Launceston Property Market: Tasmania’s Northern Gem

Launceston is one of the oldest cities in northern Tasmania, nestling at the meeting point of the Tamar and North Esk rivers. Known for its vibrant food and wine culture, Launceston is a gateway to the scenic Tamar Valley wine region. The area blends historic charm with modern living, featuring beautifully preserved colonial architecture and a strong community. With a healthy economy, affordable lifestyle, and a balance of urban and rural appeal, Launceston is an attractive destination for homebuyers and investors.

Launceston’s house prices surged during the COVID property boom. However, growth has slowed down since 2023, and over the last 12 months, it grew by just 1.8%. Will the market rebound in the coming year? Join us today to explore the city’s property market conditions and outlook!

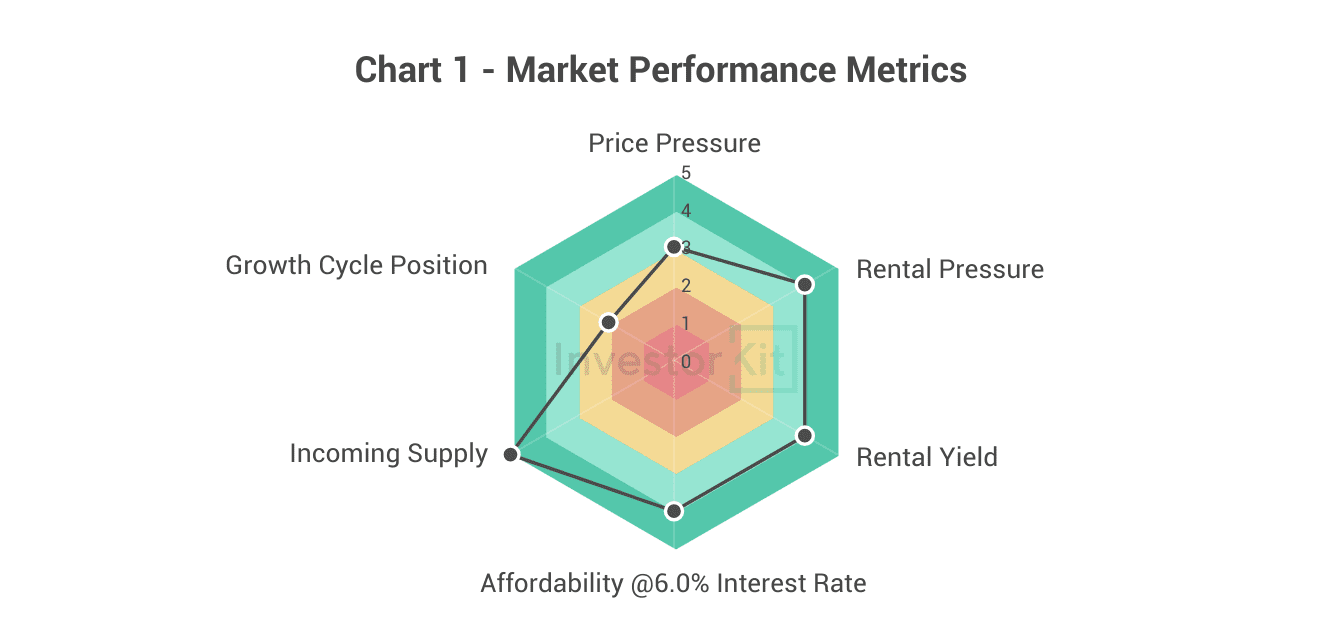

As of July 2025, Launceston’s house market pressure is moderate but improving.

Among the six metrics InvestorKit uses to measure market performance, Launceston scores 5 (very strong) in rental pressure and incoming supply, 4 (strong) in price pressure, rental yield and affordability, and 2 (weak) in growth cycle.

