Last week, a major policy shift was announced to better support first-home buyers (FHBs).

The Federal Government has just fast-tracked a notable expansion to its First Home Guarantee scheme, allowing first-home buyers to purchase with just a 5% deposit and no Lenders Mortgage Insurance (LMI) from 1st October, 2025, three months earlier than expected.

It’s a move designed to boost home ownership, but it also brings new competition into the housing markets.

In this blog, let’s unpack:

- The details of the revised scheme;

- How it could impact property demand and prices;

- Which areas are most likely to be affected;

- What smart investors should consider before October 2025 hits.

Let’s break it down.

What’s Changing Under the Scheme

From 1st October 2025, the Federal Government is rolling out a more generous version of its 5% deposit initiative for first-home buyers, three months earlier than initially planned.

This updated First Home Guarantee (Home Guarantee Scheme) allows eligible buyers to:

- Enter the market with just a 5% deposit,

- Avoid Lenders Mortgage Insurance (LMI), potentially saving tens of thousands,

- Access increased property price caps in metro and lifestyle markets.

Key policy changes:

- No income cap: All FHBs are eligible regardless of earnings

- No limit on spots: Unlimited allocations

- Raised property price thresholds, for example,

- Sydney: Up to $1.5M (up from $900K)

- Melbourne & Geelong: $950K (up from $800K)

- Brisbane & Surrounding regional hubs: $1M (up from $700K)

This means a buyer with less than $100,000 in cash can theoretically target a $1.5 million property now. That’s something not seen in a long time.

What It Could Mean for the Property Market

The scheme significantly lowers the barrier to entry, particularly in competitive metropolitan and regional lifestyle belts.

Supply remains constrained in many of these areas; the increase in first-home buyers could significantly intensify competition and, as a result, drive prices up.

A Lateral Economics model, commissioned by the Insurance Council of Australia, estimates that this change is expected to increase annual home sales by 3.8% – 7.1%, and drive up national property prices by 3.5% – 6.6%, with 9.9% in some FHB preferred markets (Insurance Council of Australia).

Which Markets Will Be Hit Hardest?

The impact of this scheme won’t be evenly spread.

It’s most likely to heat up:

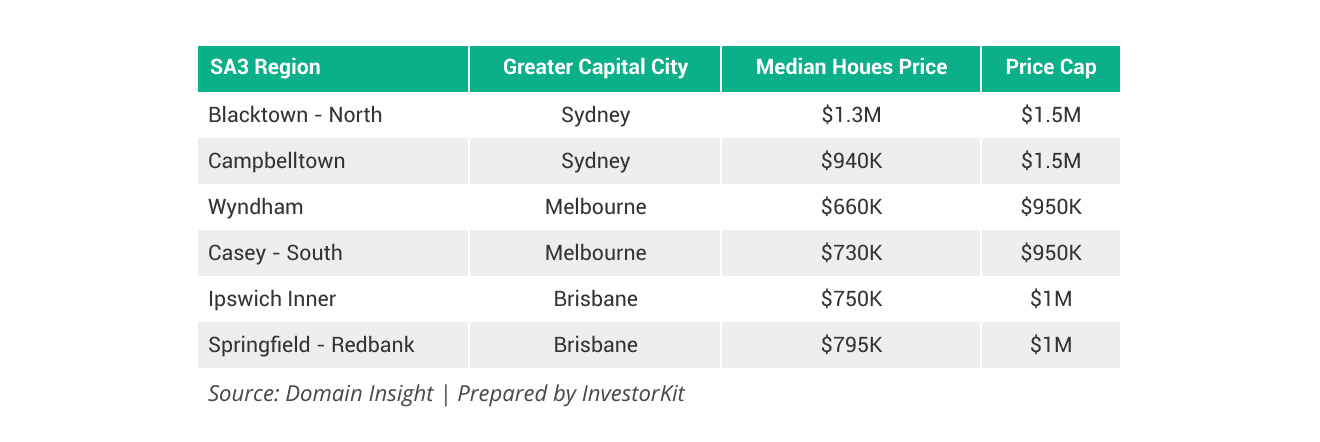

- Outer-ring growth corridors in Sydney, Melbourne, and Brisbane. These areas are relatively affordable, with nd house prices under or close to the new cap, and are popular among first-home buyers. The table below shows some examples of this type of market.

