The RBA held rates steady last week.

No cut, no hike, just a steady hand in an uncertain economy.

And, as expected, the headlines rolled in:

‘Buyers, borrowers and sellers face tough property year after RBA holds.’

’Housing market tipped to cool as rate cut hopes diminish.’

But if you’re a property investor, here’s the better question to ask:

Do interest rates really control the market, or is that just another myth?

At InvestorKit, we don’t follow headlines. We follow data, demand, and behaviour. And in our latest whitepaper, 10 Cities That Will Benefit From Rate Cuts in 2026, we broke down five key ways rate movements influence property markets.

Here, we’re sharing three of the most impactful, so you can understand what really drives performance, and when.

1. Affordability Improvement: The Trigger That Starts It All

Affordability remains one of the most significant constraints across Australian markets. Even with modest cuts earlier this year, we’re still operating in a relatively high-rate environment, and serviceability remains tight. As a result, affordability remains one of the top factors shaping buyer behaviour.

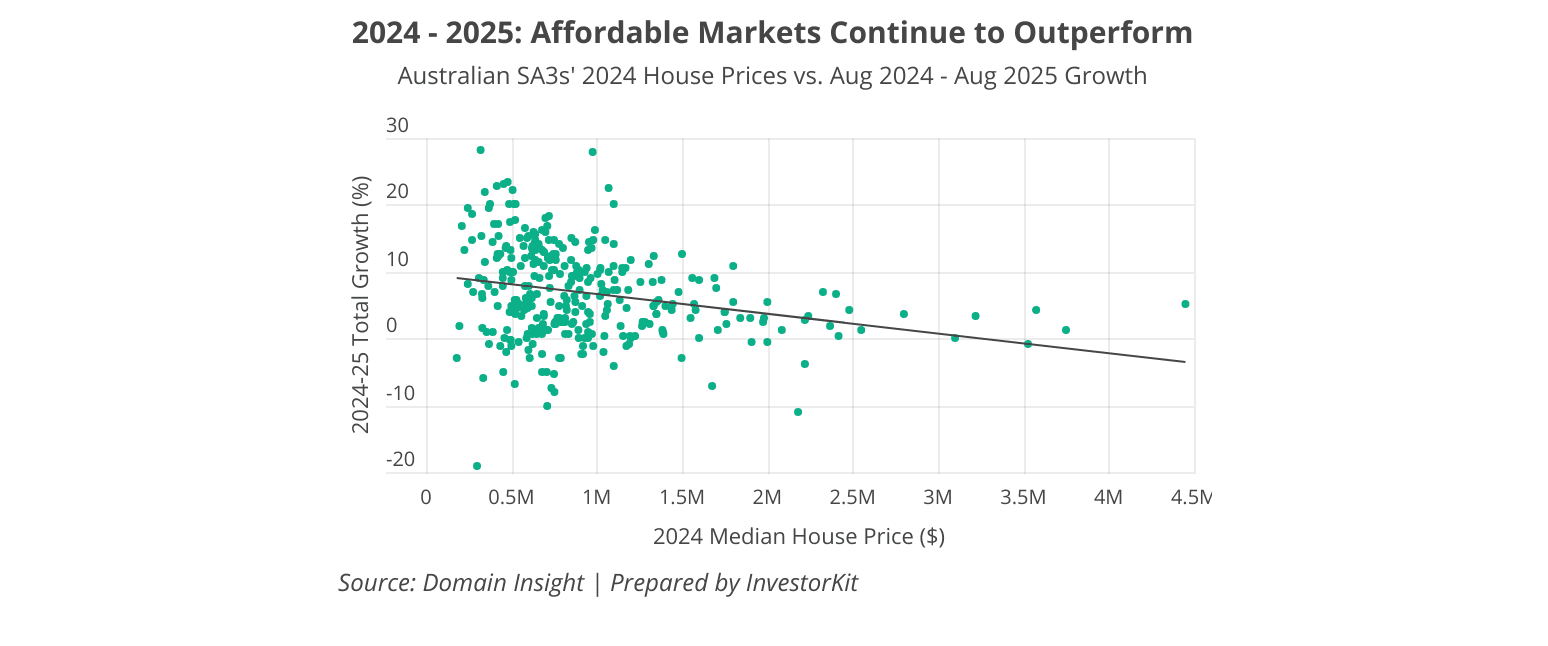

This is evident in the past year’s performance: from August 2024 to August 2025, many affordable markets have continued to outperform pricier ones, reflecting sustained demand where repayments remain within reach.

Further rate cuts are likely to continue improving affordability in two key ways:

a. Lower repayments and better serviceability – We measure market-level affordability through serviceability. With a further 0.5% cut, 12 SA3 regions would shift from “overvalued” (unaffordable) to “undervalued” (affordable). If rates fell by 1% in total, 14 additional regions could make the same transition, opening up previously unattainable markets to more buyers.

