Every week, the headlines change.

‘Prices are peaking.’ ‘A crash is coming.’ ‘The boom is back.’

But if you’ve followed the property market for any length of time, you’ll know that the truth rarely lies in the headlines. It lies beneath them.

At InvestorKit, we consistently track 25 housing fundamentals of the country’s property markets. These fundamentals are the unseen forces shaping property performance, and understanding them is what separates a confident investor from a reactive one.

So instead of guessing where the market is heading, let’s take a step back and look at what the fundamentals are really saying about Australia’s housing landscape right now.

Pillar 1: Demand, The Engine That Keeps the Markets Moving

At its core, the property market is powered by people: where they live, how they move, and what they can afford.

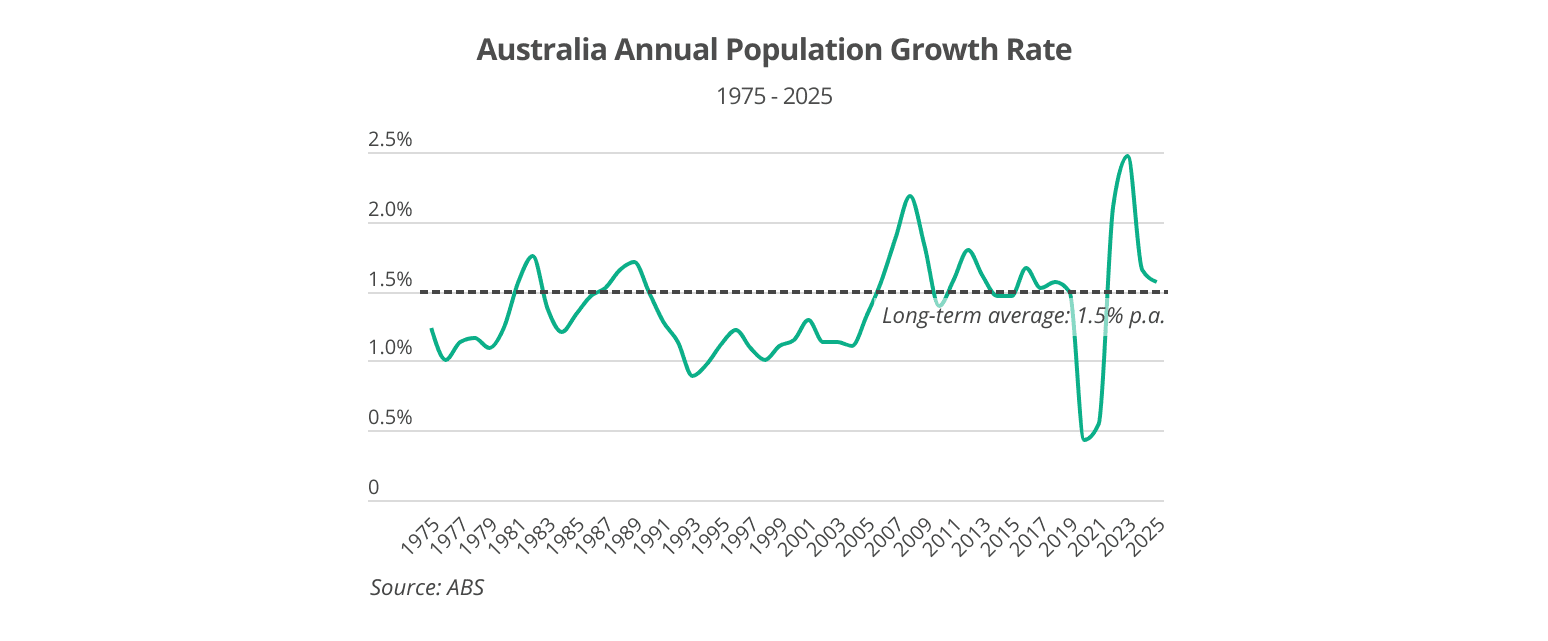

Australia’s population reached roughly 27.5 million in March 2025, up 1.6% over the year and returning to its long-term average (chart below). While migration has eased from record highs, it is still well above pre-COVID levels, and regional migration continues to hold strong.

