Toowoomba: The Garden City of Queensland

Toowoomba, a vibrant regional city in Queensland, is situated atop the Great Dividing Range, offering a unique blend of urban convenience and rural charm. Renowned for its iconic Queens Park, Laurel Bank Park, and rich heritage architecture. Toowoomba’s appeal is further enhanced by its healthy economy driven by agriculture, education, and healthcare. The city’s growing café culture, friendly community, increasing population and affordable housing make it an attractive destination for visitors, residents and investors.

Since 2021, Toowoomba’s house prices have grown robustly, increasing by around 66% over the past four years. Over the last 12 months, Toowoomba has continued to achieve a double-digit growth of around 11%. Will this strong growth continue in the coming year? Join us today to explore the city’s current property market conditions and outlook!

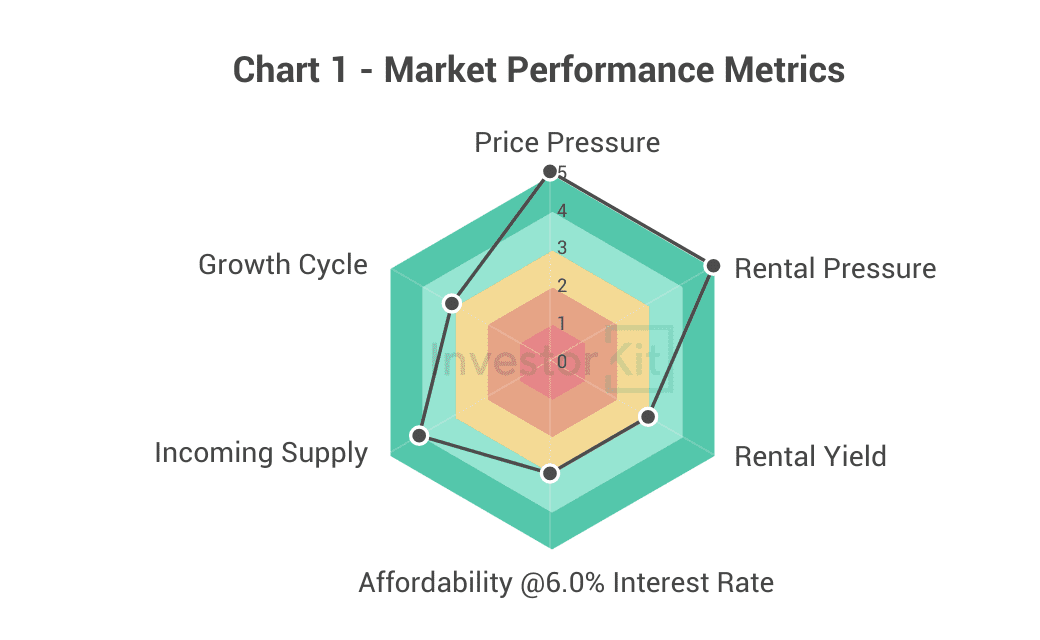

As of May 2025, Toowoomba’s House Market Pressure is high.

Among the six metrics that InvestorKit uses to measure market performance, Toowoomba scores the highest (5) in price and rental pressure, 4 in the growth cycle, incoming supply, and affordability, and 3 in rental yield.

