The Ultimate Property Toolkit:

Discover How to Buy Profitable Investment Properties in 2023

Featured in over 260+ media outlets

Dear Investor,

You’re here because you’re exploring the possibility of buying your first investment property.

Or perhaps you already own a property that you believe has yet to reach its full potential.

Like many, you're keeping an eye on the fluctuating interest rates.

You're considering acquiring a property before the interest rates eventually come down, and the buying frenzy begins...

And before so, you want to avoid rushing into a decision that could lead to costly mistakes.

Property investment is not without its potential pitfalls.

Some people save money for 5-10+ years to buy a property.

Others take a loan from the bank, anticipating that property prices will rise, and they might be able to sell at a profit later on.

However, reality can sometimes be more challenging.

Managing interest payments can be difficult.

Properties may not appreciate in value as quickly as hoped.

And instead of the expected returns, investors might find themselves left to deal with things like paying the bills and fixing toilets while their property continues to generate negative cashflow and low capital growth.

Instead of generating profits, their property turns into a cash-eating nightmare.

If we haven't met yet, I'm Arjun Paliwal. I'm the Founder and Head of Research at InvestorKit.

I recall the experiences with my first few properties when I was a CBA bank manager.

Some of those investments did not meet my expectations and resulted in both time and financial losses.

In fact, a couple of these properties were acquired before the COVID boom and then sold during the boom for roughly the same amounts...

Here they are below...

After being burnt just like that, I got serious about property investing.

I read everything I could get my hands on and learnt how successful investors thought.

After serious research and hard work, I finally felt confident enough to buy my first profitable investment property for $365K.

In just 5 years, the value of that property doubled and touched $785K.

After some renovations in 2022, that property is now worth $1M+ and rents for $1,200/week.

Since 2015, I've purchased 17 properties in various suburbs across Australia.

And throughout my journey, I devised a toolkit of strategies and identified patterns to help me understand the science behind profitable properties.

I’ve used the same strategies to help my clients buy properties that:

I’ve Helped Some Of My Clients

Build 7 and Even 8-Figure Property Portfolios That Bring in Consistent Passive Income