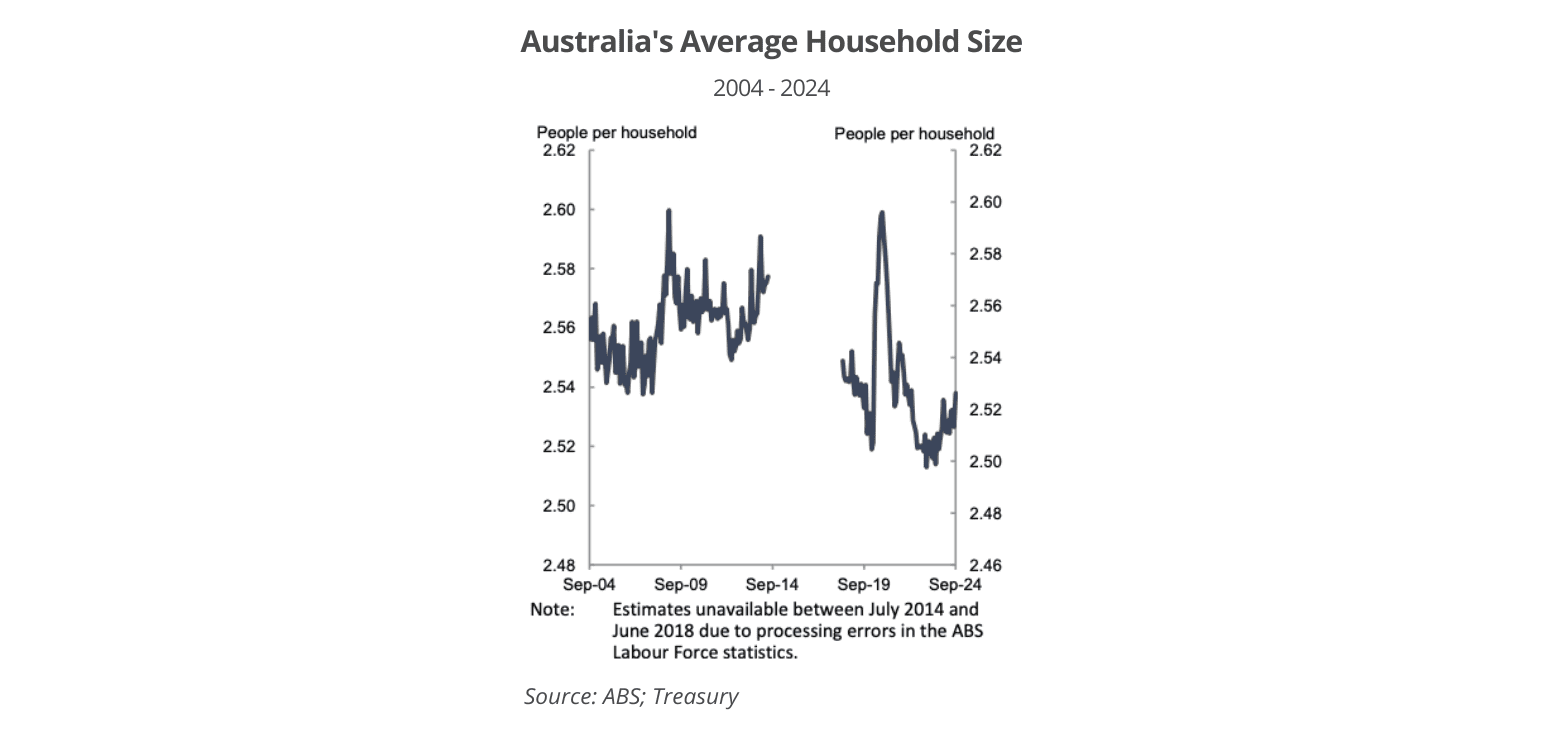

This steady flow of people, combined with smaller household sizes (2.54 people per household, still sitting near record lows, as shown in the chart below), keeps underlying demand healthy. More people and fewer people per home mean one thing: we need more dwellings than ever before.

Add to that $1 trillion in infrastructure investment currently in the pipeline: roads, hospitals, utility facilities, etc. They are generating thousands of jobs nationwide, especially in the regions.

It’s clear that population and employment fundamentals remain strong. Even with slower GDP growth, the demand side of Australia’s housing market equation isn’t showing signs of fatigue.

