September 28, 2025

Is Property Now Out of Reach for Young Investors? Not If You Look Closer

With house prices at record highs and borrowing power stretched thinner than ever, it’s no surprise that younger Australians often feel priced out. However, higher average prices doesn’t mean the…

One of the most common questions we hear today is: Has property investing become a game only for the wealthy?

With house prices at record highs and borrowing power stretched thinner than ever, many Australians, especially the young generation, often feel priced out.

It’s true that property is more expensive than it was a decade ago: A buyer who once could purchase three properties with $900,000 of borrowing power might now only be able to afford one in the same market. However, that doesn’t mean the door to investing is shut. If we zoom out, the national property landscape still holds markets that are affordable, and not just in the form of apartments. The key lies in understanding how diverse the market really is.

The Myth of One Market

The belief that property is now universally unaffordable stems from treating the Australian property market as a single market. In reality, it’s a collection of many sub-markets, each influenced by its own factors: supply and demand dynamics, infrastructure pipelines, demographics, sentiment, and more.

This matters because while broad headlines paint property as unaffordable, a closer look reveals very different conditions across sub-markets.

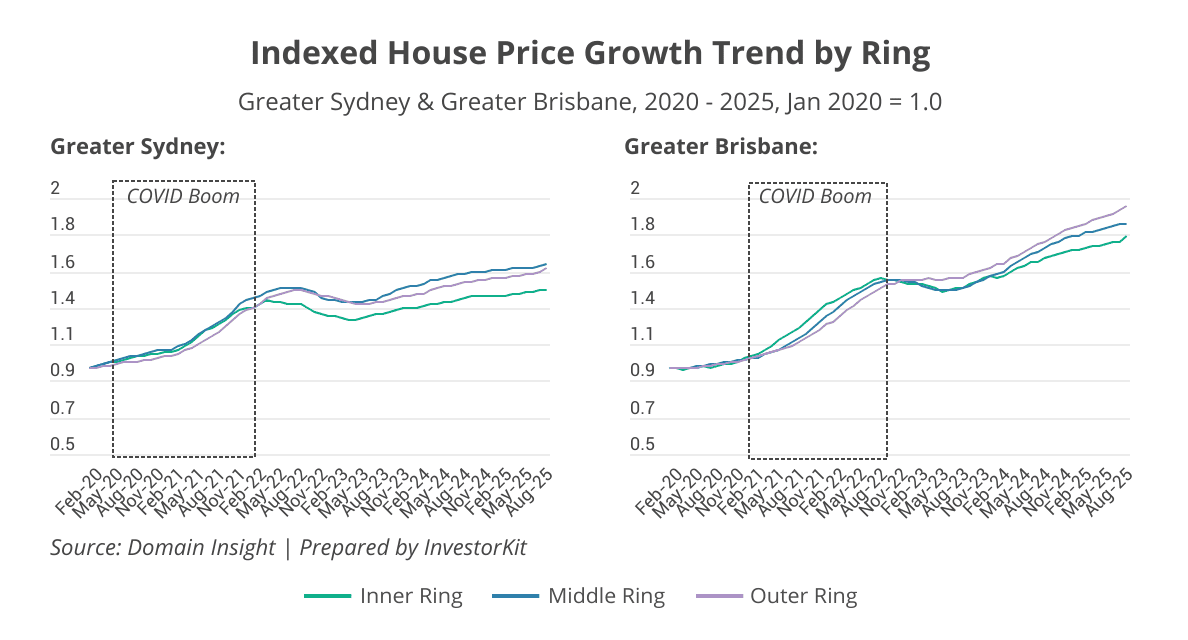

Nowhere is it clearer than in our capital cities. They’re often discussed as if they move in lockstep, but their inner, middle, and outer suburbs tell very different stories, as demonstrated by our recent whitepaper Property Trends Across Inner, Middle & Outer Suburbs: 5 Major City Breakdowns.

Case Study: Trends Across ‘Rings’ of Our Capital Cities

Let’s take a closer look at how inner-, middle-, and outer-ring suburbs have moved over recent years.

- 2020-2022: During the COVID boom

Interest rates were historically low, and affordability wasn’t the top consideration for buyers. All rings grew strongly in this period. However, in many cities, inner and middle-ring suburbs often grew earlier or faster than the outer ring, driven by their superior infrastructure, services, and proximity to the city centre. Sydney and Brisbane have demonstrated this trend clearly (see charts below).

