Gold Coast: The golden city attracting both tourists and migrants

With endless stunning beaches and easy access to lush rainforests, theme parks, world-class food and drinks, and 300 days of sunshine every year, the Gold Coast is one of the top destinations for visitors from Australia and worldwide. It is also one of the most popular destinations in Australia for interstate and overseas migrants. In the FY2022-23, Gold Coast’s net overseas migration ranked #4 across all Australian LGAs, and according to the Regional Movers Index Q4 2023 Report (by CBA – Regional Australia Institute), Gold Coast ranked #2 in all regional cities in terms of net internal migration by the end of 2023. In the meantime, Gold Coast’s house market has been growing steadily on both the sales and rental sides over the past year despite the intensifying affordability issues.

Where is Gold Coast going in the rest of 2024? Join us today to explore the city’s current property market conditions and outlook!

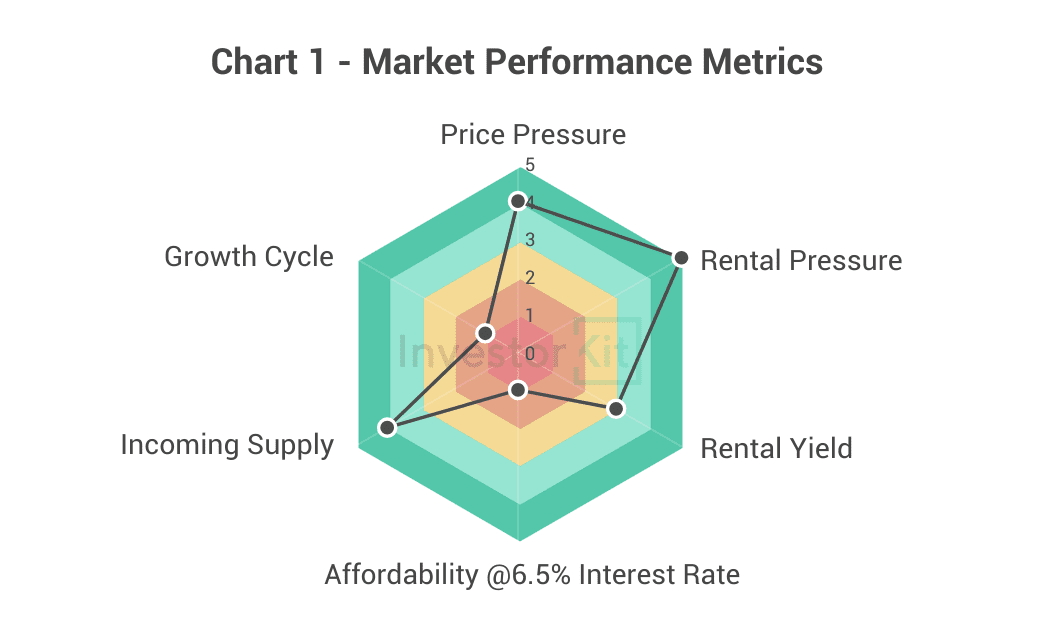

As of April 2024, Gold Coast’s House Market Pressure is still High.

Among the six metrics InvestorKit uses to measure market performance, Gold Coast stands out in market pressure in both the sales and rental markets and incoming supply. It performs moderately in rental yield level while scoring low in affordability and growth cycle.

