Canberra: A lengthy but not-too-surprising correction

Underpinned by a solid public-sector-dominated job market and high household income, the nation’s capital has always been known for its high property prices. Over the past two decades, Canberra’s house price has never lost its place in the Top 3 Most Expensive Capital Cities, except in 2012-14 when Perth and Darwin’s prices peaked.

Canberra’s house prices surged dramatically during the pandemic property boom, up by 47% in 2 years from June 2020 to June 2022, even higher than Sydney’s 42%. Just like Sydney, it went into decline in late 2022 as interest rate hikes began. However, unlike Sydney, which has been recovering for a year now, Canberra’s house prices are still stagnant.

In today’s market pressure review blog, let’s dive into Canberra’s house market data and see what’s happening there.

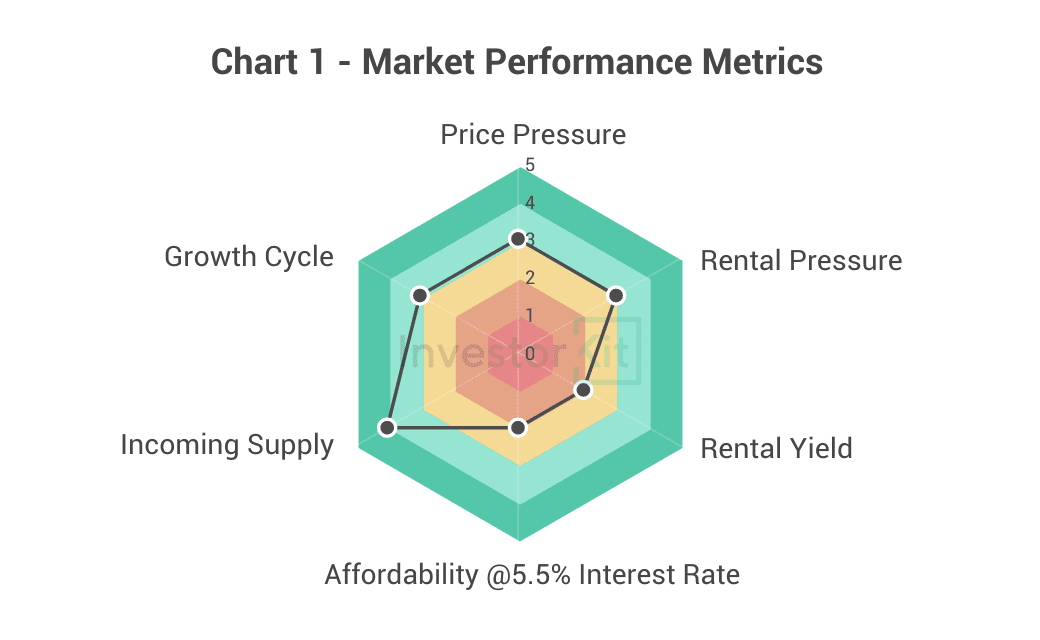

As of January 2024, ACT is showing signs of a cooling market with relatively low pressure.

While scoring high in Incoming Supply, Canberra scores average or low on all other metrics InvestorKit uses to measure market performance, especially in affordability and rental yield. We’ll discuss the details below.

