Lots have happened in Australia’s housing market in the past year:

– The RBA cash rate target surged from 0.1% to 3.6% in 10 months.

– Dwelling values in capital cities declined by -8.0% from March 22 to March 23, led by Hobart’s -12.9% drop.

– Property purchasers’ borrowing power has shrunk by over a quarter since April 22.

– …

It doesn’t seem like a favourable time for property investment. Many investors might think they better take a break and wait for the cash rate to go down, perhaps sometime next year, before purchasing the next property.

Is that a good strategy, though? Before answering the question, let’s see what’s changed in Australia’s housing financial fundamentals.

InvestorKit is known for having the deepest understanding of Australia’s housing fundamentals. Although this is the first time we comment on financial fundamentals in a blog, we release a more profound housing fundamentals analysis whitepaper at the beginning of each financial year (Check the 2022/23 version here).

Cash rate surged, leading to shrunk borrowing capacity

With 11 consecutive interest rises, the RBA cash rate is now at 3.6%, the highest in over a decade (chart below).

The cash rate hike has led to mortgage interest rates surging from lower than 3% last year to 5-6% now (chart below).

Higher interest rates led to higher repayment and lower borrowing power. According to a Canstar analysis, borrowers faced a 38% increase in home loan repayment in Nov 2022, when the cash rate was 2.85%, compared to that in May; In the meantime, borrowers’ maximum borrowing amount decreased by 24%. The borrowing power decrease should be close to one-third by now, as the cash rate has risen by another 75 basis points since Nov 2022.

Household savings rate back to the pre-COVID norm

The household saving ratio surged to a historic high during the pandemic due to the lack of consumption and the governments’ financial assistance. As life returns to normal, inflation stays high, and interest rates surge, household savings have dropped to lower than the pre-COVID average.

New loan commitment declining while refinancing booming

New loan commitment values peaked in Jan last year, and started dropping sharply since May as the cash rate hike started. As of Feb 2023, the total value of new loan commitments is down 31% from the peak, only slightly higher than the pre-COVID average, and is still trending down fast.

In the meantime, refinancing value is seeing another boom as thousands of borrowers whose low-fixed-rate term is rolling out. They are searching for better deals to reduce the massively increased repayment stress.

The change in the financial fundamentals has scared off many property buyers – both owner-occupiers and investors – evidenced by the number of new loan commitments (down 31% from the peak a year ago, as shown in the chart below).

However, is pausing the best choice for investors?

We don’t believe so because:

a. While financial fundamentals are not favourable, many other fundamentals are positive.

The property market is not just influenced by financial fundamentals. Housing supply and demand, government policies, economic activities, affordability, and many other factors are equally important, if not more.

Although the financial fundamentals don’t favour the property market, many other factors look good. Economy activities, population growth, and housing supply are among them.

• Economic activities

Economies are thriving in most Australian cities, especially in the regions. You can tell by the historically low unemployment rates (chart below). Infrastructure investments, such as railways, roads, hospitals, and renewable energy facilities, are a significant booster for local economies. These infrastructure projects not only create job opportunities in the short term, but improve connectivity and liveability of many regions and facilitate their overall development in the long run.

• Population growth

Population growth leads to housing demand increase. Australia’s population growth is primarily (circa 60%) contributed by overseas migration, which was severely impacted by the COVID border closure. As Australia’s international border reopened last year, Overseas migrants are flocking back in. Last month, the Australian published a story saying net-overseas migration would reach 650,000 over the two financial years from 2022 to 2024, which is higher than pre-COVID. With the recovery in overseas migration, Australia’s population growth is expected to return to a robust 1.4% per year by 2025 (below chart).

• Housing supply crunch

While population growth is recovering quickly, Australia’s housing supply faces a big crunch. The stock level of for-sale houses is 29% lower than five years ago, and the per-capita number has decreased by almost one-third (32%) (chart below).

The rental market is even tighter than the sales market, as the national average vacancy rate decreased in the past year to Apr from a low 1.6% to an even lower 1.1%, causing rental crises in many regions across the country.