Pillar 2: Supply, The Tightrope of Listings and Construction

If demand is the engine, supply shortage is the fuel.

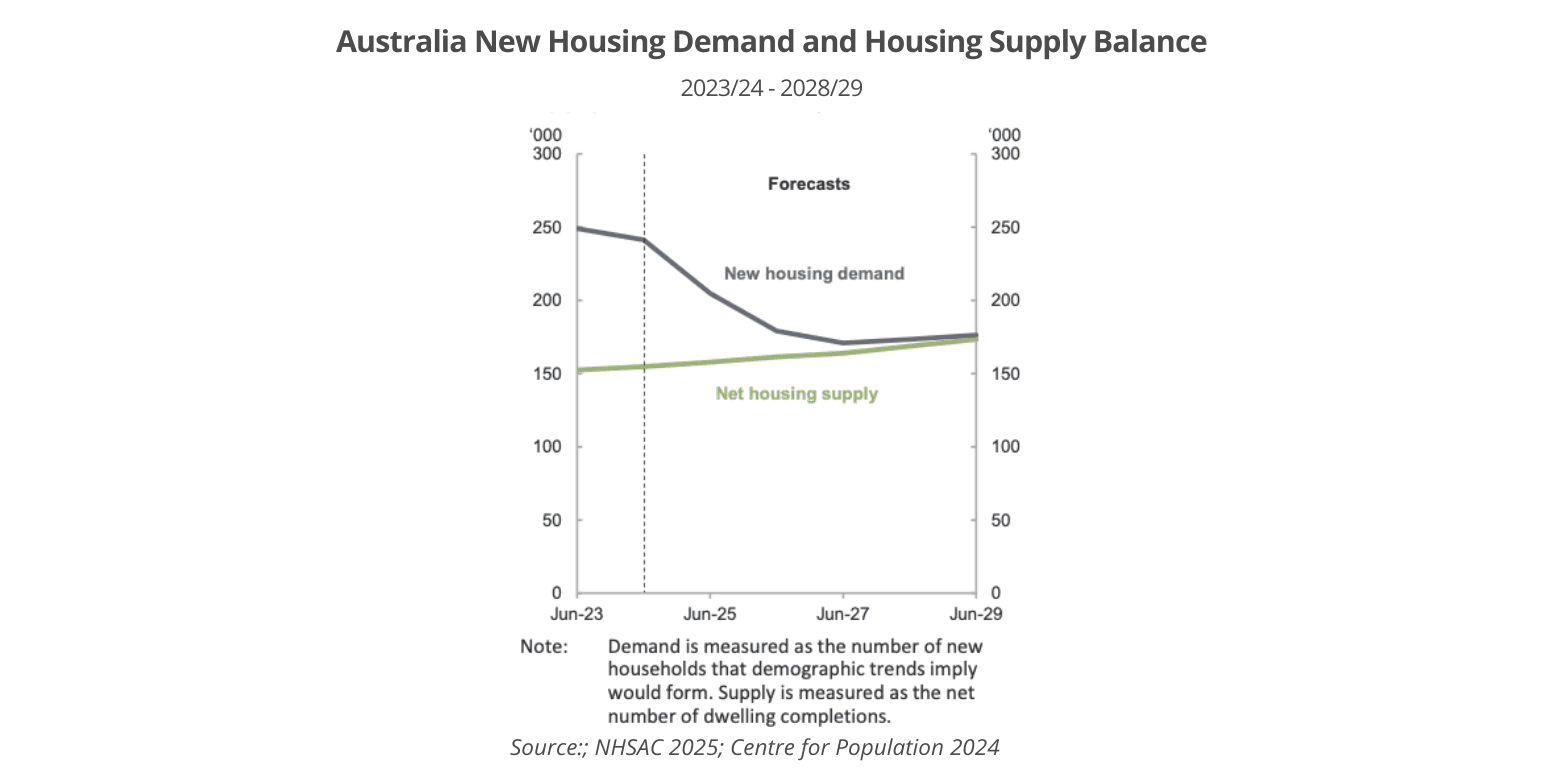

The total number of homes listed for sale nationally remains almost 30% below pre-COVID levels. Builders are still battling material costs and labour shortages, and according to the State of the Housing System 2025 report, new supply is not expected to catch up with new demand before 2029.

