Many investors choose units (“units” here refers to apartments) because they can feel like the sensible option: they’re more affordable, offer inner-city access, and seem like a lower-risk way to enter the market.

When units trail houses in long-run performance, it’s easy to read the gap as an opportunity for units to “catch up.”

However, when the house-unit performance gap looks large, it’s often less a signal of upside and more a warning that structural forces are capping unit returns.

In this blog, we’ll break down 3 structural headwinds that can hold back unit performance.

- Oversupply Risk

- Building Depreciation vs Land Appreciation

- Higher Ongoing Holding Costs (e.g.,Strata)

Why Units Underperform: 3 Structural Drivers

Oversupply Risk

Major cities, such as Sydney, Melbourne, Brisbane and the Gold Coast, saw a large pipeline of new unit approvals and completions in the mid-2010s. This led to entire suburbs transformed into high-rise communities. Eventually, this leads to excess stock and puts downward pressure on both capital growth and rental returns.

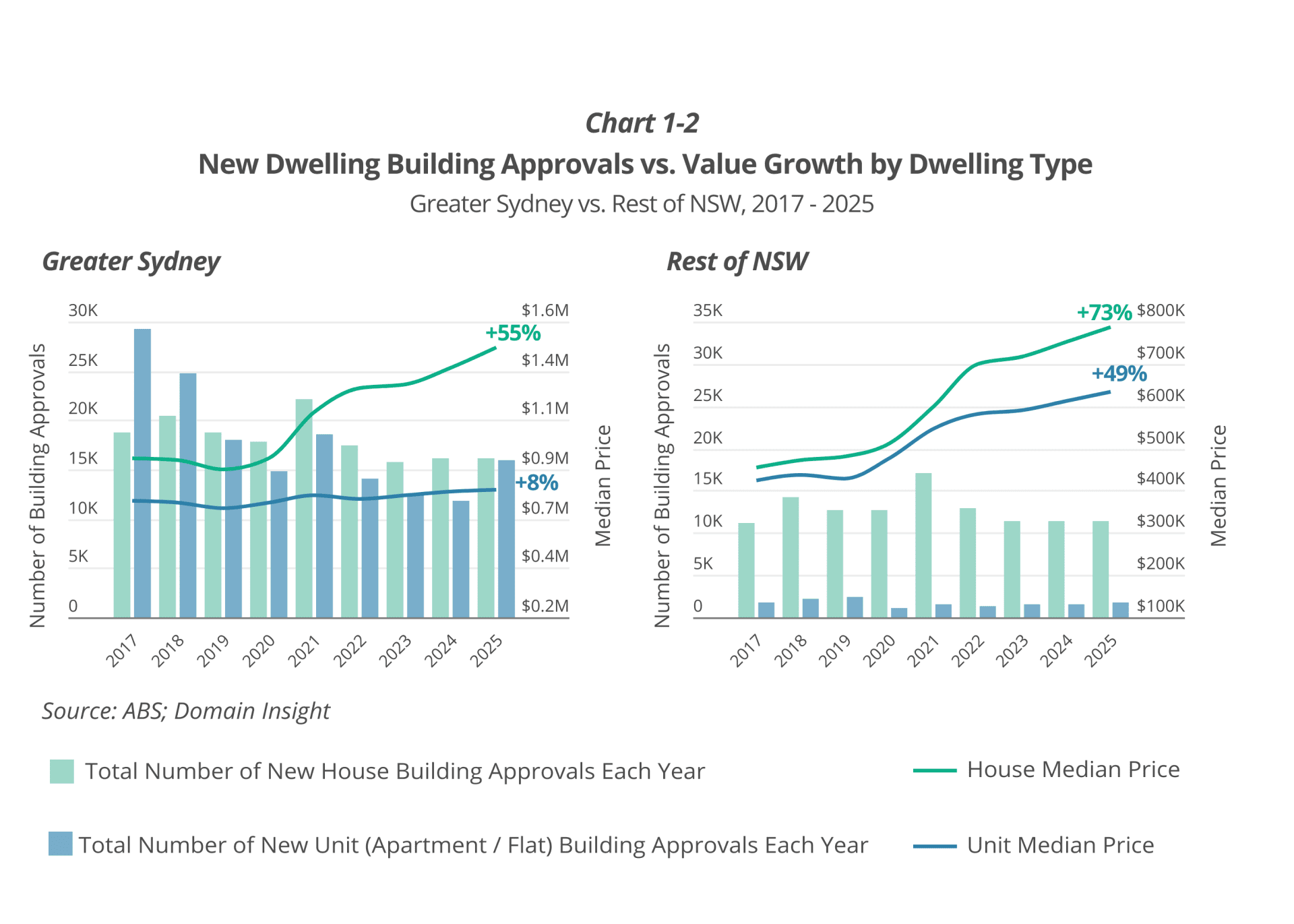

A simple comparison is Greater Sydney vs Regional NSW (Chart 1-2).

In Greater Sydney, new apartments flooded the market in the 2010s, contributing to oversupply and significant underperformance in unit prices.

By contrast, regional NSW had fewer new unit approvals. This meant a lower risk of unit oversupply, and their performance ended up tracking stronger than that of the Greater Sydney unit market.

Building Depreciation vs Land Appreciation

The long-run growth engine in residential property is typically land, not the building. Houses generally have a much larger land component than apartments, which is why they tend to benefit from long-term land appreciation.

Apartments, especially in newer, high-density projects, often have a smaller land component (5-15%), and a larger share of the purchase price is tied to the building (REA).

From a valuation standpoint, that matters because buildings tend to depreciate over time, while land is the scarce component that typically appreciates.

Houses also experience building depreciation, but because a larger portion of their value sits in land, they tend to capture more of the upside from land appreciation. As these differences accumulate year after year, the performance gap can widen through compounding.

