November 21, 2025

Wagga Wagga Property Market in 10 Charts

Located on the Murrumbidgee River, Wagga Wagga is NSW’s largest inland city with a diverse and stable economy. After a sharp upswing since 2021, the housing market has transitioned into…

Wagga Wagga: The Largest inland city of New South Wales

Located on the banks of the Murrumbidgee River, Wagga Wagga is the largest inland city in New South Wales and a key service hub for the Riverina region. Its diverse economy, anchored by education, defence, healthcare and logistics, supports a stable housing market. With its affordable housing, regional airport and a 3-hour drive to Canberra, Wagga Wagga combines regional liveability with consistent long-term investment appeal.

After a strong upswing from 2021, Wagga Wagga’s housing market has transitioned into a steady, mid-cycle phase. Price growth has remained moderate, while rental pressure remains high amid low vacancy and limited new supply. Will the city’s balanced yet tightening conditions translate into stronger price growth over the next year? Join us as we explore Wagga Wagga’s current market performance and outlook!

As of November 2025, Wagga Wagga’s House Market Pressure is Relatively High.

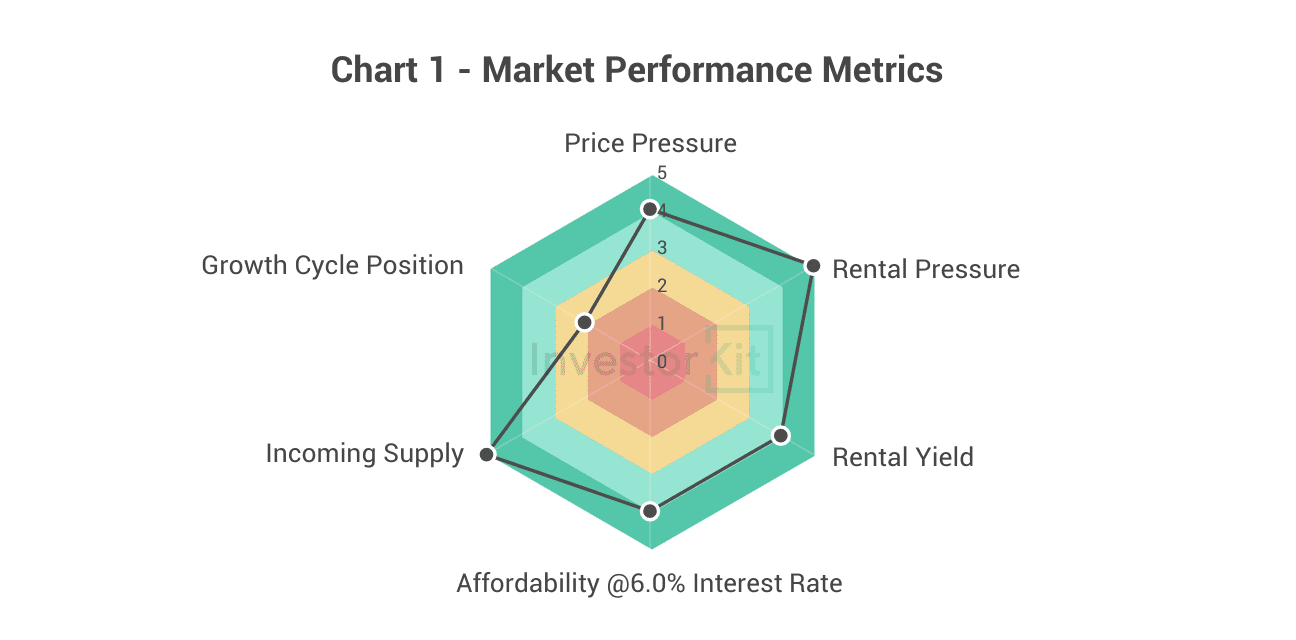

From the six metrics in the web-chart, Wagga Wagga scores:

- 5 (very strong) in incoming supply and rental pressure

- 4 (strong) in price pressure, affordability and rental yield

- 2 (relatively weak) in the growth cycle position

Overall, the market shows moderate price momentum, strong rental conditions and limited new supply.