On the rental side, vacancy rates hover around 1.3%, well below the level needed for a balanced market (2-3%). This persistent shortage means tenants are competing fiercely for limited stock, which is keeping rental growth and yields healthy for investors.

It’s what economists call a structural shortage: not a short-term supply hiccup, but a long-term gap between the number of homes we need and the number being built. Until construction meaningfully accelerates, this imbalance will continue to act as a tailwind for prices.

Pillar 3: Confidence, The Invisible Catalyst

Finally, let’s talk about the X-factor: confidence.

Sometimes, even when the fundamentals of demand and supply set the tone, sentiment can still move the market in the short term. After all, property purchase is a major decision that can be heavily influenced by emotion and expectations.

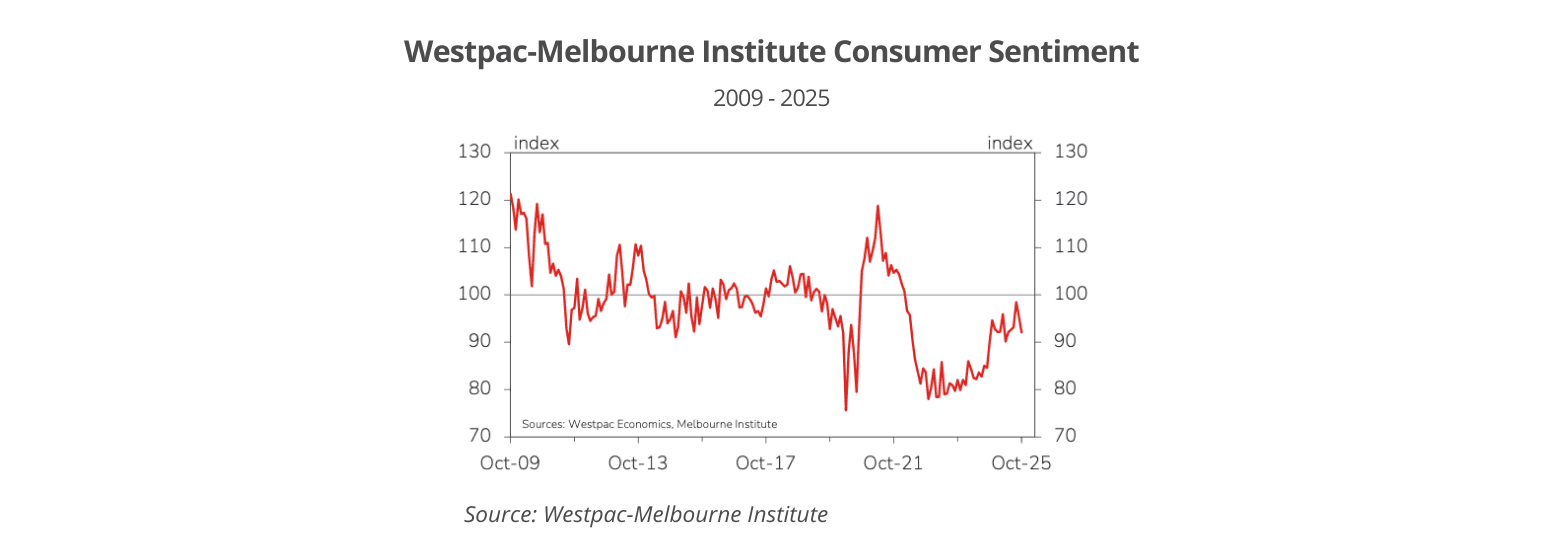

In FY2025/26, confidence is rebuilding. As the RBA has started cutting rates, consumer sentiment has improved. Both the Westpac–Melbourne Institute Consumer Sentiment Index and its ‘time to buy a dwelling’ index have largely been trending upward over the past year, up by 2.6% and 13.4% year-on-year, respectively.

