The fear of a recession is spreading across Australia.

Many property investors start to consider buying something “recession-proof”.

However, is there such a thing as a “recession-proof” property?

Before answering that question, let’s clarify what a recession is and what happened when Australia went into recession in the past few decades.

[*In this blog we’re only discussing residential property markets]

What is a recession?

The most common definition of recession is a “technical recession” in which there have been two consecutive quarters of negative growth in real GDP.

However, there are other definitions, too. For example,

- It can be a sustained period of weak or negative real GDP growth accompanied by a significant rise in the unemployment rate.

- It can be a period when real GDP per capita has grown negatively in two consecutive quarters.

- It can be when the unemployment rate increases more than a pre-specified amount.

- It can also be a period between a peak and a trough in the business cycle where there is a significant decline in economic activity spread across the economy that can last from a few months to more than a year (National Bureau of Economic Research, US).

For simplicity, let’s call these non-technical recessions “slowdowns”.

When did recession(s) happen in Australia?

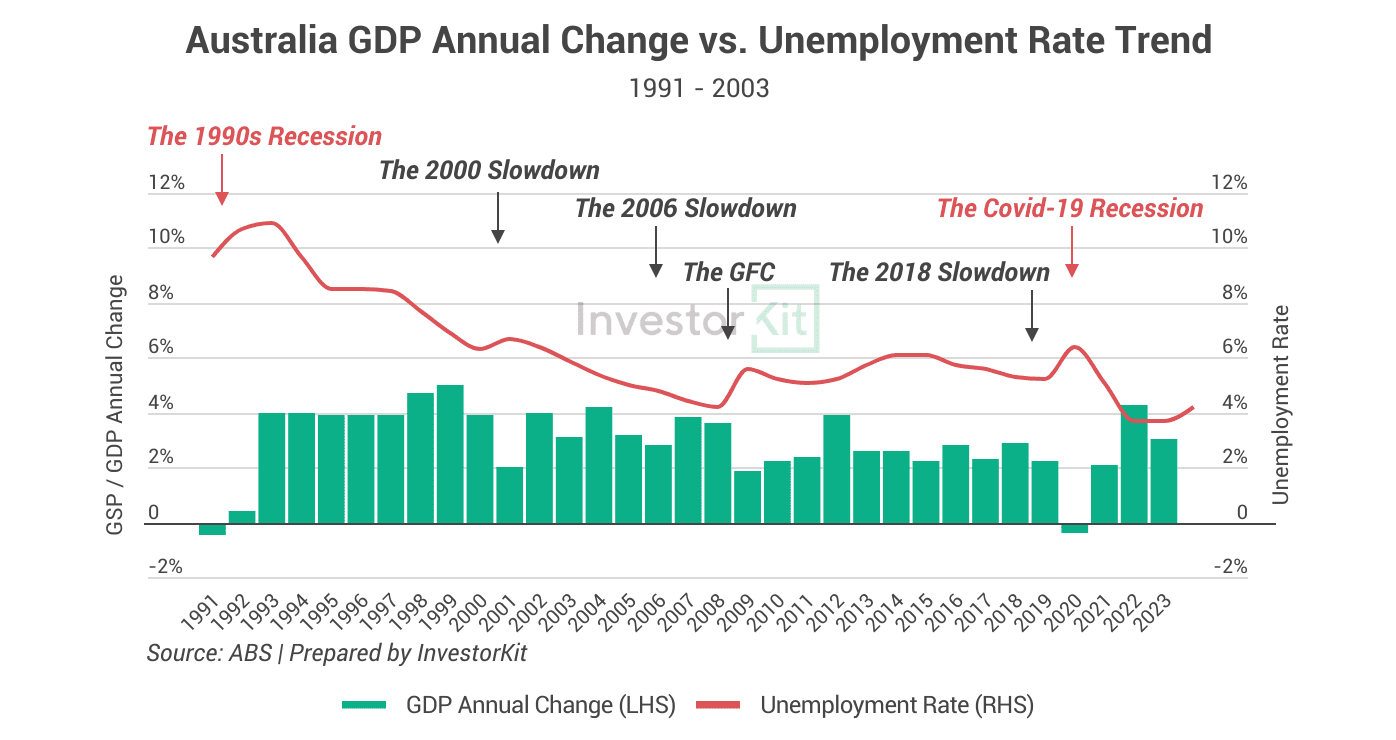

If we only use the technical recession definition, Australia has experienced three recessions since the 1980s.