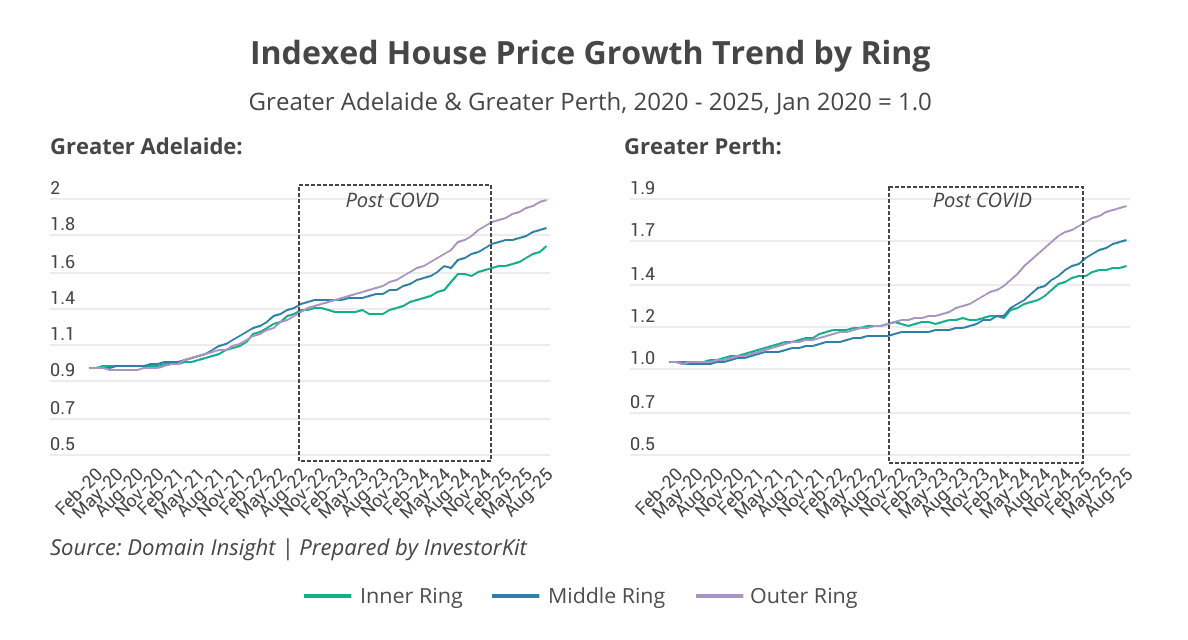

- 2022 – 2024: After the COVID boom

As interest rates rose, momentum shifted. The outer-ring suburbs, typically more affordable and accessible, outperformed the inner and middle rings. Buyers, particularly first-home buyers and affordability-driven investors, sought entry points on the city fringes. These areas became the engines of growth. The charts below show Adelaide and Perth as two examples.