Wagga Wagga’s Demographic & Economic Trends

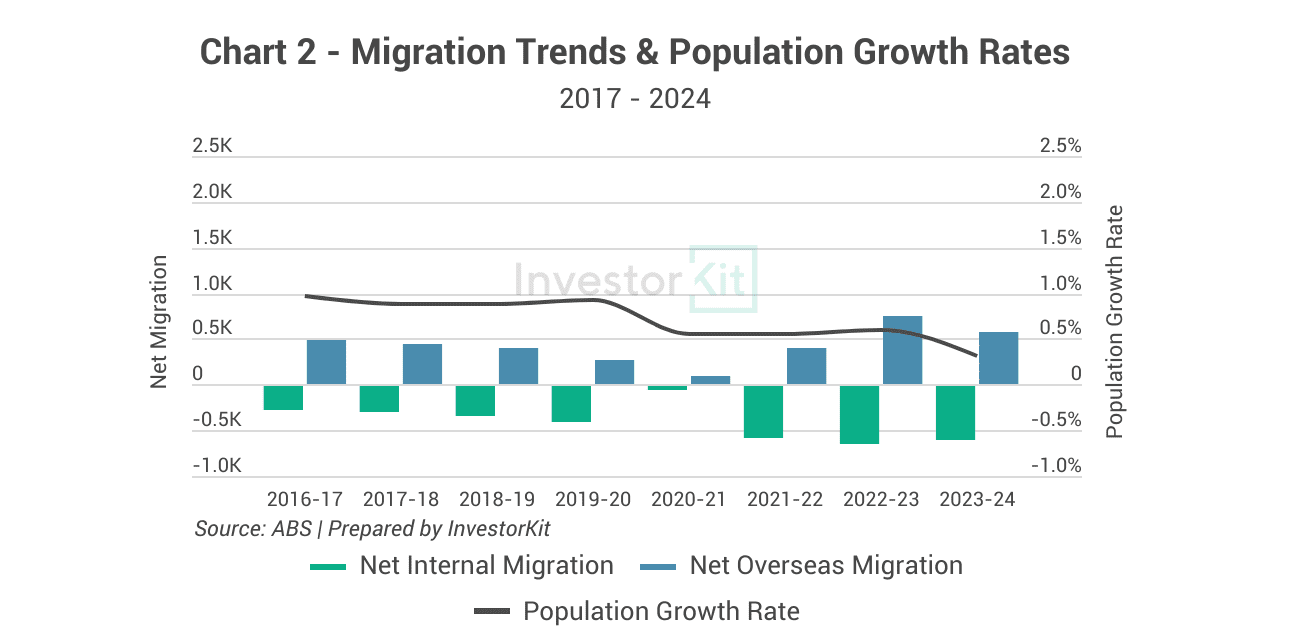

Since COVID, the population growth rate in Wagga Wagga has been softer than pre-pandemic levels. While internal migration has been declining, the overseas migration inflows have continued to support overall growth. Although the population growth rate remains modest at below 1%, this alone doesn’t determine housing performance. Instead, it must be examined together with supply conditions.

