Around this time last year, we posted a blog discussing rental yields and why investment is not all about it. One year later, Australia’s property market has greatly changed as the RBA cash rate hikes and the rental crisis continues. Today, we’ll look at rental yields again, see how it’s changed, and what investors can expect.

A Quick Re-cap: What is rental yield, and why it’s important to investors?

Rental yield is the ratio of the total rental income a property generates over a year to its market value.

There are different types of rental yields, and the three major types that investors usually care about are gross rental yield, net rental yield, and yields on purchase price.

– Gross rental yield is simply calculated with gross rental income without deducting any rental expenses.

– Net rental yield takes into account rental costs, eg. insurance, maintenance, property management fees, vacancies, and more.

Net Rental Yield =

– Yield on purchase price is used when an investor calculates the rental yield of a property that they currently own, in which case the denominator becomes the purchase price instead of the house’s market value. Yield on purchase price could differ a lot from the region’s average rental yield depending on how sales and rental prices have changed since purchase.

Understanding rental yield is important for property investors as it helps determine if an investment is financially feasible and sustainable to support portfolio building. The below chart shows how much difference rental yields can make to a property’s (see below box for purchasing details) cashflow in 30 years:

With a 2% difference in the initial rental yield, the weekly cashflow gap is close to $100 in the first year of owning it and becomes $227 in the 30th year. That is a $237,877 difference in net income in 30 years.

What are the influencing factors of rental yields?

• According to its calculation formula, rental yields change as the property values and rents change over time.

The chart below shows the rental yield trend of the Greater Sydney house market as an example: When rental growth exceeds price growth, rental yield goes up; when rental growth cannot catch up with price growth, rental yield goes down. Greater Sydney’s house rents didn’t grow as much as the sales prices from 2012 to 2021, so their average rental yield has been mainly trending down over that decade until late 2021, when the rental boom started.

As rental growth is influenced by wage growth and inflation, which are both related to interest rates, rental yield correlates with interest rate trends, too. The below chart shows that before 2021, both rental yields and rental growth rates were in line with the RBA cash rate trend – Rental growth lost speed as the cash rate declined. That was the case until the supply crisis caused a rental surge in 2021.

• At a certain point in time, rental yield is influenced by location and property type.

For example:

– Capital cities’ rental yields tend to be lower than regions. The below chart shows that the average yield level of capital city SA3s has been lower than regional SA3s by around 1%.

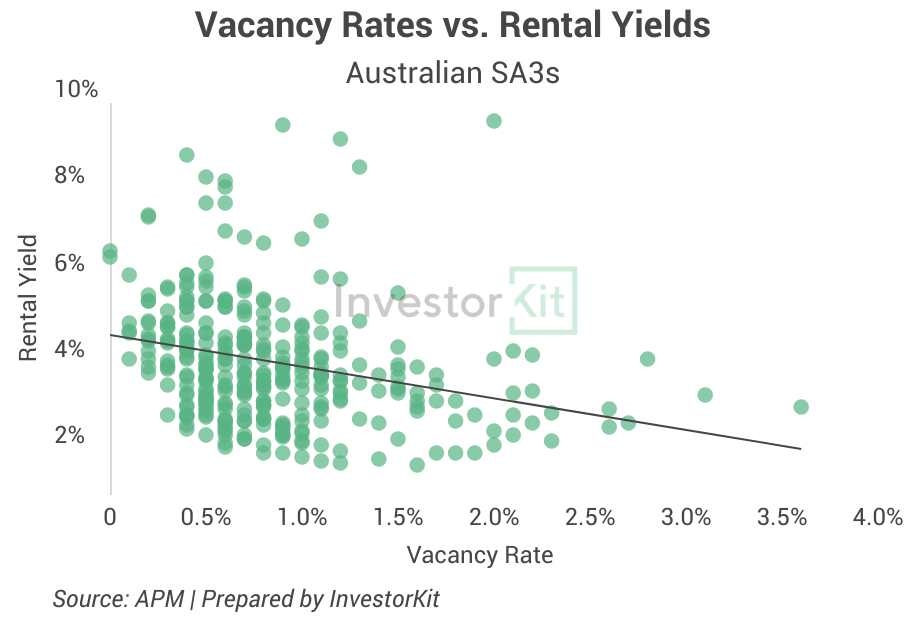

– Locations with lower vacancy rates tend to enjoy higher rental yields. The below chart shows the negative correlation between vacancy rate and rental yield, although not too significant.