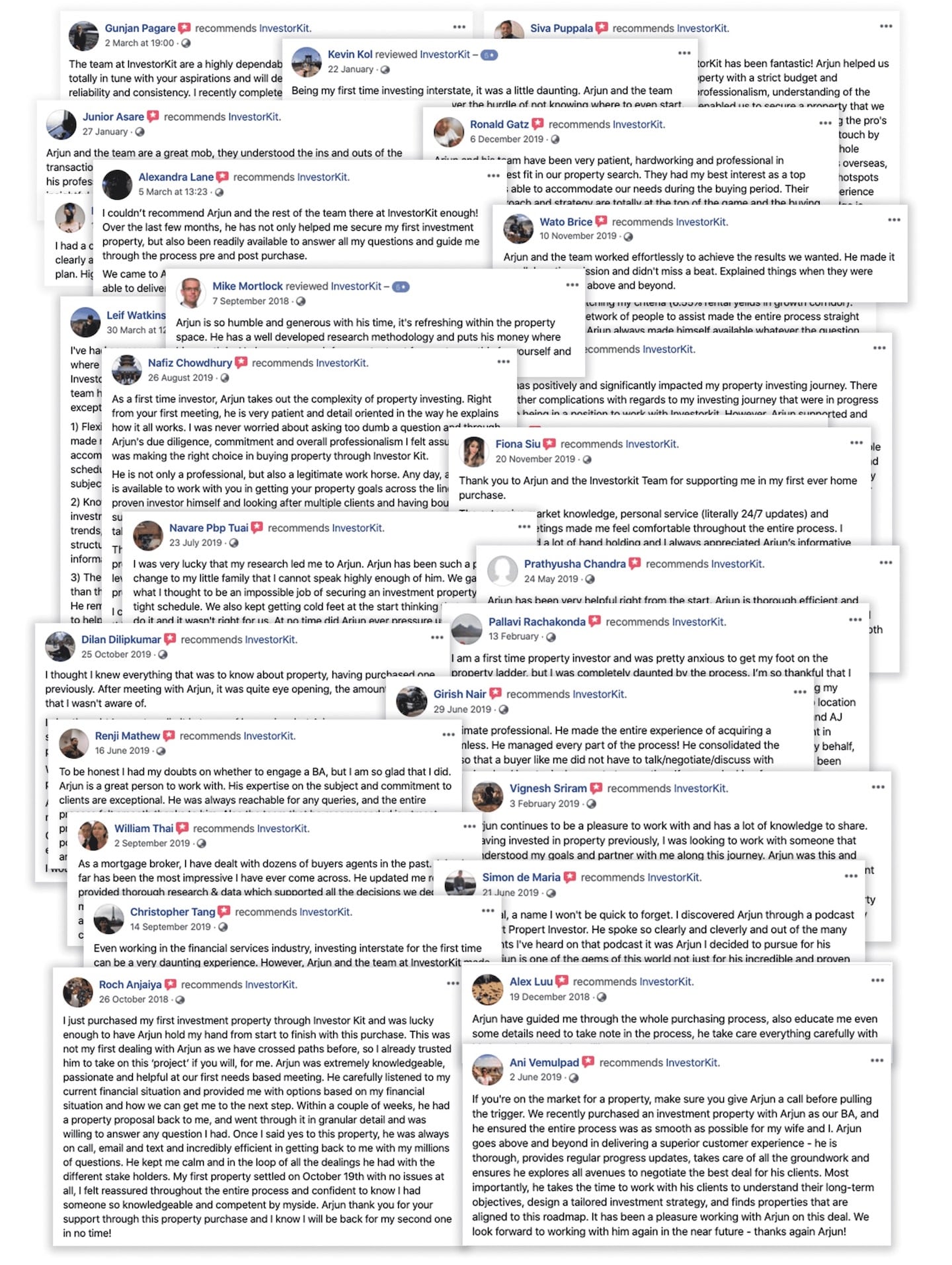

I can give you examples of our numerous clients... but I think I’ve made my point.

The strategies and tools that I’m about to share with you are effective.

They have helped us make significant equity and generating considerable passive and rental income.

Are You Ready to Learn How to Buy Profitable Investment Properties in 2023?

For a limited time, you can access The Ultimate Property Toolkit for a single payment of $27.00 (Valued $997).

Your digital copy of The Ultimate Property Toolkit will be promptly emailed to your inbox, enabling you to begin learning about our methods for uncovering investment property opportunities in 2023.

Inside The Ultimate Property Toolkit, you’ll get access to 9 resources that includes:

- 5 Investing Myths: Ignore The Noise And Get Ahead With Data-Driven Property Investing:

In this ebook, we unpack data to offer insights not only about potential pitfalls to avoid but also to provide clarity on steps you might consider taking to purchase your first property. - 10 Property Mistakes To Avoid At All Costs:

In this short eBook, I'll be sharing ten common mistakes that individuals frequently encounter when investing in property, along with strategies to navigate them. - Market Categorisation and Buying Cycle Positions:

This video aims to guide you in recognising potential property markets in Australia by examining various data indicators. - Due Diligence Checklist:

This one-page tool has been instrumental for us in steering clear of nightmare properties and identifying golden ones. - Australia’s Supply Shortage Score:

In this research report, I'll present findings and data that highlight regions which may be experiencing a supply shortage, potentially presenting interesting property opportunities. - Australia’s Top 25 Tightest Rental Market:

Don’t leave your investment to speculation, because there’s a simple solution to that could be a solution to this problem. In this short research document (that will be regularly updated), I will be sharing the data and indicators that could potentially help you identify tight rental markets. - Bundle of 18 Whitepapers from Australia's Buyer's Agency of the Year:

We provide insights into research, data, and practices that align with current government policies and interest rates, among other factors. - Property/Deal Analyser Cashflow Sheet:

This tool provides us and our clients with clarity, aiming to assist in making informed decisions for the next 10-15 years. - Golden City Research Report:

We conduct comprehensive analyses and share data related to THE GOLDEN CITY, a city that has seen substantial growth over the past couple of years. Yes even after all the interest rate rises in 2022, it was the best performing capital city for that calendar year.

keep scrolling to discover more on what's included in this toolkit...

5 Investing Myths: Ignore The Noise And Get Ahead With Data-Driven Property Investing

Do you believe that property acquisition in Australia is reserved solely for the super-rich?

Do you think that the number of bedrooms, bathrooms, the materials used in construction, or the age of the property always directly influence its price and future growth potential?

