“More homes equal better affordability.” You may think that Australia’s housing crisis can be simply resolved by increasing supply.

But the truth is far from that: the housing crunch is not just about supply. It’s about a housing system that’s fundamentally not fit for purpose, according to the State of the Housing System 2025 report from the National Housing Supply and Affordability Council (NHSAC).

Australia’s failure to deliver enough homes, at the right time and in the right places, is deeply rooted in structural dysfunction, not just in market cycles, but in workforce, land release, planning, and governance failures.

In this blog, let’s dive into the State of the Housing System 2025 report and understand why we need to fix the system that delivers housing to fix the housing crisis.

The Data: Demand Outpacing Supply

Let’s start with the basic figures. In 2024, Australia completed 177,000 dwellings. But the underlying demand, driven by population growth and household formation, was around 223,000 dwellings. That’s a shortfall of 68,000 homes in a single year.

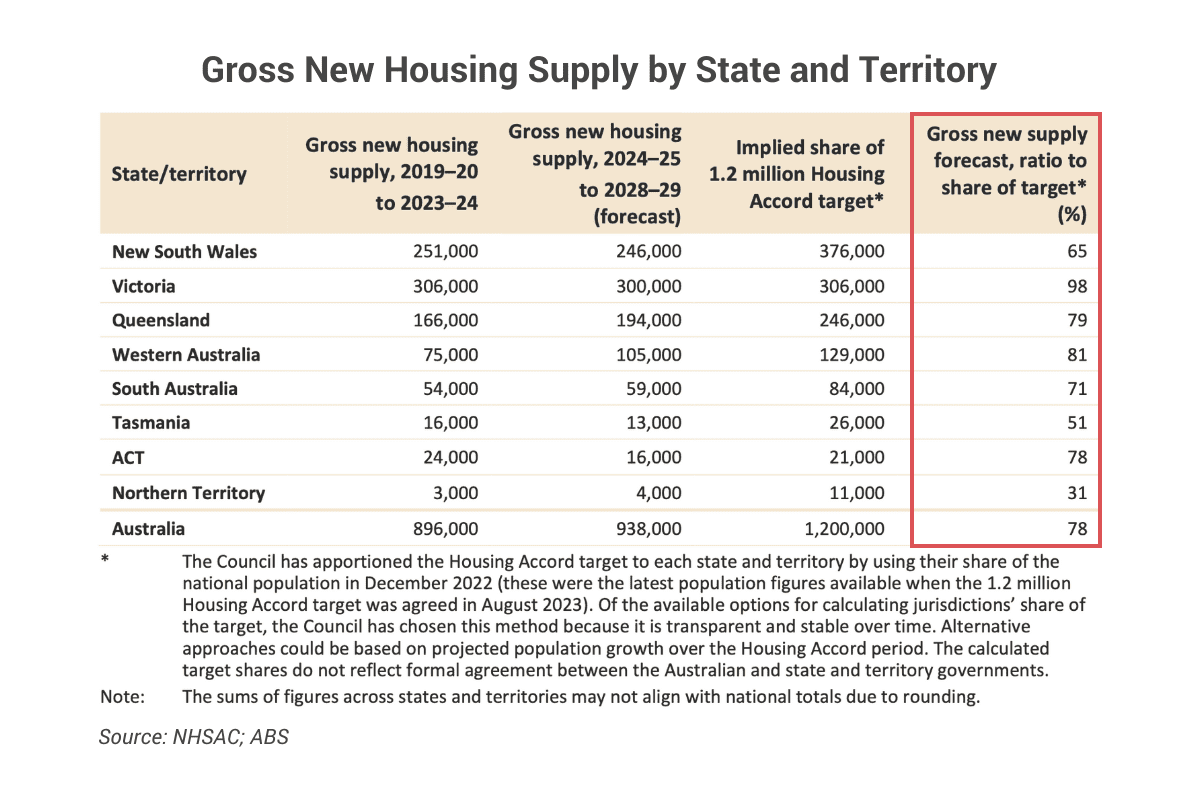

And that’s not a one-off. Over the five-year Housing Accord period (2024–2029), the NHSAC forecasts that even in a baseline economic scenario, only 938,000 homes will be built. That is slightly higher than the expected increase in underlying demand, but far short of the 1.2 million national target. In fact, none of the states/territories can hit their population-based target share (see table below).

