Maitland: The Heritage Heart of the Hunter

Located in the Lower Hunter region of New South Wales, Maitland is a thriving regional city that blends rich heritage with modern growth. Once a historic river port, it has transformed into a dynamic hub supported by strong health, education, retail, and construction sectors. Just 30 minutes from Newcastle and around two hours from Sydney, Maitland offers a balance of lifestyle and opportunity. Its strong population growth, attractive rental yields, and ongoing infrastructure investment continue to make it an appealing destination for buyers seeking long-term potential in a well-connected regional market.

Regarding its property market, after a strong period of growth between 2021 and 2022, growth has slowed. Will Maitland’s market pick up pace in the year ahead? Join us today to explore the city’s current property market conditions and outlook!

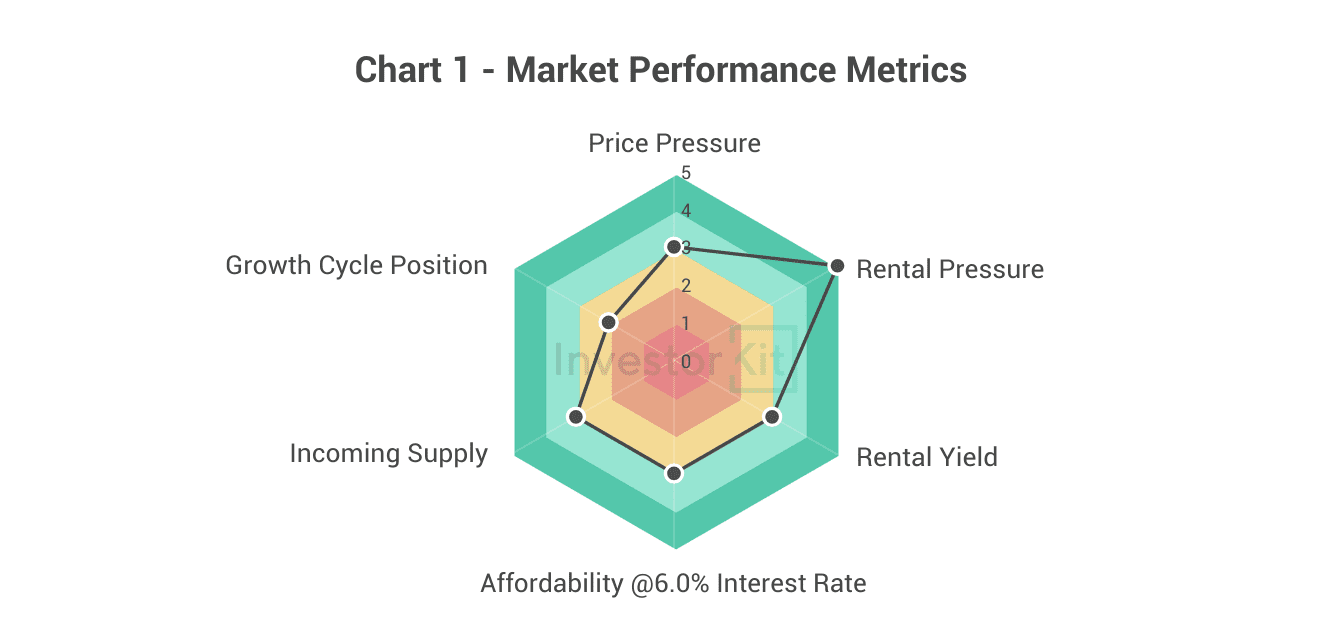

As of November 2025, Maitland’s house market pressure is moderate but improving.

Among the six metrics that InvestorKit uses to measure market performance, Maitland scores 2 (weak) in growth cycle, 3 (average) in price pressure, incoming supply, affordability, and rental yield, but 5 (strong) in rental pressure.

