Coffs Harbour Property Market: From Holiday Town to Property Market Star

Nestled on the Mid North Coast of New South Wales, Coffs Harbour is a vibrant coastal city best known for its pristine beaches, lush hinterland, and the iconic Big Banana. Positioned midway between Sydney and Brisbane, it combines natural beauty with growing economic appeal.

During the 2020-2022 property boom, Coffs Harbour experienced a sharp upswing in house prices, fuelled by lifestyle migration and infrastructure upgrades. Since 2022, growth has cooled, but the city has evolved into a magnet for families, retirees, and remote workers.

Join us today to find out how the current market conditions are and when we can expect a material recovery!

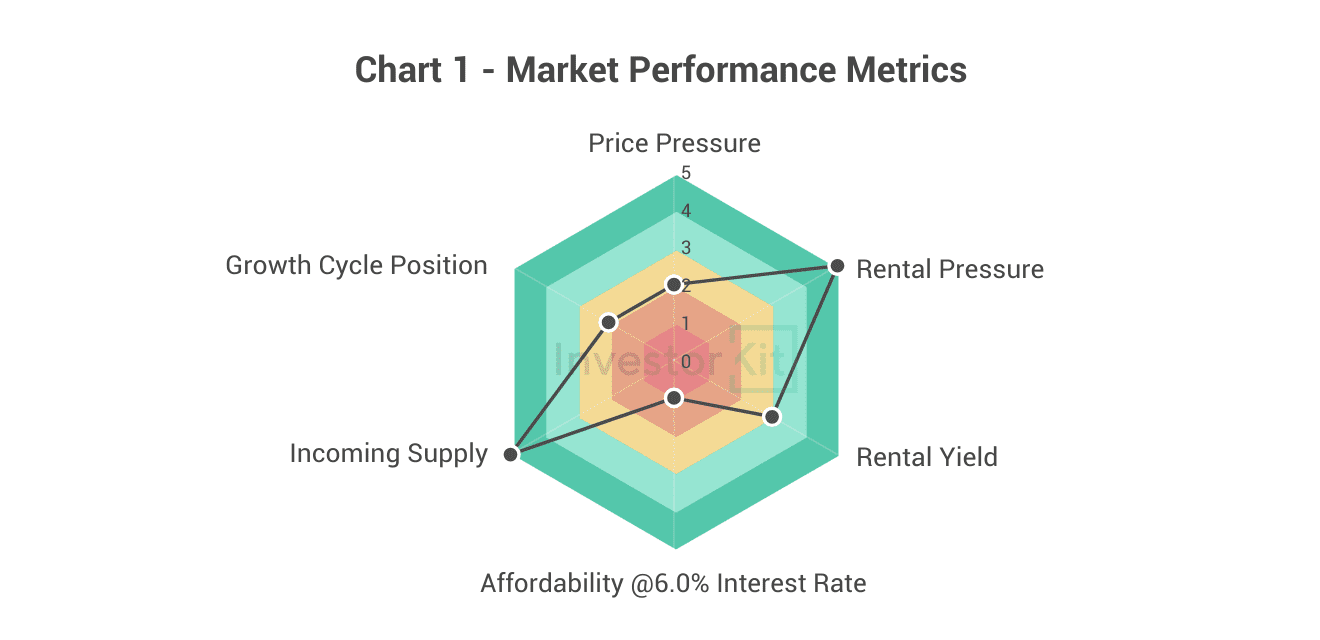

As of August 2025, Coffs Harbour’s house market pressure remains relatively low.

Among the six metrics InvestorKit uses to measure market performance, Coffs Harbour scores 5 (very strong) in rental pressure and incoming supply, 3 (average) in rental yield and 2 (weak) in price pressure and growth cycle position and 1 (very weak) in affordability.