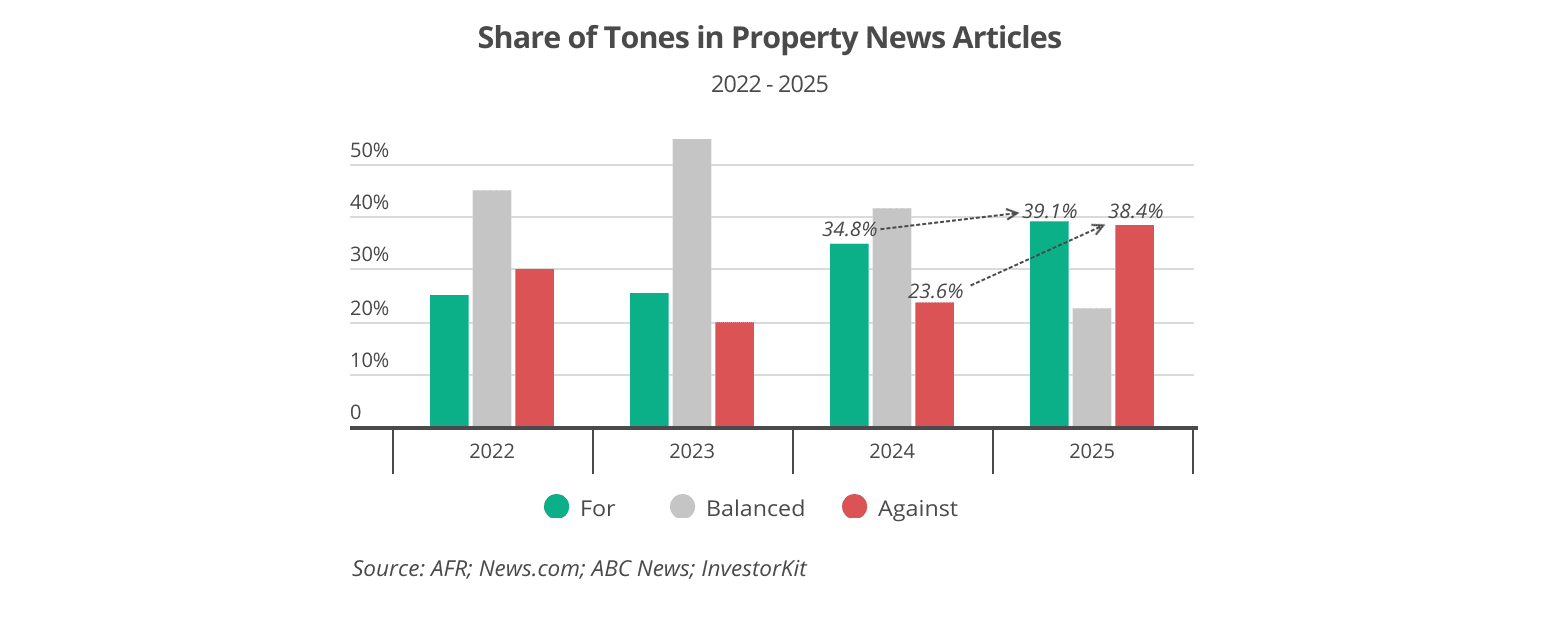

Media tone has also shifted. Over the past three years, the number of news articles expressing a positive outlook on the property market has been rising: 39% this year, up from 35% last year (chart below). However, articles with a negative outlook have also become more common. This reflects growing media attention on Australia’s worsening affordability challenges, persistent supply shortages, and the limited impact of current government policies.

In short, while confidence may fluctuate, the underlying settings are turning from caution to cautious optimism: a signal that the market’s recovery phase still has room to run.

So, What’s the Big Picture?

When we analyse all the housing fundamentals, a clear theme emerges: Australia’s property market remains structurally undersupplied, fundamentally supported, while sentimentally cautious.