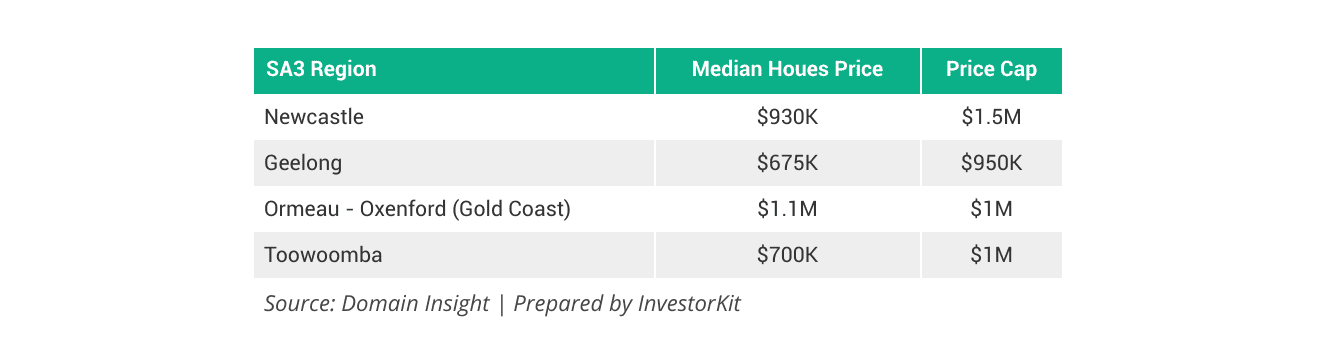

- Lifestyle-driven markets like Geelong, the Gold Coast, and Newcastle. These cities often serve as spillover destinations for first-home buyers priced out of nearby metropolitan hubs but still seeking good connectivity and lifestyle amenities.

On the other hand, affordable regional areas and ultra-premium suburbs may remain largely unaffected, as

- The affordable regional areas have already been well under the price caps even without the change, and first-home buyers are already active.

- Ultra-premium locations’ house prices are well above the price caps, keeping them largely immune from first-home buyer activity.

Investor Takeaways: Strategy Comes Before Speed

For many investors, this policy shift opens a clear window of opportunity.

Buying before October 2025 means you can sidestep the bidding wars likely to come when government-backed first-home buyers enter the ring, especially in high-demand corridors.

You may also be able to lock in capital growth before markets react to the new wave of demand.

But let’s be clear: acting fast is not the goal. Acting strategically is.

Before you jump in, ask yourself:

- Is your next purchase in a market that will be affected by this scheme?

- If yes, is now the time to move with confidence, before the competition heats up?

- If not, would waiting allow you to avoid the noise and stay focused on your longer-term portfolio goals?

Either way, the most important move right now is to revisit your investment strategy.

At InvestorKit, we work with clients to:

- Stress-test their portfolio strategy across policy shifts, market cycles, and personal income goals.

- Identify which markets are genuinely investment-ready, and which are just riding the hype.

- Make fully informed, data-backed decisions without falling into FOMO.

Australia’s 5% deposit scheme may seem like it’s just for first-home buyers, but smart investors know it reshapes the playing field, not just the scoreboard.

Don’t be reactive. Be ready.

Review your strategy. Stay focused. And act when your plan, not the headlines, tells you to.

Ready to revisit your portfolio strategy, or build one with us?

Let’s help you map your next 2–3 or more property purchases with data, clarity, and confidence, before the competition does. Book your free 15-minute Discovery Call today.

.svg)