Shepparton: The Food Bowl of Victoria

Situated in northern Victoria along the Goulburn River, Shepparton is renowned as the Food Bowl of the state, producing a large share of the nation’s fruit, dairy, and agricultural exports. Just over two hours north of Melbourne CBD, the city blends a strong regional economy, a diverse cultural community, and a growing healthcare and education hub. Its affordability, strong yields, transport links, ongoing infrastructure investment, and expanding industries make Shepparton an attractive location for families, workers, and investors alike.

But how does its property market perform? After a property boom in 2021 and 2022, growth has slowed. Will Shepparton’s market pick up pace in the year ahead? Join us today to explore the city’s current property market conditions and outlook!

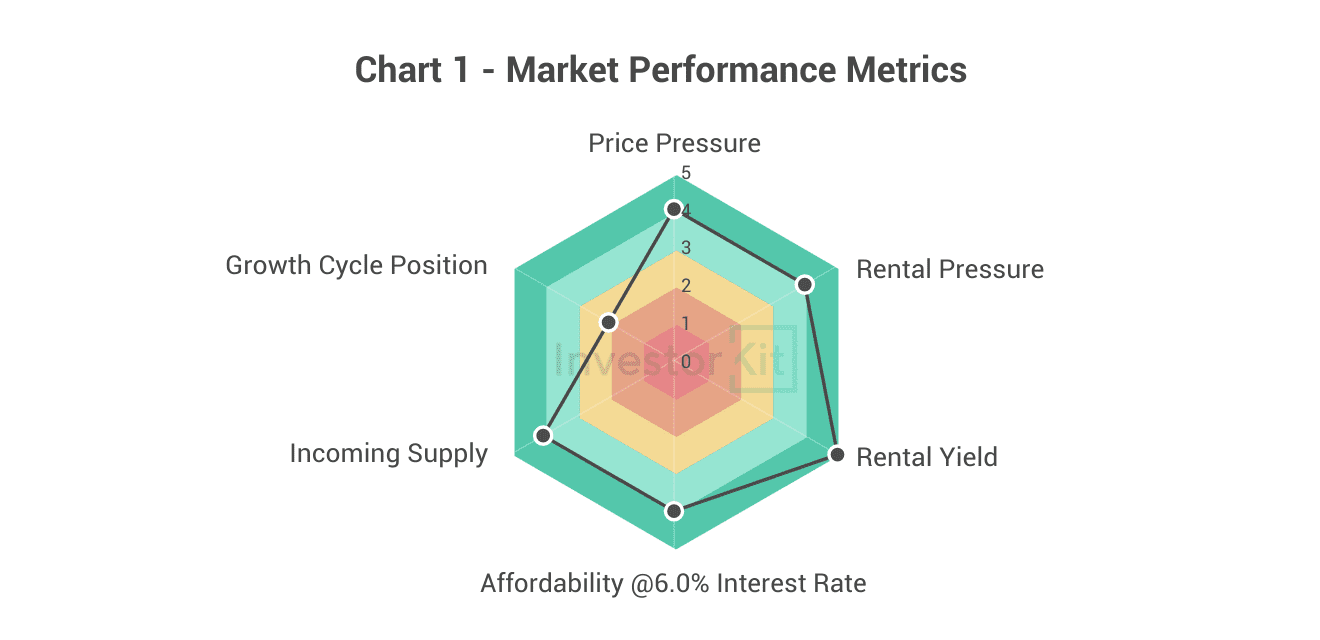

As of November 2025, Shepparton’s House Market Pressure is relatively high.