If demolitions are factored in, the net supply increase would be just 825,000 – 79,000 lower than the expected net underlying demand increase.

It’s a sobering reminder that while supply is a problem, the deeper issue is why the system consistently fails to meet demand.

The Six Structural Failures Undermining Supply

Popular narratives often point to short-term obstacles: material shortages, interest rate spikes, or inflated labour costs. These are certainly real, and the report notes that labour shortages and high input costs continue to be headwinds.

But the NHSAC has made it clear: “Structural constraints are the principal barrier to supply”. These are long-standing, persistent failures that don’t go away with lower interest rates or short-term subsidies.

Here are six structural failures undermining supply.

1. Labour Market Bottlenecks

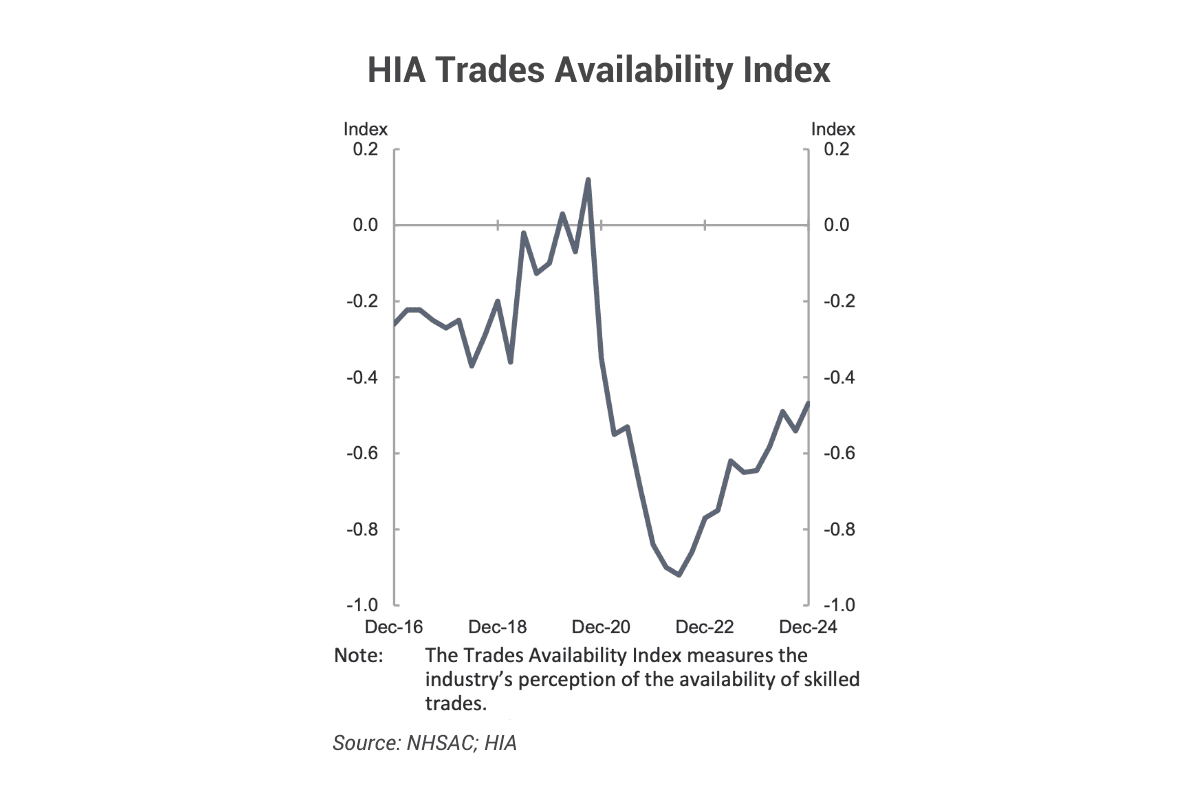

Australia does not have enough trained construction workers. The Housing Industry Association (HIA) Trades Availability Index, which measures the industry’s perception of the availability of skilled trades, remained negative and below its long-run average in 2024 (see chart below). Bricklayers, Tilers and roofers are in the most severe shortage.