- The 1982-83 recession: Australia’s economy was affected by a combination of tightened monetary policy, weak global demand, and drought. The unemployment rate surged to 10.5%, but it was followed by a quick recovery.

- The early 1990s recession: To address excess domestic demand and control inflation, interest rates were increased to a very high level. The unemployment rate surged to 11%+ in 1992, and it took almost a decade to return to a healthy level.

- The COVID-19 recession: Businesses were forced to shut down as COVID-19 hit in 2020, permanently or temporarily, leading to two-quarters of GDP decline. The unemployment rate rose for many months in a row. However, the economy quickly recovered due to high government spending and increased household consumption.

Besides the three technical recessions, there have been a few slowdowns.

- 2000: GDP per capita declined in Q3 and Q4, accompanied by a mild unemployment rise.

- 2006: GDP per capita declined in Q1 and Q2, but the unemployment rate didn’t react much.

- 2008: Affected by the Global Financial Crisis (GFC), Australia’s unemployment rate increased sharply from under 4% to 6% in 7 months.

- 2018: GDP per capita declined in Q3 and Q4, while the unemployment rate didn’t react much.

The chart below shows the recessions and slowdowns since the early 1990s (the 1980s recession is not included due to limited data availability).

What happened to the property market during the recessions and slowdowns?

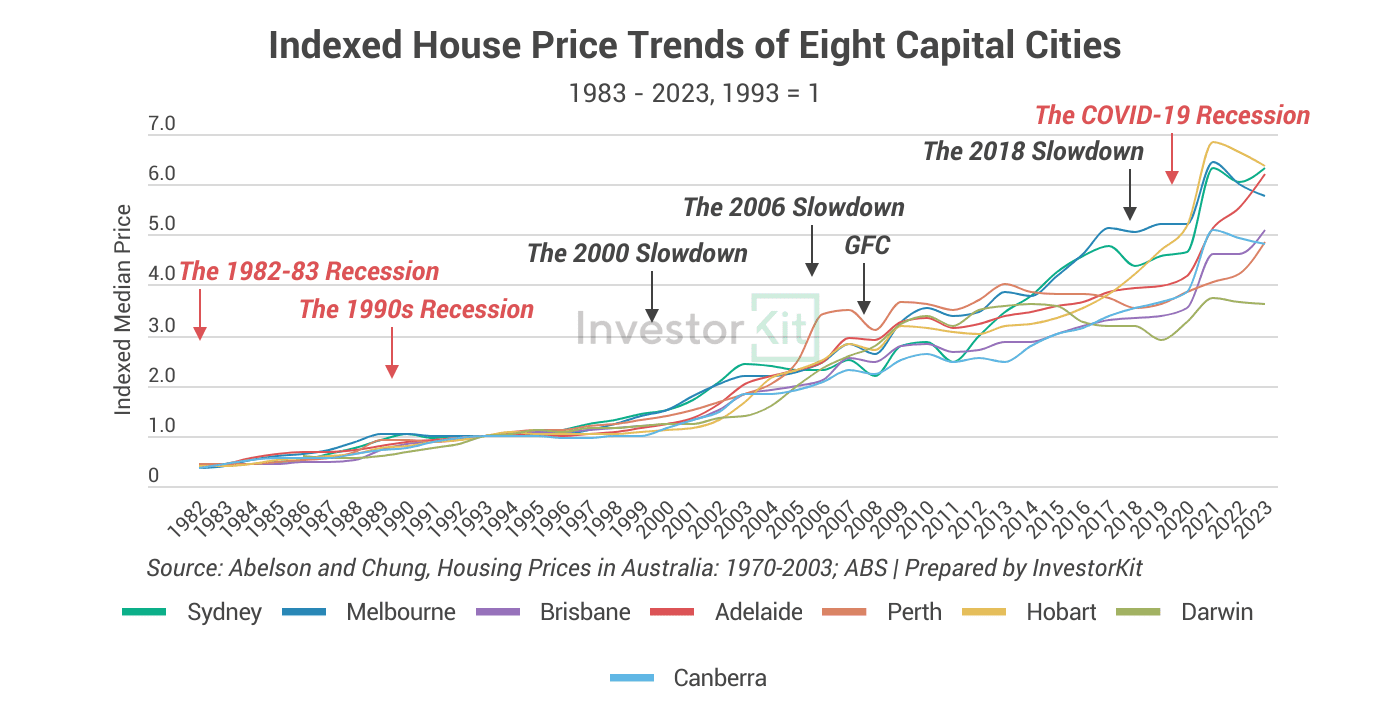

The chart below shows the house price growth trends of the eight capital cities over the past four decades. Now, let’s zoom in on each recession.