Maitland’s Demographic & Economic Trends

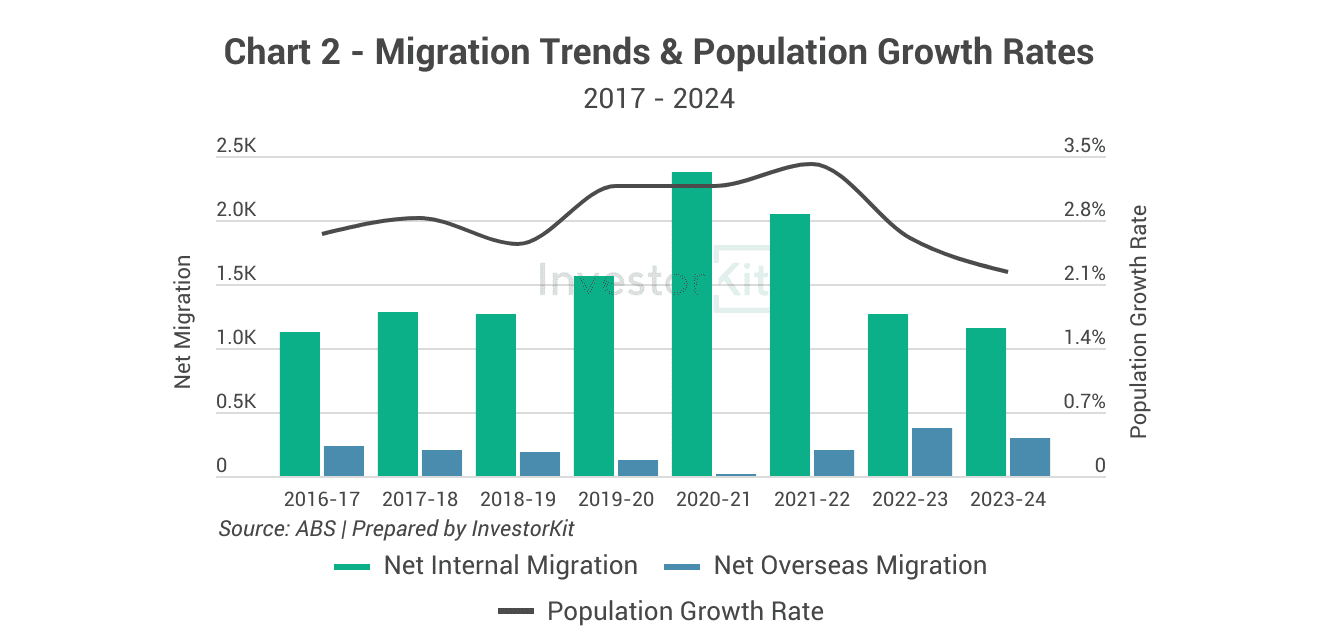

Despite a downward trend since 2022, Maitland’s population growth has been strong over the past eight years, primarily driven by internal migration. Its latest growth rate of around 2.2% sits well above the national average of 1.6%.