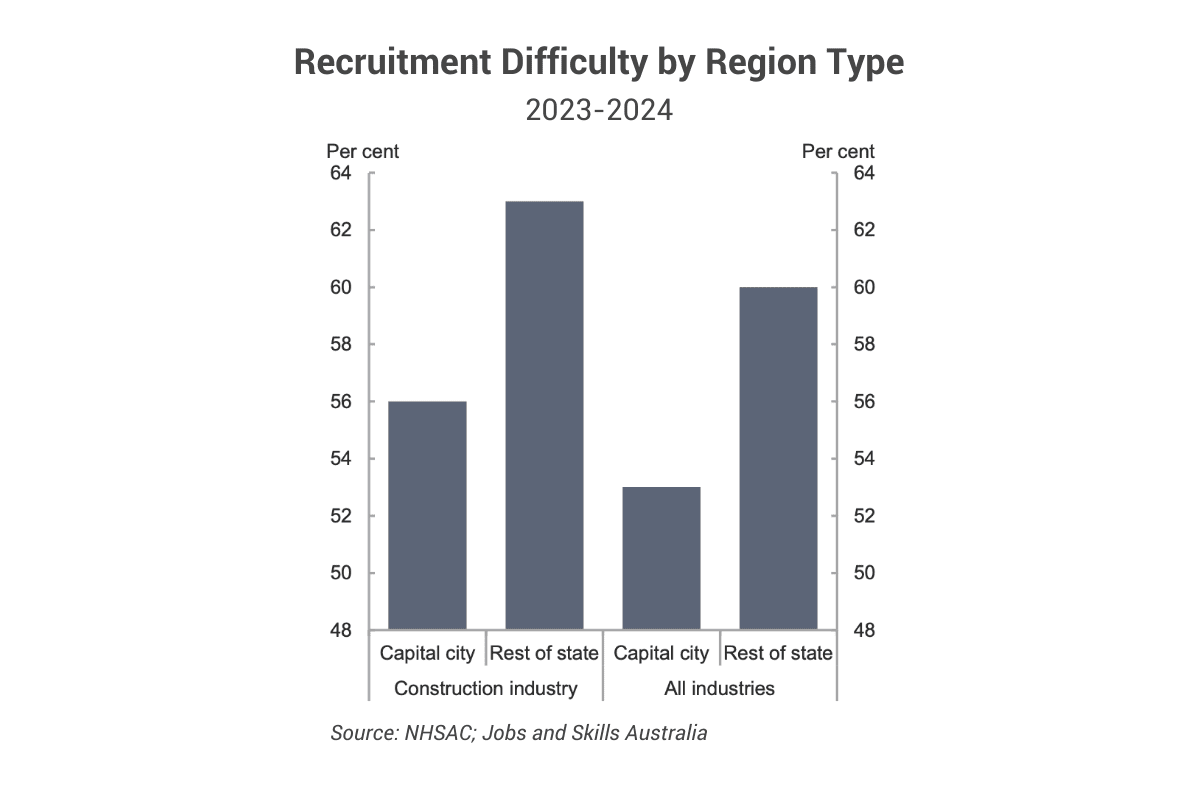

The report also notes that labour availability is particularly tight in regional areas, where recruitment difficulty in the construction sector is higher than in capital cities (see chart below).