Coffs Harbour Demographic & Economic Trends

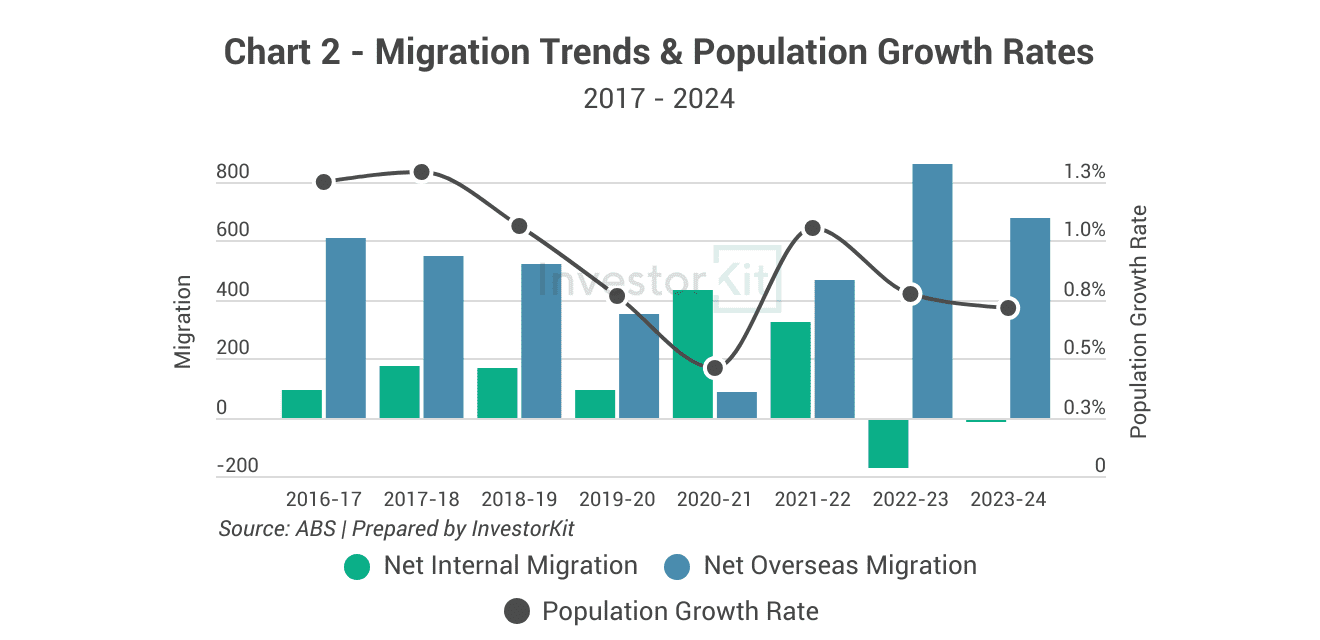

Population growth has been lower than the national average in the past 8 years, except during the pandemic.

Internal migration spiked in 2020-2022 due to the exodus-to-lifestyle trend, but the trend has softened since 2023, likely as a result of both back-to-office shifts and affordability pressures.

On the other hand, overseas migration has remained robust, attracted by the city’s delightful combination of mild climate, laid-back coastal lifestyle, improved infrastructure and job opportunities.

