At the start of 2025, the national housing outlook felt uncertain. Interest rates were high, sentiment was subdued, and momentum was concentrated in a handful of regional and affordable markets. Many investors were sitting on the sidelines, waiting for clarity. Now, as we enter 2026, the story has shifted: Australia is in the early stages of a broad-based upswing, and the data is making it harder to ignore.

What started as a patchy, affordability-driven rebound is now spreading across more markets as well as price brackets. In this post, we unpack the evidence behind this trend and what it means for investors ready to move with strategies rather than hype.

Inventory Is Tightening Nationwide

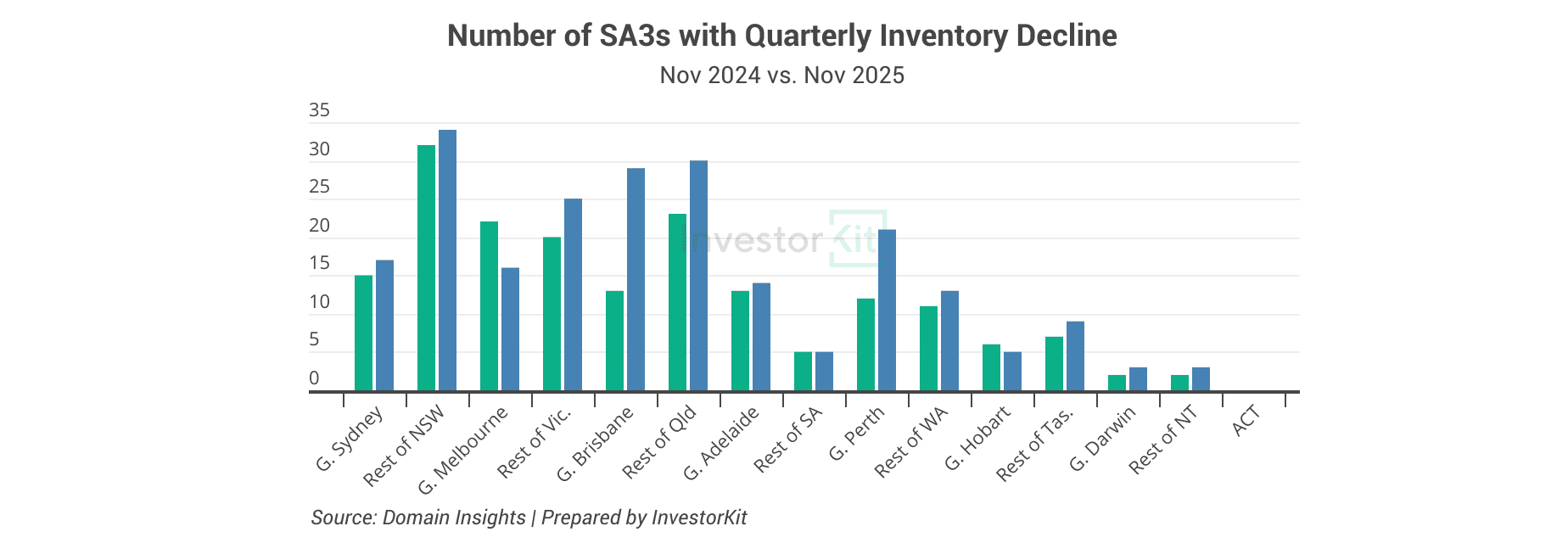

InvestorKit’s analysis of SA3-level markets shows a striking shift in supply dynamics. In almost every GCCSA (Greater Capital City Statistical Area), the number of SA3s with declining inventory rose between November 2024 and November 2025 (see chart below). This means that stock levels are falling in more locations across the country, a classic signal that demand is outpacing supply.

Two key trends stand out:

- QLD and WA are seeing a significant lift in supply constraints, with a substantial increase in the number of SA3s experiencing falling stock levels. SA, while not showing further tightening this year, continues to operate under already-high levels of supply pressure, indicating sustained heat rather than cooling.