Launceston Property Market Demographic & Economic Trends

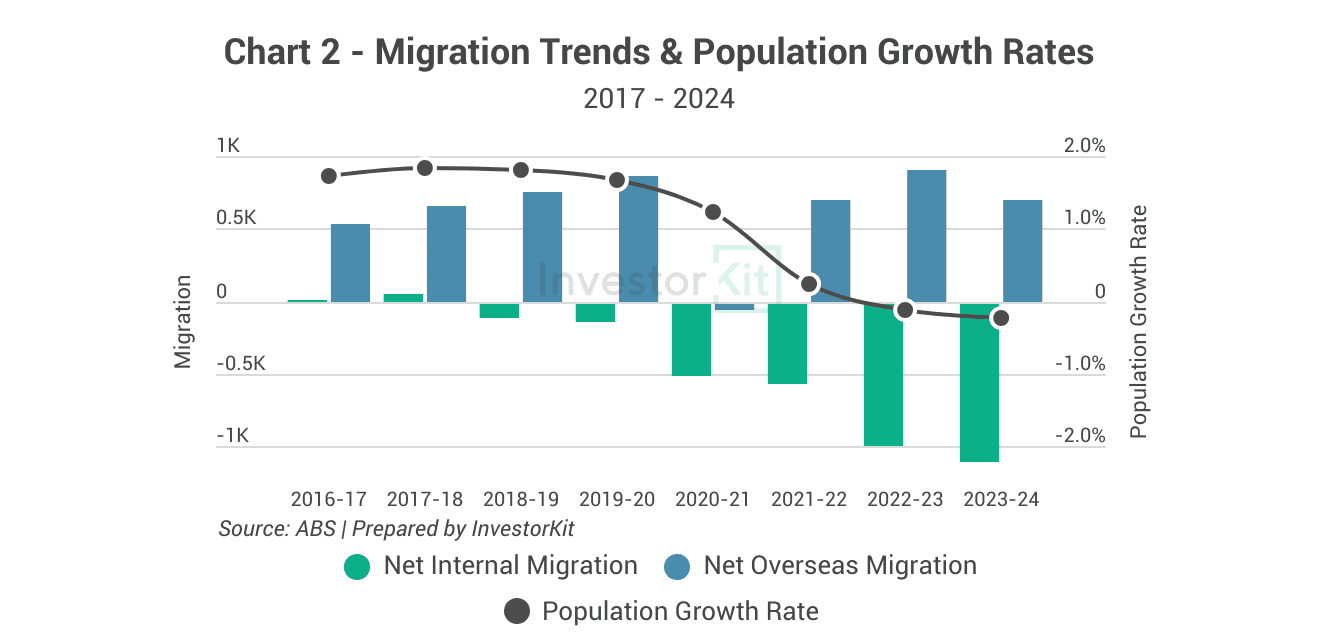

As can be seen in Chart 2, overseas migrants are the main contributors to Launceston’s population. The growth rate remained relatively consistent until 2020, when it began to decline. Launceston’s population growth was -0.23% in the 2023-2024 financial year, much lower than that of Tasmania (0.31%) and Hobart (0.37%) because of a plunge in internal migrants. The declining trend in net internal migration shows that Launceston is losing its people to other areas and states of Australia.

Launceston’s slow-growing population could lead to decreased demand for housing over the coming years.