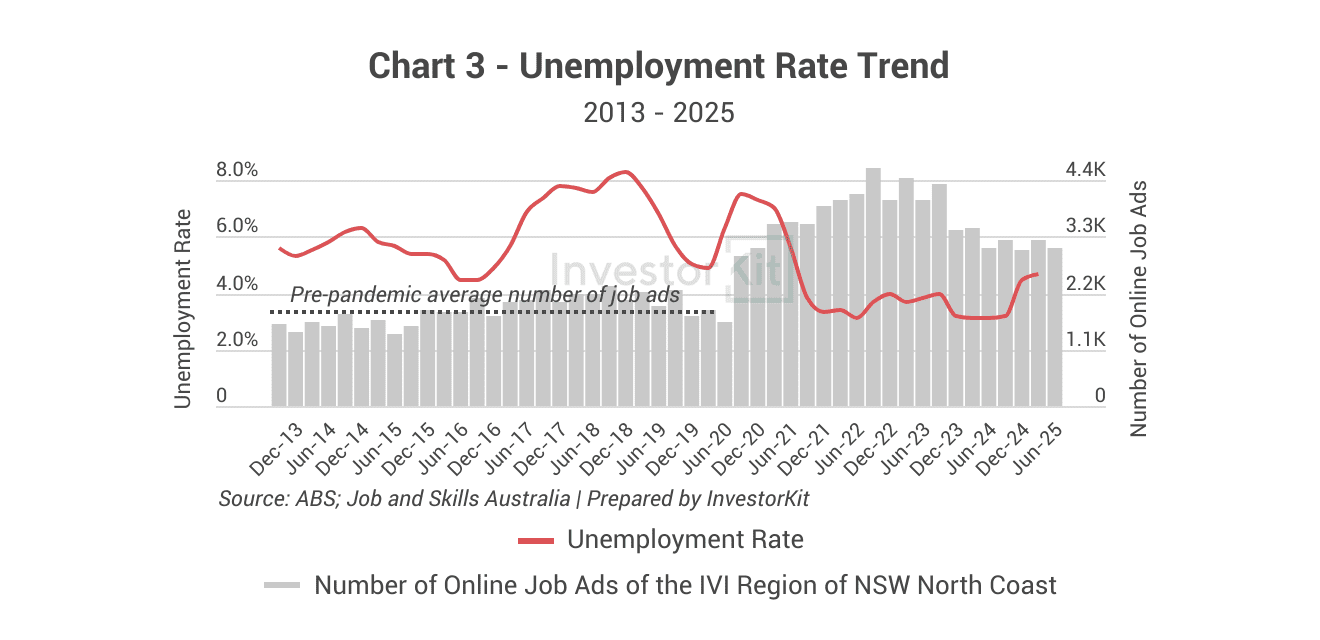

Economically, Coffs Harbour is solid. While the unemployment rate has risen in recent months, it is still well below 5% and last decade’s average level. The number of job opportunities has stabilised at around 1.6 times the pre-pandemic average level.

This economic resilience lays the groundwork for future property market recovery.