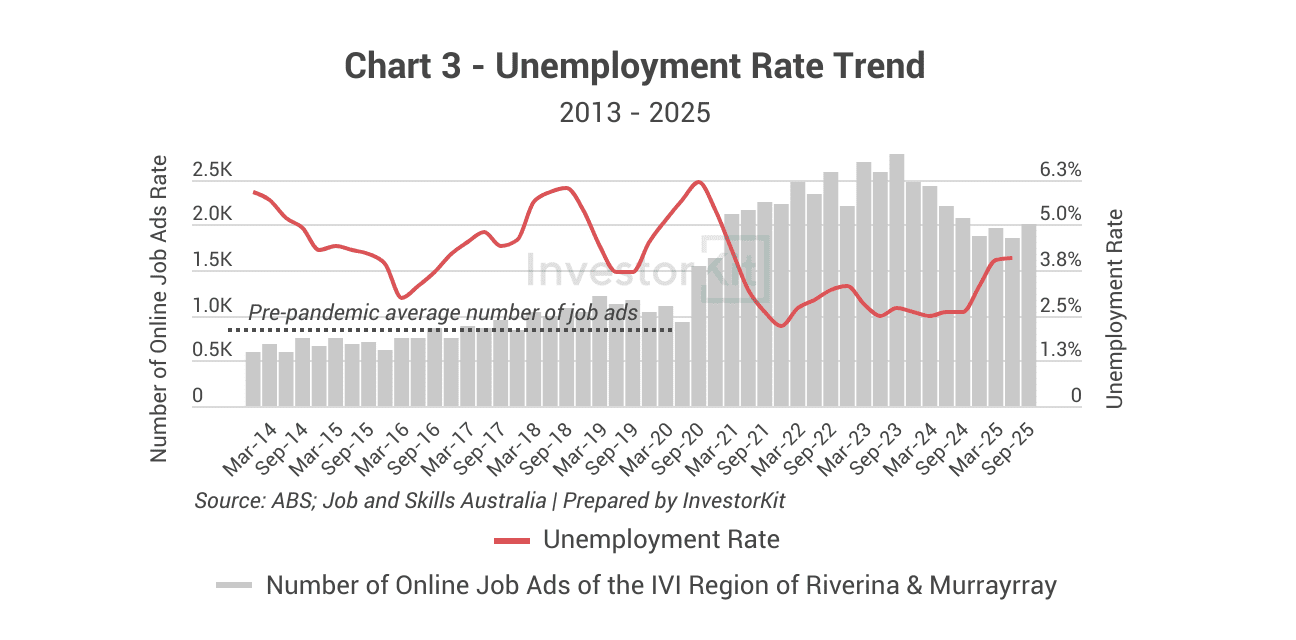

Unemployment in Wagga Wagga has lifted from record lows of 2.2% in late 2021 to around 4.1%, while online job ads remain well above pre-pandemic levels. The decline in job postings since late 2023, alongside rising unemployment, signals a normalisation of the labour market.

