The Block is back for 2025!

And if you’re tuning in this season, don’t be surprised if you see Arjun Paliwal, InvestorKit’s founder and CEO, popping up during commercial breaks!

This year’s spotlight shines on Daylesford, a charming Victorian town just 80 minutes from Melbourne, known for its mineral springs, boutique spas, fine food, and artsy vibe.

So, the million-dollar question: Is Daylesford about to become a regional investors’ goldmine?

From a buyer’s agency perspective, the answer is: not quite. While it may be a lifestyle hotspot, it doesn’t check the boxes for a strategic investment location, especially for long-term rental properties.

Let’s explore why.

Long-term Rental Investment in Daylesford: Why We’re Cautious.

1. Weak Long-Term Rental Demand

Three indicators reveal Daylesford’s true nature as a tourist and retirement town, not a tenant magnet:

- 31.4% of dwellings are unoccupied

This is compared to the Australian average of 10.1%. The extremely high share of unoccupied dwellings indicates a high proportion of holiday homes, second residences, and Airbnb properties.

- The median age is 55

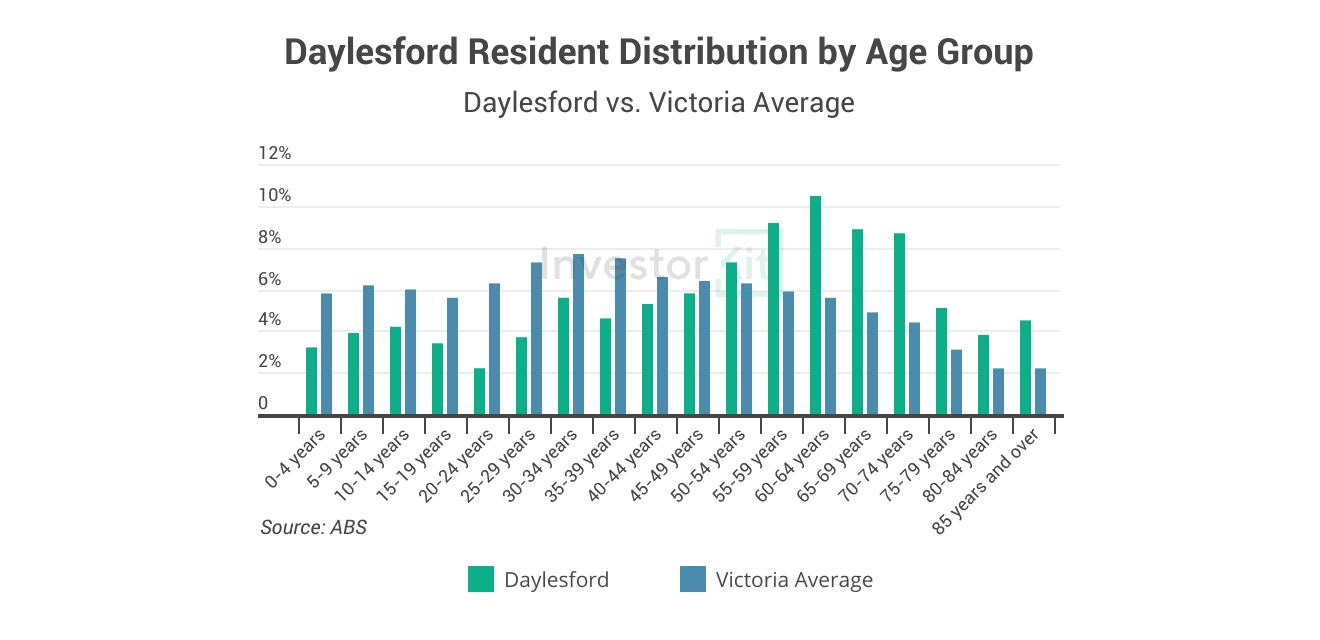

This is compared to the Australian median of 38, indicating that the town skews toward retirees. The chart below illustrates the distribution of residents across age groups, in comparison to Australia’s total population.