Toowoomba Real Estate – Demographic & Economic Trends

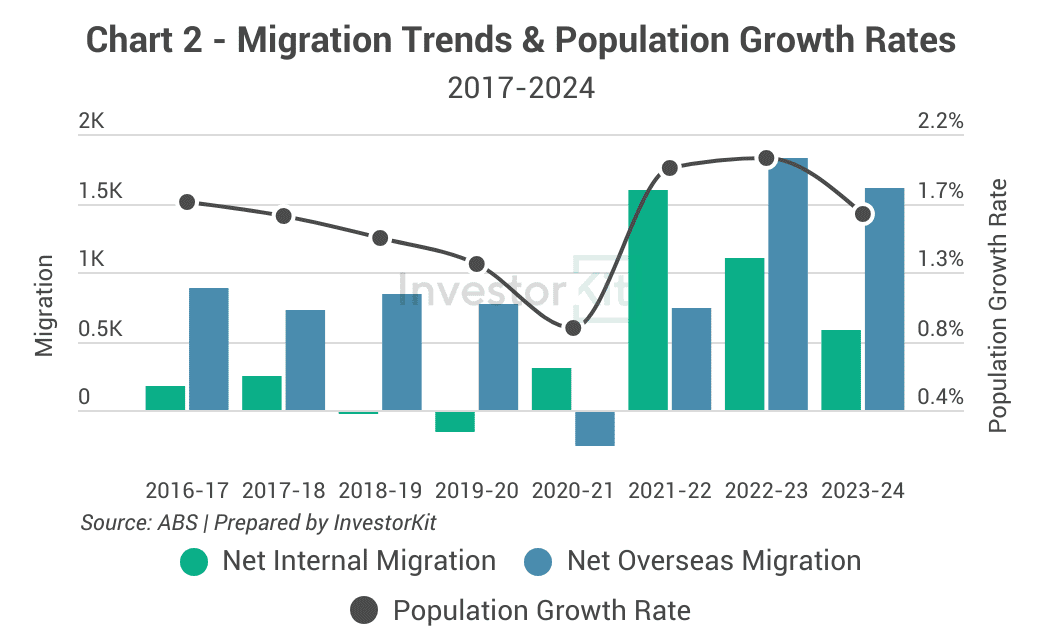

From 2017 to 2021, Toowoomba’s population growth rate dropped gradually, hitting its lowest point of 0.91% in 2021. Between 2020 and 2021, net internal migration surged as more people relocated regionally during the pandemic, while overseas migration plummeted due to travel restrictions.

Since then, the population growth has rebounded, fueled by economic recovery, high internal migration and the return of overseas migrants. In the 2023-24 financial year, Toowoomba’s population growth rate is approximately 1.67%, closely aligning with the national rate of 2.03%.

The healthy population growth rate is expected to drive higher housing demand in the region in the coming years.

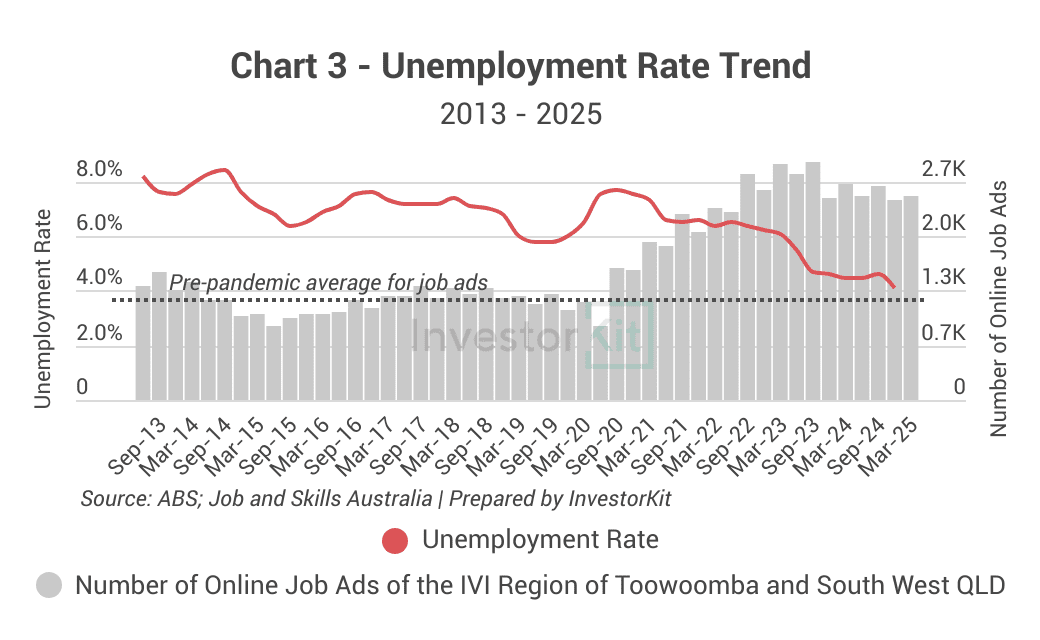

Toowoomba’s unemployment rate has steadily declined from a high of 7.7% in mid-2020 to a low of 4.1% in December 2024.

The number of job vacancies is lower than it was 12 months ago, but it has started to trend upward and remains well above the pre-pandemic average.

Both indicators show that Toowoomba’s job market is more active than ever, and the local economy is thriving.