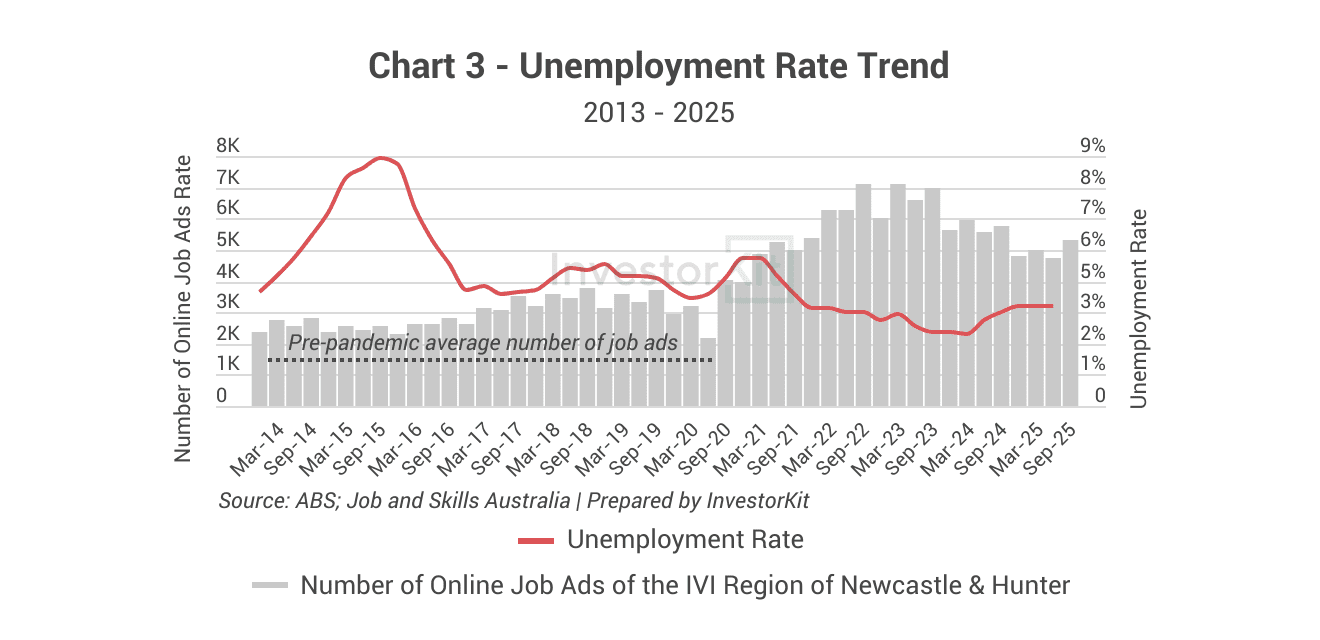

Maitland’s economy is healthy, as reflected in the low unemployment rate of about 3.6%, well below the state average of 4.3% and the pre-COVID levels. Online job advertisements also remain strong, sitting about 1.8 times the pre-pandemic average.

The solid population growth and active economy indicate sustained underlying housing demand and ongoing support for the local property market.