- In NSW and VIC, only around 40% of SA3s in Greater Sydney and Greater Melbourne are currently experiencing inventory declines. However, in the regional parts, that number has jumped to approximately 80% (NSW) and 96% (VIC). This highlights that the recovery trend is more advanced in regional markets in the two largest states.

The takeaway? Even in slower-moving states, the pressure is building. And in the tightest markets, heat hasn’t cooled, but is compounding.

Price Growth Is Re-Accelerating in Most GCCSA Regions

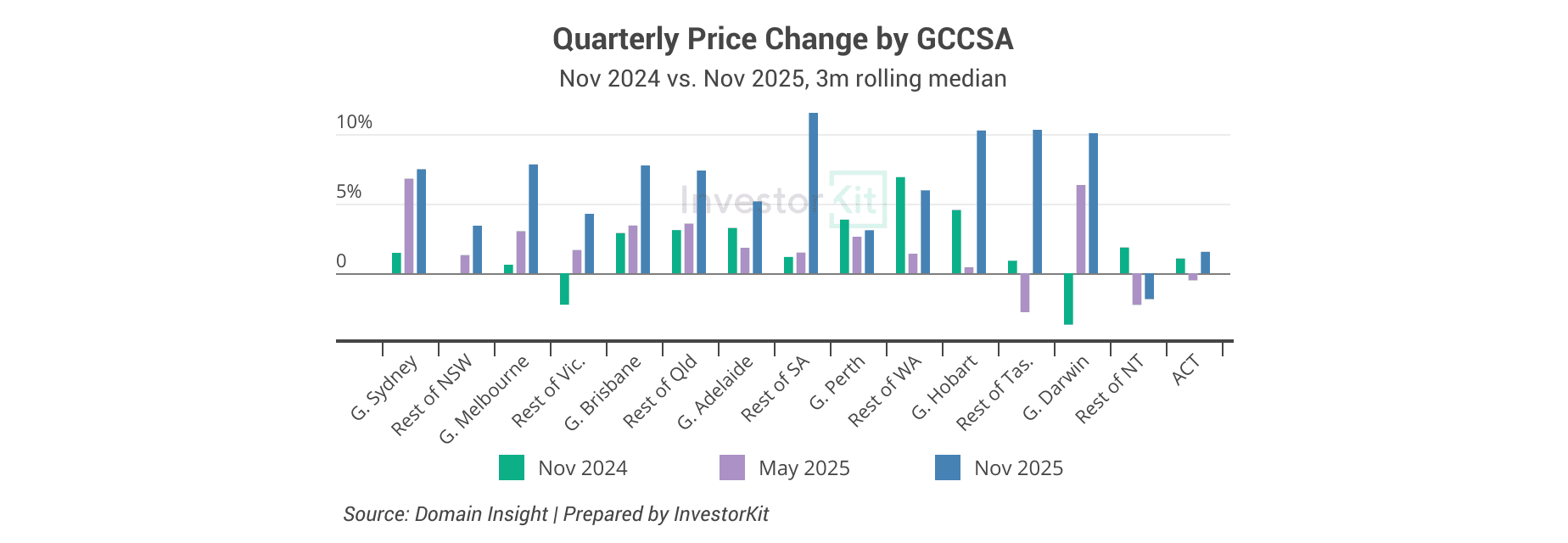

The second sign of a nationwide upswing is in quarterly price movement.

As of Q4 2025, most Greater Capital City regions are now seeing stronger quarterly growth compared to both six and twelve months ago. Sydney, Melbourne, Hobart, and the ACT, all of which were subdued in early 2025, are showing clear signs of a turnaround (see chart below).

Interestingly, Perth and Regional WA are not growing at the same speed as this time last year, despite ongoing supply constraints. This could point to affordability ceilings being reached after years of rapid growth. Even so, price growth remains positive, just more stable.

What’s Driving the Shift?

Multiple factors are behind this broadening momentum:

- Improving Affordability: While rates remain elevated, the first round of rate cuts in 2025 has boosted borrowing power and buyer confidence.