Toowoomba Property Market – Sales Market Trends

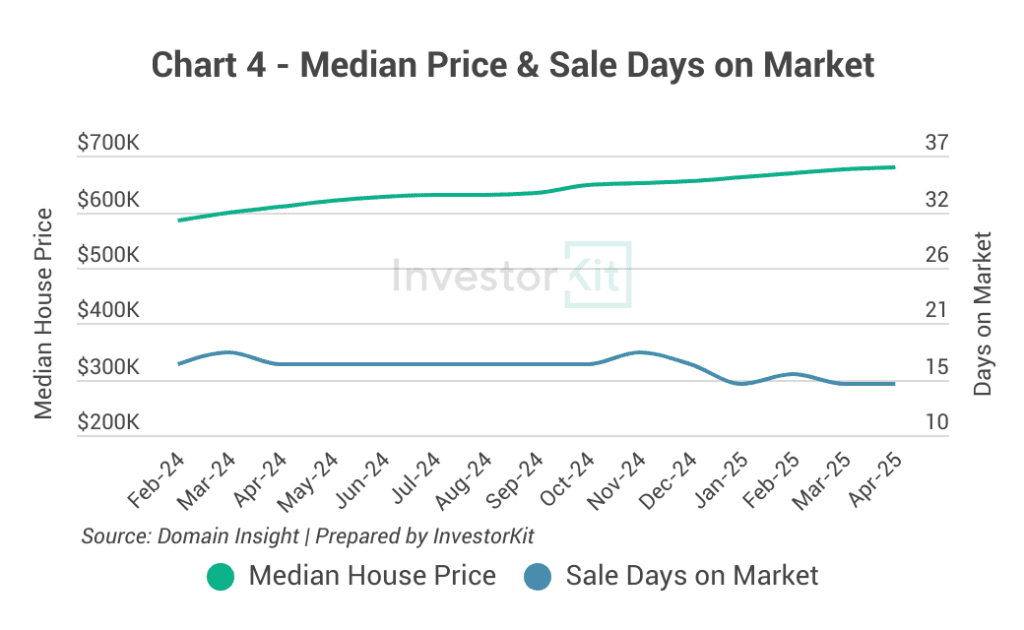

Toowoomba’s house market has grown strongly over the last 15 months. The current median house price is $680k, about 11.5% higher than a year ago.

Since late 2024, the median sale days on market has been trending downward. Currently, it takes just around 15 days for a house to go under contract. This trend suggests high demand, pointing to the potential for healthy price growth ahead.

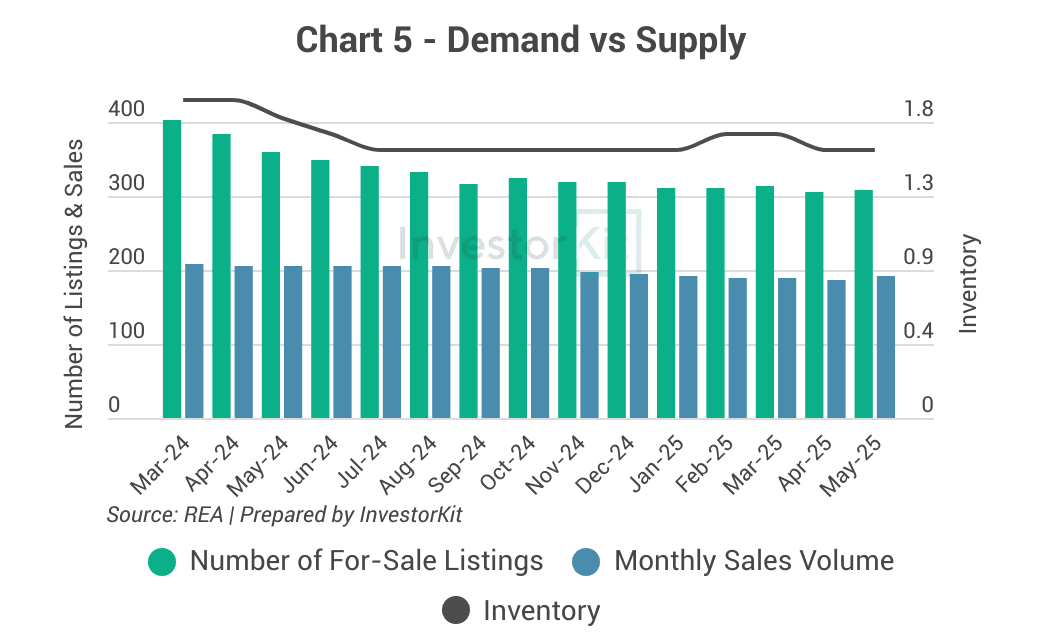

Between early and mid-2024, Toowoomba’s house listings declined while sales volumes remained steady, resulting in a quick drop in inventory to a very low level of 1.6 months. Since then, inventory has remained relatively stable around this level.