– Apartments’ rental yields are usually higher than houses due to the higher value of houses. The below chart shows that apartments’ average yield has been around 1% higher than houses’ over the past decade.

What do rental yields look like in Australia now?

In the past year, rents of all dwelling types continued surging nationwide, up 9.7% in 12 months, whilst dwelling value fell by -6.0%. That has led to an increase in rental yields: the national average gross yield rose from 3.3% last year to 3.8% this year.

Capital city houses suffer from extremely low rental yields during the national property boom. The below chart shows that house yields in all capital cities have improved in the past 12 months.

However, it’s worth noticing that rental yields are not improving everywhere.

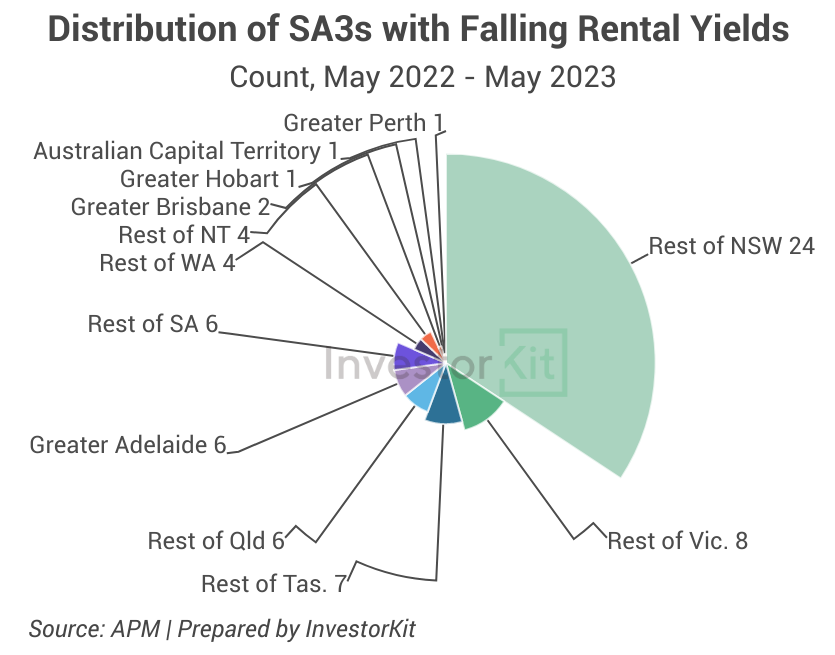

APM’s market data suggests that as of May 2023, 260 SA3 regions have seen rental yields either increased or didn’t move over the past 12 months, and 70 SA3 regions have seen rental yields fall. Most are in the regions, as shown in the pie chart below. The falling yields mean their house sales prices are still growing faster than rental prices.

The improvement in rental yields is a good thing, but it’s not good enough for investors because the mortgage interest rates are rising even faster.

Then what’s a good rental yield?

When the RBA cash rate was 0.1%, a 4% rental yield was good enough to generate a healthy cashflow. As the cash rate is currently at a decade high 4.1%, what rental yield is deemed good for a new purchase?

It depends on your investment goals, financial plans, and the rental market pressure of your target market.

We still use the $500k property mentioned at the beginning of this blog as an example –