2. Productivity Failure in Construction

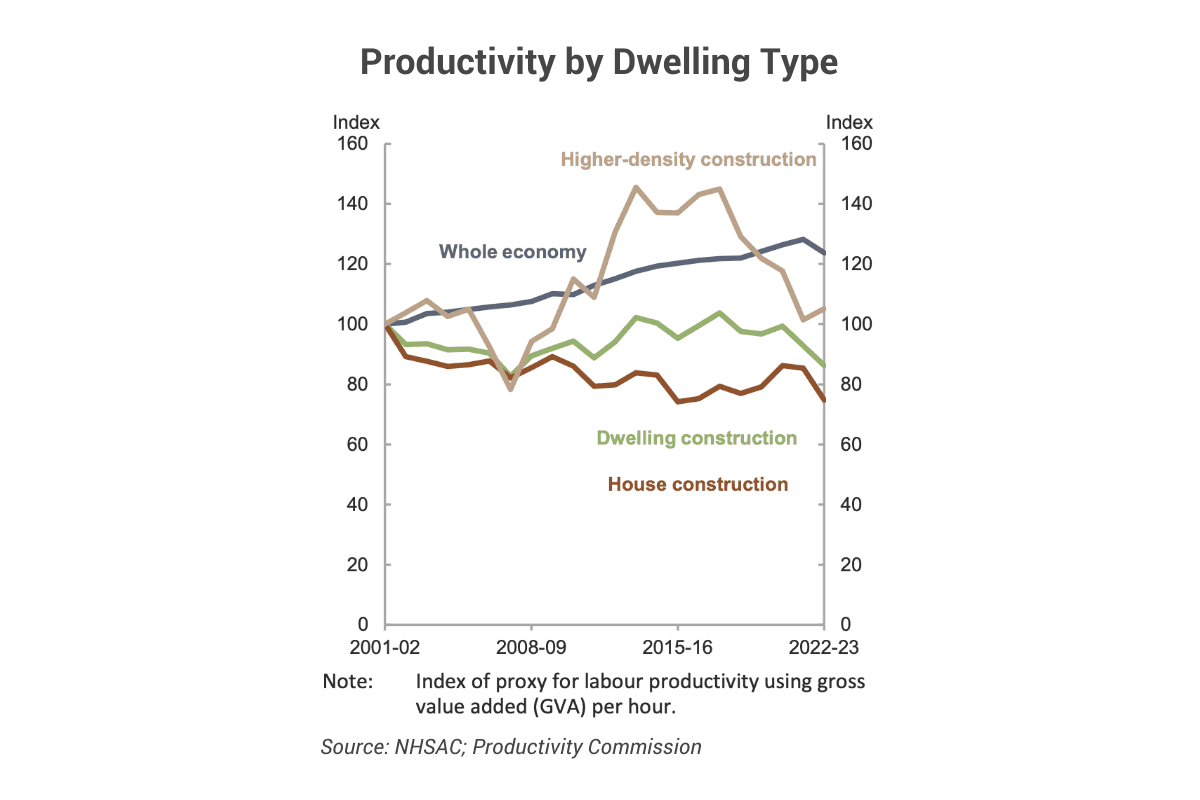

Here’s the kicker: over the past 30 years, productivity in residential construction has fallen by 12%, compared to a 49% increase in the broader economy over the same period (chart below). Detached housing saw a 25% drop in productivity. That means even with the same workforce and budget, we’re getting less housing built.

