When it comes to property investing, myths are everywhere. One of the most common goes like this:

“The lower the renter percentage, the better. Less competition means safer investing.”

On the surface, it sounds logical. After all, who doesn’t want to buy in an area where you’re not competing with hundreds of other landlords?

But when you dig deeper, the truth is more complicated. Really low renter % suburbs can actually increase your risk, both as a landlord and when you eventually sell. Let’s unpack why.

Why really low renter percentage isn’t always a good thing

Rental demand goes hand-in-hand with supply

A low supply of rental stock doesn’t automatically equal strong demand. In fact, in many owner-occupier-heavy suburbs, the housing stock simply doesn’t appeal to renters.

Think oversized prestige homes with sprawling gardens, or properties in leafy enclaves far from employment hubs and public transport. Even if supply is “tight”, demand can be equally weak, leaving you with a smaller tenant pool than you’d like.

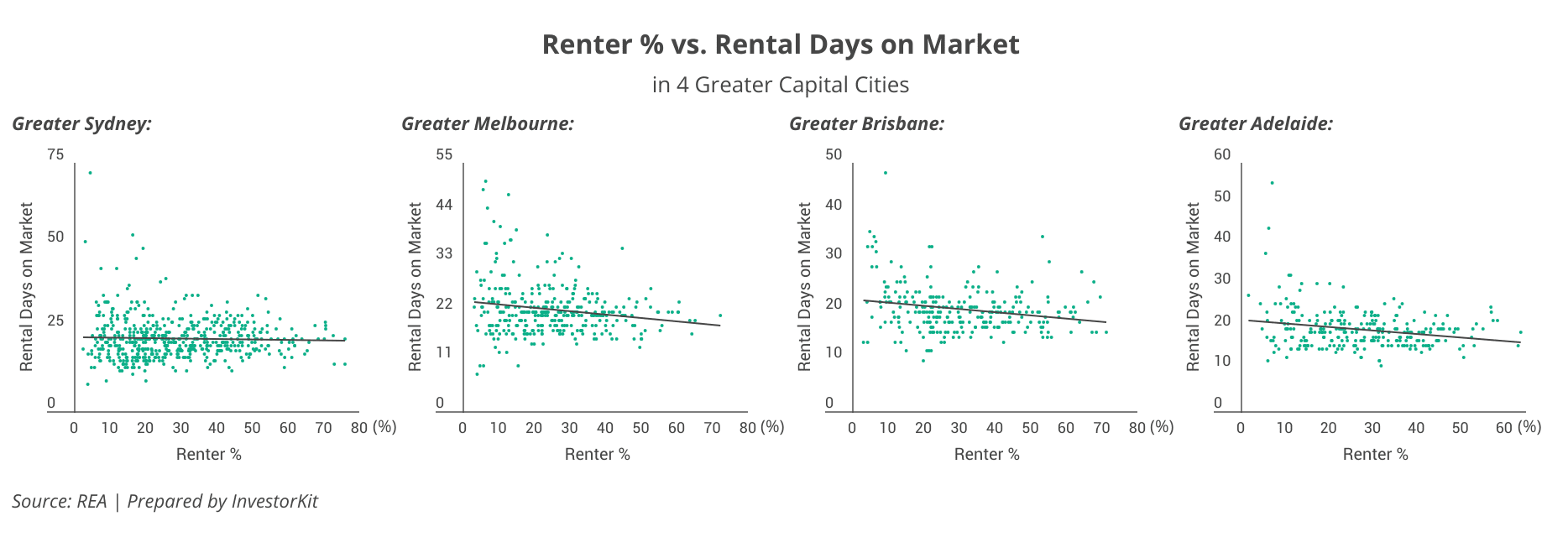

Rental days on market (DoM) is a useful indicator of rental demand. Longer rental DoM indicates lower rental demand and longer vacancy periods for landlords.

Let’s now examine the correlation between renter % and rental DoM in four major capital cities at the suburb level.

See the pattern? Suburbs with low renter % (particularly under 20%) are more likely to record high rental DoMs. By contrast, most higher renter % suburbs maintain relatively tight leasing times, except in Brisbane, where oversupplied suburbs (50%+ renters) begin to show higher DoMs.

The message? Low renter % can equal weak rental demand and higher vacancy risk.

