January 12, 2026

Rethinking the Idea of ‘Sustained Growth’ in Property Investing

It’s a question we hear often: “Which market is going to grow fast, and keep growing for the next five to ten years?” It sounds like a smart question. After…

The Common Trap: Expecting Fast Growth to Last Forever

It’s a question we hear often: “Which market is going to grow fast, and keep growing for the next five to ten years?”

It sounds like a smart question. After all, if you’re putting in the time, capital and headspace to invest in property, you want it to be worth it. Sustained growth feels like certainty. It feels safer.

But here’s the reality: that question, while intuitive, doesn’t reflect how property markets actually behave.

Markets Don’t Grow in Straight Lines

Even the strongest markets don’t grow in straight lines. They move in cycles. There are phases of acceleration, periods of moderation, and occasional plateaus. A market can deliver strong performance across a decade, but that performance will rarely be smooth or uninterrupted.

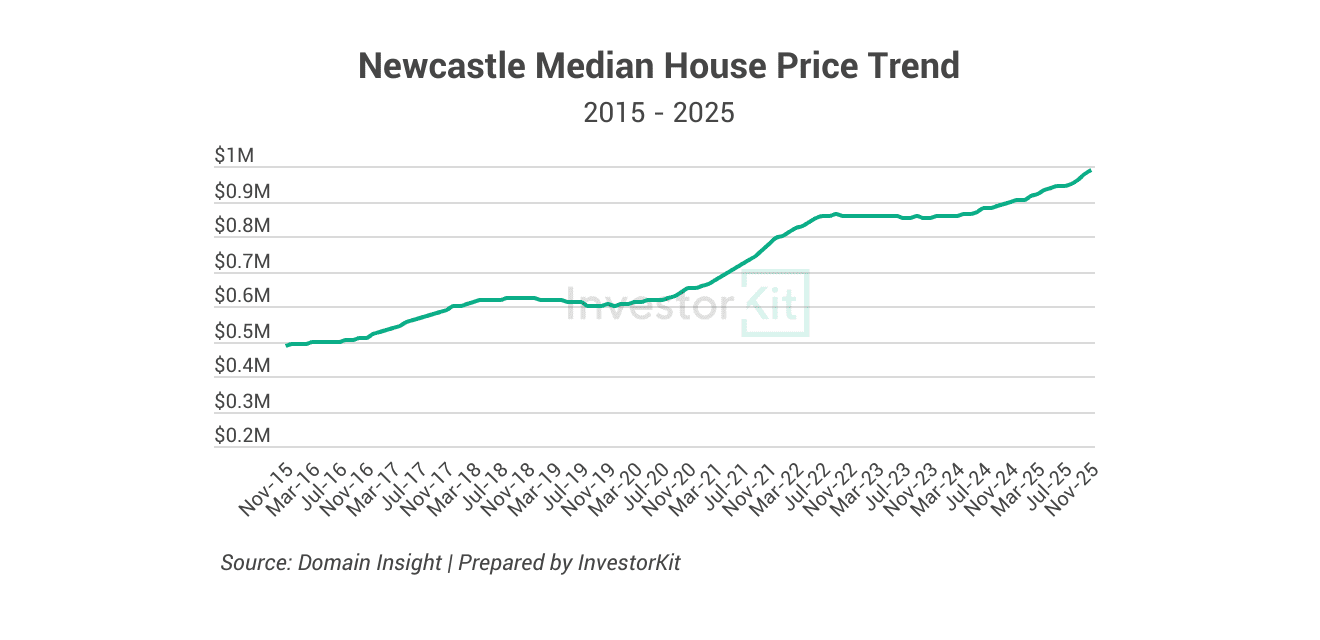

Taking Newcastle as an example. The city’s annualised growth over the past 10 years is 7.5% p.a., very impressive, but inevitably prices have experienced ups and downs over the decade, as shown in the chart below.