Demographic & Economic Trends

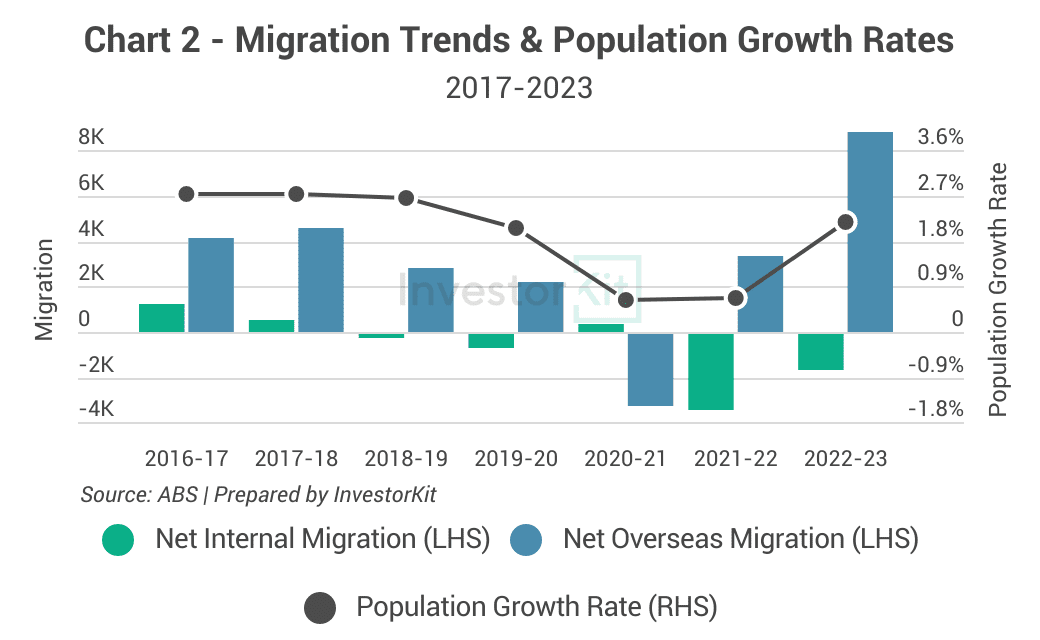

Canberra’s population growth weakened from 2018 to 2021 due to the decline in overseas migration and loss of internal migration. However, net overseas migration surged after the international border reopened, and internal migration is also recovering, leading to a strong recovery in population growth, and a boost to housing demand.

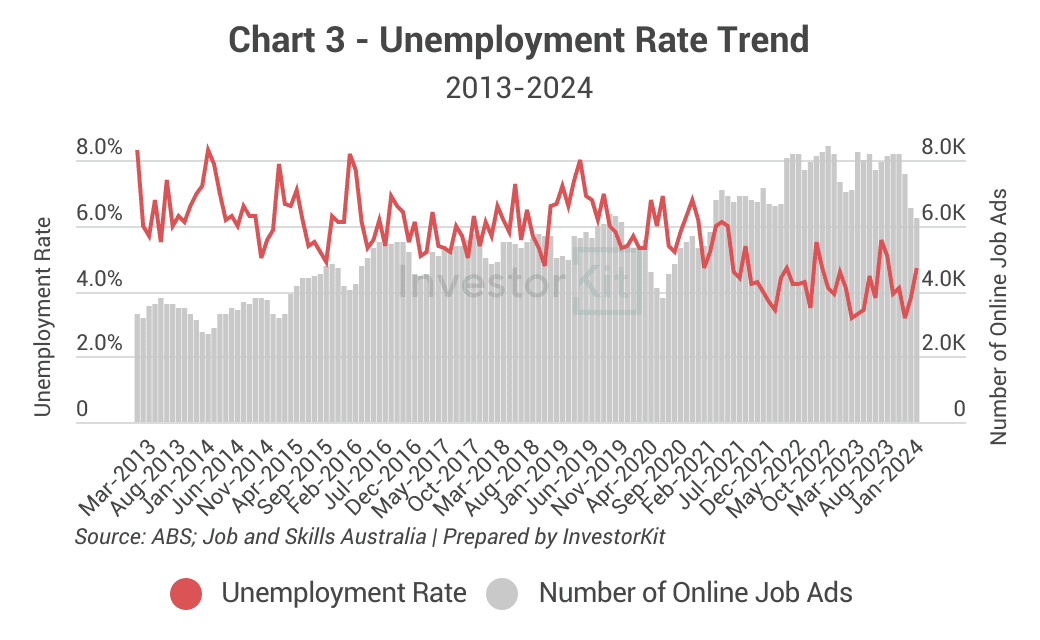

Accompanying the solid population growth is Canberra’s more active job market. Although relatively volatile over the year, ACT’s unemployment rate is at the lowest level in more than a decade. The number of job ads, which indicates the number of job opportunities, while lower than a year ago, is still much higher than pre-COVID time.

