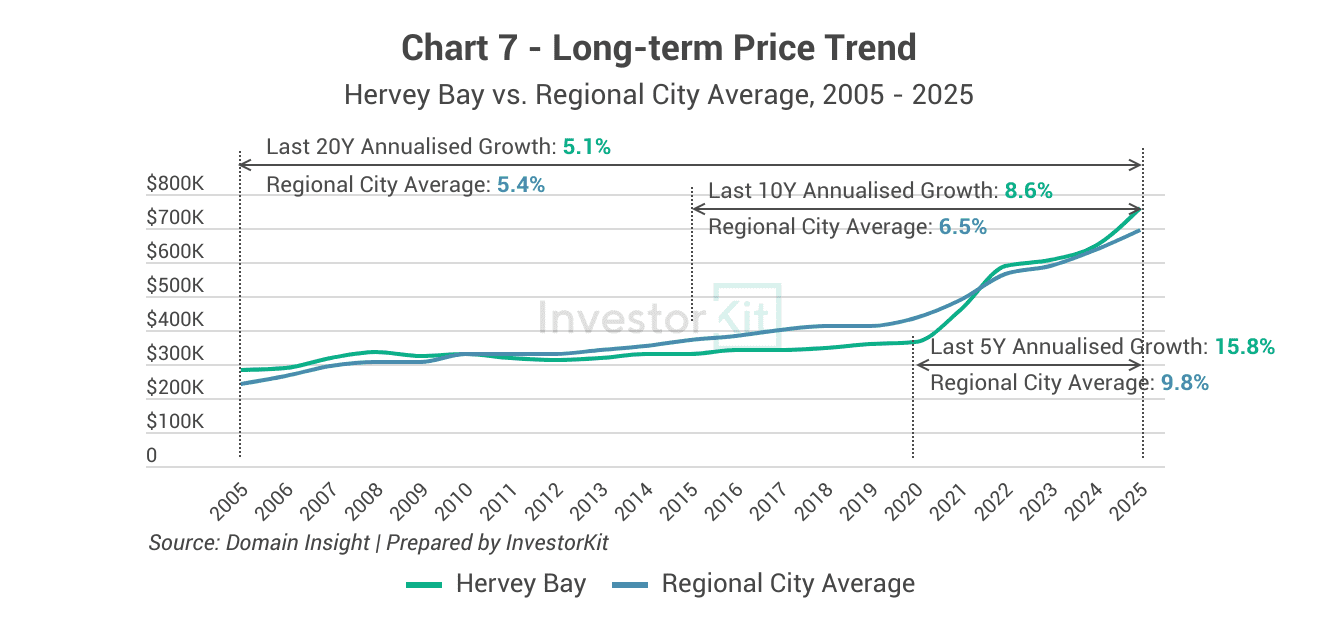

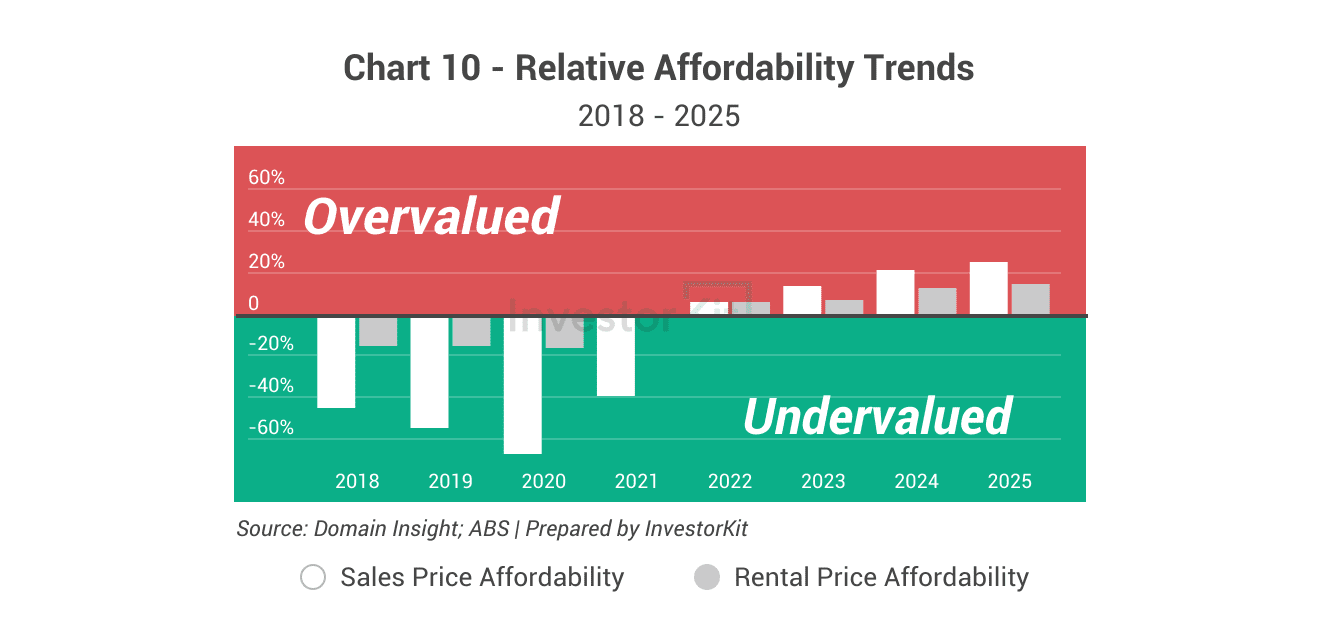

Hervey Bay was a relatively quiet performer from 2009 to 2020, with minimal movement in house prices. That changed in 2021 and 2022, when the market saw a sharp price upswing. The uplift has pushed the 10-year annualised growth rate to 8.6%, well above the national long-term average of 5 to 7%. This suggests that medium-term growth may be more