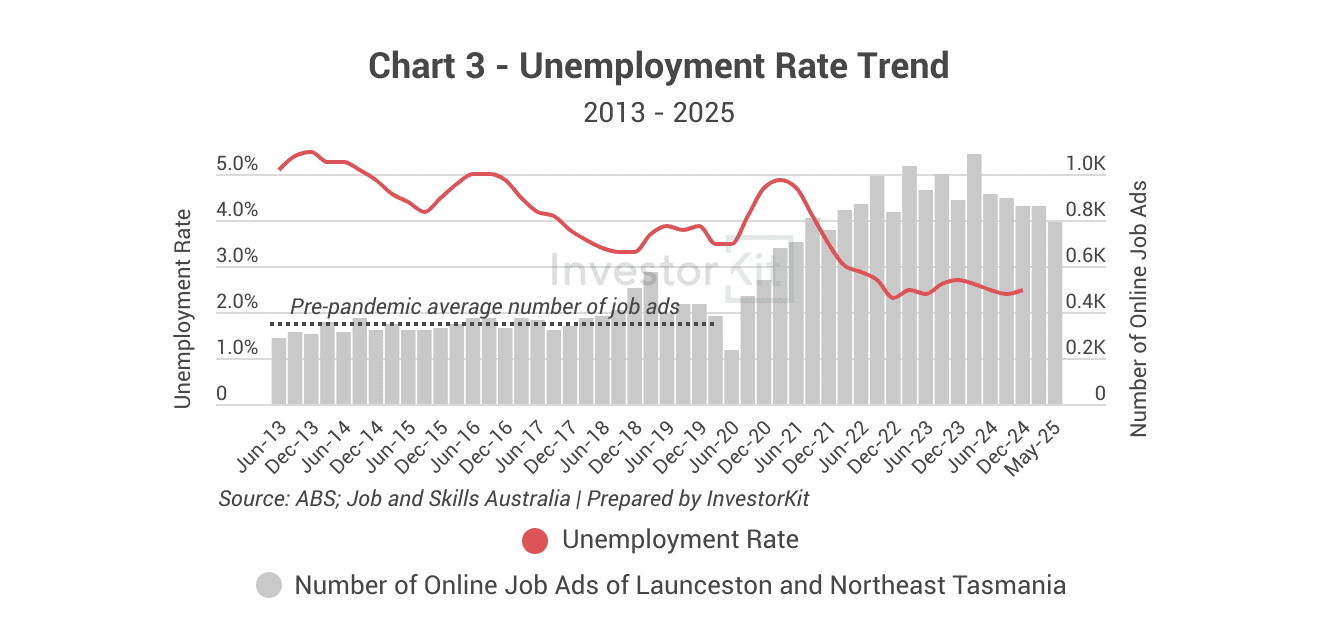

Despite the sluggish population growth, Launceston’s job market is active. Its unemployment rate has declined from over 5% since late 2013 and has remained relatively stable at around 2.5% since early 2023.

On the other hand, despite a slight drop, the number of online job ads remains significantly higher than before the pandemic.

