Local economies and housing markets are closely intertwined.

A thriving or robustly recovering local economy is a necessary condition for a booming housing market, while a strong housing market can, in turn, stimulate broader economic growth.

In this blog, we explore three standout regions that are powering ahead: Greater Melbourne – Geelong, the Greater Newcastle region, and Toowoomba. Each represents a different growth phase: an Early Adopter market, a Second-Wind market, and a current Hotspot, respectively.

Let’s dive into their economic momentum and property fundamentals to understand what’s driving opportunity in 2025 and beyond.

Greater Melbourne – Geelong

Melbourne and Geelong’s Economy

The Greater Melbourne – Geelong region is showing steady economic growth momentum. Population growth is particularly impressive.

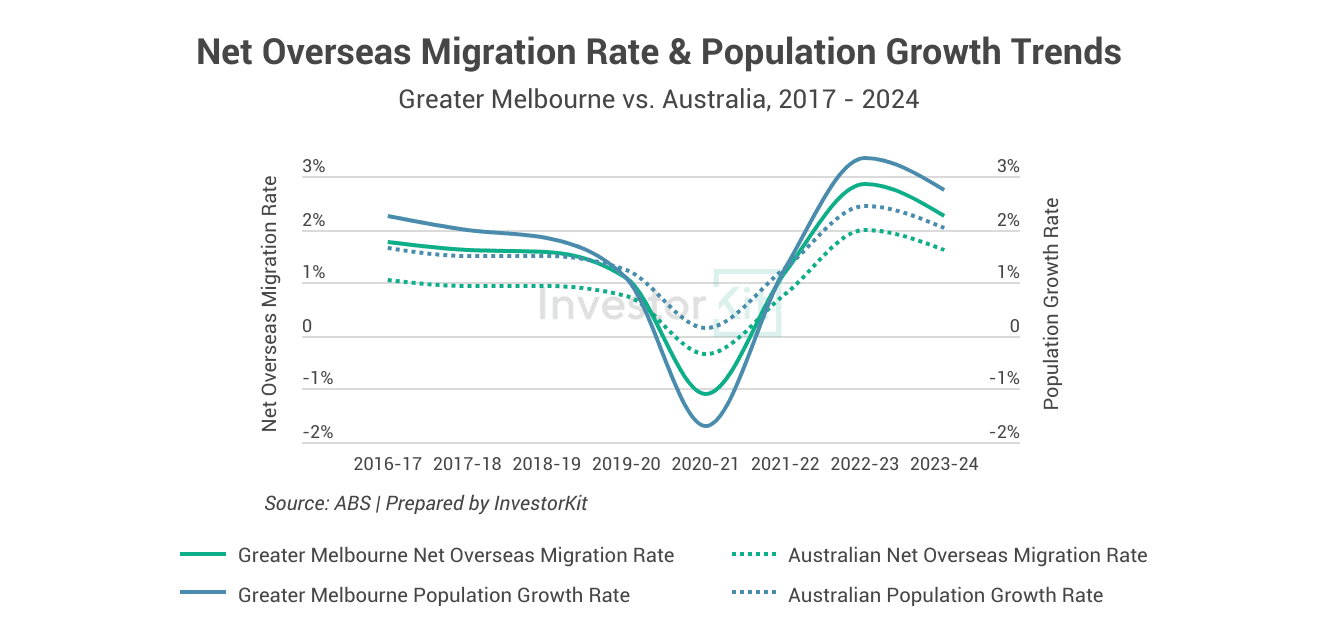

Greater Melbourne’s population growth continues to be driven by robust net overseas migration (see chart below).