Demographic & Economic Trends

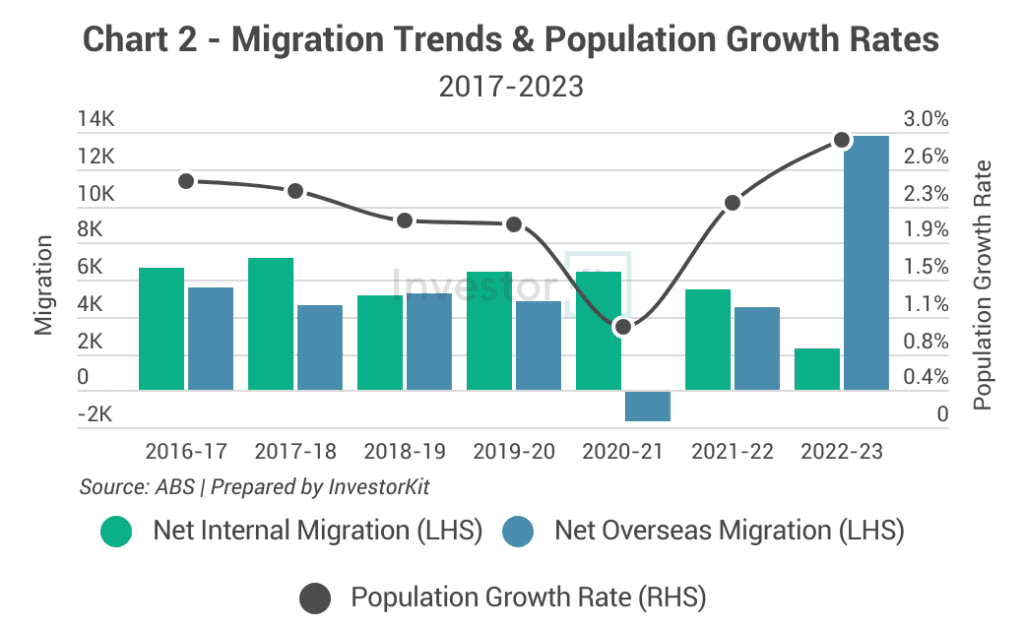

Gold Coast’s population has been surging in recent years, boosted by both internal and overseas migration.

- While the number of internal migrants has been declining as the city loses its appeal in affordability, Gold Coast is still the second-largest internal migrant receiver across all regional cities according to the latest Regional Movers Index Report by CBA and the Regional Australia Institute (The largest? Its neighbour – Sunshine Coast!).

- In the meantime, Gold Coast is becoming one of the most attractive destinations for overseas migrants: In FY22-23, Gold Coast became the 4th largest overseas migrant receiver among all LGAs, after Brisbane, Melbourne, and Sydney.

The accelerating population growth and migration surge will likely fuel the Gold Coast’s housing demand further in the coming years.

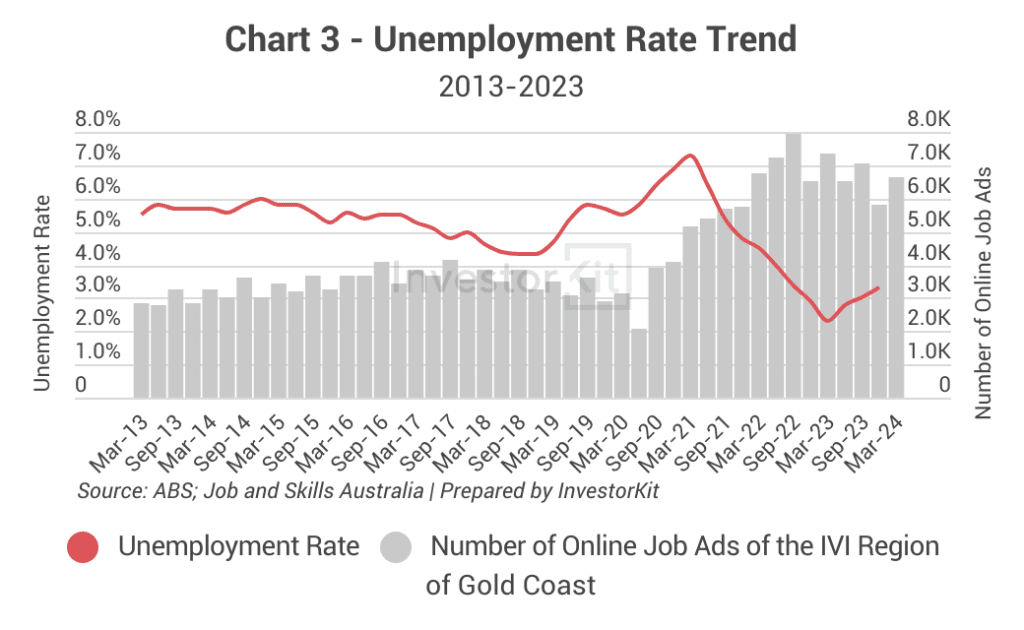

While the unemployment rate in the Gold Coast is rising as the RBA cash rate remains high, it is still at an extremely low level of under 4%, the lowest range in over a decade.

At the same time, the number of job vacancies has gradually declined since the cash rate started rising. However, it is still approximately 50% higher than the past 10-year average.

Both indicators show that Gold Coast’s job market is much more active than ever, and that the local economy is thriving.