Potentially high vacancy rates

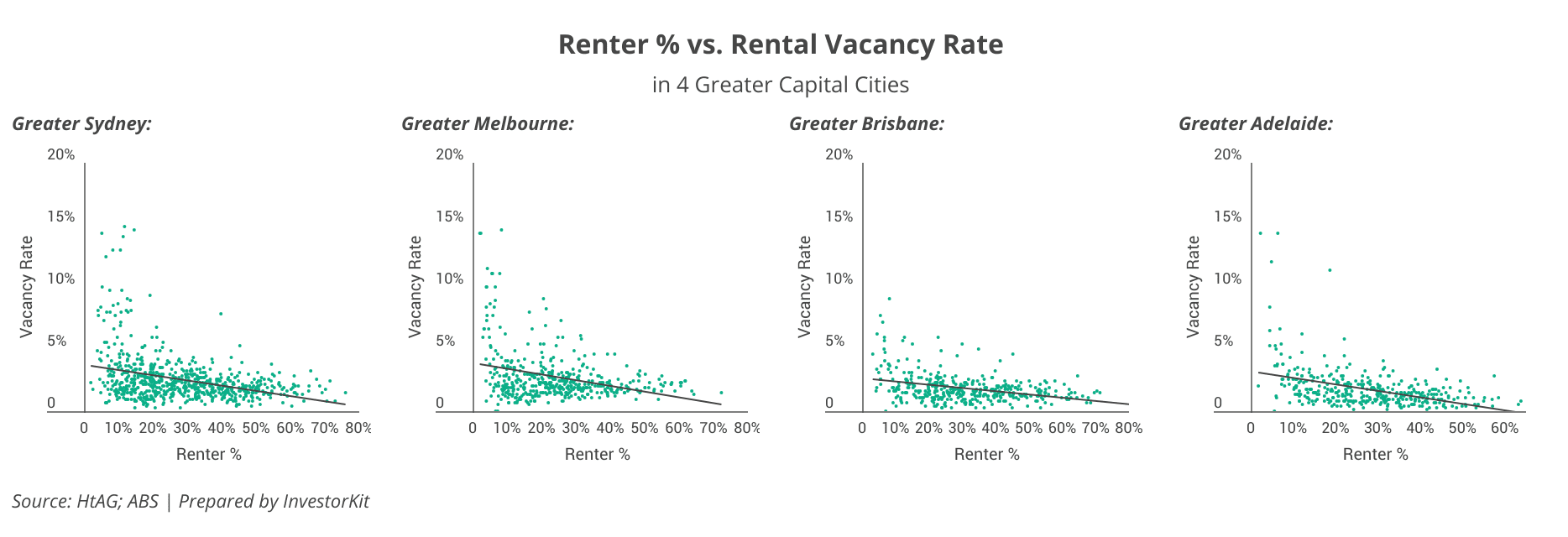

Vacancy rate is another good indicator of rental demand. The charts below show the correlation between renter % and vacancy rate at the suburb level in the four capital cities.

The pattern repeats: Suburbs with extremely low renter % show more outliers with elevated vacancy.

Also, a significant declining trend can be seen in all four cities: As renter % rises, vacancy generally falls. This is because higher renter % suburbs are usually closer to jobs, transport, or lifestyle hubs that renters actually want. In other words, a high renter % is usually driven by high rental demand.

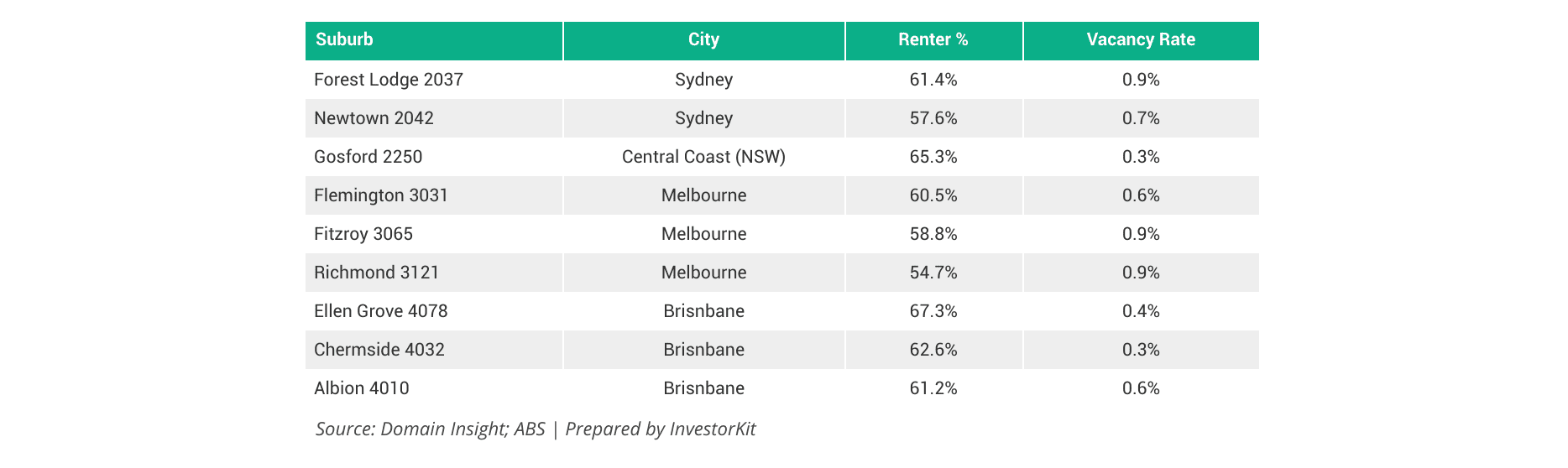

The table below shows some examples of such high-rental-demand suburbs:

