December 1, 2025

Pay Down Your Home Loan or Buy More Properties?

You often hear advice like, “Pay off your home loan as fast as possible.” It feels safe and is the simple rule many of us learned from our parents, but…

You often hear advice like, “Pay off your home loan as fast as possible.” It feels safe and is the simple rule many of us learned from our parents, who saw debt as something to get rid of, not a tool to build wealth.

For some people, that is the whole goal: having a roof over their heads and simply being free of debt. There is nothing wrong with that.

But if you aim to build wealth, it’s worth asking whether racing to clear your mortgage before investing is actually the best strategy.

In this blog, we will walk through two strategies to see what the numbers suggest for long-term wealth building.

The two strategies

Meet the couple: Michael and Emma.

They’re considering a $1.5 million house as their principal place of residence (PPOR) and estimate that, after covering the deposit and purchase costs, they would still have about $300k available. They’re comfortable with some negative cash flow and are focused on long-term wealth building.

Like many people, Michael and Emma are torn between two paths:

- Strategy A: Pay off the home loan as fast as possible before investing.

- Strategy B: Keep the home loan for longer and use the $300k to invest in properties.

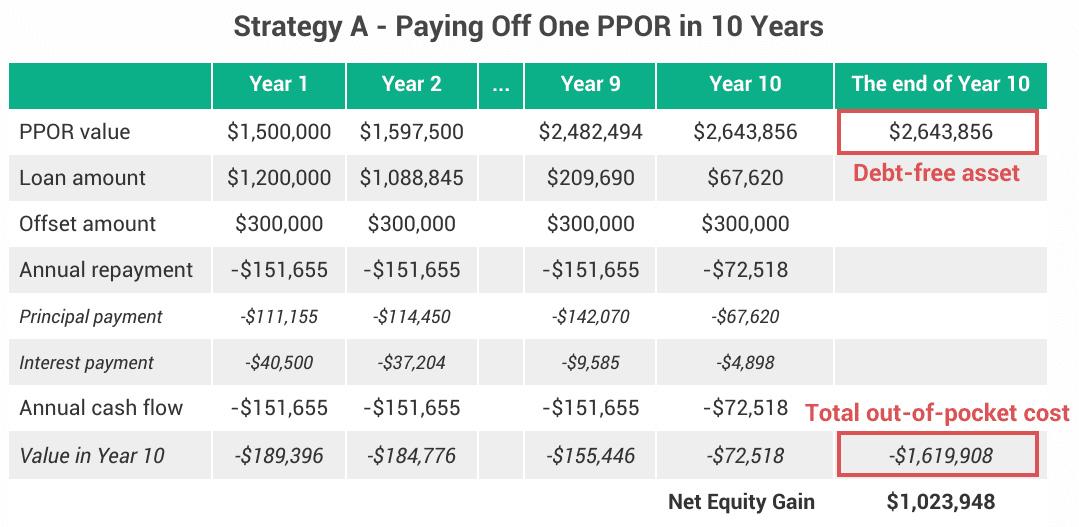

Strategy A: Michael and Emma smash the mortgage in 10 years.

In strategy A, the couple follows the classic “debt-free as fast as possible” plan. They buy a $1.5 million house (PPOR) with a 10-year loan, parking their $300k in the offset, and channelling every spare dollar of surplus cash into paying down the mortgage as quickly as they can.