Maitland’s Property Market: Sales Market Trends

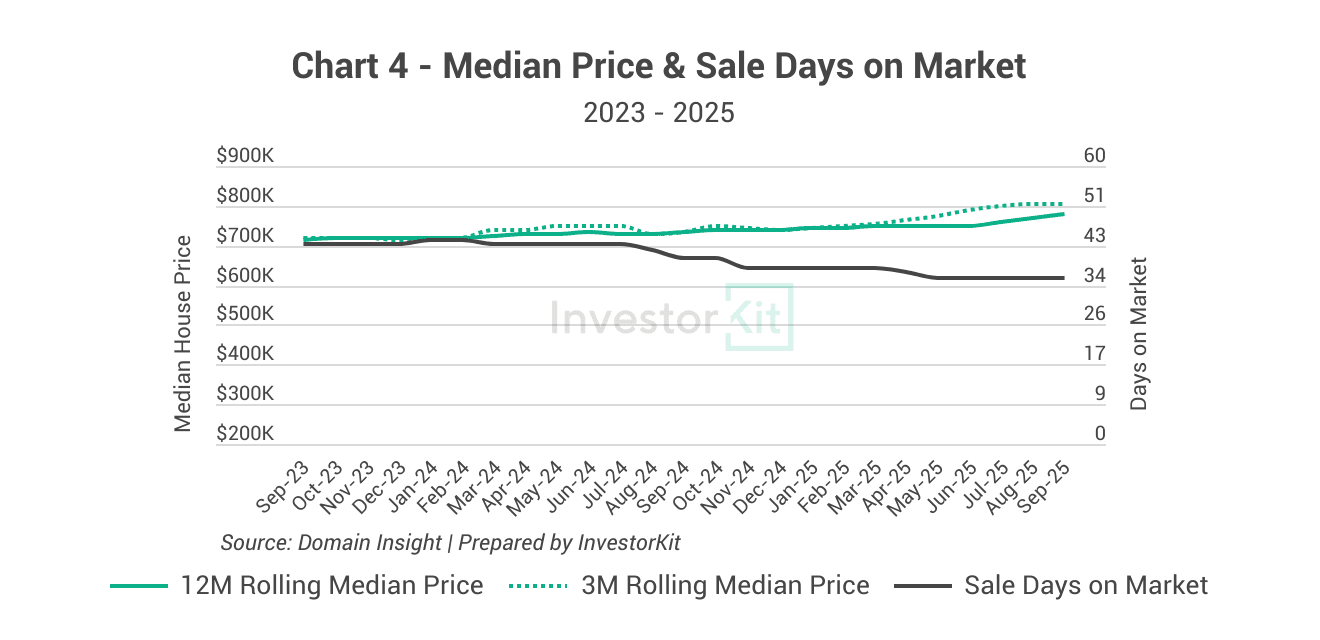

Maitland’s house prices have grown moderately over the past year, rising by around 6.5% to reach a median of $780,000.

Signs of strengthening market pressure are becoming evident. Since early 2025, the 3-month rolling median price has sped up noticeably, while days on market have already been trending down since early 2024.

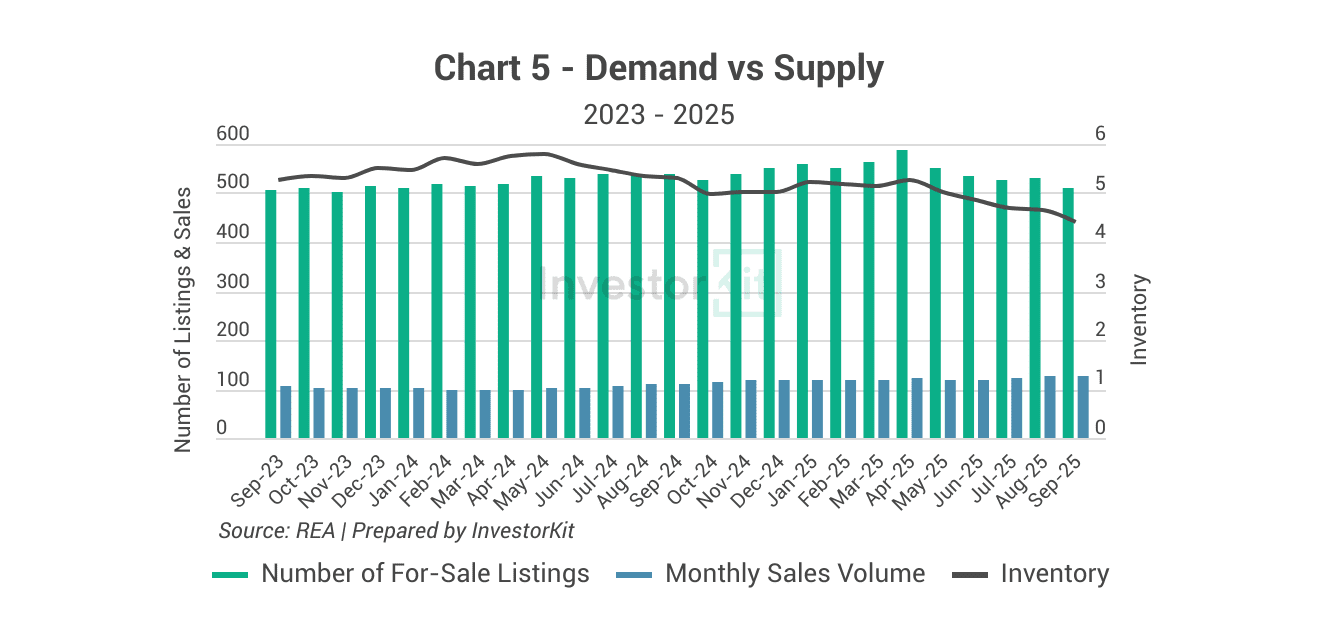

Inventory has also dropped. Since May 2025, falling listings and rising sales have pushed inventory down to a balanced level of around 4.1 months.