Among the six metrics that InvestorKit uses to measure market performance, Shepparton scores:

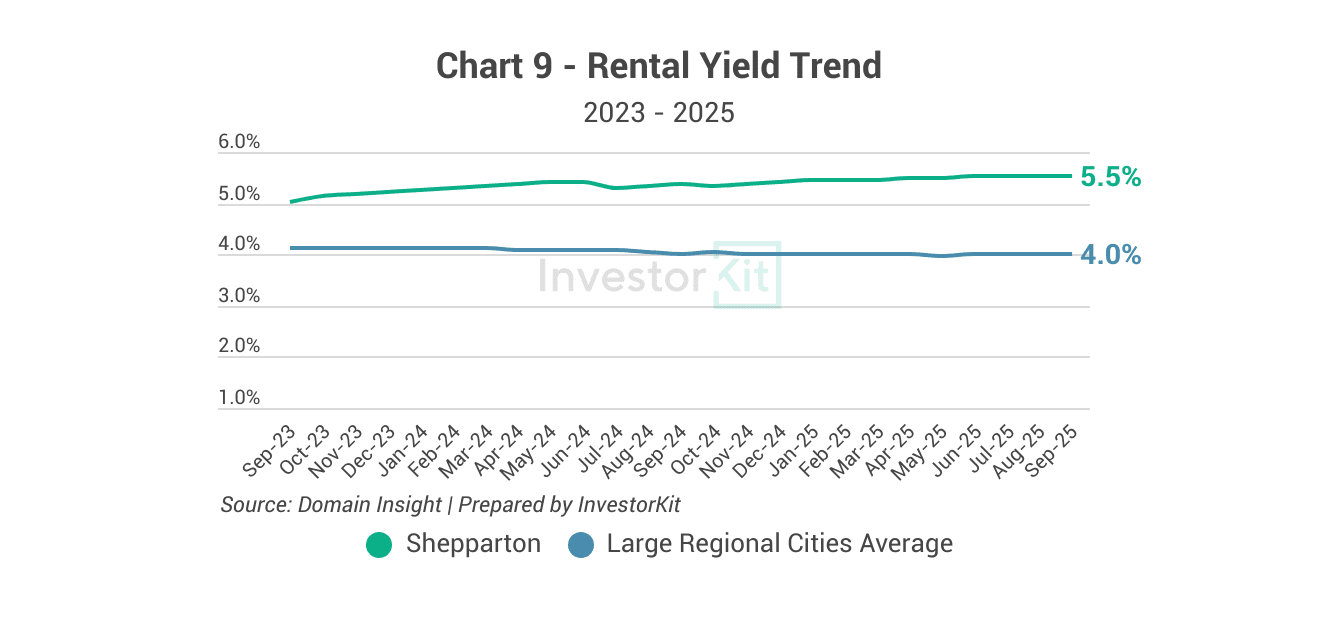

- 5 (very strong) in rental yield,

- 4 (strong) in price and rental pressure, affordability, and incoming supply,

- 2 (relatively weak) in the growth cycle.