Wagga Wagga’s Property Market: Sales Market Trends

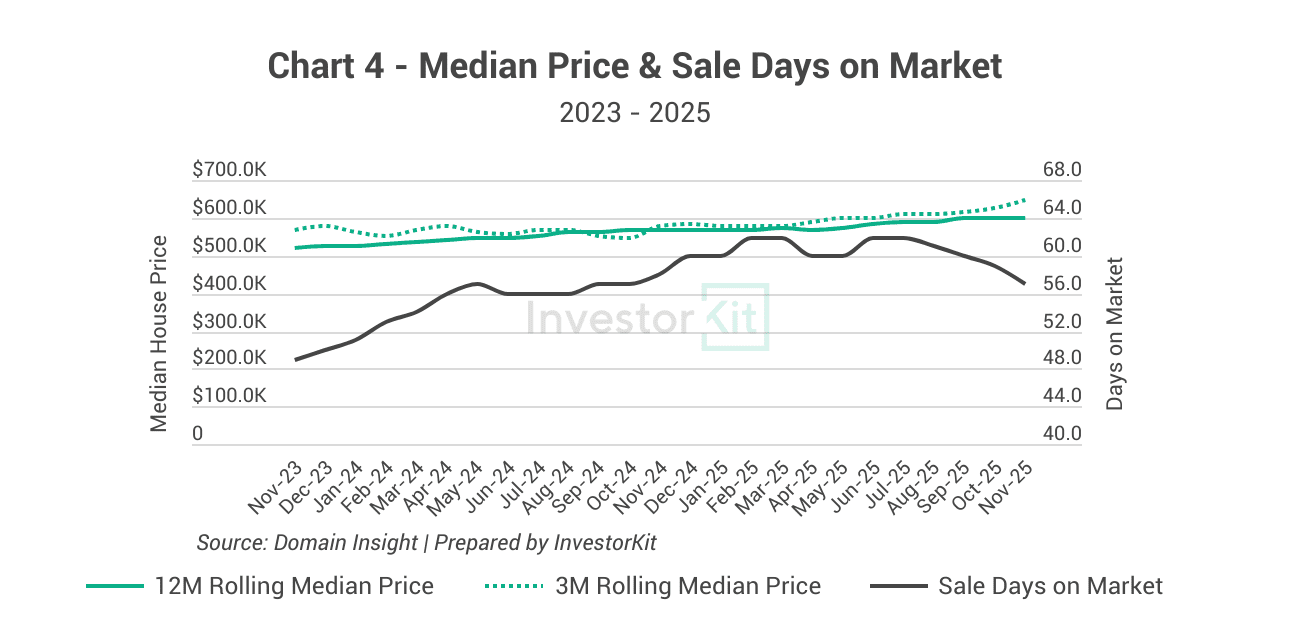

Wagga Wagga’s sales market continues to show sustained strength, supported by steady price growth and declining selling time. Over the past 12 months, median house prices have increased by around 6.0%, reaching $600k. The 3-month rolling median shows emerging momentum over the past 3 months. At the same time, days on market (currently at 57) has been falling in the last 4 months of 2025.

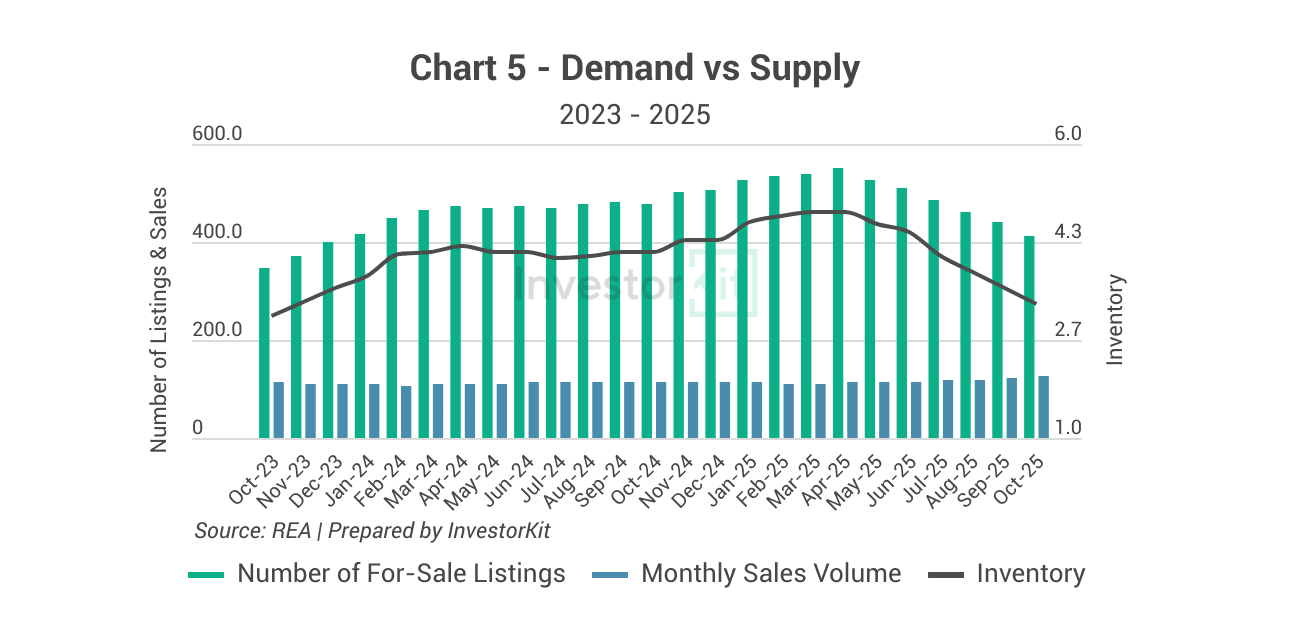

In 2025, Wagga Wagga’s for-sale listings eased after peaking at around 549 earlier in the year, Since early 2025, there is a gradual pickup in monthly sales volume. This tightening of supply, combined with recent demand lift, will support shorter selling times ahead and help sustain price growth through 2026.