Coffs Harbour Property Market: Sales Market Trends

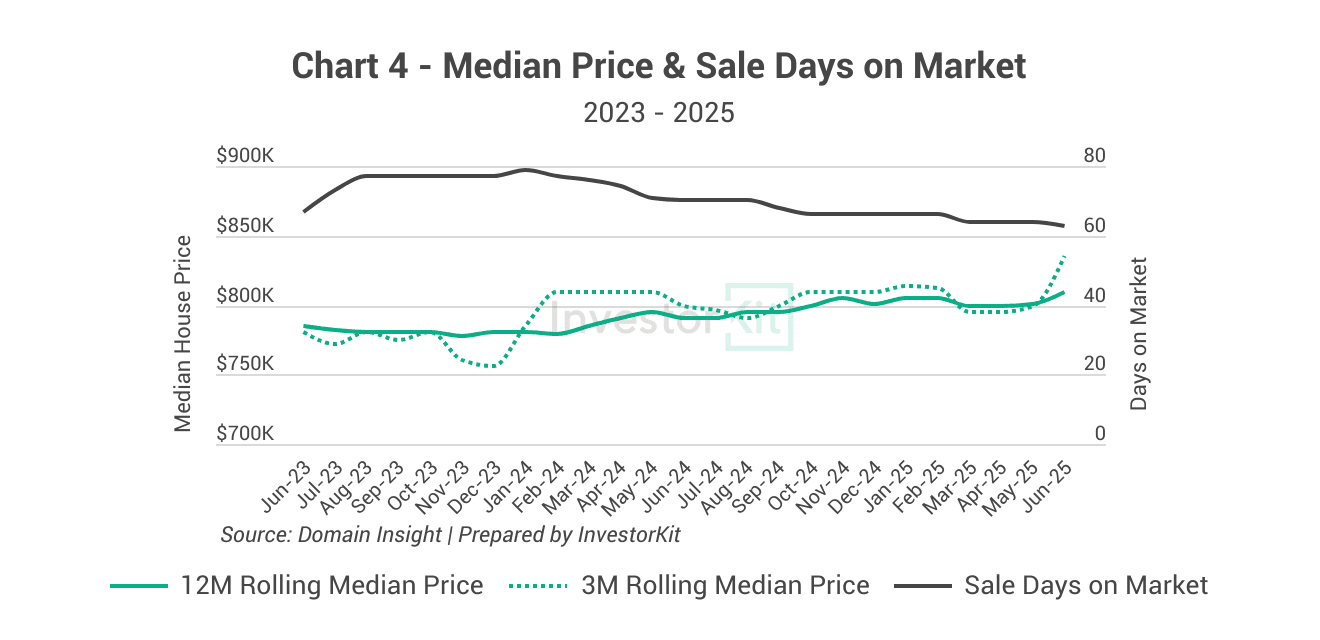

Coffs Harbour’s market pressure has been gradually improving since the beginning of 2024, as evidenced by a consistent decline in days on market. Prices are just up 2.5% year-on-year. However, in June 2025, the 3-month rolling median price recorded a noticeable surge, though it’s too early to tell whether this marks the beginning of a sustained recovery or just a temporary rise.

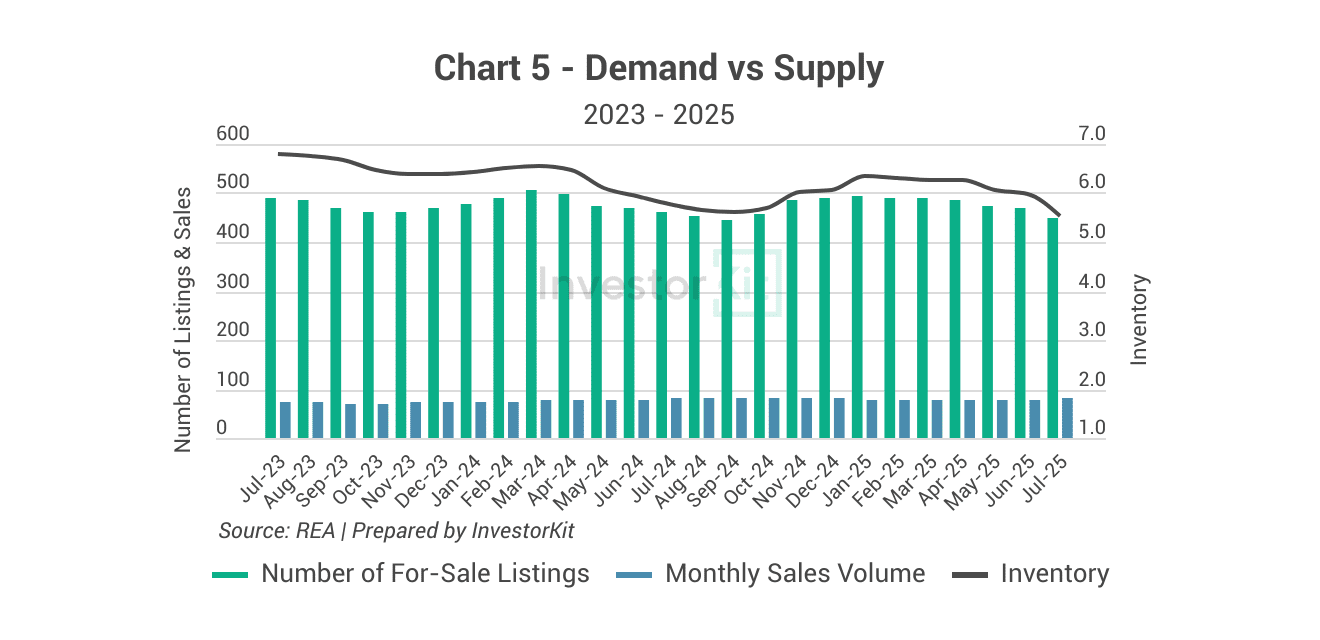

The slow recovery can be explained from a supply vs. demand perspective. Over the past two years, listings have hovered between 450 and 500, while sales volumes have stayed low, leading to high inventory levels.