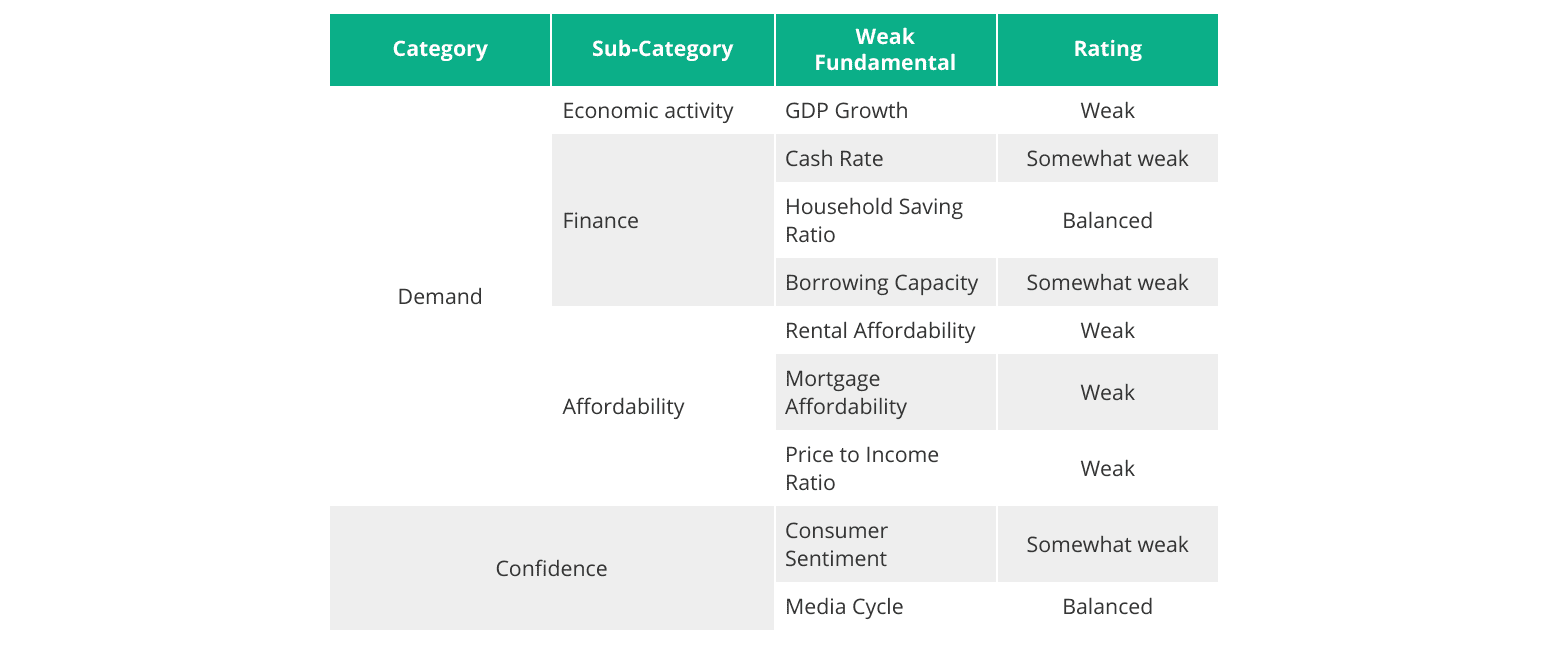

Among the 25 fundamentals, 16 are currently rated strong or very strong, from population growth, job market activity, to rental conditions. If we break the 9 non-strong fundamentals down (table below), it’s not hard to spot that all these fundamentals are more or less linked to high cost of living and high interest rates. As the RBA cash rate continues to decline, many of these fundamentals will respond and move further towards the strong end. However, some fundamentals, especially the affordability-related ones, need more than just rate cuts to come to a strong position.

How Smart Investors Use Fundamentals to Their Advantage

When you strip away the noise, fundamentals are what really drive property performance over time. They tell you why the pressure is building, where opportunities lie, and which markets are positioned to outperform.

That’s why we analyse every capital city and twenty-five of Australia’s largest regional cities across these fundamentals: from migration and employment to listings, vacancy rates, and buyer sentiment.

It’s how we help clients pinpoint the right market, at the right time, for the right reason, not based on hype, but on hard evidence.

Want the Full Picture?

This blog only scratches the surface of what’s covered in our comprehensive whitepaper, Australia’s Housing Fundamentals Analysis FY25/26. Download a copy to explore:

- Detailed analysis of all 25 fundamentals that drive the market.

- Market pressure review for 8 capital cities and 25 regional hubs.

- Which markets are poised to grow in the coming year.

If you want to invest with confidence and understand what’s really shaping Australia’s property market, this is a great place to start.

InvestorKit is a data-driven buyers’ agency that selects purchasing locations through a sophisticated market analysis system, in which fundamentals analysis is essential. This methodology has enabled our clients to achieve above-average growth and accelerate their wealth-building journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by requesting your 15-min FREE no-obligation discovery call!

.svg)