Shepparton’s Demographic & Economic Trends

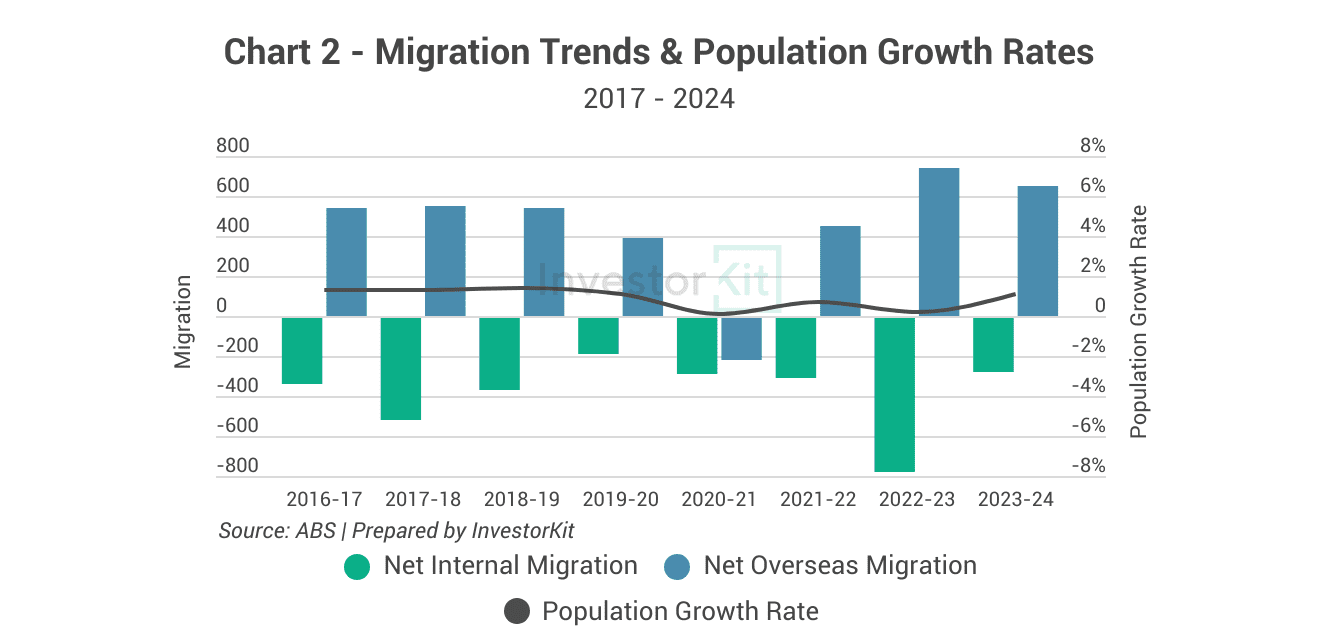

Shepparton’s population growth has been relatively stable over the past 7 years and largely driven by overseas migration. Its current population growth is 1.07%, slightly below the regional Victoria average of around 1.23%.