The low inventory level implies that market pressure in Toowoomba is high.

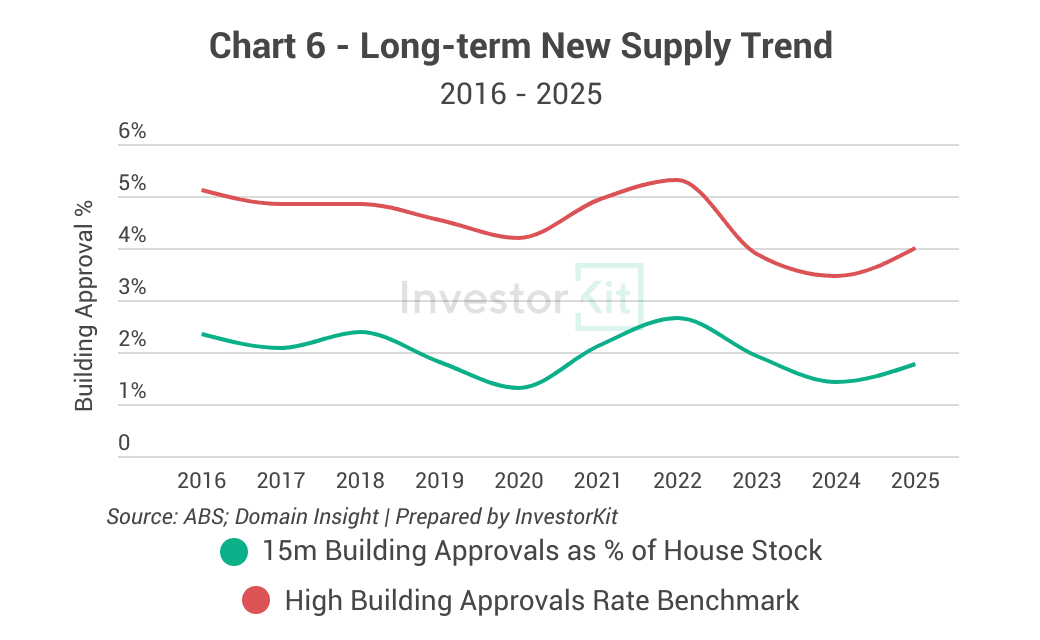

Toowoomba’s building approval rate has been below the balanced benchmark of 3% over the last decade. In 2025, the region experienced a slight increase in house construction activity, but this is not a significant concern, as it remains under 3%. Toowoomba’s low building approval rate indicates a low risk of oversupply in the housing market, which is a good sign for continued value growth.