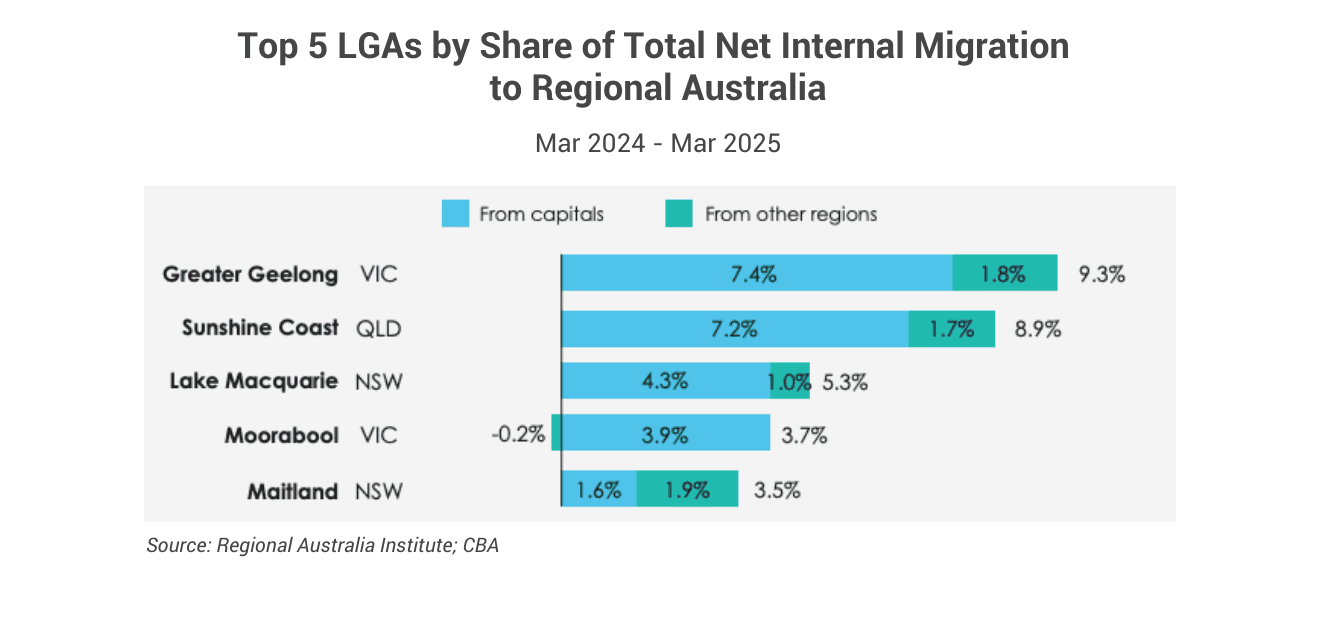

In the meantime, Geelong’s population growth benefits significantly from internal migration. The city ranks as the top internal migration destination among regional cities, according to the recent Regional Movers Index report (see chart below).

Large-scale infrastructure projects are reshaping the region. Below are five of the most significant projects, along with their estimated values.

- Suburban Rail Loop, $35 billion

- North East Link, $16 billion

- Biomedical Precinct Parkville, $14 billion

- Metro Tunnel Project, $13 billion

- West Gate Tunnel Project, $10 billion

These large-scale projects are expected to significantly enhance the employment, liveability, and connectivity of the Melbourne-Geelong metropolitan area, driving broader economic growth.

