“I bought an investment property last year; Now, as the interest rate is too high, maybe I should wait for it to come down a bit before buying the next?”

“My landlord is raising my rent again! I’m done renting. I’ll pause investing and buy a home first.”

“I have bought a residential property. Now I want to try a commercial and see where it takes me.”

…

You must have heard people talking about their investment experience like that. Whether sounding confusing or sure, they can’t be the most successful investors because they lack focus. Going with the flow without a clear goal, they’re hard to commit, and therefore, it’ll likely cost them more time and effort to achieve investment success.

In this blog, we will talk about one strategy that helps you focus and achieve investment success faster:

Phasing.

Phasing is clearly defining your goal and breaking your journey into multiple phases with specific milestones. You focus on reaching that milestone in each phase before moving to the next.

Phases don’t have to be all the same. It can be

1. Investment >> 2. Home >> 3. Optimisation of Portfolio, or

1. Residential properties >> 2. Commercial properties >> 3. Consolidation, or simply

1. Acquisition >> 2. Holding >> 3. Consolidation

…

You name it.

However, for most investors, Phase 1 should always be to hit your minimum portfolio target in the shortest possible time.

Why hit the minimum portfolio target first?

Your minimum portfolio target should generate the minimum income you want for your retirement. Hitting that target secures your retirement finance and gives you peace of mind to do everything else.

Don’t we work, save, and invest to ensure a comfortable retirement? Imagine how much peace of mind you’d have when you know you have enough properties to give you the life you want for retirement!

The question is, how do you know how big of a portfolio you’d need? Here’s a simplified example.

Say you want to retire in 30 years (2053), and at that time, you would like a minimum gross annual rental income of $120k in today’s value. Assuming that rents grow at the same rate as inflation (3%), the rental income would be around $291k in 2053. If your properties’ average rental yield is 4.5%, you’d need a $6.5m worth of investment portfolio in 2053.

Given the Australian property market’s average annual growth of around 6%, the $6.5m worth portfolio in 30 years is worth $1.1m today or $1.5m in 5 years (2028). That means you need to have 3x properties valued at $500k each by 2028 to reach your minimum portfolio target for your retirement.

When you settle your 3rd property and tick this minimum portfolio target box, wouldn’t you feel more secure about your future? That’s when you’re more comfortable in making any further moves.

And why buy in the shortest possible time?

Tightening the acquisition window helps you minimise costs and maximise growth. Let’s still look at the example above.

Assuming Jack and Jill each need 3x properties valued at $500k in 2028 to meet their minimum portfolio target. Jack tightens his acquisition window and buys 1x property every 2 years in 2023, 2025 and 2027, whilst Jill takes her time, enjoying life, and buys 1x every 5 years.

Here’s how much they spend on each purchase and how much the properties are worth in the present (2023) value:

Jill hits her minimum target in the end, but the extended acquisition window costs her around $115k in present value more than Jack, thus a lower return rate on investment.

You might think Jill’s loss may be because we use an average growth rate in the calculation. What if Jill times the market and buys in the best-growing region every time? Will she make more profit that way?

The answer is “No”. The below example of Investors A & B shows why.

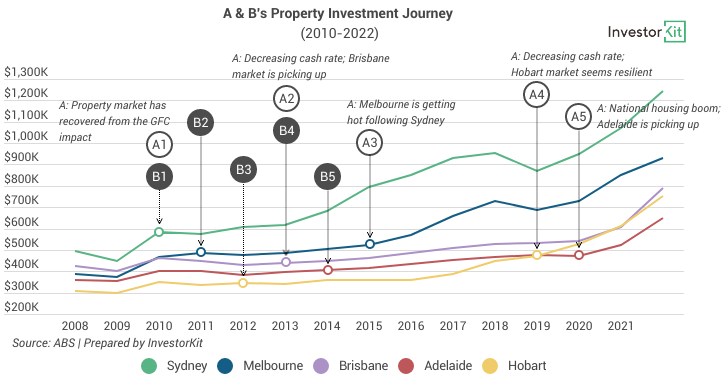

Investors A and B each purchased 5 properties across 5 cities from 2010 to 2020 (see the chart below). A only entered the market when the financial environment was favourable or a market was expected to boom. At the same time, B minimised their acquisition window and purchased in one city each year from 2010 to 2014, regardless of external influencers. In 2020, A’s total return was 72%, while B’s was 93% – Timing the market doesn’t beat time in the market.

*This example is from a previous blog Finding Good Buying Times vs. Tight Acquisition Windows, check it out for more details!

You can always make changes. But stay focused.

We’re not saying you don’t need to worry about anything once you have worked out your minimum portfolio size. We’re in an ever-changing world: your minimum income requirement may change, the economy and property market may change, etc. You may want to revisit your financial goal and update your phase targets from time to time. However, what doesn’t change is your phasing strategy. As long as you are focused on one phase with one target, you can always find a way to work things out, e.g. how to increase my borrowing capacity, how I can save faster, which bank offers me the best rate, which market has the highest pressure, etc. However, if you’re distracted by the changes and lose focus, you’re drifting away from your investment success.

InvestorKit buyers’ agency not only helps you buy properties but also helps you set clear investment goals and work out portfolio building plans/phases. Are you hesitating between buying a home first and starting to invest now? Are you wondering how many properties you need before you can relax? You need a good helper like InvestorKit! Talk to us today by clicking here and requesting your 45-min FREE no-obligation consultation!

.svg)