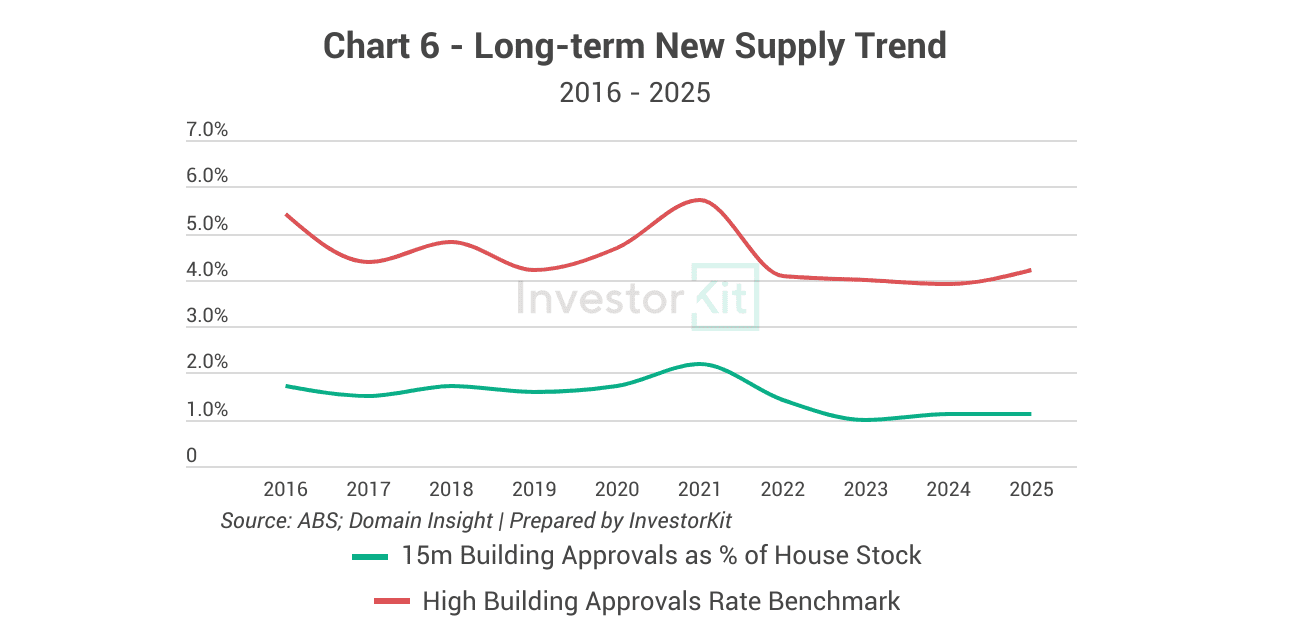

Building approvals have remained well below the high rate benchmark. After a brief uptick in 2021, approvals have trended downward and now hover around 1.1% of stock. This implies limited new construction activity and low oversupply risk.