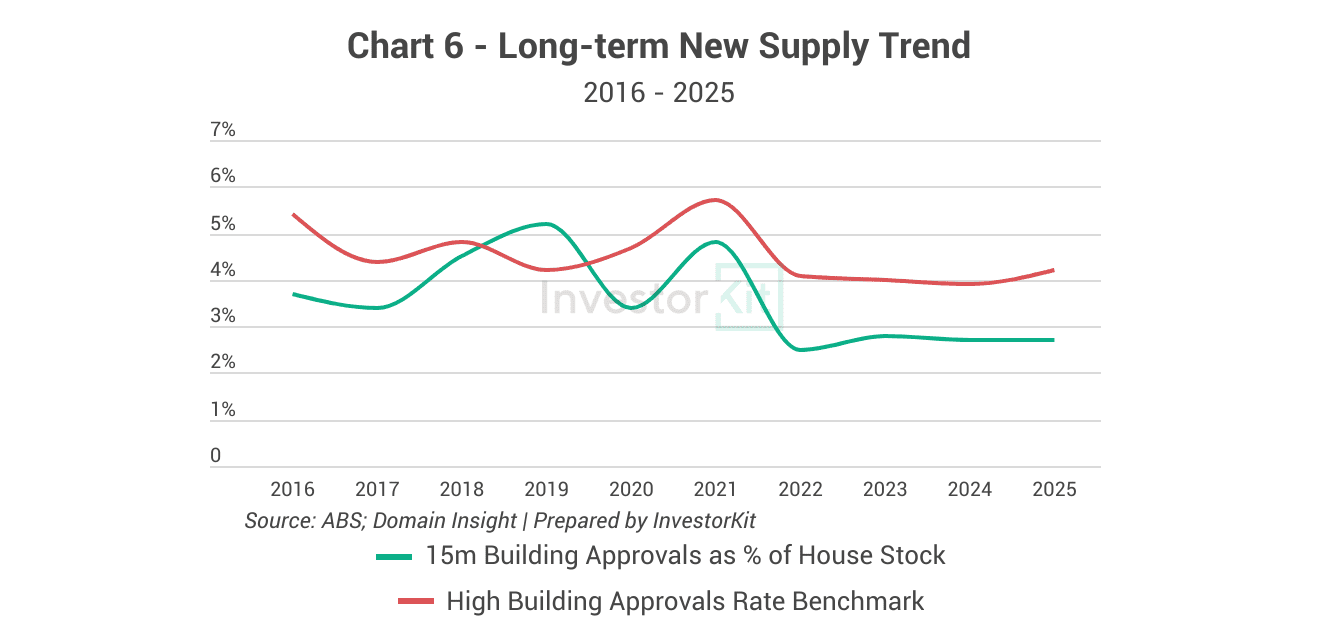

Since 2022, Maitland’s building approval rate has stayed at the balanced benchmark of 2-3%, currently sitting at around 2.7%. This suggests a controlled level of new supply entering the market in the coming year and a low risk of oversupply.