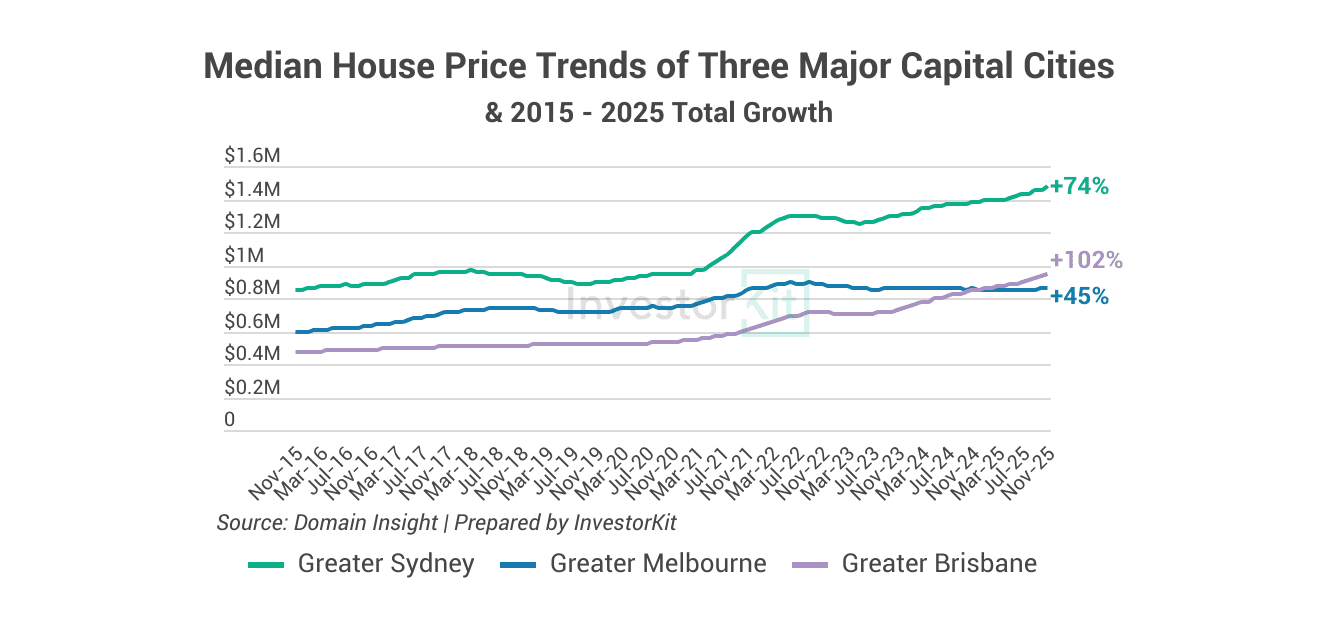

It’s not just Newcastle, even major capital cities like Sydney, Melbourne and Brisbane have gone through multiple growth and correction cycles over the last 20 years (see chart below). Yes, their long-term fundamentals are strong, but that doesn’t mean prices would move upwards every year. In fact, the deeper and more competitive the market, the more sensitive it can be to credit policy, media sentiment and capital flows.

Chasing a market that grows quickly and never cools isn’t just unrealistic. It can lead to disappointment and poor decisions, not because the market underperforms, but because the expectations were never grounded in how markets function.

Market Pressure is a Signal, Not a Guarantee

Let’s look at market pressure as an example. At InvestorKit, we use market pressure as one of our leading indicators because it reflects the imbalance between supply and demand. But it’s a snapshot, not a promise. It shows you where the heat is right now, not how long it will stay.

A market might remain under pressure for several years if fundamentals remain strong. Or, the pressure could ease within months if lending policy shifts, investor sentiment changes or supply ramps up unexpectedly. None of this means the market is broken. It means it’s responding, as healthy markets should.

The Smarter Question to Ask as an Investor

A better question to ask is this:

Which markets are structurally set up to rebuild pressure again and again over time?

This shifts the focus from speed and duration to resilience and repeatability. And that’s what tends to produce long-term outperformance.

The Key Ingredients of Long-Term Market Resilience

Markets that can repeatedly attract demand, manage supply, and bounce back from short-term setbacks tend to share some common traits:

- Economic diversity, not reliant on a single employer or sector.

- An active job market, supporting sustainable housing demand.

- Depth of demand across owner-occupiers, investors and renters.

- Population growth driven by long-term employment and lifestyle fundamentals.

- Constraints on housing supply, reducing the risk of oversaturation.

- The ability to absorb shocks, like changes in interest rates or credit policy.

These ingredients don’t guarantee uninterrupted growth. But they reduce volatility. They create conditions where the market can pause, reset and reaccelerate. That’s the kind of market you want in your portfolio.

What This Means for You

At InvestorKit, we don’t chase straight lines. We focus on helping clients select the right property, in the right market, at the right time, with a clear understanding of how that market behaves. We look for growth potential that is not just present today, but supported by structural fundamentals that can carry through multiple cycles.

Success in property isn’t about finding the one market that never slows down. It’s about building a portfolio across markets that can perform, adapt and recover,again and again.

Ready to stop chasing myths and start investing with clarity and confidence?

Book your free 15-minute discovery call to learn how to identify resilient, high-performance markets, and build a portfolio that’s built to last.