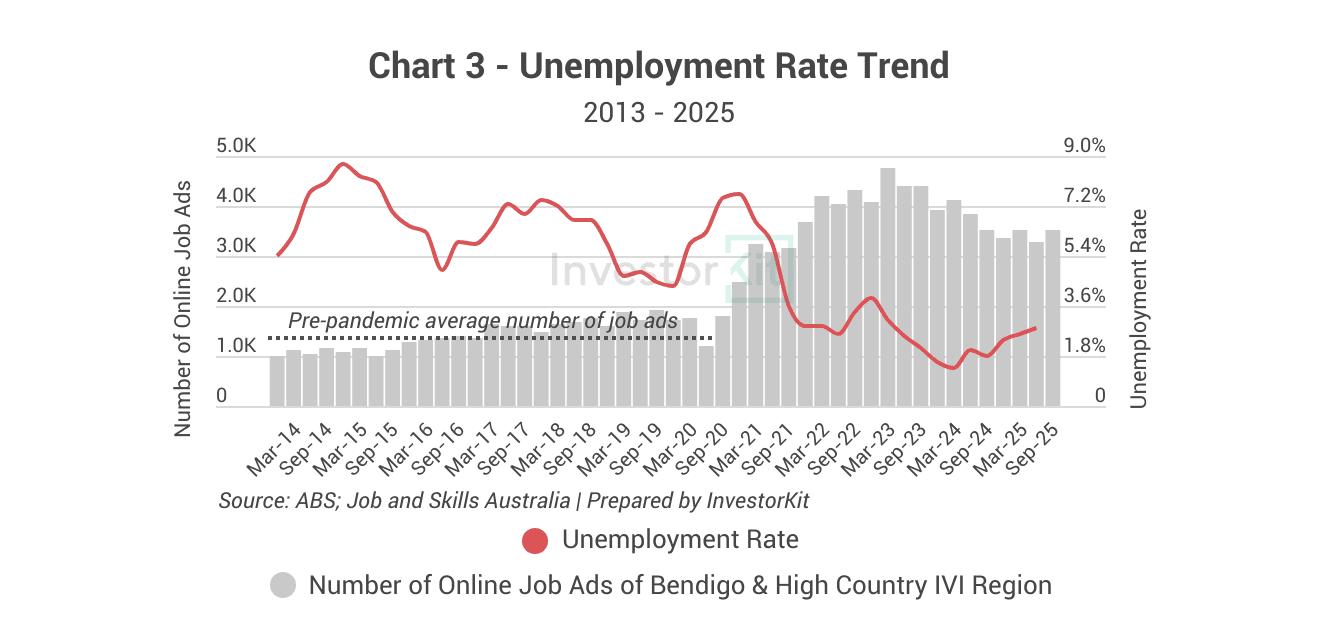

Shepparton’s economy is active, with a low unemployment rate of 2.8%, well below Victoria’s 4.2%. While the unemployment rate has ticked up recently, it is still far lower than the pre-COVID levels. Job ads have remained relatively high, around 2.5 times than the pre-pandemic average.

The stable population growth together with the healthy economy suggest sustained underlying housing demand and ongoing support for the local property market.