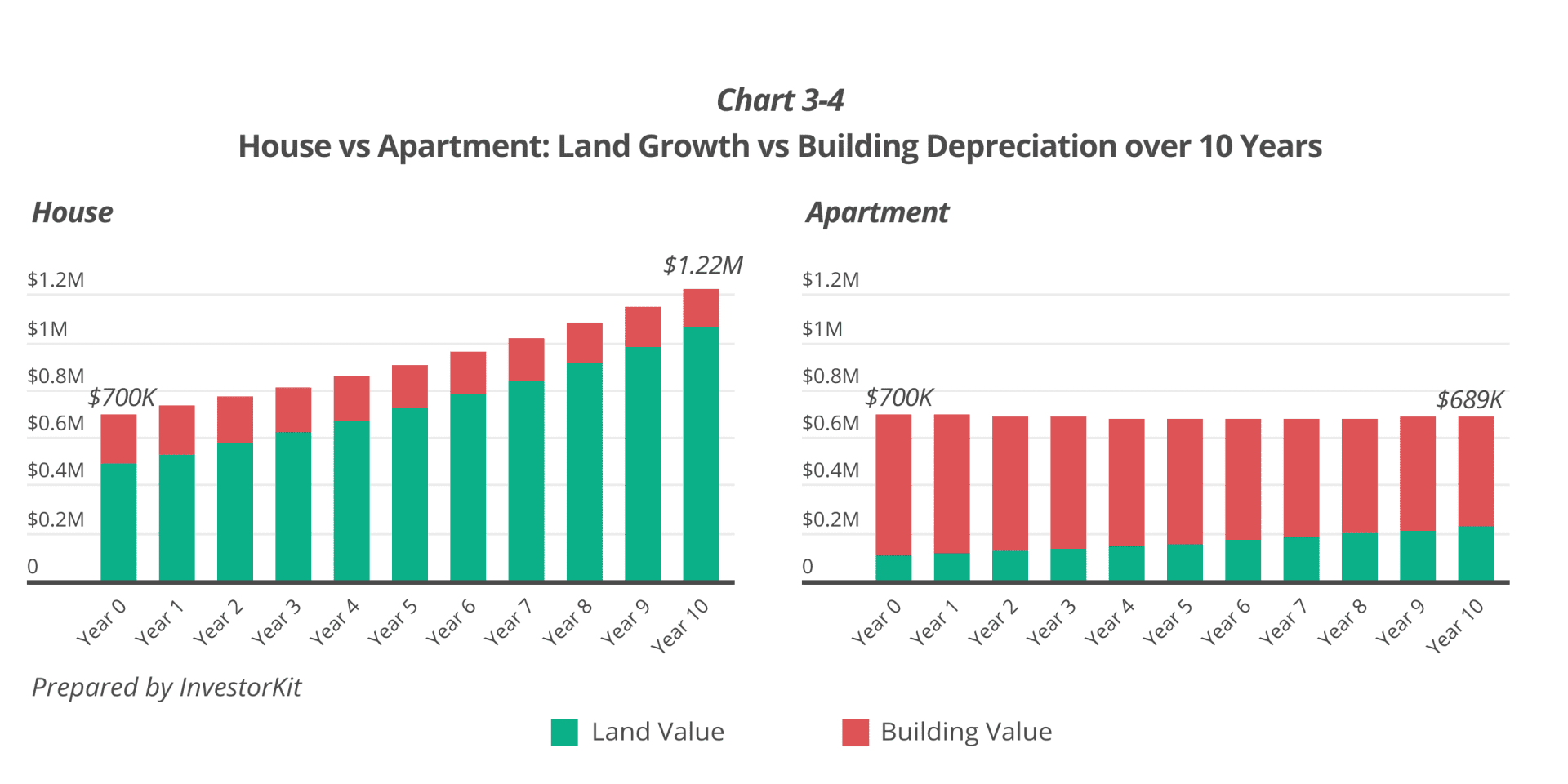

The charts below compare how building depreciation and land appreciation affect units and houses over time. The key assumptions are:

- The building structure of both assets depreciates at 2.5% per year

- The land part of both assets appreciates at 8% per year

- The house is valued at $700k with 70% land value component

- The apartment is valued at $700k with 15% land component

The house value is effectively boosted by land appreciation, achieving 74% price growth over the decade. In contrast, the apartment shows no price gains because building depreciation largely offsets its much smaller land-driven gains.

Higher Ongoing Holding Costs (e.g.,Strata)