Sales Market Trends

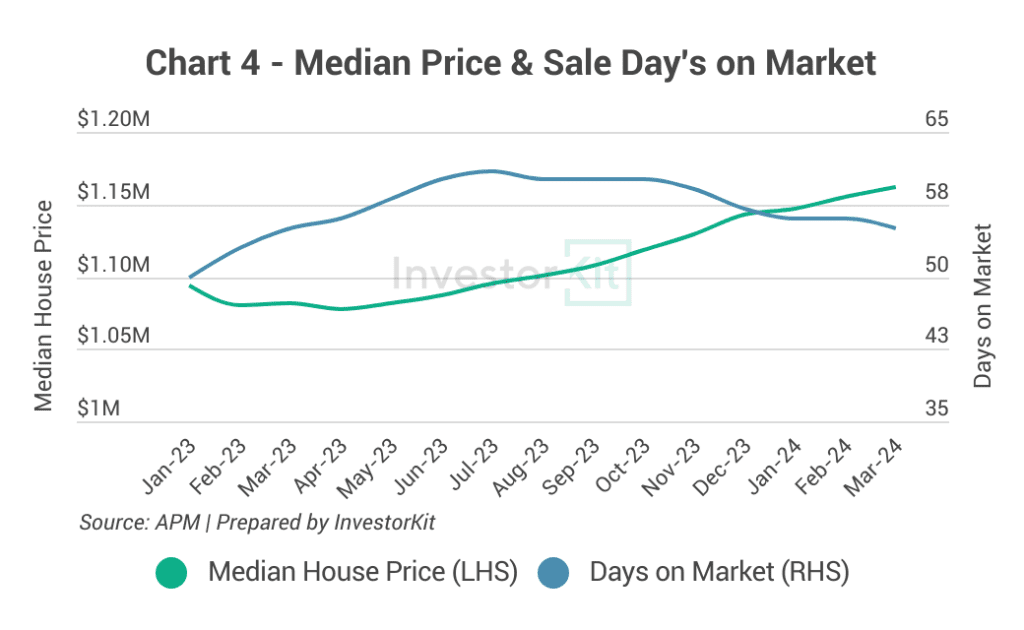

Thanks to robust population growth and the active local economy, Gold Coast’s house market is now riding a second wind. The median house price has been rising steadily over the past year after a brief decline (from the end of 2022 to early 2023). It was $1.16m at the end of March 2024, 7.4% higher than a year ago.

Rising prices are accompanied by a decline in sale days on the market since mid-2023. Currently, houses take an average of 55 days to sell, and this number is likely to become even lower in the coming months. Why? Let’s find out in the supply-demand relationship below.

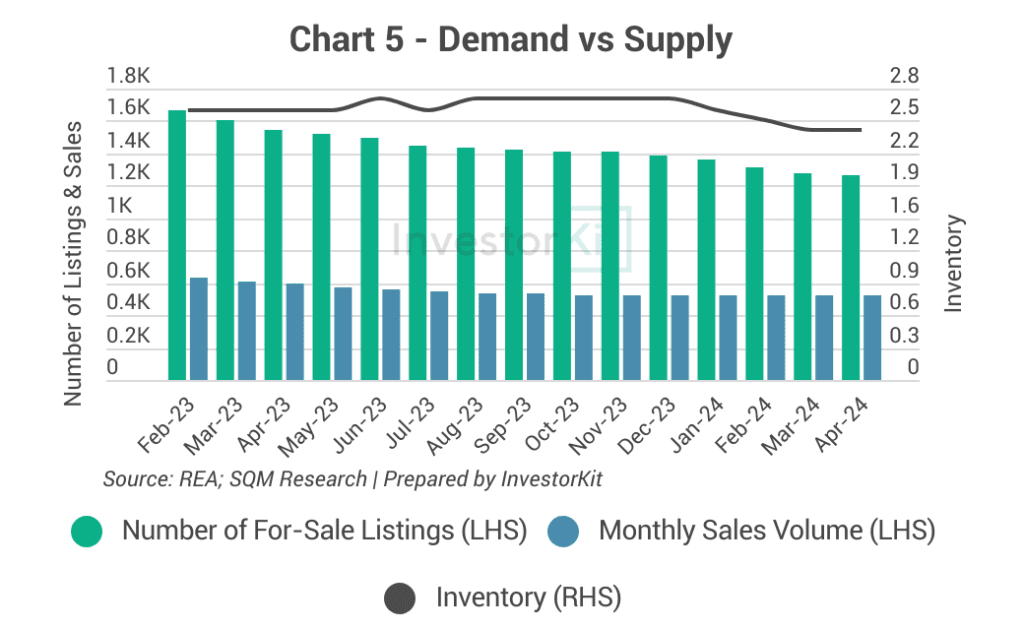

The number of for-sale house listings in Gold Coast has been trending downward in recent months, while sales have stabilised. As a result, the inventory level has been declining since the end of 2023, currently sitting at a very low level of 2.4 months of stock.