Shepparton’s Property Market: Sales Market Trends

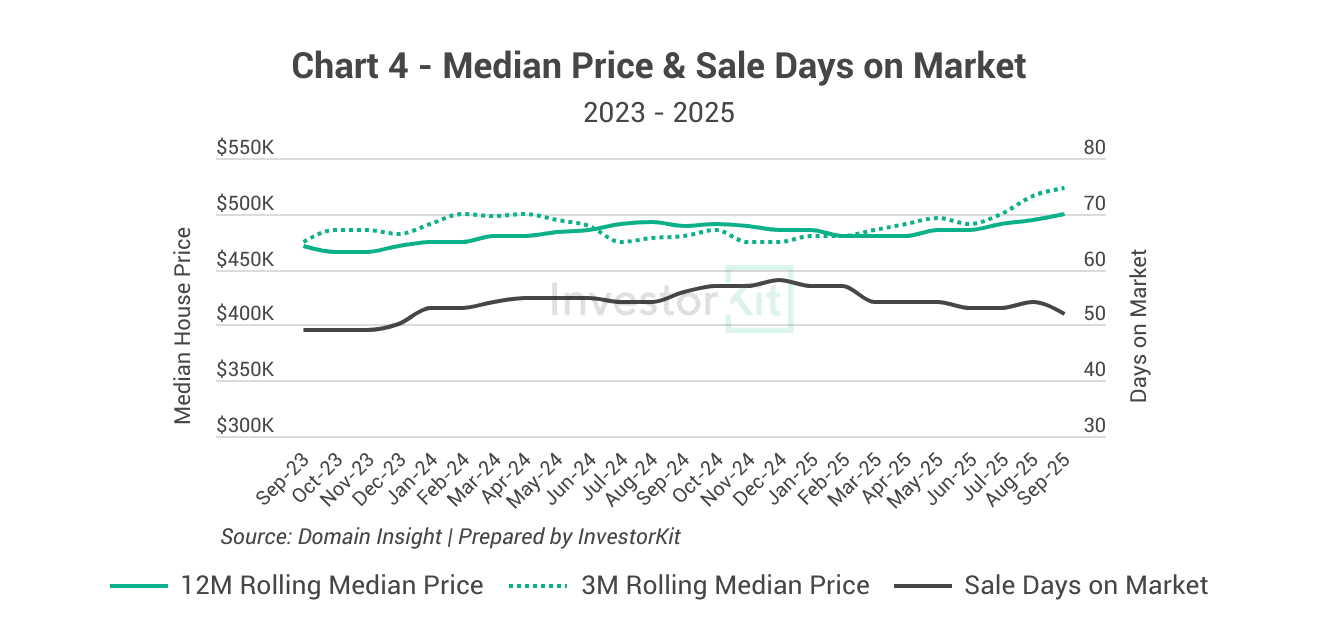

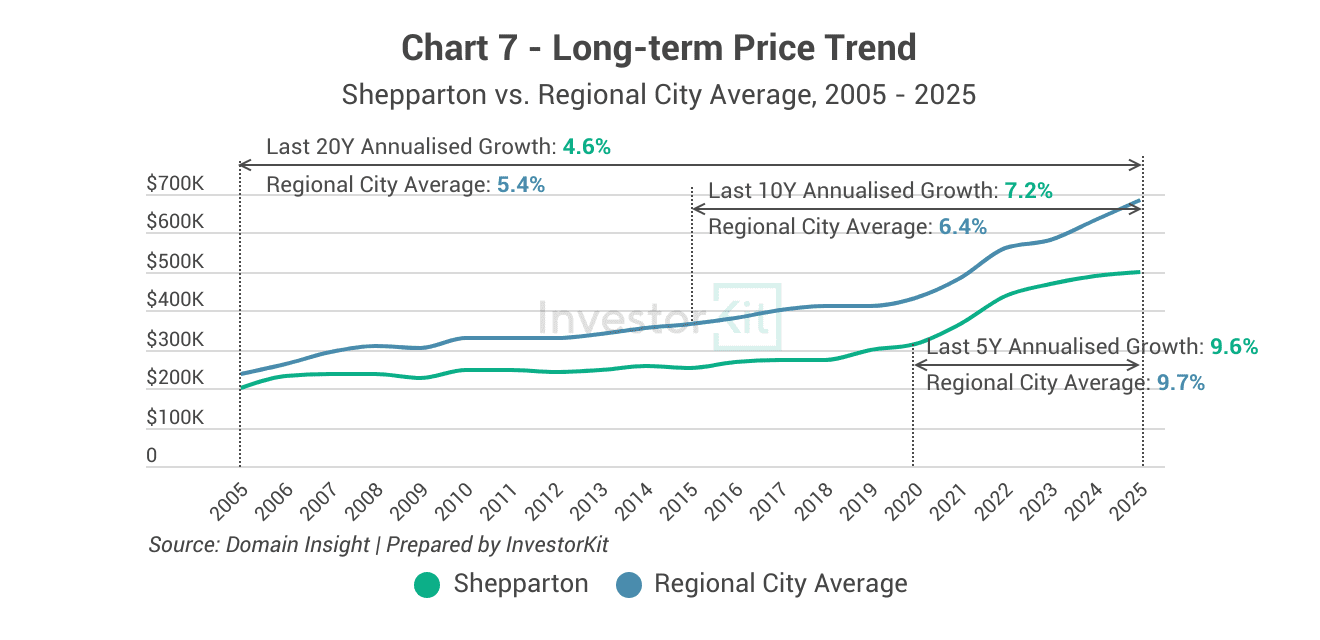

Shepparton’s house price grew slowly, up by only around 2.0% over the past year, with the current median sitting at $499k.

However, signs of rising pressure have become more evident. Since early 2025, the 3-month rolling median price has started to lift noticeably, while days on market have steadily declined.