constrained, particularly given the strong 5-year growth already recorded, the higher level of incoming supply (Chart 6), and weaker affordability (Chart 10).

Hervey Bay’s Property Market: Rental Market Trends

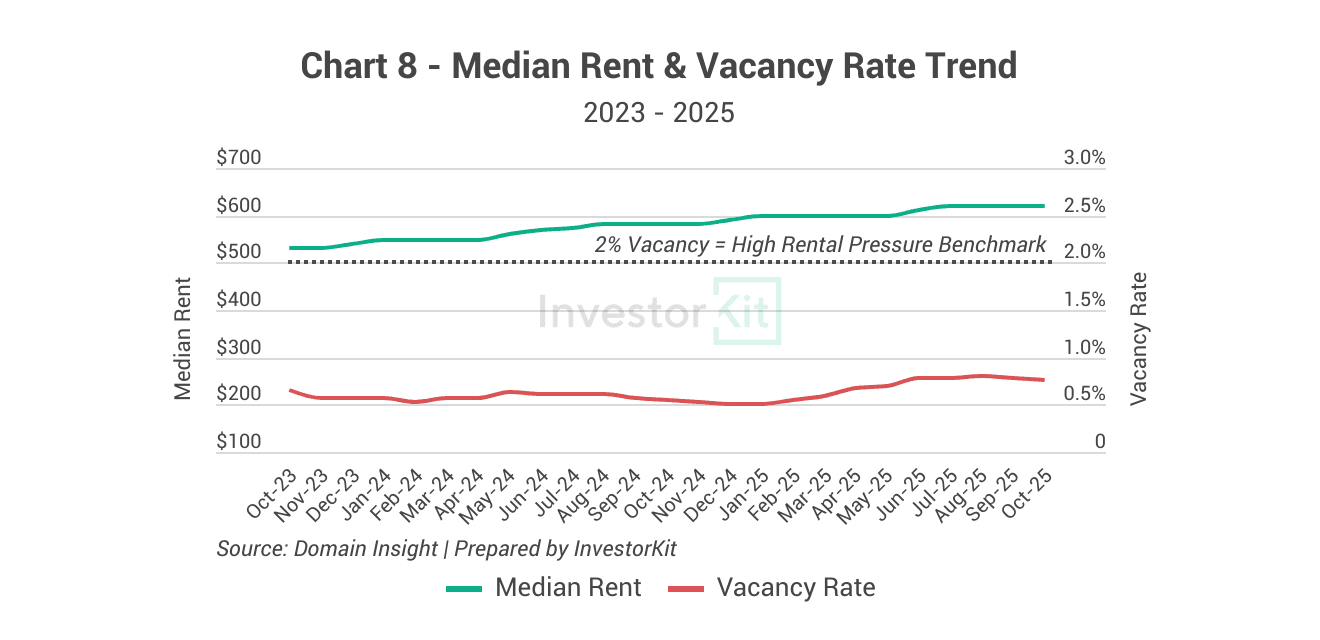

Hervey Bay’s rental market is under high pressure, as evidenced by the extremely low vacancy rates of below 1%. Median rent has grown steadily over the last 12 months, up by around 6.9%.