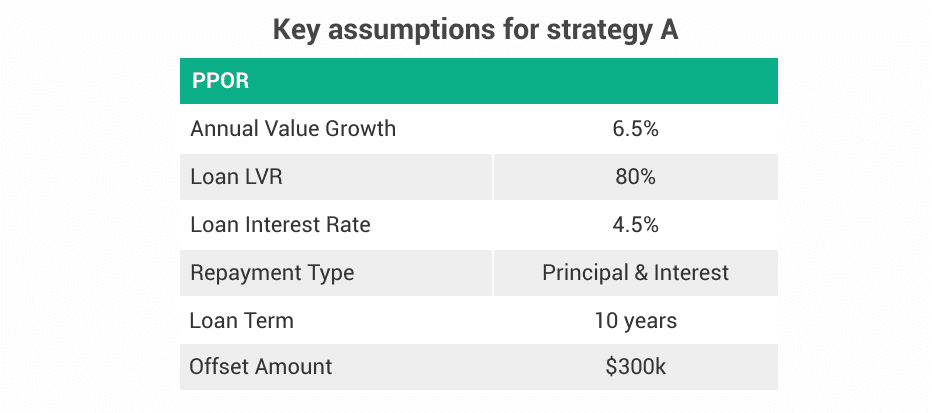

In the background, our model assumes a few things about Michael and Emma’s loan, as shown in the table below.

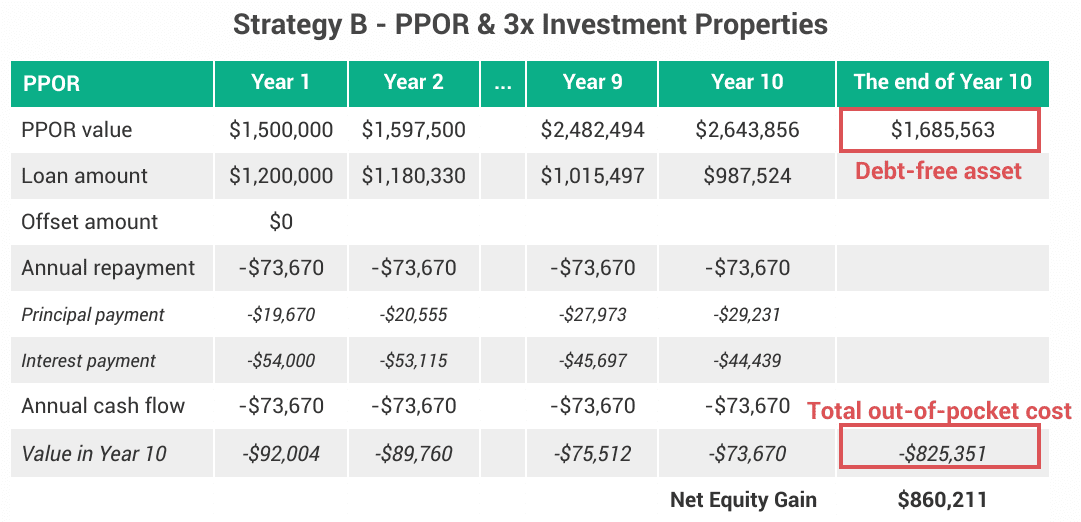

Strategy B: Michael and Emma keep the loan and build a portfolio by investing in properties.