With such a low inventory that could potentially go even lower, Gold Coast’s house market will likely remain hot, and prices are expected to continue growing healthily in the months to come.

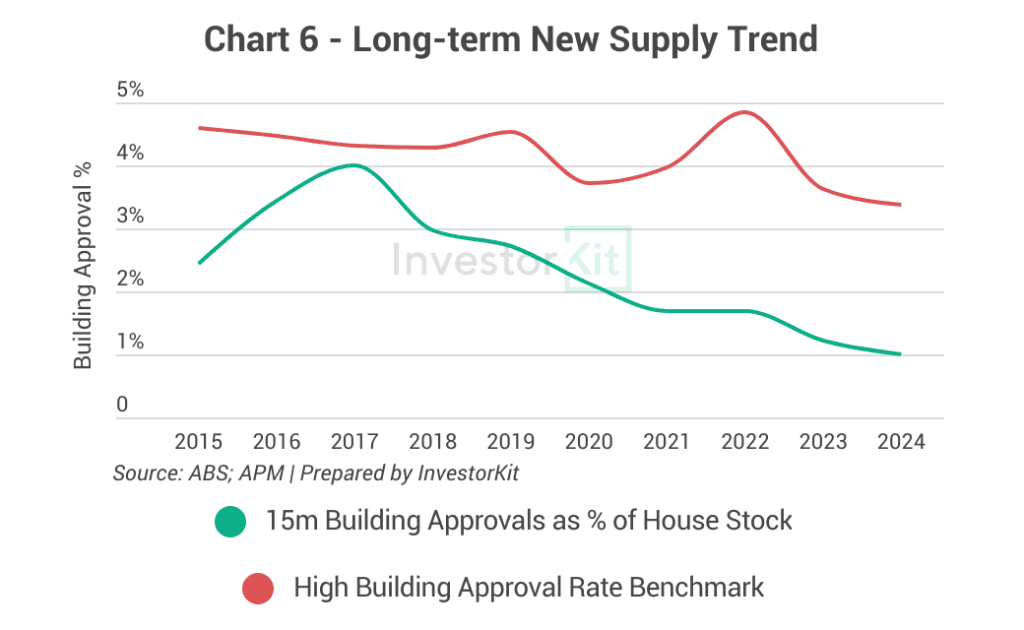

While the city’s established supply (for-sale listings) is dropping, incoming supply is decreasing, too. The number of new-house building approvals has been going down since 2018. There wasn’t even a home-builder-grant spike in 2022 (as shown in the high building approval rate benchmark curve). This means that Gold Coast will be safe from oversupply risk in the coming few years.