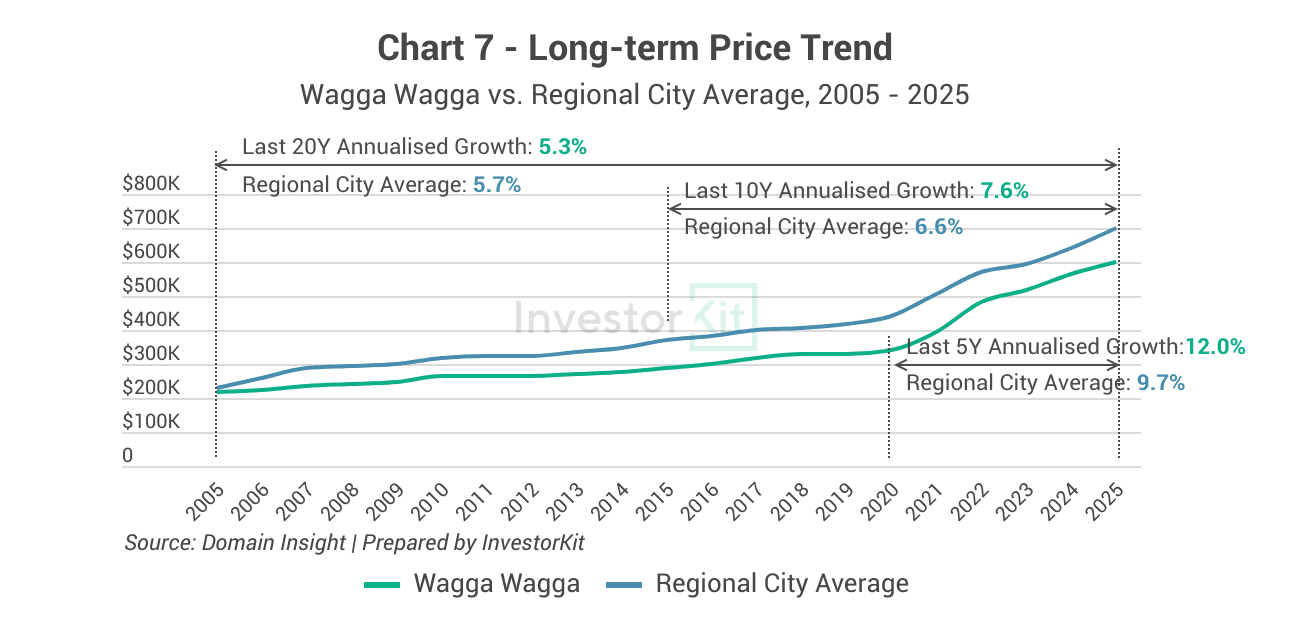

Wagga Wagga’s house price growth remained steady before 2020, then accelerated during the post-COVID period to lift its long-term trajectory. The past 5 year growth (12.0% p.a) and past decade growth (7.6%) are much higher than the 5-7% long-term average. This sustained upward momentum and outperforming the broader regional city benchmark underscore the city’s strong capital resilience. In the medium term, moderate growth is expected as the market settles after recent rapid gains.