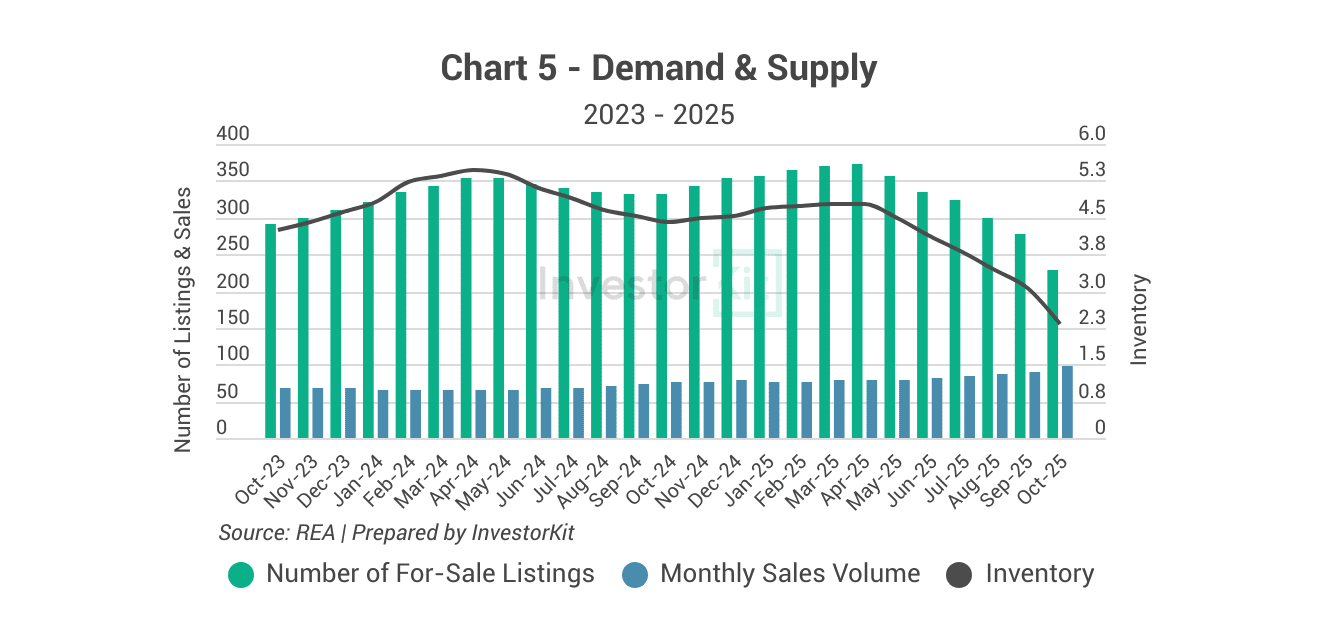

Inventory has also trended downward remarkably. Since May 2025, consistently falling listings and rising sales have pushed inventory down to a relatively low level of around 2.3 months.