3. Land Supply Is Costly and Fragmented

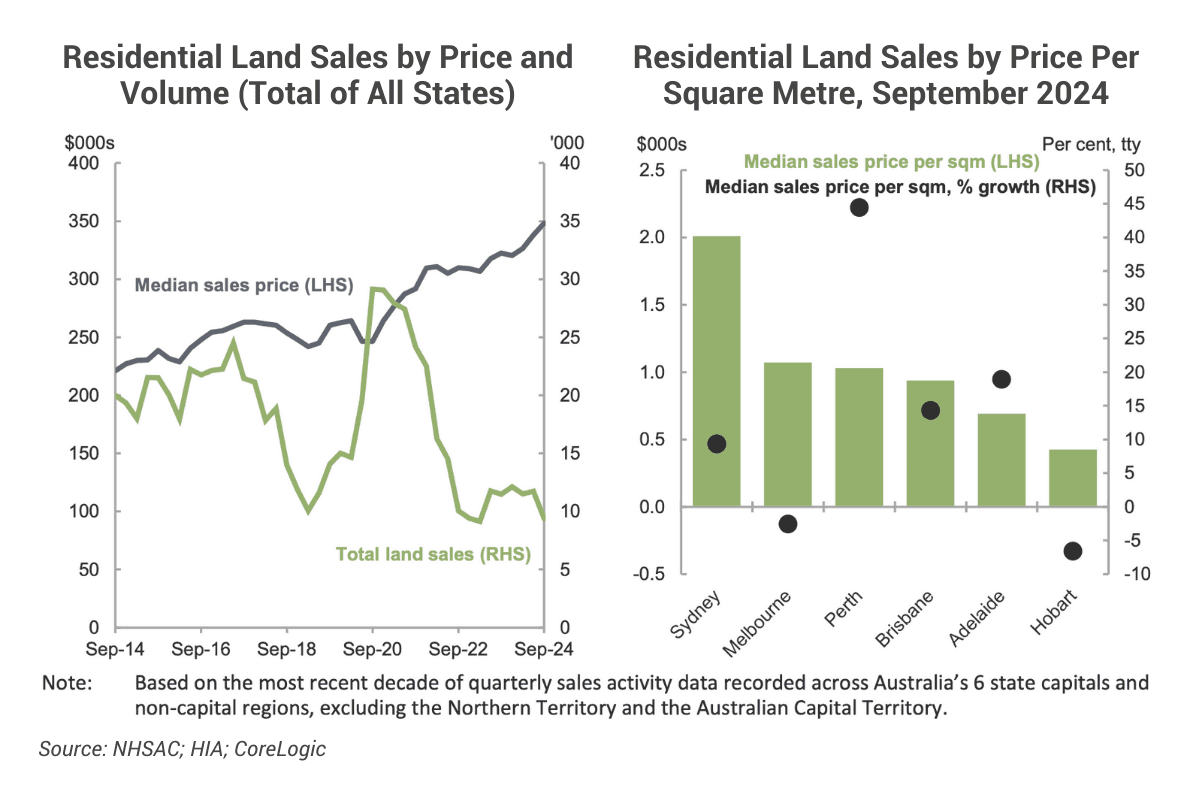

The volume of residential land sales has remained extremely low since 2022 and saw an 18% decline in the past year. As a result of limited supply, residential land prices rose 9.3% per sqm in the year to September 2024 (below charts).

What makes the situation worse is that some well-located and rezoned infill land is not suitable for development due to, for example, the fragmentation of holdings or the lack of enabling infrastructure.

4. Planning Delays and Complexity

Planning approval is plagued by inconsistency. More than 500 local councils act as planning authorities. Complex and inconsistent planning systems are difficult for developers and builders to navigate, delaying development approvals and limiting the ability of the sector to achieve scale.

The NHSAC found that the approval process is “strongly adverse” to supply outcomes, and the Productivity Commission found that planning reform is one of the most important policy actions required to address housing supply and affordability issues.

5. Misuse of Existing Stock

Almost 4 million Australian households have two or more spare bedrooms. While not all are underutilised, for example, some are used as home offices, the system offers few incentives for people to downsize when their housing needs change. Stamp duty, pension asset tests, and moving costs make relocating financially unattractive.