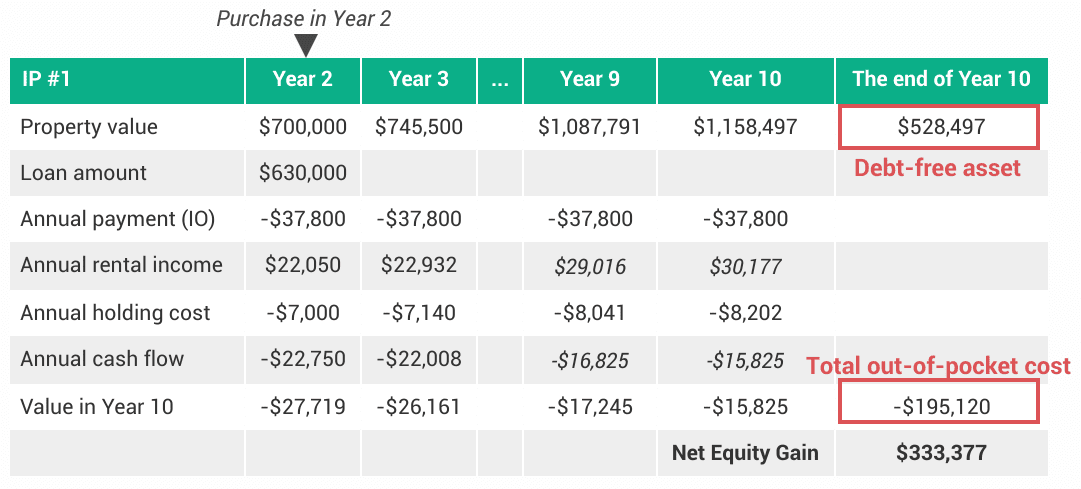

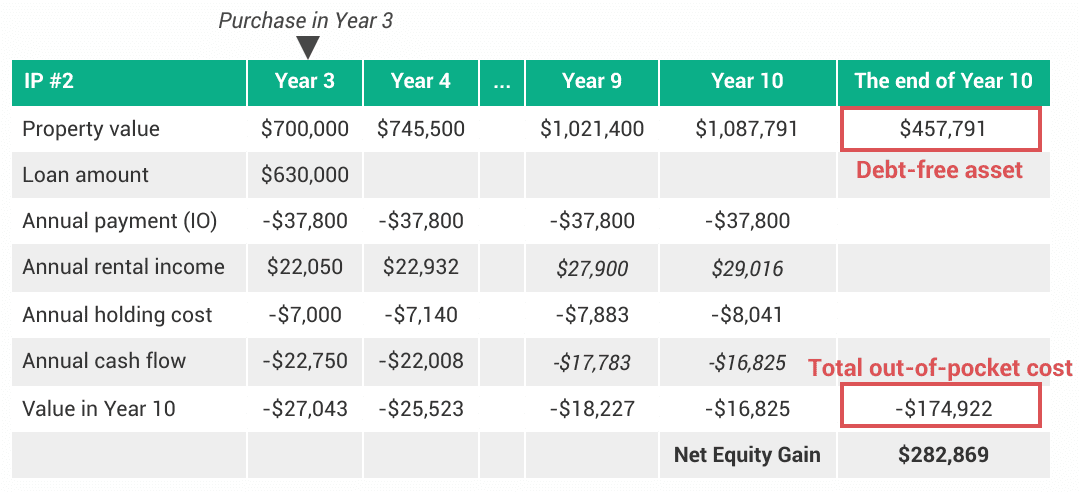

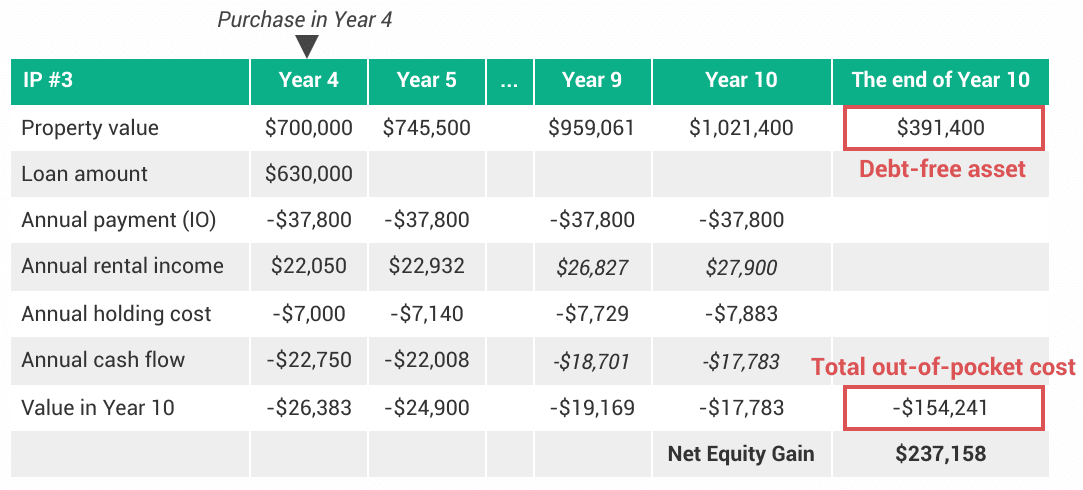

In strategy B, the couple still buy the same $1.5 million house (PPOR), but this time with a 30-year loan. Instead of leaving the full $300k in the offset, they use it over the first few years as deposits and purchase costs for three investment properties (one in year 2, one in year 3 and one in year 4), then sell all three in year 10.