Sales Market Trends

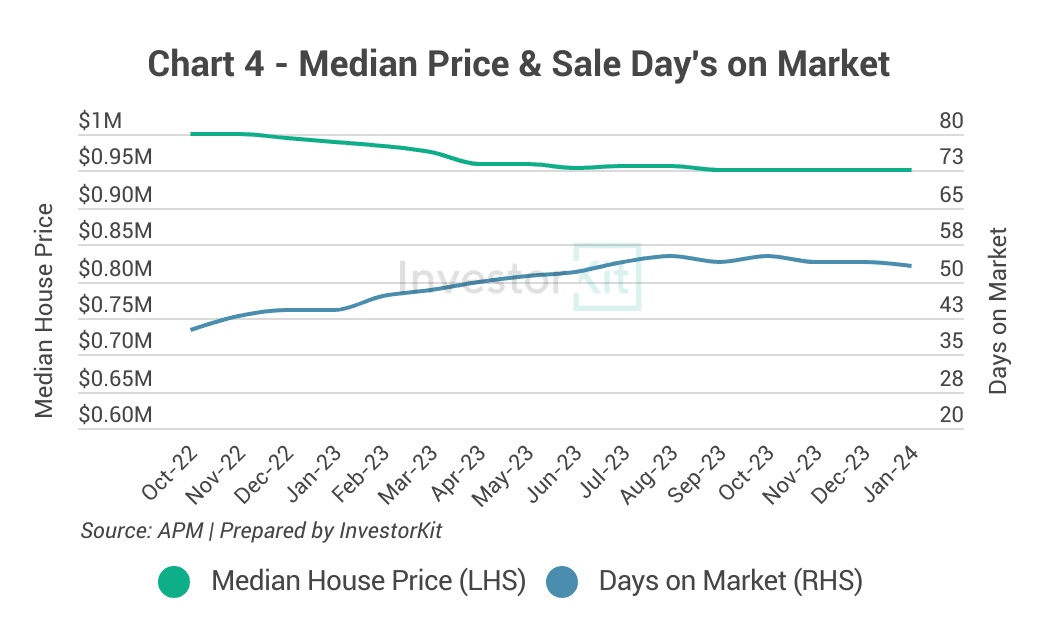

Despite the active job market and thriving economy, the Capital city’s house market has been cooling. Canberra’s median Sale Days on Market (DoM) is much higher than a year ago, indicating decreasing market pressure. As a result, house prices started declining in late 2022, down -4.5% in a year.

Now, both the DoM and house prices have been essentially flat for months without noticeable signs of recovery yet.

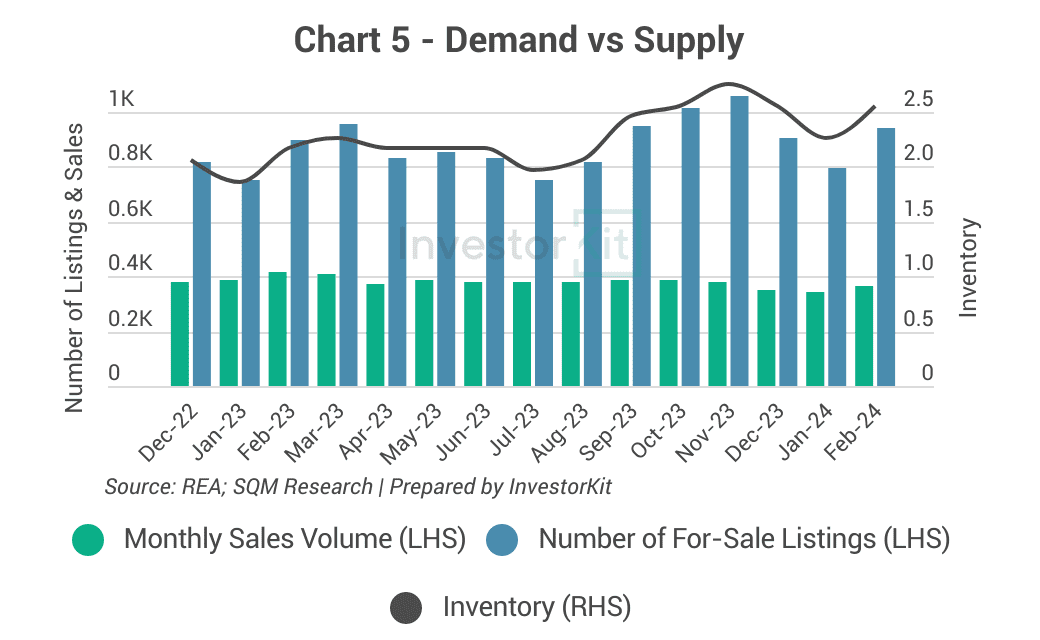

Canberra’s weakening market pressure can also be seen in its demand-supply relationship. While the monthly sales volume (demand) has been gradually trending downward over the past year, the number of for-sale listings (supply) is trending up, leading to an increasing inventory and weaker market pressure.