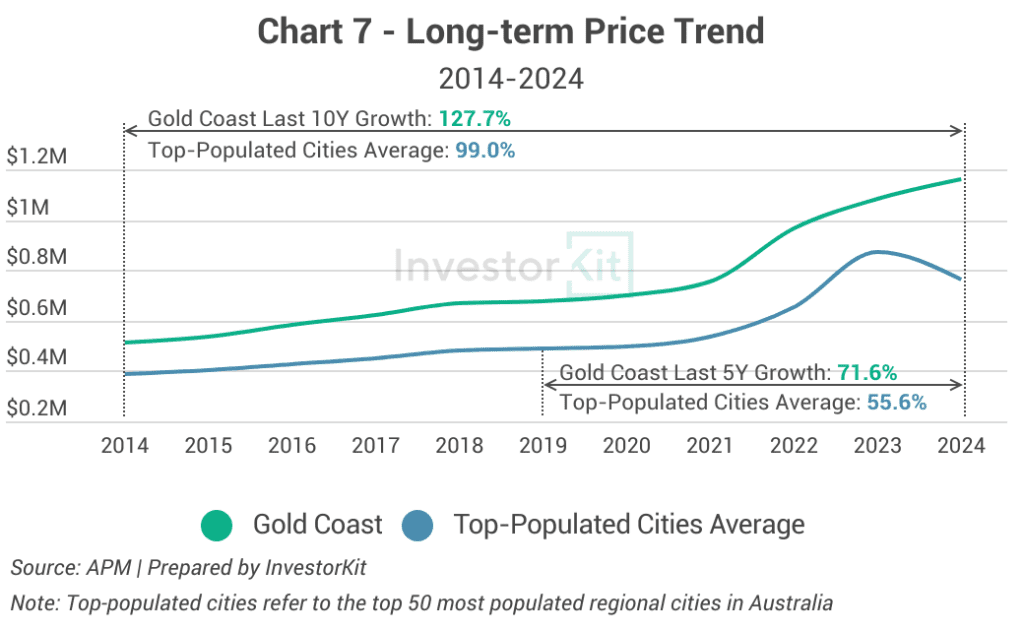

Gold Coast’s house prices increased by 127.7% in the past 10 years and by 71.6% in the past 5 years, higher than its long-term average as well as the average of the biggest regional cities. This, combined with its worsening affordability, will likely limit Gold Coast’s price growth in the medium term.