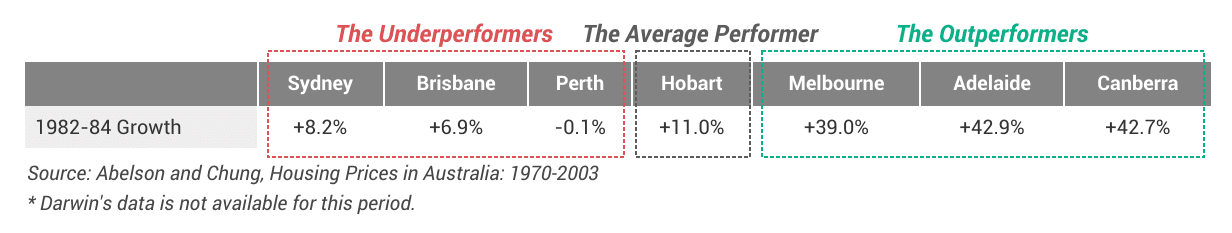

- The 1982-83 recession:

While Sydney, Brisbane, and Perth’s house prices seemed to be badly affected by the recession and recorded below-average growth (average performance = 5-6% annual growth), Melbourne, Adelaide, and Canberra did exceptionally well. The table below shows the cities’ total house price growth in two years (1982-1984).

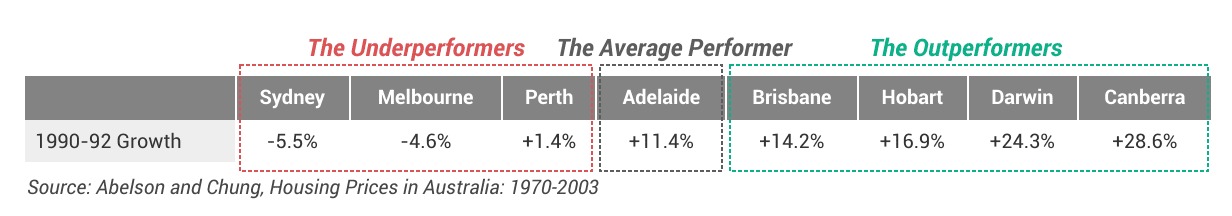

- The 1990s recession:

Sydney, Melbourne, and Perth’s house markets were immediately shocked by the recession; Adelaide recorded just average growth, while Brisbane, Hobart, Darwin, and Canberra outperformed. The table below shows their total house price growth in two years (1990-1992).

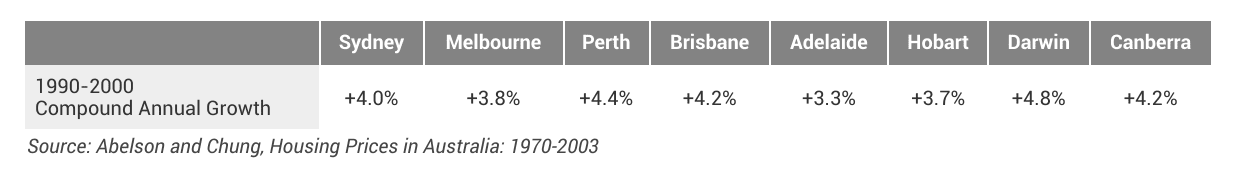

However, the impact of the early 1990s recession lingered for an extended period. It resulted in below-average annual growth (<5% p.a) in all eight capital cities over the following decade (chart below).

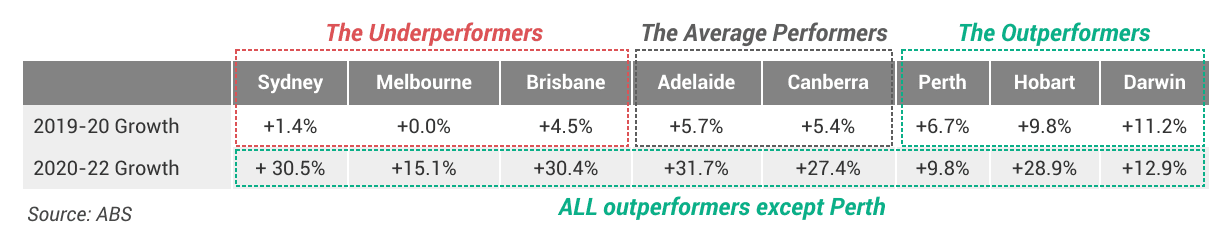

- The COVID-19 recession:

The immediate shock of COVID-19 and border closure impacted Sydney, Melbourne, and Brisbane’s house market the worst, as housing demand from immigrants sharply declined. However, cities that didn’t heavily rely on immigration didn’t feel the impact as much: Adelaide and Canberra achieved average growth, while Perth, Hobart, and Darwin saw above-average price increases (table below).