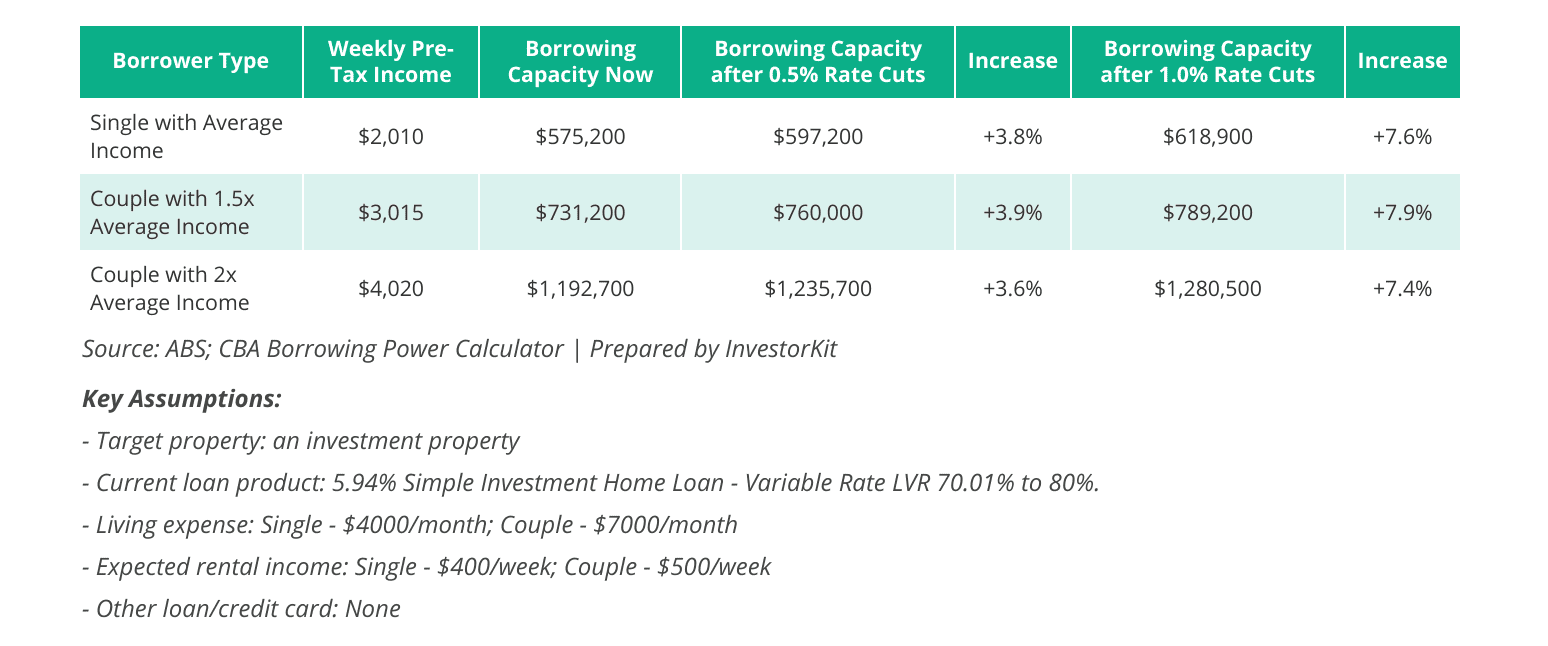

b. Higher borrowing capacity – Rate cuts also directly lift how much buyers can borrow. A further 0.5% reduction could increase borrowing capacity by 3.5% to 4%, while a 1% cut would lift capacity by close to 8%.

Together, these effects not only bring more buyers back into the market but also broaden affordability from entry-level markets to mid-tier locations, setting the stage for the next phase of growth.