In addition to the current stock, new housing supply is forecasted to be behind the household formation (new housing demand) rate in the coming few years (below chart).

b. Property investment is more about holding than timing.

Property Investment is a long-term game. Time in the market is more important than timing the market. Below is an example from our previous blog Finding Good Buying Times vs. Tight Acquisition Windows.

We have two investors.

- A is a market-driven investor who looks for the good time to buy, when everything is “rosy” amongst the mainstream for housing;

- B is a goal-driven investor who builds up their portfolio as fast as possible to hit wealth targets and enjoy a considerable asset base for a longer time to reach passive income numbers.

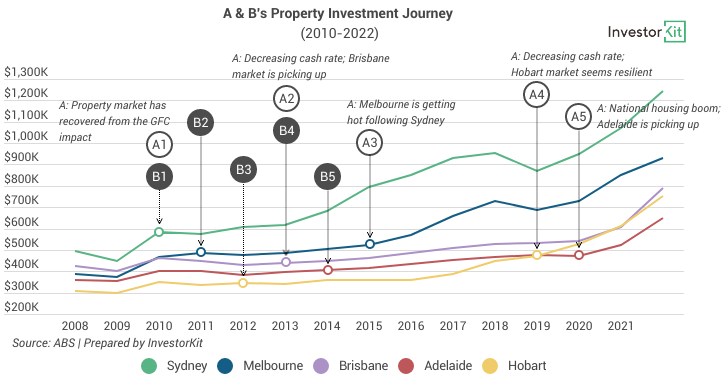

Their investment journey started in 2010, and both have built a 5-property portfolio across 5 major Australian cities. The chart below shows their assumed purchasing time and location over time.

• A purchased a median-price house in Sydney, Brisbane, Melbourne, Hobart, and Adelaide in 2010, 2013, 2015, 2019, and 2021 respectively. They took their time and carefully picked the purchasing time and location (the reason for purchasing at each point is noted in the chart). Diversifying across various cities was their plan, and they picked what seemed to be great macro environments.

• B purchased a median-price house in the five cities in 2010-2014, one property yearly. Diversity and acquiring assets were simply their goal.

The table below shows how their properties have grown up to 2022.

Their portfolios’ current values are the same, but B gets a return rate 21% higher than A by simply buying early and holding for longer.

c. While some markets’ house values have dropped, others remain strong.

In general, time in the market is more important than timing, but it’s not uncommon to see an InvestorKit client achieving both. The reason is that Australia is a market comprising many sub-markets, each with a different growth pattern. Our recent suburb review reveals that while a large portion of Australian suburbs, especially in Sydney, Melbourne, and Hobart, have seen their median house prices lower than half a year ago, others’ haven’t dropped.

It’s true that suburb-level data is not as precise due to the small sample sizes. However, it shows that market activity and growth trends can be very diverse on a micro level, and healthy growers and poor performers always co-exist.

d. Banks are competing heavily for clients.

Let’s not forget banks’ competition for clients, either. As the number of new loan applications has declined significantly by 30%+ since last year and more than 2300 people refinancing their home loan every working day (70% of whom are switching lenders), banks are competing fiercely for new and existing customers. Big banks are reportedly offering up to 1% rate discount and cashback offers to new and existing customers, even though the discount could impact the banks’ profitability. The lending market is now a buyer’s market.

Something is happening around the property market all the time. The below chart shows just the major events that occurred in the past three decades. You can hardly find a time when all fundamentals are just perfect for property purchasing – Even if there was a perfect moment, you might not be in your best position to buy. So, instead of waiting for a “better” financial environment for everyone, it’s more important to go micro: actioning based on your investment goal and portfolio plan and finding the best market/property and financial solution that suits YOU.

At InvestorKit, we help our clients work out portfolio plans to achieve their own investment goals and match them with performance markets across the country based on data analysis. That’s why we’re seeing even more returning customers at this “gloomy” time. Want to get out of the “waiting for a better time” mindset and accelerate your portfolio-building journey? Talk to us today by clicking here and requesting your 45-min FREE no-obligation consultation!

.svg)