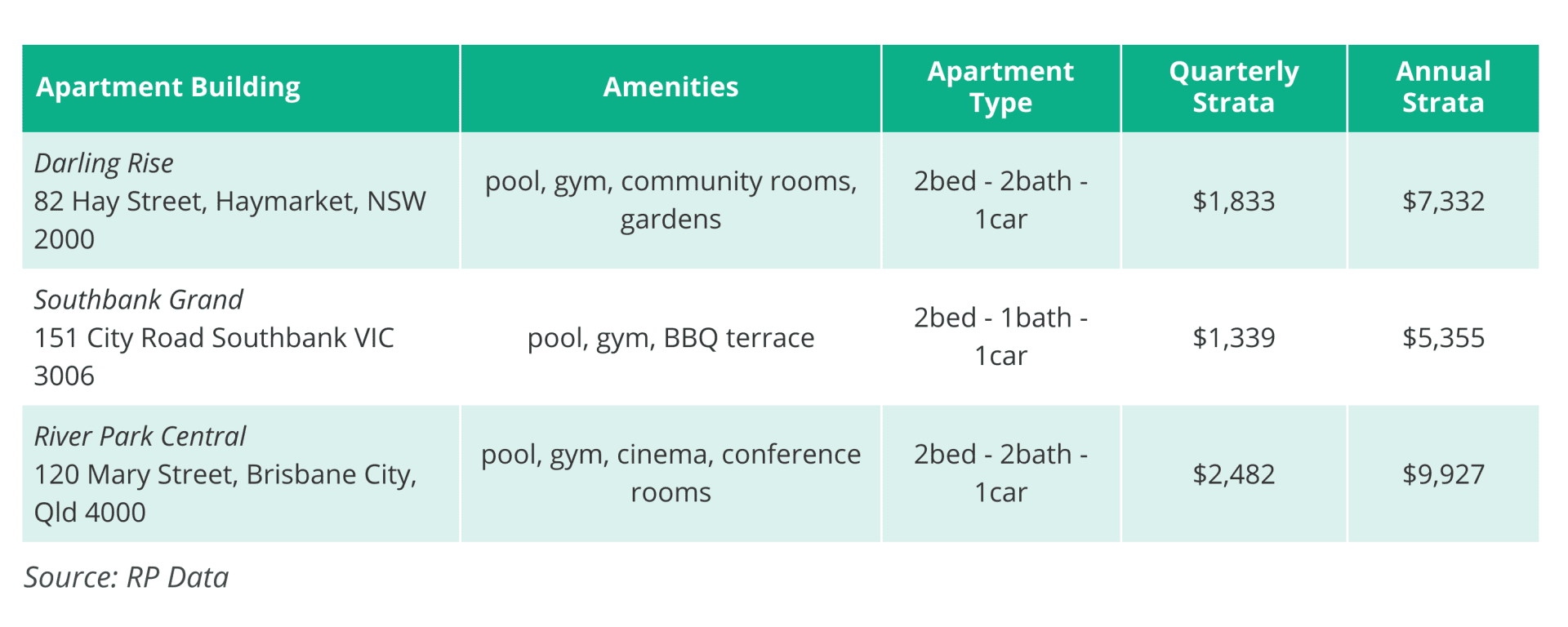

Buildings with extensive facilities, such as pools, saunas, and gyms, require regular maintenance and typically come with higher strata fees. Even if amenities improve tenant appeal, strata costs are recurring and reduce net cash flow. The table below shows 3 examples in Sydney, Melbourne and Brisbane.

On top of that, owners can face special levies for major works, which adds an extra layer of cost risk that doesn’t exist in the same way for houses.