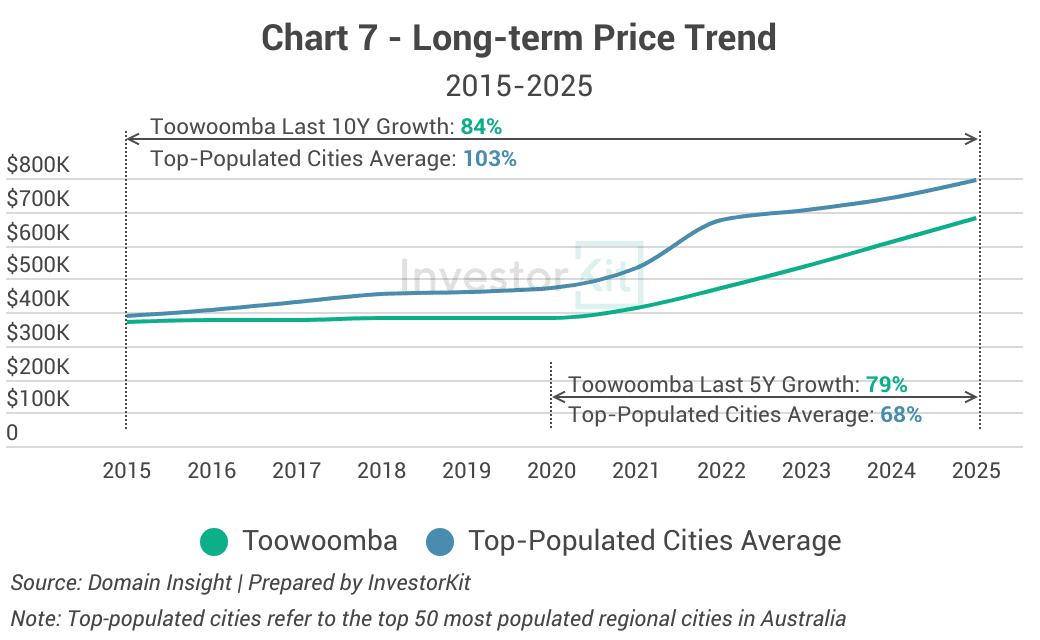

Toowoomba’s house price growth accelerated in 2021. It increased by 84% over the last decade, which is lower than the average of top-populated regional cities and is in line with its long-term average. This moderate 10-year growth implies that Toowoomba is at a healthy cycle position; thus, there is room for further growth.

Toowoomba Property Market – Rental Market Trends

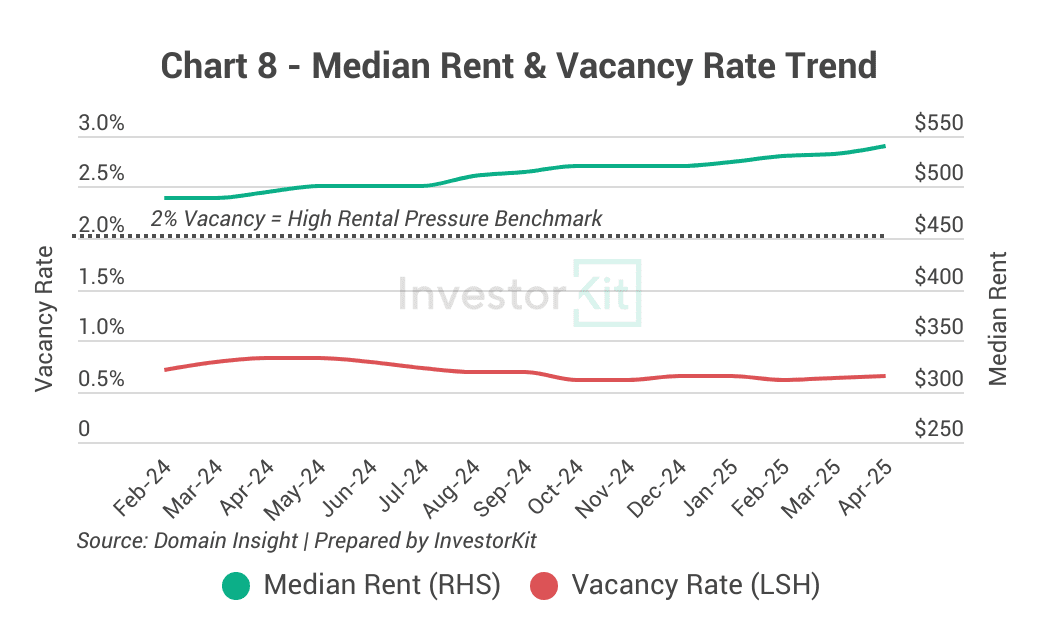

Toowoomba’s rental market is under high pressure. The vacancy rate has been trending downward and is currently at a crisis level of around 0.65%. Rents have risen relatively strongly, up by 9.1% over the last 12 months. Given the high rental market pressure, we expect healthy rental growth to continue in the coming year.