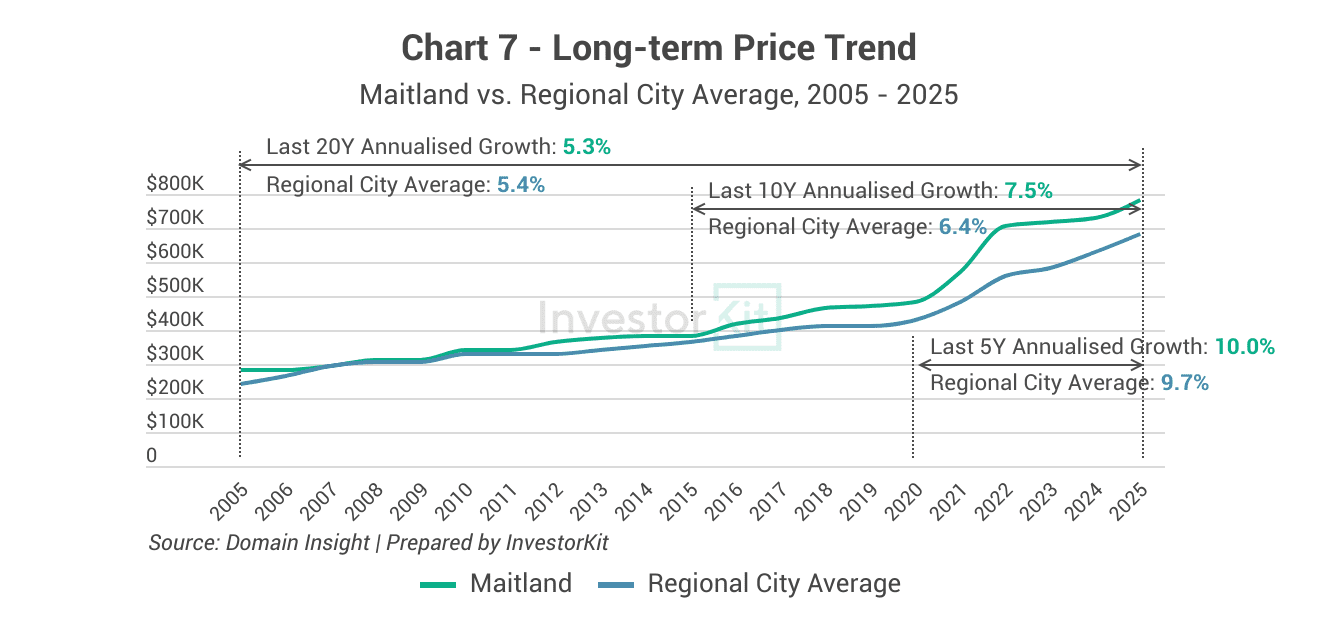

Maitland’s house prices surged between 2021 and 2022 but have since slowed. With its 10-year annualised growth above the national long-term average of 5-7%, the market is likely to experience moderate growth in the medium term.