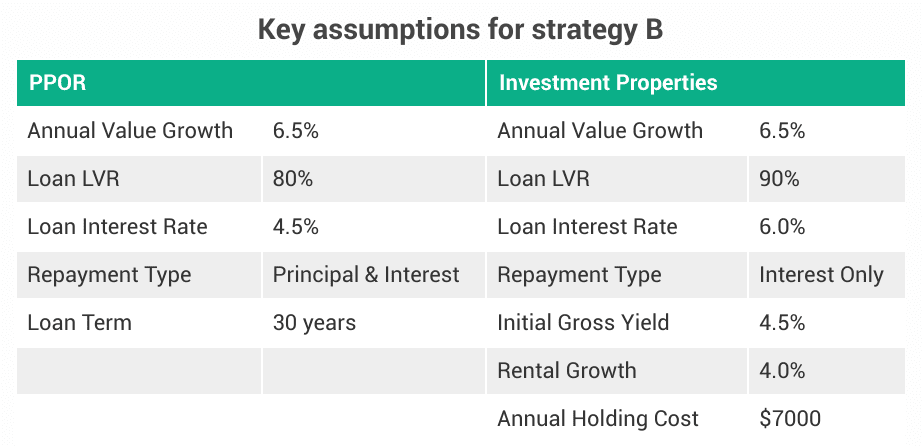

For this strategy, we add a few more assumptions to the model:

What did the numbers show?

When we ran the numbers for Michael and Emma over the same time frame, the gap between the two paths became clear. In 10 years, the total net equity gain in strategy B is around 1.7 times that in strategy A before tax.

Under strategy A, which focuses on paying off the mortgage quickly, the couple achieves a net equity gain of around $1 million over 10 years.

Over the same time period, strategy B, which keeps the home loan for longer and buys three investment properties (IP), shows a much higher total net equity gain of about $1.7 million.

Even if the couple sells all three investment properties in 10 years and pays capital gains tax of around $254k, they still end up with roughly $400k more net equity than under strategy A, where they wouldn’t pay any tax when selling their home (PPOR).

What are the takeaways from this blog?

This kind of modelling is not a promise of what will happen to Michael and Emma. It is simply a way to compare different choices under a clear set of assumptions. Still, a few lessons stand out for them, and for anyone in a similar position.

1. Racing to clear your mortgage is not the best strategy for wealth building.

Throwing everything at one home loan means giving up the chance to use leverage. In strategy B, by borrowing to purchase additional properties, Michael and Emma use leverage to control more assets with the same amount of their own cash, so if values grow over the long term, that leverage can accelerate their wealth. However, leverage comes with risks. If property values are flat or fall, the debt does not shrink with the market, so leverage can work against them and erode their equity more quickly.

2. The right strategy depends on the people, not just the maths

There’s no single formula that’s right for everyone. Strategy A may suit someone with a lower tolerance for risk or who wants the strong emotional comfort of a debt-free home. Strategy B will appeal more to someone with a higher risk tolerance or to those who want to build wealth through property investments aggressively. Michael and Emma could even choose strategy C: pay down their home loan to a comfortable level, then shift more focus to investing. There are different ways to do it, but the best approach is the one that fits your goals, risk comfort and lifestyle.

***Disclaimer: This blog is based on specific assumptions and is general information only, not personal financial advice. If those assumptions change, the results for each strategy would change as well.

That’s why it’s crucial to understand your circumstances, risk tolerance, tax position and borrowing capacity, rather than focusing only on which strategy “wins” on paper. And when you do invest, choosing the right markets matters just as much as your strategy.

Before making any decisions, it’s better to speak with a qualified professional and run the numbers for your own situation, as well as research the areas you’re planning to invest in.

At InvestorKit, we are dedicated to helping our clients design a personalised portfolio growth strategy and identifying markets that align with their goals, backed by solid data and our on-the-ground experience. Book your 15-minute free Discovery Call and talk to the InvestorKit team today to get expert help.