In the last quarter (Q2 2025), a drop in listings, together with a rise in sales, caused inventory levels to fall from above 6 to around 5.5 months. However, 5.5 is still an elevated level, keeping market pressure subdued.

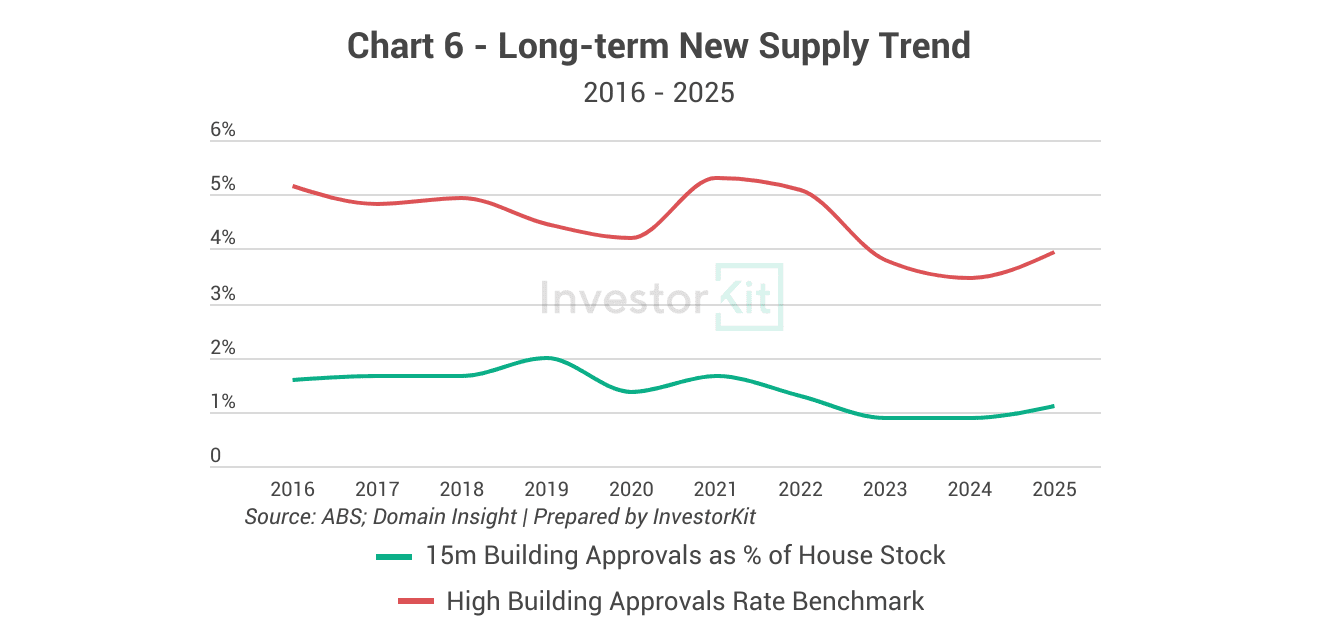

While Coffs Harbour has a large pool of established housing, new supply remains limited. Over the past decade, house building approvals have stayed below 2% annually, keeping the risk of future oversupply low.