In the following two years, all capital cities, except Perth, recorded the steepest house price rise ever (see the chart at the beginning of this section). If anyone wonders why Perth didn’t boom, it was gathering momentum to become the best performer in 2023 and 2024.

So far, we’ve learned that not all cities performed poorly in each recession — there have been outperformers, average performers, and underperformers. How about during economic slowdowns?

Below are two examples: the 2000 slowdown and the GFC.

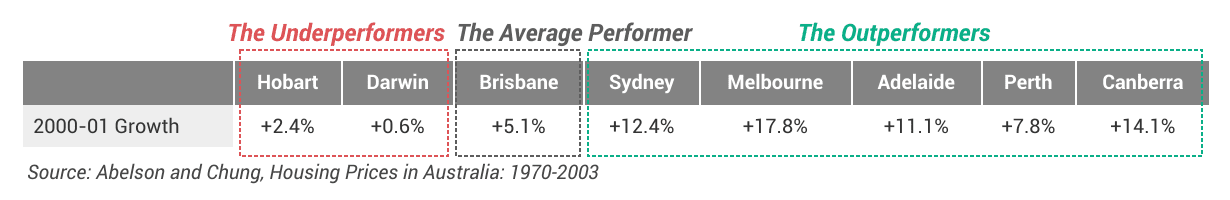

- The 2000 slowdown:

The national-level slowdown didn’t affect all property markets in 2000, either. Only Hobart and Darwin recorded below-average house price growth; Brisbane performed averagely, and all other cities boomed.

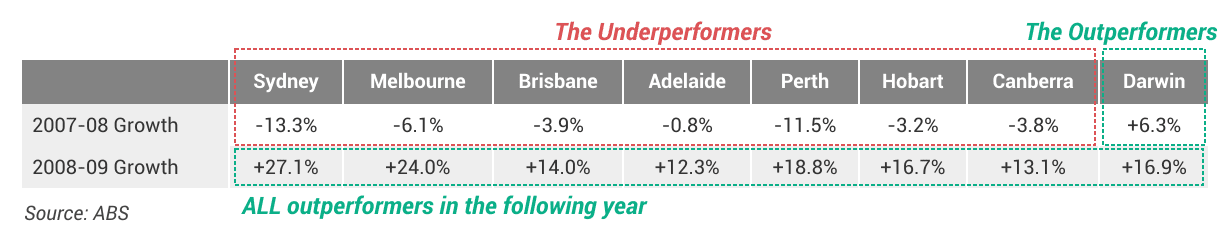

- The Global Finacial Crisis:

The GFC hit Australia’s property markets hard in 2008. All capital cities saw negative house price growth except Darwin, with Sydney and Perth feeling it the most. However, the impact was short-lived: all cities quickly bounced back in the following year (chart below).

Local economies don’t necessarily follow national trends.

What happened in the past shows that not all property markets would react to national-level recessions or slowdowns to the same extent.

Sydney, contributing more than 1/5 of Australia’s GDP, tends to be heavily impacted by national trends: look how many times Sydney has been an underperformer in the event of a national recession/slowdown.

On the other hand, smaller economies such as Adelaide or Hobart, not to mention the regional cities, are much less affected by national trends: In the three recessions, Adelaide and Hobart were never among the under-performers.

When it comes to property market trends, it’s important to consider not just the macro trends on the national level but also the local economy and local market demand & supply. As long as the local economy is strong with high housing demand relative to supply, your property will be safe from any national decline.

Property market performances converge in the long term.

You may ask: What if my investment is in Sydney, which tends to be heavily impacted by national recessions? Where can I find a “recession-proof” property?

The answer to this question might not be where to find the property but how your investment strategy should be.

Property investment is a long-term game. You make money by holding instead of trading.

While Sydney tends to feel the immediate impact of a recession and experience sharp declines in a short period of time, its recovery can be quick, too, leading to similar long-term growth to other cities.

One example is Sydney’s last 40-year journey versus Adelaide and Hobart’s.