House Prices Launceston: Sales Market Trends

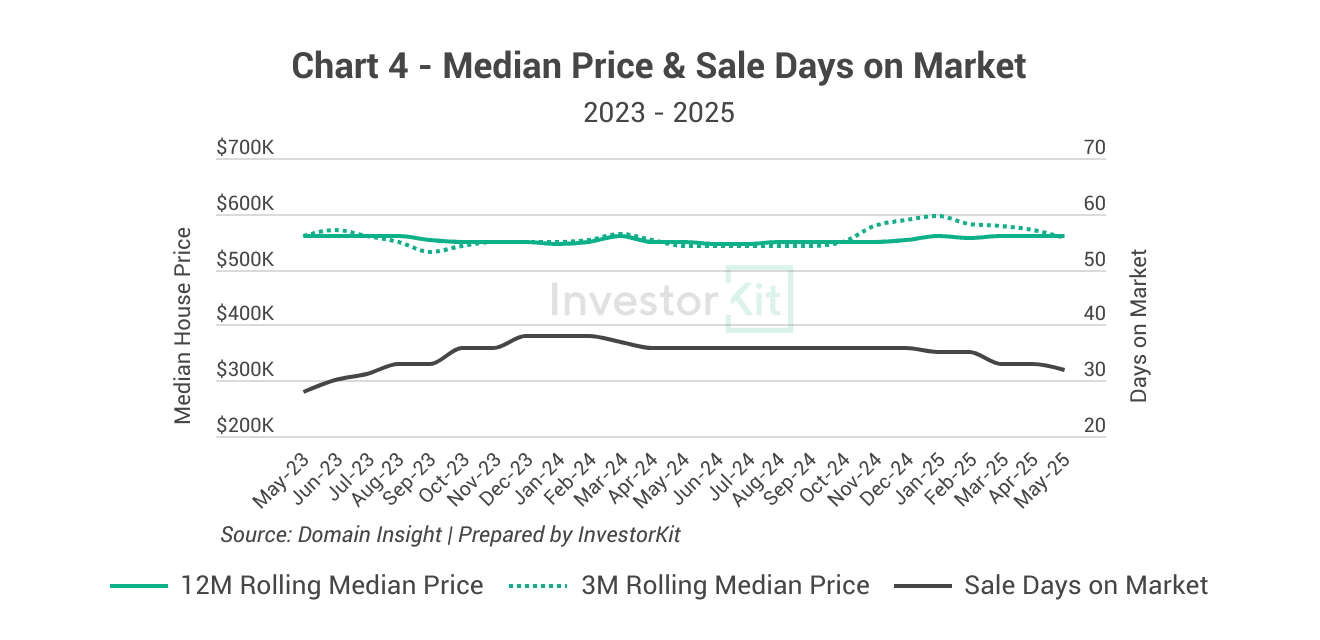

Launceston’s house market has stagnated over the past year. The median house price is $560k, about 1.8% higher than a year ago. Since early 2025, houses have been selling faster, with the median days on market around 32 days.

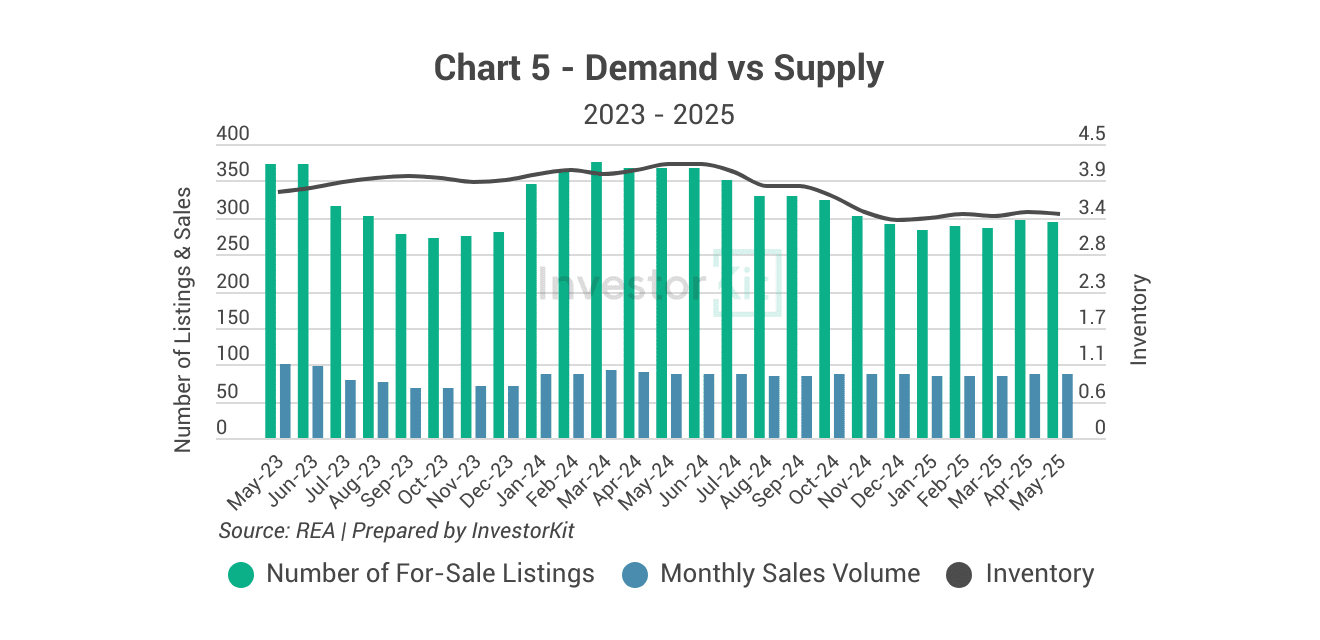

Over the past 12 months, Launceston’s for-sale house listings have fallen steadily while the sale volume has remained relatively stable, resulting in a drop in inventory to a moderate level of 3.4 months of stock.