Affordability is likely one of the primary reasons for the decline in demand. Canberra is now the second most expensive city to buy a house. Although the city has the highest household income level among all capital cities, the median house price is still 26% higher than what the locals can afford in the current high-interest-rate environment (assuming the home loan interest rate is 6.5%).

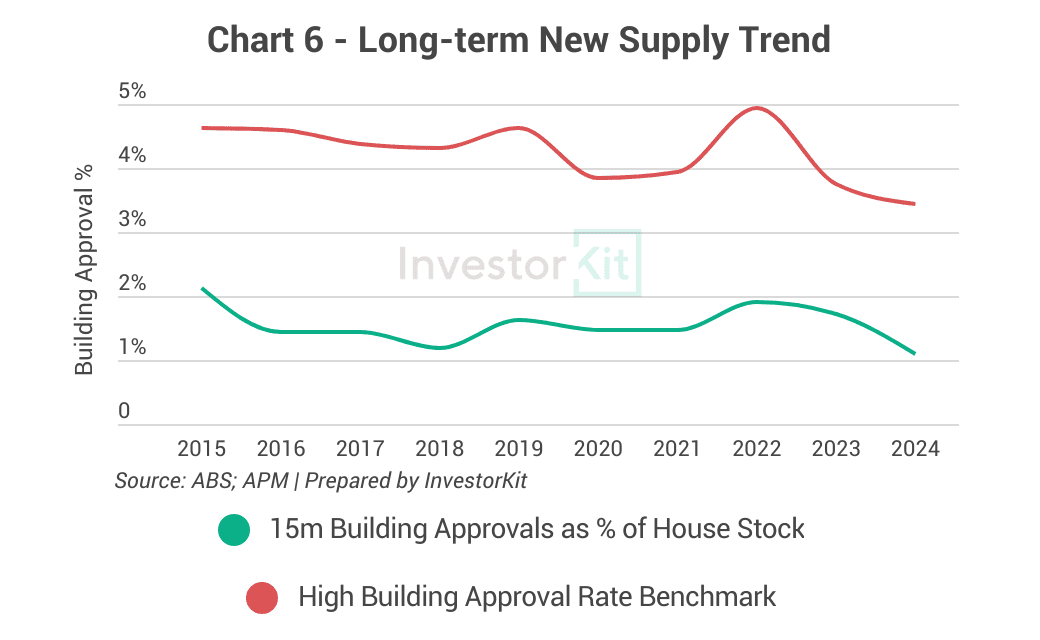

The good news is that although Canberra has received a surging number of immigrants in recent years, new house construction activity is low, which makes the city’s house market oversupply-proof and will eventually contribute to price growth.