- First-Home Buyer (FHB) Policy Support: The expansion of the 5% deposit scheme in October 2025 is lifting demand in key entry-level markets.

- Structural Undersupply: With for-sale listings still 24% below pre-COVID levels, even modest demand growth is enough to push prices up.

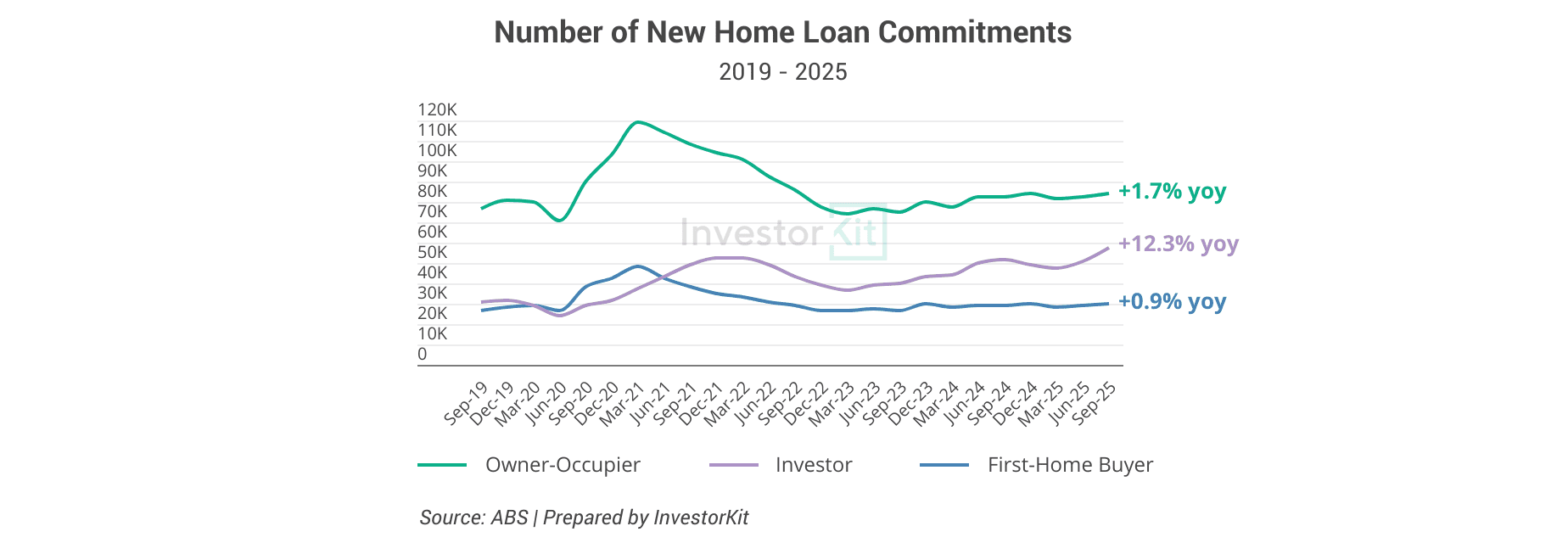

- Strengthening Investor Activity: Investor loan activity rose 12.3% over the year to September (see chart below), continuing an upward trend and signalling growing confidence in the market.

What This Means for Investors

The upswing is no longer a one-city or one-segment story. More markets are entering recovery mode, and competition is intensifying. But that doesn’t mean investors should blindly chase momentum.

In a broadening market, fundamentals matter more than ever. The smart move isn’t to buy where growth just happened; it’s to position yourself where supply is tight, demand is building, and affordability still supports long-term entry. Think of the current landscape not as a green light everywhere, but as a signal to look wider and act with clarity.

InvestorKit clients already know: data comes first, hype comes last.

This blog is just one piece of our flagship 2026 property market whitepaper. Download the full report, 7 Trends That Will Shape Australia’s Property Market in 2026, for deeper insights, charts, and strategic takeaways.

Want a clearer picture of where the fundamentals are strongest? Book a free discovery call with our team today and take the guesswork out of your next move.

.svg)