Melbourne and Geelong Property Market Conditions

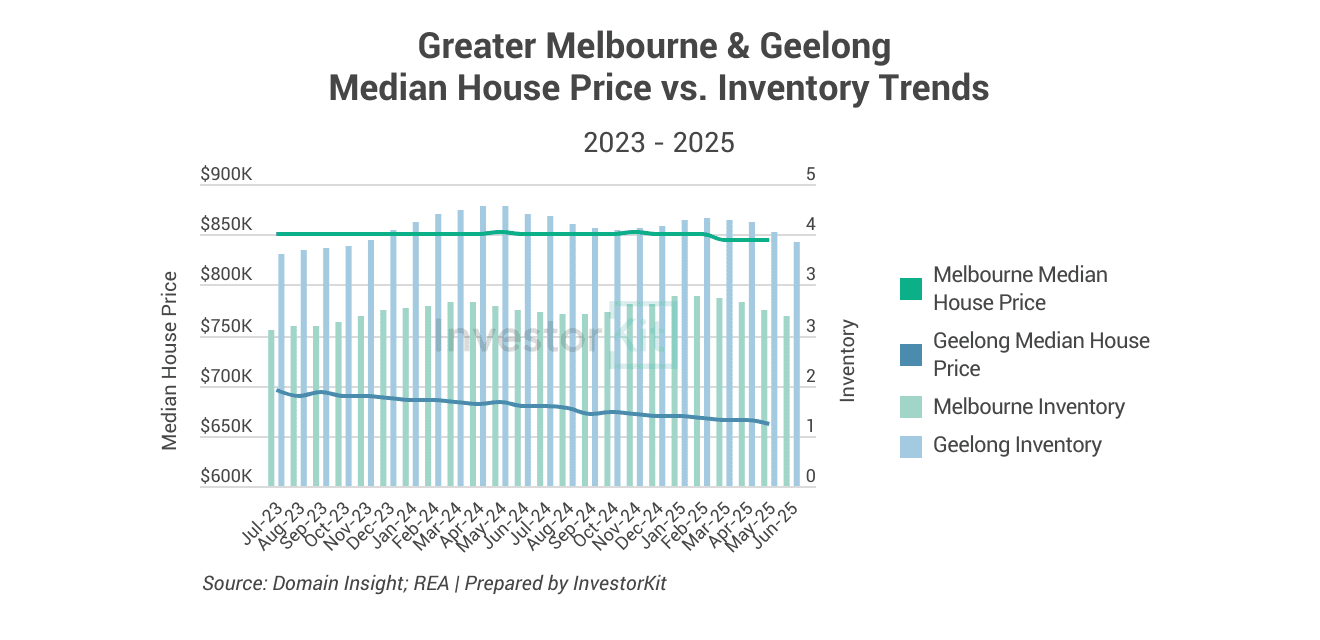

Melbourne and Geelong’s property markets are both early adopters: prices haven’t increased over the past two years but are now showing signs of recovery. One of the signs is the decline in inventory levels, as shown in the chart below.

