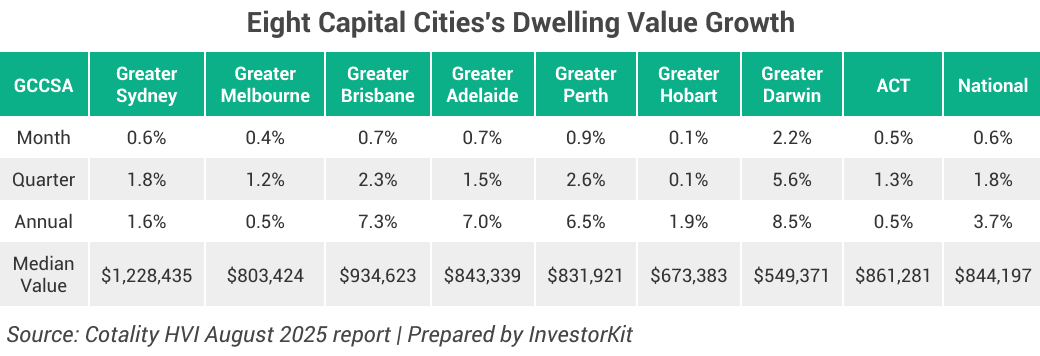

Moving into the second half of 2025, Australia’s housing market is gaining momentum across all capital cities. According to the latest Cotality Home Value Index report, national dwelling values rose 0.6% in July, marking the sixth consecutive month of growth.

The quarterly change of 1.8% indicates an increasingly optimistic market outlook. The July quarter was the strongest 3-month performance since 2024, suggesting that confidence is quietly returning to the market despite affordability constraints and high interest rates.

Value growth was recorded in all capitals

Across the board, every capital city recorded an increase in values in July, though not all markets are moving equally. Darwin leads the pack with a 2.2% rise in dwelling values, followed by Perth at 0.9%, and both Brisbane and Adelaide at 0.7%. Slower movers like Hobart and Melbourne also saw growth, albeit at a more subdued pace (0.4% and 0.1% respectively).

Low Supply is Boosting Buyer Confidence and Sustaining Price Pressure

The ongoing imbalance between demand and supply is a key driver behind the growth. National listings are around 19% below the 5-year average, while annual sales are 1.9% above average. The tension between demand and supply is pushing clearance rates higher, resurging buyer confidence and sustaining price pressure, especially in the undersupplied markets.

As Cotality’s research director, Tim Lawless, noted, while interest rates and affordability constraints remain present, investors are beginning to move again, slowly, but surely.

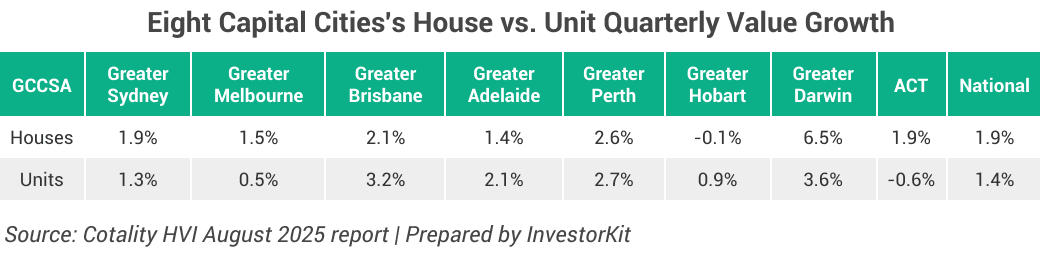

Houses Are Outpacing Units

Over the past three months, house values rose by 1.9%, compared to a 1.4% rise for units. This reflects an underlying shift in borrower preferences. Higher-income households, family buyers, and investors looking for longer-term capital growth are leaning toward houses.

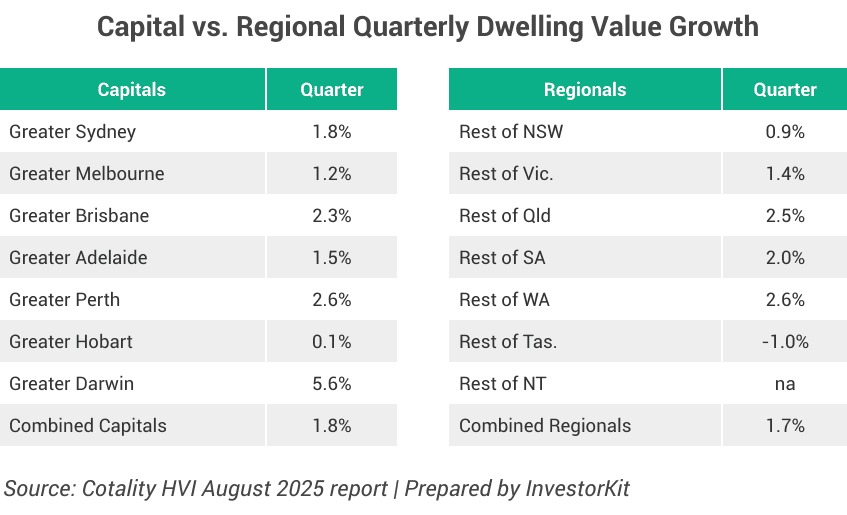

Regional vs Metro: The Capital Comeback

For much of the last few years, affordability and lifestyle shifts have driven buyers into regional markets. However, in a surprising turn, combined capital cities posted slightly stronger quarterly growth (1.8%) than regional areas (1.7%), reversing the long-standing trend of regional outperformance since the early pandemic. Still, regional markets in Victoria (1.4%), Queensland (2.5%), and South Australia (2.0%) continue to outperform their capital counterparts over the quarter.

Rental Growth Accelerates

Australia’s rental market is gaining strength, supported by historically low vacancy rates of around 1.7% in July and a resurgence in tenant demand, putting upward pressure on both house and unit rents. In the July quarter, seasonally adjusted house rents rose 1.1%, more than twice the increase seen in the previous quarter, while unit rents climbed 1.3%.

Across the capital cities, Darwin is at the top in annual rental growth, with house rents up 6.2% and unit rents soaring 9.2%, followed by Perth (4.7%) and Hobart (5.4%). In contrast, Melbourne remains the weakest rental market, with annual house rent growth at just 0.7% and unit rents climbing a modest 1.7%.

Source: Cotality HVI August 2025 Report

Housing Market Outlook: What Does It Mean for Investors?

Australia’s housing market is expected to see continuing growth through late 2025, supported by anticipated interest rate cuts, improved consumer sentiment, and persistently low housing supply. Core inflation has eased to 2.7%, opening the door for further rate reductions, which could boost borrowing power and buyer confidence.

Low supply is still a key driver of price growth, with limited new housing due to high construction costs and project delays. However, significant barriers remain. Affordability is stretched, with the national dwelling value-to-income ratio near record highs at 7.9. Elevated household debt is another constraint, with regulators closely watching credit conditions.

External risks like geopolitical tensions and slower population growth could also dampen demand. Still, with the balance tipping toward lower rates and constrained supply, the market is positioned for gradual gains, rather than dramatic surges, over the remainder of 2025.

If you’re considering buying a property, now is a strategic time to act. At InvestorKit, we’re dedicated to helping you identify high-performance markets and assisting you in making data-backed decisions to accelerate your portfolio’s growth. Would you like to talk to our experts? Get in touch today by clicking here to request a free, no-obligation 15-minute discovery call!

.svg)