6. Reduction of Social Housing

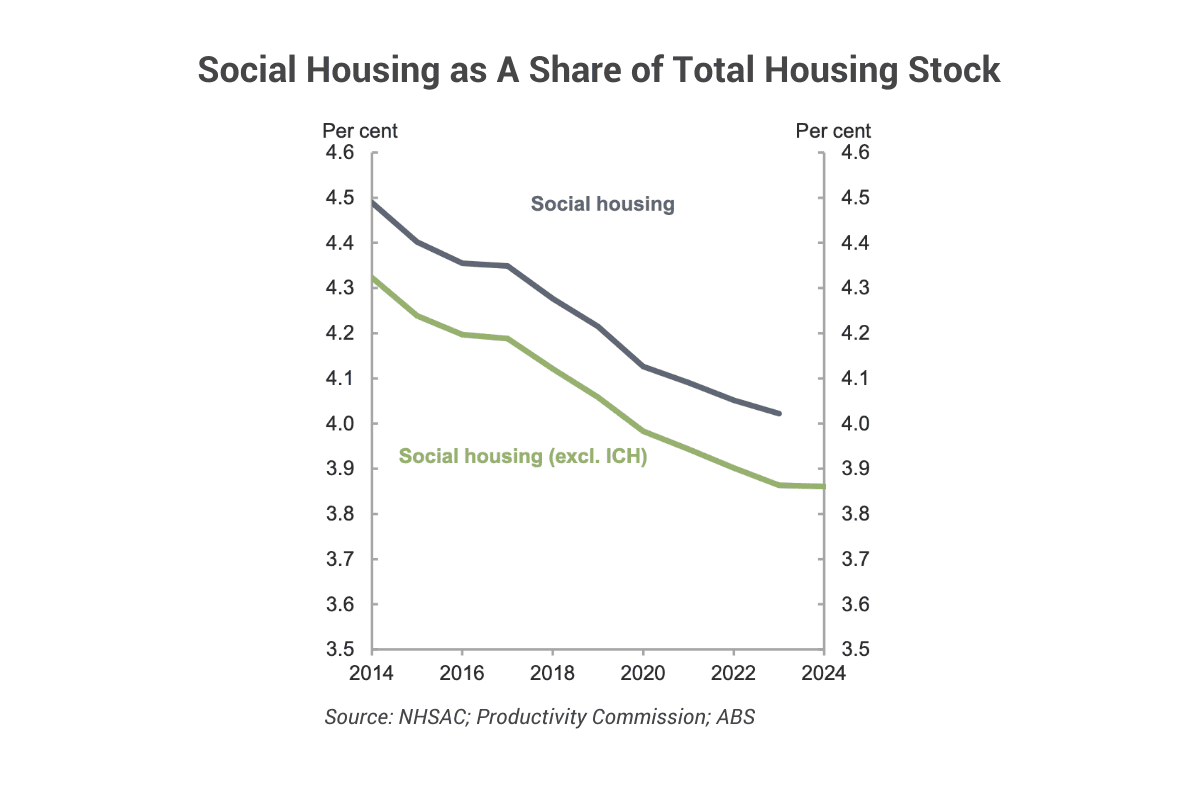

Whilst the number of social housing units has increased over the years, the share of them in the total housing stock has been shrinking due to low investment rates and sale/transformation/demolition of existing social housing stock. In contrast to the decline in supply, social housing demand has been rising amid the housing affordability crisis. Waitlist for social housing has remained near record-high levels last year, and close to 43% of the applicants on waitlists are in the greatest need (eg. homeless applicants).

7. Fragmented Governance

Housing outcomes are shaped by a patchwork of government bodies across transport, treasury, planning, infrastructure, and social services, with poor coordination. This fragmented system lacks unified accountability, making comprehensive reform difficult to execute.

A More Housing Market Is Possible: We Need to Fix the System

Yes, we need more homes. But more importantly, we need a housing system capable of delivering them. As the NHSAC bluntly states, decades of neglect and policy fragmentation have brought us to this crisis point. The good news? We already know where the bottlenecks are, and the NHSAC proposes a clear direction: system-wide reform. This includes:

- Boosting investment in social and affordable housing

- Enhancing construction sector productivity through modern methods.

- Streamlining planning and zoning approvals.

- Reforming tax settings (e.g. transitioning from stamp duty to land tax).

- Coordinating efforts across all levels of government.

These aren’t easy or quick wins. They require political courage and long-term commitment. But they’re necessary if we are to turn housing from a source of national stress into a foundation for national wellbeing.

InvestorKit is a buyer’s agency that doesn’t just buy properties for you, but also delivers to you the latest data and industry insights and helps you make informed decisions and smart moves. Would like to have us by your side for your next investment? Click here to book your 15-min FREE no-obligation discovery call!

.svg)