Or that you should only invest in properties located in high-income, low-crime areas?

These are common assumptions, but it's important to understand that each property investment scenario is unique and dependent on a variety of factors.

The market has many individuals sharing information, and the accuracy can vary. This includes reporters who may sometimes dramatise situations to attract readership, individuals sharing advice based on their personal experiences (which may not necessarily align with your situation), and well-intentioned people who, despite their best efforts, may not be fully informed about the intricacies of the property market.

In this short ebook, we unpack the data and show you:

10 Property Mistakes To Avoid At All Costs

Property investment mistakes are costly.

It doesn’t just cost you your hard-earned money…

It might also affect potential equity gains and passive income opportunities that could have been explored with careful planning.

It's not uncommon to hear of people who have found themselves in challenging financial situations due to unfortunate investment outcomes.

Others may find themselves under significant debt as a result of decisions that didn't pan out as hoped.

And some might be earning less than they had anticipated from their investments due to various factors.

It's important to learn from these experiences to make informed investment decisions.

In this eBook, I highlight 10 common property investment pitfalls that people may encounter and offer insights into how they might be navigated.

Market Categorisation and Buying Cycle Positions: Learn To Identify Hot Property Markets

Location A might be booming right now, Location B might be crashing down and Location C might be running in circles.

When considering investing in property, you need to study all these locations.

Some investors seek locations that appear to be at the bottom of its cycle and could potentially shift towards an upward trend.

This video aims to provide insight into this approach.

You'll uncover...

Yep, we don’t just teach you how to identify what could be hot markets…

We also offer a list of undersupplied regions (Resource #5) that have the hottest property deals available.

We update this list every month according to the new data we gather.

So, whenever you’re ready to buy a property and want to know about could be an undersupplied market…

Just look at the cheat sheet in Resource #5 below and you could potentially identify locations that align with your investment interests.

Due Diligence Checklist

How do you separate good properties from bad ones?

How do you know if a property will outperform the market, generate passive income for you and help you reach your goals with minimal risk…

Or if it will turn out to be your most expensive nightmare?

Some of these things may potentially impact the growth of property negatively (we call them detractors).

We use this checklist to make sure the property we’re buying has none of the detractors.

We use this checklist as a guide in our decision-making process to try to ensure the property we're considering ideally has no detractors.

When we find a property that aligns with most of the checklist criteria, we aim to buy it.

Simple, but very powerful.

This one-page guide has assisted us in sidestepping less desirable properties and focusing on the golden ones.

Understanding how to utilise this tool may potentially help you avoid costly property mistakes.

Australia’s Supply Shortage Score

Net demand increases when relative supply decreases.

And prices increase when the greater this imbalance becomes.

This suggests that identifying locations with a supply shortage might point you towards markets where a significant part of the equation could potentially be addressed.

These metrics could contribute to an environment for price and rental growth.

I'll share a report that'll be updated every month, so you can stay up-to-date with the latest market trends, supporting you in your property decision-making process.

When you consider buying a property, this dashboard will serve as a useful resource, providing insights into regions that appear to be undersupplied.

Australia's Top 25 Tightest Rental Markets

As a buyer, you want the rent to rise. But tenants want the opposite of that.

So, how can you navigate the delicate balance of adjusting rent annually, while maintaining a good relationship with your tenants?

Many individuals purchase a property under the assumption that they can figure this out later.. and that's where they may be making a mistake...

Don’t leave your investment to speculation, because there’s a simple solution to that could be a solution to this problem.

And that’s why you need to buy properties in tight rental markets because it could help you reach your goals faster.

This is why targeting properties in such tight rental markets can potentially help you reach your investment goals.

In this short research document (that will be updated regularly), I will be sharing the data and indicators that could help you potentially identify the tightest rental markets.

Whenever you're ready to make a property investment, this data can provide a shortlist of top locations in Australia. These areas present properties with the highest potential for robust rental income growth and strong demand.

Property/Deal Analyser Cashflow Sheet

Ever seen a fantasy movie in which a fortune teller uses a magical crystal to predict future events and help our hero?

You can think of a Deal Analyser Cashflow Sheet as that magical crystal.

We put in some numbers like rental income, property bills, pricing and growth assumption details etc… and it gives us insights into our 10-year cashflow and growth with high levels of conservatism.

