If you are still having doubts, or finding it hard to persuade a friend who insists on investing in new properties, we are going to present you some solid reasons why new properties are more harmful than good to your investing goals, which are:

– High depreciation means losing money

– New property does not enjoy the renovation potential benefits.

– New property suffers from the risk of oversupply.

– New property markets have a lack of reliable data, creating market uncertainty.

Depreciation = Losing Money

One of the biggest selling points of new properties is the “high depreciation benefits”. Smart investors would not be trapped by it, because they know that depreciation means losing money, its strange that many people see it as a benefit.

The fact is that assets appreciate (increase in value) while liabilities depreciate (decrease in value). In a property, land is the asset, and the building is the liability. A smart investor would be looking to maximise appreciation and minimise depreciation. An ideal land-to-asset ratio is 70%, where you put 70% of your money on the land. Any land-to-asset ratio that is lower than 50% would be harmful to your capital growth, and new properties usually have that low ratio.

Example

Let’s assume there are two properties with the same size and same value. Property A is a new building valued $350k standing on a land valued $350k; Property B is an old building valued only $250k standing on a land valued $450k. Below table shows each of their value composition.

By merely looking at the value composition, we can already tell that by buying Property A, you are paying more for liability than asset. Then what would happen in a few years’ time?

Let’s simply assume that 5 years later, the land value for both properties have grown by 30% (approx. 6% annual growth); and the buildings both depreciated by 15% (approx. 3% depreciation per year). What are their values now?

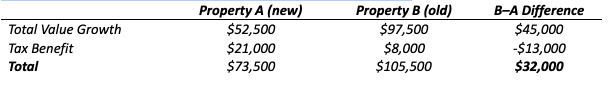

One might argue that we haven’t taken the tax depreciation benefit into account yet. Yes, we are now going to include that in our calculation.

For Property A, the owner can claim a total $350k-$297.5k = $52.5k depreciation on the property. For Property B, the owner can claim at most $37.5k, however, as there are different rules on depreciation claims on an old property, let’s assume that they can claim $20k.

In this calculation, an important assumption is the two owners’ income tax rate. To maximise the tax return benefit, we assume that they both pay 40% tax for their personal income.

Of course, we haven’t considered the cash flow yet. A new property is usually rented for a higher price and costs less on maintenance each year. What if we factor all those in?

We assume that Property A charges $20 higher per week than Property B (that is $5,200 for 5 years), and costs $1500 less per year (that is $7,500 for 5 years). Let’s put that in our calculation.

In five years, the old property has generated $19,300 more than the new one, despite the lower rental income and higher maintenance costs. You must have noticed that the difference in the land value growth contributed the vast majority in Property B’s advantage. The differences in tax benefit, rental income and maintenance costs are not significant comparing to the land appreciation.

LAND APPRECIATION RULES. High depreciation is not beneficial, it prevents you from making more money from land value growth. It’s also not your ‘benefit’ forever, as upon sale these get clawed back.

Renovation Upside of Old Properties

Investors often think that it is painful to renovate or rebuild an old house after purchasing while it is much more relaxing buying a new property as the developer has done all the work in advance. However, the truth is, renovation or rebuild brings more than pain, there is also the gain.

- Renovations can increase your capital gain: Using Property B as an example. Say the owner undertakes $70k renovation that can increase the value of the property by $100k to a total $900k, they gain $30k out of the renovation; However, if someone buys the renovated property with $900k, they have lost the chance of making that profit.In simple terms, for the same amount of work, you are just paying the construction cost if renovating the house yourself, however, if buying new you would be paying both construction cost and developer’s profit.

- Renovations can increase the rental income, and reduces the excessive maintenance costs: Usually, we assume that the weekly rent for an old property would be lower than a new one, as the latter provides brand new facilities which would be more comfortable and more appealing. However, by replacing the old carpets, repainting the walls and renew the appliances, one can easily refresh the space and enhance living experience, and therefore increase their rental price. Also, fewer maintenance works would be needed after the renovation, making the expense gap between the old and new even smaller.

The Risk of Oversupply

Most of the new properties don’t come alone, they either belong to a new development project, or even worse, are in a newly developed area where hundreds of new houses are being built.

everyone knows that capital growth occurs when demand exceeds supply. With hundreds of new properties (supply) coming to the market, you will likely have the odds stacked against you with regards to achieving capital growth.

Example

Here is an example from Queensland. Newport and Redcliffe are two adjacent suburbs on the Redcliffe peninsula, 29km north from Brisbane CBD.