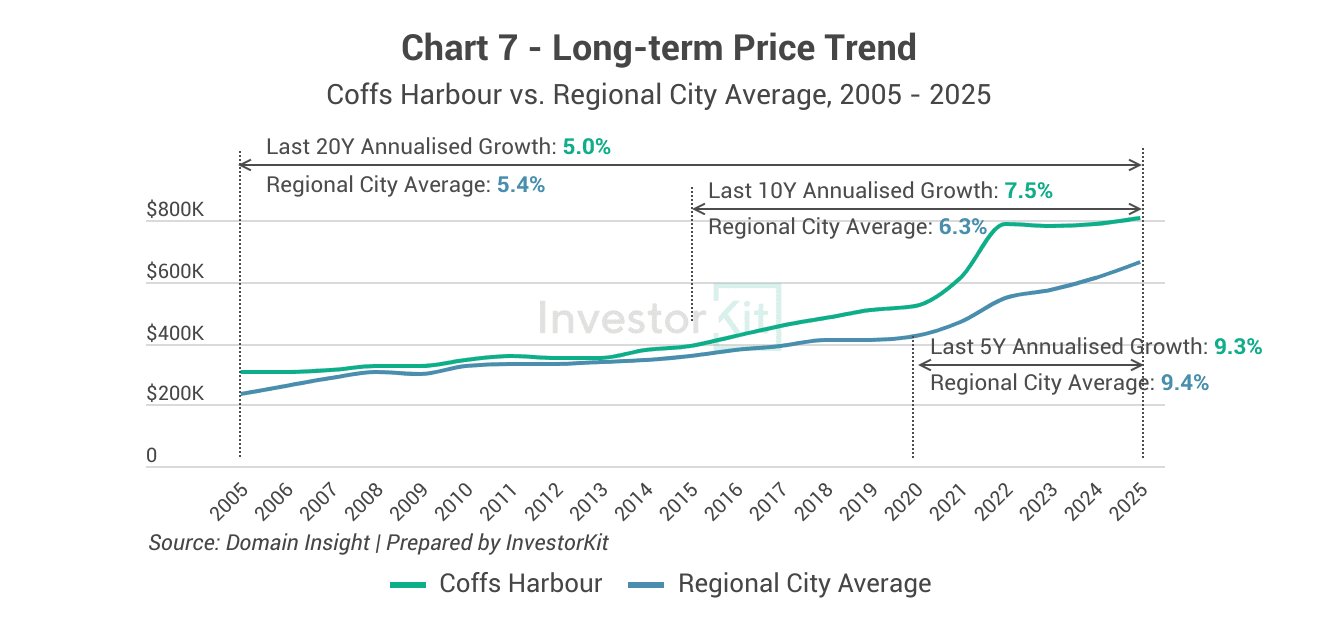

Coffs Harbour’s house prices surged dramatically during the COVID boom, pushing the past 5-year and 10-year annualised growth rates above the long-term average (5-7%). This, coupled with the relatively slow population growth and low current market pressure, suggests that growth in the short to medium term is likely to be moderate.