The moderate and declining inventory level and days on market indicate moderate and improving market pressure, suggesting an improvement in price growth in the year ahead.

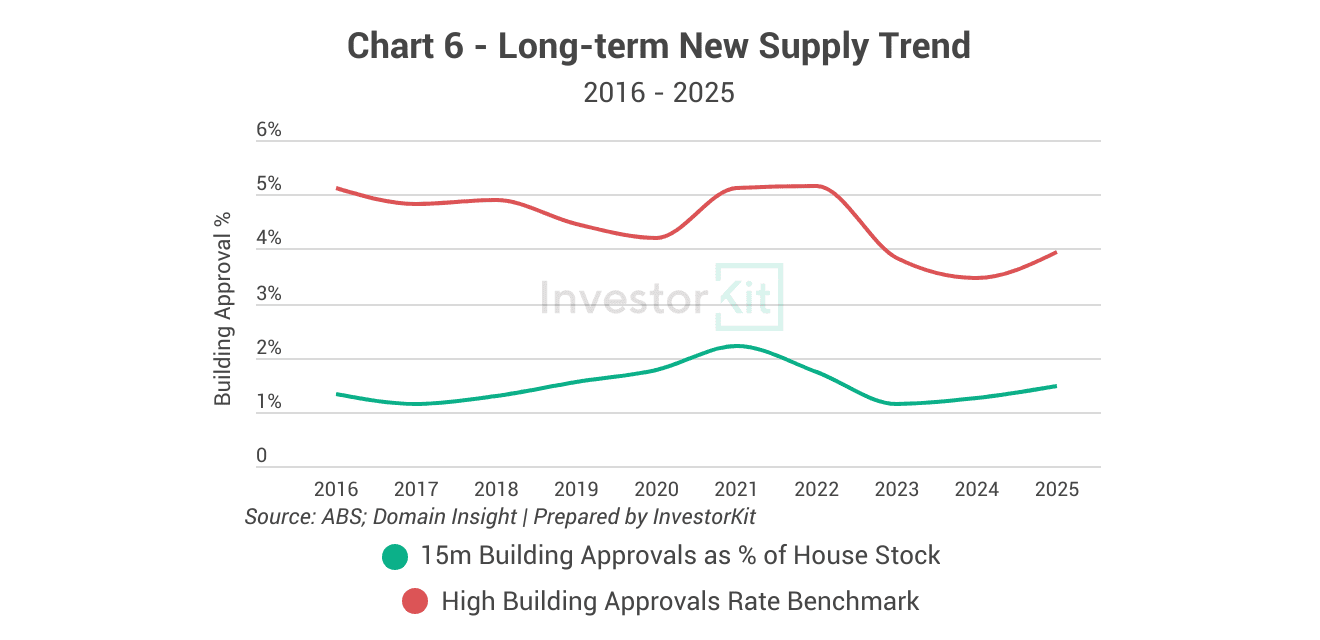

Launceston’s building approval rate has remained relatively low for a decade, indicating a low risk of oversupply in the housing market. In 2025, the region saw a slight uptick in house construction activity, but it’s still much lower than the balanced benchmark of 3%.