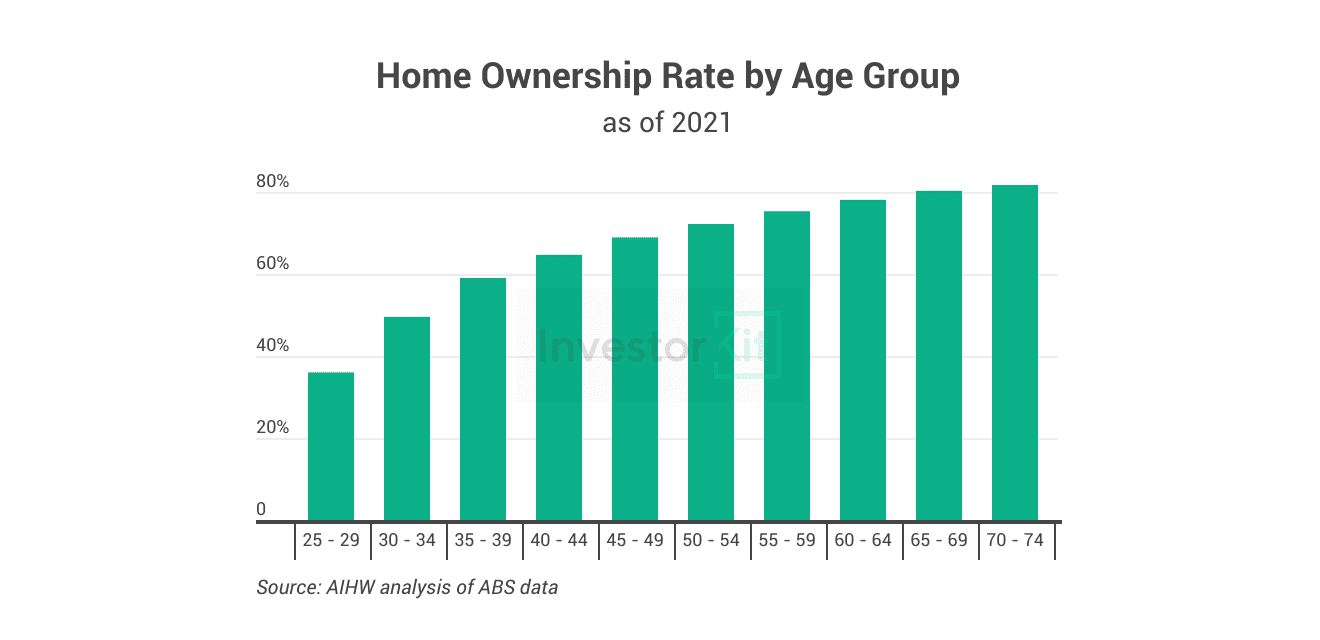

Retirees are typically owner-occupiers rather than renters (see chart below), so rental demand in a retirement town tends to be lower than usual.

- At least 16.2% of the workforce is in accommodation and food services

Census data show that in Daylesford, 3 of the top 5 employment sectors are in the accommodation and food services industry: Accommodation (7.8%), Cafes and Restaurants (6.1%), and Pubs, Taverns and Bars (2.3%).

These numbers are much higher than Australia’s average (0.9%, 2.2%, and 0.6% respectively), reflecting the town’s holiday destination nature. What does that mean?