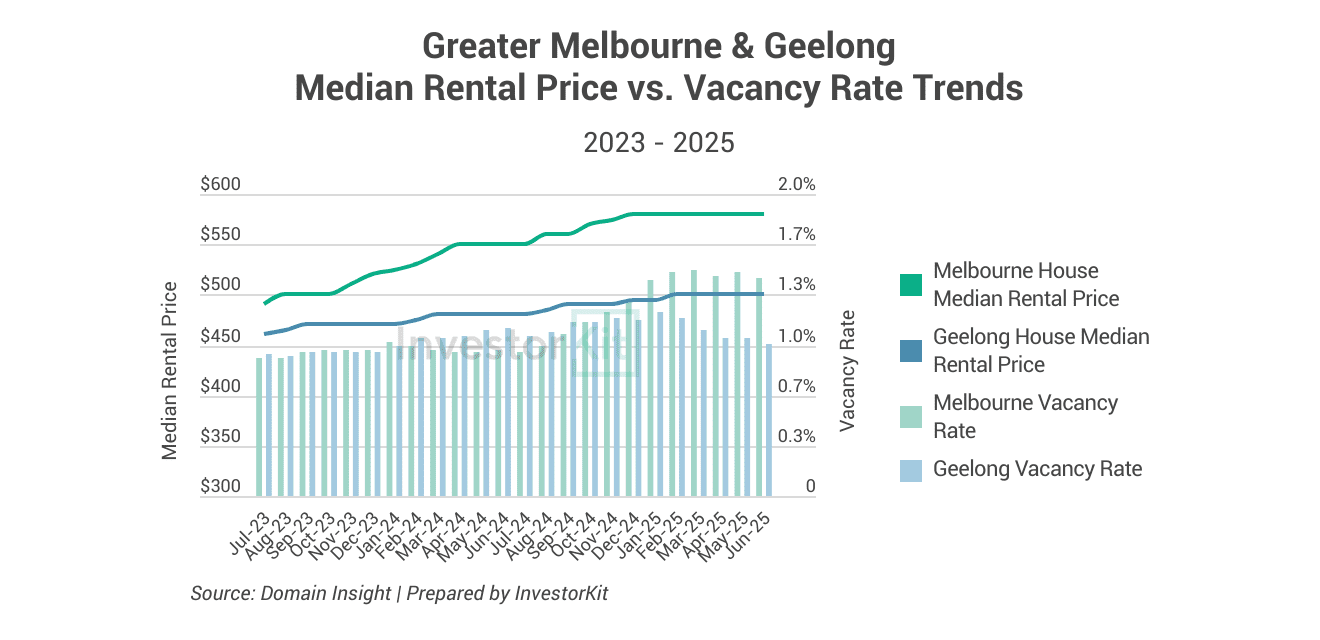

Rental conditions vary across submarkets. While the inner-city and middle-ring suburbs’ rental markets have been tight, vacancy rates surged in many outer suburbs of Melbourne (especially in the west) and Geelong in the second half of 2024, leading to slower rental growth. That was likely due to the large number of new builds flocking to the market. As the population continues growing robustly, new demand is gradually absorbing the excessive supply, driving vacancy rates down over time (see chart below).

Melbourne and Geelong’s property markets are Early Adopters in recovery. The robust population growth and heavy infrastructure investment are poised to fuel their rebound.

The Greater Newcastle Region

Newcastle’s Economy

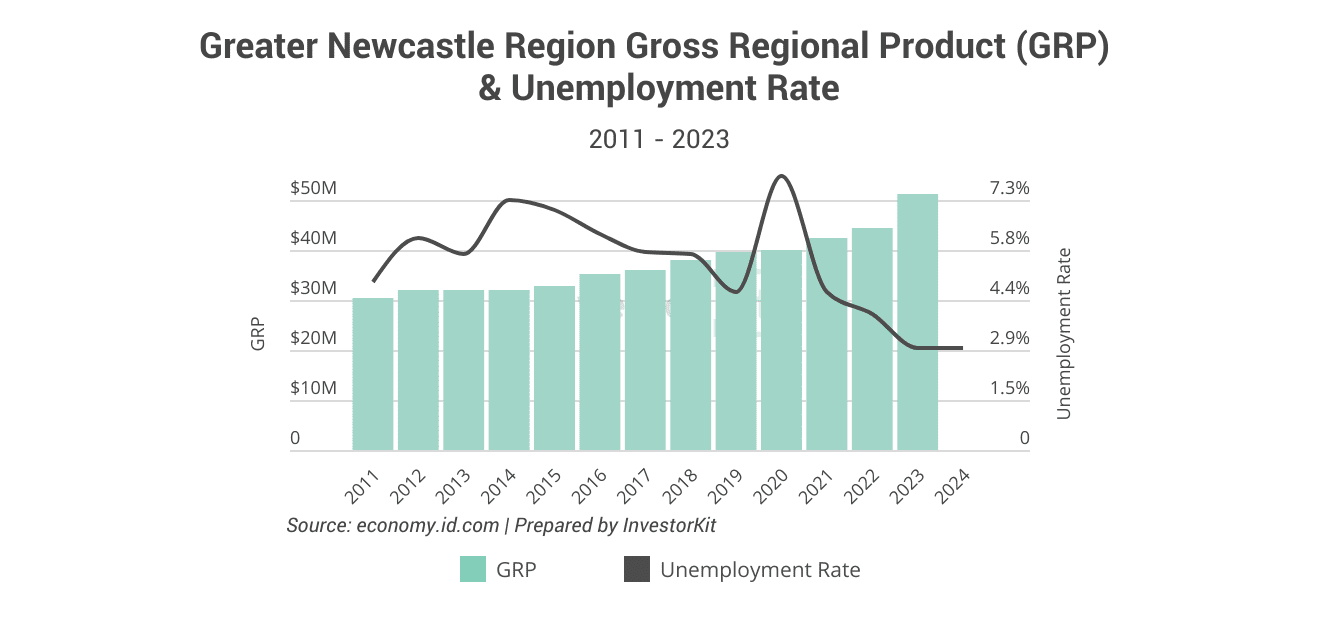

The Greater Newcastle region’s economic growth has accelerated since 2020, with Gross Regional Product (GRP) rising steadily, population growth gaining pace, and unemployment remaining at historically low levels (see chart below). This booming economy is underpinned by significant transport infrastructure upgrades and innovation-driven job creation projects, such as the Astra Aerolab, which are positioning the region as the “epicentre of Australian aerospace and defence”.