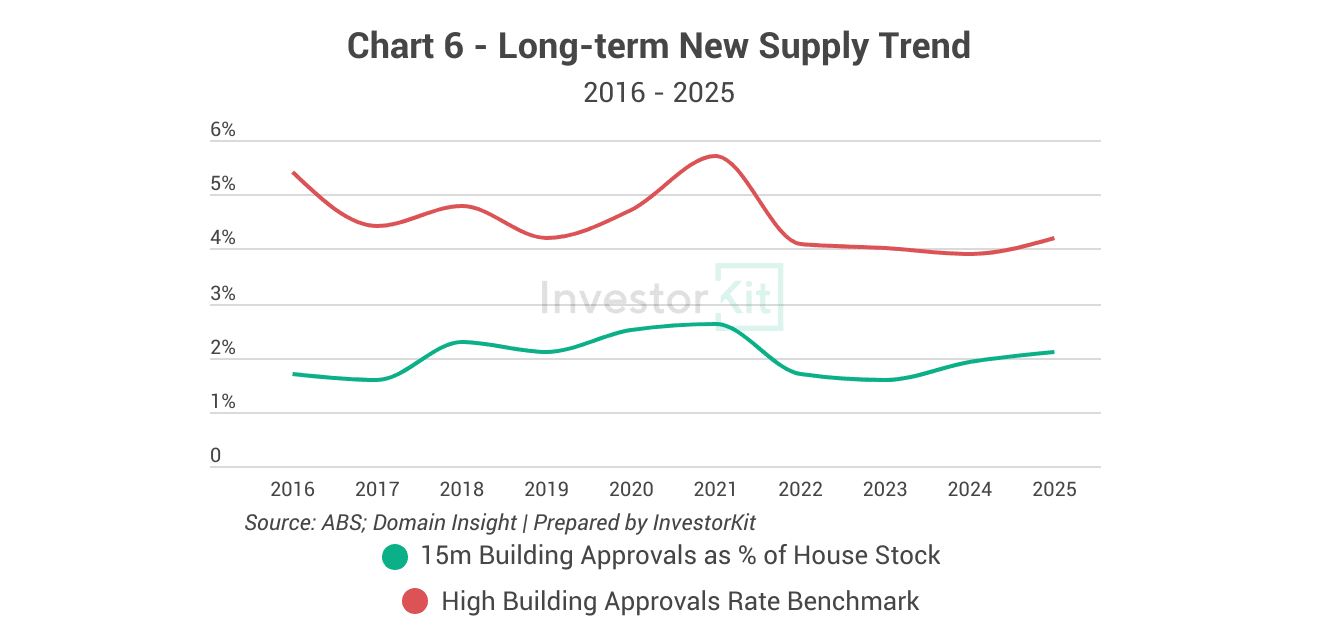

Over the past decade, Shepparton’s building approvals have remained well below the high rate benchmark and currently sit at about 2.1%, suggesting a low oversupply risk.

Shepparton’s house prices surged between 2021 and 2022 but have slowed since then. With a 10-year annualised growth rate above the long-term average of 5% to 7%, the market is expected to see moderate medium-term growth.

Shepparton’s Property Market: Rental Market Trends

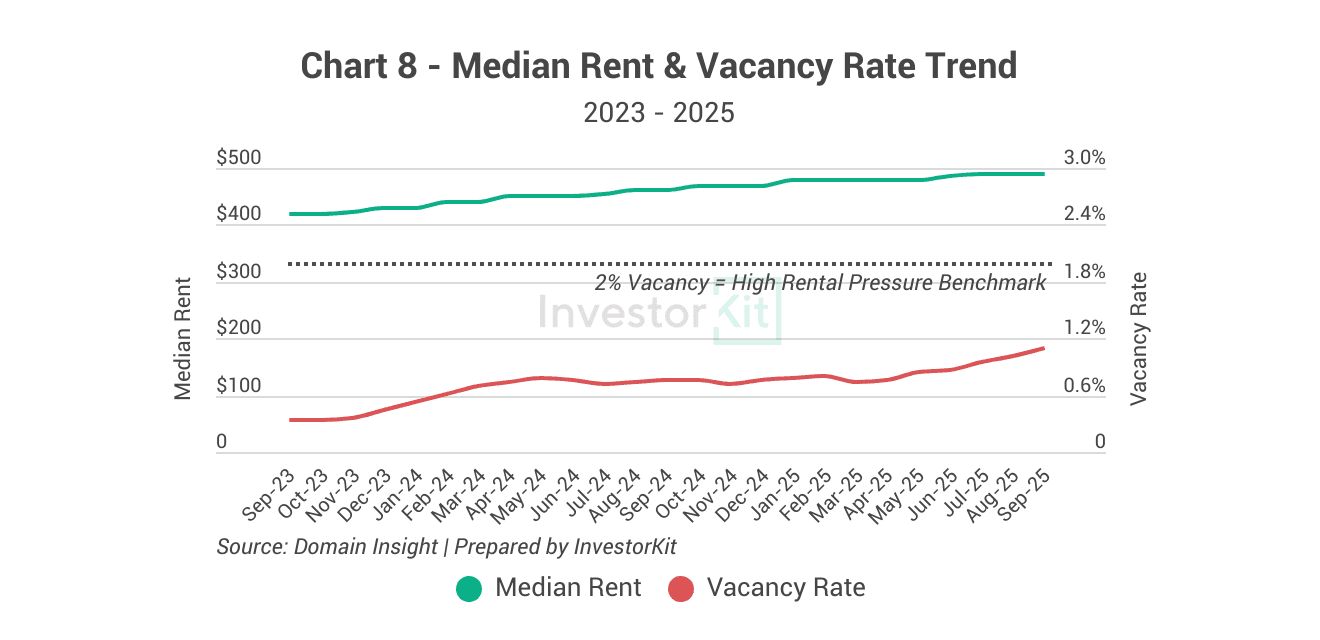

Shepparton’s rental market is under high pressure, as seen in its low vacancy rates. Median rent has grown steadily over the last 12 months, up by around 6.5%.