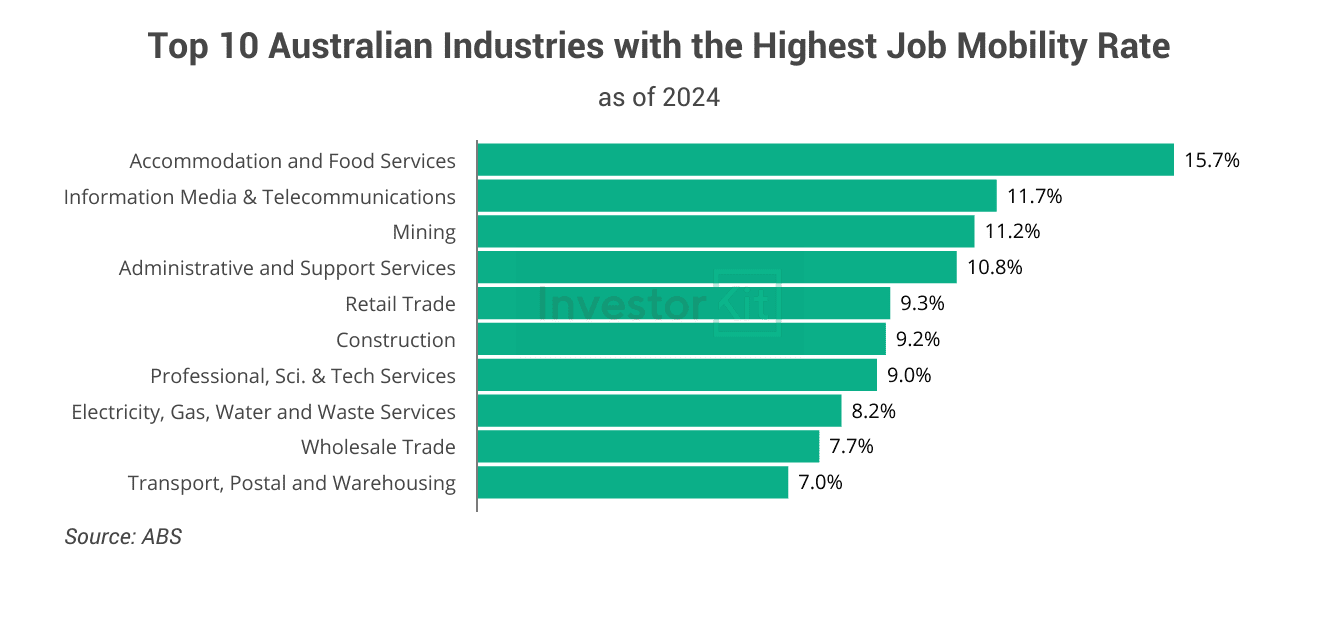

The accommodation and food services industry has the highest turnover rates in the country (see the chart below), resulting in transient workers and unstable rental demand.

For investors seeking long-term tenants, the above indicators are all red flags.

2. High Purchase Prices, Low Rental Yields

Yield, or rental return rate, is one of the most important factors that investors consider.