Newcastle Property Market Conditions

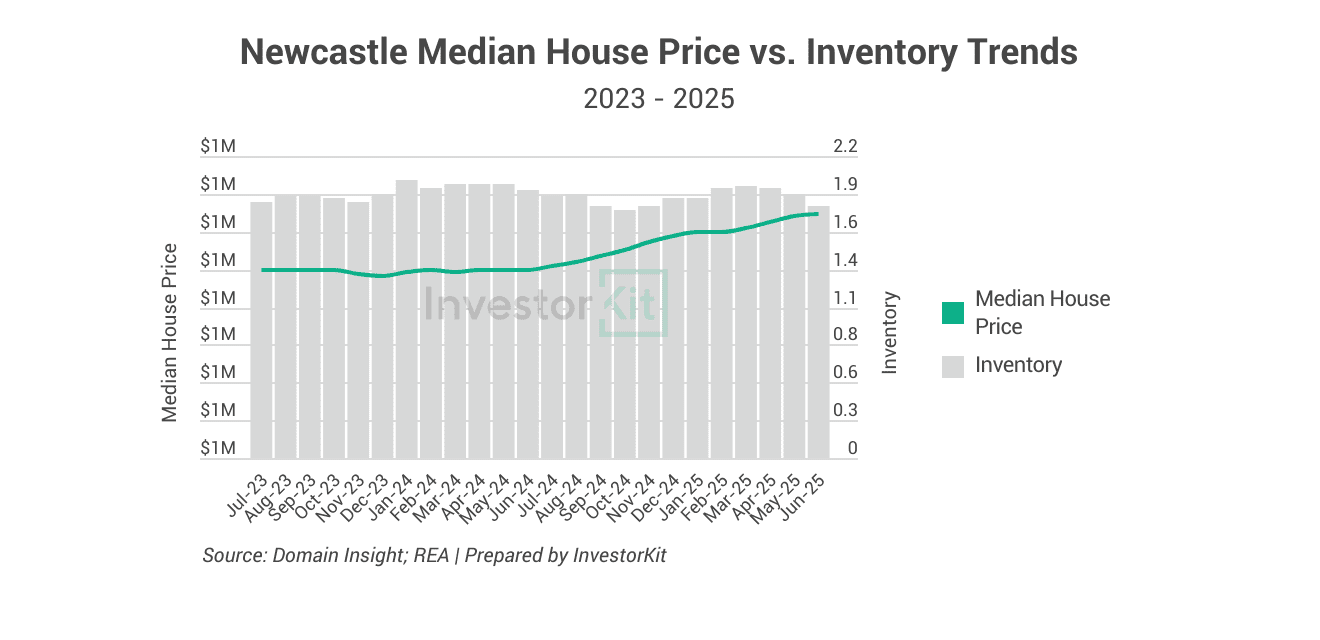

Newcastle is a Second-Wind market that has regained momentum since the second half of 2024, recording 8.5% growth in the past year. The healthy growth is supported by the region’s persistently low supply level: inventory has always been lower than 2 months’ worth of stock (see chart below), meaning prices tend to respond quickly when demand improves.