2. Home-Buyer Activity Recovery Is Forming

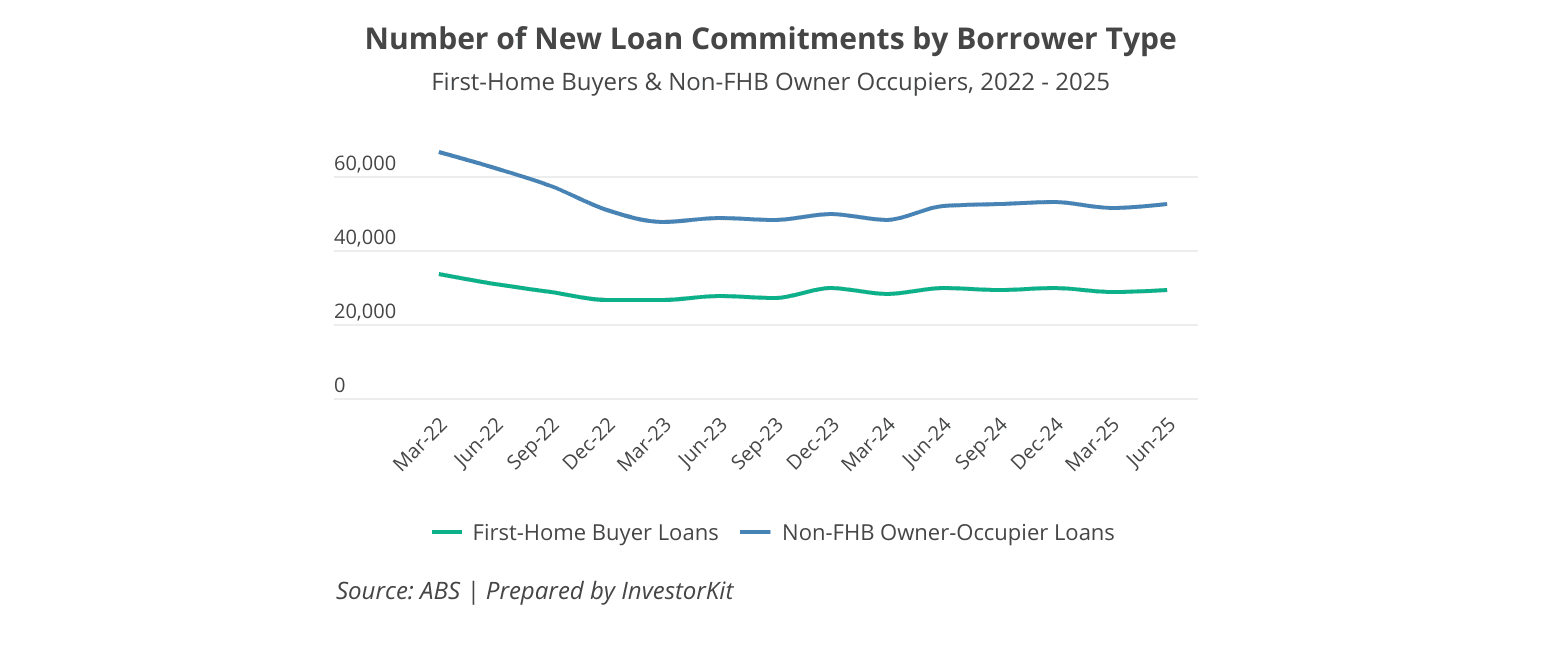

Over the past year (Aug 2024–Aug 2025), owner-occupier lending activity has remained relatively stable, with no significant lift among either upgraders or first-home buyers (top chart on the right). This stagnation suggests that the 75-basis-point cash rate reduction so far has not yet provided enough relief to meaningfully expand affordability or borrowing power.

However, as further rate cuts are anticipated over the coming year, the conditions for a home-buyer rebound are forming. The latest ABS lending data only captures the impact of the early-2025 rate reductions; more recent market effects are yet to be reflected.

In parallel, the rental market remains extremely tight. Vacancy rates have continued to decline through 2025, and rents are still rising across most regions. As rental costs climb while borrowing costs ease, many renters will begin reassessing the buy vs. rent equation, particularly those with stable incomes who have delayed entering the market over the past three years.

Together, these factors point to a gradual but strengthening recovery in home-buyer demand through 2026, led by first-home buyers seeking to escape record rents and supported by the renewed FHB assistance schemes, such as the expanded 5% deposit program.

3. Yield Requirements Are Easing, Reopening More Markets

A lower cash rate environment also reshapes investor preferences. When interest rates were elevated, investor demand was heavily skewed toward high-yield (5%+) markets, as these provided the best chance to maintain neutral cash flow.

