When searching for an investment property, many investors begin by looking in markets that feel familiar or comfortable. Often, that means narrowing the search to just two or three locations they already know.

That approach can feel sensible, but it can also work against your strategy if those markets don’t align with what you actually need your next purchase to achieve.

Limiting your search can mean a longer wait and missed growth

Restricting your search to only two or three markets significantly reduces the pool of suitable properties available at any given time. In lower-supply environments, this often translates into longer search periods simply because fewer opportunities meet your criteria.

While you’re still searching, other investors may have already secured assets and begun participating in capital growth and rental income. Even relatively short delays can create opportunity costs when markets are moving.

For example, Armidale’s median house price rose from around $540,000 to approximately $566,000 between October and November 2025, illustrating how quickly market conditions can change while some investors are still on the sidelines.

The key issue isn’t waiting itself, but that a narrow market focus increases the likelihood of delay, which reduces your exposure to growth over time.

Limited choice increases the risk of overpaying or accepting risk

When options are limited, decision pressure builds. That pressure typically shows up in one of two ways.

In highly competitive markets, demand for quality properties is strong. To secure a solid asset, buyers often need to stretch on price, effectively paying a premium to compete. In this scenario, the trade-off is price rather than quality.

At the other end of the spectrum, investors trying to avoid overpaying may gravitate toward less competitive pockets or listings within the same market. These can appear like value opportunities, but lower competition often exists for a reason, such as flood exposure, bushfire risk, planning constraints, oversupply, or weaker tenant demand. Here, the trade-off is not price, but risk.

In both cases, the root cause is limited choice. When the opportunity set is narrow, investors are more likely to make compromises they would not otherwise consider.

Popular markets often reward early entry, not late participation

Markets that attract strong media attention are often already well into their growth phase. By the time a location becomes widely discussed, prices may already reflect much of the recent upside.

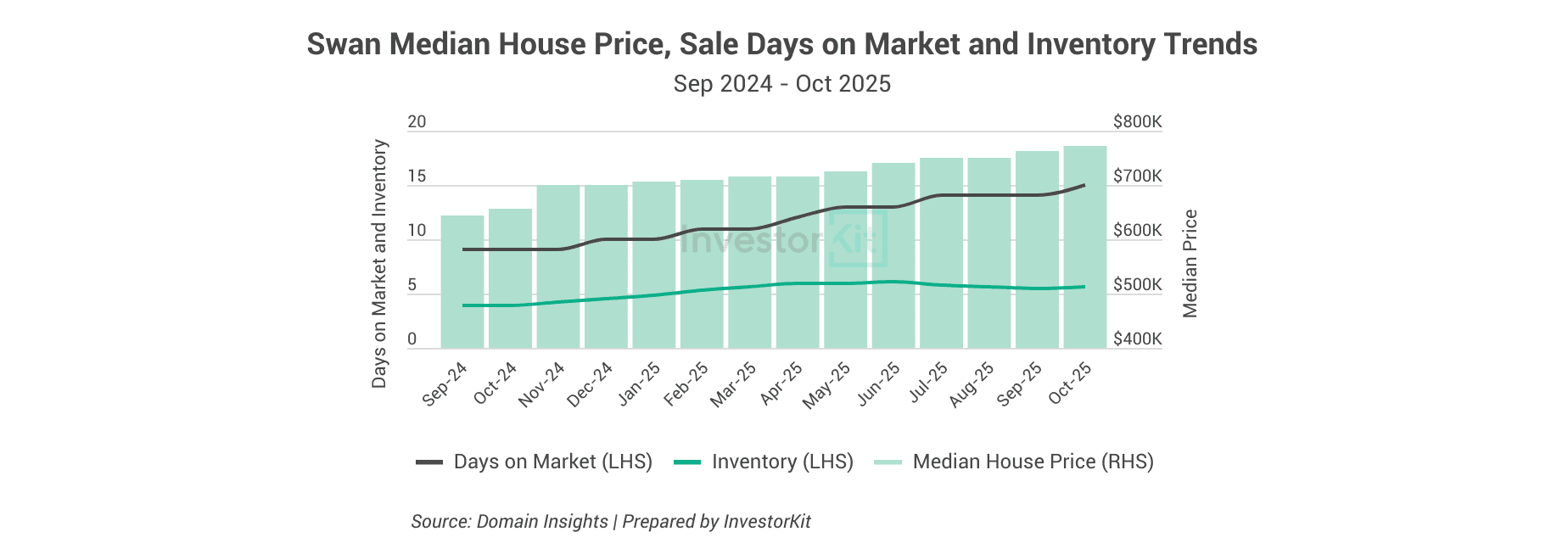

The SA3 region of Swan in Perth illustrates this dynamic. Over the past year, the region recorded strong headline growth of around 17.9%, which can make it appear highly attractive at first glance. However, a closer look shows that days on market and inventory levels have become high.