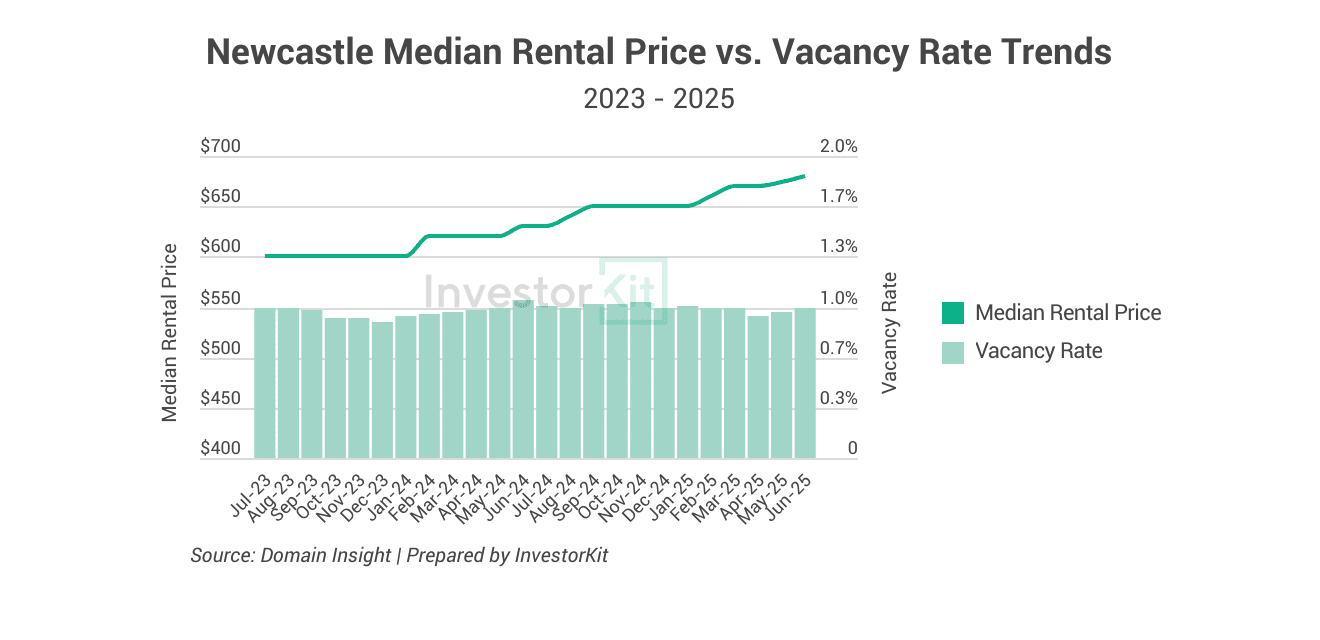

Rental market remains tight, too, with vacancy rates hovering around 1%. Rents have been rising steadily over the past year, achieving an 8.1% annual growth.

In the year ahead, the Newcastle region is expected to maintain its momentum, benefiting from the combination of a thriving local economy, declining interest rates, and investment demand from Sydney, which is driven by higher rental return rates.