Investor takeaway: Compounding cuts both ways. Strata is a recurring drag on cash flow. Each year, it leaves less to reinvest or to pay down debt, thereby reducing the base for next year’s returns. Over time, that repeated drag can widen the performance gap.

Caveat: Not all Unit Markets Underperform

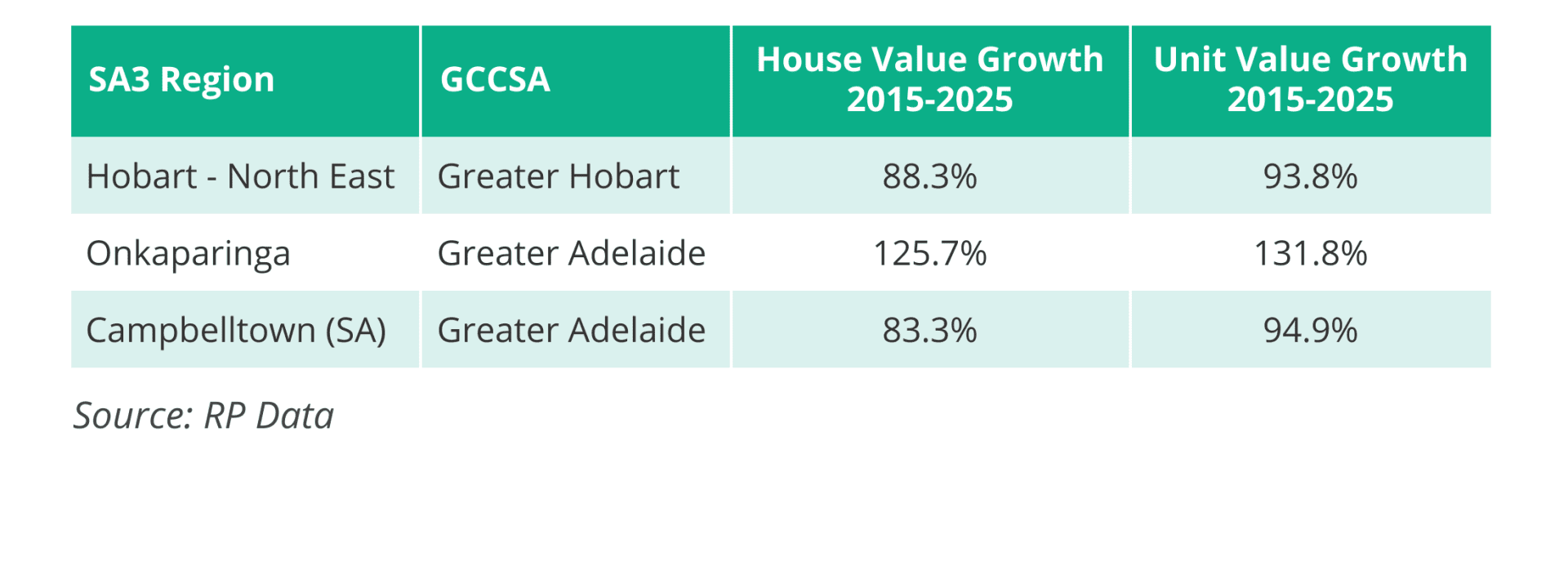

There are regions where units have outperformed houses. This occurs particularly when unit supply is tight and development has been limited. The table below highlights 3 unit markets where tight supply has aligned with demand, resulting in strong performance.