Rental Market Trends

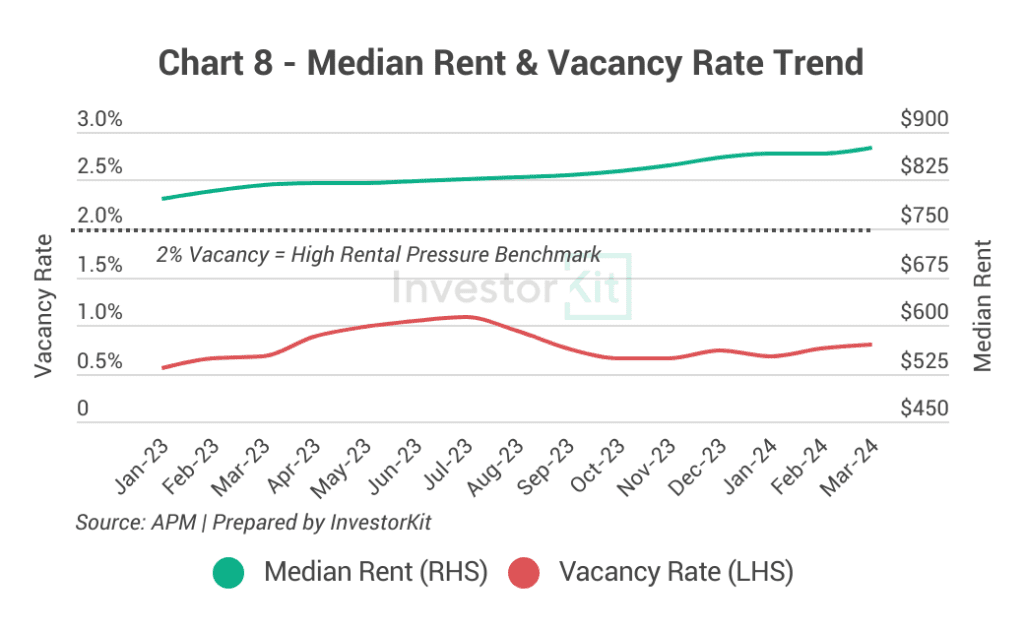

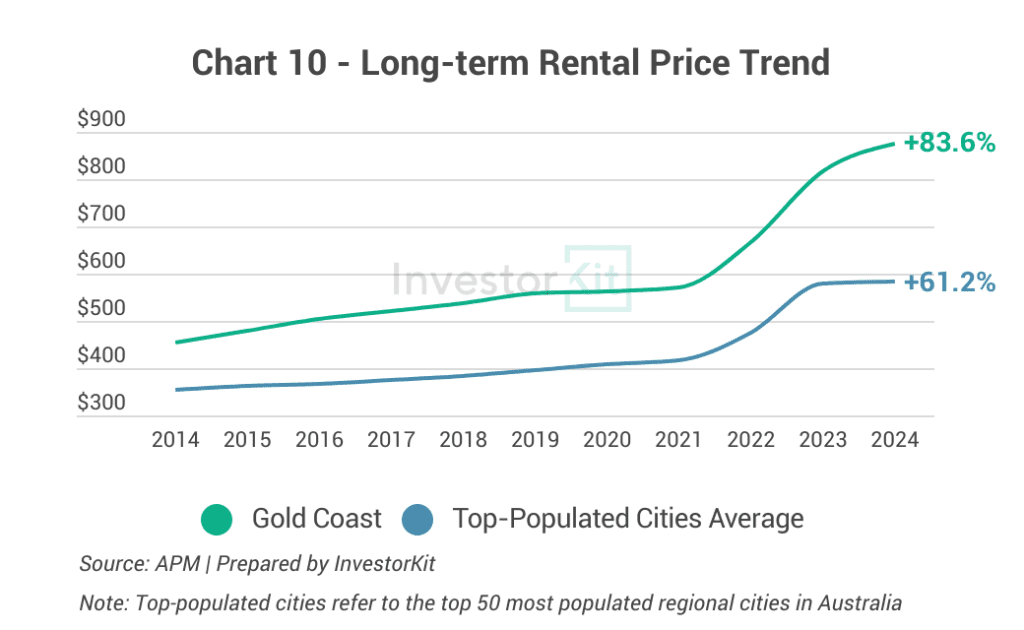

Due to Gold Coast’s active job market and high incoming migrant numbers, the rental market is under high pressure, with a vacancy rate of under 1.0%, leading to steady growth in rental prices, up by 7.5% in a year. Further rental increases are expected due to the high pressure, but they’re most likely to remain moderate as rental prices are approaching the affordability ceiling as well.

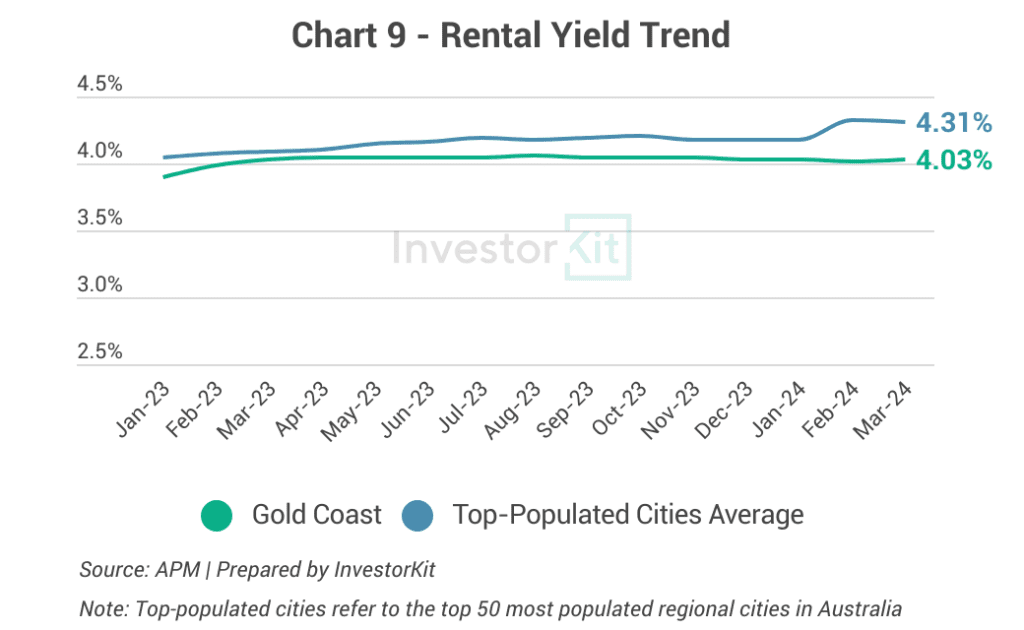

At 4.0%, Gold Coast’s rental yield is, surprisingly, not extremely low: It is the same yield level as Greater Adelaide, where house prices are 38% lower; Melbourne, with a median house price 27% lower than the Gold Coast’s, only sees a 3.4% rental yield.

The not-too-low rental yield level shows how high Gold Coast’s rental prices are. That’s one of the reasons why high housing prices are not driving too much demand toward the rental market.

Over the past decade, Gold Coast’s rental prices have grown by 83.6%, higher than the average growth rate of the top-populated regional cities. We expect the gap to get smaller as Gold Coast’s growth slows and other cities catch up fueled by the nationwide rental crisis.

In the next 6-12 months…

Gold Coast’s property market is currently under high pressure, both in the sales and the rental markets. Price growth is, on the one hand, fuelled by limited supply and robust population growth and, on the other hand, constrained by affordability. Therefore, we expect the healthy growth to continue in the next 6-12 months in response to the high market pressure, but in the medium term (2-5 years), be prepared to see corrections in both markets: either a slow-down or a decline, similar to what happened in Sydney’s housing market.

Gold Coast is the second regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE discovery call!

.svg)