Maitland’s Property Market: Rental Market Trends

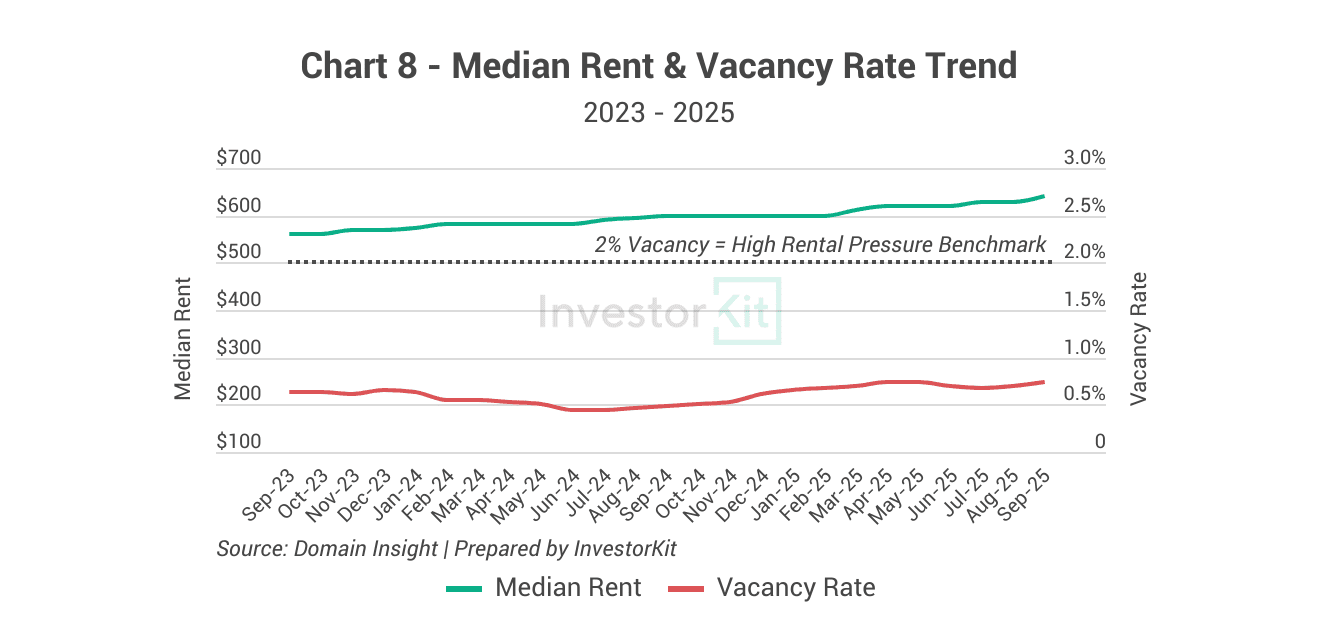

Maitland’s rental market is under high pressure, as evidenced by the extremely low vacancy rates of below 1%. Median rent has grown steadily over the last 12 months, up by around 6.7%.

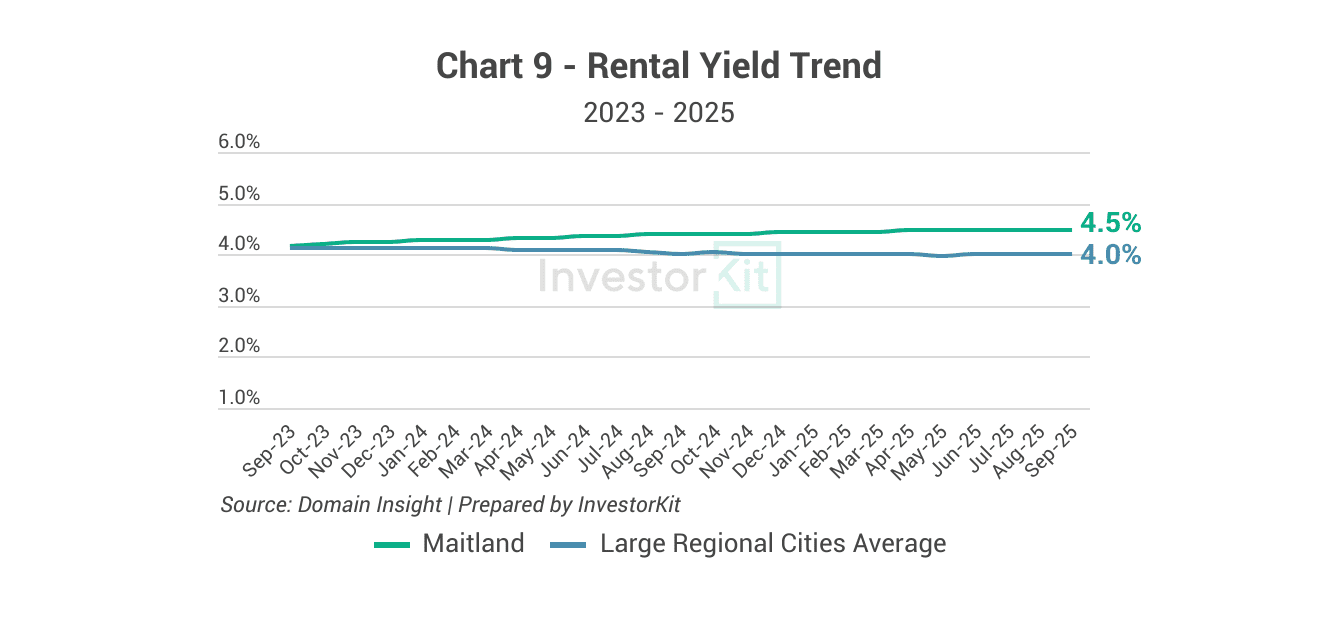

Maitland’s median rental yield has gradually improved over the last 2 years. Its current median yield is at a healthy 4.5%, well above the average yield of top-populated regional cities.