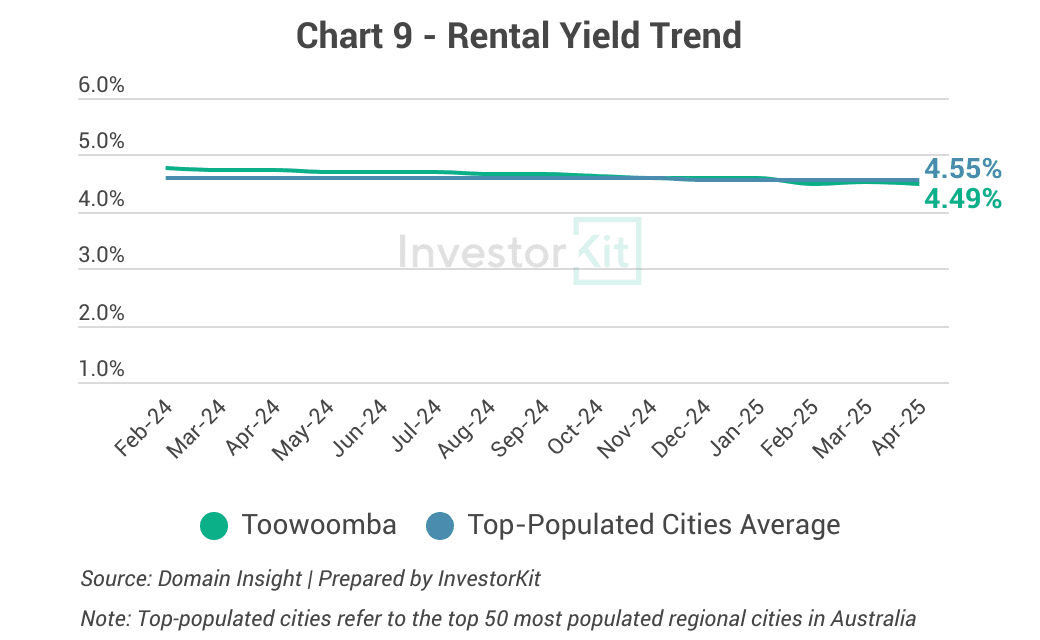

Toowoomba enjoys a healthy rental yield of 4.5%, which aligns with the average of the top-populated cities. Since sales prices have grown faster than rental prices, yields have decreased steadily since 2021. We expect this downward trend to continue, as sales prices will likely continue to outperform.

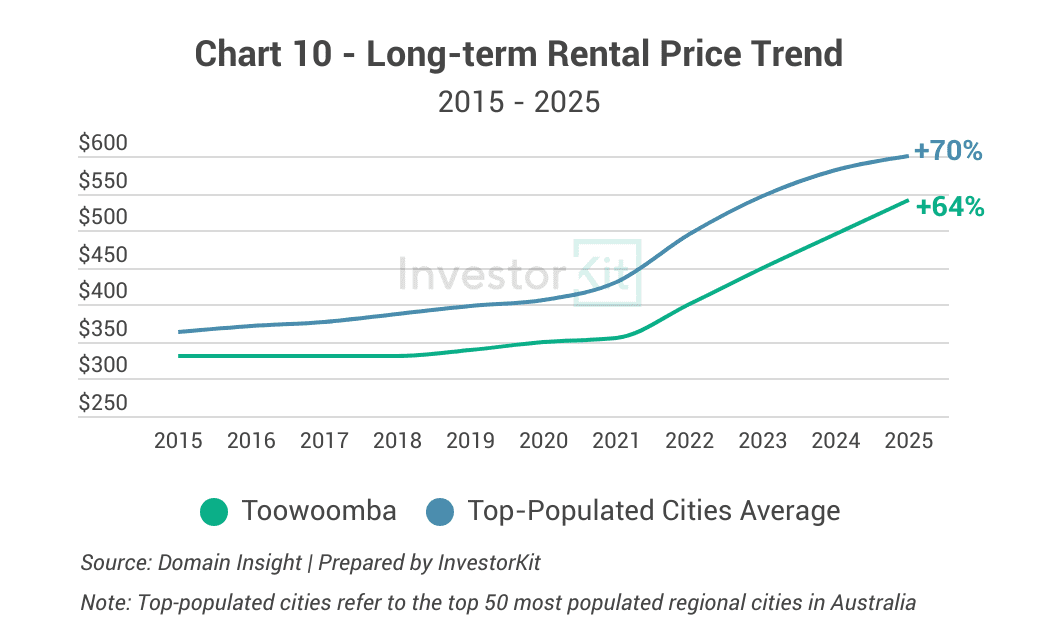

Over the past decade, Toowoomba’s rental prices have increased by 64%, lower than the average growth rate of the top-populated regional cities. We expect rents to rise further, given the increasing housing demand driven by the thriving economy, job opportunities, and high rental market pressure.

In the next 6-12 months…

Toowoomba’s house market is currently under high pressure, evidenced by low inventory and short days on the market. At the same time, the rental market is tight, with vacancy rates remaining extremely low. In the coming 6-12 months, we expect Toowoomba’s house prices to grow healthily, driven by its high market pressure and affordability.

Toowoomba is the 13th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clickinghere and requesting your 15-minute FREE discovery call!

.svg)