Toowoomba

Toowoomba’s Economy

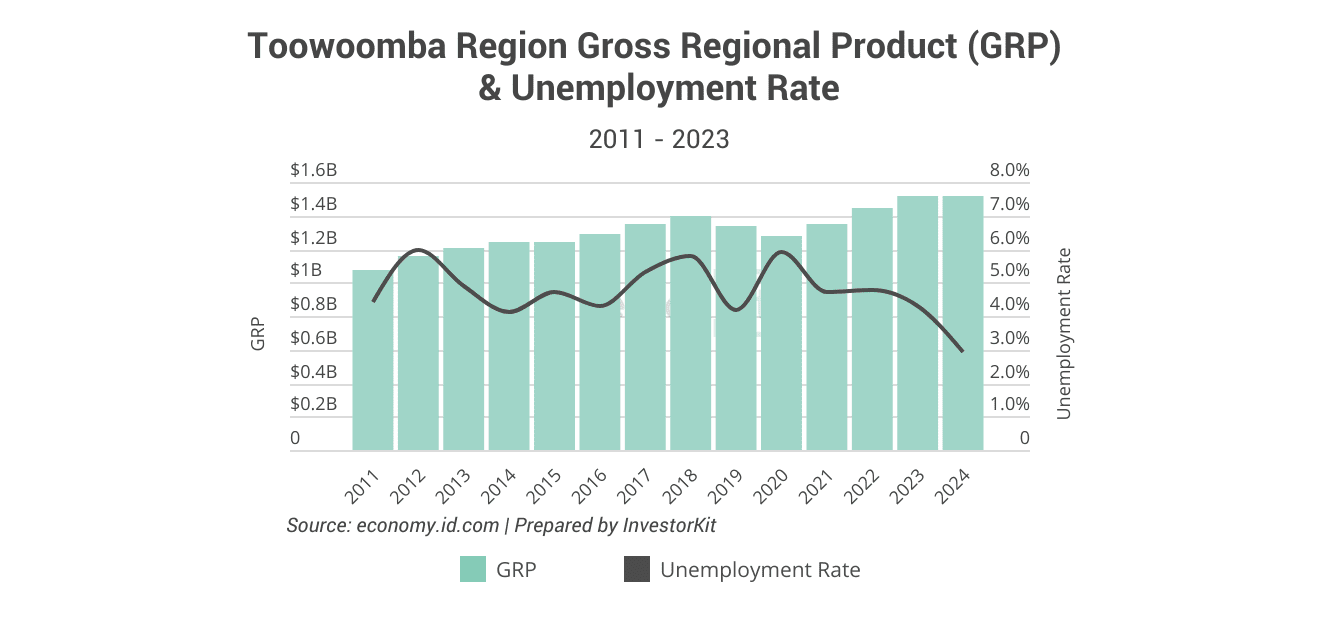

Toowoomba’s local economy has returned to strong growth since 2021, recording 18% Gross Regional Product (GRP) growth over the 4 years from 2020 to 2024. In addition to this high growth rate, the city is also experiencing rapidly declining unemployment rates (see chart below), despite high interest rate headwinds, alongside healthy population growth.

Toowoomba Property Market Conditions

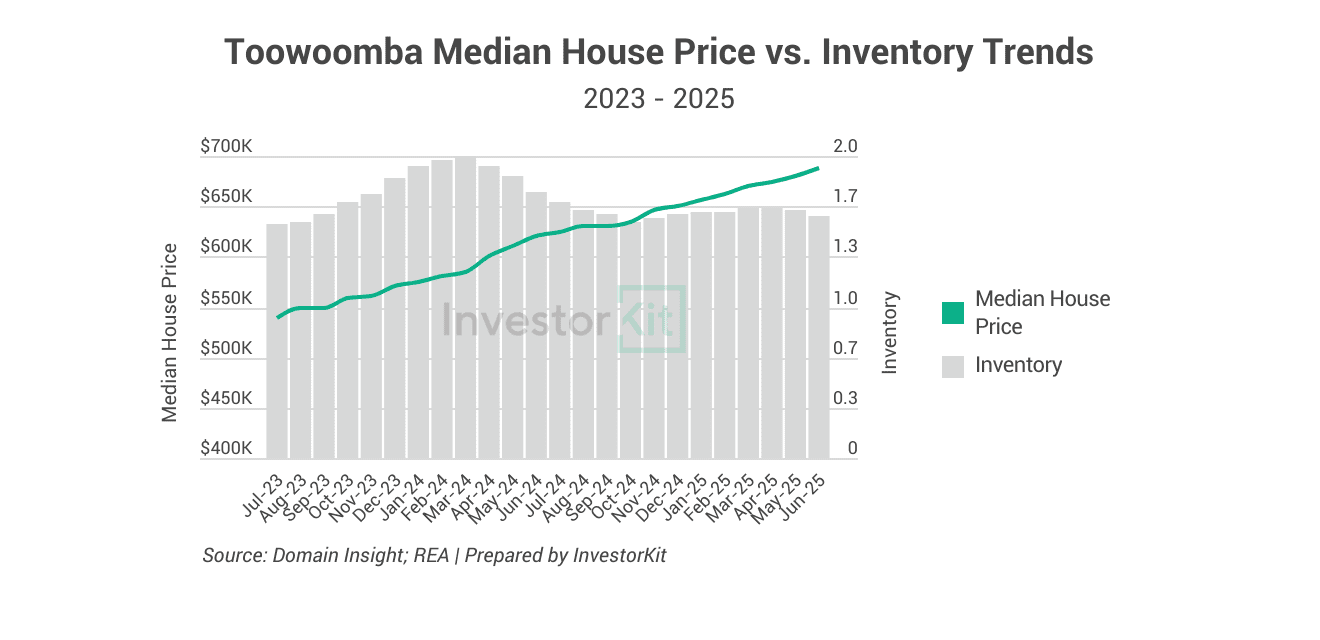

Toowoomba remains a hotspot market, despite having achieved double-digit growth for five years in a row. The market is still tight with an inventory well below 2 months’ worth of stock (see chart below). Prices rose by 11% last year and are showing no signs of slowing.