Rising days on market and increasing listings are early signs that growth momentum may be easing and the market could be transitioning from acceleration toward moderation. For investors chasing fast capital growth, this matters. Entering later in the cycle often means paying prices that already embed recent gains, with less upside available than earlier entrants experienced.

This does not make these markets poor investments, but it does mean outcomes are likely to differ depending on timing and strategy.

When your market choice doesn’t match your strategy

A common issue arises when investors choose markets first and keep their strategy fixed.

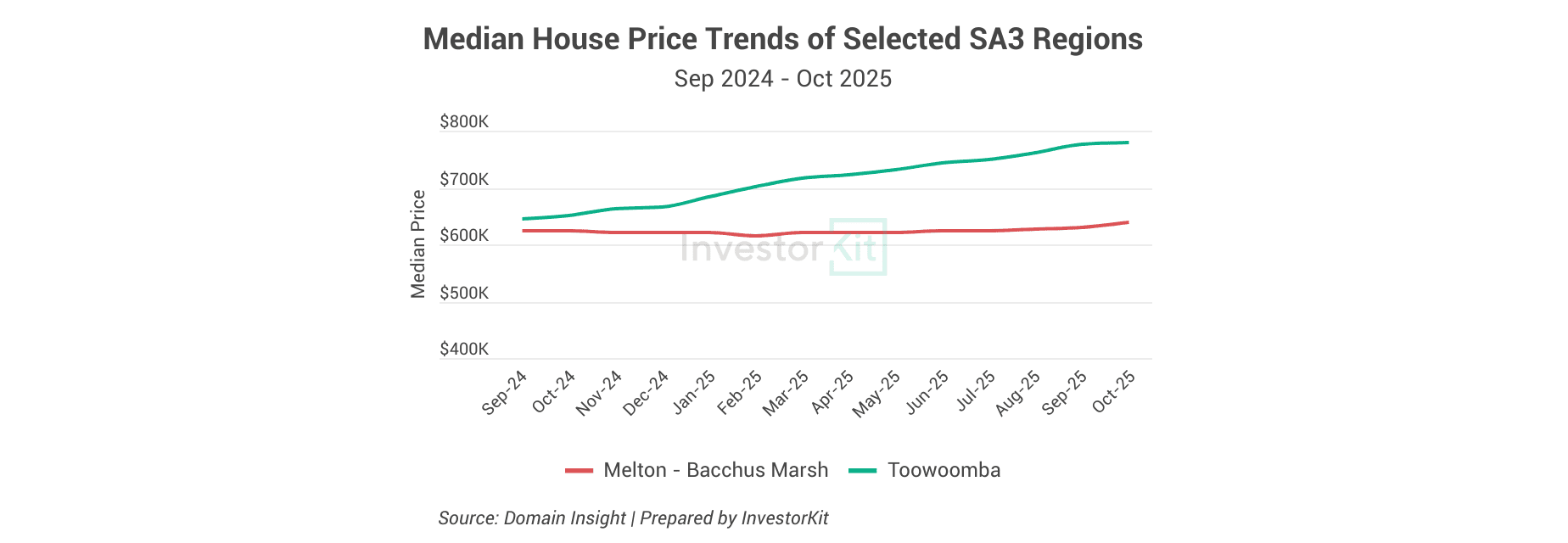

For example, a Melbourne-based investor aiming for strong near-term capital growth may restrict their search to areas such as Melton because of familiarity. However, Melton remains earlier in its growth cycle, with market pressure still building. In this context, focusing solely on that area may not align well with a short-term growth objective, particularly when other similarly priced markets are further along in their cycle.

The same applies to cash-flow-focused strategies. Restricting a search to high-priced, low-yield markets, such as Sydney, where median rental yields sit around 3%, makes it harder for rental income to meaningfully support holding costs. By contrast, markets with lower entry prices and higher yields, for example, Dubbo, where median rental yields are close to 5%, allow rental income to do more of the work, improving cash flow and serviceability.