Asking the Better Question

At InvestorKit, we don’t stop at “Can units perform?” We ask a more practical question: “What performs best at the same price point?” In most cases, we can still identify detached houses with comparable entry prices, without the typical unit trade-offs like ongoing strata fees, a smaller land component, and higher exposure to oversupply risk.

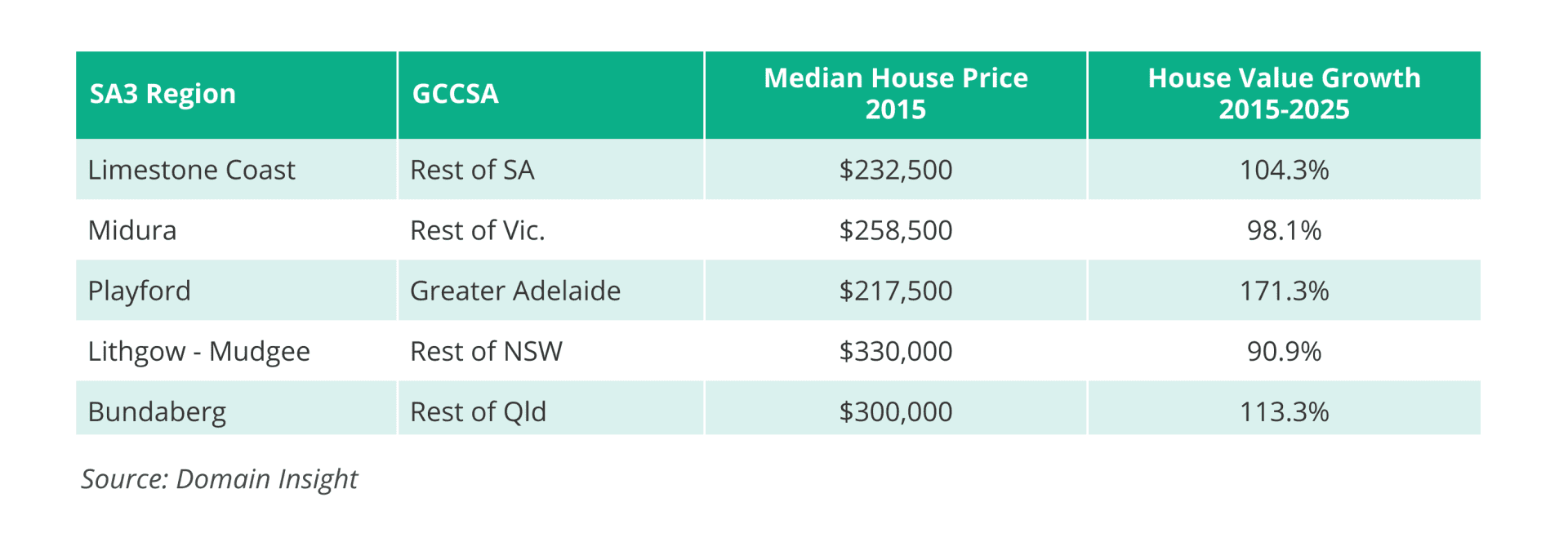

The table below highlights markets where detached houses had relatively low median prices (much lower than those of major city apartments) in 2015, yet still delivered strong growth over the next decade.

We feature these lower-priced house markets to demonstrate that affordability doesn’t automatically imply units; in some locations, detached houses were still achievable at a comparable entry point.

Conclusion

In summary, an affordable entry price alone shouldn’t determine your strategy. What matters is whether the fundamentals support long-run performance. That includes the supply pipeline, land-versus-building value mix, and the ongoing costs you’ll carry as an owner.

If you want to go deeper, download the full whitepaper. It breaks down 7 SA3 regions with the largest house-unit performance gaps and walks through the key indicators behind each case study, so you can see what’s really driving the results.

And if you’re weighing up houses versus units and want to put your capital behind what the data supports at your price point, let’s talk. Book a discovery call with InvestorKit below and invest with confidence, backed by research-led insights.

.svg)