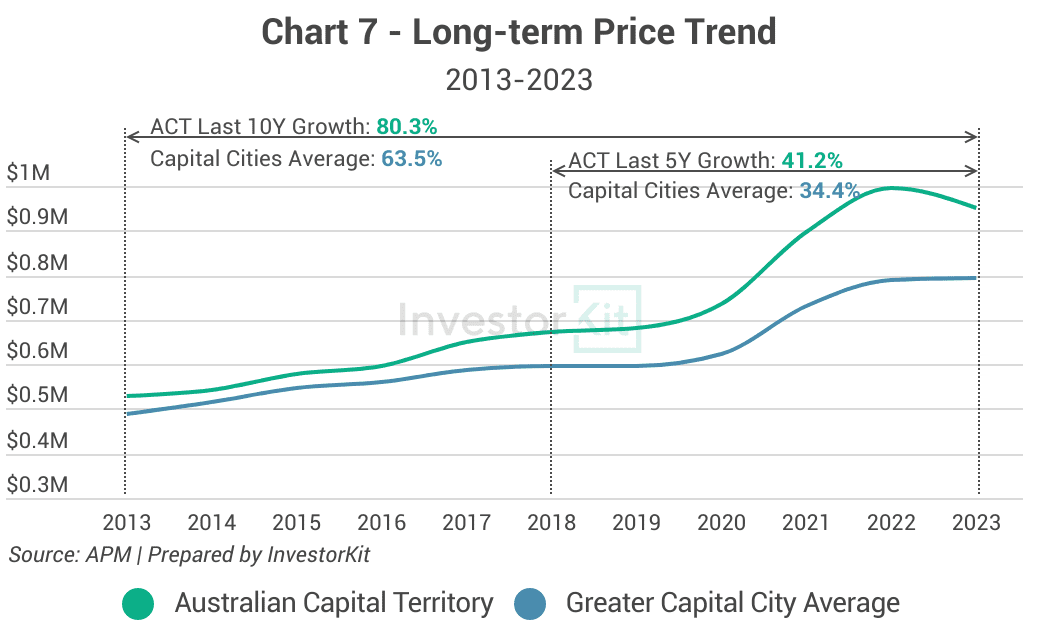

Canberra’s house price growth in the past decade and the past 5 years have both been strong, higher than capital cities’ average level. This indicates that the city has just experienced its peak growth phase and is now going through the correction phase. More time and price adjustments are needed to re-balance demand and supply before the market regains pressure and growth momentum.

Rental Market Trends

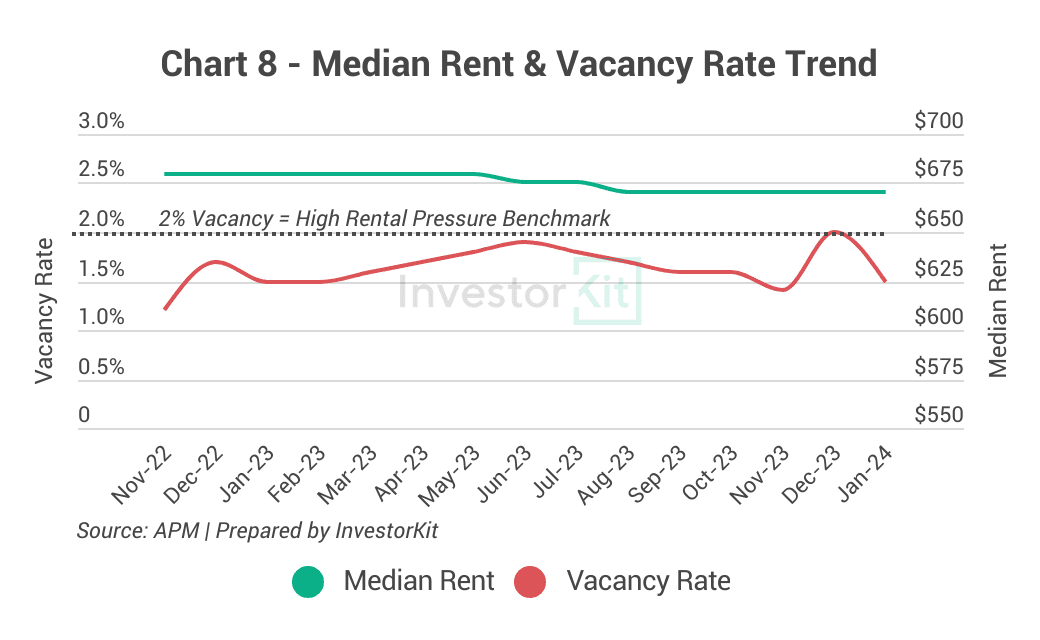

Unlike most other Australian cities, Canberra’s rental market pressure is relaxing. The city’s vacancy rates have been around 1.5-2% over 2023, much lifted compared to during the pandemic. As a result, Canberra has become the only capital city that witnessed rental declines – the median rent decreased by -1.5% over the past year.