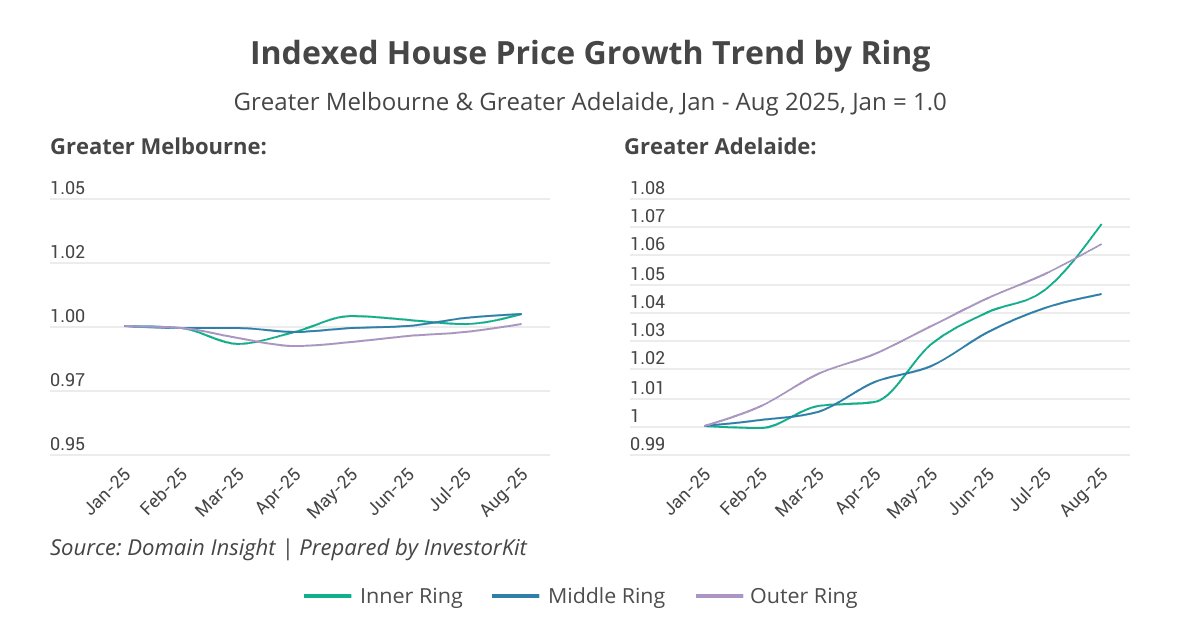

- 2025: With rate cuts and easing conditions

The pendulum is swinging back. As borrowing power slowly recovers and the affordability advantage of outer suburbs fades, demand is again strengthening in inner and middle-ring suburbs. The charts below show the notable recovery of inner and middle rings in Melbourne and Adelaide.

The above cycle shows that even within a single city, sub-markets don’t all rise or fall the same way. Inner, middle, and outer rings each respond differently to economic conditions and shifts in affordability.

What This Means for Investors

For investors, the lesson is clear: it’s not enough to say “houses are too expensive.” The real questions are: where are they expensive, where are they still accessible, and which market suits my needs and budget the most?

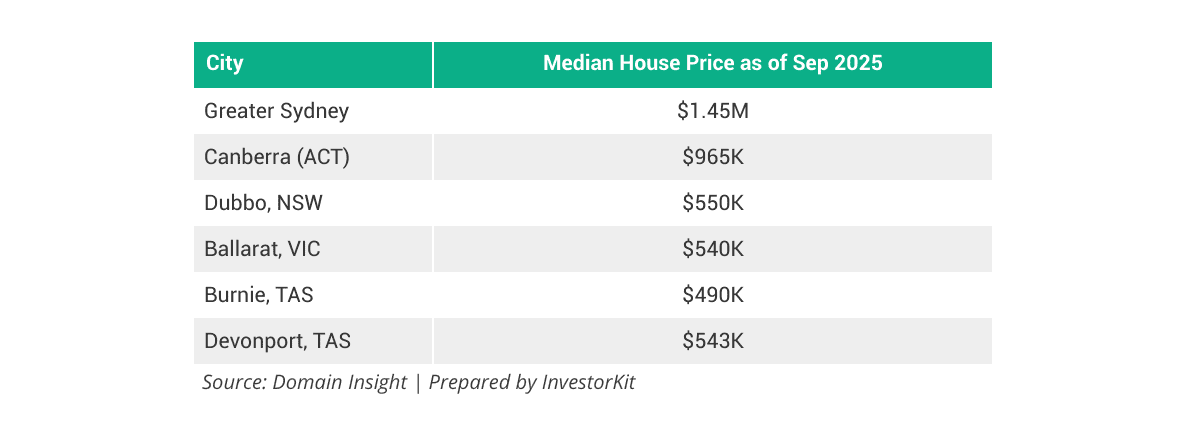

Just as inner, middle, and outer suburbs within the same city show different trends, so too do different cities/regions across the country. For example, in Sydney or Canberra, a borrowing capacity of $900K may not be sufficient to secure a quality detached house. Yet, in regional centres such as Dubbo, Ballarat, Burnie, or Devonport, where median house prices are under $600K, $900K is more than enough to enter the house market.

The point is not whether property is “too expensive” overall, but where the opportunities lie within Australia’s many sub-markets. Success depends on matching your strategy to the right location, at the right time.

Looking Beyond Headlines

Too often, media headlines flatten the property market into a single story: prices up, prices down, affordability worsens. But smart investors know that success lies in drilling deeper, into the sub-markets and the micro-trends shaping each area.

Today’s investors are actually in a favourable position compared to previous generations, because they have access to far more information, research, and professional guidance. What once required significant time and effort, or was simply unavailable, is now accessible in data-driven insights and professional analysis. This empowers investors to make sharper, evidence-based decisions, which can lead to even better results.

Yes, property is more expensive today. But markets are not monolithic, and opportunities don’t disappear just because averages have shifted upward. The diversity of Australia’s property markets means there is no single answer. With the right information and strategy, there is always a path forward. If you’re rethinking your approach, our team at InvestorKit can help map out the right strategy for your goals. Just book your free Discovery Call today!