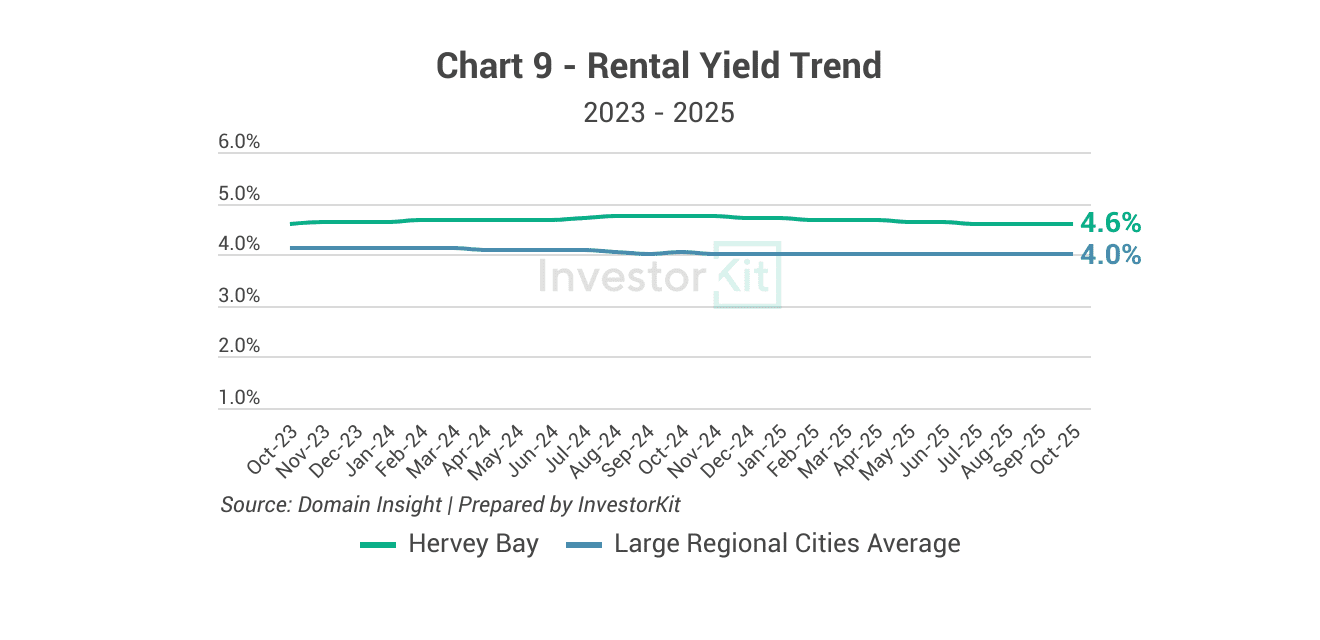

Hervey Bay’s median rental yield has declined slightly over the last two years due to the strong rise in house price values. However, its current median yield is still at a healthy 4.6%, well above the 4.0% average yield of top-populated regional cities.

In terms of affordability, houses in Hervey Bay have become unaffordable since 2022, with prices now sitting roughly 25% above local income capacity. Similarly, rents are approximately 14% above the local income threshold. If affordability continues to weaken, it is likely to be one of the key constraints on future growth.

Hervey Bay’s Short-term Outlook

Over the next 6 to 12 months, we expect:

- Healthy price growth: House prices are likely to keep rising, supported by balanced inventory and short days on market. However, growth may not be as strong as last year, given that days on market have shown early signs of picking up, and affordability continues to tighten.

- Sustained rental strength: Rental pressure will remain high due to persistently low vacancy rates, supporting further rental growth and maintaining healthy yields. That said, rental growth may start to cap if affordability worsens further.

Hervey Bay is the 21st regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that selects purchase locations using a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve above-average growth and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-minute FREE discovery call!

.svg)