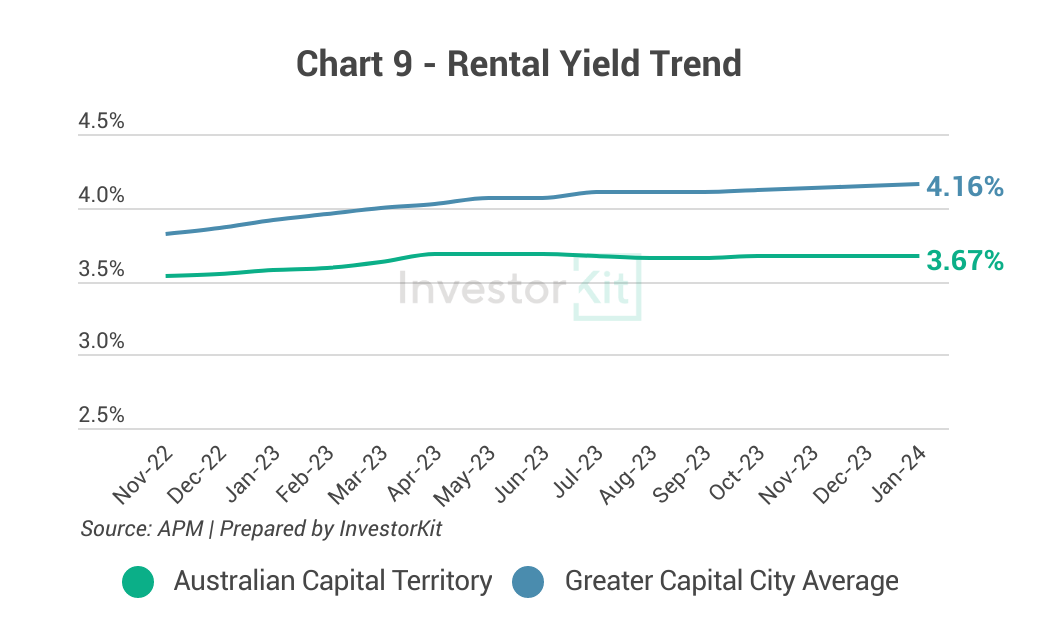

As house values and rents have both been stagnant, Canberra’s rental yield has been flat since mid-2023, whilst most other capital cities are experiencing rising yields. High prices combined with moderate rents make the city’s rental yield only at 3.67%, the third lowest among all capital cities (after Sydney and Melbourne).

High prices, low yields, and high land taxes are all pushing investors away from Canberra’s house market.

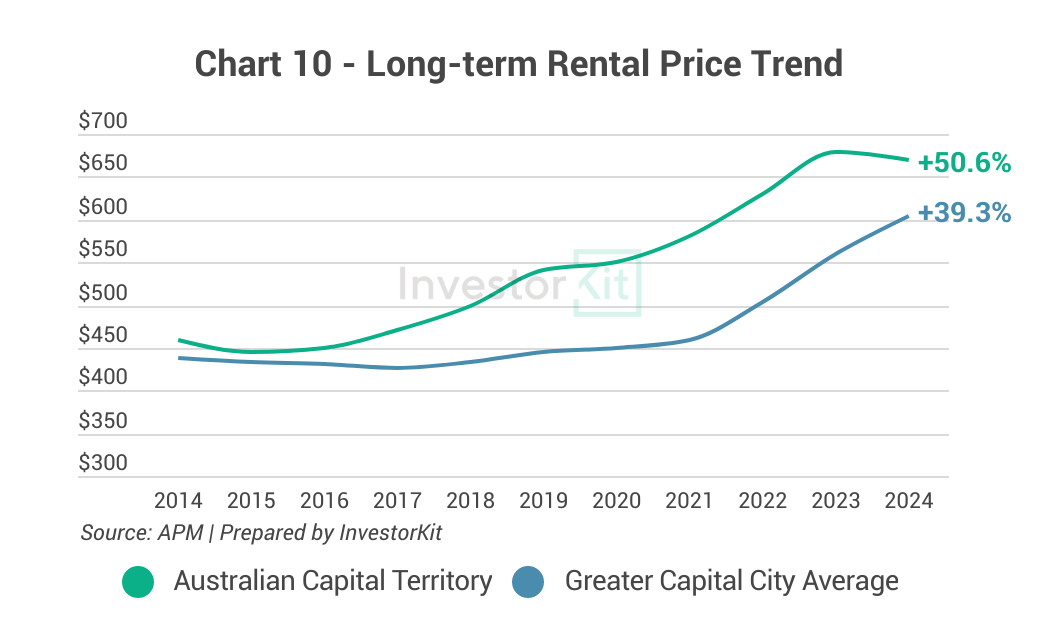

Over the past decade, Canberra’s rental prices have grown by 50.6%, higher than the capital cities’ average growth rate. However, as rental pressure declines and rents don’t see strong growth, it may be caught up by other capital cities soon.

In the next 6-12 months…

Canberra is experiencing relatively low market pressure in both the sales and rental market. We believe it is due to its market cycle (the correction phase) as well as a combination of high prices and decreased demand as interest rates stay high.

We do not see Canberra’s house price grow much in the coming 6-12 months because of the low market pressure. However, in the medium term (2-3 years), we will see it regaining strength as interest rates come down, boosting borrowing capacity, population growth lifts demand, and the low level of new supply comes into play.

Canberra is the last capital city we examine in this Market Pressure Review Series. Stay tuned for the first regional city to come! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-min FREE no-obligation discovery call!

.svg)