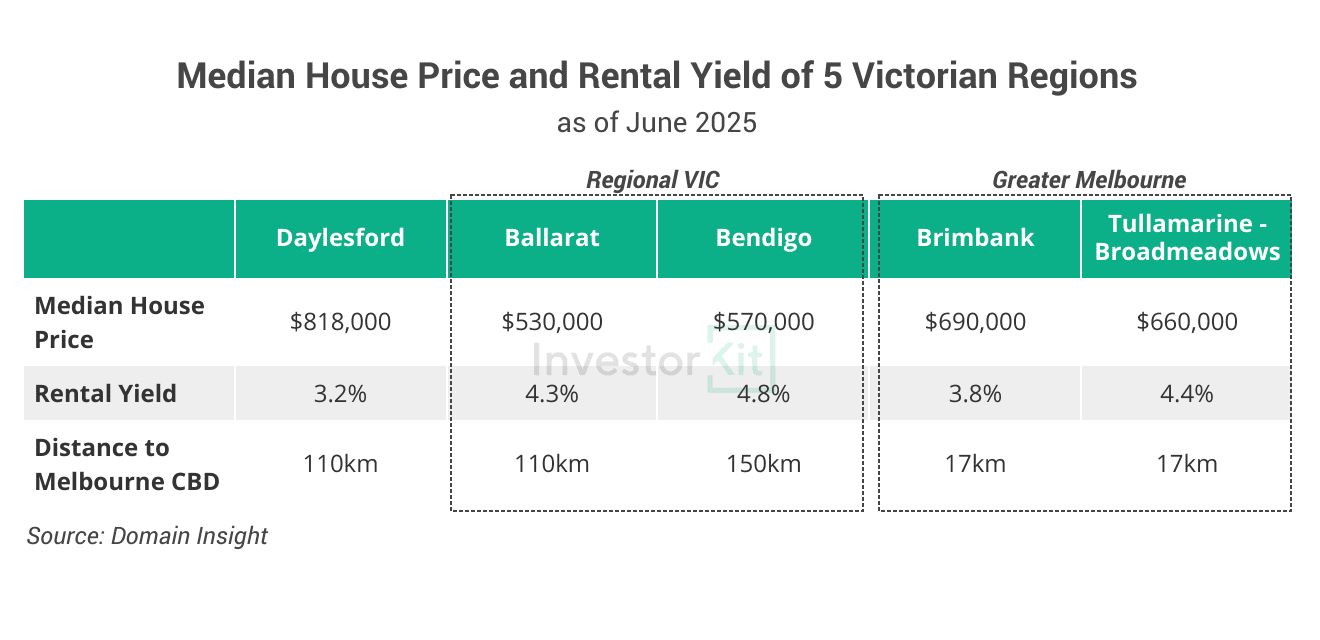

The median house price in Daylesford is $818,000, and the median rental price is $525 per week, resulting in a gross rental yield of 3.2%.

This rental yield is significantly lower than in other Victorian regional towns and many Melbourne sub-regions, which, at the same time, offer higher long-term rental demand and higher tenant stability. The table below shows some examples.

3. Lack of Suitable Stock

Even if you don’t mind the lower rental yield, good luck finding the right property quickly.

A quick scan of sold properties in the past 3 months would show that many homes are:

- Priced above $1 million (or even multi-million dollars)

- Uniquely renovated for short-term rental appeal

- On large parcels of land

These aren’t the bread-and-butter properties we typically source for long-term investors who need a balance between price, yield, and demand.

When you’re ready to buy an investment property, timing matters. Not only is sourcing the right property often exhausting, but getting into the market early maximises your exposure to compound growth. Unfortunately, Daylesford’s limited stock can significantly hinder your ability to act quickly and may cause unnecessary frustration.

What about Short-term Rental Investment?

Fair question. Daylesford’s spa culture and boutique tourism make it a natural fit for Airbnb.

Here’s what the data says for the Creswick–Daylesford–Ballan region (Jun 2024 to May 2025):

- Occupancy rate: approx. 49%

- Average daily rate: $335

- Annual revenue per listing: approx. $61K

At face value, that’s a 7-8% gross yield, 2 to 3 times the long-term rental returns. Sounds promising.

But short-term rental success comes with higher costs:

- Cleaning & consumables (approx. $150 per turnover, although your guests will share part of this cost)

- Utilities

- Maintenance & repairs

- Insurance

- Property management (15-20% of revenue, much higher than long-term rentals)

- Software, automation, guest comms, etc.

Additionally, as of 1 January 2025, a 7.5% short-stay levy has been implemented in Victoria.

Combined, these costs can consume 40-60% of your gross income, reducing your net yield to 3-5%, which no longer outperforms long-term rentals dramatically, but requires more work and bears higher volatility.

So, yes, short-term rental investment in Daylesford can work, but only if you execute it strategically and understand your numbers.

To summarise, not every town that trends on TV makes sense for investment.

Daylesford has charm, no doubt. But for property investors, that’s not enough. We need:

- Strong rental demand

- Healthy rental yields

- An abundance of suitable stock

In these areas, Daylesford underdelivers.

At InvestorKit, we don’t follow hype; We follow data. Our team supports clients from market selection and portfolio planning through to due diligence, acquisition, and negotiation.Ready to invest with strategy, not guesswork? Book a discovery call with us today, and let’s build your high-performance portfolio together!

.svg)