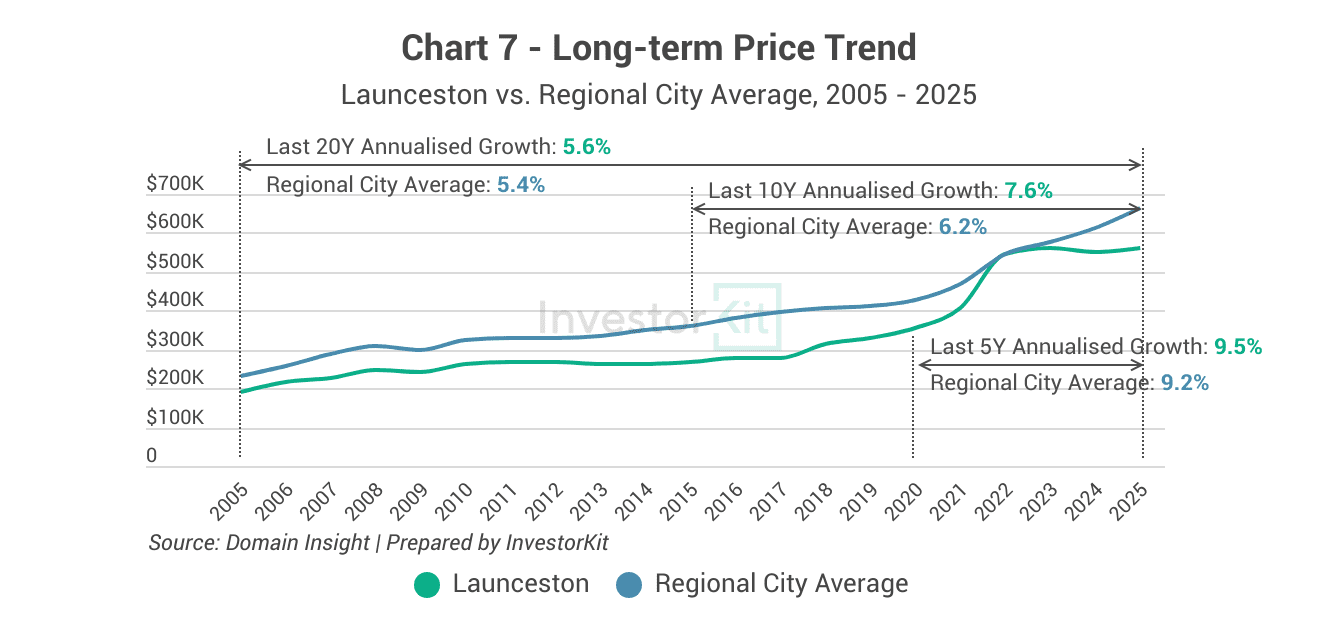

Launceston’s house price growth has grown robustly over the last decade. Its 5-year and 10-year annualised growth rates are above the long-term average (5-7%), higher than the averages of the top-populated regional cities. Growth is likely to be moderate in the medium term.