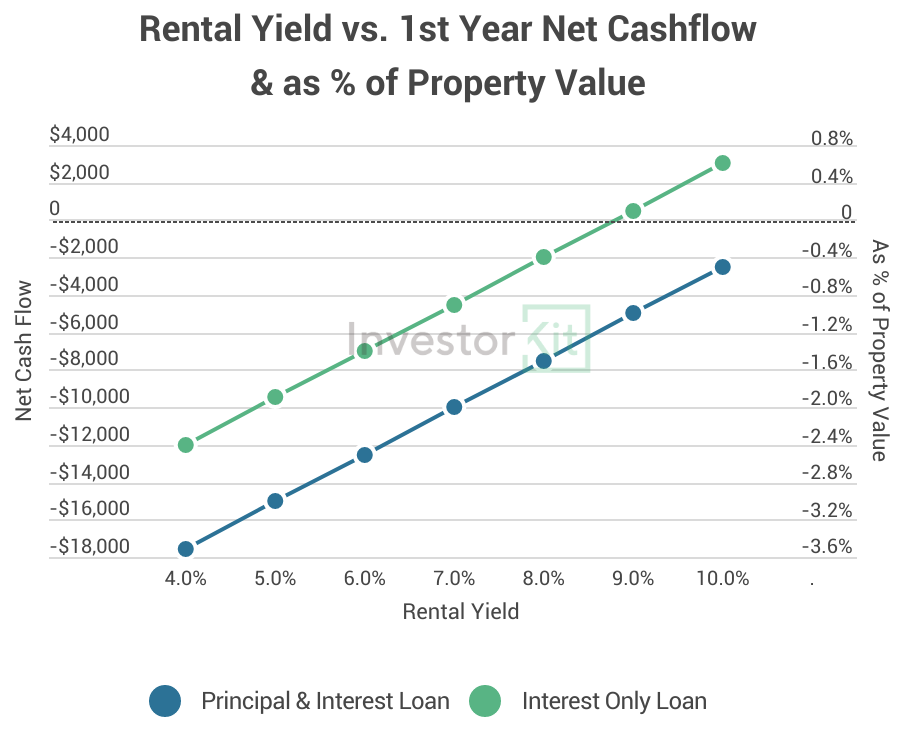

The below chart shows how much its net cash flow would be with different rental yields (ranging from 4% to 10%) in two loan scenarios: Principal and Interest (P&I) and Interest Only (IO).

With the interest rates soaring, achieving positive net cash flow would require an extremely high rental yield. One could almost say that positive cashflow is non-existent in this current environment from day one.

Therefore, examining your overall gain, i.e. equity growth and cashflow, has become important when deciding whether an investment is worthwhile. For example, if the house’s current rental yield is 5.5% and is expected to grow by 7% in value in the first year of purchase. According to the model above, you’d be losing 1.6% of the house’s value in the first year (in the IO loan scenario), so your first year’s return from this investment would be 5.4% – Is this return rate in line with your investment goal and financial plan? If yes, 5.5% is a good rental yield for you.

The biggest mistake we see investors make in the current environment is “yield hunting”.

Yield hunting means ignoring all likely to perform markets in favour of ones that have high yields to minimise impact. Leading you to drop down from say 10+ trending markets to 1-2 markets. Interest rates are temporary, rents rising is likely a permanent and an ongoing activity when looking at history. As a result, do you want to make a long term decision with a temporary lens (interest rates) ? Instead, you should look at it with a view of what you are comfortable losing in the short term during this high rate environment for your long term goals. As a result your yield range will open up to include some lower ones but not “too low” (a personal formula you will need to make) and so will the markets of choice and performance.

Besides, remember that the initial yield doesn’t mean everything. Remember the yield on purchase price we mentioned earlier? As time goes by and your rents grow, rental yield can increase quickly to a much higher level than the initial one. It’s especially true if you invest in a high-rental-pressure market that expects solid rental growth.

Then, the next question is, how do you find the market that meets your yield, value growth and rental growth requirement?

Data will help.

Say in May 2022, considering the potential cash rate hikes, you decided to invest in a market with a 5%+ rental yield, annual price growth to be 8%, and a vacancy rate below 1.0% (indicating a tight rental market) to ensure strong rental growth. Could you find such markets? Let’s check what data shows.

As of May 2022, 60 SA3s were enjoying 5%+ rental yields. The below chart shows their performance in house price growth in the year to May 2023.

30 of them have achieved 8%+ price growth in the following 12 months. In these 30 regions, only one had a relatively high vacancy rate of above 1.0% (Outback – North And East (SA), 1.6%); 28 out of 30 of them had their rents grow in the past year, 16 of which saw double-digit growth, including:

These regions are some of those where InvestorKit has been buying for our clients in the past year. By interpreting data, we identified these markets, among others, with just the sweet combination of a good rental yield and high pressure for price growth and rental growth.

InvestorKit buyers’ agents focus on helping property investors achieve their investment goals faster. Our data-driven approach ensures that we always match you with market(s) meeting your requirement, no matter how the interest rates, the national average rental yields, or the national dwelling value are trending.

Would like to buy your next investment property with InvestKit by your side? Talk to us today by clicking here and requesting your 45-min FREE no-obligation consultation!

.svg)