Wagga Wagga’s Property Market: Rental Market Trends

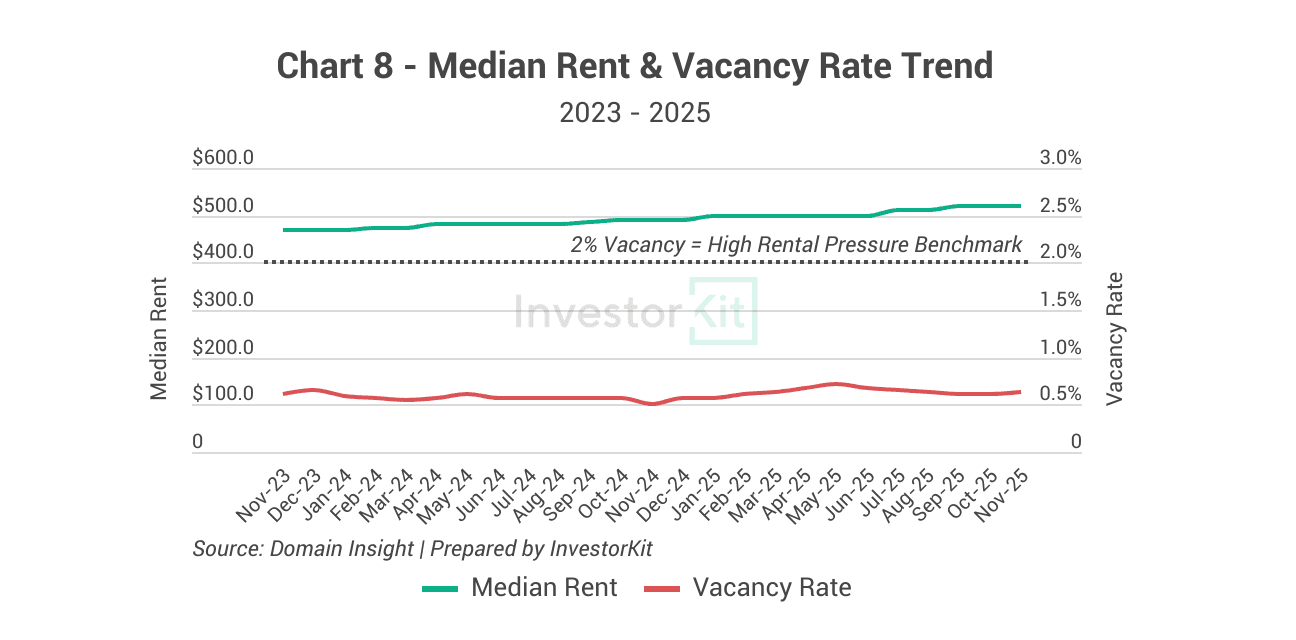

In the last year, Wagga Wagga’s median rent has increased strongly from $470 to $520 (+10.6%), and the vacancy rate has been below 1%. This signals extreme rental tightness, and this ongoing imbalance between limited rental supply and strong rental demand continues to apply upward pressure on rents.

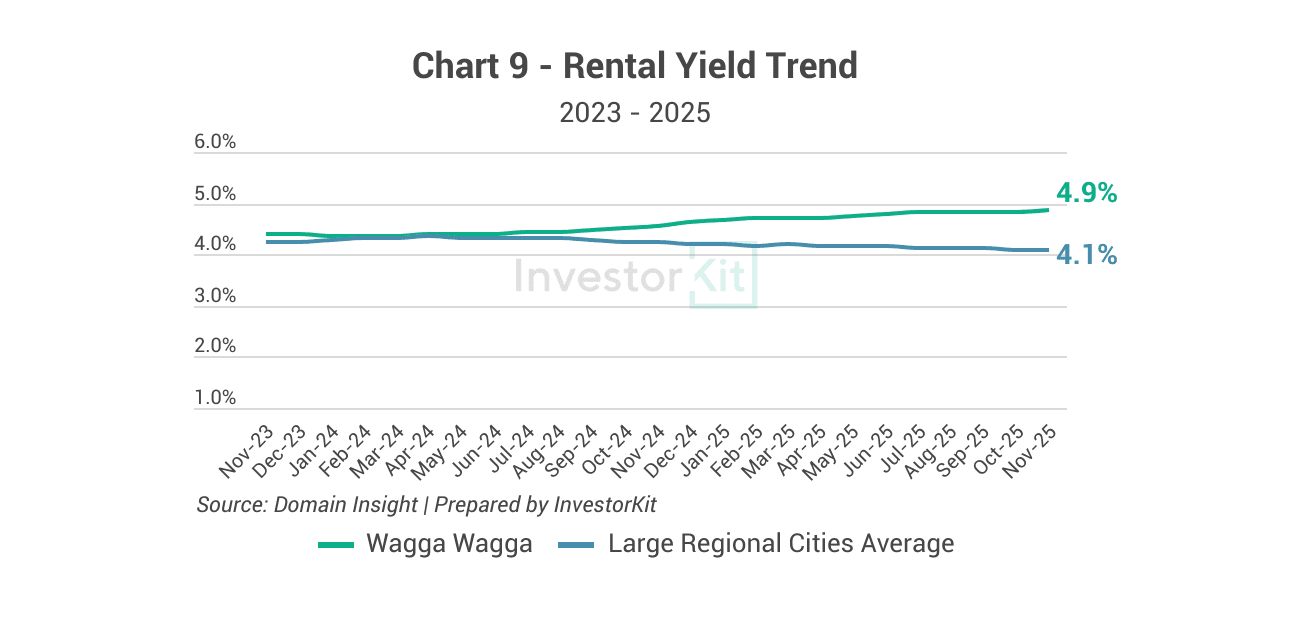

Rental yields increased from 4.4% to 4.9% by November 2025, maintaining a clear lead over large regional city averages of 4.1%. This resilience in yield highlights that rental income growth continues to offset slow price gains, preserving healthy returns for investors. The sustained gap above the regional benchmark reinforces Wagga Wagga as a strong income-producing market.