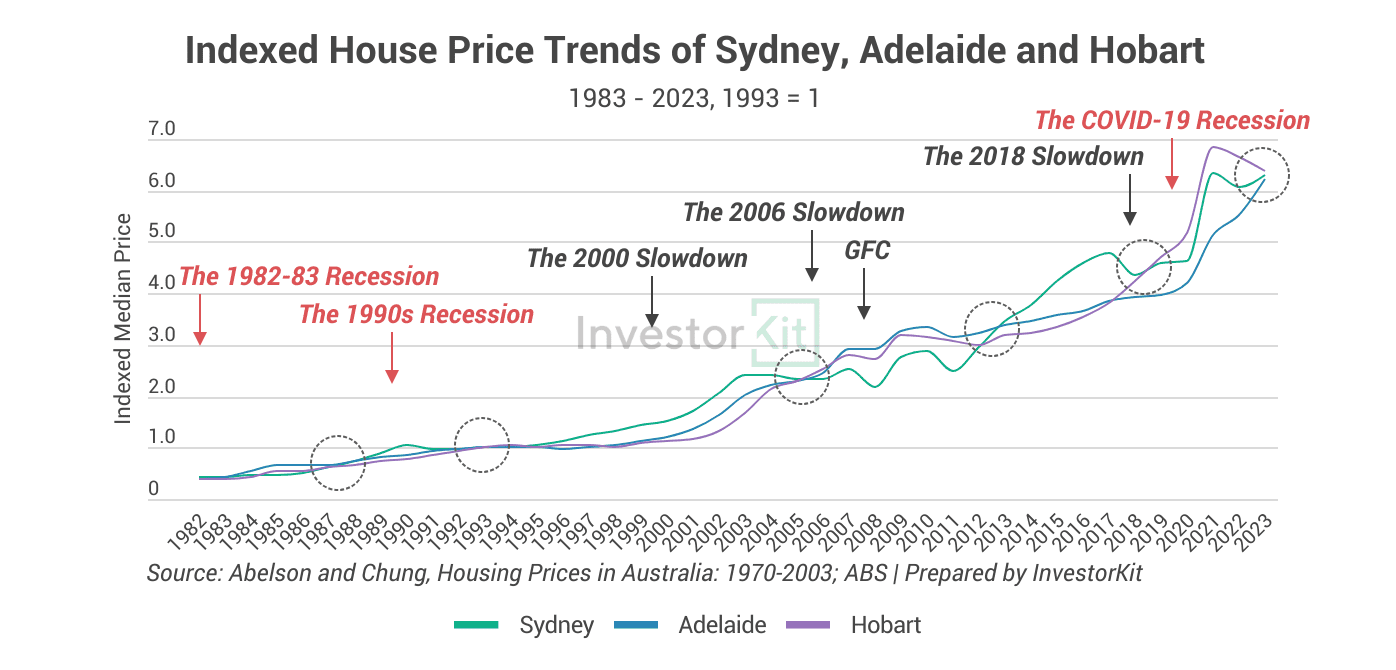

The chart below shows the house price growth in Sydney, Adelaide and Hobart since 1983. While they have followed various trajectories, the trend lines cross over once every few years: Whether impacted by a recession or not, the long-term growth won’t let you down.

You don’t need to find “recession-proof” properties because they don’t exist.

So, is there such a thing as “recession-proof” property?

The simple answer is no.

When we’re just looking at residential properties, if a market is impacted by a recession, no property in it can be spared: people lose jobs, wages won’t grow, buyers can’t borrow as much, and renters may not be able to afford their rents anymore. Can you name a suburb in Sydney that didn’t experience house value and rental decline at the immediate shock of COVID-19 back in 2020?

It doesn’t matter if the property is close to a major employment hub or in a “premium” suburb: If I’ve lost my job, why should I stay near the company paying higher rents? If I’m making less money, why don’t I move to a more affordable area?

Instead of chasing non-existing “recession-proof” properties, it’s more crucial to look for markets with thriving local economies that are not likely to experience a recession or be impacted by a macro-level recession.

Furthermore, keep in mind that in the long term, all markets tend to perform similarly, whether or not they are impacted by recessions. What’s lost today will be recovered tomorrow, and that’s the beauty of market cycles. Any doubts? Just think of what has happened in Sydney, Adelaide, and Hobart over the past 40 years.

InvestorKit is a data-driven buyer’s agency dedicated to busting property investment myths, helping you clarify your investment goals and plans, and identifying the right markets and properties, so you can achieve your wealth-building goal faster. Would like some assistance on your investment journey? Connect with us today for a free 15-minute discovery call!

.svg)