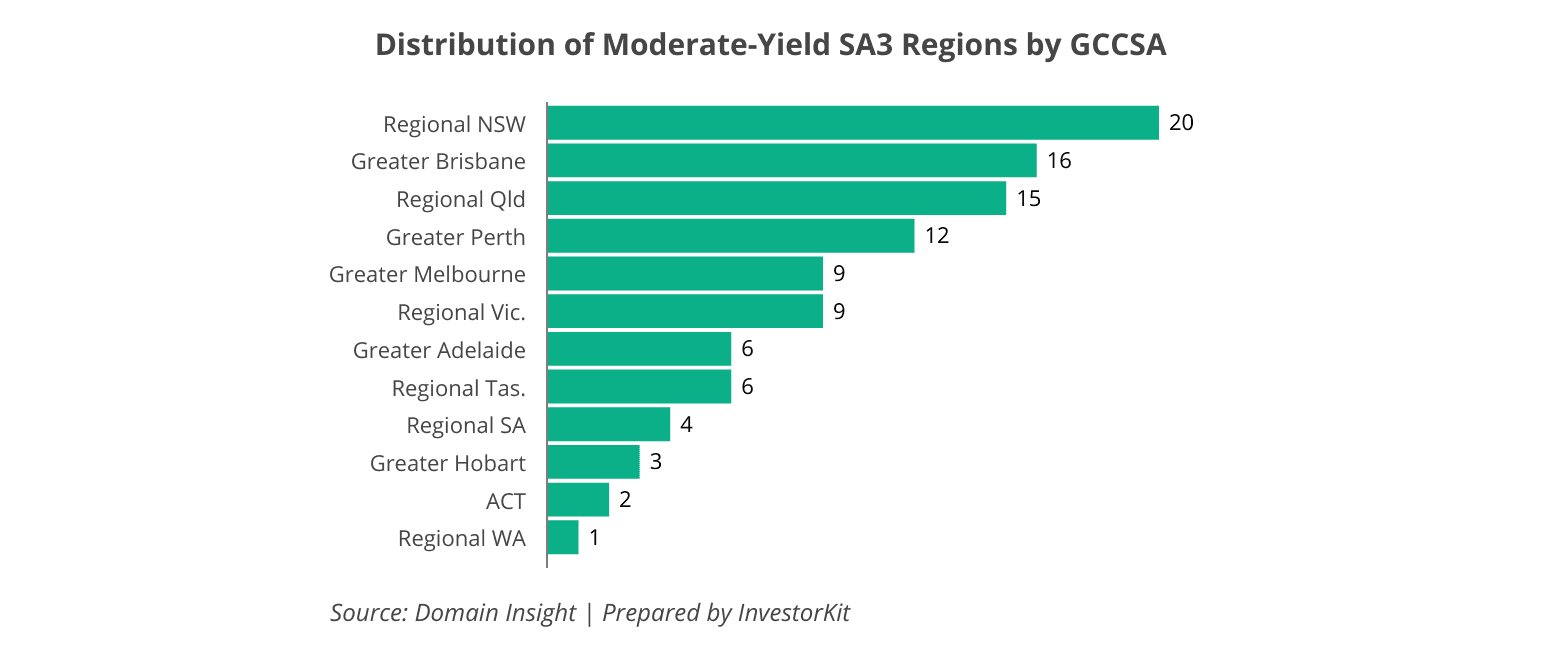

However, such opportunities were limited. Although around 83 of Australia’s 330+ SA3 regions offered yields above 5% in 2025, more than one third of them don’t have have diverse economies or active, sustainable property markets.

As borrowing costs continue to ease, the required yield threshold for balanced cash flow falls, making moderate-yield markets, typically in the 4%–5% range, far more attractive. As of H2 2025, about 103 regions sat in this band.

Importantly, many of these moderate-yield regions, particularly across Victoria and regional New South Wales, have underperformed during the past three years due to their cyclical downturn. Now, as these markets transition into the recovery phase, they offer investors not only improved cashflow potential but also favourable entry points for long-term capital growth.

In other words, rate cuts are not only improving the cashflow equation; they’re realigning the growth cycle, positioning previously overlooked markets for renewed performance.

So… Do Interest Rates Drive Property Growth?

They influence it, but not in the simplistic, cause-and-effect way often portrayed in the media.

Rate cuts don’t cause instant booms. What they do is changing the conditions. They improve serviceability; They restore options for borrowers; They reduce cash flow strain for investors. And when these changes interact with already-tight supply and strong local fundamentals, growth can follow.

Understanding how interest rates affect behaviour, not just metrics, is what separates average investors from strategic ones.

Want the Full Picture?

In our latest whitepaper, we unpack all five mechanisms that link interest rate changes to market performance, including two lesser-known catalysts that could shape the next phase of Australia’s property cycle.

We also reveal the 10 cities best positioned to benefit from these shifts in 2026 based on a full analysis of affordability, inventory, rental conditions, and demand pressure.

Download your free copy of the whitepaper now to see where the smart money is moving and how you can stay ahead of the curve.

At InvestorKit, we don’t chase headlines or follow hype. We’re a data-driven buyer’s agency that digs deep into fundamentals, analysing how each influencing factor truly impacts the property market.

This research-led approach helps our clients make strategic purchases based on facts, not FOMO, which is exactly why they have been able to consistently secure high-performing properties, even in uncertain times.

If you’re planning your next move and want a clear, expert voice in your corner, we’re here to help. Book your free 15-minute discovery call today and let’s explore how InvestorKit can support your next property purchase.

.svg)