Launceston Real Estate: Rental Market Trends

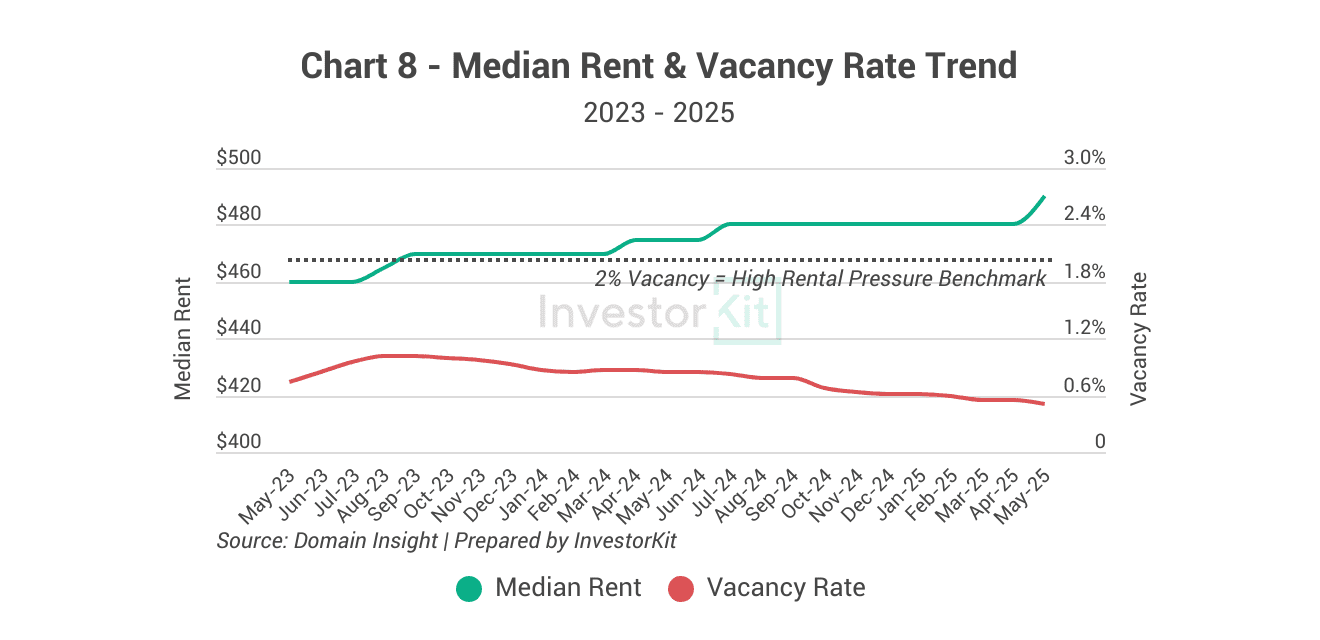

Launceston’s rental market is under high and increasing pressure, as seen in its declining and low vacancy rate (around 0.5%). Rents have increased by 3.2% over the last 12 months.

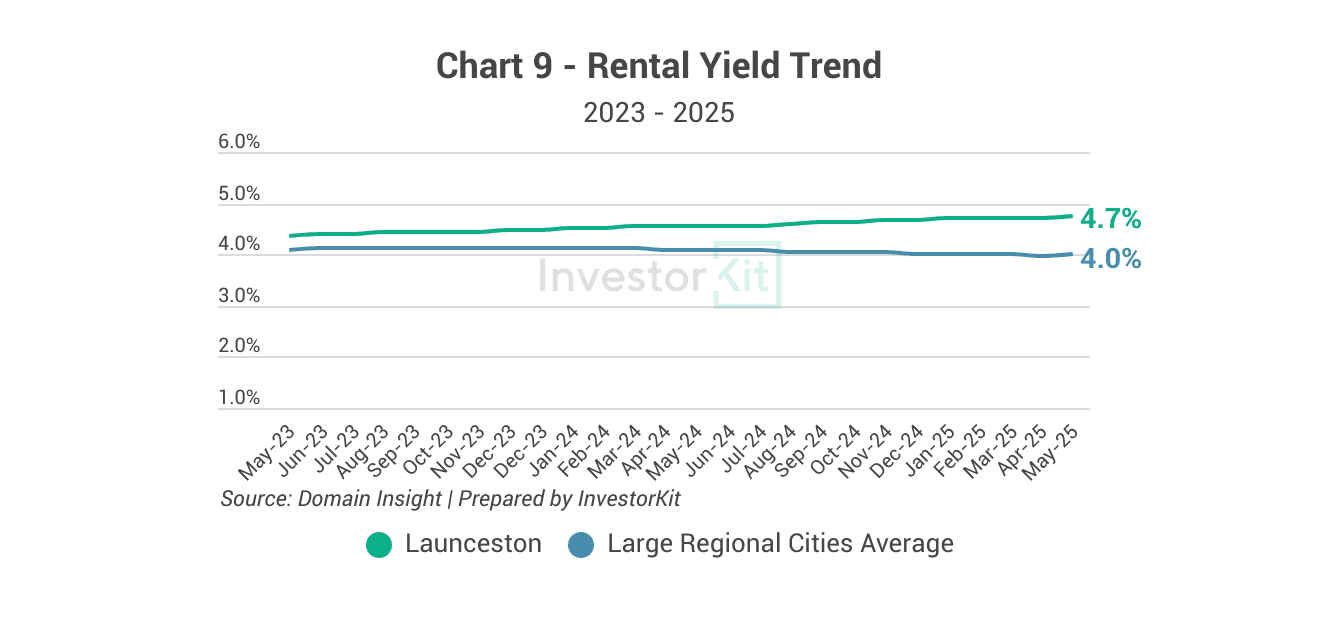

Launceston enjoys a healthy rental yield of 4.7%, well above the average of the top-populated cities. Yield has been improving (around 4.2% higher than the last 12 months) because median rent has grown faster than median sales price.