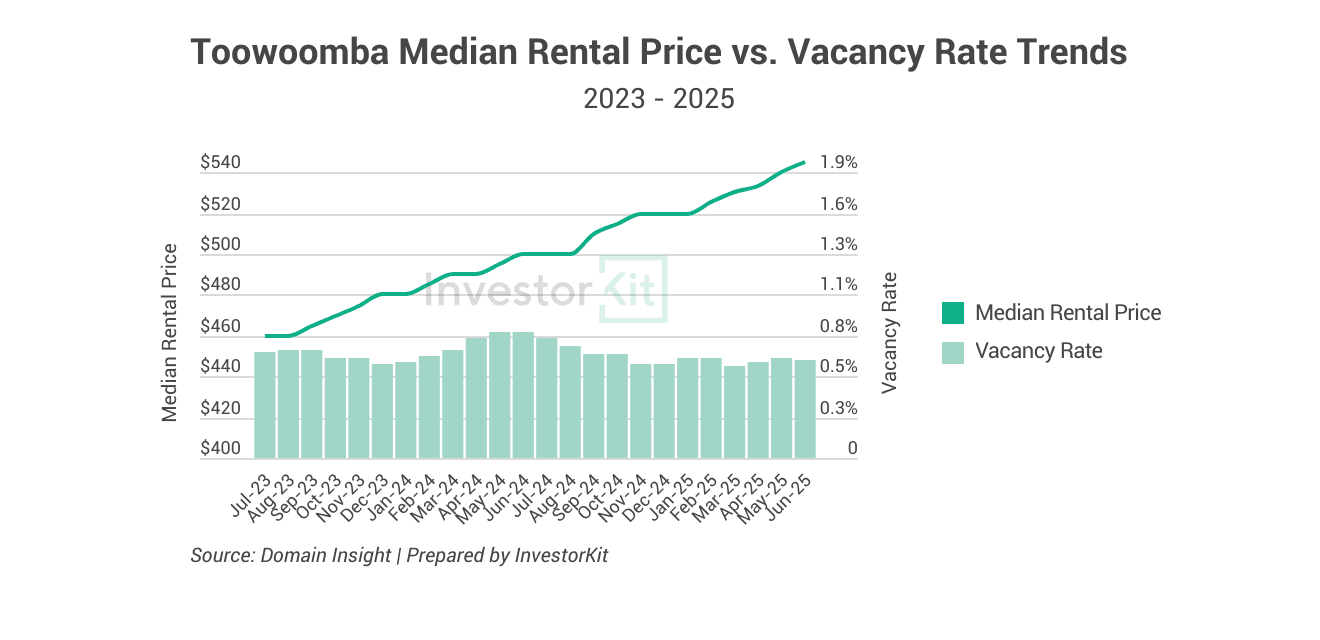

Rental market conditions are even tighter. Vacancy rates are well below 1%, while rents have increased by 8.2% year-on-year. These figures highlight intense rental pressure and high demand for housing.

While no market sustains double-digit growth indefinitely, Toowoomba is well-positioned for continued healthy performance even after the current boom, thanks to its thriving local economy, active job market and high housing demand.

From Greater Melbourne-Geelong’s strong population growth and heavy infrastructure investment, to the robust GRP growth and active job markets in Newcastle and Toowoomba, these cities are some great examples of how local economic strength can fuel property market performance.

The three cities are picked from InvestorKit’s whitepaper ‘10 of Australia’s Economic Powerhouse Cities’. Curious about the other 7 cities? Download your copy here!

At InvestorKit, we don’t just analyse property market trends; We monitor every key influencer, including local economic conditions, to provide a holistic view of each market. Want expert guidance on your investment journey? Book your FREE 15-minute discovery call today.

.svg)