Rental Market Trends for Coffs Harbour

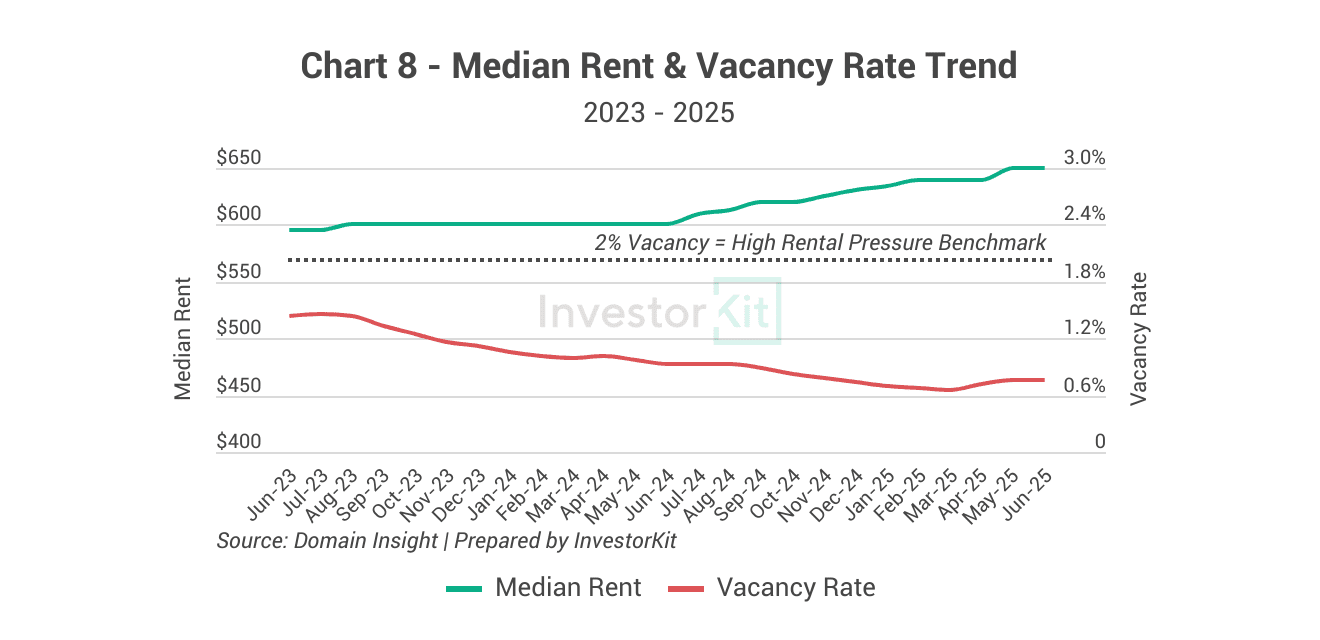

Rental market is under high pressure, as seen in its low vacancy rate. The declining vacancy rate has led to a return to growth in rents since mid-2024, achieving 8.3% growth from June 2024 to June 2025.

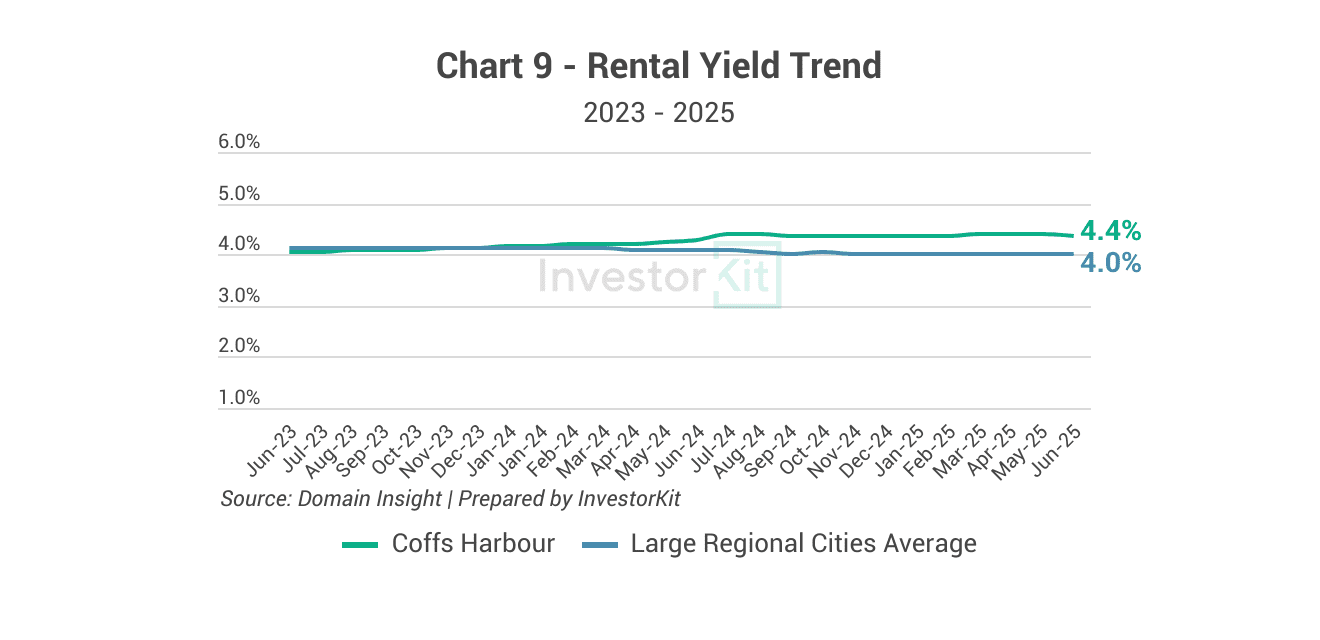

Rental yields have been improving as rents have grown faster than sales prices. While 4.4% may not seem particularly high in today’s high-interest-rate environment, as interest rates continue decreasing in the rest of 2025 and rents continue to outgrow sales prices, Coffs Harbour will become more attractive to investors gradually.