Just a few years ago, the west half of Newport was vacant. The 143ha land was acquired by Stockland for residential development in 2014 and has been filled with new houses during the past few years. The satellite maps taken in 2014, 2017 and 2020 show the process.

On the contrary, Redcliffe is a well-established suburb with few new developments occurring during the last decades.

2014:

2017:

2020:

How was their respective capital growth in the last decade? The below charts show the median sale price trends of the two suburbs over the last 10 years. Newport’s median price has been fluctuated due to the releases of new supply, while Redcliffe market has been much steadier. Looking at their capital growth, Newport has only achieved a poor 14% growth (approx. 1.3% per year), while Redcliffe has witnessed a stronger 62% growth (approx. 5% per year). In the latest housing market boom, Newport’s house price increased by 9% in a year which is, honestly, great, until comparing to the neighbour. Redcliffe’s house price surged by an outstanding 23% from 2020 to 2021.

Unreliable

Before buying a property, you want to be sure of the value of the property you are looking to buy and be confident about the capital growth and rental income potential. Older properties beat newer ones here.

Why? Because both the current value and growth prospect are estimated based on data, which older properties have abundantly while new property markets don’t. Therefore, there is more certainty around established properties than the new ones.

– Certainty of Current Value

We need to first understand how the market value is determined for a property. According to the International Valuation Standards Council (IVSC) and Australian Property Institute (API), market value is the estimated amount for which an asset or liability should exchange on the valuation date between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion. Among various valuation methods, direct comparison is adopted the most commonly by residential property valuers, where they compare the object property to similar (comparable) properties sold lately.

Older properties have been sold at least once before, between a willing buyer and a willing seller, and you can access all the history and see the previous sale prices, so it’s easy for you to get a rough idea how much it would be worth now based on the local market trends. On the contrary, a new property has no history to tell.

When it comes to valuation, an established property has plenty of comparable sales around, with similar land size, house conditions and other features. Valuers can easily give a valuation result that is close to its market value, and personal perspective usually does not make much difference. However, a new property would have much fewer comparable sales, especially when it is in a development project at an early stage. It is not rare to see dramatic variation between different valuers’ estimation on a new property value.

– Certainty of Capital Growth and Rental Income Prospect

The capital growth and rental income prospect of a property depends on various factors such as local demographic structures, employment industry composition, sale and rental market trends etc. Taking demographic structure as an example. This feature includes age composition, family to non-family ratio, education level, household income, rent/mortgage affordability, etc. and it plays an important role influencing the local lifestyle, housing demands, and price levels. For an established area, the demographic structure is relatively stable, and you can easily get an idea from Census and ABS data; However for a newly developed area, the demographic structure changes fast and the 5-year Census data can be easily dated and therefore not reliable.

Example

Let’s use Newport again as an example. As discussed previously, the west half of the suburb is recently developed, and the east half is well established. Below is a snapshot of the 2016 Census stats.

It looks that Newport’s demographics really favour property investment because of the low unemployment rate and high household income. But wait, if you scroll up and take another look at the satellite map, you will probably notice that when the last Census was carried out in 2016, the west half was still under construction, so the Census stats were basically just for the east part. During the following 5 years, hundreds of new homes have settled, and thousands of people have moved in. The demographic structure of the whole suburb could have consequently changed, but the change won’t be reflected to Census data until 2022.

As an investor, would you prefer to invest in the new community of west Newport, where there is not sufficient data showing the residents’ feature and supporting growth prospect, or in the well-established east Newport, where stats clearly show a picture that would not have changed by much.

Another thing to note is that capital growth of a property is usually aligned to similar stock. By similar, we mean land size, because, as you may remember, land appreciation rules. When we look at the long-term (10-year or more) growth trend of an area, data behind the line are contributed by established houses with bigger lands compared to new developments. If you buy a 4-bed new property sitting on a 400 sqm land in west Newport and hope to achieve the same growth as an established 4-bed property on a 600sqm land in east Newport at the same price, well, we wish you luck.

Conclusion

After discussing the four reasons why new properties underperform, you must have noticed that the fatal flaw of new properties is their low land-to-asset ratio, leading to high depreciation, accompanied by the lack of renovation potential, risk of oversupply and market performance uncertainty.

Many investors are misled by developers or their agents to believe that a newly developed area has high growth potential and high depreciation benefits you. But please always remember, the growth they are talking about is the local economy and their pockets, not your wallet.

As a buyer’s agent, InvestorKit puts the buyer’s interests first. We analyse markets with solid data and search for properties in an established yet fast-growing (price not number of people) communities to scale your portfolio.

.svg)