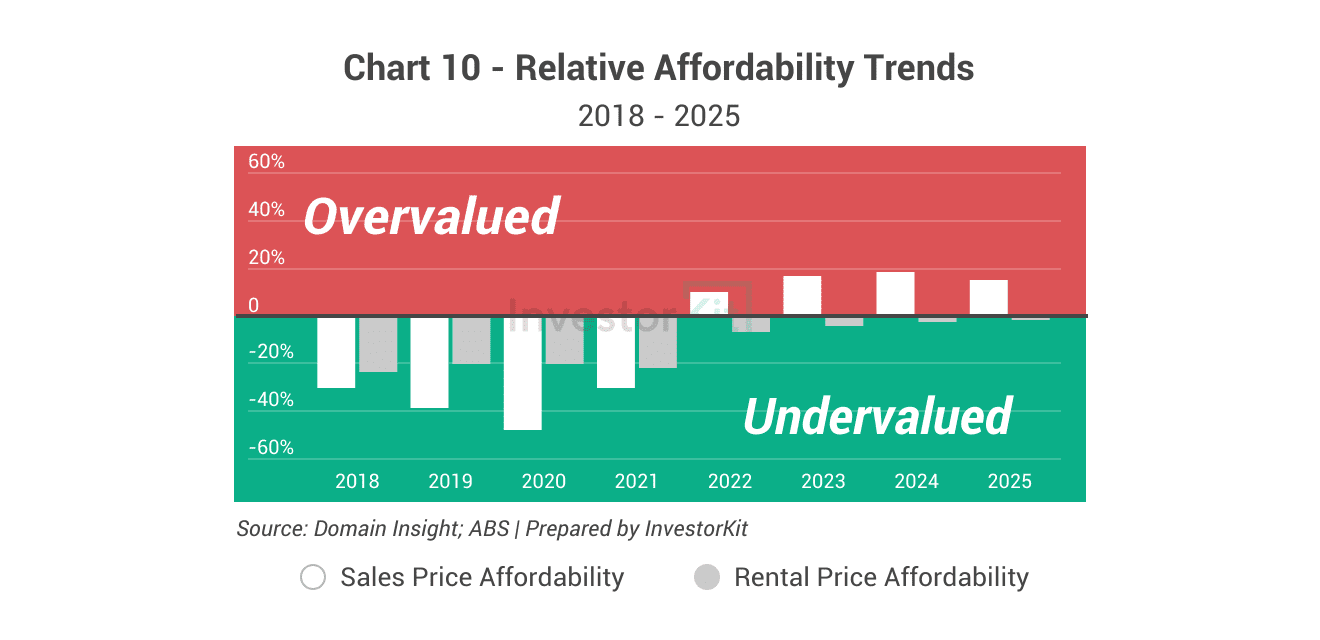

In terms of affordability, houses in Maitland have been unaffordable since 2022, with current house prices about 15% above what local income can support. Meanwhile, rents remain relatively affordable, roughly 1% below local income, though much of the affordability advantage has eroded since 2022.

Over the next 6 to 12 months,

Maitland’s house prices are expected to accelerate as market pressure strengthens, reflected in the consistently declining inventory and shorter days on market. Rental pressure is likely to stay high amid persistently low vacancy rates, supporting further rental growth and maintaining healthy rental yields.

Maitland is the 19th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that selects purchase locations using a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve above-average growth and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-minute FREE discovery call!

.svg)