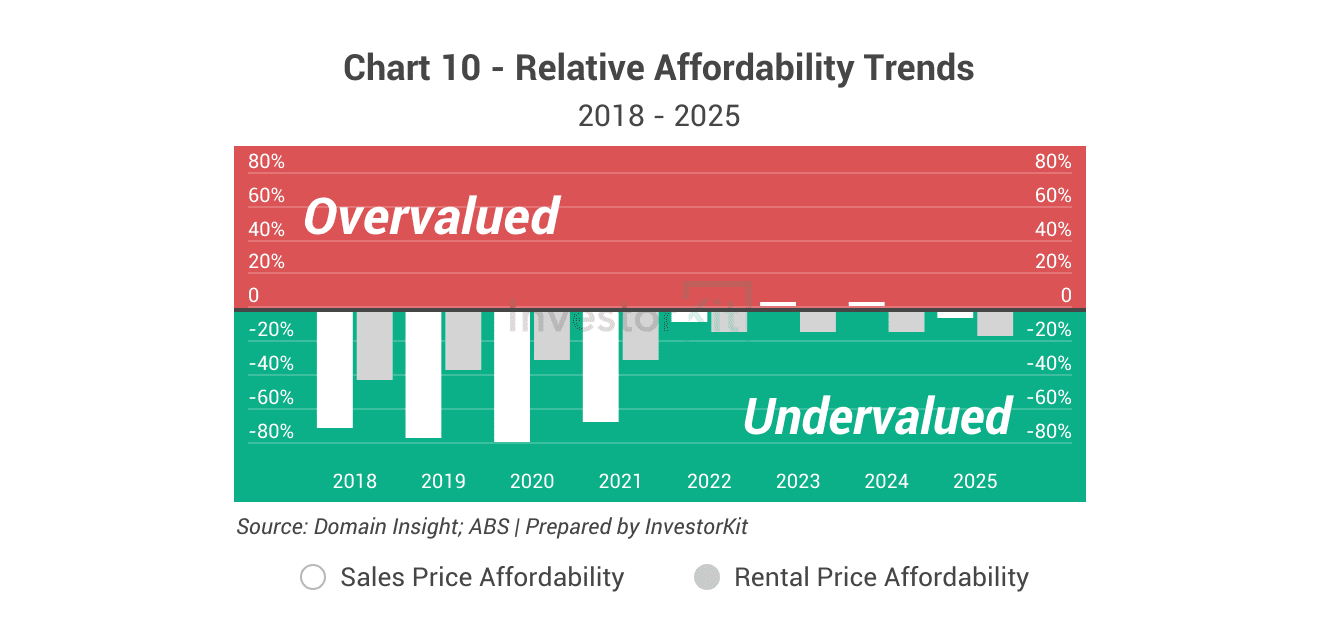

Aside from 2023 and 2024, Launceston has offered relatively affordable housing in both the sales and rental markets, though not to the same extent as before 2022. Currently, the median house price is about 6% below value, while the median rent is around 16% undervalued. With interest rate cuts expected in the coming year, affordability is likely to improve further.

Over the next 6 to 12 months…

Launceston’s house market pressure is increasing but quite slowly. Rental market pressure remains high and is continuing to rise, with vacancy rates at crisis levels and still falling. Over the coming 6 to 12 months, house prices are expected to grow moderately, while yields are likely to improve as rental growth continues to outpace price growth.

Launceston is the 14th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Talk to us today by clicking here and requesting your 15-minute FREE discovery call!

.svg)