Liquidity challenges

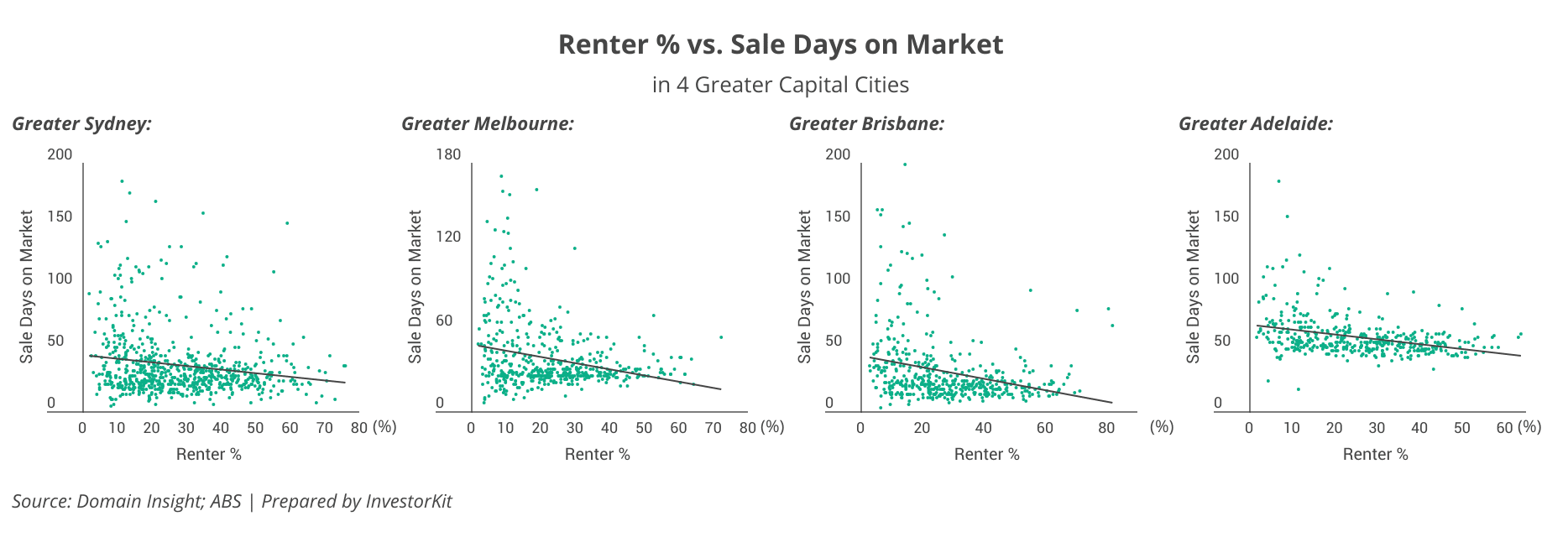

Property investing isn’t just about buying well; it’s also about having a solid exit strategy. In low renter % suburbs, the buyer pool is dominated by emotional owner-occupiers who may take longer to decide. That can mean longer sale campaigns, or worse, missing opportunities because your capital is tied up in a property that takes too long to sell.

Data confirms this. The charts below show the correlation between renter % and sale days on market in the same four capital cities.

The trends are again quite pronounced: Suburbs with very low renter percentages are more likely to record longer sale days on market. In Sydney, Melbourne, and Brisbane, while the lower bound of DoM tends to rise slightly as renter % increases, it generally remains in a relatively tight range, rather than surging dramatically.

The Other Extreme: Too Many Renters Bring Their Own Risks

Of course, this doesn’t mean investors should flock to high-renter % suburbs either. Some suburbs with a high renter percentage may face oversupply, transient tenant bases, and weaker community stability.

Take the Melbourne suburb of Carlton. Its renter % is 72.3% and vacancy rate, as of mid-2025, sits at 4%, much higher than Melbourne’s average. Why?

- Students dominate the rental market, creating seasonal demand fluctuations and high tenant turnover;

- A large number of apartment buildings were built over the past decade, leading to an oversupply issue.

The lesson is, extremes on either end, very low or very high renter %, could carry risk. So, what’s the sweet spot? A balanced market where there are:

- Enough renters to provide steady demand and yield;

- Not too much rental supply to maintain a competitive market.

The bigger picture

It’s also important to always remember: renter percentage should never be the sole factor in your investment decision.

We’ve written before about this exact point: Does Renter Percentage Matter for Property Growth? The answer is clear: It matters in some cases, but only as part of the bigger picture. The property market is driven by many factors, among which economic strength and the demand and supply relationship in both the sales and rental markets are vital for performance. Renter percentage is helpful as a reference for risk management, but it is not fundamental.

At InvestorKit, we don’t fall for myths or surface-level stats. Renter % is just one of dozens of data points we monitor in market assessment. We layer it with affordability levels, economic drivers, market pressure signals (demand vs. supply), building activities, etc., to find locations that can deliver growth in the upswing and resilience in the downturn.

If you’re tired of noise, myths, and guesswork, it’s time to get data-driven clarity. Book your free 15-minute discovery call today, and let’s map your next step toward building a resilient, high-performing property portfolio.

.svg)