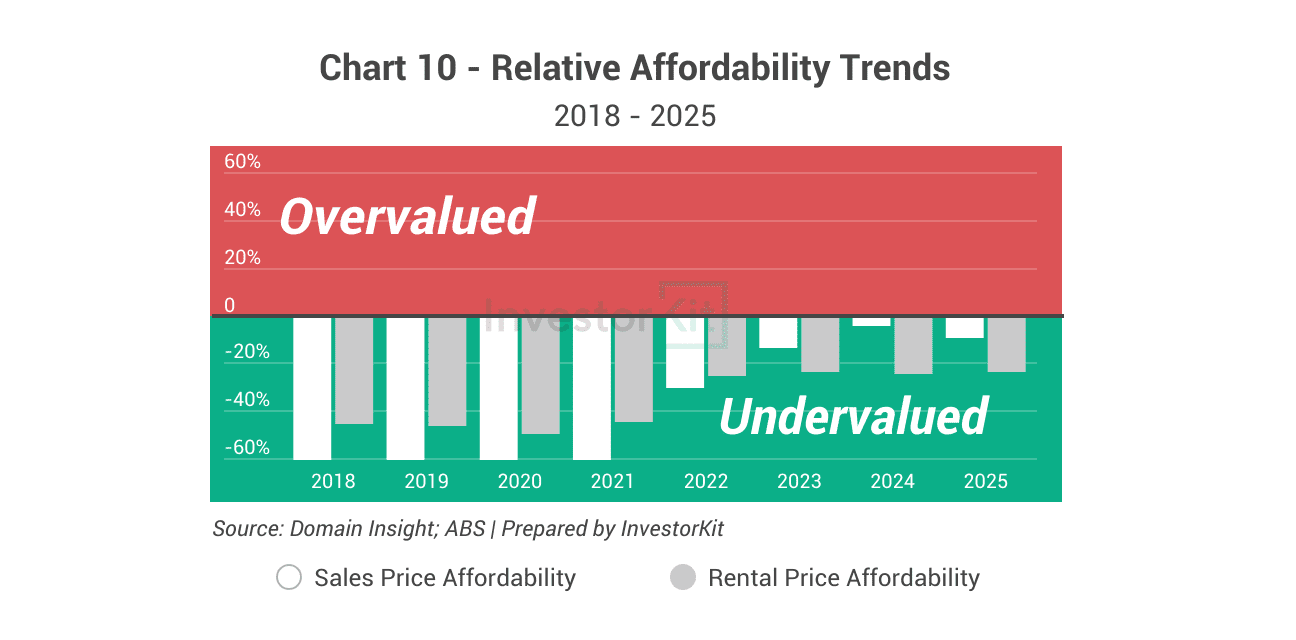

Both sales and rental affordability in Wagga Wagga remain in the undervalued zone, reflecting favourable price-to-income conditions. From 2019 to 2024, strong house price growth made buying progressively less affordable. From 2024 to 2025, affordability improved, driven by the recent interest rate cuts and income growth, which contributed to strengthening the region’s appeal for investors. Over the past 3 years, rental affordability has been comparatively stable, with no significant deterioration since 2022.

In the next 6 to 12 months

Wagga Wagga’s house prices are expected to accelerate as inventory continues to tighten and new housing supply remains limited. Rental pressure will stay elevated, with a vacancy rate below 0.7%, which is likely to drive further rent increase through 2026.

Wagga Wagga is the 20th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyer’s agency InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-minute FREE discovery call!