We can use that insight to assist us in making wise decisions and potentially avoiding stupid ones, accelerating the pace to reach our goals faster.

It offers a holistic way to look at a purchase with all costs and income considered rather than the simple price vs rent.

Bundle of 18 Whitepapers

At InvestorKit, we produce one whitepaper every month to keep our subscribers informed with different things happening in the property market.

We share research, data, and what we believe are the best practices according to the changing government policies and interest rates, among other factors.

When you buy this bundle, you will get access to the 18 whitepapers we’ve written so far.

Some of these whitepapers are:

Based on our analysis, we've made a list of all property markets that appear overvalued and undervalued in 2023. If you’re really serious about buying a property in 2023, this whitepaper may give you the insights of where you should look to find the undervalued cities in Australia. Whilst few in number, they do exist.

If you just read all the 18 whitepapers, you may know more than 90% of property investors in Australia.

Golden City Report

So you have all this data and insights into the property market. Now, how do you put this into use and actually find the best location that has the best property deals?

In this short report, we aim to do that for you.

We've undertaken comprehensive analysis and share data on a city we've dubbed THE GOLDEN CITY. This city has shown significant resilience, with growth remaining in the double digits over the last several years, even in light of the interest rate rises in 2022. It still grew by double digits.

We were one of the first to consistently and publicly call it before it happened, and now you can assess the research for this city.

We’ve bought a number of properties in this city that have increased by nearly 70%+ over the last 2-3 years.

Things will change in future and this GOLDEN CITY could run out of steam, however, knowing the research behind it may set you up to find the next city just like it.

But if you want to buy a property in 2023, this is THE REPORT for you right now. It aims to uncover how you may apply this analysis to potentially find the next GEM like how we did.

In this research report, we show you the data and indicators we believe that truly matter, including our comprehensive market scorecard.

We’ve used these tools to help some of our clients build a multi-million dollar portfolio in just 3-5 years.

We’ve used these 9 tools to help our clients in identifying locations and properties that we believe, has outperformed the market by a mile.

And Now We’re Giving it to You For Just $27 (Valued $997)!

If you could get your hands on the strategies that could potentially help you:

After being burnt just like that, I got serious about property investing.

And if you could get it at the price of a Sunday Big Breakfast…

Wouldn’t it be the best deal ever?

It’s just like exchanging $1 for $100,000.

Now, I’m going be honest with you.

Giving away all these tools for just $27 is insane… especially when it's valued at $997.

So, why am I doing it?

So, I'm offering access to our resources for just $27 (Valued $997), in the hope of earning your trust and demonstrating our process.

Now, I’m not sure how long I’ll be offering this deal for $27…

So, fill the form below and claim this deal.

No Questions Asked 100% Money-Back Guarantee

Here’s a simple promise:

If you’re not satisfied with the toolkit for ANY reason…

... just let my team know with a quick email to [email protected] within 7-days of purchase, and we’ll send you a refund for your purchase.

This is a 7-day money-back guarantee!

We're giving it all away for $27 so we can:

☑ Win your trust,

☑ Show you our deep and sophisticated research and

☑ Show you how we help our clients buy properties that potentially outperform the market.

And that's our ultimate goal: To help you secure an investment property that will could outperform the market, while you sit at home and watch the next season of your favourite Netflix show.

All the tools, videos ebooks and research data in this toolkit are really easy to understand (and have helped us build a $700,000,000 collective portfolio for our clients)…

So if you're really interested in buying a property in 2023, you may find it super helpful.

But in the rare case that you don't find it helpful, we'll return every penny.

Just send an email to [email protected] with the subject "Refund for Toolkit" within 7 days of purchase...

And my team will transfer the amount to your account within 14 business days.

The real estate market is ever-changing.

For that reason, we keep updating our data every month so we can stay on top of things.

But when you buy this toolkit, you DON'T have to keep paying every month to get access to this fresh data.

We aim to keep our dashboards updated every month, giving you lifetime access.

The problem is: There’s too much information online.

You could spend hours going through all the pages and finding the most reliable source of information…

And then you can spend another few days reading and understanding the complex data.

Or you can simply go through all the videos, ebooks and tools in this toolkit and know everything you want to know in one place. The internet is a reveal some but not all world, it is full of scatters of info, and is only surface level.

Nothing goes as deep as this at this cost with expert level interpretation broken down for you.

I’ll leave the decision to you.