In both cases, outcomes are shaped not by the strategy alone, but by whether the chosen market structurally supports it.

Diversification is about behaviour, not distance

Owning properties in different postcodes does not automatically mean you are diversified. Diversification is about how independently markets behave, not how far apart they are on a map.

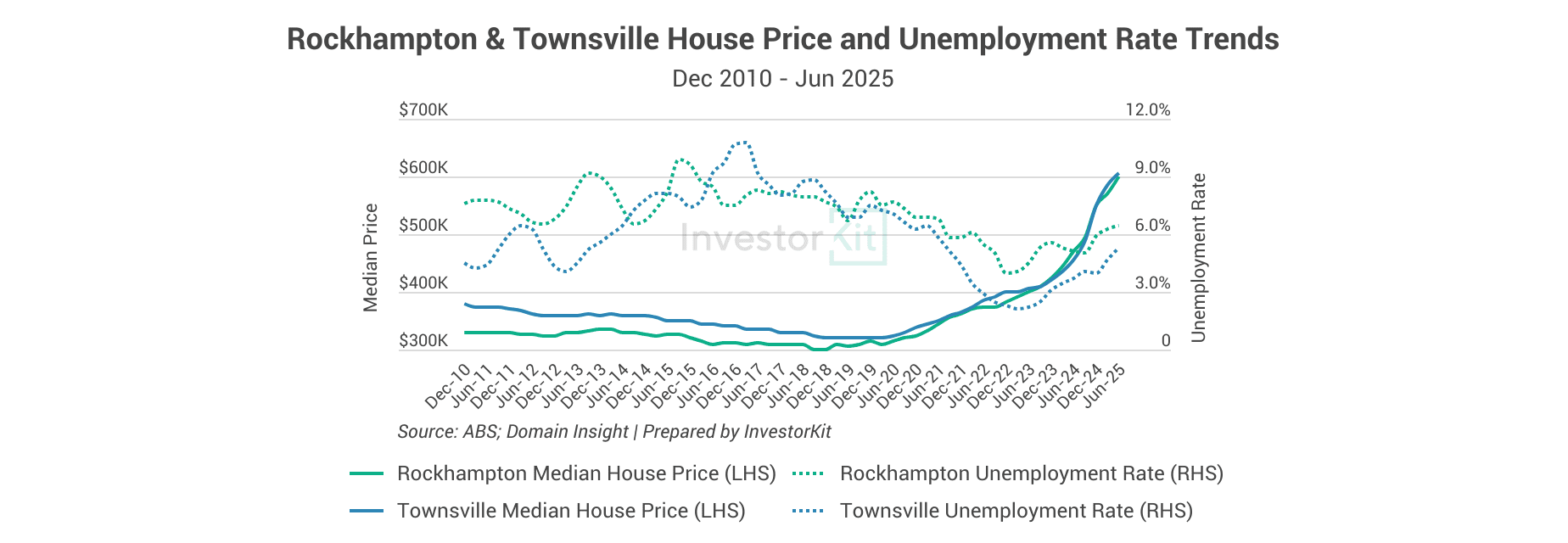

Markets driven by similar economic conditions tend to move together. For example, Townsville and Rockhampton are influenced by similar economic drivers, which means their economic cycles and property market cycles tend to move closely together. This does not make either market inherently risky, but it does mean that owning both provides less diversification than owning markets with different underlying drivers.

When multiple properties are exposed to the same economic conditions, portfolio risk becomes more concentrated, reducing resilience when conditions change. True diversification comes from spreading exposure across markets with different economic drivers and cycle positions, so that no single economic shift affects the portfolio all at once.

Bringing It All Together

Focusing on just two or three familiar markets can feel safe, but safety in property investing comes from alignment rather than familiarity.

The key question is not whether a market feels comfortable, but whether it suits the role your next property needs to play in your portfolio. Broadening your market options improves flexibility, supports diversification, and increases the likelihood that your investment strategy delivers the outcomes you are actually targeting.

If you’re considering your next property purchase and want to make sure your market selection actually aligns with what you’re trying to achieve, we can help. InvestorKit works with investors to build clear, strategy-led plans and identify markets that genuinely support their goals. If you’d like to talk through your situation and next steps, book a free 15-minute discovery call with our team.

.svg)