Shepparton’s median rental yield has improved since the rental price has outpaced the sales price. Its current median yield is at a high 5.5%, well above the average yield of top-populated regional cities.

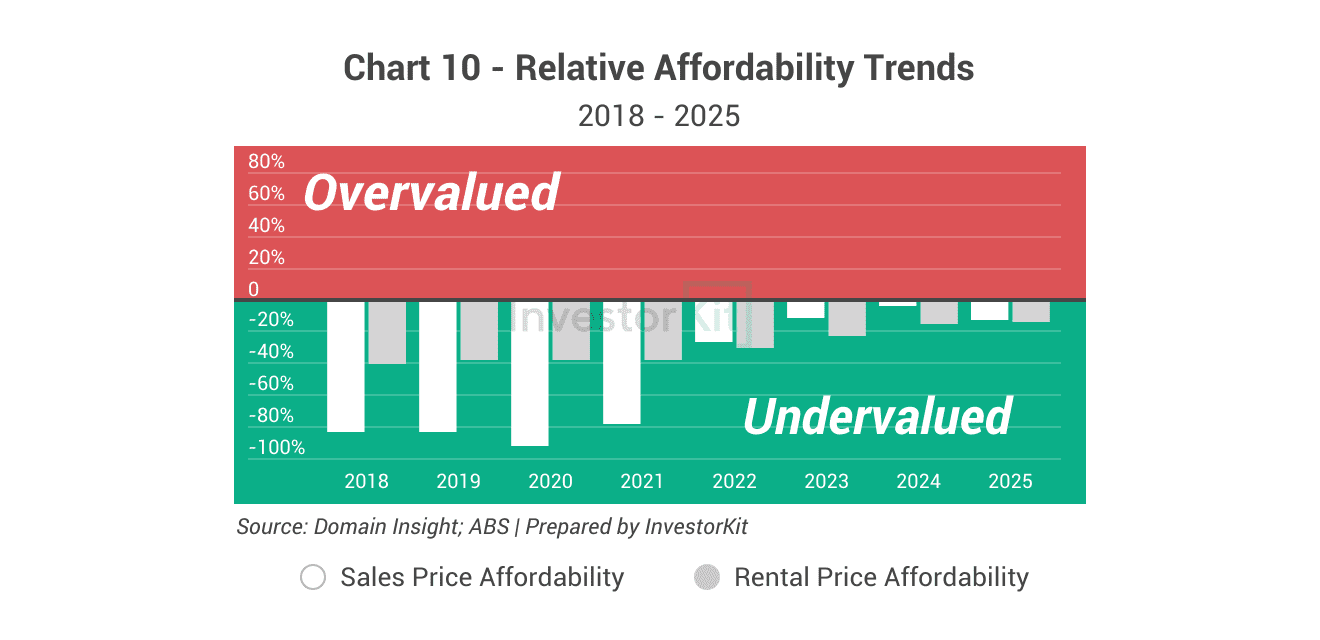

In terms of affordability, houses in Shepparton are relatively affordable in both the sales and rental markets. House prices are around 12% undervalued, while the rental prices are around 13% undervalued.

Over the next 6 to 12 months

Shepparton’s house prices are expected to accelerate due to rising market pressure, as shown by declining inventory and shorter days on market. Rental pressure will likely remain elevated with low vacancy rates, driving further rental growth and sustaining strong yields.

Shepparton is the 18th regional city we examine in this Market Pressure Review Blog Series. Stay tuned for more cities to follow! InvestorKit is a data-driven buyers’ agency that chooses purchasing locations through a sophisticated market pressure analysis system. This methodology has enabled our clients to achieve growth higher than the average and expedite their investment journey. Interested in learning more about InvestorKit’s research and services? Talk to us today by clicking here and requesting your 15-minute FREE discovery call!

.svg)