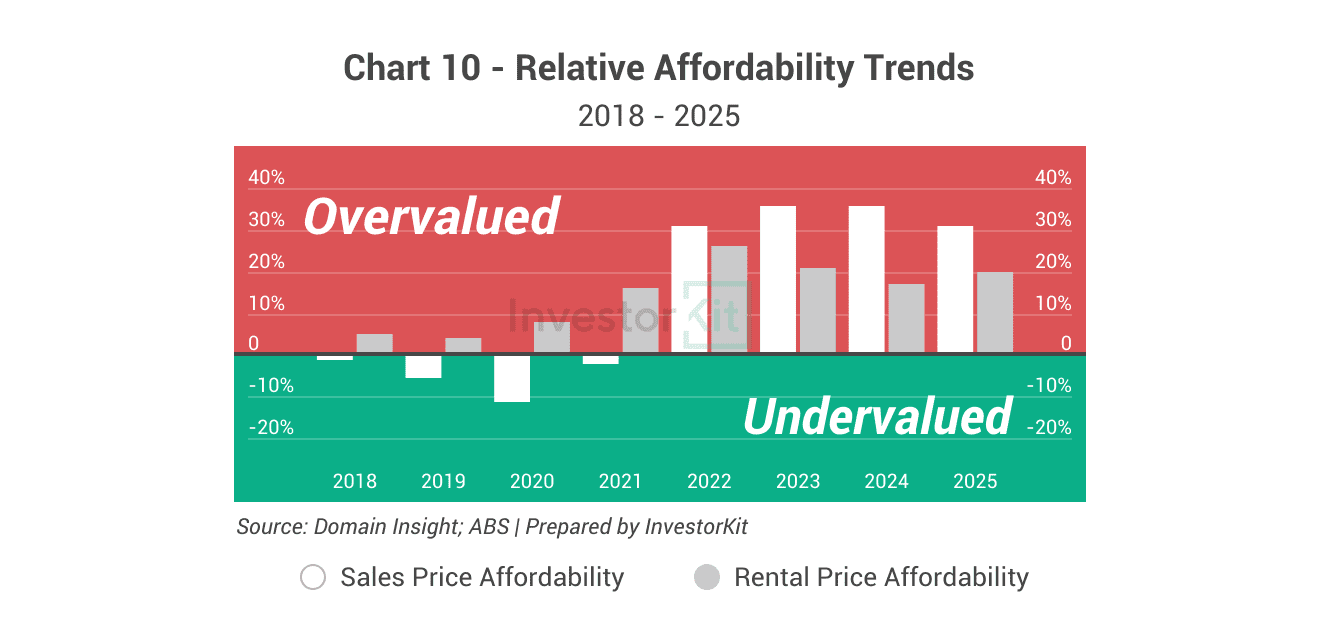

Affordability has worsened significantly in both the sales and rental markets in recent years, with the median house price 31% overvalued and the median rental price 20% overvalued in 2025.

In the coming year, sales market affordability is expected to improve further as interest rates decline, while rental market affordability is expected to continue deteriorating as rents are likely to outpace salaries. Therefore, we expect demand in the sales market to continue increasing.

In the next 6-12 months…

Coffs Harbour’s market pressure is still low but improving, evidenced by the high yet declining inventory levels and sale days on market. Rental market pressure remains high, with healthy rental growth and rising rental yields.

In the coming six months, we expect prices to continue growing moderately, while rental prices will likely outpace sales price growth, further lifting rental yields. As interest rates decline, affordability is set to improve, particularly in the sales market. With yields strengthening and attracting investors back, and improved affordability drawing more demand from the rental pool, a material recovery is likely to follow.

Coffs Harbour is the 15th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Talk to us today by clicking here and requesting your 15-minute FREE discovery call!

.svg)